Abstract:BlackBull Markets launches zero-spread trading on major FX pairs for Prime accounts, delivering up to 71% spread cost reduction through the LMAX partnership.

BlackBull Markets has eliminated spreads on major forex pairs for Prime account holders, marking the most significant pricing enhancement in the New Zealand-based broker's history. The enhancement, announced September 18, 2025, delivers zero spreads on key currency pairs including EURUSD, GBPUSD, and AUDUSD, throughout most trading hours.

Partnership Drives Zero-Spread Initiative

The breakthrough stems from BlackBull's strategic partnership with LMAX, a premier institutional liquidity provider known for transparent execution and deep FX pools. LMAX operates multiple global institutional exchanges with liquidity centers in London, New York, Tokyo, and Singapore, enabling BlackBull to access institutional-grade pricing previously reserved for major financial institutions.

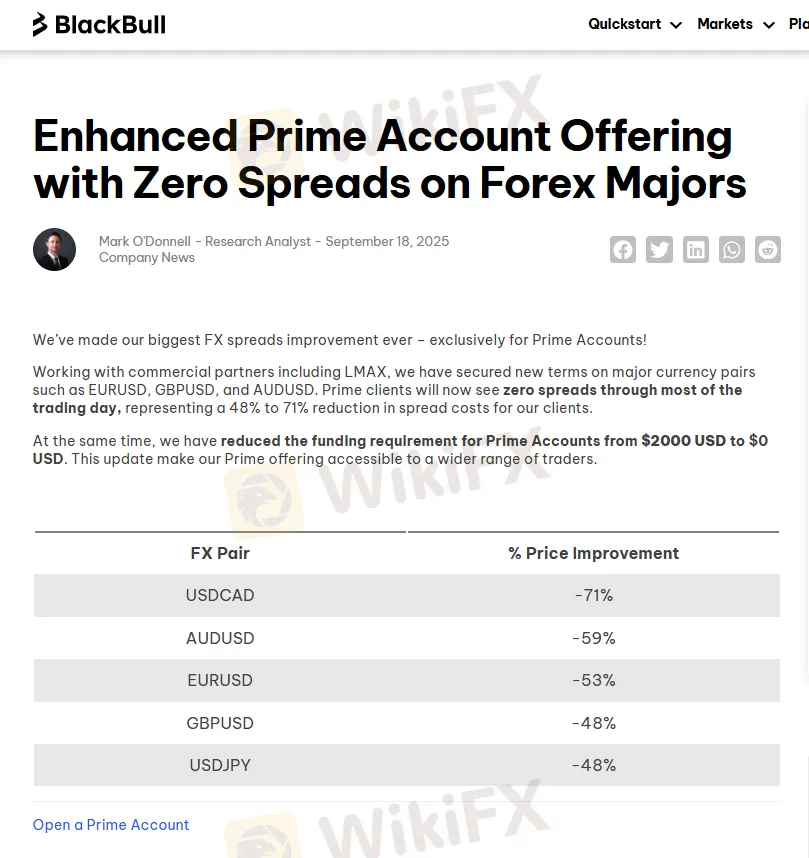

Research Analyst Mark O'Donnell emphasized the magnitude of this development, noting that Prime clients now experience spread cost reductions ranging from 48% to 71% across major currency pairs. The most substantial improvement affects USDCAD trading, where spreads dropped by 71%, followed by AUDUSD at a 59% reduction.

Account Accessibility Transforms

BlackBull simultaneously eliminated the $2,000 USD minimum funding requirement for Prime accounts, reducing the barrier to $0 USD. This democratization allows broader trader access to institutional-level trading conditions previously restricted to high-net-worth clients.

The ECN broker, established in 2014 by Michael Walker and Selwyn Loekman, serves traders across 180+ countries through its Auckland headquarters. BlackBull maintains multi-regulatory compliance and operates with Electronic Communication Network execution, providing direct market access without dealing desk intervention.

Comprehensive Spread Reductions

The zero-spread implementation covers five major forex pairs, with specific percentage improvements clearly documented. USDJPY and GBPUSD both achieved 48% spread reductions, while EURUSD captured a 53% improvement. These enhancements apply throughout most trading sessions, maximizing cost savings for active forex traders.

BlackBull's infrastructure supports over 26,000 tradable instruments across forex, commodities, indices, and equities. The company operates multiple trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and TradingView, ensuring compatibility with diverse trading strategies.

Institutional Technology Foundation

LMAX's award-winning technology platform provides the backbone for BlackBull's enhanced offering. The liquidity provider operates FCA-regulated exchanges and maintains a commitment to the FX Global Code, ensuring transparent price discovery and firm execution without last-look rejections.

The partnership leverages LMAX's central limit order book system and peer-to-peer institutional liquidity pools, delivering consistent execution with minimal latency. This infrastructure enables BlackBull to pass institutional pricing advantages directly to retail Prime account holders.

Conclusion

BlackBull Markets' zero-spread initiative represents a significant shift in retail forex pricing, bringing institutional trading conditions to individual traders through strategic liquidity partnerships. The elimination of funding requirements further enhances accessibility, positioning BlackBull competitively in the evolving forex brokerage landscape.

Experience zero-spread trading on major forex pairs with a BlackBull Markets Prime account. Open your account today to access institutional-grade pricing with no minimum deposit requirement.