Company Summary

| Quilter Financial PlanningReview Summary | |

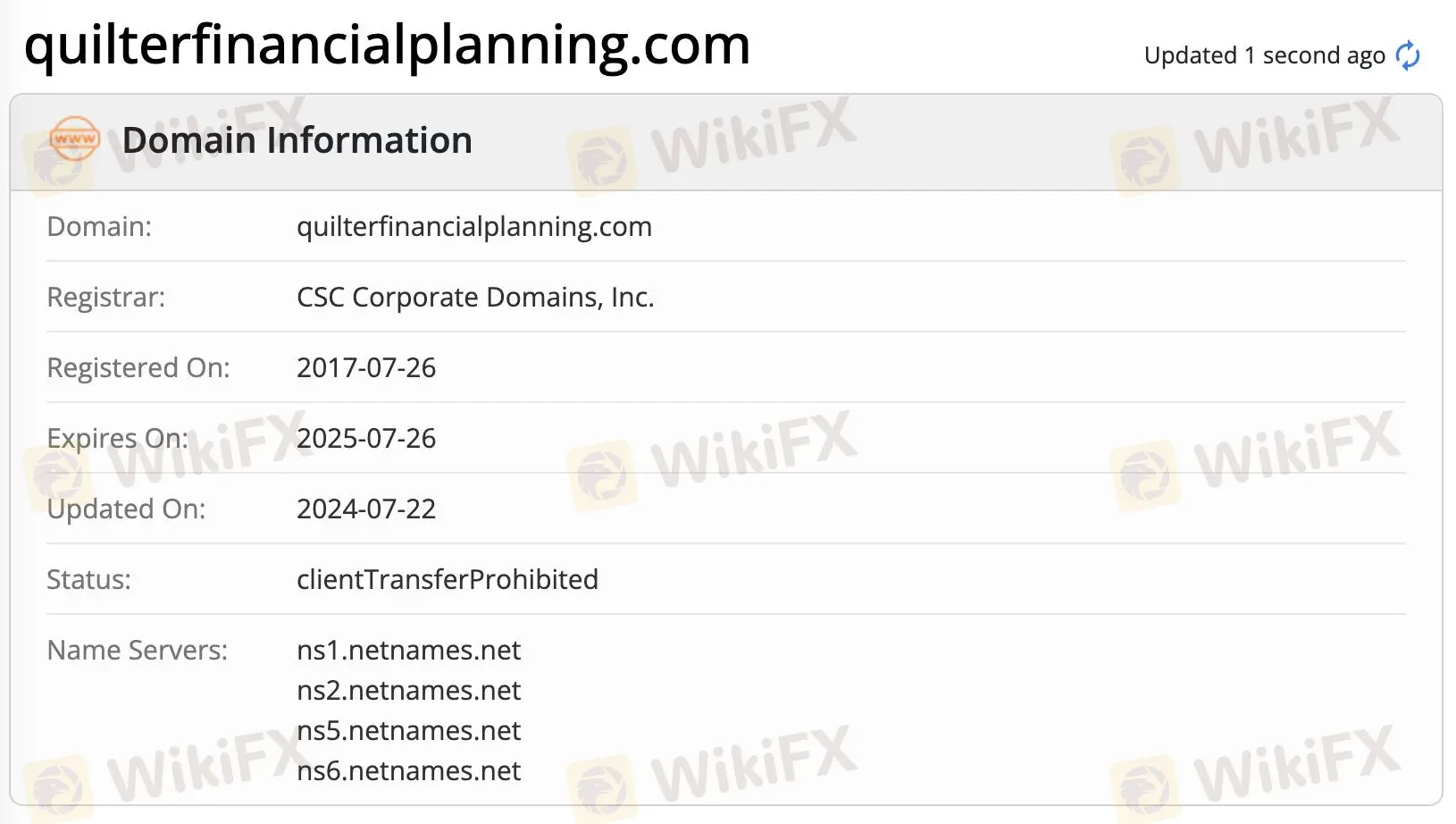

| Founded | 2017 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA (Exceeded) |

| Products & Services | Customers: pensions, ISA and junior ISA, collective investment account, investment bond, family linking, cash savings accounts |

| Advisors: pensions, ISA and junior ISA, collective investment account, onshore bond, cash savings accounts | |

| Demo Account | ❌ |

| Trading Platform | The Quilter app, the Quilter Investment Platform |

| Min Deposit | £99 |

| Customer Support | Facebook, X, instagram, linkedin |

| Email: QFPComplaints@quilter.com | |

| Phone: 0207 562 5800 | |

| Regional Restrictions | Only clients from the United Kingdom, Singapore and Ireland are allowed |

Quilter Financial Planning Information

Based in the United Kingdom, Quilter Financial Planning offers a range of services and products for both customers and advisers. However, Quilter Financial Planning currently operates without valid regulation from the FCA in the United Kingdom.

Pros and Cons

| Pros | Cons |

| Various contact channels | No demo accounts |

| Various financial products and services |

Is Quilter Financial Planning Legit?

No. Quilter Financial Planning exceeds the business scope regulated by United Kingdom FCA. Therefore, it currently has no valid regulation, which means that there is no government or financial authority oversighting their operations.

Products & Services

For customers:

| Products & Services |

| Pensions |

| ISA and junior ISA |

| Collective investment account |

| Investment bond |

| Family linking |

| Cash savings accounts |

For advisors:

| Products & Services |

| ISA and Junior ISA |

| Collective Investment Account |

| Onshore bond |

| Cash savings accounts |

Account Type

For customers:

| Account Type | Min Deposit |

| The Collective Retirement Account | £99 |

| ISA | £99 |

| Collective Investment Account | £99 |

| Collective Investment Bond | £99 |

For advisors:

| Account Type | Min Deposit |

| The Collective Retirement Account | / |

| ISA | £99 |

| Collective Investment Account | £99 |

| Collective Investment Bond | £10,000 |

| Cash Saving Accounts | £1,000 |

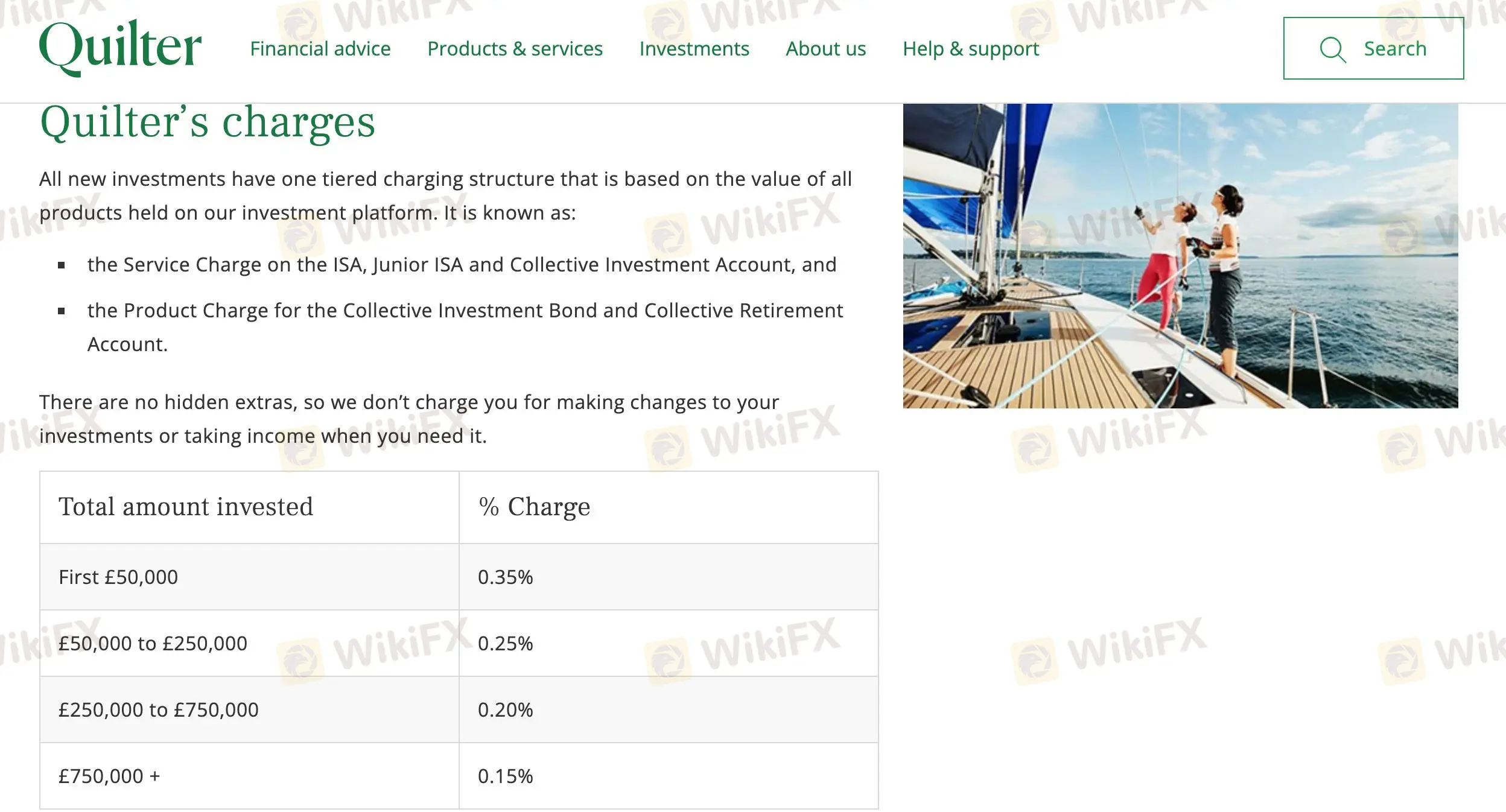

Quilter Financial Planning Fees

Trading Fees

| Total Amount Invested | Charge |

| First £50,000 | 0.35% |

| £50,000 to £250,000 | 0.25% |

| £250,000 to £750,000 | 0.20% |

| £750,000 + | 0.15% |

Non-Trading Fees

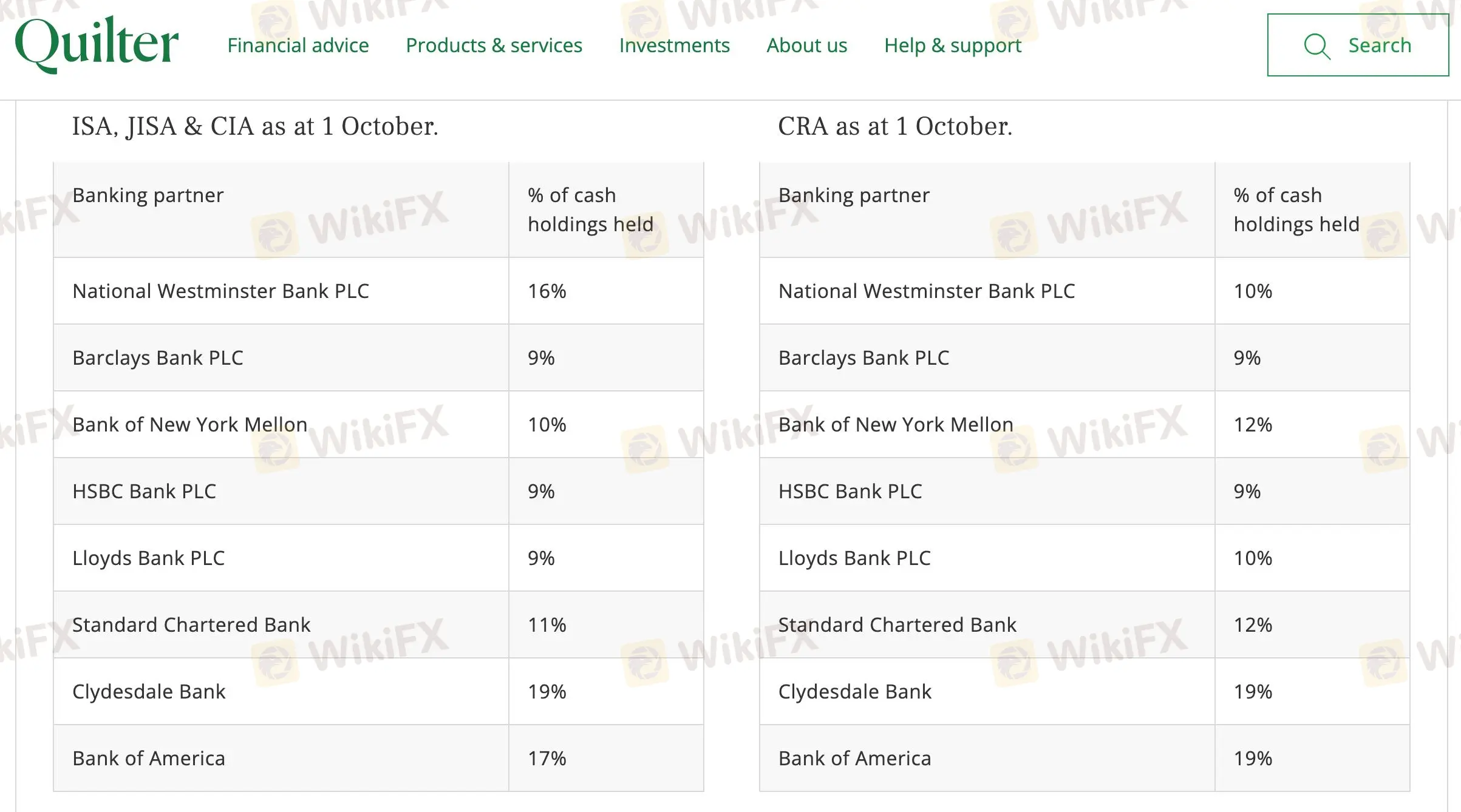

There is no Product/Service Charge applied to any money held in cash in the Collective Investment Account, ISA, JISA or Collective Retirement Account. Customers will not be charged directly for opening savings accounts on the CashHub. The charge for the CashHub is taken as a share of the interest.

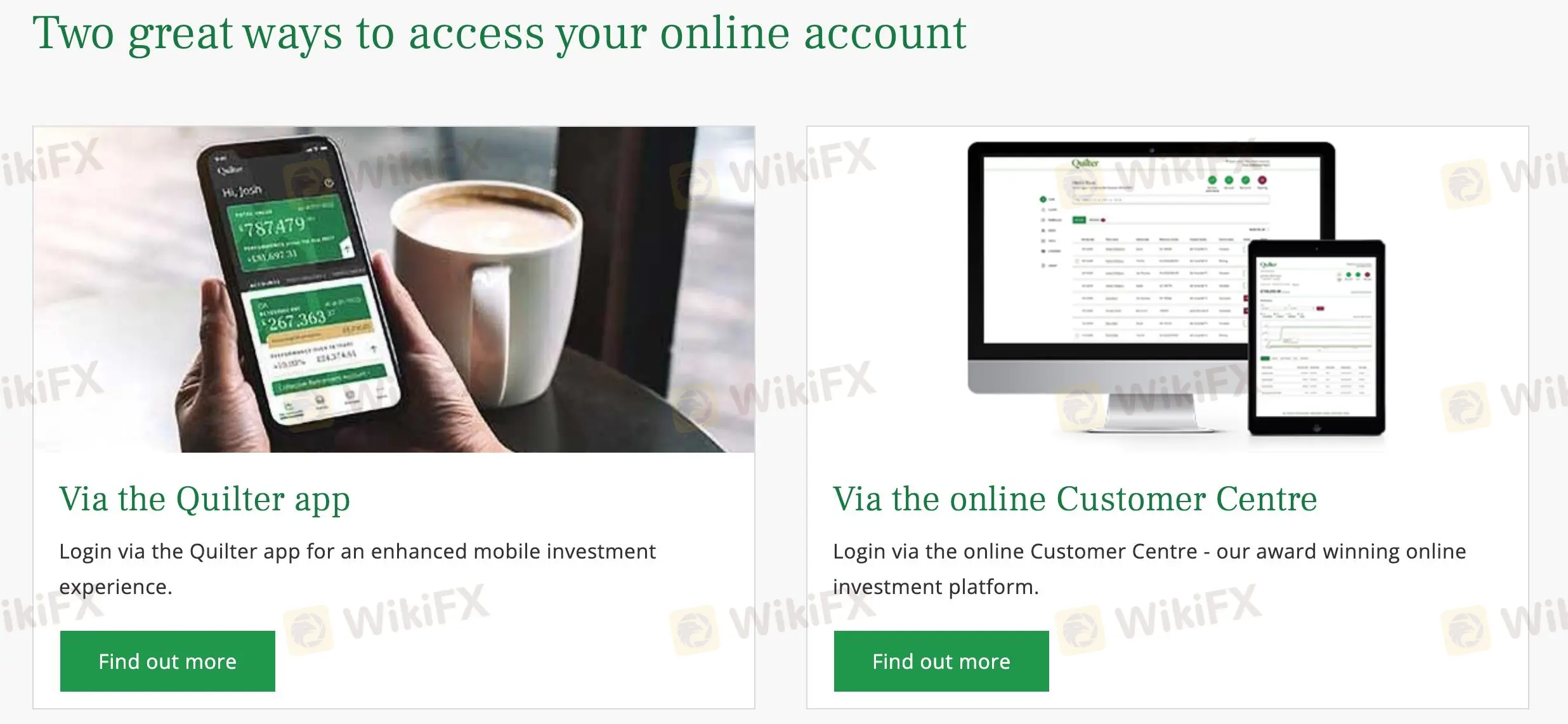

Trading Platform

| Trading Platform | Supported | Available Devices |

| The Quilter app | ✔ | Mobile |

| The Quilter Investment Platform | ✔ | PC, laptop, tablet |

Deposit and Withdrawal

The broker accepts payments done via debit cards. No minimum withdrawal amount defined and no fees specified.