Company Summary

| Aspect | Information |

| Company Name | ZIVEST |

| Registered Country/Area | South Africa |

| Founded year | 2023 |

| Regulation | Unauthorized |

| Market Instruments | Forex, Indices, Shares, Metals, Commodities |

| Account Types | Mini, Standard, Managed |

| Minimum Deposit | $1 (Mini), $100 (Standard, Managed) |

| Maximum Leverage | 1:500 |

| Spreads | From 1.2 Pips |

| Trading Platforms | MetaTrader 5 |

| Customer Support | Phone +27 615144588, Email info@zivestfx.com |

| Deposit & Withdrawal | Visa, Osow, Bank Wire, Neteller, Skrill |

Overview of ZIVEST

ZIVEST, established in South Africa in 2023, offers a wide range of trading assets including Forex, indices, shares, metals, and commodities. The platform boasts competitive spreads, user-friendly MT5 trading software, and responsive customer support.

However, it operates without regulatory oversight, potentially posing risks to traders due to the absence of investor protections. While ZIVEST provides convenient payment methods and no commissions on deposits, it lacks comprehensive educational resources and research tools.

Is ZIVEST legit or a scam?

ZIVEST operates without authorization from the National Futures Association (NFA), indicating a lack of regulatory oversight.

It holds a Common Financial Service License but isn't regulated by any specific agency within the United States. This unregulated status poses potential risks for traders on the platform, as they don't benefit from the investor protections and oversight mechanisms typically provided by regulatory bodies. Consequently, traders should exercise caution and conduct thorough due diligence before engaging with ZIVEST, as the absence of regulatory scrutiny could expose them to heightened vulnerabilities in their trading activities.

Pros and Cons

| Pros | Cons |

| Multiple assets available for trading, including Forex, indices, shares, metals, and commodities | Lack of regulatory oversight |

| User-friendly trading platform (MT5) | Limited educational resources |

| Variety of payment methods | Limited research tools |

| Responsive customer support | |

| Competitive spreads as low as 1.2 pips | |

| No commissions on deposits |

Pros:

Multiple assets available for trading: Zivest offers a wide range of assets for trading, including Forex, indices, shares, metals, and commodities. This variety allows traders to explore different markets and diversify their investment portfolios according to their preferences and strategies.

User-friendly trading platform (MT5): Zivest utilizes the MetaTrader 5 (MT5) platform, known for its intuitive interface and comprehensive features. MT5 provides advanced charting tools, analytical capabilities, and customizable indicators.

Variety of payment methods: Zivest supports various payment methods for deposits and withdrawals, providing flexibility and convenience to traders. Accepted methods include Visa, bank wire transfers, e-wallets like Neteller and Skrill, offering options suitable for different preferences and geographical locations.

Responsive customer support: Zivest offers responsive customer support through multiple channels, such as phone and email. Traders can seek assistance for inquiries, technical issues, or account-related matters, ensuring prompt and helpful responses to their queries.

Competitive spreads as low as 1.2 pips: Zivest provides competitive spreads starting from 1.2 pips, enabling traders to access favorable pricing on their trades. Low spreads contribute to reduced trading costs, allowing traders to retain more of their profits.

No commissions on deposits: Zivest does not charge commissions on deposits, ensuring that traders can fund their accounts without incurring additional fees. This fee-free approach to deposits maximizes the amount of capital available for trading, enhancing cost-effectiveness for traders.

Cons:

Lack of regulatory oversight: Zivest operates without regulatory oversight from reputable financial authorities, potentially exposing traders to higher risks due to the absence of investor protections and regulatory scrutiny.

Limited educational resources: Zivest lacks comprehensive educational resources or materials to support traders in their learning journey. A lack of educational resources could hinder traders' abilities to develop their trading skills and knowledge effectively.

Limited research tools: Zivest offers limited research tools or market analysis resources for traders to conduct in-depth analysis and make informed trading decisions. Access to comprehensive research tools can be crucial for traders seeking to stay informed about market trends and developments.

Market Instruments

Trading assets of Zivest are as follows:

Forex: Zivest offers over 70 FX pairs for trading via Contracts for Difference (CFDs), promising narrow spreads and efficient order execution to enhance traders' experiences in the foreign exchange market.

Indices: Traders can engage in CFD trading on prominent indices from Europe, Asia, and the Americas, providing access to various global market opportunities.

Shares: With thousands of global stocks available for CFD trading, Zivest ensures rapid order processing and competitive trading terms, facilitating swift execution and potentially lucrative trading experiences.

Metals: By participating in CFD trading with Spot Metals, traders can uncover new market prospects and potentially capitalize on previously unseen advantages in metal trading.

Commodities: Zivest offers a range of commodities including coffee, copper, cotton, sugar, and cocoa for CFD trading, allowing traders to select and trade their preferred options in the commodity markets.

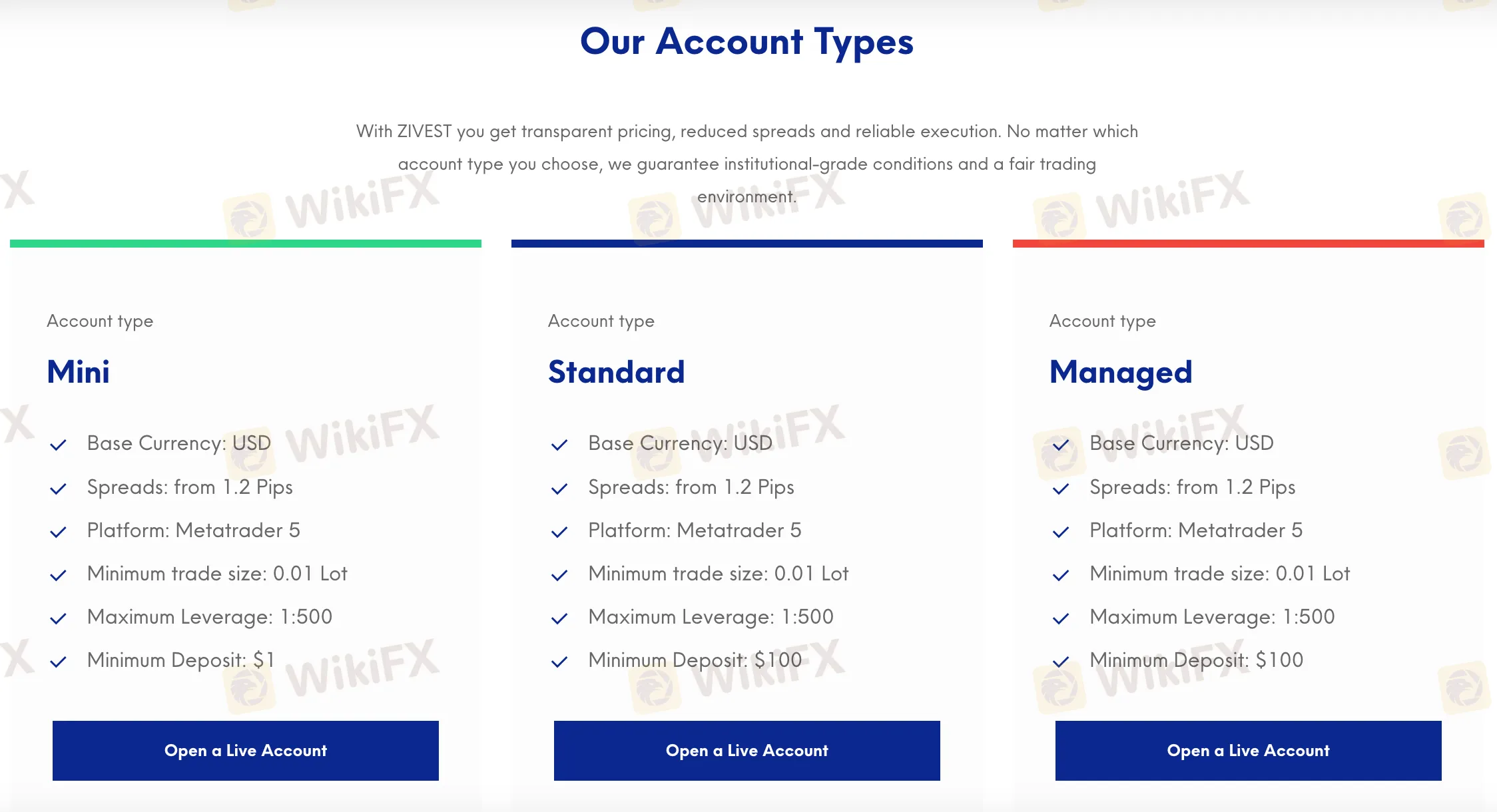

Account Types

Zivest provides 3 account types:

Mini Account: The Mini account type offered by Zivest features a base currency of USD, spreads starting from 1.2 pips, and utilizes the Metatrader 5 platform. With a minimum trade size of 0.01 lot and a maximum leverage of 1:500, this account type is suitable for novice traders or those who prefer to start with smaller investments. The low minimum deposit requirement of $1 makes it accessible to traders with limited capital, allowing them to gain experience in the financial markets without significant financial commitment. However, traders should exercise caution and ensure they understand the risks involved in trading with leverage.

Standard Account: Zivest's Standard account is denominated in USD, offering spreads from 1.2 pips and utilizing the Metatrader 5 platform. With a minimum trade size of 0.01 lot and a maximum leverage of 1:500, this account type is suitable for a broader range of traders who have more experience or are willing to commit a higher initial investment.

The minimum deposit requirement of $100 provides access to the same trading conditions as the Mini account but appeals to traders with a slightly larger trading capital. Traders utilizing this account type should still exercise prudent risk management practices to safeguard their investments.

Managed Account: The Managed account option at Zivest operates with USD as its base currency, offering spreads starting from 1.2 pips and utilizing the Metatrader 5 platform. With a minimum trade size of 0.01 lot and maximum leverage of 1:500, this account type is suitable for traders who prefer to have their trading activities overseen by a professional manager. With a minimum deposit requirement of $100, traders can entrust their funds to experienced professionals who may employ various trading strategies on their behalf. However, users should conduct thorough due diligence before engaging in managed account services and ensure they fully understand the terms and risks involved.

| Account Type | Mini | Standard | Managed |

| Base Currency | USD | USD | USD |

| Spreads | from 1.2 Pips | from 1.2 Pips | from 1.2 Pips |

| Platform | Metatrader 5 | Metatrader 5 | Metatrader 5 |

| Minimum Trade Size | 0.01 Lot | 0.01 Lot | 0.01 Lot |

| Maximum Leverage | 1:500 | 1:500 | 1:500 |

| Minimum Deposit | $1 | $100 | $100 |

How to Open an Account?

To open an account with Zivest, follow these four concrete steps:

Registration: Visit the Zivest website and locate the “Open an Account” button. Click on it to start the registration process. Provide the required personal information, including your full name, email address, phone number, and residential address. Ensure that all details are accurate and up-to-date.

Account Verification: After completing the registration form, you'll need to verify your identity and residency. Upload clear and legible copies of your identification documents, such as a passport or driver's license, and proof of address, which could be a utility bill or bank statement. Zivest will review these documents to validate your identity and comply with regulatory requirements.

Deposit Funds: Once your account is verified, you can proceed to deposit funds into your trading account. Zivest typically offers various deposit methods, including bank transfers, credit/debit cards, and electronic payment systems. Choose the most convenient option for you and transfer the desired amount of funds to your trading account. Ensure that you meet the minimum deposit requirement specified for your chosen account type.

Start Trading: With funds deposited into your account, you're now ready to start trading. Download and install the trading platform provided by Zivest, such as MetaTrader 5, and log in using your account credentials. Familiarize yourself with the platform's features, tools, and trading instruments. Then, analyze the markets, place trades, and monitor your positions accordingly. Remember to adhere to proper risk management practices and stay informed about market developments to make informed trading decisions.

Leverage

Zivest offers a maximum leverage of 1:500 to its traders, allowing them to amplify their trading positions significantly compared to their initial investment. This level of leverage enables traders to control larger positions in the market with a relatively small amount of capital.

Spreads & Commissions

Zivest offers competitive spreads and commission structures across its different account types. The spreads start from 1.2 pips for all account types, including Mini, Standard, and Managed accounts.

These spreads represent the difference between the bid and ask prices of a currency pair and are a significant factor in determining trading costs.

Additionally, Zivest does not charge commissions on trades, meaning traders only need to consider the spreads when calculating their trading expenses. The absence of commissions can be particularly attractive for traders with smaller trading volumes or those who prefer a straightforward fee structure.

Trading Platform

Zivest utilizes MetaTrader 5 (MT5) as its trading platform, suitable for both desktop and mobile users. MT5 is recognized within the industry for its growing popularity, building upon the familiar features of its predecessor, MT4, while introducing enhancements and optimizations. One notable feature of MT5 is its provision of an optimized environment for Expert Advisor (EA) trading, appealing to traders who rely on automated strategies.

For desktop users, Zivest offers the option to download the MT5 platform, providing a comprehensive trading experience on desktop computers. This version of MT5 grants access to a wide range of trading tools, indicators, and charting capabilities, empowering traders to conduct in-depth technical analysis and execute trades efficiently.

Mobile traders can access the markets on the go through the MetaTrader 5 Mobile app, available for both iOS and Android devices. This mobile platform enables traders to monitor their positions, execute trades, and access real-time market data from anywhere with an internet connection, enhancing flexibility and convenience.

In addition to the desktop and mobile platforms, Zivest also offers MetaTrader 5 Webtrader, allowing traders to access their accounts and trade directly from web browsers without the need for downloading or installing any software. This web-based platform offers a user-friendly interface and seamless integration with the desktop and mobile versions of MT5, providing a consistent trading experience across different devices.

Deposit & Withdrawal

Zivest provides traders with multiple payment options to facilitate deposits and withdrawals conveniently. Accepted methods include Visa, Osow, Bank Wire, Neteller, and Skrill. Traders can select the payment method that aligns with their preferences and needs, ensuring seamless transactions to and from their trading accounts.

Minimum Deposit: Zivest maintains flexibility in its minimum deposit requirements, tailored to different account types. For the Mini account, traders can begin with a minimum deposit of $1, allowing for accessible entry into trading for those with limited initial capital.

The Standard and Managed accounts require minimum deposits of $100, accommodating traders seeking additional features or services along with a slightly higher initial investment.

Payment Fees: Zivest adopts a fee-free approach for deposits made through Visa, Osow, Bank Wire, Neteller, and Skrill, reflecting its commitment to transparent and cost-effective trading experiences. By waiving commissions and fees on deposits, Zivest empowers traders to maximize their trading capital without incurring additional costs.

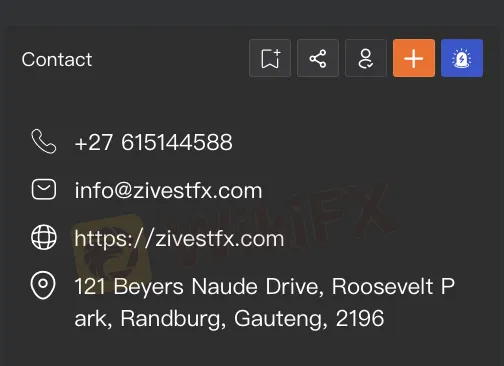

Customer Support

Zivest offers customer support through various channels, including phone and email. Traders can reach the support team by dialing +27 615144588 or sending an email to info@zivestfx.com. These contact options provide direct access to assistance for inquiries, account-related matters, or technical support.

Conclusion

In conclusion, ZIVEST presents a platform that offers various trading opportunities across multiple asset classes, accompanied by competitive spreads and a user-friendly MetaTrader 5 platform.

However, its unauthorized status and lack of regulatory oversight deter some traders due to the potential risks involved. While the minimum deposit requirement accommodates both novice and experienced traders, the limited educational resources and research tools could hinder traders' abilities to make informed decisions and enhance their trading skills effectively.

FAQs

Q: Is ZIVEST regulated?

A: No, ZIVEST operates without regulatory oversight.

Q: What account types does ZIVEST offer?

A: ZIVEST offers Mini, Standard, and Managed accounts.

Q: What is the minimum deposit required to open an account?

A: The minimum deposit is $1 for Mini accounts and $100 for Standard and Managed accounts.

Q: What trading platform does ZIVEST use?

A: ZIVEST utilizes the MetaTrader 5 platform.

Q: Are there any commissions on deposits?

A: No, ZIVEST does not charge commissions on deposits.

TAKESHI5245

Japan

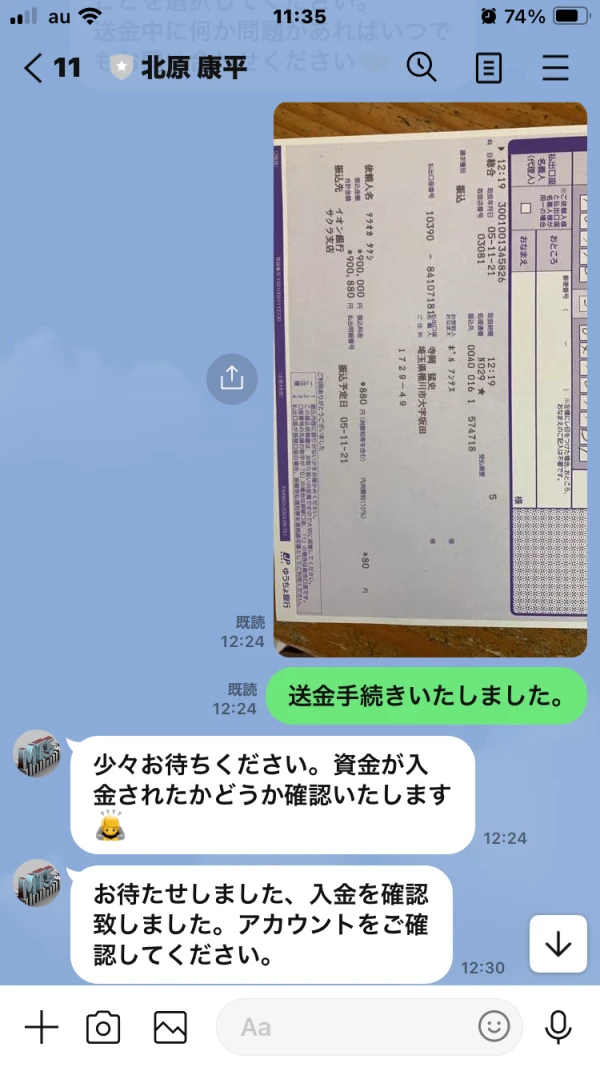

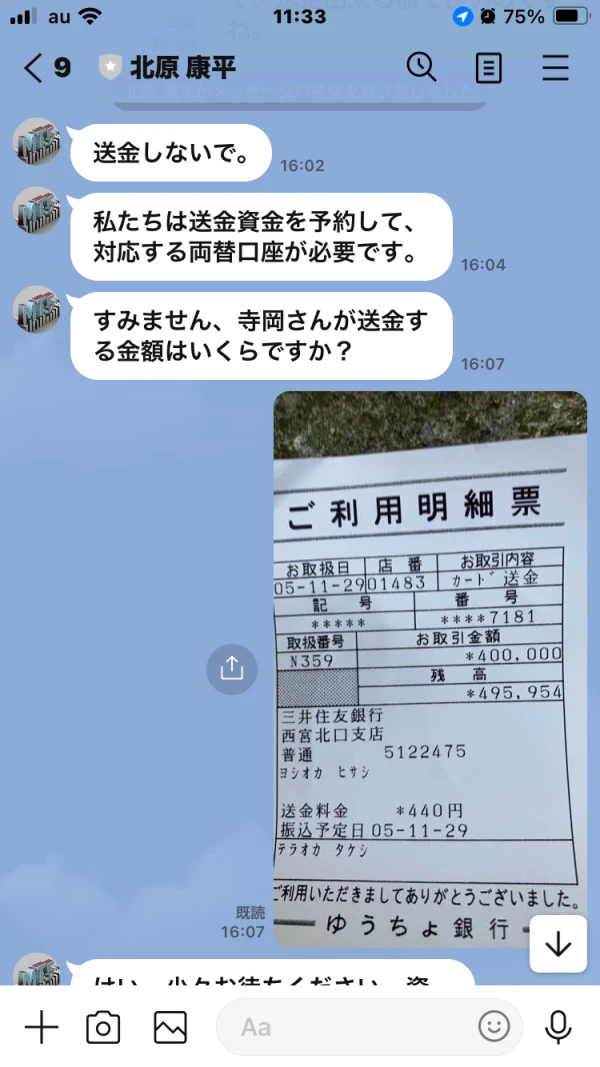

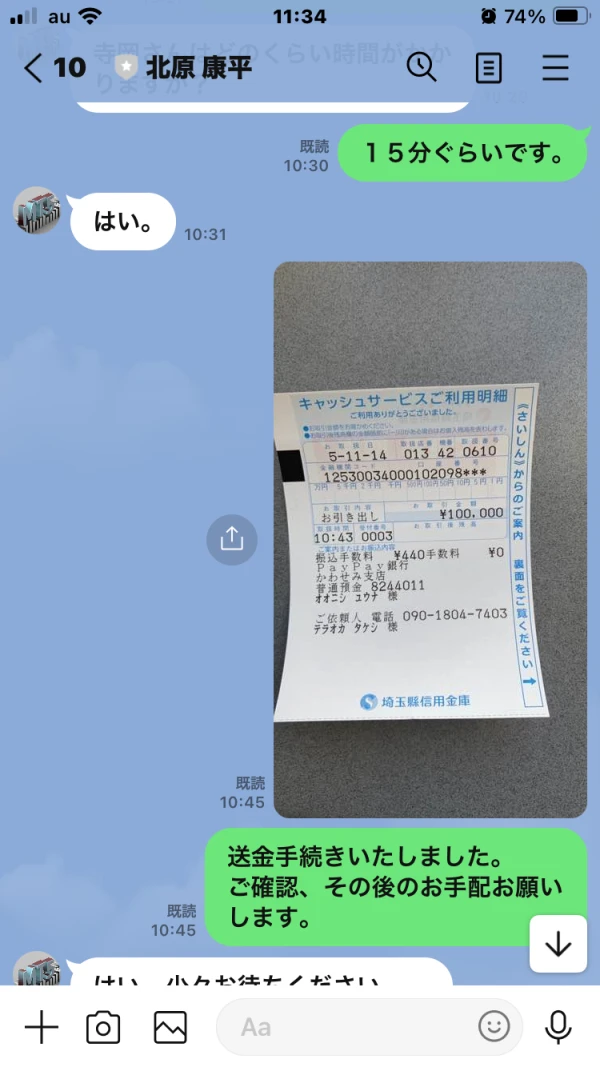

(Counterparty) ① Hiroki Sawada (CITADEL) Instructor on stock and FX trading ② Female assistant ③ Kohei Kitahara Learn how to install and use the trading platform (MT5), fund management (CRM fund management system), how to deposit and withdraw money for transactions, etc. Instructions ・Platform to use MT5 Download from Apple Store ・Securities company to open account (designated by Kitahara) Zivest (Pty) Ltd...No registration with Financial Services Agency Registration number 2017 101396 07 Registered address 121 Beyers Naude Drive, Roosevelt Park, Randburg, Gauteng, 2195, South Africa Website www.zivestfx.com Phone +27100123398 ・CRM Fund Management System URL hppt://www.allianzcrm.com/ Current balance $15,281.60 (transfer) 11/14 100,000 yen PayPay Bank Kawasemi Branch 8244011 Yuna Onishi 11/21 900,000 yen Aeon Bank Sakura Branch 0574718 Bol Antes 11/29 400,000 yen Sumitomo Mitsui Banking Nishinomiya Kitaguchi Branch 5122475 Yoshioka Hisashi All Banks 1 Contacted 2/15 (flow) Early 11/YouTube or something From that advertisement to Hiroki Sawada's official LINE. I will teach you financial transactions, and since the company is not well-known, I am also doing this for advertising purposes, so it is free of charge. From there, please register as a friend of Kohei Kitahara, who is in charge of group chat (a place for investment trading lectures) and MT5. 11/7 Go to Kitahara's LINE. Learn how to download MT5 and set up asset management (CRM). 11/14 First 100,000 yen transfer. Start FX trading from there. Mainichi Sawada's lecture on trading via group chat and trading instructions from the official Traded on MT5 after receiving instructions on brand ○○, ○○ lot number, direction (buy or sell) *Win rate was almost 100%. On 11/21 I was making a profit so I increased my capital and made the second remittance of 900,000 yen. Everyone has made a considerable amount of profit from Sawada (I don't know if it's Sakura or not, but some people have uploaded the details of transferring 10 million units to the group chat) After this, there will be an important announcement from the United States, Teraoka. Please prepare for that as well. If you answer that you don't have the funds and are satisfied with the current profits, you will no longer be able to participate in future transactions. The reason is that there is a risk of a loss cut due to insufficient deposit. 11/29 His third remittance, was 400,000 yen. You can also participate in trading. After that, he was asked to increase capital in a roundabout way, and Sawada even said that if he didn't have the funds, he would lend it to him. I got fed up with that and asked Kitahara for a refund. He told me the procedure for refunding and remittance, and I did so. Please allow 1-5 business days for system review, funds entry, etc. In addition, the group chat and Sawada's official LINE have been deleted. 12/1 I felt strange and a little distrustful of Kitahara's sentence above, but I followed the instructions. 12/7 He hasn't received the money, so I checked with Japan Post Bank (the bank where the money was being sent this time). The only way to know the current status of the money is at the financial institution where the money was transferred, so please contact that financial institution. 12/8: There was no remittance on my bank card, so I contacted Kitahara, and he told me, ``Taxes will be charged on profits from FX trading, and you cannot remit money unless you pay that amount.'' I was afraid that if I put in too much money, it would be deleted and I wouldn't be able to contact them, so I agreed and got a bank account to pay the tax, but I had to postpone it. 12/14 Telephone consultation with Ageo Police → Please consult a consumer center or a lawyer first. 12/14 Call the Okegawa City Consumer Center → Tell them you will visit the center on 12/15. 12/15 Face-to-face counselor at Okegawa City Consumer Center → Contacted the Financial Services Agency and introduced a law firm. 12/15 Call the Financial Services Agency → Please contact the financial institution where the transfer was made. 12/15 Contacted each financial institution. 12/19 Consult with Ageo Police Receipt number 2023-167477 12/22 Consult with Saitama Chuo Law Office That's it. thank you.

Exposure

Carlos González G

Spain

The mini account here has wide spreads, so I upgraded to the standard account to try to find really low spreads, but unfortunately, it still has the same wide spreads.

Neutral

Jacob Wilson Duke

Australia

I used to get some of the lowest spreads while trading with ZIVEST. Yet, their reputation seems to have declined in recent years. 🙃 🙃🙃

Neutral

CUI

Pakistan

Simple, clear and very well designed mobile application. But - you can't click on information through the

Neutral