Company Summary

| Aspect | Information |

| Registered Country | New Zealand |

| Founded Year | 2010 |

| Company Name | CTRL INVESTMENTS |

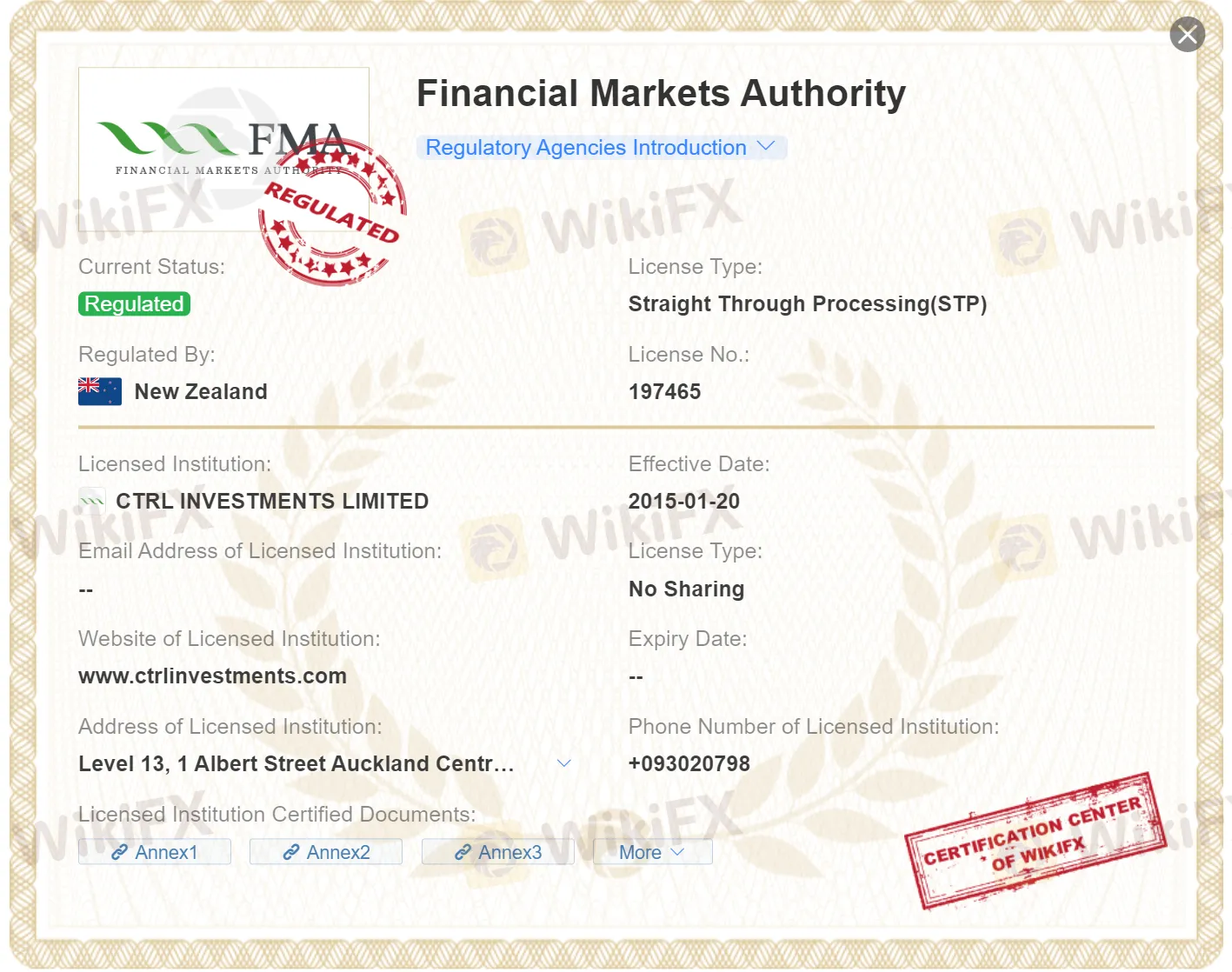

| Regulation | ASIC, FMA |

| Minimum Deposit | $250 |

| Maximum Leverage | 1:400 |

| Spreads | N/A |

| Trading Platforms | MT4 |

| Tradable Assets | forex currency pairs, commodities, indices, cryptocurrencies, shares, and ETFs (exchange-traded funds) |

| Account Types | N/A |

| Demo Account | Available |

| Islamic Account | Available |

| Customer Support | Email and Phone |

| Payment Methods | VISA, MasterCard, Bank Transfer |

| Educational Tools | Not specified |

Please note that some information is not specified or available for CTRL INVESTMENTS. It is recommended to reach out to the broker directly for more detailed and up-to-date information regarding their services and offerings.

Overview of CTRL INVESTMENTS

CTRL INVESTMENTS, founded in 2010, is a brokerage firm registered in New Zealand. It operates under the regulation of ASIC and FMA, offers a diverse range of tradable assets, including forex currency pairs, commodities, indices, cryptocurrencies, shares, and ETFs.

To open an account with CTRL INVESTMENTS, a minimum deposit of $250 is required. This entry-level deposit allows traders with varying budgets to participate in the financial markets. For traders who follow Islamic principles, CTRL INVESTMENTS offers Islamic accounts that are compliant with Sharia law. These accounts are designed to accommodate the unique requirements of Islamic finance, such as the prohibition of interest. The maximum leverage offered by the broker is up to 1:400, which provides traders with the potential to amplify their trading positions. However, it's important to note that higher leverage also carries higher risk, so prudent risk management is advised.

The trading platform available is MT4, which is widely recognized and popular among traders. They also provide a demo account for traders to practice their strategies. When it comes to customer support, CTRL INVESTMENTS offers assistance via email and phone. This ensures that traders can easily reach out for any inquiries or support they may require throughout their trading journey.

Accepted payment methods include VISA, MasterCard, and bank transfer. Although not specified, CTRL INVESTMENTS may provide educational tools to support traders' learning and development.

Is TRI legit or a scam?

CTRL INVESTMENTS operates under the oversight and regulation of reputable financial authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Markets Authority (FMA). These regulatory bodies ensure that CTRL INVESTMENTS complies with the necessary rules, regulations, and standards to provide financial services in a secure and transparent manner. By being regulated by ASIC and FMA, CTRL INVESTMENTS demonstrates its commitment to maintaining a high level of professionalism and protecting the interests of its clients. The regulation helps foster trust and confidence in CTRL INVESTMENTS, assuring clients that their investments are being handled by a company that operates within the framework of regulatory guidelines and industry best practices.

Pros and Cons

CTRL INVESTMENTS offers several advantages to traders, such as a wide range of tradable assets including forex, commodities, indices, and cryptocurrencies. The availability of multiple trading platforms, including MT4 and a web-based platform, provides flexibility and convenience for traders. The broker also offers competitive leverages, allowing traders to potentially maximize their profits. Additionally, CTRL INVESTMENTS is regulated by ASIC and FMA. On the downside, CTRL INVESTMENTS does not provide specific information about minimum deposits, which may make it challenging for some traders to determine the initial investment required. Furthermore, the lack of information regarding educational resources and customer support options may be seen as a drawback for traders seeking additional guidance and assistance.

| Pros | Cons |

| Wide range of tradable assets | Lack of information about minimum deposits |

| MT4 trading platform supported | Limited educational resources |

| Competitive leverages | Lack of detailed customer support options |

| Regulated by ASIC and FMA | Limited payment methods |

| User-friendly interface | Inactivity fees |

| Demo account available | Limited research tools |

| Advanced charting and analysis tools | Limited account types |

| Access to market news and analysis | Limited transparency on pricing execution |

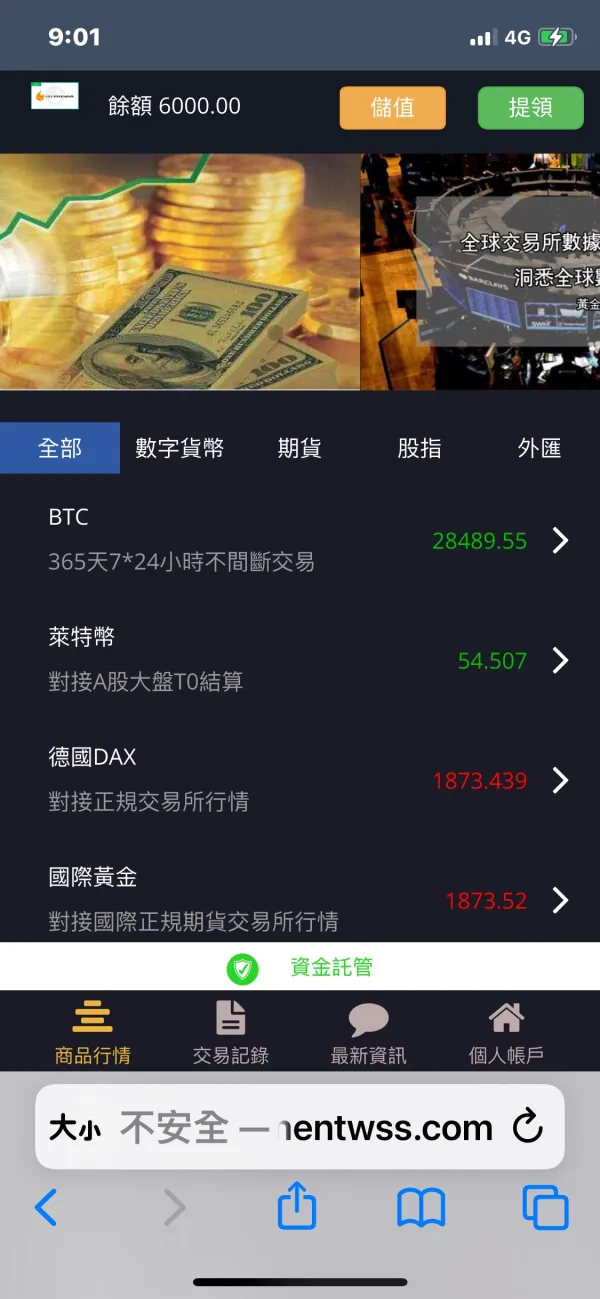

Market Intruments

CTRL INVESTMENTS offers a wide range of market instruments for trading, including forex currency pairs, commodities, indices, cryptocurrencies, shares, and ETFs (exchange-traded funds). These instruments provide traders with diverse opportunities to participate in the global financial markets.

Forex trading involves the buying and selling of different currency pairs, allowing traders to speculate on the exchange rate fluctuations.

Commodities include various raw materials such as gold, silver, oil, and agricultural products, which can be traded based on their market prices.

Indices represent a group of stocks from a specific region or sector, providing a snapshot of the overall market performance.

Cryptocurrencies are digital currencies that offer traders the chance to speculate on their price movements.

Shares refer to ownership in individual companies, allowing traders to invest in specific businesses.

ETFs are investment funds that track the performance of a specific market index or sector, offering traders diversified exposure to a basket of assets.

With these market instruments, CTRL INVESTMENTS aims to cater to the trading preferences and strategies of its clients, providing them with a wide array of options to build their portfolios and potentially profit from various market movements.

Account Types

CTRL INVESTMENTS offers a range of account types designed to cater to the diverse needs of traders. These account types provide different features and benefits to enhance the trading experience. While live trading accounts are currently not available with CTRL INVESTMENTS, traders can still access two specific account types.

Firstly, CTRL INVESTMENTS offers Islamic accounts, which are tailored for clients who follow the principles of Islamic finance. These accounts comply with Shariah law by ensuring that trading activities are conducted in a manner that aligns with Islamic principles.

Secondly, CTRL INVESTMENTS provides demo accounts, allowing traders to practice their trading strategies and familiarize themselves with the trading platform. Demo accounts simulate real market conditions without the risk of losing actual funds, providing a risk-free environment for traders to hone their skills and explore the platform's features.

To open an account with CTRL INVESTMENTS, a minimum deposit of $250 is required. It's important to note that the minimum deposit may vary depending on the type of account and trading platform chosen.

How to open an account?

Opening an account with CTRL INVESTMENTS is a straightforward process that can be completed in a few simple steps.

To begin, visit the official website of CTRL INVESTMENTS and locate the “Open Account” or “Sign Up” button. Click on it to initiate the account opening procedure.

You will be directed to a registration page where you need to provide your personal information, including your full name, email address, phone number, and country of residence. Additionally, you may be required to choose the desired account type, such as a demo or Islamic account.

Once you have filled in the required details, carefully review the terms and conditions of CTRL INVESTMENTS and, if you agree, proceed to submit your application. Depending on the broker's verification process, you may need to provide additional documentation to confirm your identity and address.

After your account has been successfully verified, you will receive your login credentials, including a username and password. These credentials will grant you access to the trading platform and allow you to fund your account.

It is important to note that the account opening process may vary slightly depending on the specific requirements and procedures of CTRL INVESTMENTS. Therefore, it is recommended to refer to the broker's official website or contact their customer support for detailed and accurate instructions on how to open an account.

Leverage

CTRL INVESTMENTS offers traders the opportunity to utilize leverage of up to 1:400. This leverage allows traders to potentially amplify their trading positions in the financial markets, enabling them to control larger positions with a smaller amount of capital. By leveraging their investments, traders can potentially increase their potential profits, although it's important to note that higher leverage also involves higher risk. CTRL INVESTMENTS provides this leverage option to empower traders with greater flexibility and potential opportunities in their trading activities.

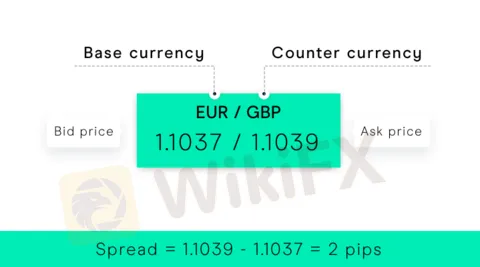

Spreads & Commissions (Trading Fees)

CTRL INVESTMENTS distinguishes itself as a broker that prioritizes a commission-free trading environment. This means that clients can execute trades without incurring any additional commission charges. As for the spreads, which represent the difference between the bid and ask prices, they are not fixed and can fluctuate based on market conditions. Specifically, when considering the widely traded EUR/USD currency pair, the spread typically starts from approximately 1.8 pips. While this spread may be slightly higher than the average industry standard of around 1.5 pips, it is important to note that the impact on trading costs remains relatively moderate.

Non-Trading Fees

CTRL INVESTMENTS imposes certain non-trading fees on its clients. These fees are separate from the costs directly associated with trading activities. While specific details regarding the non-trading fees of CTRL INVESTMENTS are not available, it's important to be aware that such fees may include charges for account maintenance, inactivity, withdrawals, or currency conversions. These fees are applicable in situations where clients engage in non-trading activities or require specific services beyond the scope of regular trading. It is advisable for clients to review the terms and conditions provided by CTRL INVESTMENTS to obtain a comprehensive understanding of the applicable non-trading fees.

Trading Platform

CTRL INVESTMENTS offers a robust trading platform, the CTRL Trader, which provides traders with a powerful and intuitive trading experience. The CTRL Trader platform is based on the popular and widely used MetaTrader 4 (MT4) trading platform. It allows traders to access real-time market data, execute trades, analyze charts and indicators, and manage their trading accounts efficiently. With a user-friendly interface and advanced features, the CTRL Trader platform enables traders to make informed trading decisions and take advantage of market opportunities. Whether it's placing market orders, setting stop-loss and take-profit levels, or utilizing expert advisors, the CTRL Trader platform offers a range of tools and functionalities to enhance the trading experience. Traders can also benefit from the platform's mobile version, enabling them to stay connected to the markets and manage their trades on the go.

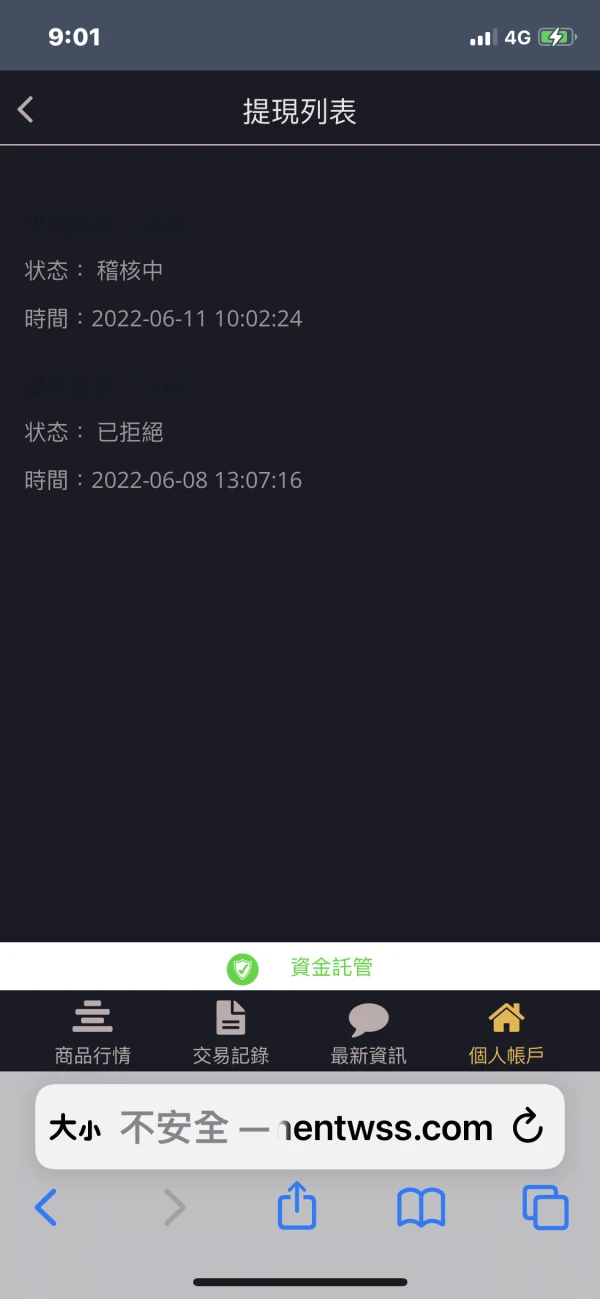

Deposit & Withdrawal

CTRL INVESTMENTS offers a limited range of payment options for depositing and withdrawing funds. The supported methods include VISA, Mastercard, and bank transfer. While these options provide some flexibility for clients, it is worth noting that the available choices are relatively limited compared to other brokers in the market. Clients may find it necessary to consider alternative payment methods if they prefer more diverse options for managing their funds. It is advisable to carefully review the available payment options before choosing CTRL INVESTMENTS as a broker, especially if specific payment methods are important to you.

The withdrawal processing time at CTRL INVESTMENTS is typically up to five business days. It is important to note that this timeframe is an estimate and can vary depending on various factors, including the payment method chosen and any potential delays caused by third-party payment processors or banks.

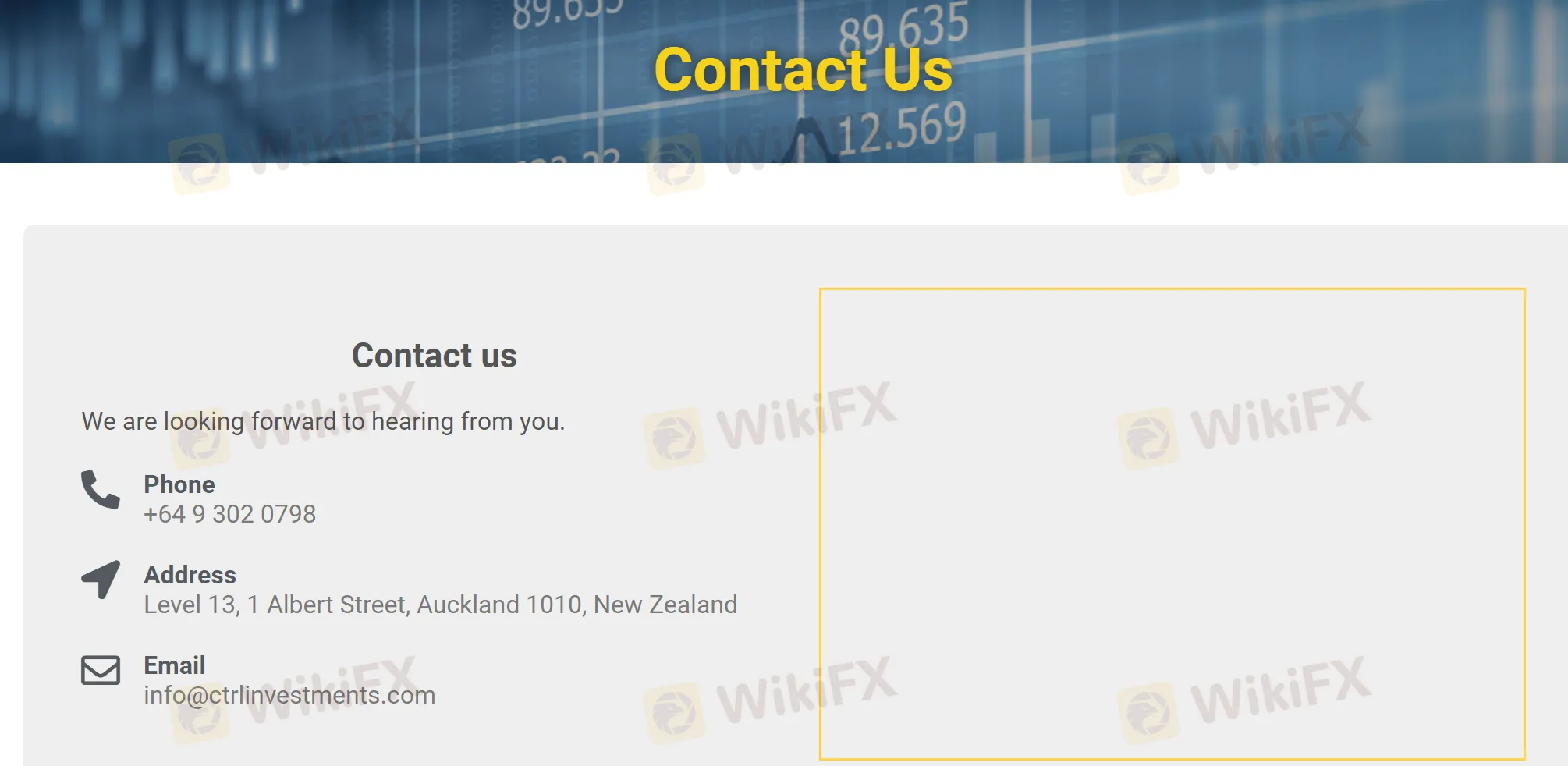

Customer Support

Clients can contact the customer support team through various channels, including email and phone. However, online chat support is not available at the moment. The customer support team is dedicated to providing timely and professional assistance, ensuring that clients' needs are addressed promptly and effectively. Whether clients have questions about their accounts, trading platforms, or any other related inquiries, the customer support team is readily available to provide support and guidance.

Conclusion

In conclusion, CTRL INVESTMENTS offers a user-friendly trading platform and a variety of tradable assets, allowing clients to diversify their investment portfolios. Additionally, the availability of a demo account can be beneficial for traders looking to enhance their knowledge and skills without risking any real money.

However, there are also some drawbacks to consider. CTRL INVESTMENTS has a limited range of payment options, which may be inconvenient for clients who prefer alternative methods. Additionally, the absence of specific information regarding regulation and the minimum deposit requirement may raise concerns for some traders. It is important to thoroughly research and evaluate the broker's offerings and consider these factors before making a decision.

FAQs

Q: Is CTRL INVESTMENTS regulated?

A: CTRL INVESTMENTS is a regulated broker. It operates under the jurisdiction of ASIC and FMA, which ensures compliance with certain standards and guidelines to protect the interests of clients.

Q: What is the minimum deposit required to open an account with CTRL INVESTMENTS?

A: The minimum deposit requirement to start trading with CTRL INVESTMENTS is $250.

Q: What trading platforms are offered by CTRL INVESTMENTS?

A: CTRL INVESTMENTS provides its clients with a popular MT4 trading platform.

Q: Does CTRL INVESTMENTS offer a demo account?

A: Yes, CTRL INVESTMENTS offers a demo account for clients to practice and familiarize themselves with the trading platform. The demo account allows users to trade virtual funds without risking real money.

Q: What payment methods are accepted by CTRL INVESTMENTS?

A: CTRL INVESTMENTS accepts various payment methods, including VISA, MasterCard, and bank transfers. These payment options provide clients with flexibility in depositing and withdrawing funds from their trading accounts.

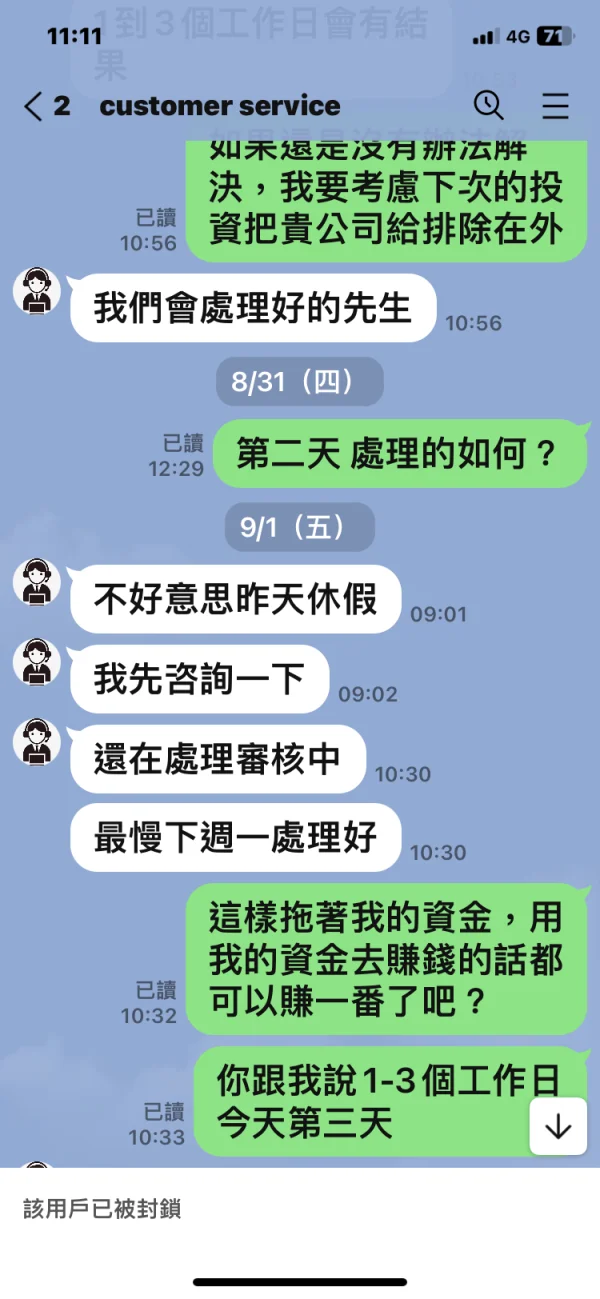

大熊5739

Taiwan

From the moment I applied for a withdrawal, the platform kept saying for various reasons that my account was suspected of money laundering. Someone complained that there was a problem with my account. They also asked me to pay a deposit of 1,000 USDT and asked for bank statements. Then they ignored me.

Exposure

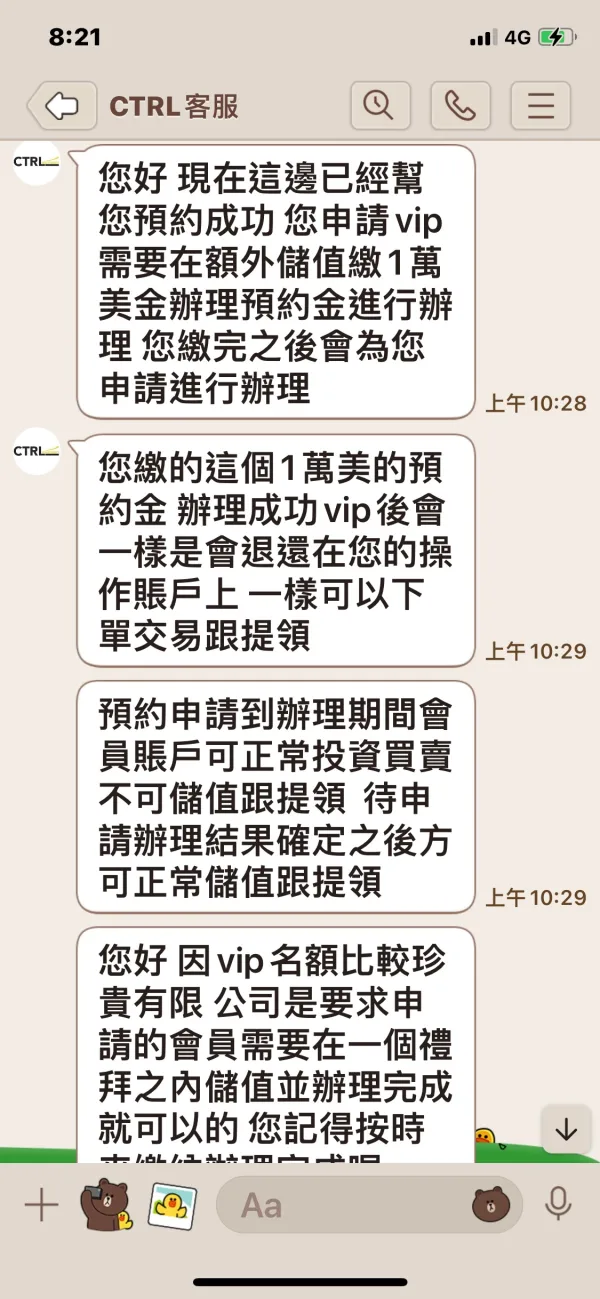

FX8583568842

Taiwan

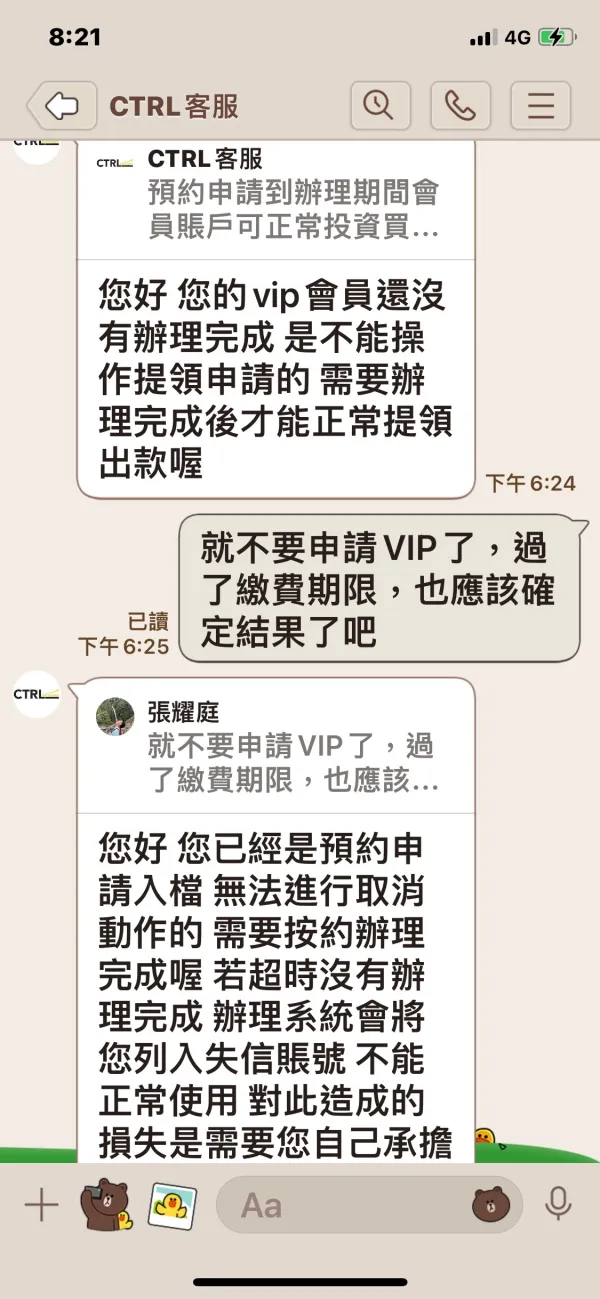

http://www.ctrlinvestmentwss.com/index/login/login/token/a720fb405779e12854ea1012a138d4e3.html The registered area code 1507 was knocked on the dating software, and we had a good chat. Invest, pique your interest, and then give you the above platform. (This is the great part. I will chat with you awkwardly, and then I will slowly lead you to be hooked. It is not like the usual knocking on you and directly chatting with you.) This woman will keep asking you to deposit money...wait for it, she will be deducted when the withdrawal is made. The 10% handling fee was not told to you at the beginning, but in the end, you will be asked to apply for VIP without handling fees. When applying, the customer service will ask to pay an appointment deposit of 10,000 USD within one week, and the deposit cannot be withdrawn during this period. At this time, I noticed something was different. I tried to withdraw it during the period, but it was rejected. I wanted to wait for a week to automatically cancel the reservation, and then deduct 10% for it, and then the customer service will always ask you to deposit 10,000 USD to withdraw normally. . Who wants to be ripped off a second time. A total of 8333 USD was lost. Then the girl also lost contact during the middle period. Anyway, I have been asking you to deposit gold under some names (the color of the background deposit and withdrawal of gold is close to black, and the pictures must be carefully placed to see clearly)

Exposure

Mark Martinez

Netherlands

User-friendly platform is powerful, even for beginners. Great selection of research tools and economic calendars.

Positive

wsadqer

Mexico

Everything went smoothly. I did as the customer service said and the funds arrived in my account in less than an hour.

Positive

amy3931

South Korea

This platform is good. I have operated it for more than a year, and the market is still very accurate.

Positive

tayyab5718

Pakistan

CTRL INVESTMENTS holds a valid regulatory license and has been operating for over a decade, during which there have been no reported cases of fraud. Therefore, you can confidently entrust your funds to this firm. As someone who traded with them for several months, I can attest to the excellence of their services.

Positive

芯芯爸爸

Cyprus

Terrible! Quotes are freezing and lagging, and I cannot close my order. CTRL INVESTMENTS’ s customer support is doing nothing. I feel so scammed.

Neutral

Fredo5836

Nigeria

Very very good, I received my withdrawal n less than 1 hour n my wallet

Positive

彬斌

New Zealand

CTRL INVESTMENTS has been established for more than ten years and has a qualified regulatory license. No one has been defrauded so far, so you can safely hand over your money to him. I tried trading for a few months and I think this company is really good!

Positive