Company Summary

| FXPRIMUS Review Summary | |

| Founded | 2009 |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC |

| Market Instruments | Forex, Equities, Energies, Precious Metals, Indices, Cryptocurrencies, Stocks |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 1.5 pips (PrimusCLASSIC account) |

| Trading Platforms | MT4, MT5, WebTrader |

| Minimum Deposit | $15 |

| Customer Support | Contact form, live chat 24/5 |

| Email: support@fxprimus.com | |

| Facebook, Twitter, Instagram, LinkedIn, YouTube | |

| Address: Govant Building, BP 1276, Port Vila, Vanuatu | |

| Kolonakiou 57, Linopetra, 4103, Limassol Cyprus | |

FXPRIMUS is a CySEC-regulated retail forex and CFD broker, founded in 2009 and headquartered in Cyprus. FXPRIMUS offers trading on diverse financial instruments including Forex, Equities, Energies, Precious Metals, Indices, Cryptocurrencies, and Stocks. It provides different account types with $15 minimum deposits and flexible leverages. As to trading platforms, MT4, MT5, and WebTrader are supported.

Pros and Cons

| Pros | Cons |

| Regulated by CYSEC | Expired license with the FSCA |

| Diverse customer support channels | Offshore license with the VFSC |

| Demo accounts available | High leverage risks |

| A wide range of products | |

| Diverse account types | |

| Low minimum deposit | |

| Flexible leverage ratios | |

| Multiple trading platforms |

Is FXPRIMUS Legit?

Yes, FXPRIMUS is regulated by CySEC. However, please note that it has an expired license with the FSCA and an offshore license with the VFSC.

| Regulated Country | Regulated Authority | Current Status | Regulated Entity | License Type | License Number |

| The Cyprus Securities and Exchange Commission (CySEC) | Regulated | Primus Global Ltd | Market Maker (MM) | 261/14 |

| The Financial Sector Conduct Authority (FSCA) | Expired | PRIMUS AFRICA (PTY) LTD | Financial Service Corporate | 46675 |

| The Vanuatu Financial Services Commission (VFSC) | Offshore Regulated | Primus Markets INTL Limited | Retail Forex License | 14595 |

What Can I Trade on FXPRIMUS?

On FXPRIMUS, you can trade with Forex, Equities, Energies, Precious Metals, Indices, Cryptocurrencies, and Stocks.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Energies | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Mutual Funds | ❌ |

Account Type

| Account Type | Minimum Deposit |

| PrimusCLASSIC | $15 USD |

| PrimusPRO | $500 USD |

| PrimusZERO | $1,000 USD |

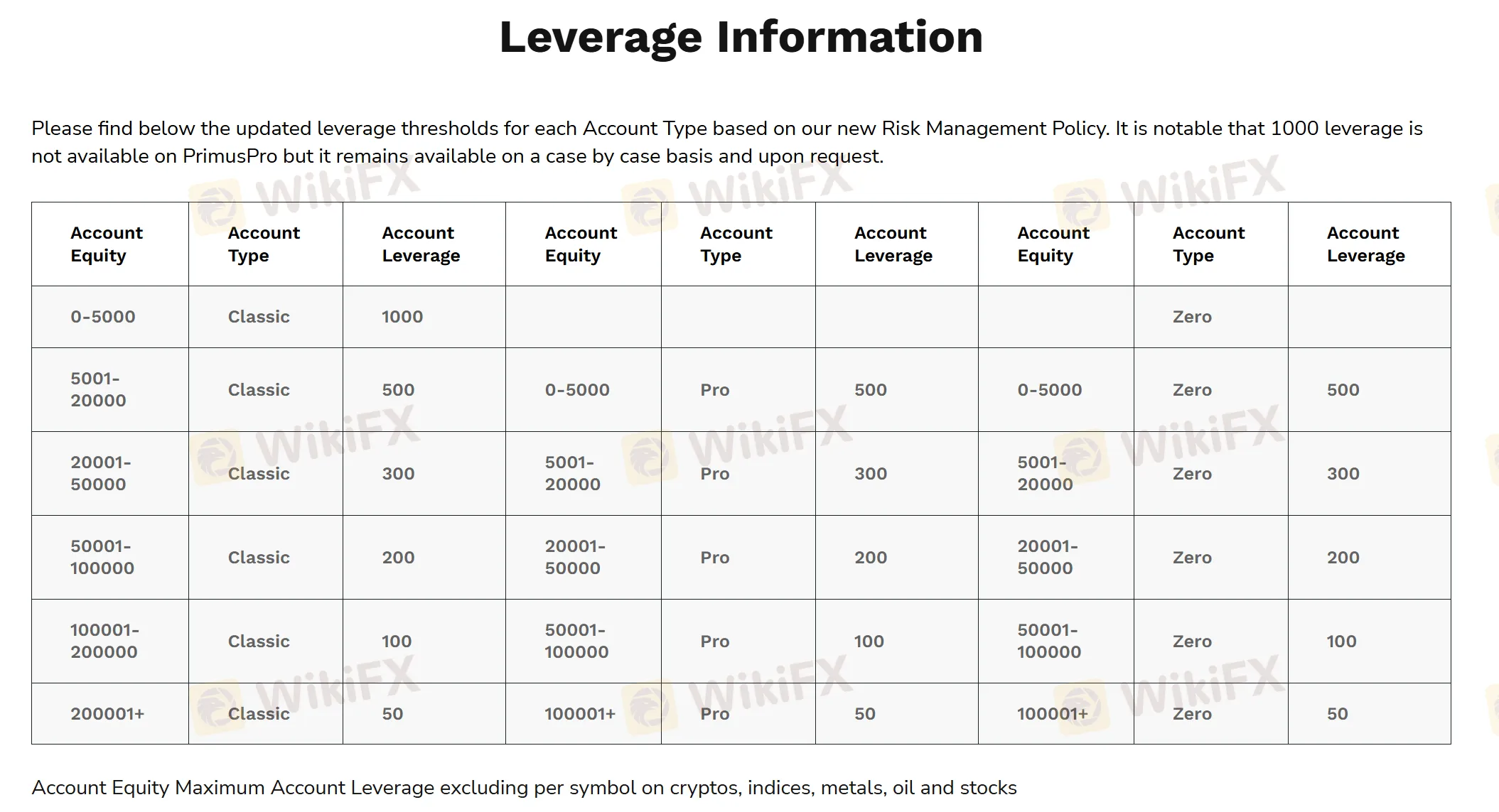

Leverage

The maximum leverage is up to 1:1000 for PrimusCLASSIC account. Note that high leverage can amplify both profits and losses.

| Account Type | Maximum Leverage |

| PrimusCLASSIC | 1:1000 |

| PrimusPRO | 1:500 |

| PrimusZERO | 1:500 |

Spreads and Commissions

Spreads and commissions vary on the account type, detailed info are as follows:

The PrimusCLASSICaccounthas no commission fees, both starting from 1.5 pips for the average spread.

ThePrimusPRO account offers a lower spread starting from 0.3 pips, but with a commission of $8 (on MT5).

ThePrimusZERO account has the lowest spread, starting from 0 pips, and charges a commission of $5.

| Account Type | Spread | Commission |

| PrimusCLASSIC | From 1.5 pips | ❌ |

| PrimusPRO | From 0.3 pips | $8 (MT5) |

| PrimusZERO | From 0 pips | $5 |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Windows, iOS, Android | Beginners |

| MT5 | ✔ | Windows, iOS, MAC, Android | Experienced traders |

| WebTrader | ✔ | / | / |

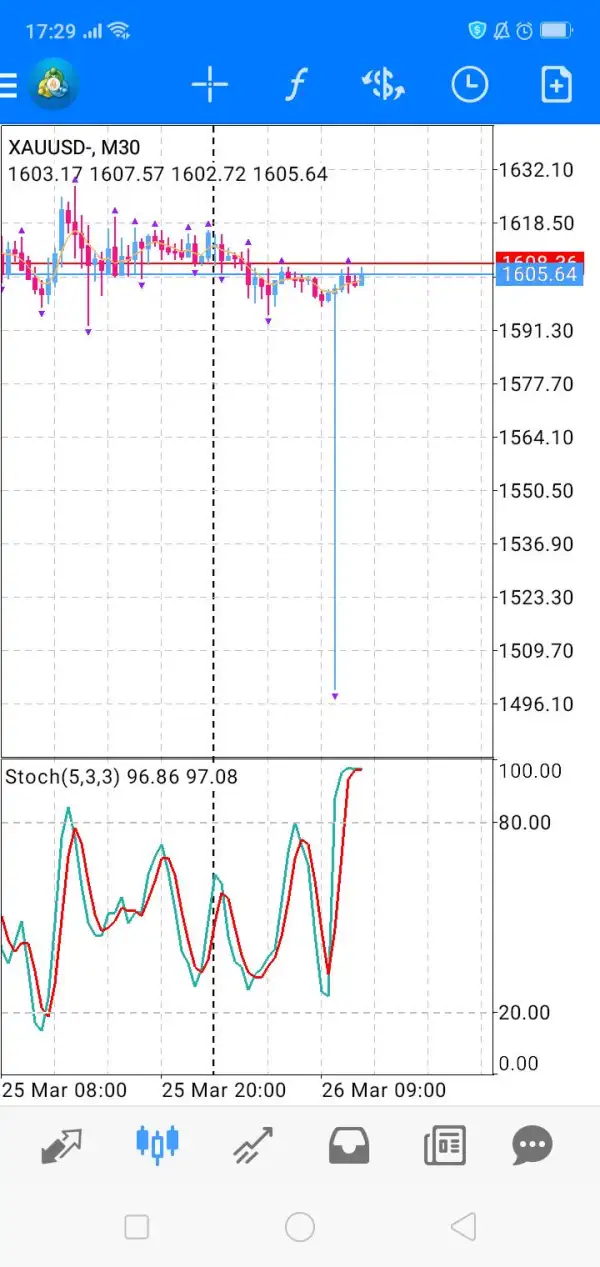

ShahAET15

Malaysia

FxPrimus outrages insane ridiculous spike and slippage. You guys can check today date 26th March 2020 for commodity Gold at 10:00 metarader time. You can clearly this broker are doing SL hunting. You guys can compare with other broker most of it don't have this crazy down spike as FxPrimus. I've already check myself to compare with other broker such as Gkfx, XM , RoboForex, Liteforex, VantageFx and IG. All these broker don't have that even a slide slippage they are clean.

Exposure

MrTrader

United States

A pure Market making who use plugins against their customers; beside that if you make profits they will take your profits and ban your account ( without any notification) accusing you about something that they don't even show any proofs. Also they violate the AML rules, where I deposit in BTC and they returned all my funds via skrill. DONT OPERATE WITH THEM. THEY WILL NOT PAY YOUR PROFITS.

Exposure

FX4223519069

Vietnam

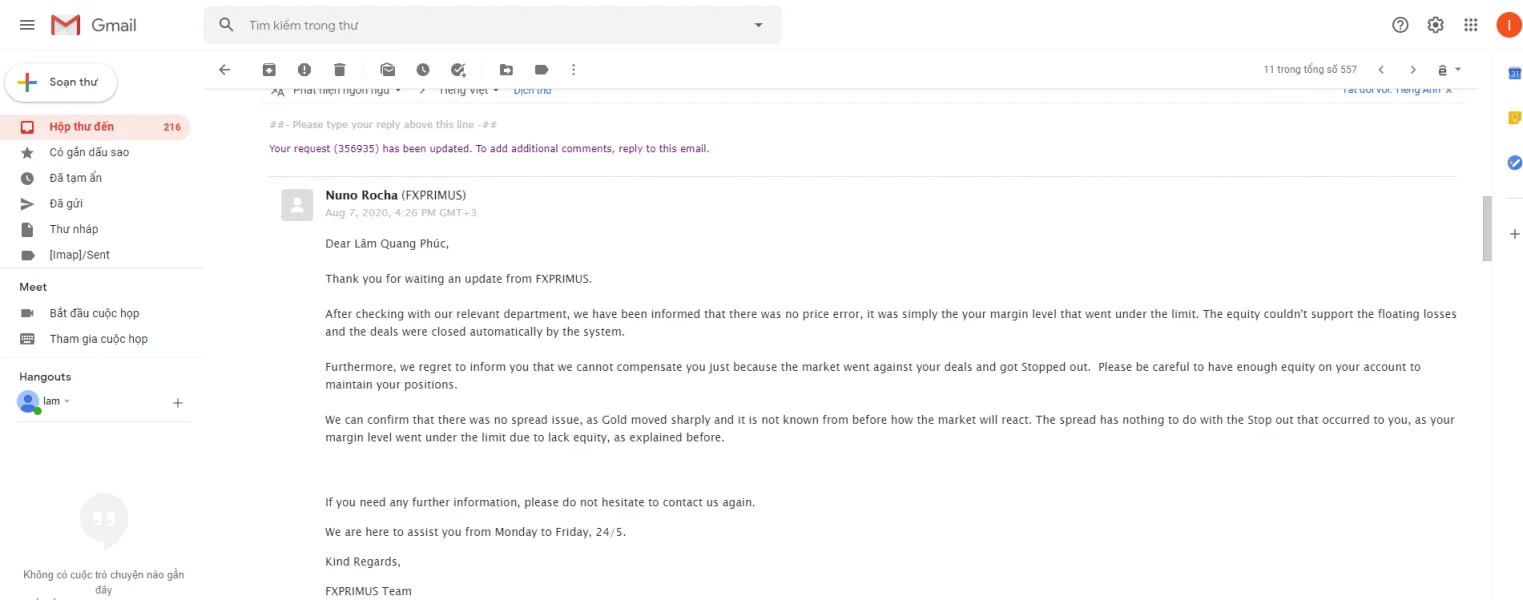

fxprimus mt4 platform running xauusd command on 1990.61, causing my account to fail stopout 4 sell xauusd orders resulted in my account being -1211.8 $ -Gold price at the server Fx-primusMarket live highest at the time above was 1990 (see attached photo) -Gold price at the server Fx-primusMarket live 3 highest at the time above was 1985 (attached photo) I emailed the team support and receive feedback (photo attached): The support team confirmed to me that there is no spread spread problem but the price difference at 2 servers is 50 pips, this is really unacceptable. I checked the gold price at that time on other exchanges like Icmarket, GoMarket, tickmill… and tradingview are also 1985 highs. Even though I did send a counter email many times on this issue but the support team did not consider compensating me. If the gold price were to follow the market, my account would not have burnedand make a profit on that day (the lowest price of gold that day is 1958). This is a deceitful act is condemned and deserves a low rating.

Exposure

FX4689902532

Pakistan

I am using from 3 month and satisfied easy withdrawal and deposit

Positive

JohnMalati

India

Their loyalty program offers nice perks for regular traders

Positive

Jerry444

India

Very transparent with fees and commissions.

Positive

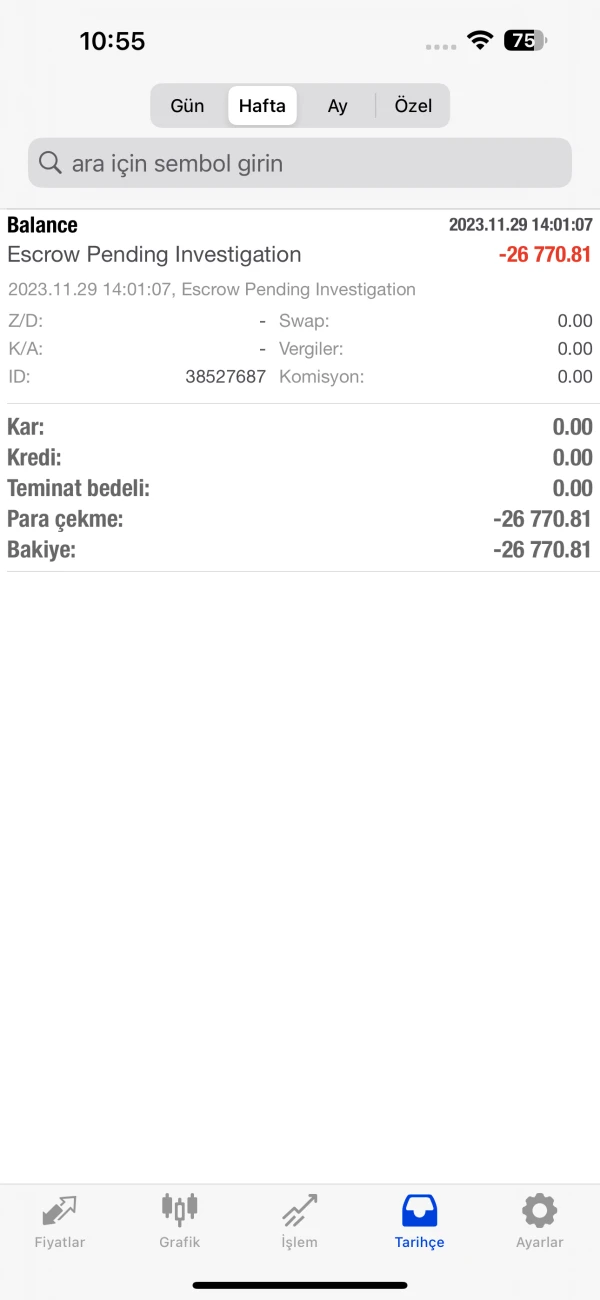

Nil223

Turkey

This fraudulent company has not paid my money in any way for 2 months. If you look at the complaints, they stole the money of many investors and finally deleted the money from the commodity, there is no ongoing investigation, they just slander and do not give any feedback.

Exposure

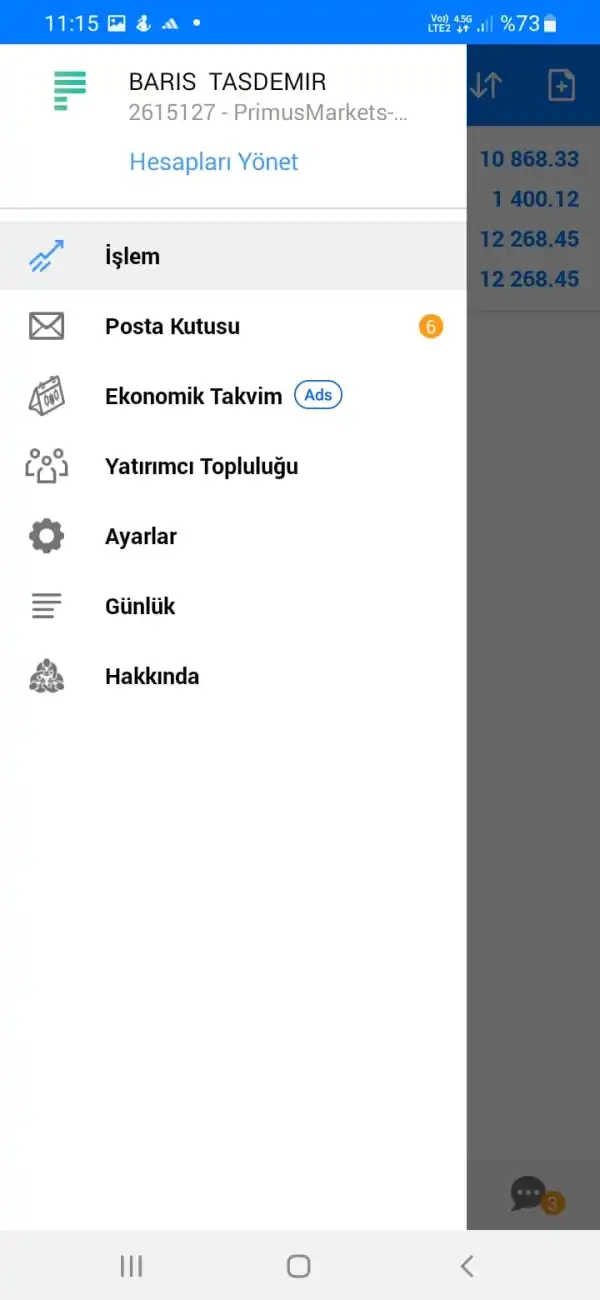

barış

Turkey

fxprimus does not pay my money and I cannot reach any official. They have taken the money from my account. Do not trust this institution. Do not invest at all.

Exposure

uygar

Turkey

Primus did not pay my money, they deducted my money from Met4 and added it to their own safe. They do not pay my money and I cannot reach any official.

Exposure

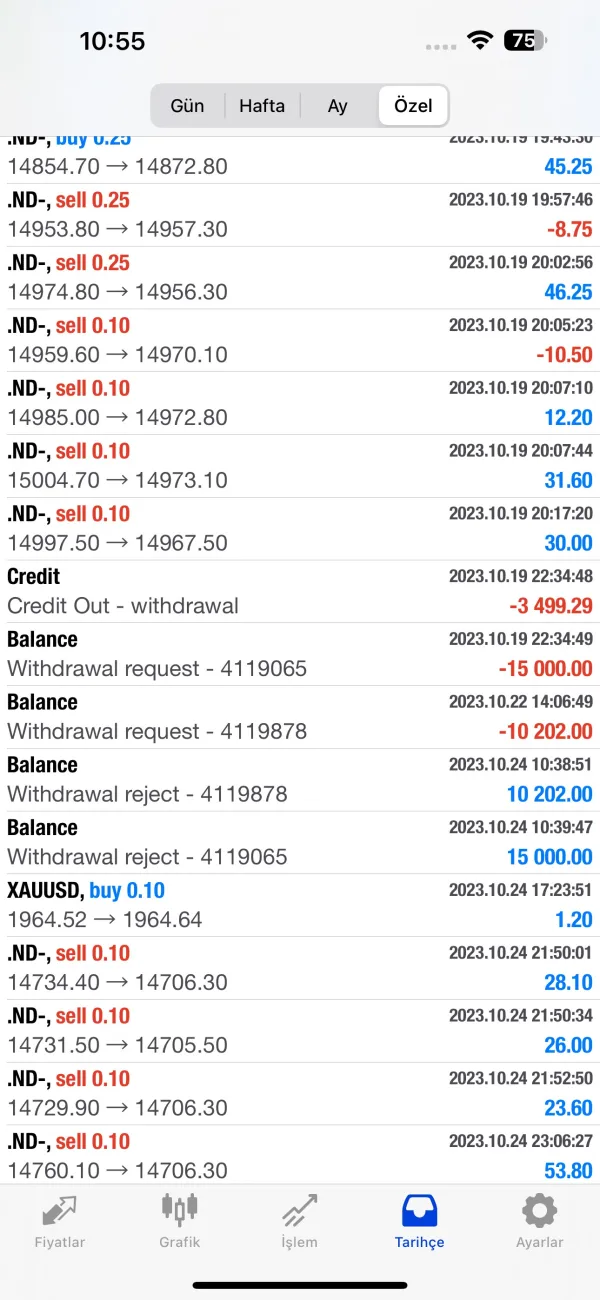

Dilvin

Turkey

Hello,Company on the subject: Primus Markets INTL LtdI first created my account on October 18, 2023.I secured funding and started trading on October 19, 2023.I tried to withdraw my money after October 20, 2023, but the company says it will not pay my money.I don't even understand what I'm accused of.They constantly send me an e-mail and say it is based on this.I am an individual trading normally.I request you to help me get my money from the company.They deleted my money from the Metatrader application. It's starting to get very annoying now.Thanks.

Exposure

Poul6012

Germany

Started trading with Primus broker at FXPRIMUS recently. As a newbie, I'm finding their platform user-friendly and pretty straightforward. Spreads seem fair, and the support team is helpful when you're in a bind. So far, it's a decent experience for someone just getting into the trading scene.

Positive

XGOLD

Australia

FXPRIMUS impresses with strong protection measures, including negative balance protection and segregated accounts. The diverse account types cater to various trading styles, though some require higher minimum deposits. Competitive spreads, multiple platforms, and comprehensive educational resources make it a reliable choice for traders concerned about fund security.

Neutral

Friscoo

Peru

OFX has been my go-to platform for seamless currency exchange. The competitive rates and 24/7 customer support make it reliable for international transactions. However, the user interface could use some improvement, as it's not as intuitive as I'd like. Overall, a trustworthy choice for businesses, but a more user-friendly platform would enhance the experience.

Neutral

Austina

Australia

FXPRIMUS has been my go-to broker for a year.The low $15 minimum deposit and absence of fees make it beginner-friendly. The diverse market instruments and transparent trading platforms like MT4 and MT5 add versatility. Customer service is available 24/5 through live chat and email.

Neutral

barış

Turkey

This institution is not paying the money I invested, it is making me a victim. It has been a month and still no solution has been found and it does not provide any response, I need you to help me.

Exposure

uygar

Turkey

This company does not pay my money, it says that it cannot pay for ridiculous reasons, it has been 2 months and it has confiscated my money and now there is no response.

Exposure

Aziz3152

Turkey

I have made a deposit to fx primus company 2 times And although my account is below the amount I deposited, it does not send my money, I have been scammed very badly, I cannot withdraw my money, The company has cut off communication with me And is not responding, This is a big fraud case, I hear that many investors in Turkey have been scammed by the same method.

Exposure

uygar

Turkey

I cannot get my money in this institution. I expect you to intervene in this. I have full faith that this fraud disturbs you as well.

Exposure

Janny9015

Netherlands

"I've been trading forex for a few years now, and I've tried a number of brokers. But when I came across fxprimus, I felt like I'd found a good fit. I decided to go for the primus classic account. The range of markets available on fxprimus is vast, which is great for someone like me who likes to keep my options open. But what really impresses me about fxprimus is their commitment to safety. They have third-party oversight for client withdrawals and negative balance protection, which gives me a sense of security when I'm trading. The primus classic account comes with a bunch of perks. There's a little commission, and the average spread starts from just 1.5 pips. Plus, the leverage goes up to 1:1000 on MT4 and MT5, which is pretty impressive. The customer service is also worth mentioning. They're always there when I need them, ready to assist."

Positive

uygar

Turkey

This institution does not withdraw my money and is fraudulent.

Exposure

Nil223

Turkey

I INVESTED 10,000 DOLLARS IN THIS COMPANY ON 10.12.2023 AND ABOUT A WEEK LATER I REQUESTED THE FIRST WITHDRAWAL AND MY MONEY DID NOT ARRIVE. THEN I WANTED TO WITHDRAW MY WHOLE BALANCE. I WAS TOLD THERE IS A TECHNICAL PROBLEM. MAKE YOUR WITHDRAWAL MANUALLY. MONEY HAS BEEN TRANSFERRED AGAIN TO META REQUIRED DOCUMENTS FOR MANUAL WITHDRAWAL REQUEST I CONDUCTED IT, AND I UNDERSTANDED IT AS IT WAS A TECHNICAL PROBLEM AND MY CHECKS DID NOT REACH ME. THE COMPANY DOES NOT RESPOND IN ANY WAY. IF YOU LOOK AT THE OTHER COMPLAINTS, YOU WILL UNDERSTAND THAT THEY FRAUD MANY INVESTORS. THE NECESSARY EVIDENCE IS ATTACHED.

Exposure

Bahar6657

Turkey

I received a withdrawal request from fxprimus company 5 days ago, they still haven't sent my money, they created different activities as I tried to communicate.

Exposure

Alyaz

Turkey

HelloI funded the account number 4614629 on Friday, and although I did not make any transactions, the company rejects the withdrawal request. Even though I haven't made any transactions, I haven't been able to withdraw money for a week because of the company, my e-mails are not answered, and I cannot contact anyone from the company.

Exposure