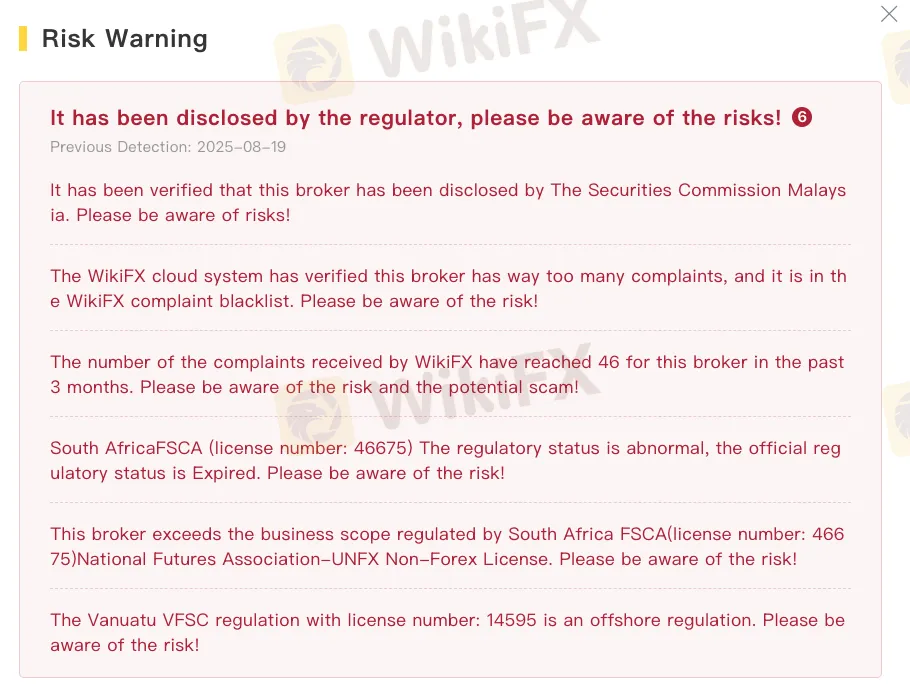

Abstract:Malaysian retail traders still using FXPRIMUS should be aware that the broker has been named on the Securities Commission Malaysia (SC) Investor Alert List for carrying out unlicensed capital market activities.

Malaysian retail traders still using FXPRIMUS should be aware that the broker has been named on the Securities Commission Malaysia (SC) Investor Alert List for carrying out unlicensed capital market activities. FXPRIMUS (“FXprimus” on the SC notice) was added to the list on 23 October 2020 and remains a warned entity. Malaysian investors are advised not to deal with unauthorised entities, per SC guidance.

Why this matters for Malaysians

Under Malaysia‘s Capital Markets and Services Act 2007, dealing in securities/derivatives and providing investment services to the public requires a licence from the SC. The SC’s Investor Alert List is a public warning about firms not authorised to operate in Malaysia. Trading with such firms can leave investors without local recourse if things go wrong.

FXPRIMUSs stated licences and the gaps

- Cyprus (CySEC): FXPRIMUS‘s Cyprus entity (Primus Global Ltd / FX Primus Europe (CY) Ltd) holds CySEC licence 261/14. This can be verified on CySEC’s public register.

- South Africa (FSCA): FXPRIMUS previously referenced FSP 46675 (Primus Africa Pty Ltd). However, an FSCA media release confirms that this FSP number had expired in January 2022.

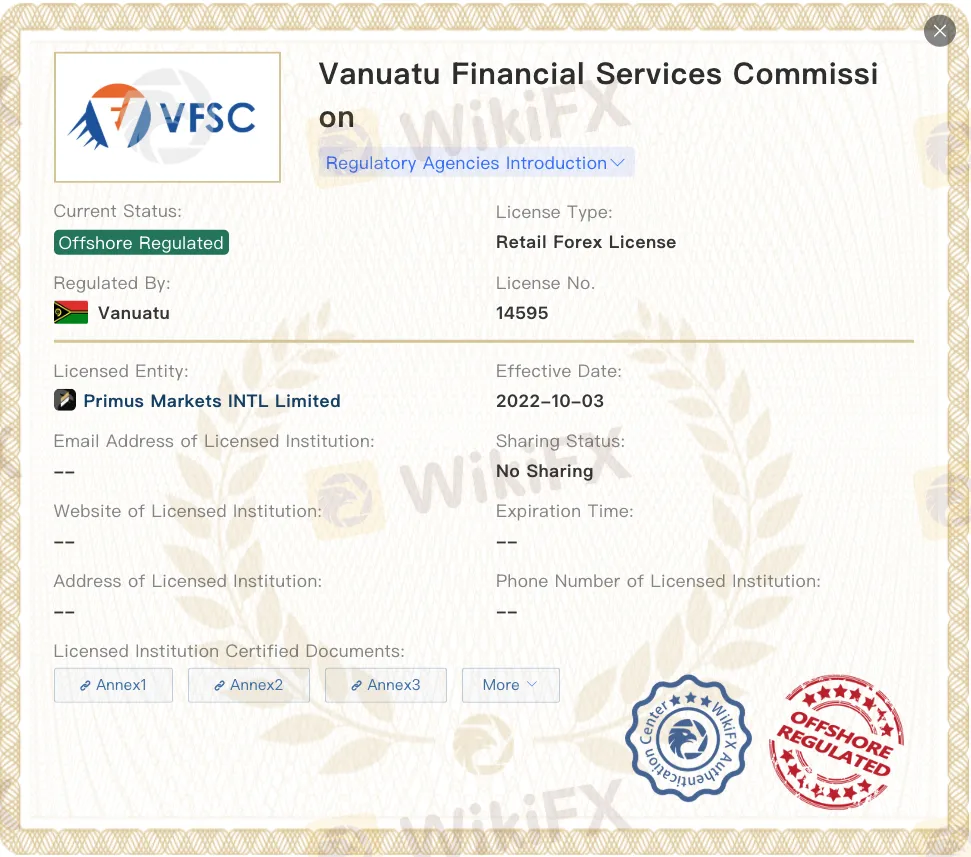

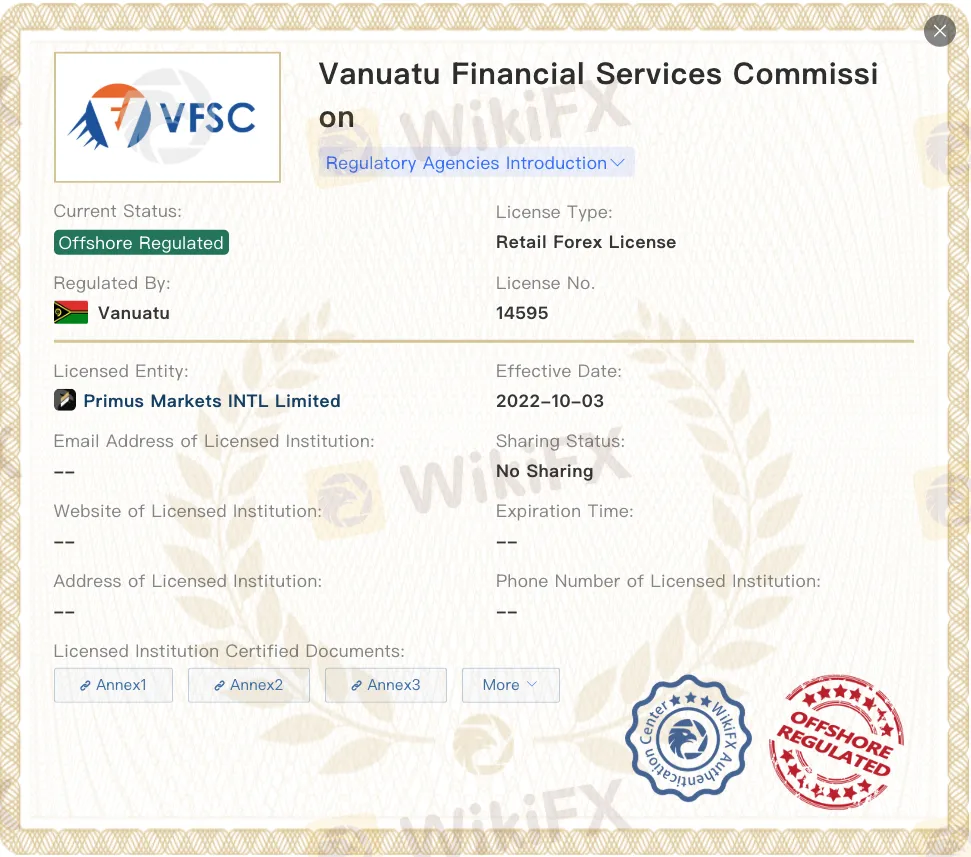

- Vanuatu (VFSC): FXPRIMUS‘s site states Primus Markets INTL Ltd is authorised by the VFSC (licence 14595), an offshore regime whose protections are not equivalent to Malaysia’s.

Critically, none of the above is a licence from the SC to offer capital market services in Malaysia. Being regulated elsewhere does not authorise a firm to solicit Malaysian clients unless it is also approved locally. This is precisely why the SC maintains its alert list.

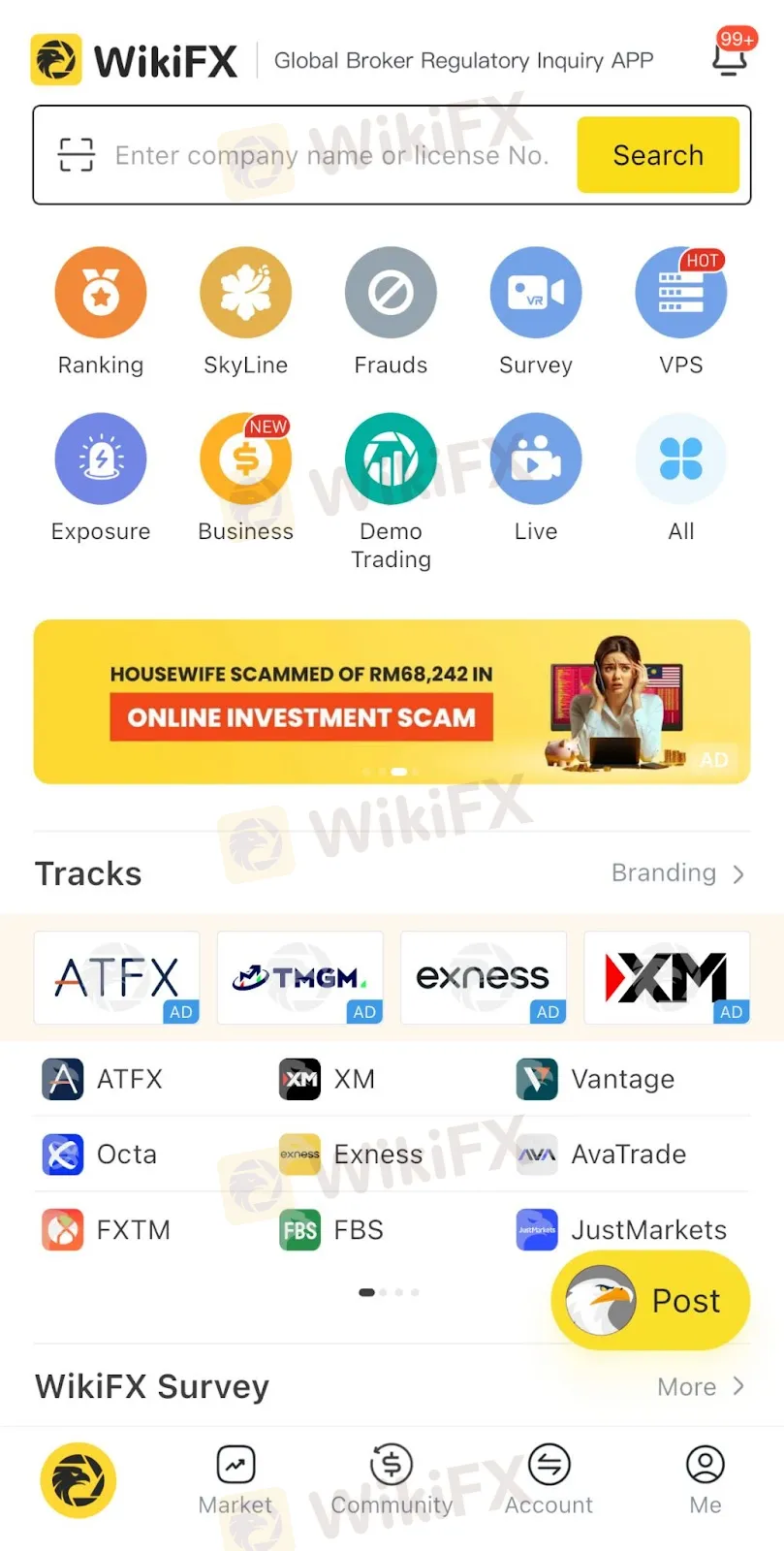

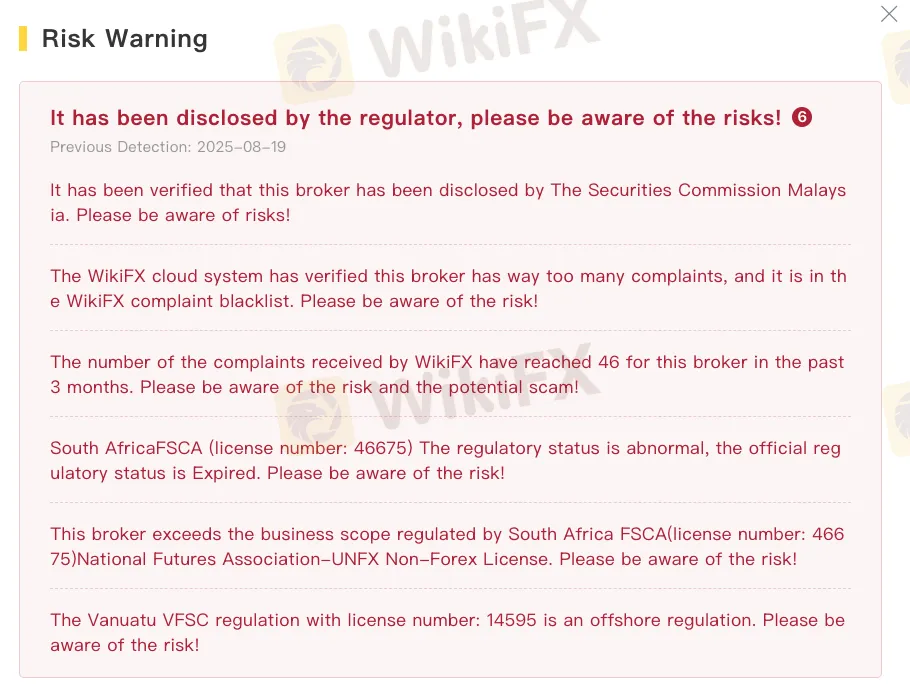

WikiFX, an independent global broker regulatory query platform, currently assigns FXPRIMUS a low score of 2.47/10, reflecting regulatory concerns and a pattern of client complaints (e.g., withdrawal disputes). FXPRIMUS is also the subject of recent complaint round-ups on WikiFXs news desk.

What Malaysian traders should do now

The first step for Malaysian traders is to check if their broker is licensed. Before putting in money or continuing to trade, investors should look at the Securities Commission Malaysia‘s (SC) Investor Alert List and Investment Checker. These tools show which companies are allowed to operate in Malaysia and which are not. By confirming a broker’s status early, traders can avoid sending money to unlicensed or risky firms.

For those who already have accounts with FXPRIMUS, extra caution is needed. Traders may want to lower their trading activity and withdraw any available funds while checking the withdrawal rules in their client agreements. It is also wise to keep detailed records of all messages, transactions, and account activity. These records could be important if a complaint needs to be filed with the SC, which has official channels for both complaints and whistleblowing.

Looking ahead, Malaysian traders should only use brokers that are licensed locally. Brokers approved by the SC, and in some cases Bank Negara Malaysia, must follow strict rules and are supervised under Malaysias financial laws. Both regulators publish public registers where traders can quickly check if a broker is legitimate.

Traders should also be careful about “passporting” claims. A licence from another country, such as Cyprus (CySEC) or Vanuatu (VFSC), does not mean a broker can serve clients in Malaysia. Without local approval, Malaysian investors are not protected under local law.

To add another layer of safety, traders can use tools like the WikiFX mobile app. WikiFX offers a large database of broker profiles, licensing details, user reviews, and live risk alerts. By checking a broker on such platforms, traders can spot red flags and avoid scams or unreliable firms. This helps protect their savings and reduces the risk of falling victim to fraudulent scams.