Basic Information

Saint Lucia

Saint Lucia

Score

Saint Lucia | 2-5 years |

Saint Lucia | 2-5 years |https://luzuna.com/

Website

Rating Index

Forex License

Forex License No forex trading license found. Please be aware of the risks.

Saint Lucia

Saint Lucia  luzuna.com

luzuna.com  United States

United States | Aspect | Information |

| Company Name | Luzuna |

| Registered Country/Area | Saint Lucia |

| Founded Year | 2023 |

| Regulation | Unregulated |

| Minimum Deposit | Varies by account type (e.g., $500 for Beginner) |

| Maximum Leverage | Up to 400:1 |

| Spreads | N/A |

| Trading Platforms | Desktop, MAC, Linux, Mobile (Smartphones/Tablets) |

| Tradable Assets | Over 600 across various asset classes |

| Account Types | Beginner, Basic, Premium, Premium Pro, Investor, VIP |

| Demo Account | Available |

| Customer Support | 24/7, Live chat, Email, Telephone |

| Deposit & Withdrawal | Various methods including credit cards, debit cards, wire transfers; withdrawal fees not charged |

| Educational Resources | Library of articles and videos, Demo Account, Live chat support. Limited but basic resources available. |

Luzuna, a trading platform established in 2023 and based in Saint Lucia, operates as an unregulated broker. The company provides a versatile trading experience with a range of account types, including Beginner, Basic, Premium, Premium Pro, Investor, and VIP, each requiring varying minimum deposits. Traders can access a maximum leverage of up to 400:1, allowing for amplified market exposure. The platform boasts over 600 tradable assets across diverse classes, accessible through user-friendly trading platforms compatible with desktop, MAC, Linux, and mobile devices.

Luzuna supports various deposit and withdrawal methods, including credit cards, debit cards, and wire transfers, with no withdrawal fees imposed. The company prioritizes customer support, offering assistance 24/7 through live chat, email, and telephone. Educational resources include a library of articles and videos, a demo account for practice, and live chat support, providing a foundation for traders, although the resources are somewhat limited. Overall, Luzuna meets the diverse needs of traders, emphasizing accessibility, flexibility, and round-the-clock support.

| Pros | Cons |

| Wide range of tradable assets | Unregulated broker |

| Competitive leverage options | Limited educational resources |

| User-friendly trading platform | Higher minimum deposits may be a barrier for some traders |

| 24/7 customer support | |

| No withdrawal fees |

Pros:

Wide range of tradable assets: Luzuna offers over 600 tradable assets across various asset classes, including currencies, commodities, stocks, and indices. This gives traders a wide range of options to choose from and allows them to diversify their portfolios.

Competitive leverage options: Luzuna offers flexible leverage options of up to 400:1. This allows traders to amplify their market exposure and maximize their profits, but it is important to note that leverage also increases risk.

User-friendly trading platform: Luzuna's trading platform is designed to be user-friendly and easy to navigate, even for beginners. It offers a variety of features, such as technical indicators, charting tools, and news feeds, to help traders make informed trading decisions.

24/7 customer support: Luzuna offers 24/7 customer support via live chat, email, and telephone. This ensures that traders can always get help when they need it.

No withdrawal fees: Luzuna does not charge any withdrawal fees, which allows traders to keep more of their profits.

Cons:

Unregulated broker: Luzuna is an unregulated broker, which means that it is not subject to the same regulatory oversight as regulated brokers. This can increase the risk of fraud and other problems.

Limited educational resources: Luzuna's educational resources are limited, especially compared to other brokers. This can be a disadvantage for beginner traders who need help learning the basics of trading.

Higher minimum deposits may be a barrier for some traders: The minimum deposit requirements for some of Luzuna's account types may be too high for some traders, especially beginners.

Luzuna is an unregulated broker that does not hold any regulated licenses. This means that it is not subject to the same regulatory oversight as regulated brokers. As a result, Luzuna is not required to comply with the same standards of customer protection and financial reporting.If you are considering trading with Luzuna, it is important to be aware of the risks involved.

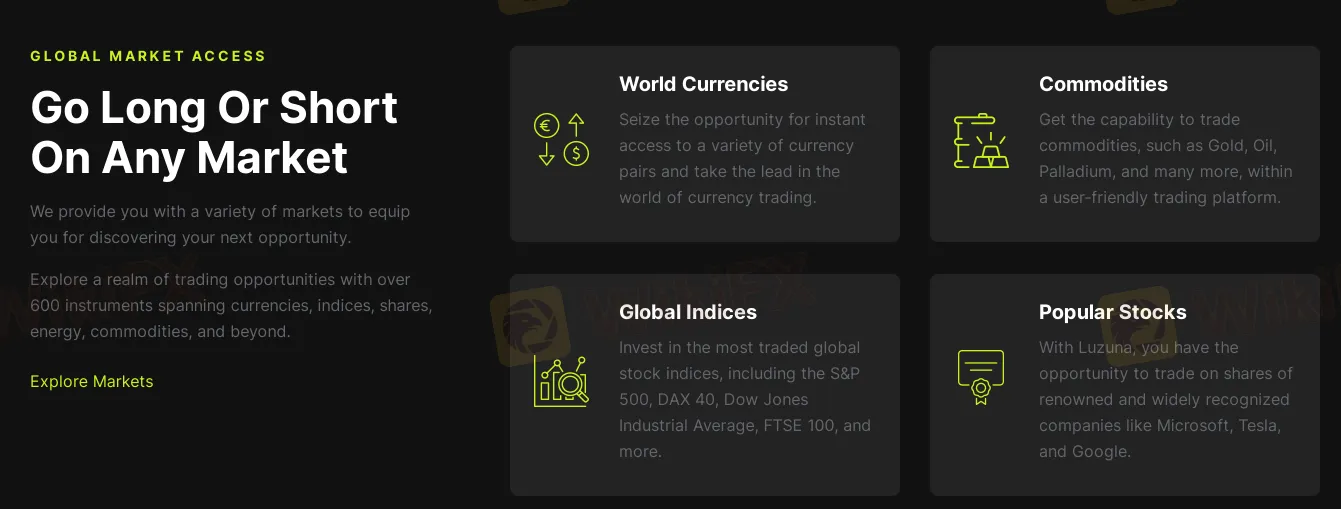

Luzuna offers a comprehensive suite of financial products under the banner of Global Market Access, providing traders with versatile options to navigate and capitalize on diverse market opportunities. The platform encompasses over 600 instruments across various asset classes, ensuring that users can engage in both long and short positions.

Investors can delve into the dynamic realm of currency trading with a wide array of world currencies, facilitating instant access to different currency pairs. Additionally, Luzuna empowers users to trade commodities such as Gold, Oil, and Palladium through a user-friendly platform. The platform also caters to those interested in global stock indices, allowing investment in well-known indices like the S&P 500, DAX 40, Dow Jones Industrial Average, and FTSE 100. Furthermore, Luzuna extends its reach to individual stocks, offering the opportunity to trade shares of renowned companies such as Microsoft, Tesla, and Google. Overall, Luzuna's product lineup ensures a diverse and inclusive approach to global market participation.

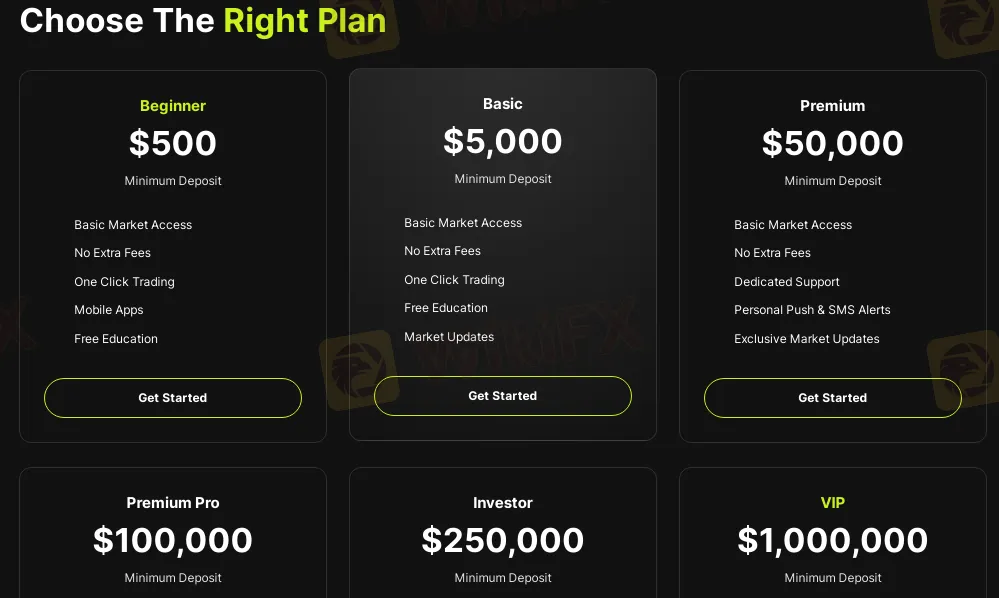

Luzuna provides all levels with a tiered account system designed to meet individual needs and preferences.

The Beginner account, requiring a minimum deposit of $500, provides a user-friendly entry point into trading, offering basic market access with no extra fees. With one-click trading and mobile apps, beginners can easily navigate the platform. Free educational resources further empower users to build their trading knowledge.

Moving up, the Basic account, requiring a $5,000 minimum deposit, builds on the Beginner offering market updates to keep users informed. It maintains the simplicity of one-click trading and free education, making it suitable for those ready for a more comprehensive trading experience.

The Premium account, starting at $50,000, introduces dedicated support and personal push & SMS alerts, providing a more tailored approach to trading. Users can also access exclusive market updates, enhancing their decision-making capabilities.

For serious investors, the Premium Pro account requires a $100,000 minimum deposit, unlocks full market access and a private account manager. With additional perks like free installment and exclusive updates, this account level is ideal for those seeking a more hands-on and personalized trading experience.

Stepping into higher tiers, the Investor account, starting at $250,000, provides full market access along with exclusive updates and alerts. No extra fees and the inclusion of a personal account manager make this account suitable for investors aiming for a sophisticated trading environment. The VIP account, with a minimum deposit of $1,000,000, offers a premium experience with access to new features, best execution, and pricing. Priority support, exclusive events, and a dedicated VIP account manager further elevate the trading journey for high-net-worth individuals.

| Account Type | 24/7 Live Video Chat Support | Withdrawals | Demo Account | Copy Trading Tool | Other Features |

| Beginner | No | Standard | Yes | No | One-click trading, Mobile apps, Free education |

| Basic | No | Standard | Yes | No | Market updates, Free education |

| Premium | Yes | Expedited | Yes | No | Dedicated support, Personal alerts, Exclusive updates |

| Premium Pro | Yes | Expedited | Yes | No | Private account manager, Free installment, Exclusive updates |

| Investor | Yes | Expedited | Yes | Yes | Exclusive updates, Personal alerts, No extra fees |

| VIP | Yes | VIP Service | Yes | Yes | New features, Best execution, Priority support, Exclusive events, VIP account manager |

Opening an account with Luzuna involves 5 steps.

Visit the Luzuna website: Go to Luzuna's official website to initiate the account opening process.

Choose an account type: Select the desired account type based on your trading preferences and financial commitment.

Complete the registration form: Fill out the required information in the registration form, including personal details and financial information.

Verify your identity: Submit the necessary documents for identity verification to comply with regulatory requirements.

Fund your account: Deposit the minimum required amount into your newly created Luzuna trading account to start trading in the chosen market.

Luzuna offers flexible leverage options to traders, allowing them to manage their trading risk effectively. Traders can access leverage of up to 400:1, providing an opportunity to explore new trading techniques and fully unlock the potential of their trading strategies. This level of leverage enables traders to amplify their market exposure, but it's crucial for them to use it judiciously, considering the associated risks and market conditions.

Luzuna offers a trading platform designed to provide traders with a quick, transparent, and intelligent approach to navigating financial markets. Accessible on desktop, MAC, Linux devices, and mobile platforms, including smartphones and tablets, the platform ensures flexibility and convenience for users. Boasting a rich set of features, the multi-asset platform supports a wide range of tradable assets, exceeding 600 in number.

With a focus on accessibility and assistance, Luzuna's trading platform is equipped with 100 technical indicators to aid in analysis, ensuring a comprehensive toolset for traders. The platform's commitment to low margin fees contributes to cost-effectiveness, enhancing the overall trading experience.

Luzuna provides a variety of secure payment methods to accommodate both deposits and withdrawals, ensuring accessibility for traders globally. When funding your account, major credit cards such as Visa, Mastercard, and American Express are accepted, though a 2.5% fee applies to credit card deposits. Debit card options, including Visa Debit and Mastercard Debit, are available with a 1% fee on deposits. For those opting for more traditional transfers, Luzuna accepts wire transfers, but there is a $25 fee per transaction.

Importantly, Luzuna distinguishes itself by not charging any withdrawal fees, allowing traders to retain the full amount of their withdrawals. This fee-free withdrawal policy contributes to a transparent and straightforward process, ensuring that traders can maximize their returns without any hidden fees.

| Payment Method | Deposit Fee | Withdrawal Fee |

| Visa | 2.50% | None |

| Mastercard | 2.50% | None |

| American Express | 2.50% | None |

| Visa Debit | 1% | None |

| Mastercard Debit | 1% | None |

| Wire Transfer | $25 | None |

Luzuna emphasizes a commitment to real customer care with its round-the-clock, multilingual support services. Traders can reach out for assistance through various channels, including live chat, email (support@luzuna.com), and telephone (+18007071562). The availability of multilingual support professionals underscores Luzuna's dedication to providing swift and attentive assistance to its users, fostering a responsive and helpful customer service experience. Whether you have inquiries, need guidance, or require support, Luzuna aims to ensure that its customers feel well-supported at all times.

The educational resources of Luzuna are free, they offer a few things to help traders get started.

First, Luzuna has a library of articles and videos on a variety of trading topics, including technical analysis, fundamental analysis, and risk management. These resources are available to all Luzuna customers, regardless of their account type.

Second, Luzuna offers a demo account. This allows traders to practice trading with virtual money before they start trading with real money. This can be a great way to learn the basics of trading and to test out new strategies.

Finally, Luzuna offers live chat support. This means that traders can get help from a Luzuna representative 24/7. This can be helpful for traders who have questions about their account or who need help troubleshooting problems.

Overall, the educational resources of Luzuna are limited. However, they do offer some basic resources that can help traders get started.

In conclusion, Luzuna, founded in 2023 and headquartered in Saint Lucia, offers a trading platform catering to a diverse range of traders. While providing a variety of account types and boasting over 600 tradable assets, the platform is unregulated, lacking the oversight and customer protections associated with regulated brokers.

However, Luzuna excels in customer support, offering 24/7 assistance through various channels and enabling accessibility with a demo account. High maximum leverage and varying minimum deposit requirements provide flexibility but may also increase risk and pose barriers for some traders. Traders considering Luzuna should carefully weigh the advantages of a diverse asset selection and accessible customer support against the potential risks associated with its unregulated status and limited educational resources.

Q: What types of accounts are offered by Luzuna?

A: Luzuna provides a range of account types, including Beginner, Basic, Premium, Premium Pro, Investor, and VIP, each catering to different trading preferences and experience levels.

Q: How can I contact Luzuna's customer support?

A: Luzuna offers 24/7 customer support, and you can reach them through various channels, including live chat, email (support@luzuna.com), and telephone (+18007071562).

Q: What is the minimum deposit required to open an account with Luzuna?

A: The minimum deposit varies depending on the chosen account type. For example, the Beginner account requires a minimum deposit of $500.

Q: Does Luzuna charge withdrawal fees?

A: No, Luzuna does not charge withdrawal fees, allowing traders to retain the full amount of their withdrawals. This fee-free withdrawal policy simplifies the withdrawal process for users.

Q: Can I access Luzuna's trading platform on mobile devices?

A: Yes, Luzuna's trading platform is accessible on mobile devices, including smartphones and tablets, providing flexibility for traders to engage in trading activities on the go.

Q: Is there a demo account available on Luzuna?

A: Yes, Luzuna offers a demo account, allowing traders to practice and familiarize themselves with the platform using virtual money before engaging in real-money trading.

Q: What is the maximum leverage offered by Luzuna?

A: Luzuna provides flexible leverage options, allowing traders to access leverage of up to 400:1, providing an opportunity to explore new trading techniques and strategies.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Warrane Brodeur

France

My experience investing in indices with Luzuna is really positive. Deposits are easy, withdrawals are fast, and the platform is secure.

Positive

Pryor Vincent

France

Luzuna offers an exceptional currency investing experience. Withdrawals are fast, and customer support is always ready to help, which gives me confidence.

Positive

Orson Gougeon

France

Investing in stocks with Luzuna is a decision that I do not regret. Deposits are easy, withdrawals are fast, and security is excellent.

Positive

Porter Pouchard

France

Luzuna made investing in indices very simple and profitable for me. The speed of withdrawals and quality customer service make it my favorite platform.

Positive

Gradasso Verreau

France

Investing in currencies with Luzuna is a great experience. Deposits are fast, and the security of the platform gives me confidence in my transactions.

Positive

Walter L. Nelson

Australia

My confidence in Luzuna has been strengthened by investing in currencies. Fast withdrawals and deposits, exceptional customer service, and a secure platform that ensures consistent winnings.

Positive

Richard A. Jackson

Australia

Luzuna offered me an exceptional opportunity to invest in stocks. Easy withdrawals and deposits, exceptional customer service, a safe and stable platform that has brought me considerable returns.

Positive

Brittany Patchell

Australia

Luzuna made my foreign exchange investing experience amazing. Fast withdrawals and deposits, exceptional customer support, a secure platform that guarantees continuous profits.

Positive

James E Barks

United Kingdom

Luzuna makes investing in currencies easy. Fast withdrawals and reliable customer support make this platform my trusted choice.

Positive

Verna Overby

United Kingdom

Luzuna makes investing in currencies easy. Fast withdrawals and reliable customer support make this platform my unquestionable choice.

Positive

Mark Russell

United Kingdom

Luzuna makes investing in currencies much easier. The secure platform and responsive customer service make it a wise choice to maximize my profits.

Positive

John Hankey

United Kingdom

Investing in indices through Luzuna was a smart move. The speed of withdrawals and the security of the platform are undeniable strong points.

Positive

George L. McLaughlin

United Kingdom

My experience with Luzuna in currency trading is great. The profits are there, and the speed of transactions is impressive. Customer support is always attentive.

Positive

John A Burnam

United Kingdom

I am excited to invest with Luzuna. Stocks brought me impressive profits. Fast withdrawals and exceptional customer support make it a reliable platform.

Positive

Richard M. Simpson

United States

My investments in indices on Luzuna.com have been successful. The winnings are impressive, and the quick withdrawals make the experience even better.

Positive

Sean Thompson

United States

Investing in currencies with Luzuna.com has been an exciting adventure. I have made huge profits, and their customer support has always stood behind me. A truly safe platform.

Positive

Jackie Wofford

United States

Luzuna.com is my choice for clues. The secure platform and growing profits are priceless. The best place to invest with confidence.

Positive

r264

United States

Luzuna.com has allowed me to thrive in the currency market. Their secure platform gives me confidence. Customer service is always ready to answer my questions.

Positive