Company Summary

| Trust CapitalReview Summary | |

| Founded | 2003 |

| Registered Country/Region | Seychelles |

| Regulation | CMA, FSA (Offshore), CYSEC (Suspicious Clone) |

| Market Instruments | Metals, Energies, Forex, Commodities, Indices, Shares |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 0 pips |

| Trading Platform | MT4, MT5 |

| Min Deposit | $10 |

| Customer Support | Phone: +971 50 463 0311 |

| Email: cs@trustcapital.com | |

| Live Chat, Contact Form | |

| Social Media: Facebook, Instagram, YouTube, Linkedin | |

| Company Address: Al Saqr Business Tower, Office 703, 91 Sheikh Zayed Rd, Trade Centre, PO Box 125112, DIFC, Dubai, UAE. | |

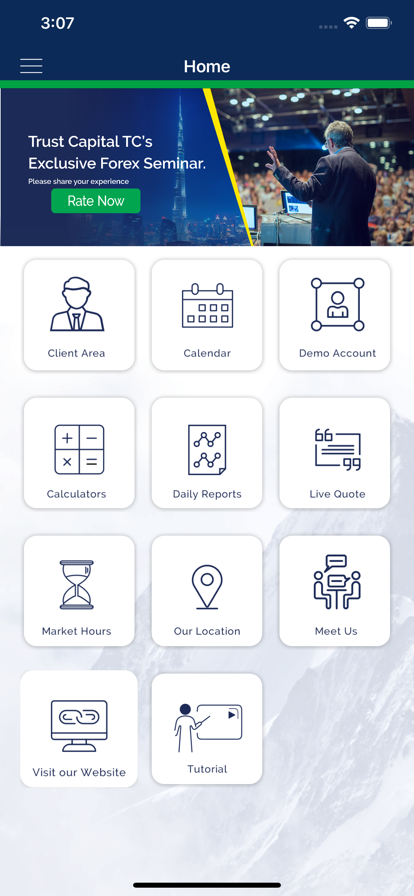

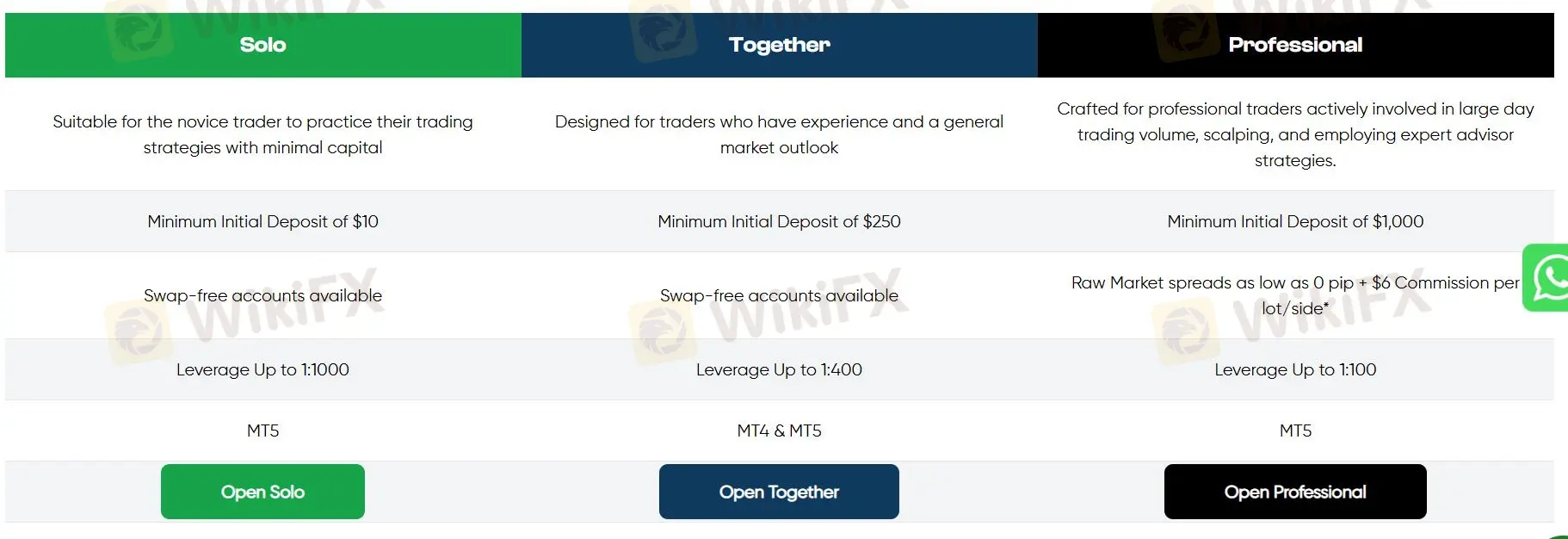

Trust Capital is an online trading platform headquartered in Seychelles. Trust Capital claims to provide a wide range of tradable assets, including Forex, shares, commodities, indices, metals, and energy. It offers a variety of account types tailored to different trader profiles, with different minimum deposit requirements ranging from $10 to $1,000 and maximum leverage varying from 1:100 to 1:1000.

Pros & Cons

| Pros | Cons |

| Wide range of market offerings | Suspicious clone CYSEC license |

| Multiple customer support channels | |

| Regulated by CMA and FSA |

Is Trust Capital Legit?

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Regulatory Status |

| Capital Markets AuthorityLEBANON | Trust Capital SAL | Retail Forex License | 20 | Regulated |

| The Seychelles Financial Services Authority | Trust Capital Ltd | Retail Forex License | SD122 | Offshore Regulated |

| Cyprus Securities and Exchange Commission | Trust Capital TC Ltd | Straight Through Processing (STP) | 369/18 | Suspicious Clone |

What Can I Trade on Trust Capital?

| Trading Asset | Available |

| forex | ✔ |

| metals | ✔ |

| commodities | ✔ |

| indices | ✔ |

| energies | ✔ |

| shares | ✔ |

| cryptocurrencies | ❌ |

| options | ❌ |

| funds | ❌ |

| ETFs | ❌ |

Account Type/Leverage

| Account Type | Min Deposit | Max Leverage | Swap-free Account | Trading Platform |

| Solo | $10 | 1:1000 | ✔ | MT5 |

| Professional | $250 | 1:100 | Raw spreads from 0 pips + $6 commission per lot/side | MT4, MT5 |

| Together | $1000 | 1:400 | ✔ | MT5 |

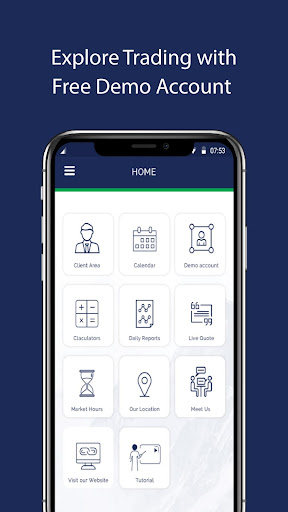

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

| MT4 | ✔ | Desktop, Mobile, Web | Beginners |

Deposit and Withdrawal

Deposit Options

| Deposit Option | Fee | Processing Time |

| Bank Transfer | 2.5% per transaction | 2-5 working days |

| Credit and Debit Cards | 1 working day | |

| Sticpay | 1 day | |

| Maestro and Mada |

Withdrawal Options

| Withdrawal Option | Fee | Processing Time |

| Bank Transfer | 2.5% per transaction | 3-5 working days |

| Credit and Debit Cards | 3-10 working days | |

| Sticpay | 1 day | |

| Maestro and Mada | 3-10 days |