Basic Information

United States

United States

Score

United States | 2-5 years |

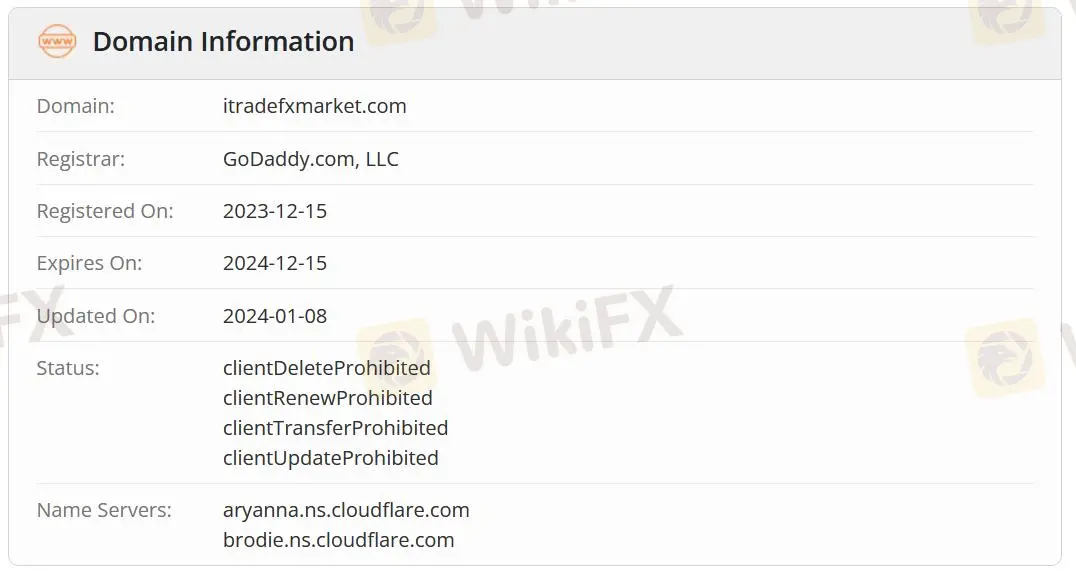

United States | 2-5 years |https://www.itradefxmarket.com/

Website

Rating Index

Forex License

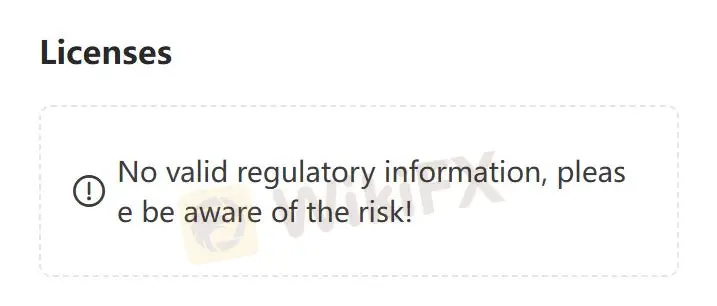

Forex License No forex trading license found. Please be aware of the risks.

United States

United States

| ITrade FX Market Review Summary | |

| Founded | 2023 |

| Registered Country/Region | United States |

| Regulation | Unregulated |

| Market Instruments | CFDs, futures, shares, energies, metals and indices |

| Demo Account | ❌ |

| Leverage | / |

| Spread | From 0.0 pips |

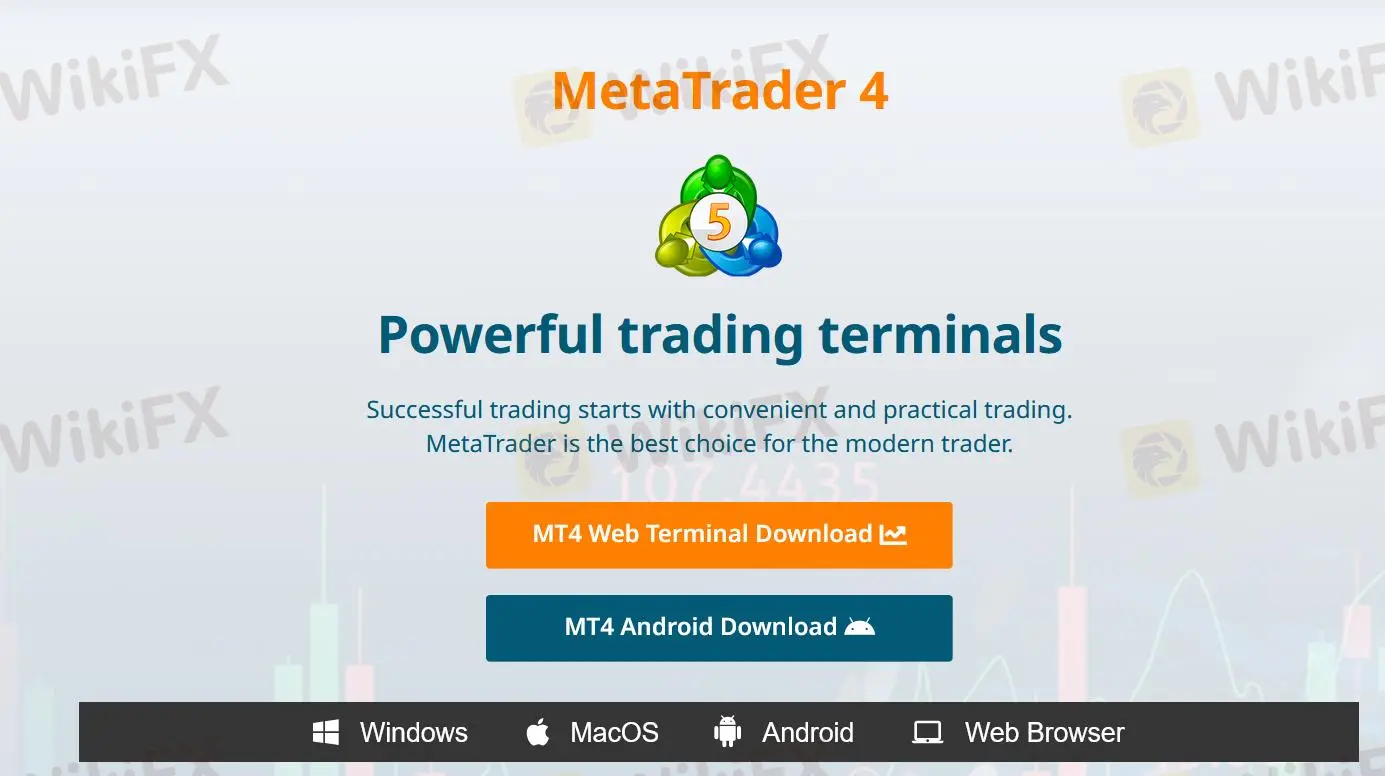

| Trading Platform | MT4, mobile app |

| Min Deposit | $100 |

| Customer Support | Email: Support@itradefxmarket.com |

| Facebook, Instagram, TikTok, Line, Youtube | |

Founded in 2023, ITrade FX Market is an unregulated broker registered in the United States, offering trading in CFDs, futures, shares, energies, metals and indices on the MT5 and mobile app platforms. Demo accounts are not available and the minimum deposit requirement to open a live account is $100.

| Pros | Cons |

| Various trading products | Unregulated |

| MT4 platform | Unclear fee structure |

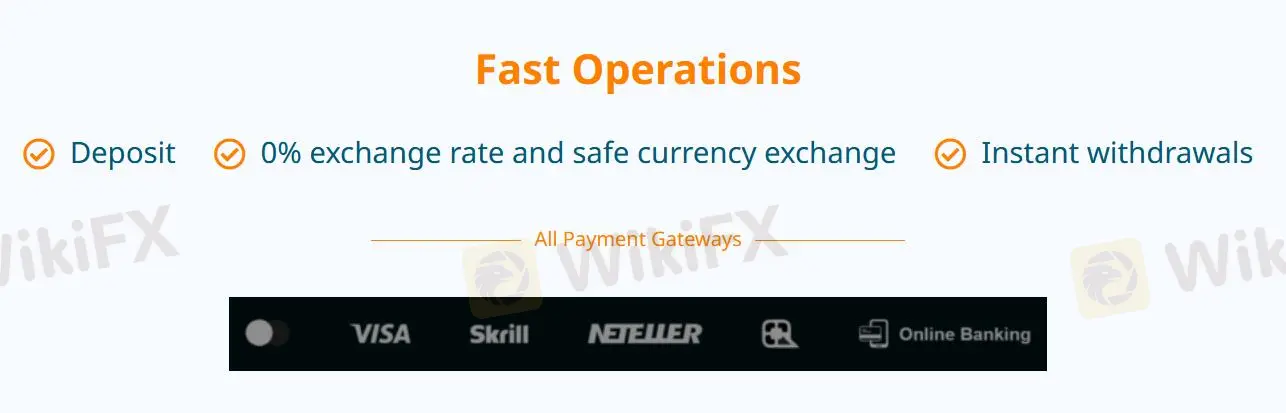

| Popular payment options | Limited contact channels |

No. ITrade FX Market has no regulations currently. Please be aware of the risk!

| Tradable Instruments | Supported |

| CFDs | ✔ |

| Futures | ✔ |

| Shares | ✔ |

| Energies | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Windows, MacOS, Android, Web | Beginners |

| MT5 | ❌ | / | Experienced traders |

iTrade FX Market accepts payments via major credit cards like VISA, digital wallets such as Skrill and NETELLER, and online banking.

ITrade FX Market's $30 No Deposit Bonus Might Come With Risks.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now