Company Summary

| TGReview Summary | |

| Founded | 1997 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Market Instruments | Futures, options, stocks |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | T G iTrader, eBrokerKey |

| Minimum Deposit | HK$50 |

| Customer Support | Phone: (852) 2869 8870 |

| E-mail: contact@tgshk.com | |

| Fax: (852) 2540 9399 | |

| Address: Suite 1409, 14/F, North Tower, World Finance Centre, 19 Canton Road, Tsim Sha Tsui, Kowloon, Hong Kong | |

TG Information

TG, founded in 1997, is a brokerage registered in Hong Kong. The trading instruments it provides cover futures, options, and stocks. It uses its own trading platforms, and the minimum deposit is HK$50. Besides, it is regulated well in Hong Kong.

Pros and Cons

| Pros | Cons |

| SFC regulated | Limited withdrawal options |

| Multiple trading instruments | No account type information |

| Low minimum deposit of HK$50 | Fees charged |

| Various contact channels |

Is TG Legit?

TG is regulated by the Securities and Futures Commission of Hong Kong (SFC) in Hong Kong.

| Regulated Authority | Current Status | Regulated Country | Regulated Entity | License Type | License Number |

| Securities and Futures Commission of Hong Kong (SFC) | Regulated | China (Hong Kong) | T G Securities Limited | Dealing in futures contracts | AHU779 |

What Can I Trade on TG?

FPG offers traders the opportunity to trade futures, options, stocks.

| Tradable Instruments | Supported |

| Futures | ✔ |

| Options | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ❌ |

| Indices | ❌ |

| Bonds | ❌ |

| Forex | ❌ |

| Commodities | ❌ |

TG Fees

TG charges HK$30 per contract for futures and HK$10 per contract for stock options.

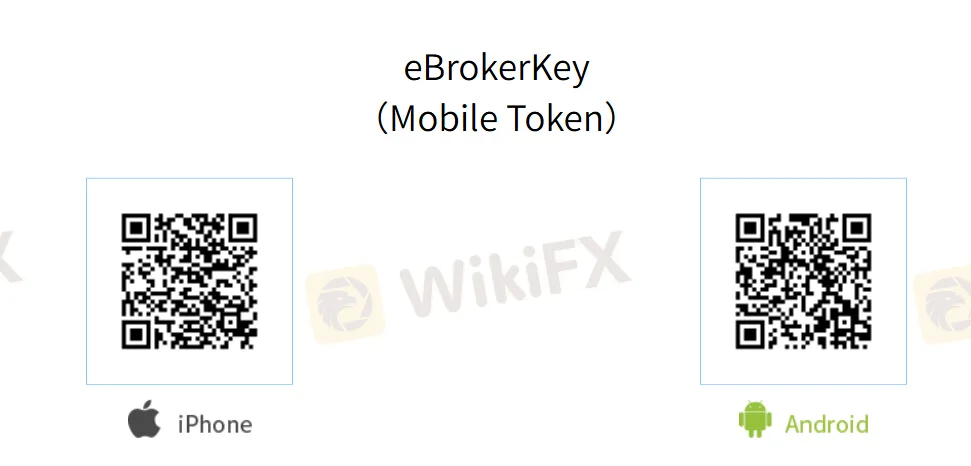

Trading Platform

TG's trading platform is T G iTrader and eBrokerKey, which support traders on PC, Mac, iPhone and Android.

| Trading Platform | Supported | Available Devices | Suitable for |

| T G iTrader | ✔ | PC, Web, Mobile | / |

| eBrokerKey | ✔ | Mobile | / |

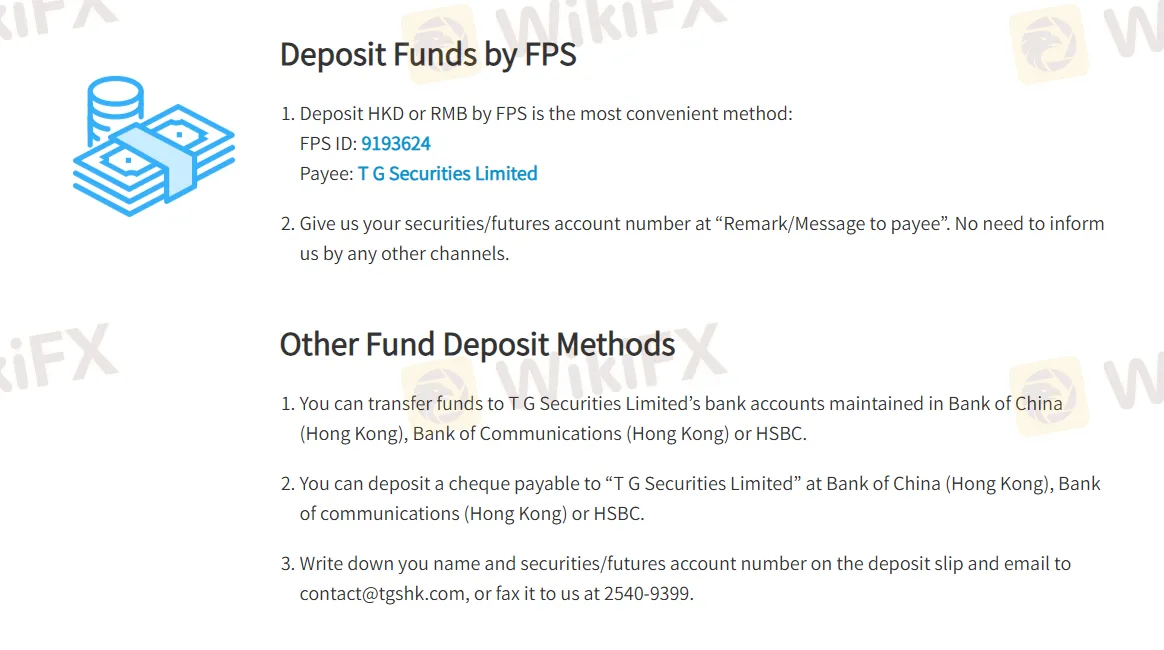

Deposit and Withdrawal

It supports four deposit methods: FPS, Bank Transfer, Cheque, Deposit slip.

Traders can withdraw money by T G securities/futures account, Withdrawal Slip.