Company Summary

| Pure MarketReview Summary | |

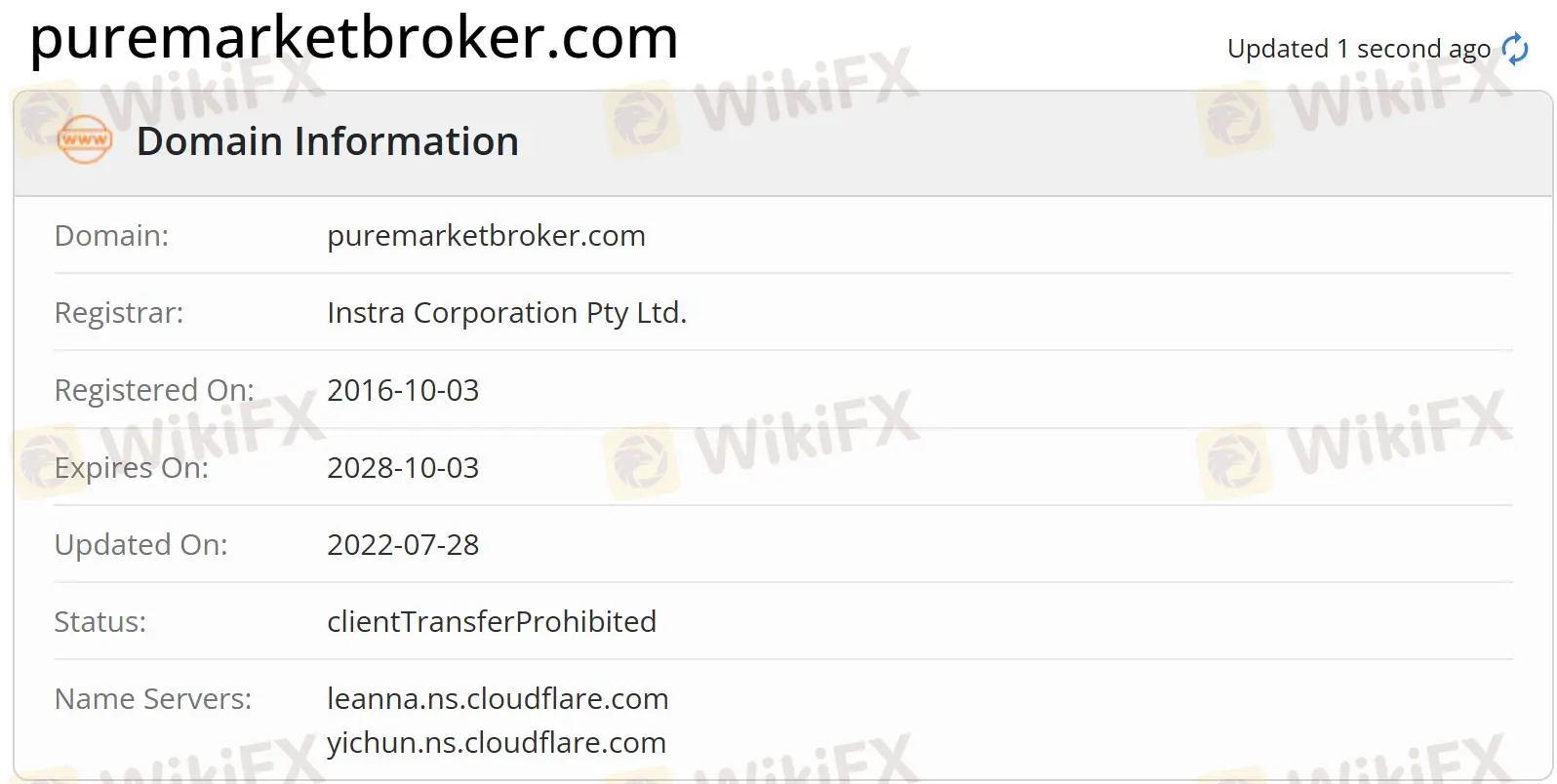

| Founded | 2016 |

| Registered Country/Region | Vanuatu |

| Regulation | VFSC (offshore), FCA (clone) |

| Market Instruments | FX pairs, spot metals, CFDs, indices, and commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:200 |

| Spread | From 0.2 pips (MT4 Standard account) |

| From 0.0 pips (MT5 Standard account) | |

| Trading Platform | MT4, MT5 |

| Min Deposit | €/$100 |

| Customer Support | Online chat, contact form |

| Tel: +44 20 36 088 986 (24/5) | |

| Email: support@puremarketbroker.com, info@puremarketbroker.com | |

| Social media: Facebook, Instagram | |

| Address: Stade, Leasehold Title: 11/0E22/028, Port – Vila, Vanuatu | |

| Regional Restrictions | Afghanistan, Cuba, Eritrea, Iraq, Islamic Republic of Iran, Israel, Liberia, Libya, Nicaragua, Pakistan, Russian Federation, Somalia, Syrian Arab Republic, Sudan, United States, Malaysia, Vanuatu |

Pure Market was registered in 2016 in Vanuatu, which is a broker offering trading services related to FX pairs, metals, CFDs, indices, and commodities. It uses MT4 and MT5 as trading platforms, and it provides 2 types of accounts, with a minimum deposit of 100 EUR/USD and a maximum leverage of 1:200. However, this company is offshore regulated and it holds a clone license, which means potential risks are high.

Pros and Cons

| Pros | Cons |

| Diverse tradable instruments | Offshore regulation risks |

| Demo accounts | Clone FCA license |

| MT4 and MT5 supported | No popular payment methods |

| No deposit fees | Regional restrictions |

| Multiple channels for customer support | |

| Live chat support |

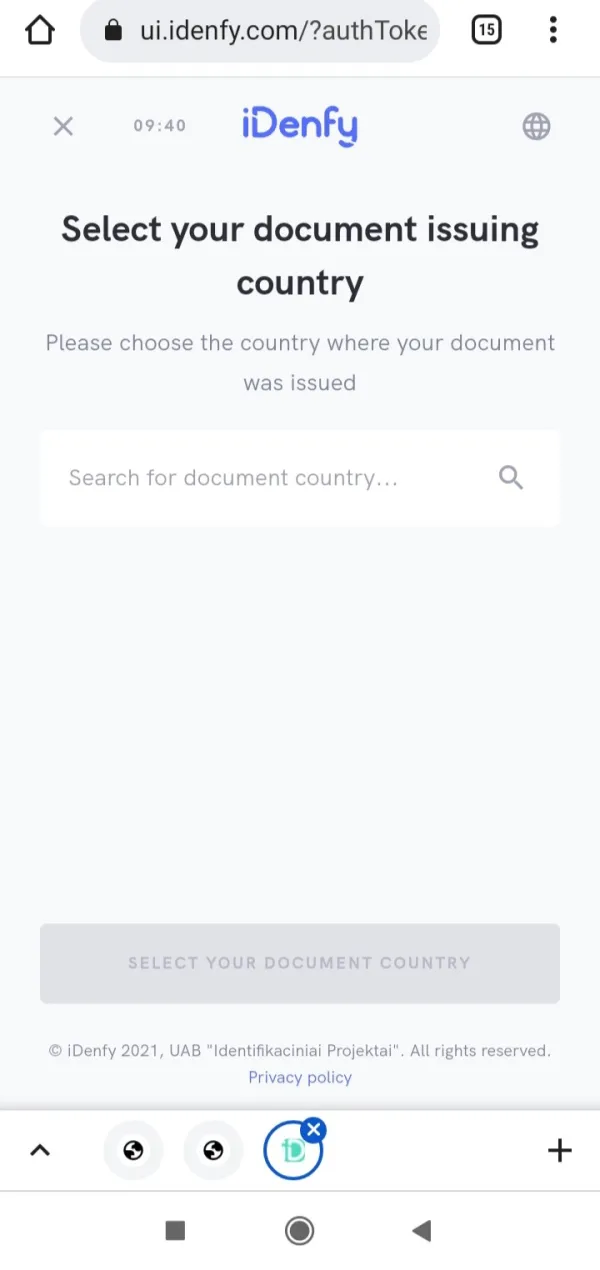

Is Pure Market Legit?

Pure Market is offshore regulated by Vanuatu Financial Services Commission (VFSC). Moreover, it holds a clone license of Financial Conduct Authority (FCA).

| Regulated Authority | Current Status | Regulated Country | License Type | License No. |

| Vanuatu Financial Services Commission (VFSC) | Offshore Regulated | Vanuatu | Retail Forex License | 14801 |

| Financial Conduct Authority (FCA) | Clone Firm | UK | Straight Through Processing (STP) | 725804 |

What Can I Trade on Pure Market?

On Pure Market's trading platforms, customers can trade FX pairs, spot metals, CFDs, indices, and commodities such as oil.

| Tradable Instruments | Supported |

| FX Pairs | ✔ |

| Spot Metals | ✔ |

| CFDs | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type/Fees

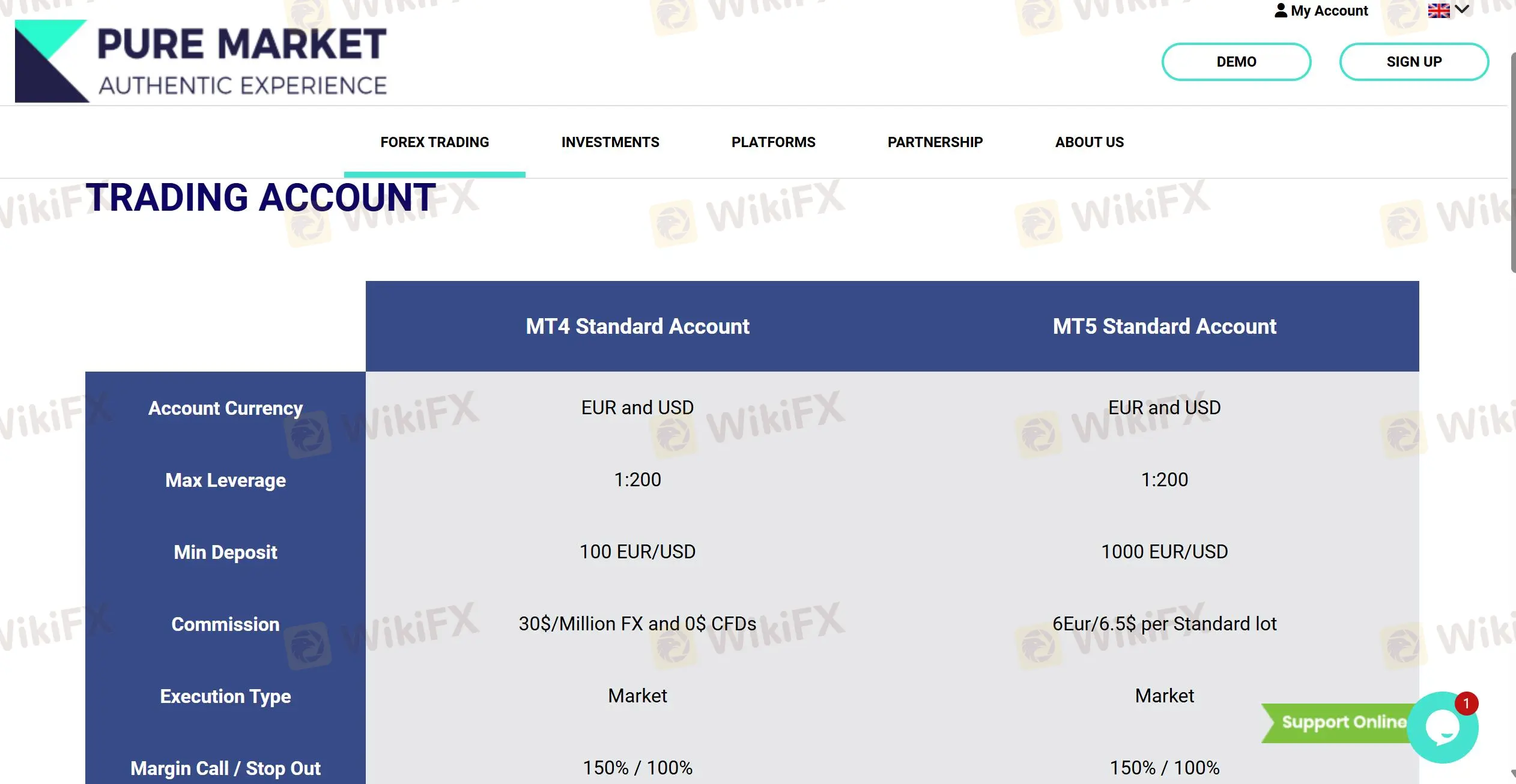

Pure Market offers 2 types of accounts, including MT4 Standard Account and MT5 Standard Account. Besides, a demo account is also available.

| Account Type | Min Deposit | Max Leverage | Spread | Commission |

| MT4 Standard | 100 EUR/USD | 1:200 | From 0.2 pips | $30/Million FX, $0 CFDs |

| MT5 Standard | 1,000 EUR/USD | From 0.0 pips | €6/$6.5 per Standard lot |

Leverage

The leverage can be up to 1:200 for both account types. Careful considerations are recommended, since high leverage is likely to bring high potential risks.

Trading Platform

Pure Market uses MT4 and MT5 as its trading platforms, which are available on PC, web, and mobile devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web, PC, mobile | Beginners |

| MT5 | ✔ | Web, PC, mobile | Experienced traders |

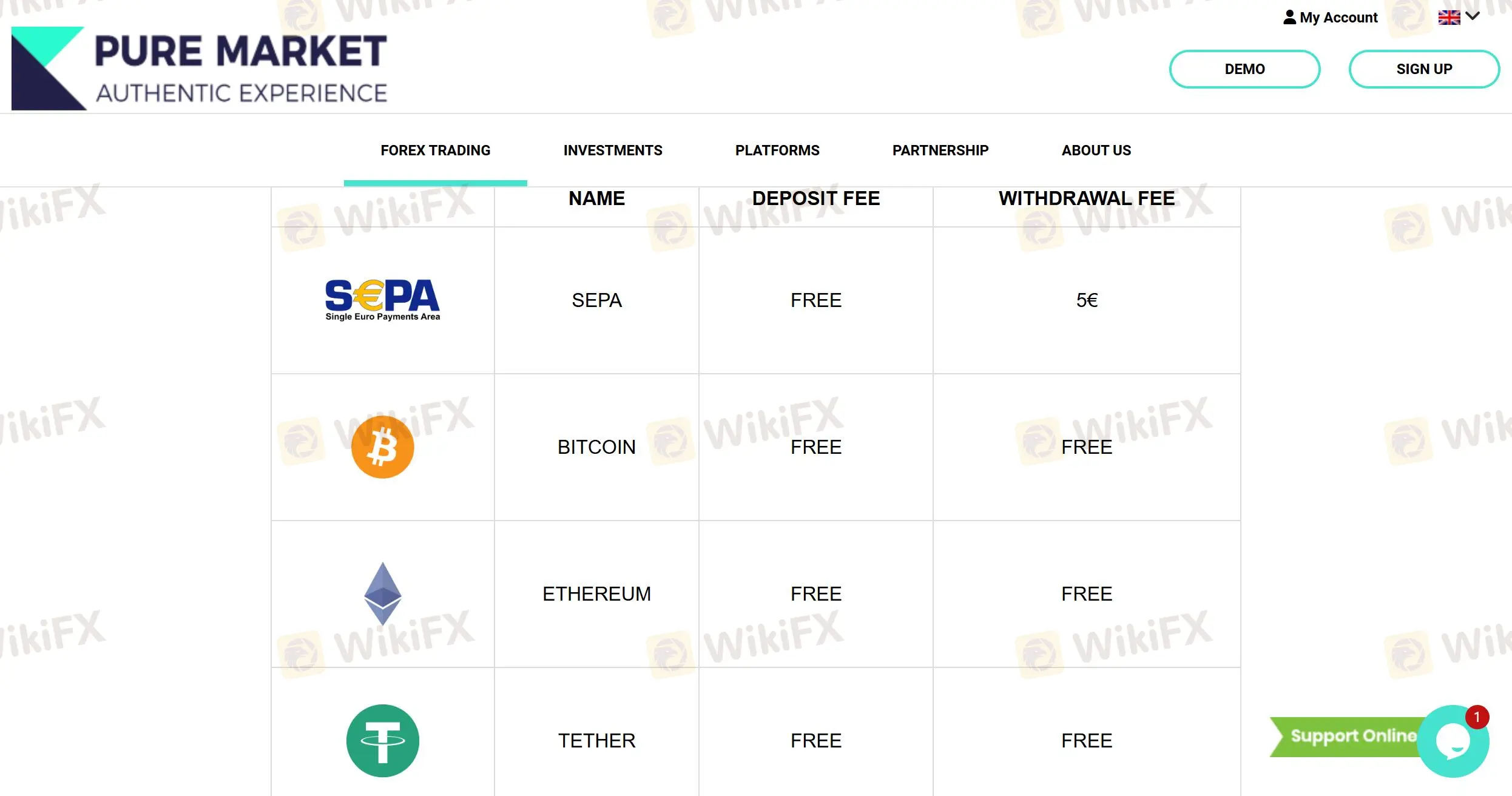

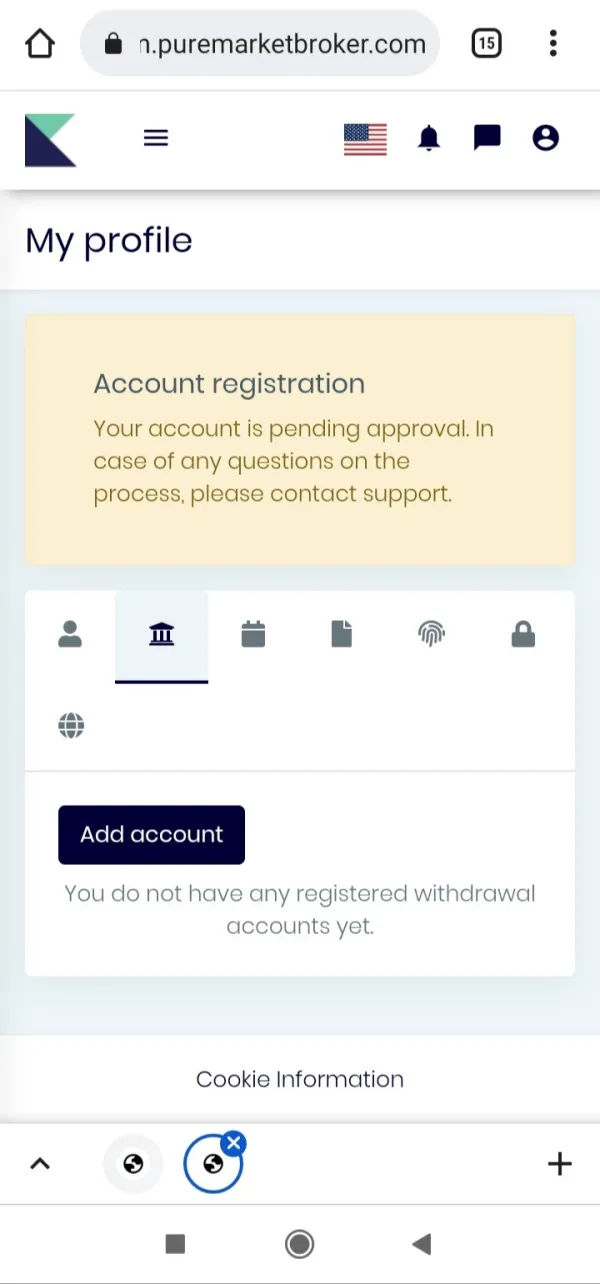

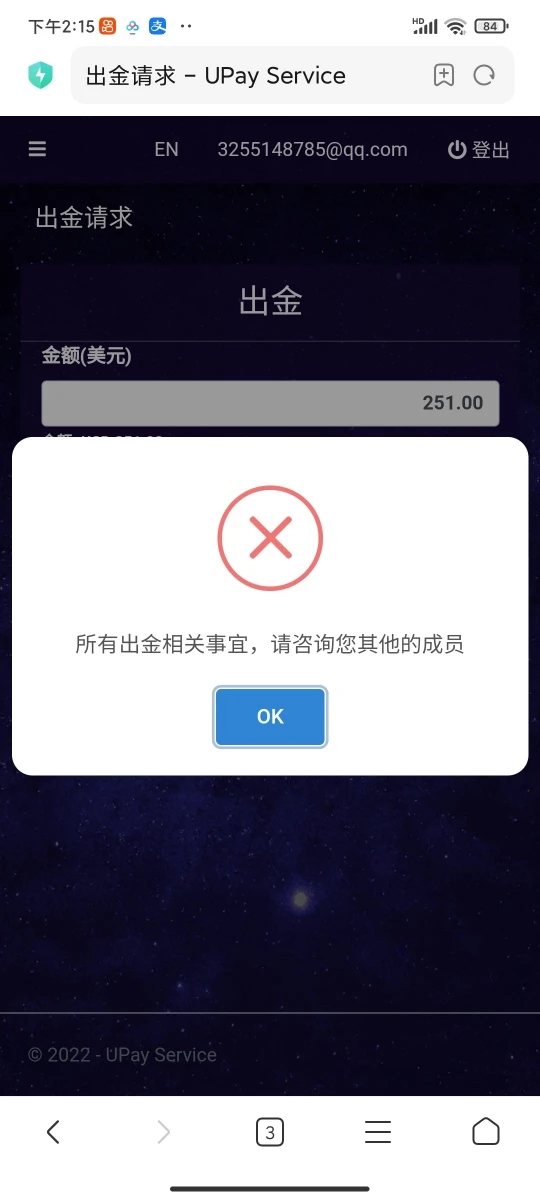

Deposit and Withdrawal

Pure Market supports 4 types of payment options: Sepa, Bitcoin, Ethereum, and Tether.

| Payment Options | Deposit Fees | Withdrawal Fees |

| SEPA | ❌ | €5 |

| BITCOIN | ❌ | |

| ETHREUM | ||

| TETHER |

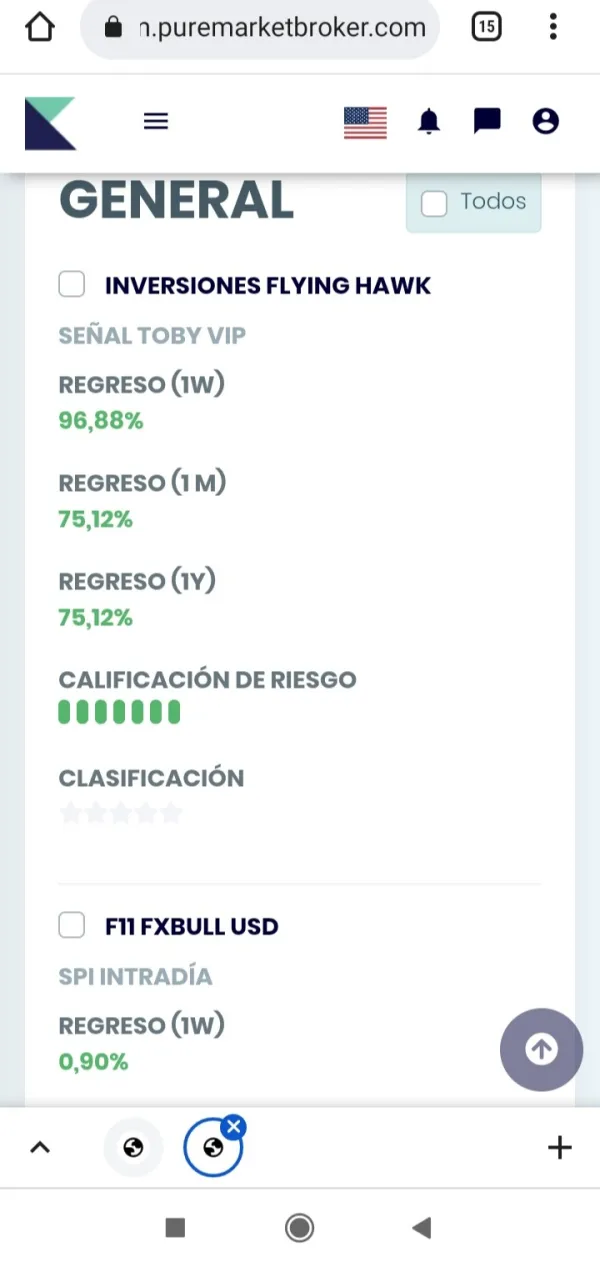

FX2448933115

Argentina

I deposited $ 67.21 in this company but they said everything was wrong. They did not deal with my payment and sent me the signal that they broke down.

Exposure

FX4183501898

Hong Kong

Ponzi Scheme that cannot withdraw anymore. Everyone does not be deceived. It is romance scam.

Exposure

7791

Indonesia

It's pretty chill—easy to navigate and the support team is always ready to help. But the fees for opening and closing trades caught me off guard. Just keep that in mind if you're thinking about jumping in.

Positive

Geeky

Malaysia

Trading with Pure Market? It's been okay. Their service - pretty solid and the communication was spot on. Uri, one of their brokers, was really good at finding deals within my budget. That was neat. What wasn’t so neat was their fee structure. High commission, charges for opening and closing trades, even a withdrawal fee. All those costs started eating into my profits. That's something I didn't experience with other brokers. On a brighter note, their customer support was prompt and withdrawals were smooth. After a year of trading though, I’m still waiting to see some serious profits. To sum up, Pure Market has its upsides but the downsides are there too.

Neutral

Ln

Indonesia

If you look for brokers to trade with, please ignore Pure Market. It is a very bad and cheap broker, offering you fake spreads and trading conditions, slow order execution, and its customer service were very unprofessional… Please don’t come, guys.

Neutral