JDC Markets

Cyprus

Cyprus

Time Machine

Check whenever you want

Download App for complete information

Exposure

1 pieces of exposure in totalJDC Markets · Company Summary

| Company name | JDC Markets |

| Registered in | Cyprus |

| Regulated | CYSEC |

| Years of establishment | 2015 |

| Trading instruments | Forex, precious metals, CFDs on stocks, indices, commodities |

| Account Types | Live Trading Account, Demo Trading Account |

| Minimum Initial Deposit | $500 |

| Maximum Leverage | 30:1 (major currency pairs), 20:1 (non-major currency pairs, gold, and major indices), 10:1 (commodities other than gold and non-major equity indices), 5:1 (individual equities) |

| Minimum Spread | 2.0 pips (EUR/USD) |

| Trading Platform | MetaTrader 5 (MT5) |

| Deposit and Withdrawal Methods | Wire transfer, Skrill |

| Customer Service | Phone, email |

Overview of JDC Markets

JDC Markets is a Cyprus-based forex and CFD broker that was founded in 2015. The company is regulated by the Cyprus Securities and Exchange Commission (CySEC), and it offers a wide range of trading instruments, including forex, precious metals, CFDs on stocks, indices, and commodities.

JDC Markets also offers two types of trading accounts: a Live Trading Account and a Demo Trading Account. The minimum initial deposit for the Live Trading Account is $500, and the maximum leverage is 30:1 for major currency pairs. The trading platform offered by JDC Markets is MetaTrader 5 (MT5), and the company accepts deposits and withdrawals via wire transfer and Skrill.

Is JDC Markets legit or a scam?

JDC Markets being regulated by CYSEC (Cyprus Securities and Exchange Commission) and holding an STP (Straight-Through Processing) license adds legitimacy to its operations. The regulation by CYSEC indicates that the broker adheres to strict financial and operational standards set by the regulatory authority, which aims to safeguard the interests of investors and ensure fair and transparent trading practices.

The STP license further enhances the legitimacy of JDC Markets by indicating that they operate with a direct market execution model, forwarding clients' orders to liquidity providers without any interference or conflict of interest. This model ensures that trades are executed swiftly and without manipulation, providing traders with better transparency and improved execution quality.

With these regulatory credentials, traders can have confidence in JDC Markets as a reputable and trustworthy brokerage. The regulation by CYSEC and the use of an STP license demonstrate the company's commitment to maintaining high standards, protecting clients' interests, and providing a reliable and fair trading environment.

Pros and Cons

JDC Markets boasts several advantages, including being regulated by CYSEC, ensuring compliance with strict financial standards and offering a secure trading environment. Clients benefit from a diverse range of market instruments, granting them opportunities to trade various assets, and the use of MetaTrader 5 platform, a user-friendly and powerful tool for market analysis and execution.

However, the brokerage has limited leverage options, which might restrict some traders' strategies. Additionally, the presence of variable spreads can lead to fluctuations in transaction costs. JDC Markets could enhance its services by expanding its account types to cater to different traders' needs and by providing 24/7 customer support for prompt assistance across different time zones.

| Pros | Cons |

| Regulated by CYSEC | Limited leverage options |

| Diverse market instruments | Variable spreads |

| MetaTrader 5 platform | Limited account types |

| No 24/7 customer support |

Market Instruments

JDC Markets offers a diverse range of market instruments for trading. In the Forex and Metals category, traders can access a variety of currency pairs and precious metals like gold and silver. The Futures CFDs provide opportunities to trade contracts based on various underlying assets, offering exposure to different financial markets. The trading hours cater to global markets, enabling traders to participate in various sessions.

Additionally, the Swap Rates are relevant for traders who hold positions overnight, as they represent the cost or benefit of keeping positions open. With this wide selection of market instruments, JDC Markets provides traders with ample opportunities to diversify their portfolios and capitalize on different market conditions.

Account Types

Jin Daocheng Ltd (JDC Markets) offers two main types of trading accounts: Live Trading Account and Demo Trading Account.

The Live Trading Account requires a $500 initial deposit, supports multiple account currencies (EUR, USD), and offers standard lot size with leverage ratios ranging from 30:1 to 5:1 for various instruments. It operates on a No Dealing Desk (NDD) execution model with variable spreads (average 2.0 pips for EUR/USD) and incurs trading costs based on spreads. The account provides access to Forex and Precious Metals instruments, with margin call and stop-out levels set at 70% and 50%, respectively. Risk warning: Trading CFDs and Forex instruments may risk all your invested capital.

The Demo Trading Account allows risk-free practice with the MT5 platform, offering the same trading conditions as the Live Trading Account. Traders can test strategies and develop skills without using real money. Jin Daocheng Ltd is a licensed and regulated broker, adhering to high compliance and KYC standards. Account verification is necessary before live trading. Risk warning: Trading CFDs and Forex instruments may risk all your invested capital.

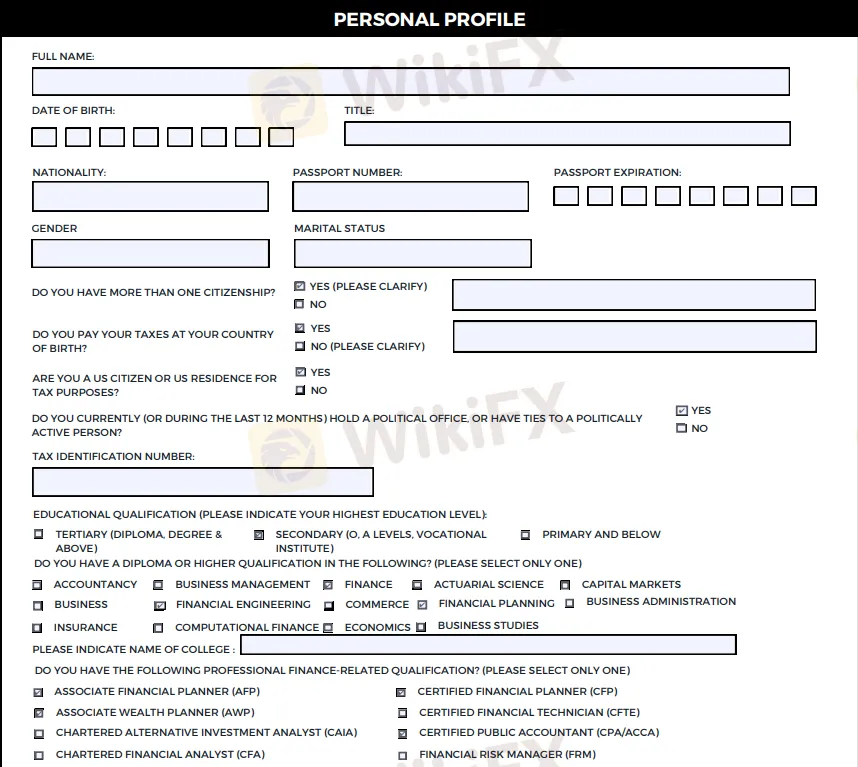

How to Open an Account?

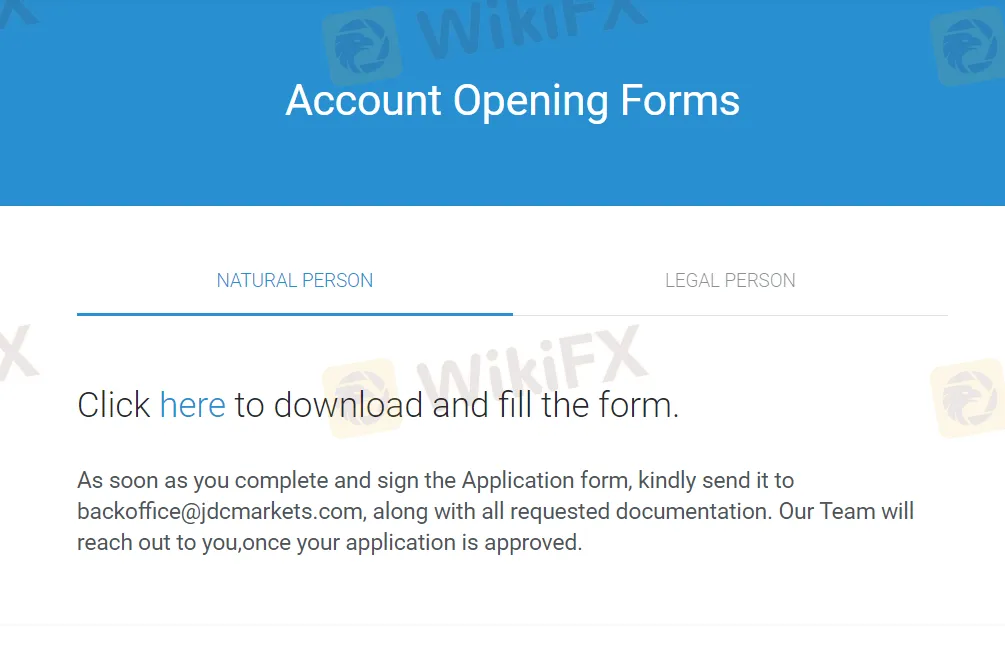

To open an account with JDC Markets, follow these five simple steps:

Visit the Website: Go to the JDC Markets website at https://www.jdcmarkets.com/ and navigate to the account opening page.

Download and Fill the Form: Click on the provided link to download the account opening form. Complete the form with accurate and up-to-date information, ensuring all required fields are filled.

Submit Documentation: Along with the filled application form, gather and submit any requested documentation to verify your identity and address. This typically includes a valid government-issued ID (passport, driver's license, etc.) and proof of address (utility bill, bank statement, etc.).

Sign the Application Form: After filling in the necessary details, sign the application form to confirm your agreement with the terms and conditions of JDC Markets.

Email the Form and Documents: Send the completed and signed application form, along with the requested documentation, to the designated email address backoffice@jdcmarkets.com.

Leverage

The maximum leverage offered by JDC Markets varies depending on the instrument being traded. Here are the maximum leverage ratios for different types of instruments:

Major currency pairs: Maximum leverage of 30:1

Non-major currency pairs, gold, and major indices: Maximum leverage of 20:1

Commodities other than gold and non-major equity indices: Maximum leverage of 10:1

Individual equities: Maximum leverage of 5:1

These leverage ratios define the amount of leverage a trader can use when opening positions in different markets. Higher leverage allows traders to control larger positions with a smaller amount of capital, but it also increases the risk. Traders should carefully consider the appropriate leverage level based on their risk tolerance and trading strategy.

Spreads & Commissions

JDC Markets offers variable spreads on its trading instruments. A variable spread means that the difference between the bid and ask prices can fluctuate depending on market conditions. For the EUR/USD currency pair, the average spread is specified as 2.0 pips. However, the actual spreads may vary during different market conditions and trading sessions.

As for commissions, the information provided in the initial description does not explicitly mention any separate commission charges. Instead, JDC Markets operates on a spread-based trading cost model. This means that the trading cost is incorporated into the spread offered for each instrument. Traders do not incur additional commissions on their trades; they pay the difference between the buy and sell prices as their transaction cost.

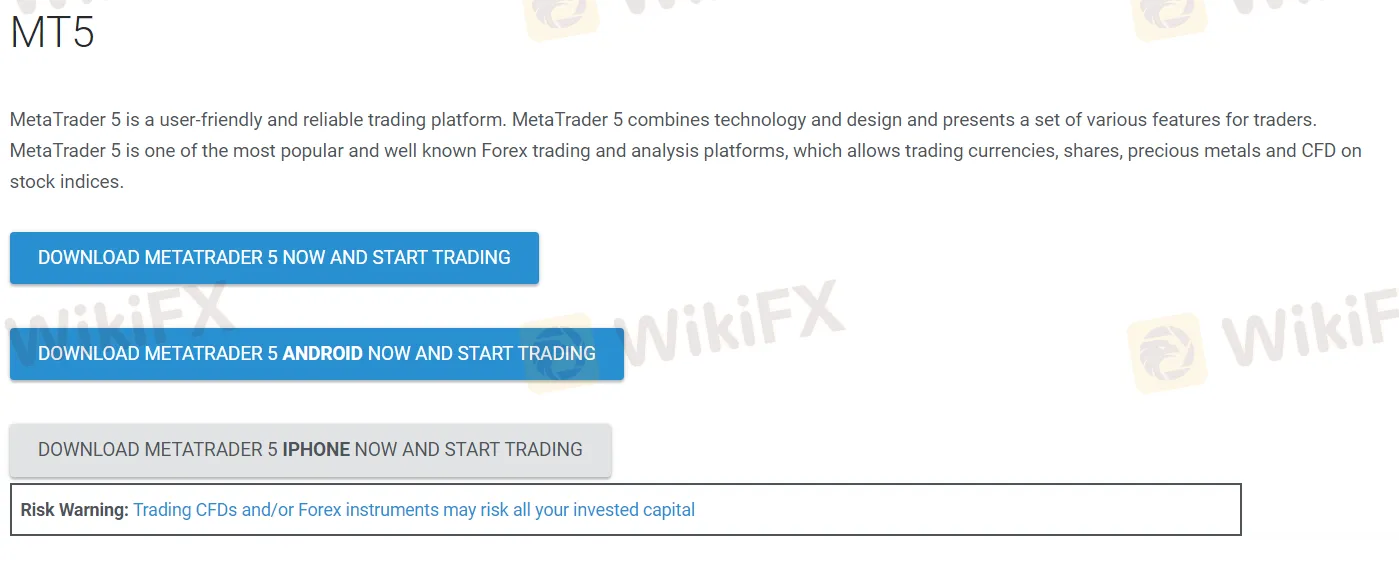

Trading Platform

JDC Markets provides traders with access to the widely recognized and versatile trading platform, MetaTrader 5 (MT5). This user-friendly and reliable platform offers a seamless trading experience, combining cutting-edge technology and an intuitive design. With a comprehensive set of features, MT5 caters to the needs of both novice and experienced traders, providing a powerful tool for analyzing markets and executing trades.

Traders on the JDC Markets platform can utilize MetaTrader 5 to access a diverse range of financial instruments, including Forex, shares, precious metals, and CFDs on stock indices. This broad selection allows for diversified trading strategies and portfolio building. Additionally, the platform supports algorithmic trading through Expert Advisors (EAs), enabling automated trading strategies for more efficient execution.

Deposit & Withdrawal

JDC Markets offers convenient and secure methods for both Deposit and Withdrawal transactions. For deposits, clients can utilize wire transfers, enabling them to transfer funds directly from their bank accounts to their JDC Markets trading accounts. This method ensures reliability and safety for transferring larger sums of money.

Additionally, JDC Markets accepts ePayments through Skrill, providing clients with a quick and easy way to fund their trading accounts online. Skrill offers various options for funding, including credit/debit cards, bank transfers, and other e-wallets. For Withdrawals, clients can similarly opt for wire transfers or use Skrill to transfer their funds from their JDC Markets accounts to their personal bank accounts or e-wallets.

Customer Support

JDC Markets offers customer support services that are dedicated to providing prompt and efficient assistance to its clients. Clients can reach out to the support team via phone or email, with phone lines (+357-25-260900 and +357-25-260999) available during business hours. Additionally, clients can send their questions and concerns to the provided email address (info@jdcmarkets.com) for a timely response.

Educational Resources

JDC Markets is committed to empowering its clients with valuable knowledge and expertise through its comprehensive Educational Resources. These resources are designed to equip traders of all levels with the necessary tools to enhance their trading skills and make informed decisions in the financial markets. The Educational Resources at JDC Markets encompass a wide range of materials, including interactive video tutorials, webinars, eBooks, market analysis, and trading guides.

These resources cover various topics such as technical and fundamental analysis, risk management strategies, trading psychology, and market trends. With access to these educational materials, clients can develop a deeper understanding of the financial markets, improve their trading strategies, and ultimately increase their chances of achieving trading success.

Conclusion

JDC Markets demonstrates legitimacy and trustworthiness as a regulated broker under CYSEC. With a diverse range of market instruments and the use of the powerful MetaTrader 5 platform, clients are offered ample opportunities for diversified trading strategies. However, the brokerage could further improve by expanding its leverage options and account types to cater to a wider range of traders. Additionally, providing 24/7 customer support would enhance their commitment to assisting clients across different time zones. Overall, JDC Markets stands as a reputable option for traders seeking a secure and comprehensive trading experience.

FAQs

Q: Is JDC Markets a regulated broker?

A: Yes, JDC Markets is regulated by CYSEC.

Q: What is the maximum leverage offered?

A: Leverage varies by instrument, up to 30:1 for major pairs.

Q: Which trading platform does JDC Markets use?

A: JDC Markets uses MetaTrader 5 (MT5) platform.

Q: How can I fund my trading account?

A: Deposit via wire transfers or Skrill (ePayments).

Q: Does JDC Markets offer educational resources?

A: Yes, it provides comprehensive educational materials.

News

No data