Company Summary

| 24markets Review Summary | |

| Founded | 2014 |

| Registered Country/Region | South Africa |

| Regulation | Suspicious clone |

| Market Instruments | Forex, Commodities, Crypto, Indices, Stocks, CFDs |

| Demo Account | ❌ |

| Leverage | Up to 1:500 |

| Spread | From 1.5 pips (EUR/USD, Discovery account) |

| Trading Platform | WebTrader, MetaTrader 5 (MT5), Mobile App |

| Min Deposit | $100 |

| Customer Support | Email:support@24markets.com |

| Phone:+27 101 577 500 (Available 24/5) | |

| Live chat | |

24markets Information

24markets is a South Africa-based broker launched in 2014, offering CFDs on Forex, indices, commodities, stocks, and crypto. While it features a range of platforms including MT5 and web-based trading, it falsely claims FSCA regulation under another companys license.

Pros and Cons

| Pros | Cons |

| Offers MT5 and a web platform | Cloned license |

| Multiple account types with tiered benefits | Demo and Islamic accounts not available |

| Supports Forex, stocks, crypto & more | Limited information of swap and inactivity fees |

Is 24markets Legit?

The broker claims to be regulated by FSCA using license No. 50640, which actually belongs to DEDA CAPITAL MARKETS (PTY) LTD. However, the brokers name and domain do not match the licensed entity, clearly indicating a fake or cloned license intended to mislead users.

| Regulatory Status | Suspicious clone |

| Regulated by | South Africa – Financial Sector Conduct Authority (FSCA) |

| Licensed Institution | DEDA CAPITAL MARKETS (PTY) LTD |

| Licensed Type | Financial Service Corporate |

| Licensed Number | 50640 |

What Can I Trade on 24markets?

24Markets offers a wide selection of CFD trading instruments, including dozens of Forex pairs, over 10 global indices, major commodities, and popular cryptocurrencies. While stocks are supported, ETFs are not mentioned.

| Tradable Instruments | Supported |

| Forex | ✅ |

| Commodities | ✅ |

| Crypto | ✅ |

| CFD | ✅ |

| Indexes | ✅ |

| Stock | ✅ |

| ETF | ❌ |

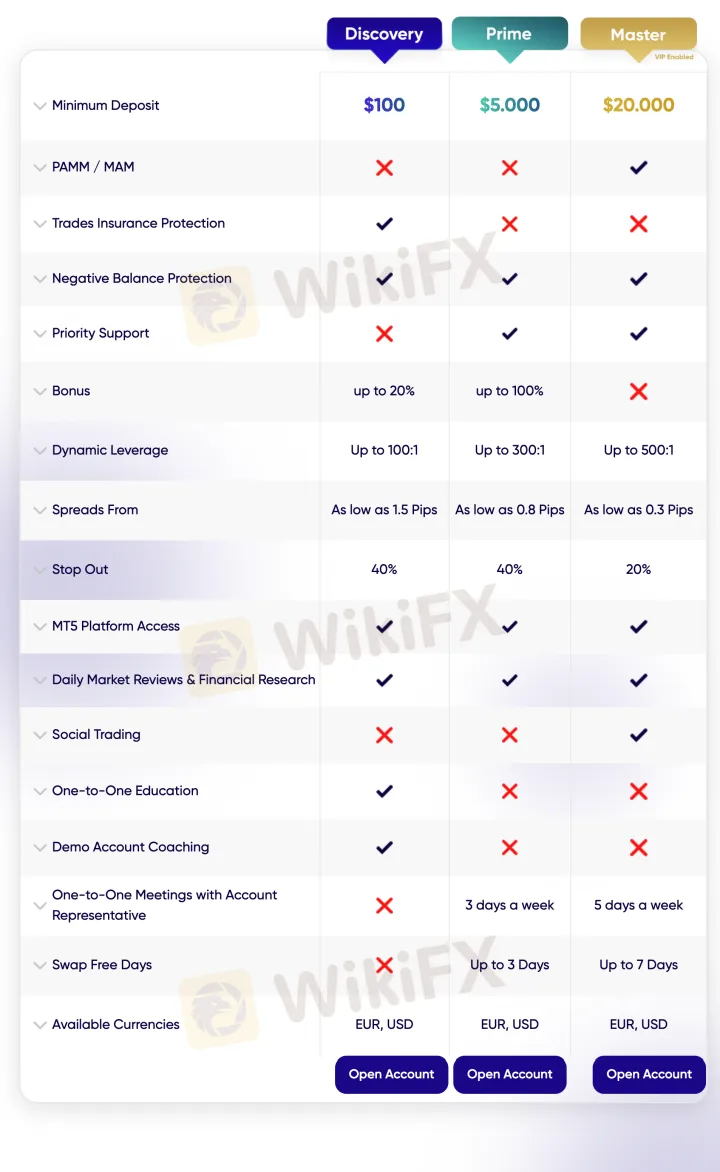

Account Types

24Markets offers three live account types: Discovery, Prime, and Master. Each suits different trading levels—from beginners to professionals—with increasing benefits like tighter spreads, higher leverage (up to 1:500), and VIP services.

| Account Type | Min Deposit | Key Features | Best For |

| Discovery | $100 | 1.5 pip spreads, up to 100:1 leverage, no priority support, some education tools | Beginners |

| Prime | $5,000 | 0.8 pip spreads, up to 300:1 leverage, 3 swap-free days, 3x weekly rep meetings | Intermediate traders |

| Master | $20,000 | 0.3 pip spreads, up to 500:1 leverage, 7 swap-free days, full VIP features | Advanced/professional traders |

Leverage

24Markets offers dynamic leverage of up to 1:500, depending on the account type. While high leverage can increase profits with little capital, it also increases the danger of significant losses without appropriate risk management.

24markets Fees

Compared to industry standards, 24Markets trading fees are moderate to slightly high, especially for entry-level accounts. While spreads decrease with higher-tier accounts, the absence of transparent commission and swap rate details limits cost comparison for advanced traders.

| Account Type | EUR/USD Spread (From) | Commission |

| Discovery | 1.5 pips | $0 |

| Prime | 0.8 pips | $0 |

| Master | 0.3 pips | $0 |

Spreads: Start from 1.5 pips on the Discovery account and go as low as 0.3 pips on the Master account.

Commissions: No commissions are stated across all account types.

Swap Rates: Swap-free trading is available for up to 7 days on higher-tier accounts. Exact overnight swap fees are not publicly disclosed.

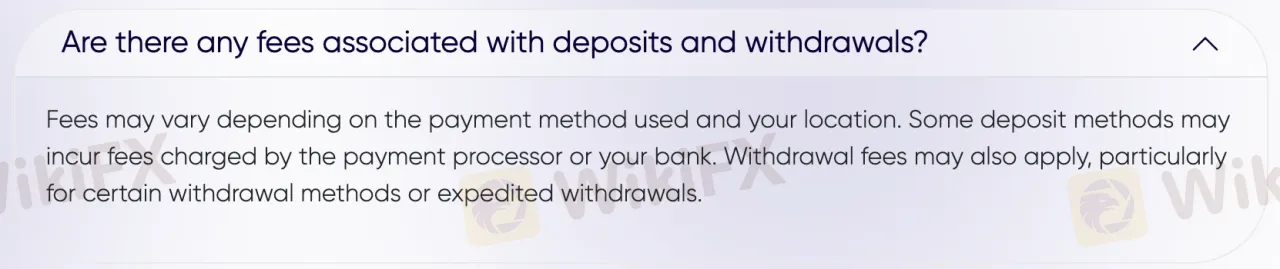

Non-Trading Fees

| Non-trading Fees | |

| Deposit Fee | Varies by payment method and bank; some may incur third-party processing fees |

| Withdrawal Fee | May apply depending on withdrawal method or expedited request |

| Inactivity Fee | Not mentioned |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| WebTrader | ✔ | Web browser (desktop/mobile) | Traders looking for intuitive, real-time web-based trading |

| MetaTrader 5 (MT5) | ✔ | Windows, macOS, Android, iOS | Advanced traders needing analytical tools and multi-asset access |

| Mobile Trading App | ✔ | iOS, Android | Traders who prefer on-the-go access and mobile convenience |

| MetaTrader 4 (MT4) | ❌ | – | Not supported |

Deposit and Withdrawal

24markets does not charge fixed deposit or withdrawal fees itself, but third-party processors or banks may apply charges depending on the method and location. The minimum deposit required to open an account is $100.

Deposit Options

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Bank Wire Transfer | $100 | May vary by provider | Few minutes to a few hours |

| Credit/Debit Cards | $100 | May vary by provider | Few minutes to a few hours |

| E-wallets | $100 | May vary by provider | Few minutes to a few hours |

| Online Payment Methods | $100 | May vary by provider | Few minutes to a few hours |

AC141

Spain

Just look at the photo and you will understand what I mean. Be Careful!!!

Exposure

Jenniee

United States

24markets is the real deal! Their maximum leverage is impressive, giving traders the power to make the most of their capital. And their customer service is second to none, always available and eager to help. Very satisfied with my experience so far!

Positive

FX1492746351

Australia

Joined 24markets recently and have mixed feelings. The platform is user-friendly with tight spreads and the customer service is responsive. However, the registration process was a bit cumbersome due to strict security measures, and I noticed they don't offer ETFs, which was a letdown.

Neutral

Claudio942

Italy

Recorded by myself. I got a call to introduce myself but mostly I trade myself. Checked the license and all, very good. I have the ability to trade better. For me everything is fine. Tried to withdraw my funds, no problem that way. Great mt5 platform. Overall good experience

Positive

Pasquale847

United Arab Emirates

I am very happy with the experience, platform overall good experience

Positive

Bruno4553

Italy

I am very happy with the service of 24makets. Fast service, advice at all times. 9.5/10

Positive

FX1320962681

New Zealand

24markets is the company that have ever seen in my Life is just a good company so far since I start to invest in that company have been able to feed me and my family! Thank you for everything!

Positive