ritzyshona

1-2年

Is automated trading with Expert Advisors (EAs) available on the platforms offered by BRAC EPL?

As someone with significant experience in the trading industry, I approached BRAC EPL with a thorough eye for key features that matter to active traders like myself, especially those interested in automated strategies. What stood out immediately was that BRAC EPL operates primarily as an equity brokerage in Bangladesh, and their offering centers on equities rather than forex or other asset classes. The information available confirms that BRAC EPL does not provide access to popular platforms like MetaTrader 4 or MetaTrader 5, which are commonly associated with automated trading through Expert Advisors (EAs).

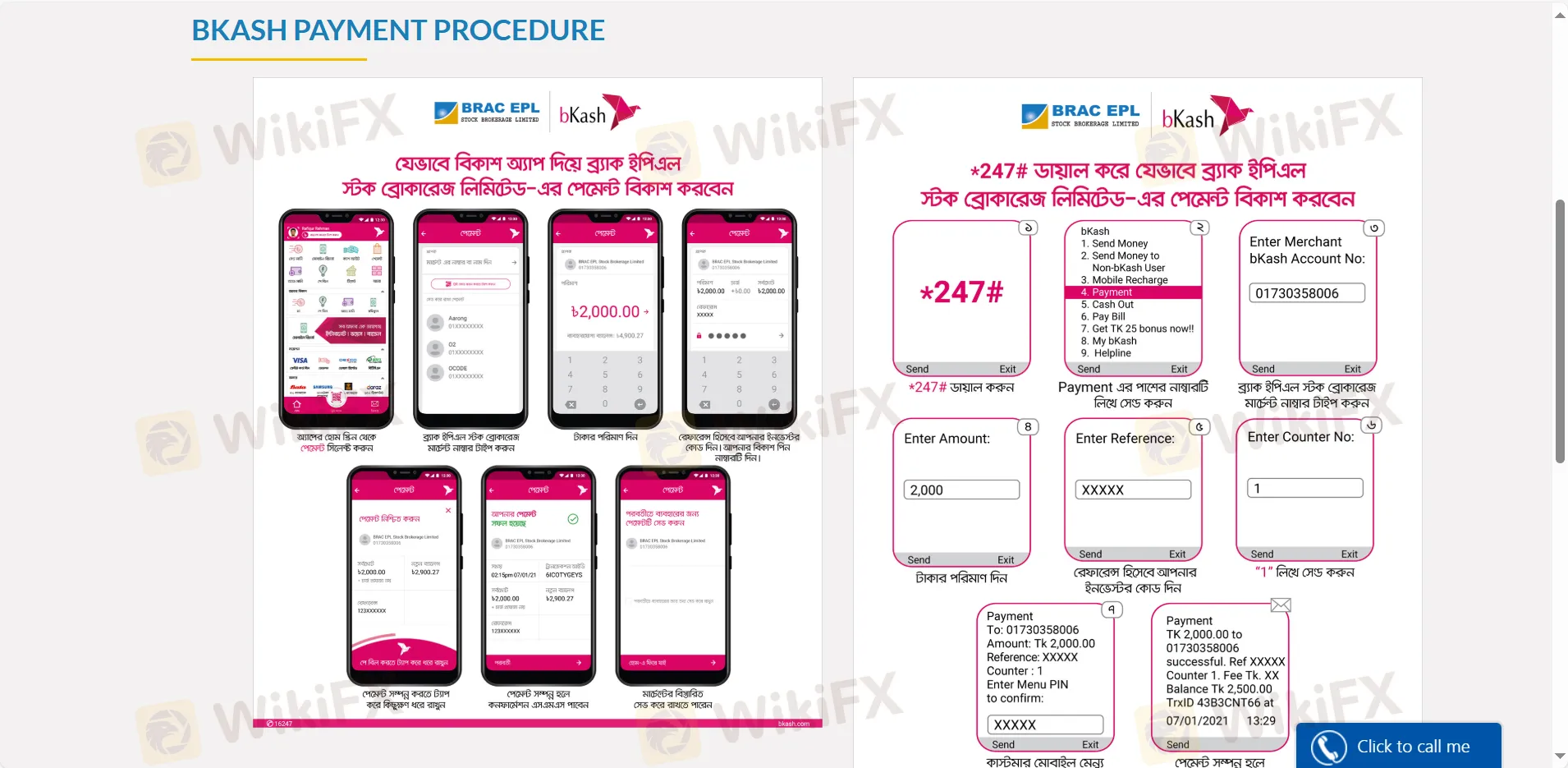

Instead, the only trading platform referenced is via the bKash app, which is focused on payments, and there is no indication of support for desktop or conventional trading terminals that facilitate custom scripts, automation, or algorithmic trading functionalities. For me, as someone who values testing and refining automated strategies, the absence of MT4, MT5, or similar platforms is a dealbreaker. I also could not find any mention of demo accounts or backtesting environments, making it impossible to safely trial algorithms before risking real capital.

Given these limitations, I do not see any pathway for automated trading with Expert Advisors through BRAC EPL’s current infrastructure. Anyone looking to deploy EAs or engage in algorithmic trading would, in my view, need to consider other brokers with proper platform support, regulatory clarity, and transparency. For now, BRAC EPL seems best suited to standard manual equity trading, not automated strategies.

Broker Issues

Account

Platform

Leverage

Instruments

edgeisedge

1-2年

Could you break down the total trading costs involved for indices such as the US100 when trading through BRAC EPL?

Based on my experience assessing brokers with diverse offerings, I need to clarify that BRAC EPL does not provide access to indices such as the US100. Their product range is restricted to Bangladeshi equities and related services, and they do not offer indices, forex, or commodities trading. This limitation is especially important for a trader like myself seeking diversified exposure or focused index trades like the US100.

When reviewing their overall trading cost structure, I found that the only fee clearly outlined is the commission, set at a maximum of 1% of the total trade value. This applies to equity transactions. There is no detailed information available about spreads, overnight financing charges, or platform fees for other asset classes because those instruments are simply not available. Additionally, the absence of a demo account and the lack of regulatory oversight raises concerns for me about transparency and fee predictability, both of which are critical for prudent capital management in equity trading.

In summary, for anyone interested specifically in indices such as the US100, BRAC EPL would not be a suitable venue. Investors should always verify a broker’s regulatory status and product range—especially before committing any funds. For my own trading, the inability to access key global indices and the absence of regulation are major factors that would lead me to look elsewhere for such products.

Broker Issues

Fees and Spreads

JV1s24K_g0ld

1-2年

How do BRAC EPL's swap fees (overnight financing charges) stack up against those of other brokers?

As an experienced trader who thoroughly evaluates broker costs, I have not found evidence that BRAC EPL offers swap fees or overnight financing options, unlike many global forex brokers. This is because, based on my research and user experience, BRAC EPL focuses exclusively on equity trading within Bangladesh, without providing access to forex, commodities, or leveraged instruments that usually incur overnight charges. What stands out for me is the lack of transparency around fee structures, with BRAC EPL only disclosing a maximum 1% commission on total trade value.

For someone used to trading with internationally regulated brokers, I expect clear and open disclosure, especially regarding often-overlooked costs like swap fees. The absence of such information raises a red flag for me, especially when factoring in their unregulated status and higher-than-average risk profile. Many brokers I’ve used in the past are very explicit about their overnight rates, helping me plan my trading costs with precision. With BRAC EPL, this simply isn’t possible. Thus, for traders who prioritize understanding the full range of fees—including swaps—BRAC EPL does not currently provide the level of clarity or product offering to allow for a meaningful comparison in this area.

Broker Issues

Fees and Spreads

helpneeded

1-2年

What are the key advantages and disadvantages of trading through BRAC EPL?

In my experience as a trader, evaluating BRAC EPL reveals both notable advantages and serious drawbacks. One positive aspect is the broker’s longevity; having operated for over five years suggests a degree of stability in the Bangladeshi financial landscape. Additionally, BRAC EPL provides multiple channels for customer support, including email, phone, and social media, which, in my view, is helpful if issues arise. They also have a physical address in Dhaka, which adds a layer of accessibility for local clients.

However, the disadvantages are more significant for me, especially given the gravity of regulatory oversight in financial services. BRAC EPL is not regulated by any recognized financial authority, which signals high potential risk. From an expert’s perspective, lack of regulation means there is no external body monitoring the broker’s practices or providing protection to clients’ funds. This is a primary concern for any trader who values security and transparency over convenience.

Furthermore, I noticed that BRAC EPL doesn’t offer a demo account, which means there’s no safe way for new clients to test their services before risking real capital. Their product range is extremely limited to equities only—there is no forex, commodities, or other typical trading instruments. The commission fees, capped at a maximum of 1%, could also eat into returns, especially for frequent traders. Given these factors, I would approach BRAC EPL cautiously and ensure any involvement aligns with my personal risk tolerance and strict capital protection measures.