Company Summary

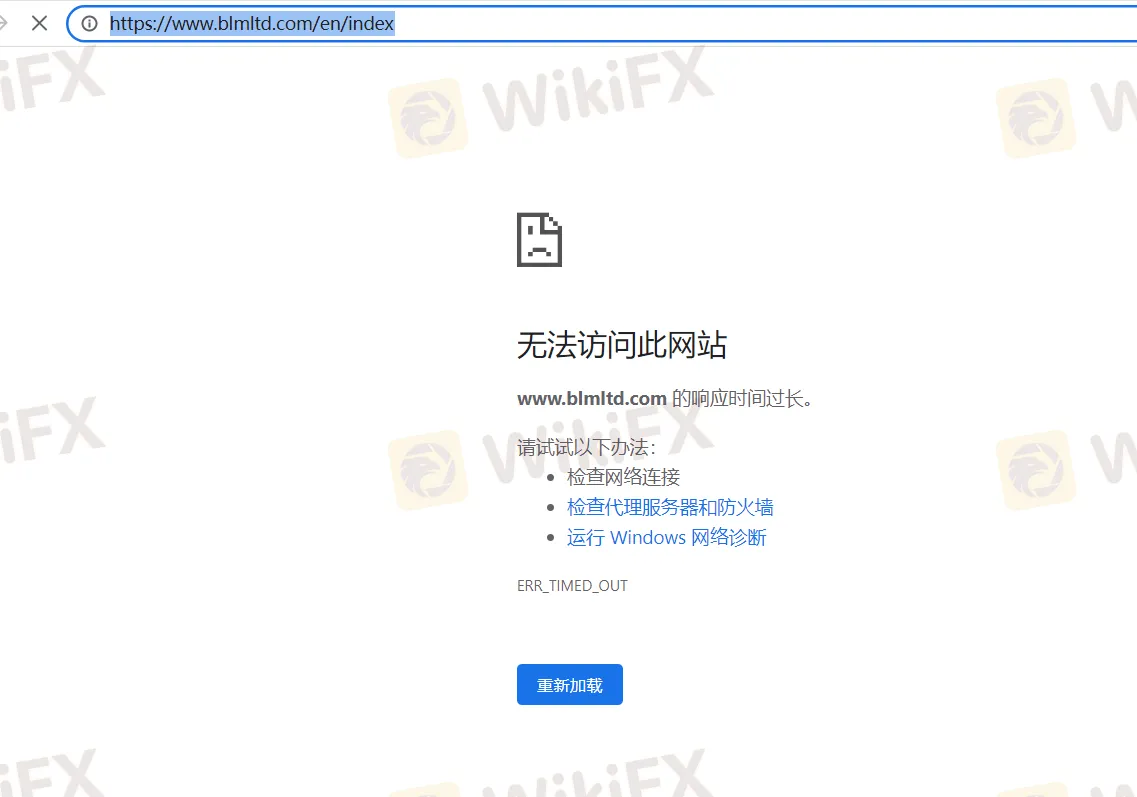

The original official website of BLOOMS MARKETS LIMITED (https://www.blmltd.com/en/index)is down.

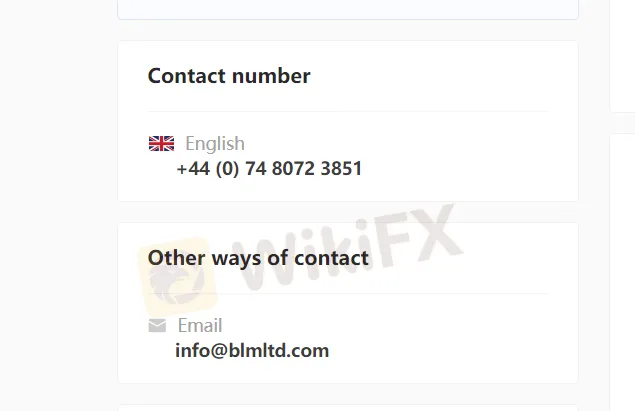

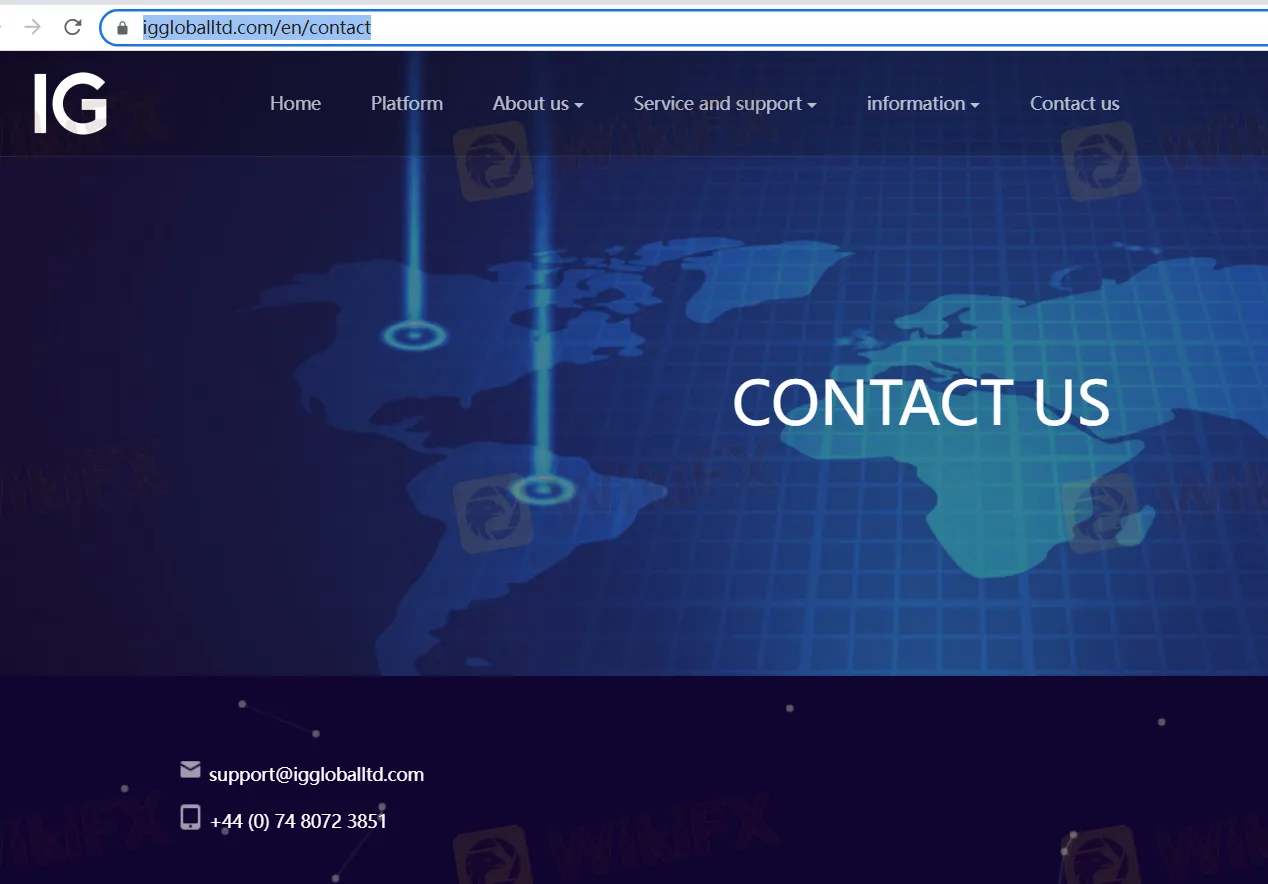

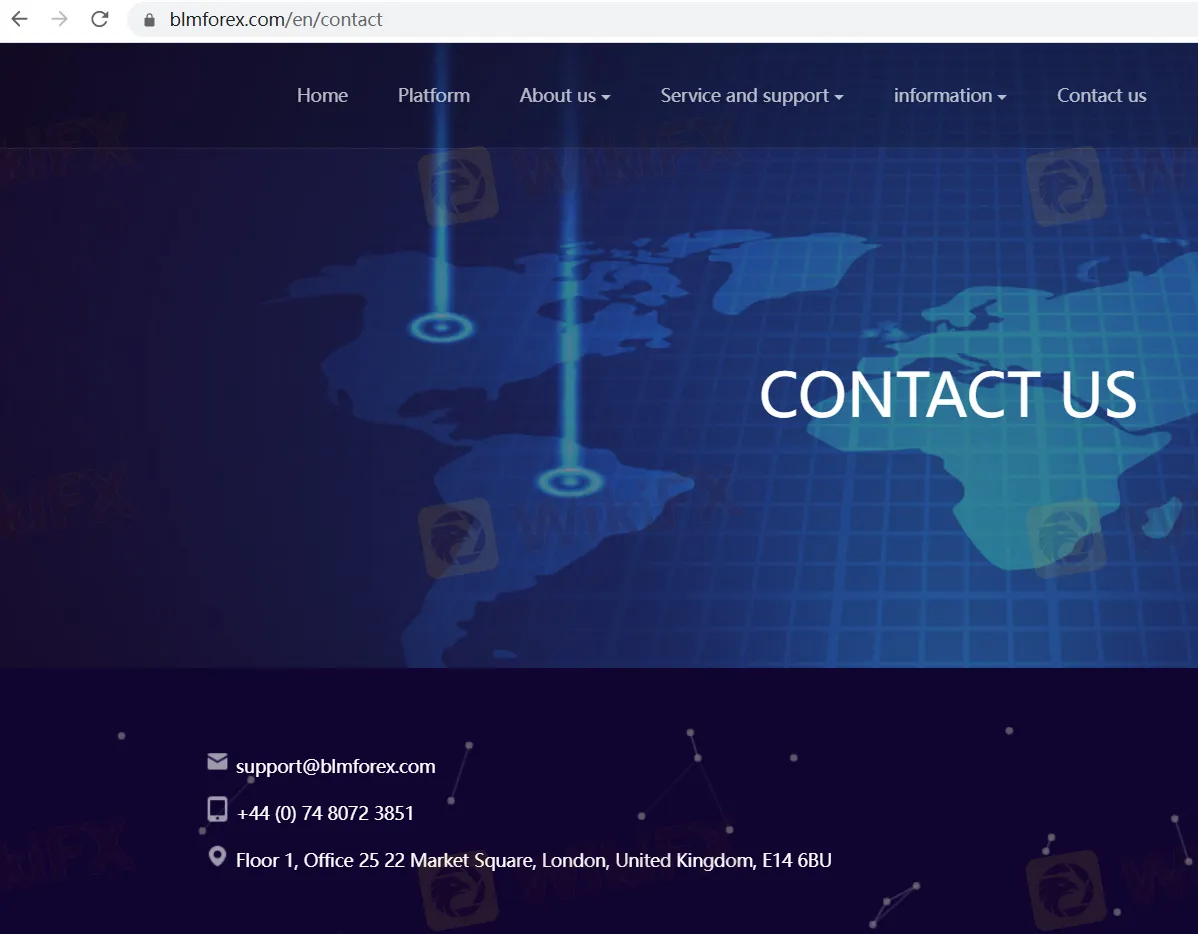

I searched for the companys phone number, +44 (0) 74 8072 3851,

and found it associated with two forex trading websites.

https://www.iggloballtd.com/

Warning: It appears that the content on these two websites is exactly the same, which does raise some suspicions.

| Attribute | Details |

| Company Name | BLOOMS MARKETS LIMITED |

| Regulation | No regulation |

| Trading Instruments | Stocks, futures, crude oil, gold, Bitcoin, currencies |

| Account Types | 1. Comprehensive Account |

| 2. Finance Account | |

| 3. Financial STP Account | |

| Leverage | Up to 1:500 |

| Spreads & Commissions | Specific information not available, contact customer support for details |

| Deposit & Withdraw | Specific information not available, contact customer support for details |

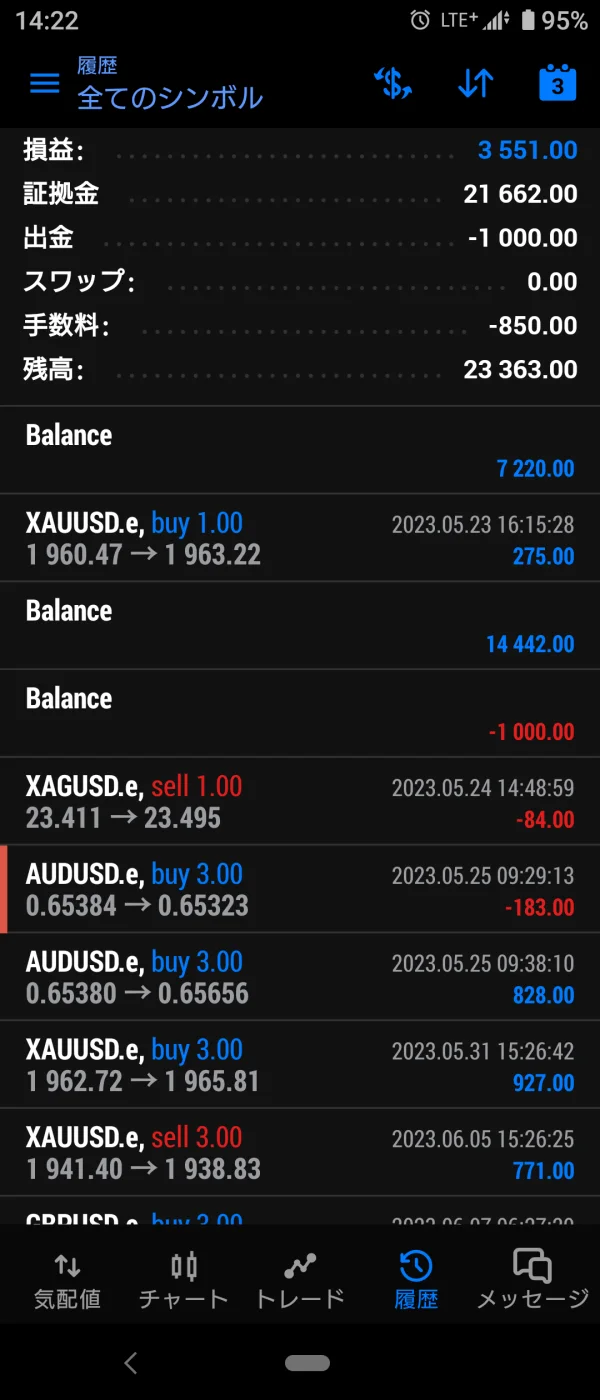

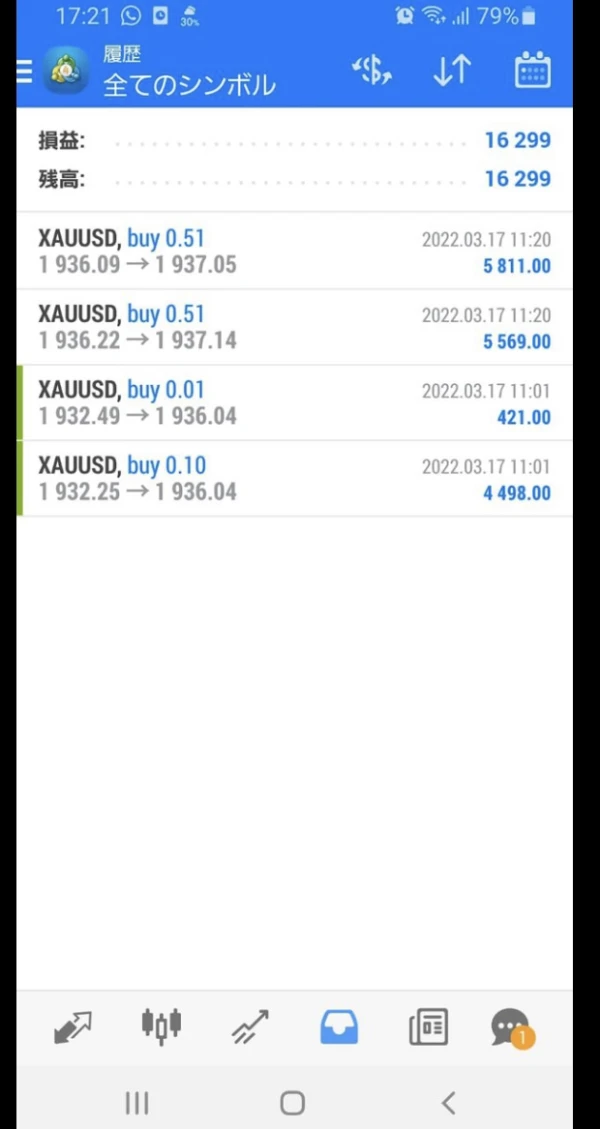

| Trading Platform | MetaTrader 5 (MT5) |

| Company Type | Private limited Company |

| Company Status | Active |

| Incorporation Date | December 15, 2022 |

| Registered Office Address | 69 Aberdeen Avenue, Cambridge, England, CB2 8DL |

| Director | Xiao Lin |

| Director's Nationality | Australian |

| Director's Country of Residence | England |

| Director's Occupation | Engineer |

| Nature of Business (SIC Codes) | 46900 - Non-specialised wholesale trade |

| 47820 - Retail sale via stalls and markets of textiles, clothing and footwear | |

| 62020 - Information technology consultancy activities | |

| 62090 - Other information technology service activities | |

| Phone Number | +44 (0) 74 8072 3851 |

| Accounts Due Date | September 15, 2024 |

| Confirmation Statement Due Date | December 28, 2023 |

Regulation: No regulation.

When a brokerage firm is described as having “no regulation,” it means that the company operates without oversight or supervision from a regulatory authority. Regulatory bodies are government agencies or independent organizations that establish rules and regulations to protect investors, ensure fair market practices, and maintain the integrity of the financial system.

In the case of Blooms Markets Limited, the absence of regulation implies that there is no external authority monitoring their activities or enforcing compliance with specific industry standards. Without regulatory oversight, investors may have limited protection and recourse in the event of fraudulent or unethical practices by the broker. It is important to note that regulated brokers are subject to certain requirements and obligations, such as maintaining segregated client accounts, providing transparent pricing and execution, and adhering to strict codes of conduct.

The lack of regulation can raise concerns for investors who prioritize the safety and security of their funds. Regulatory oversight typically provides a level of assurance that the broker operates within established guidelines, and there are mechanisms in place to address potential issues or disputes. In the absence of regulation, investors may need to exercise extra caution and perform thorough due diligence before engaging with the broker.

It is worth noting that regulatory requirements and jurisdictions can vary across different countries and regions. Investors should familiarize themselves with the regulatory landscape in their jurisdiction and consider the potential risks associated with trading with an unregulated broker.

Market Instruments

The broker offers a wide range of trading instruments, catering to the diverse needs of investors and traders. Among the market instruments available, they provide options for stocks, futures, crude oil, gold, Bitcoin, and currencies.

Stocks: Trading stocks allows individuals to buy and sell shares of publicly traded companies. This instrument provides investors with an opportunity to participate in the ownership and potential profits of well-established corporations or emerging companies.

Futures: Futures contracts are agreements to buy or sell assets at a predetermined price on a specified future date. These instruments are commonly used for commodities, such as agricultural products, energy resources, and precious metals. Futures provide a way to hedge against price fluctuations or speculate on future market movements.

Crude Oil: Trading crude oil involves speculating on the price movements of this essential commodity. Investors can participate in the energy market by buying or selling crude oil futures contracts, enabling them to profit from changes in oil prices.

Gold: Gold has long been considered a safe-haven asset and a store of value. Trading gold allows investors to take positions on the price movements of this precious metal, which can be influenced by various factors such as economic conditions, geopolitical events, and inflationary pressures.

Bitcoin: As a leading cryptocurrency, Bitcoin has gained significant attention in recent years. Trading Bitcoin offers investors the opportunity to speculate on its price movements without physically owning the digital currency. Cryptocurrency markets are known for their volatility and can provide opportunities for both short-term trading and long-term investing.

Currencies: The broker also offers trading in various currency pairs. Forex (foreign exchange) trading allows investors to speculate on the relative value of different currencies. Currency markets are highly liquid and can provide opportunities for traders to profit from fluctuations in exchange rates.

By providing access to a diverse range of market instruments, the broker caters to investors and traders with different risk profiles and investment strategies. This variety allows individuals to build diversified portfolios, hedge their positions, and potentially capitalize on market opportunities across different asset classes.

Account Types

This broker offers three tiered trading account types, each designed to meet the specific needs of traders based on their trading preferences and goals. Let's explore the details of these account types:

Comprehensive Account:

The Comprehensive Account provides traders with a comprehensive trading experience. It allows users to trade Contracts for Difference (CFDs) based on a unique and proprietary composite index that accurately simulates real market movements. This account type offers flexibility, enabling traders to engage in CFD trading across various markets, including stocks, commodities, and indices. With the Comprehensive Account, traders have the opportunity to access and trade CFDs around the clock, taking advantage of market fluctuations.

Finance Account:

The Finance Account is designed for traders interested in a wide range of financial instruments. It allows trading in forex, commodities, and cryptocurrencies, both in large and microtransaction sizes. This account type offers high leverage, enabling traders to amplify their positions in the market. With access to major currency pairs, commodities, and popular cryptocurrencies, traders can diversify their portfolio and capitalize on various market opportunities.

Financial STP Account:

The Financial STP (Straight Through Processing) Account caters to traders who prioritize market liquidity and competitive spreads. This account type provides options for major currency pairs as well as currency pairs with smaller spreads that have gained significant trading volume. By offering STP execution, the broker ensures that traders' orders are directly routed to liquidity providers, reducing potential delays and providing faster order execution. This account type is suitable for traders who focus on currency trading and seek optimal trading conditions.

By offering these three tiered trading account types, the broker caters to traders with different trading preferences, strategies, and risk tolerance levels. Traders can choose the account type that aligns with their specific needs and gain access to a wide range of financial instruments and trading opportunities.

Leverage

This broker offers a maximum trading leverage of up to 1:500, allowing traders to control larger positions in the market with a smaller amount of capital. Higher leverage ratios offer the potential for increased profits but also magnify potential losses. Traders should use leverage responsibly, understand the risks involved, and implement proper risk management strategies. The maximum leverage of 1:500 provides experienced traders with the opportunity to engage in larger trades and potentially capitalize on market movements. However, traders should carefully assess their risk tolerance and trading strategy before utilizing high leverage.

Spreads & Commissions

Specific information regarding spreads is not readily available on the broker's website, and it is recommended to contact their customer support for accurate details.

Deposit & Withdrawal

The information regarding deposit and withdrawal methods is not mentioned on the broker's website, and it is advisable to reach out to their customer support for specific details.

Trading Platforms:This broker offers the MT5 (MetaTrader 5) trading platform, which is recognized as one of the most popular and widely used online trading platforms globally. MT5 provides an all-in-one CFD trading platform with access to over 100 tradable assets, including forex, synthetic indices, stocks, stock indices, and cryptocurrencies. With powerful charting tools, including 50+ technical indicators and intraday analysis tools, MT5 caters to both novice and advanced traders. The platform is known for its security, reliability, and user-friendly interface, making it a standard choice for online trading. Traders can also benefit from 24/7 trading availability, including weekends, and the option to sign up for a demo account to practice trading with virtual funds. Additionally, the broker is licensed and regulated, instilling trust and confidence in their services.

`

Customer Support:

Customer support for this broker can be reached via email at support@blmforex.com or by phone at +44 (0) 74 8072 3851. Their offices are located on Floor 1, Office 25, 22 Market Square, London, United Kingdom, E14 6BU. Traders can contact the broker through these channels to seek assistance, ask questions, or address any concerns they may have regarding their trading accounts or platform-related inquiries.

Summary:

Blooms Markets Limited is a brokerage firm that offers a variety of trading instruments, including stocks, futures, crude oil, gold, Bitcoin, and currencies. They provide three tiered trading account types: Comprehensive, Finance, and Financial STP, catering to different trading preferences. The broker offers a maximum leverage of up to 1:500, allowing traders to control larger positions with smaller capital. They utilize the popular MetaTrader 5 (MT5) trading platform, known for its powerful charting tools and 24/7 trading availability. However, specific information about spreads, deposit/withdrawal methods, and customer support responsiveness is not readily available on their website. The broker is not regulated, which may raise concerns about investor protection.

Pros:

Wide range of trading instruments available.

Different account types catering to various trading preferences.

Maximum leverage of up to 1:500 for potential higher profitability.

Utilization of the popular MT5 trading platform with powerful charting tools.

24/7 trading availability.

Cons:

Lack of specific information on spreads and deposit/withdrawal methods.

Customer support responsiveness and quality may vary.

No regulatory oversight.

Limited information on additional features, educational resources, or trading tools.

It's important for traders to thoroughly research and consider the potential risks and limitations associated with trading with Blooms Markets Limited before making investment decisions.

FAQs:

Q: What trading instruments are available with Blooms Markets Limited?

A: Blooms Markets Limited offers a wide range of trading instruments, including stocks, futures, crude oil, gold, Bitcoin, and currencies.

Q: What is the maximum leverage offered by Blooms Markets Limited?

A: Blooms Markets Limited offers a maximum trading leverage of up to 1:500, allowing traders to control larger positions in the market with a smaller amount of capital.

Q: Which trading platform does Blooms Markets Limited use?

A: Blooms Markets Limited utilizes the MetaTrader 5 (MT5) trading platform, known for its powerful charting tools and 24/7 trading availability.

Q: Is Blooms Markets Limited regulated?

A: No, Blooms Markets Limited is not regulated, which may raise concerns about investor protection.

Q: How can I contact customer support at Blooms Markets Limited?

A: You can reach customer support at Blooms Markets Limited by emailing support@blmforex.com or calling +44 (0) 74 8072 3851.

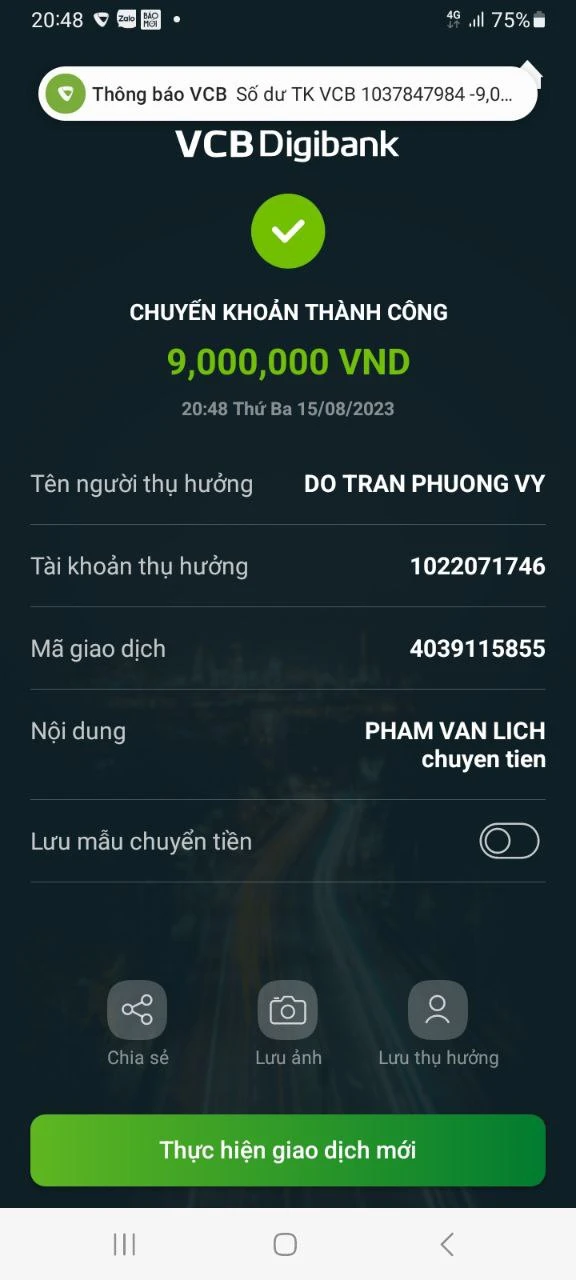

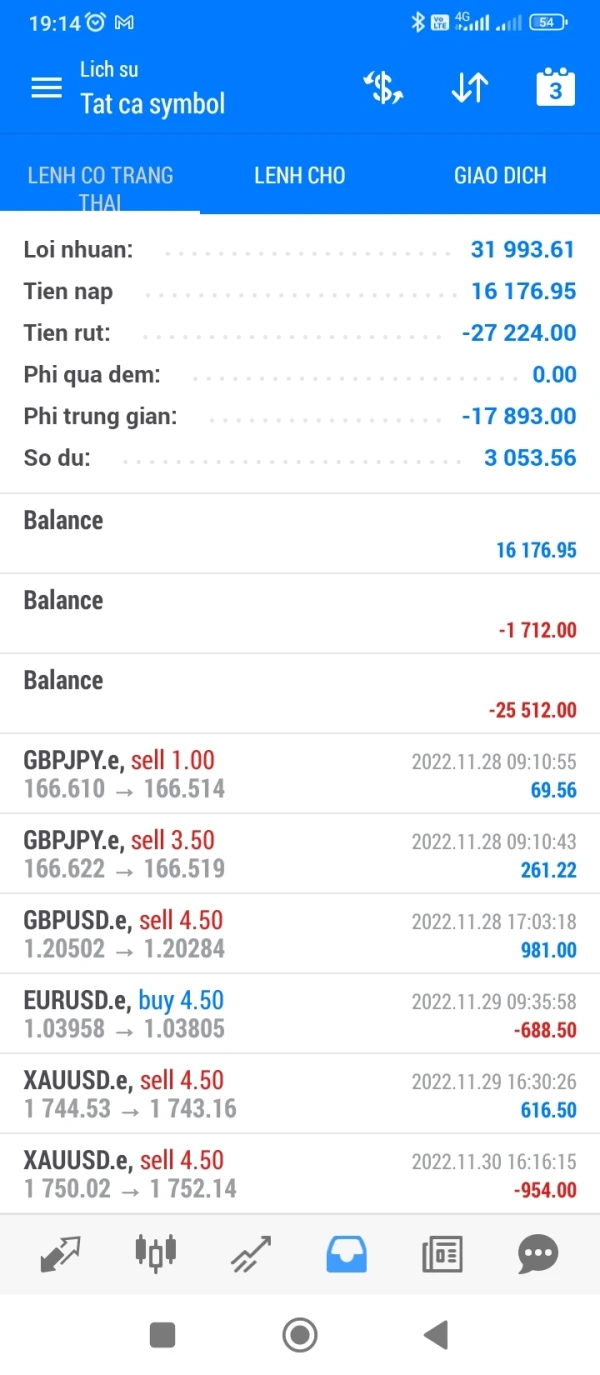

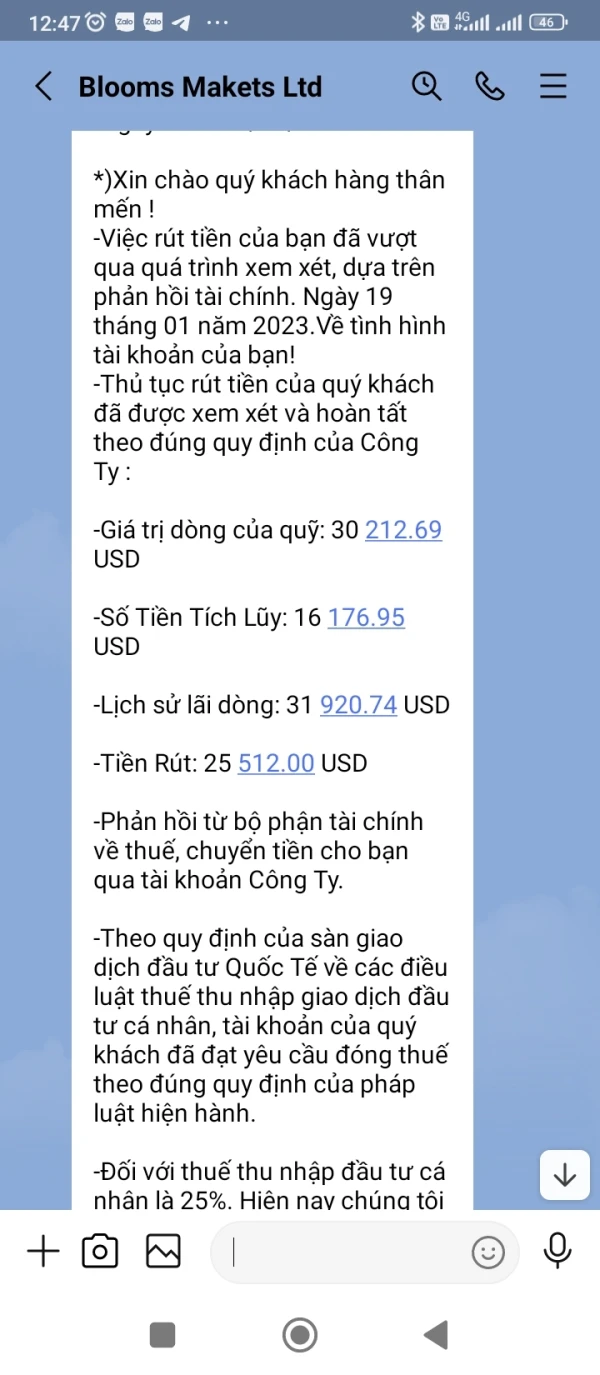

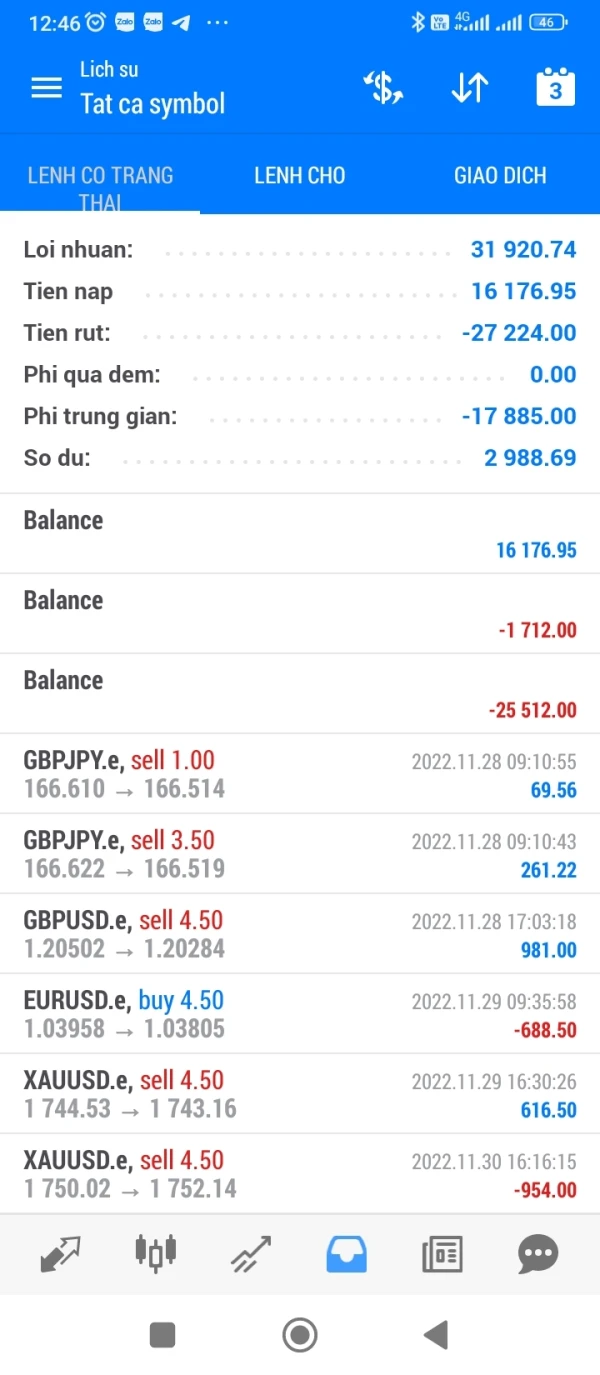

phạm văn lịch

Vietnam

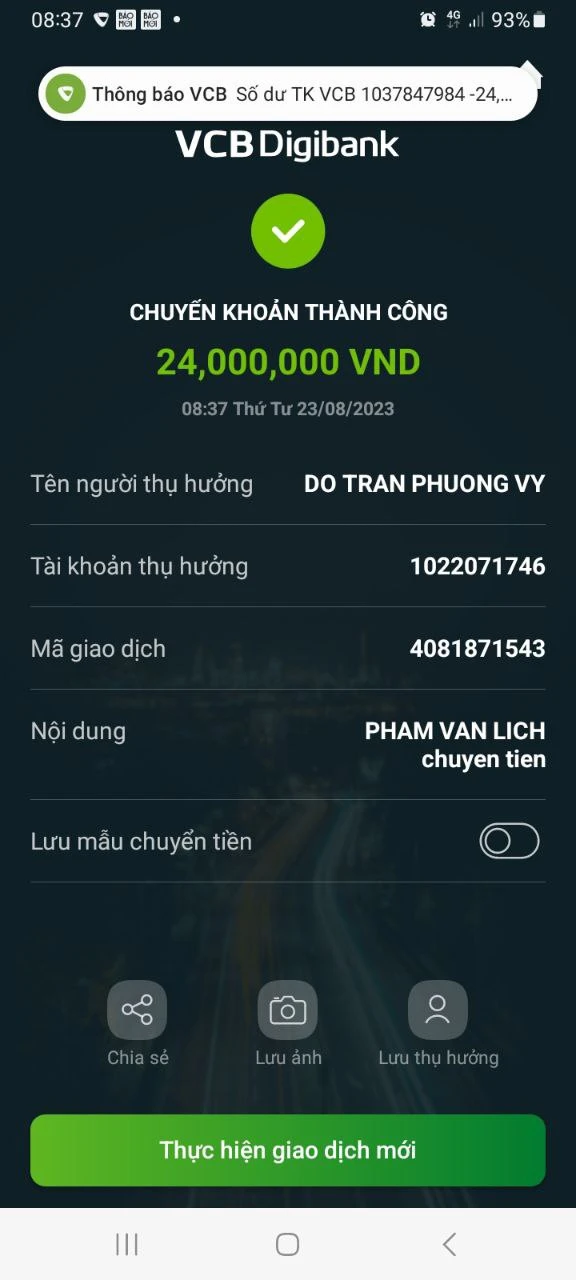

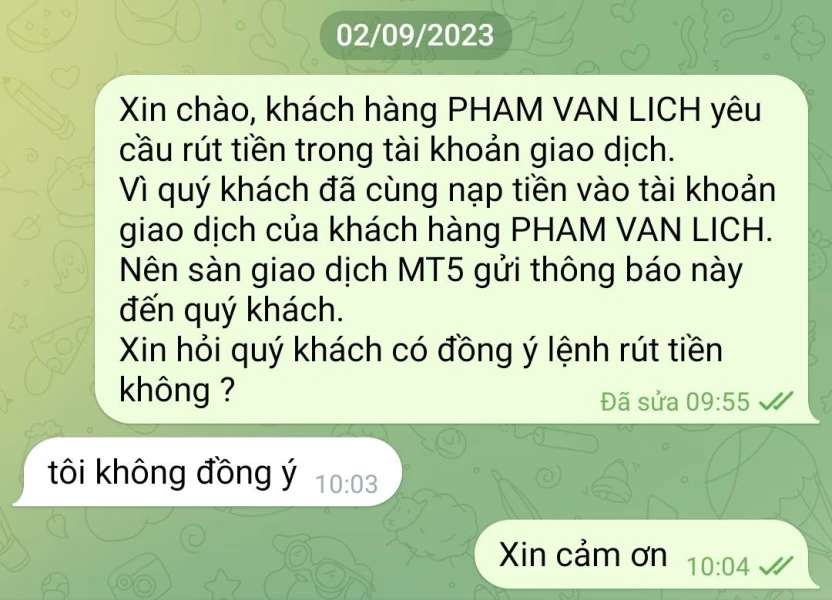

I'm Pham Van Lich id stk 113936 my Gmail address is phamvanlich091990@gmail.com, my account has been played and there is 1 friend who has loaded into my account, now I want to withdraw money, customer care says yes got the consent of both, so let's me ask if the floor is reputable, now my account is close to 21000 USD but I can't withdraw, so I hope to get help from the technical team.

Exposure

JT0

Japan

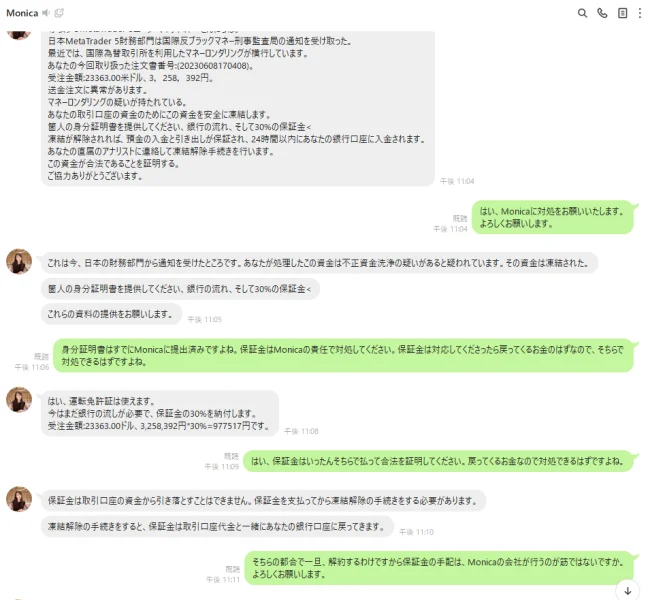

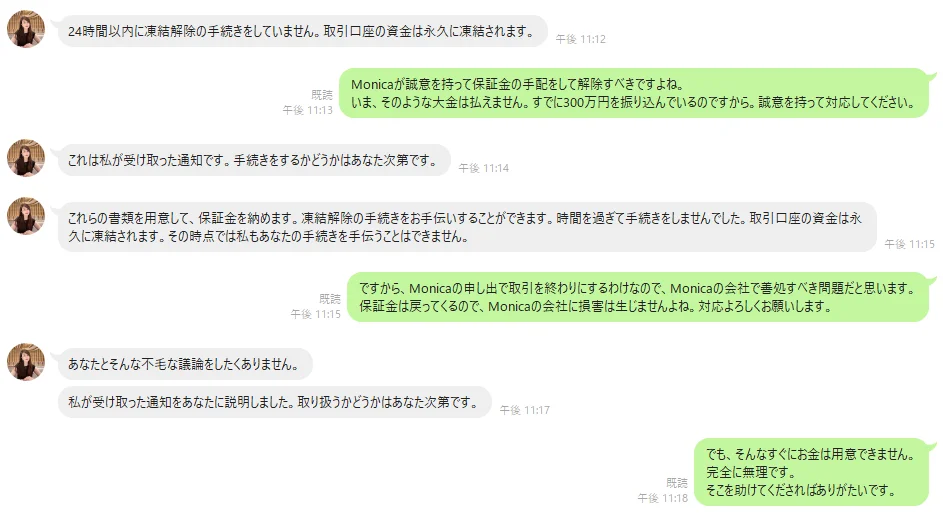

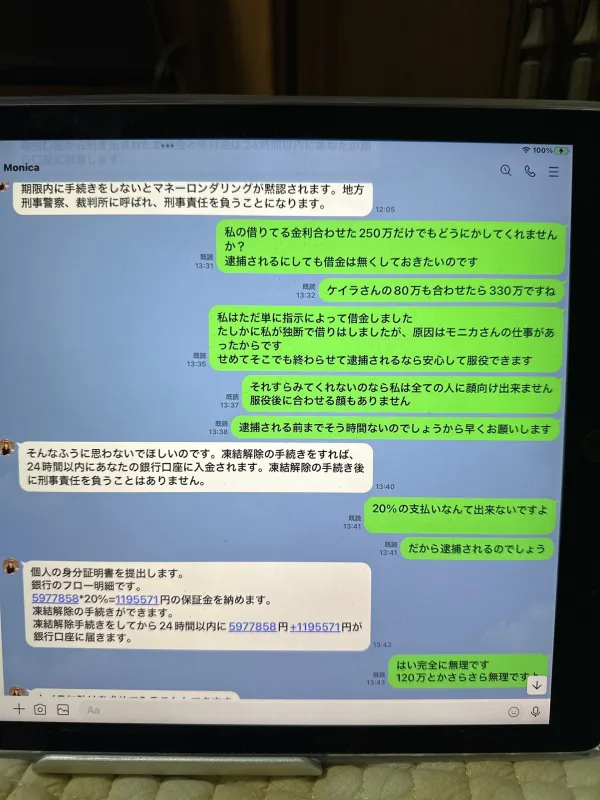

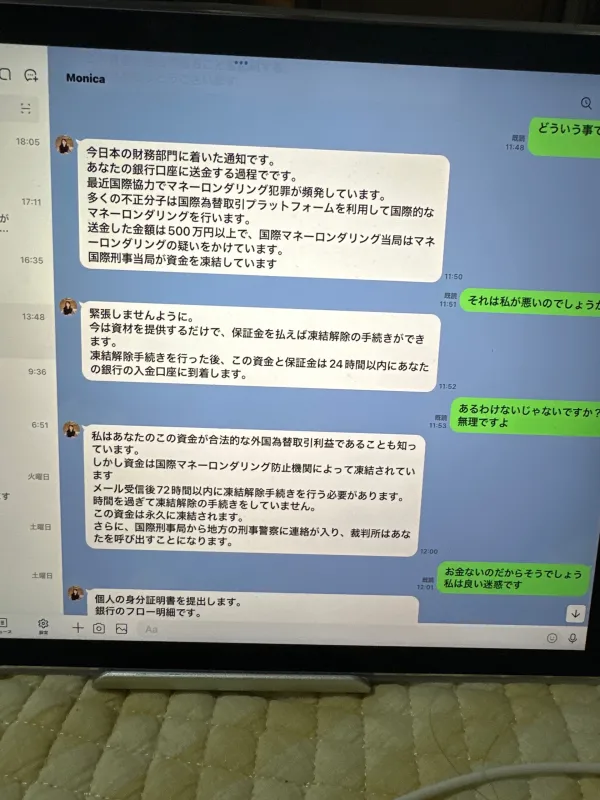

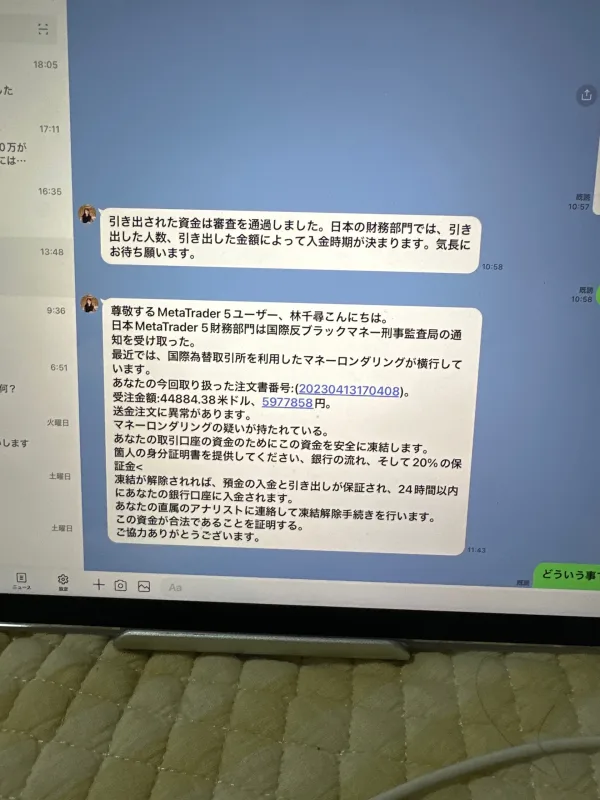

I was told that I could not withdraw money due to suspicion of money laundering even though the transaction was terminated due to their circumstances. I want you to solve it somehow.

Exposure

FX1358320967

Japan

It's a strange story that I'm arrested for moving according to the analyst's instructions, isn't it? Rather, if monika, who is giving instructions, is arrested, I will still understand. I was told that the police organization could not withdraw money due to suspicion of money laundering.

Exposure

bùi đình khôi

Vietnam

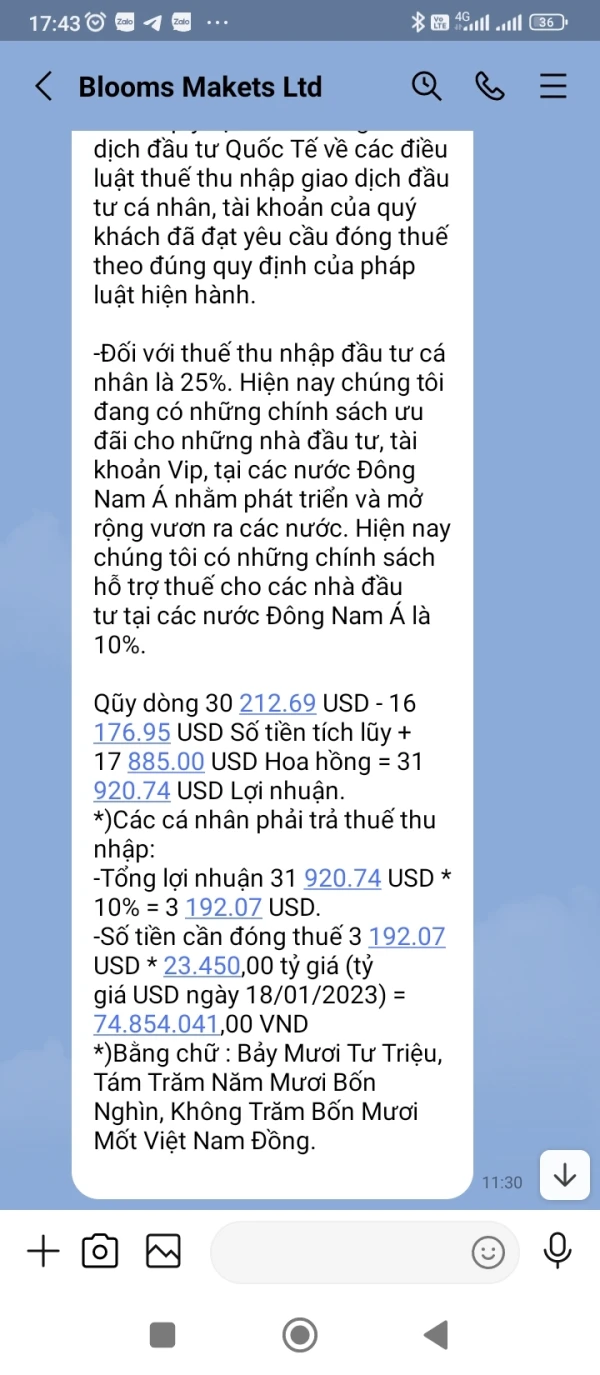

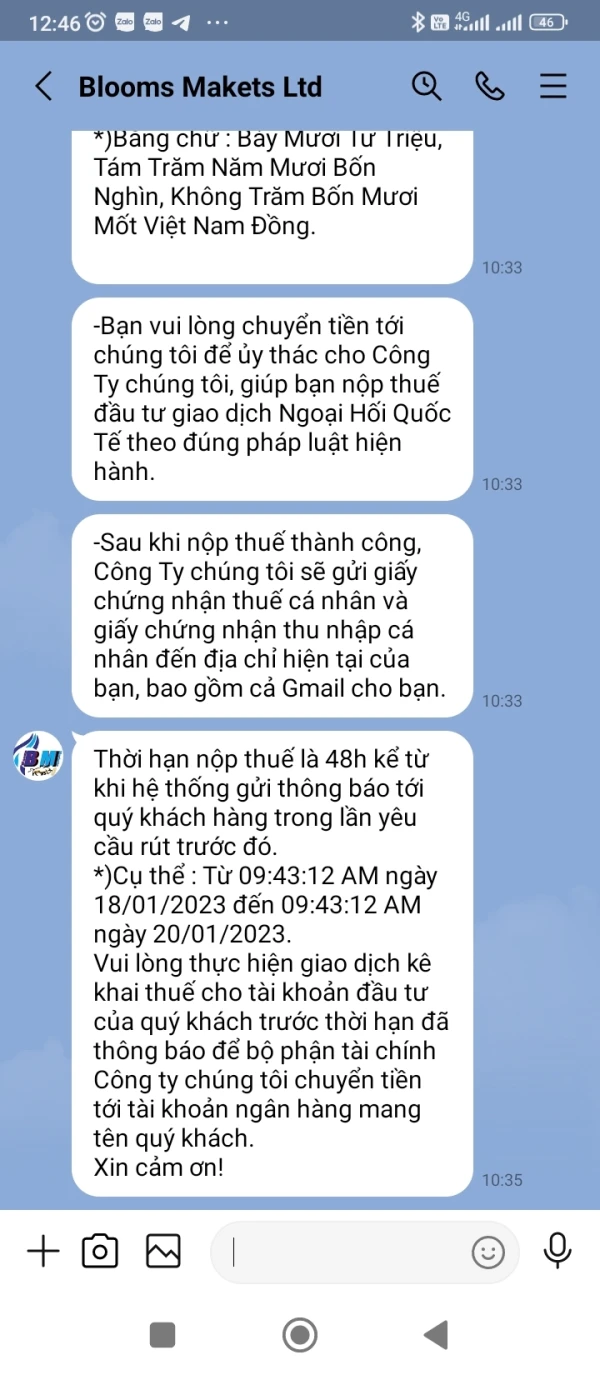

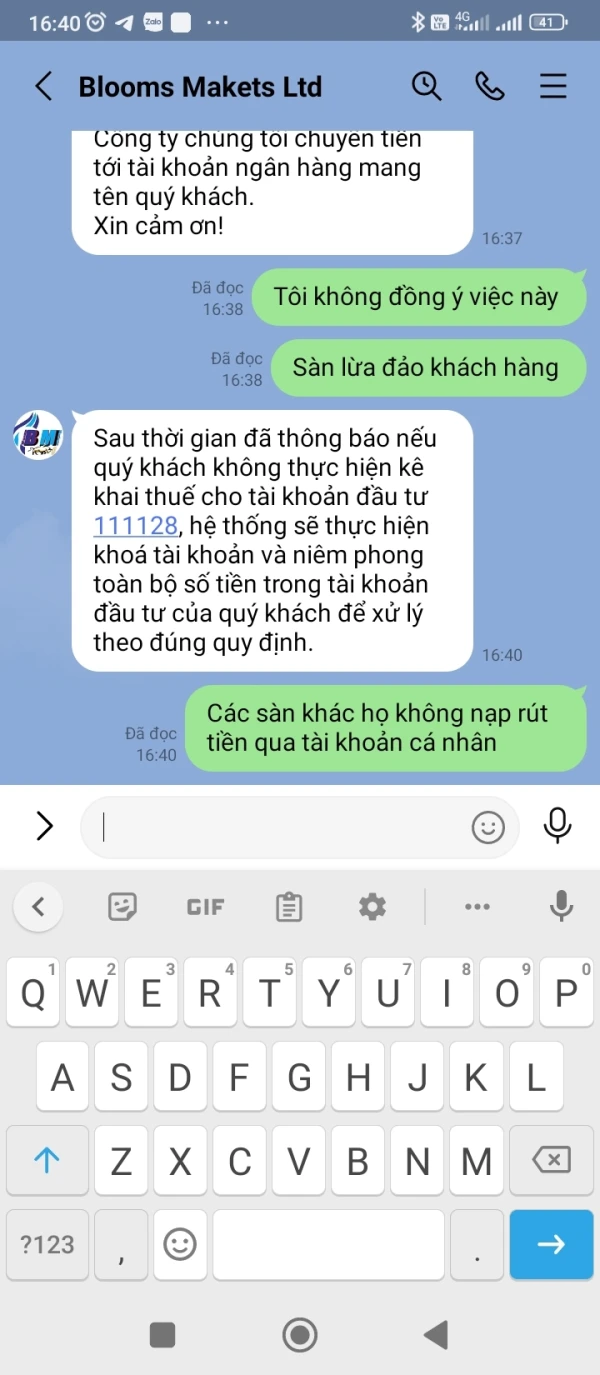

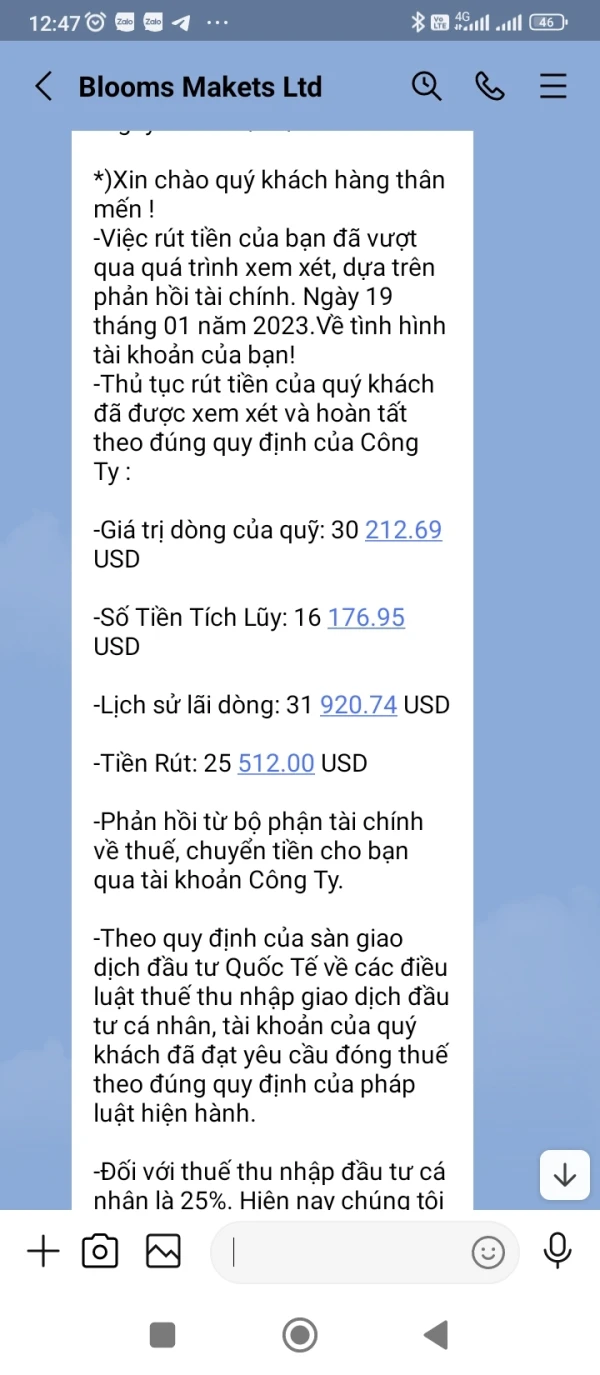

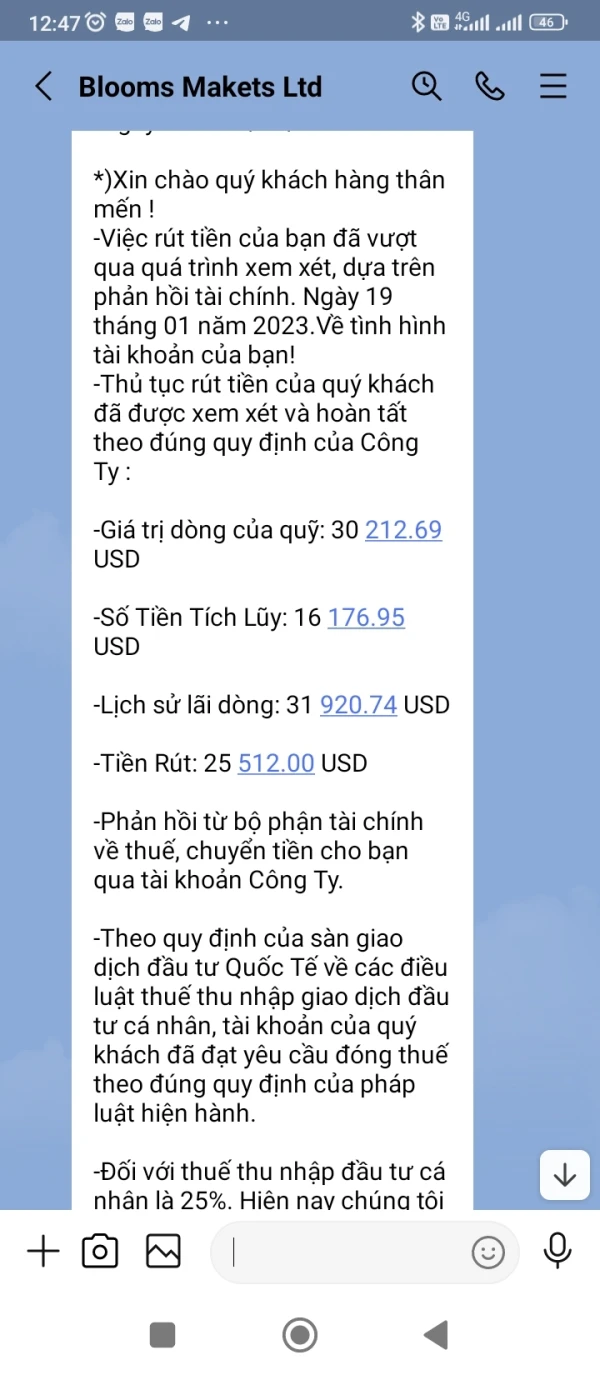

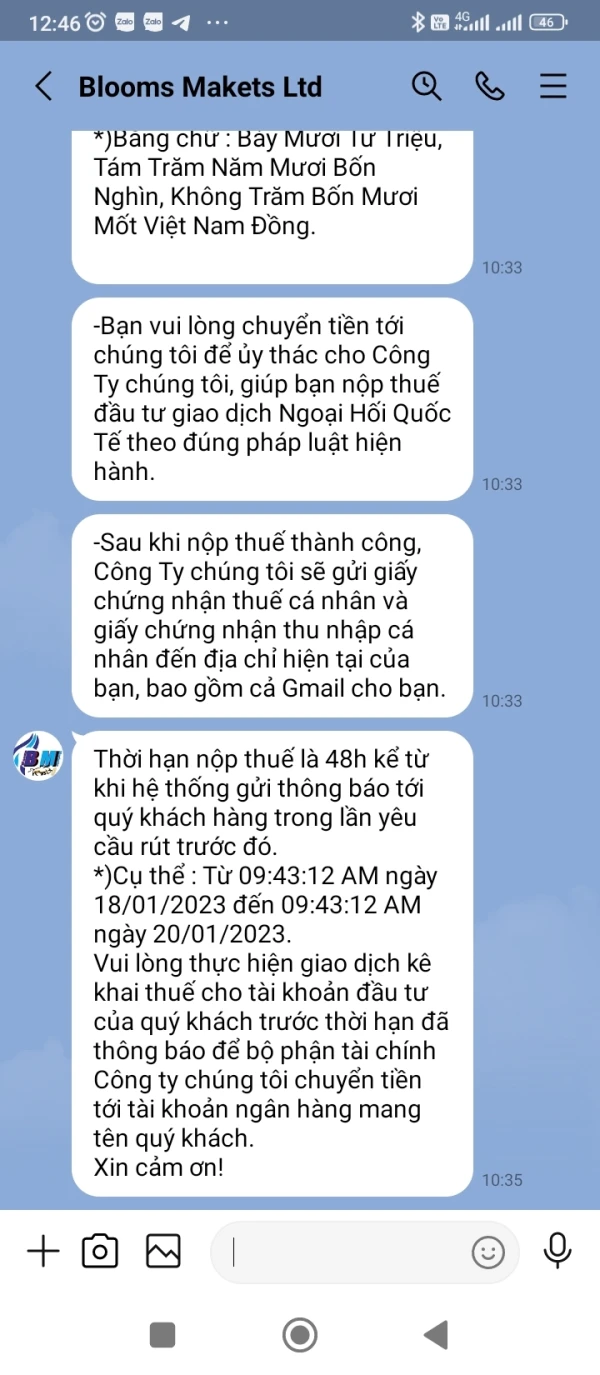

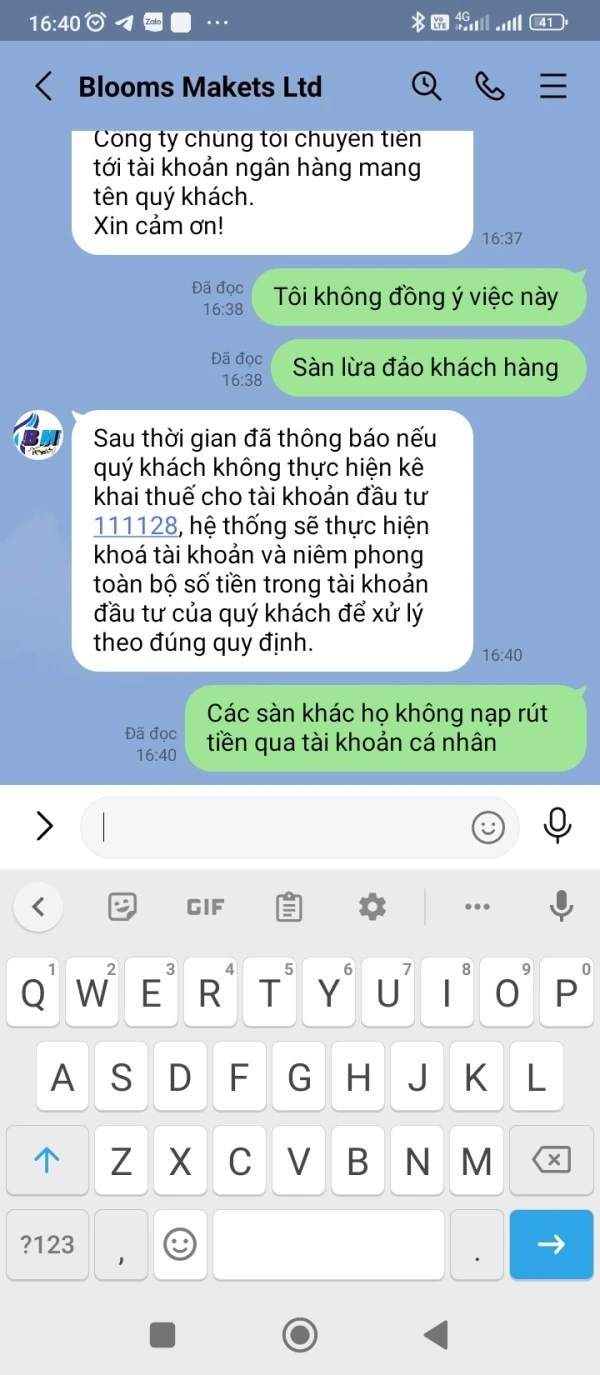

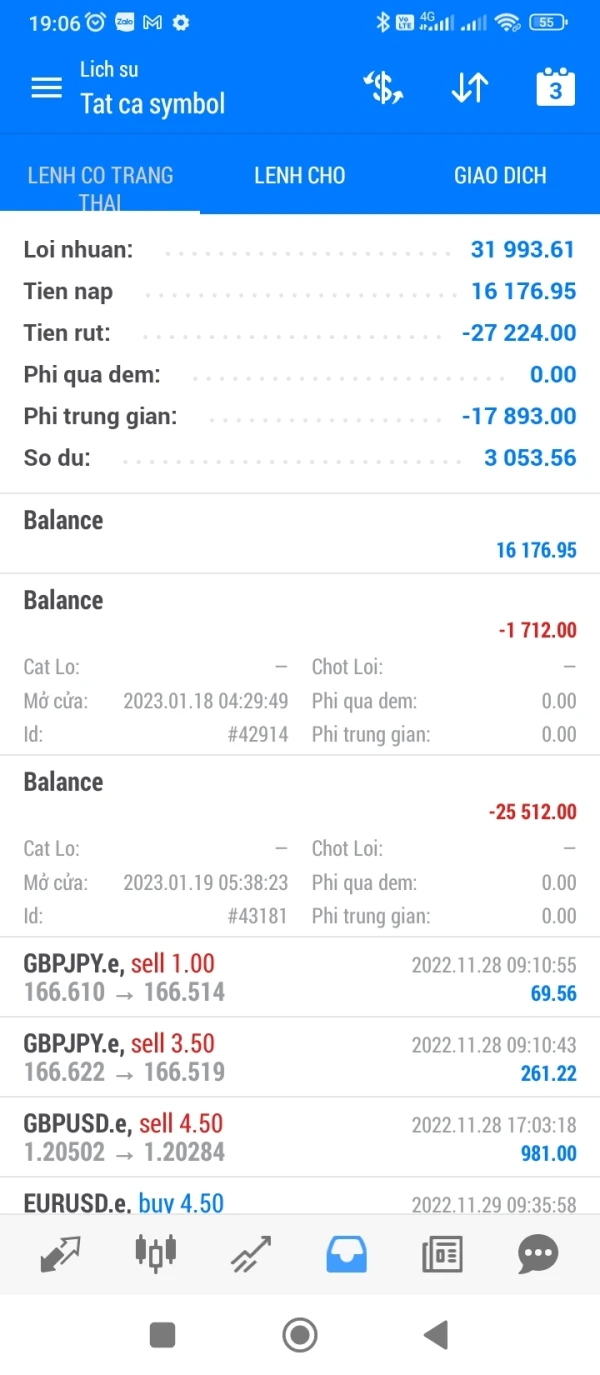

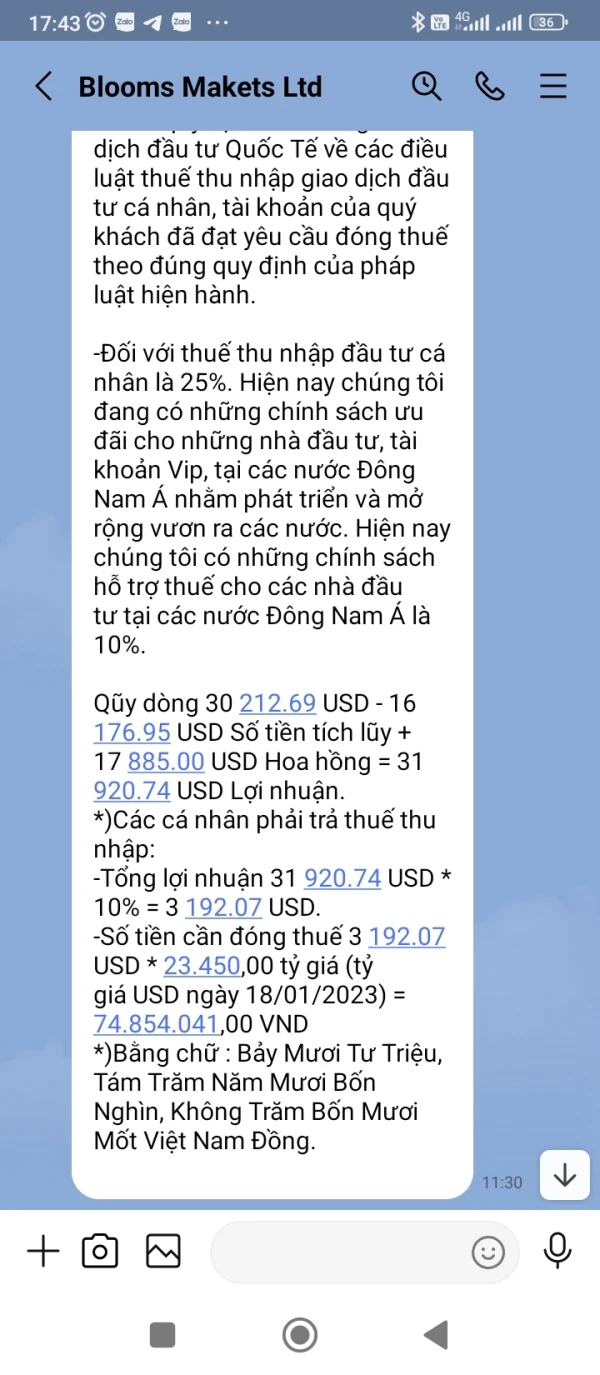

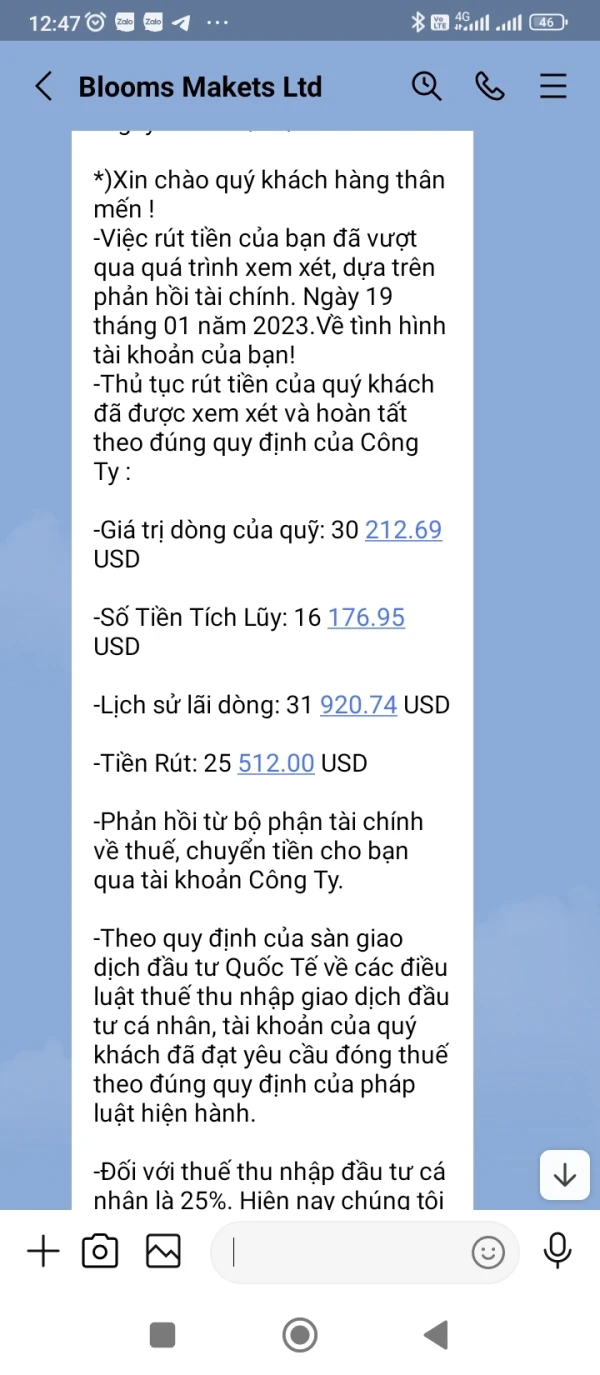

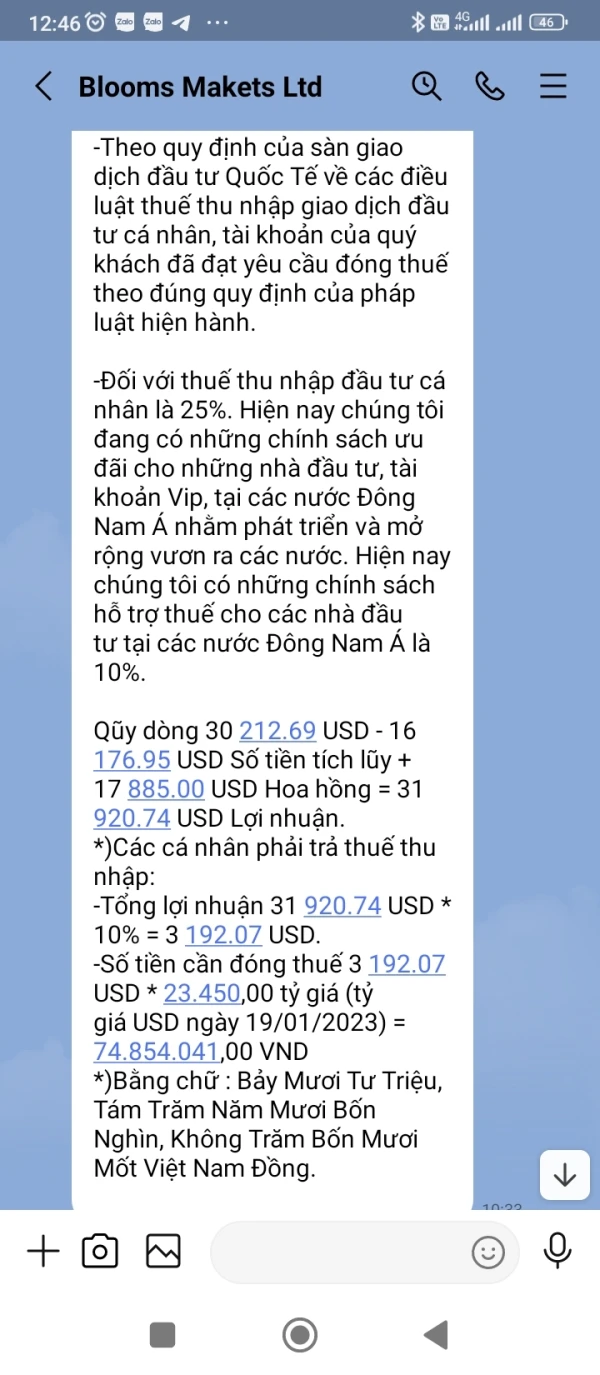

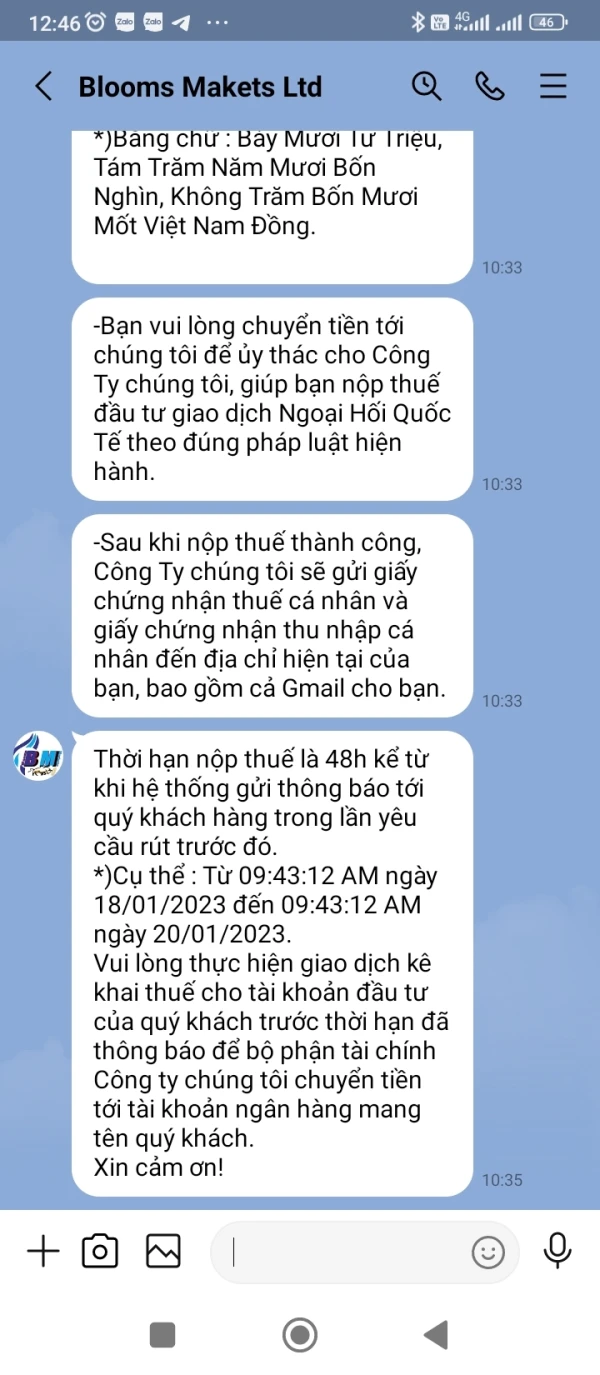

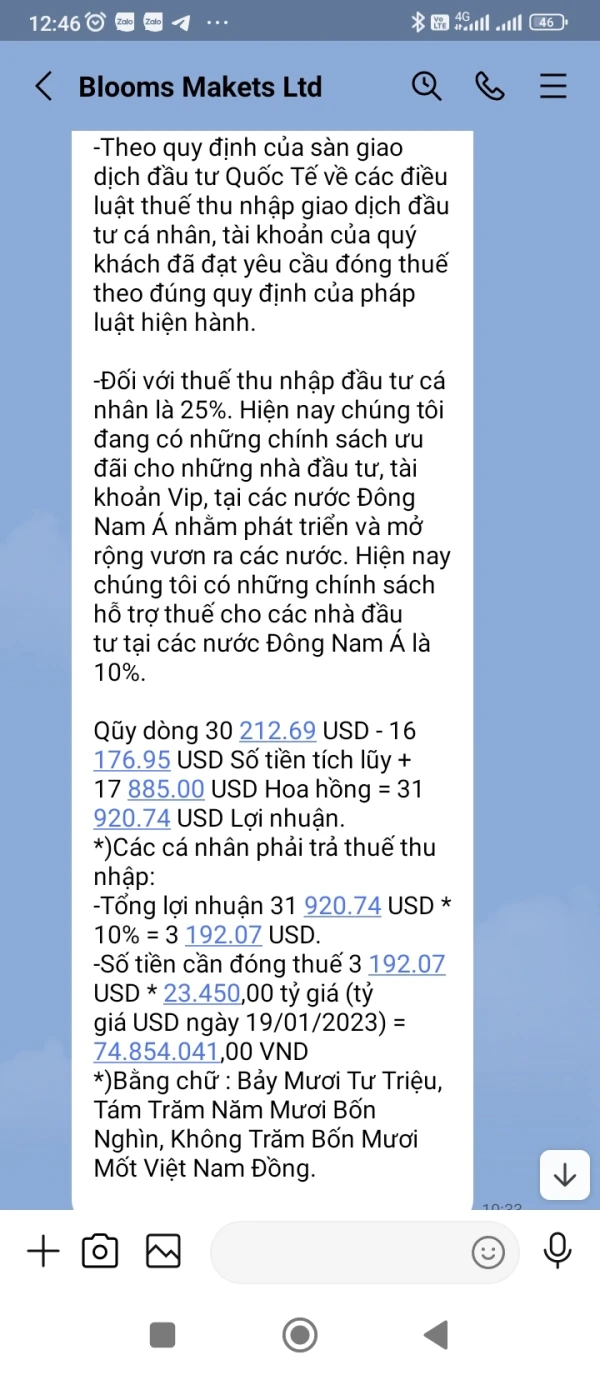

I have deposited money and participated in trading at the exchange BLOOMS MARKETS LIMITED ltd but when the transaction is profitable. I want to withdraw my money, the exchange forces me to pay taxes and lock my account

Exposure

bùi đình khôi

Vietnam

i have deposited money and participated in trading at the exchange BLOOMS MARKETS LIMITED ltd, but when a profitable transaction wants to withdraw money, the exchange has deducted money from my account without transferring money to me, asked me to pay taxes and then locked my account,

Exposure

FX5358003

United Arab Emirates

This business is a scam; don't invest in it. After I made a substantial investment with them, they banned all of their contact information and my account when I sought to withdraw money from it. With this company, don't waste your money. I applied for a r fund with Cyb3rnub*net. This is a significant con. company, I have changed the password of my Metatrader4 account. I can log in and see that the money is still in the account even after withdrawal.

Exposure

bùi đình khôi

Vietnam

I have deposited money and participated in trading at blooms markets limited when the transaction is profitable. When I withdrew, the exchange deducted money from my account without transferring money to me and force me to pay tax. Now, my account is locked. Please help me get my money back, thank you very much!

Exposure

bùi đình khôi

Vietnam

I have deposited and traded at blooms markets limited but when I made a profit and wanted to withdraw my money, the exchange forced me to pay taxes.

Exposure

bùi đình khôi

Vietnam

I was involved in trading with blooms markets limited. When I made a withdrawal request,the exchange wouldn't let me withdraw, demanded to pay taxes and threatened to lock my account if I didn't pay after 48 hours.

Exposure

bùi đình khôi

Vietnam

The platform does not allow withdrawals, so I have to pay new taxes for withdrawals, please help me

Exposure

ngocduy

Vietnam

I have deposited money in blooms market limited but can't withdraw now. Requested support but no support

Exposure