公司簡介

RK Global 的一般信息和法規

RK Global 於 1995 年在印度新德里成立,並於 2000 年開設了自己的零售經紀服務。RK Global 為印度 24 個州的 150 多個城市提供一系列金融服務,旨在贏得客戶信任並創造高效透明的交易環境,通過電子郵件、電匯、網絡表格和聊天為客戶提供 24/7 全天候客戶服務。 RK Global 網站上沒有可用的監管信息。

安全分析

RK Global 目前不作為股票經紀人受到監管,這意味著投資者的交易活動和資金不受任何保護。

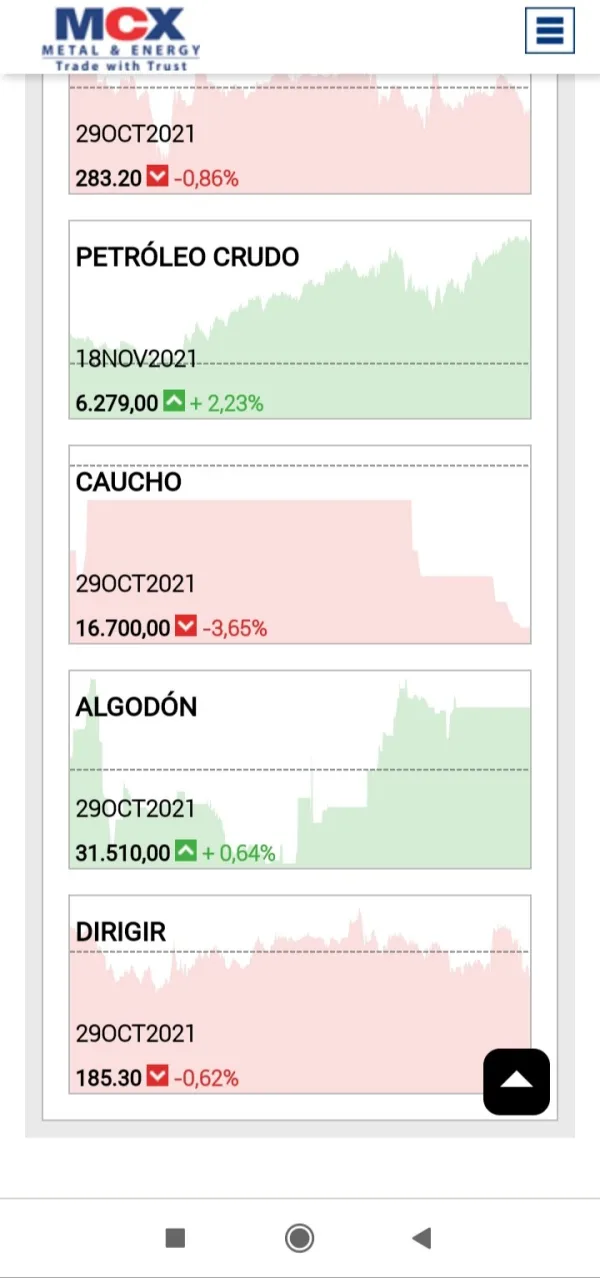

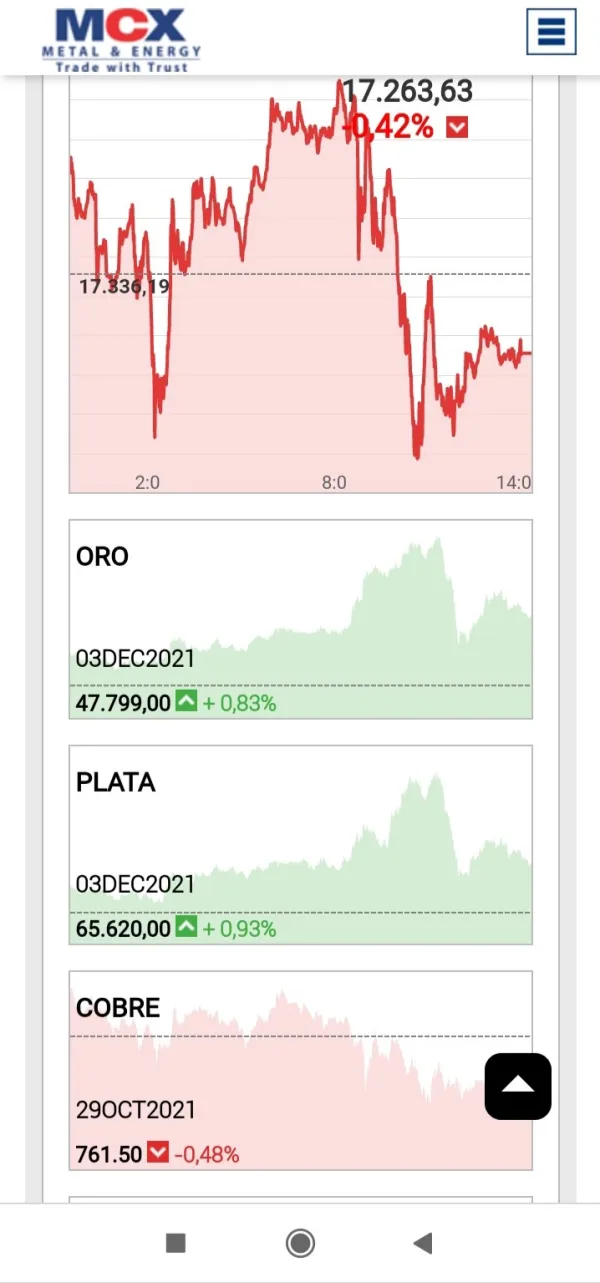

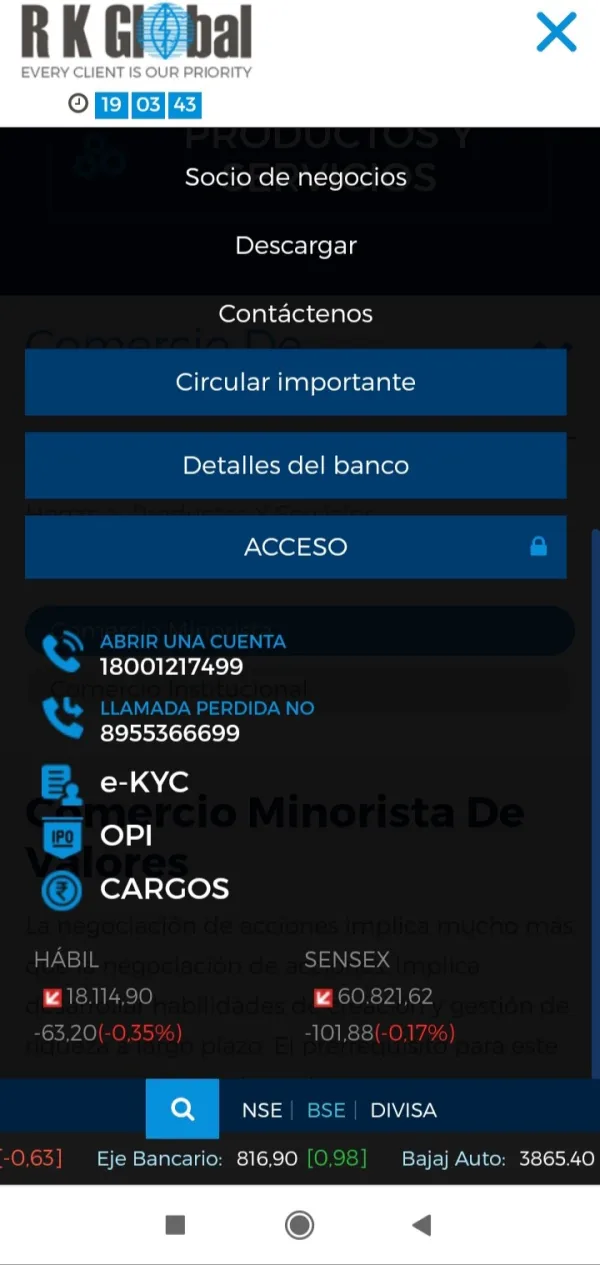

主營業務

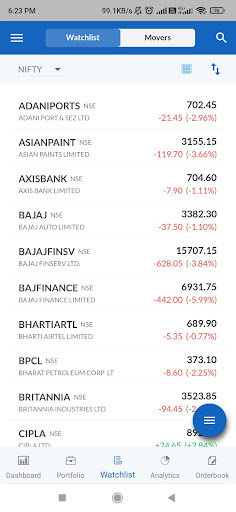

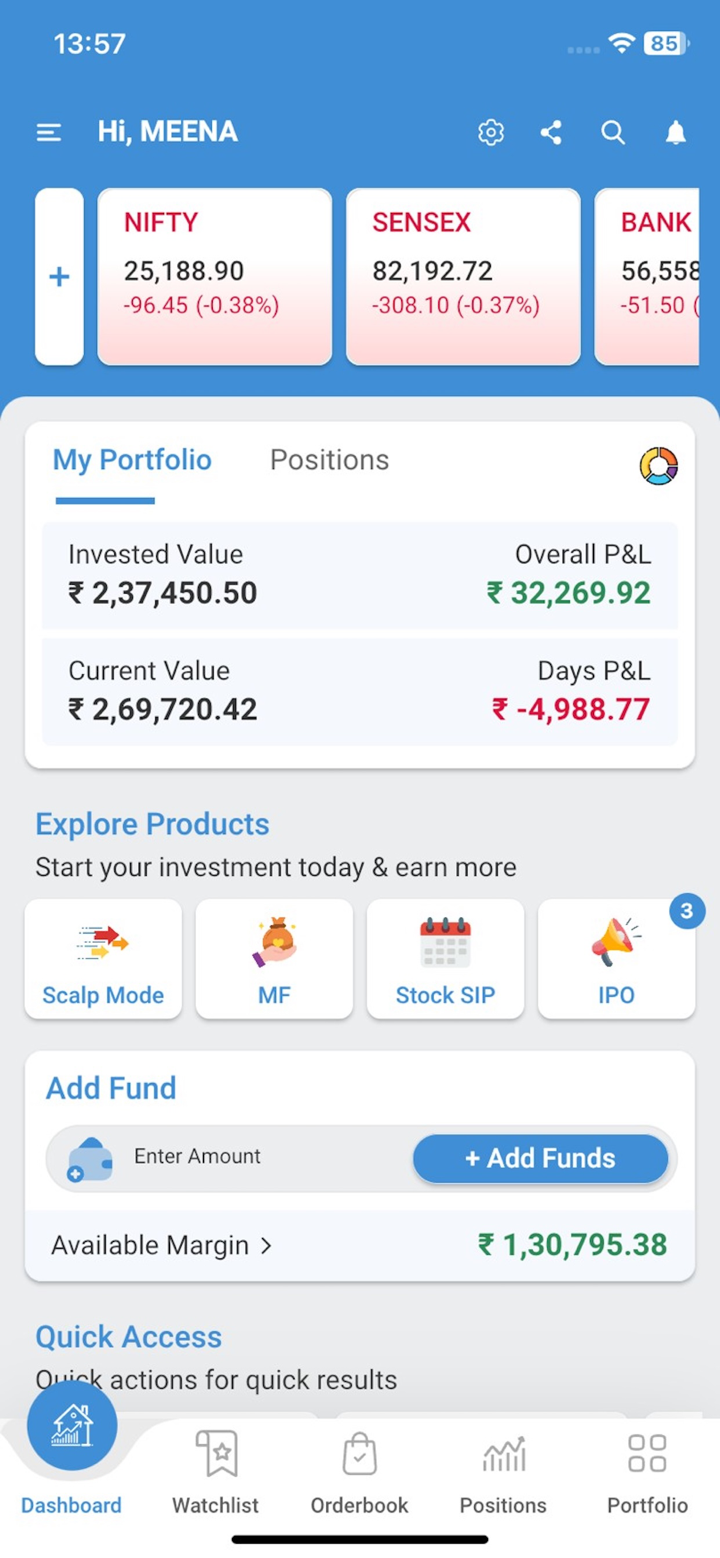

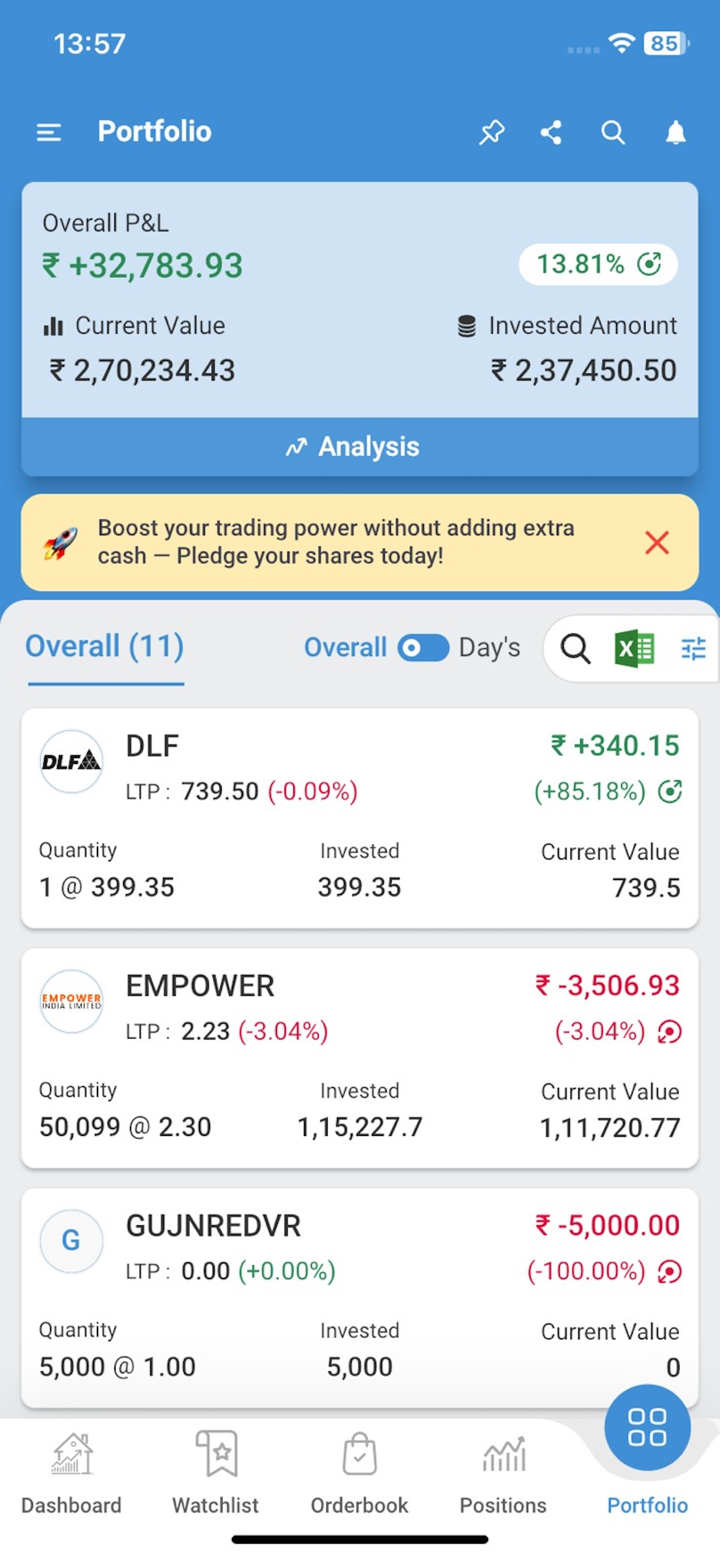

RK Global 提供股票、IPO/IPO、衍生品、商品、共同基金和貨幣方面的服務。

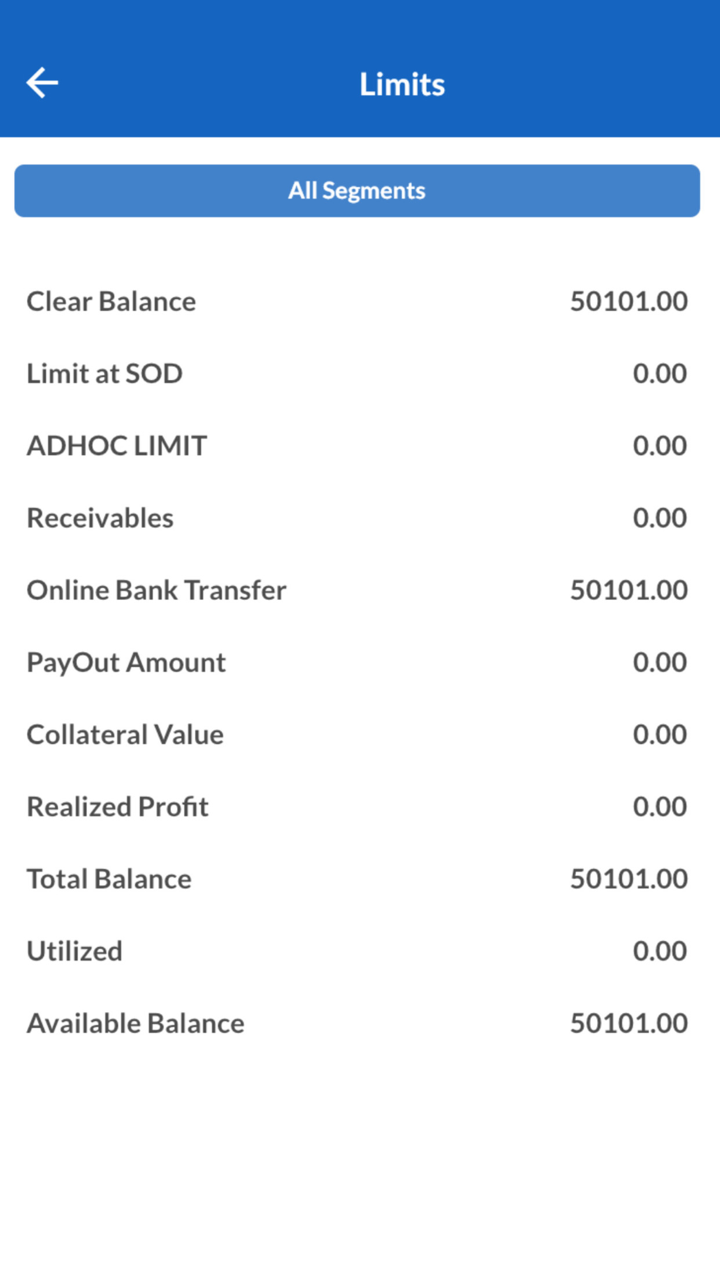

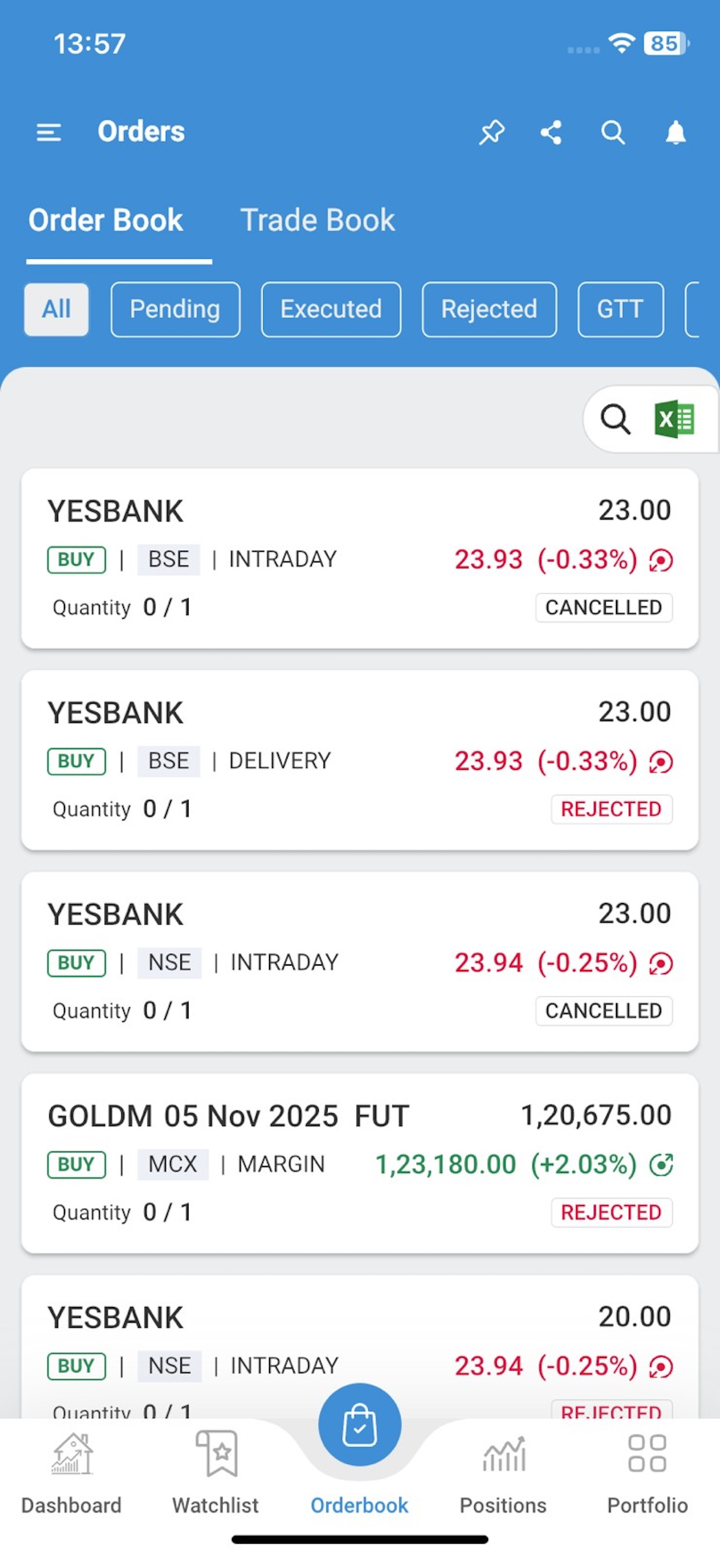

RK Global的費用

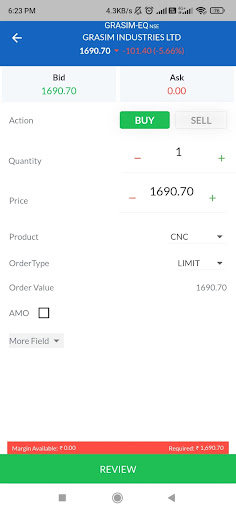

RK Global 為 NSE/BSE 資本市場領域的零售經紀商提供股票市場和衍生品無限交易兩種方案。資本市場以外的零售客戶的交易佣金為盧比。每批 9 個。其他費用包括僅基於賣方的基於交易的股權出售的 DP 費用 - 盧比。每筆交易 12.5 盧比的額外費用。 25 用於電話交易,通過電子郵件發送數字合同需要額外支付 Rs。訂購快速合同的實物副本每份合同 30;盧比的 Demat 開戶費(一次性)。 50。

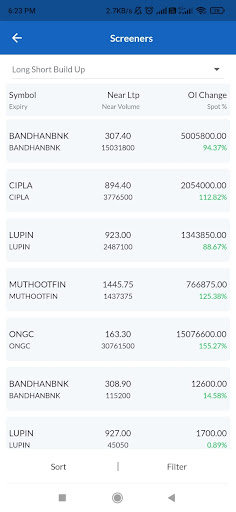

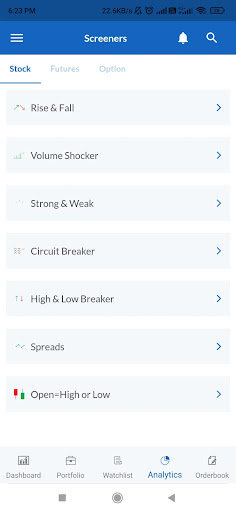

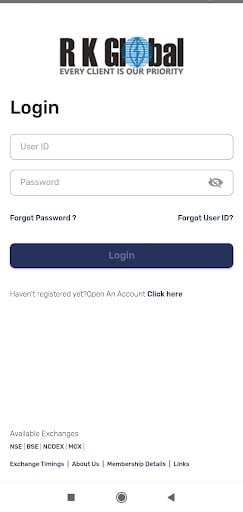

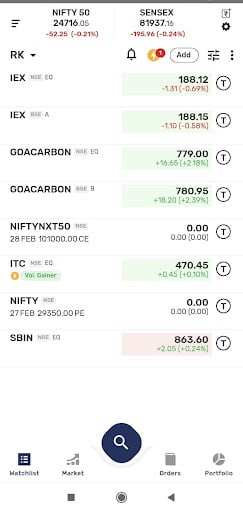

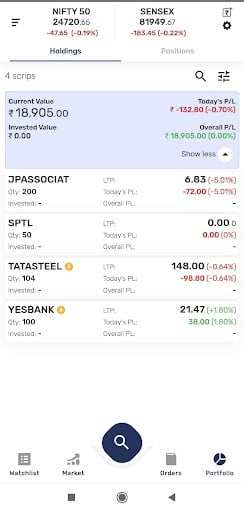

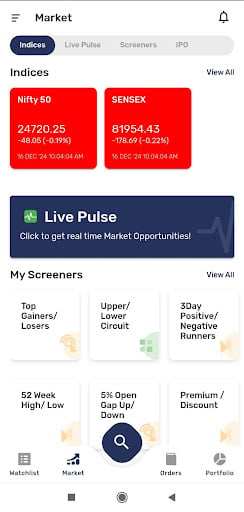

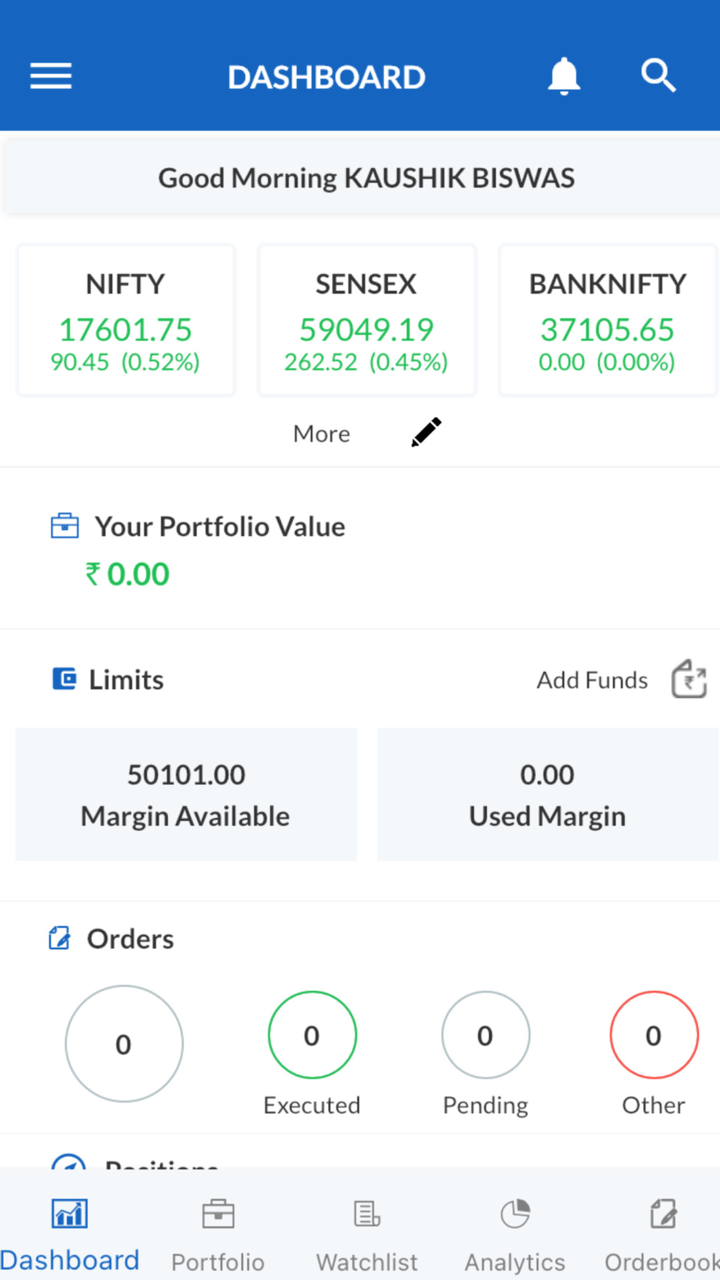

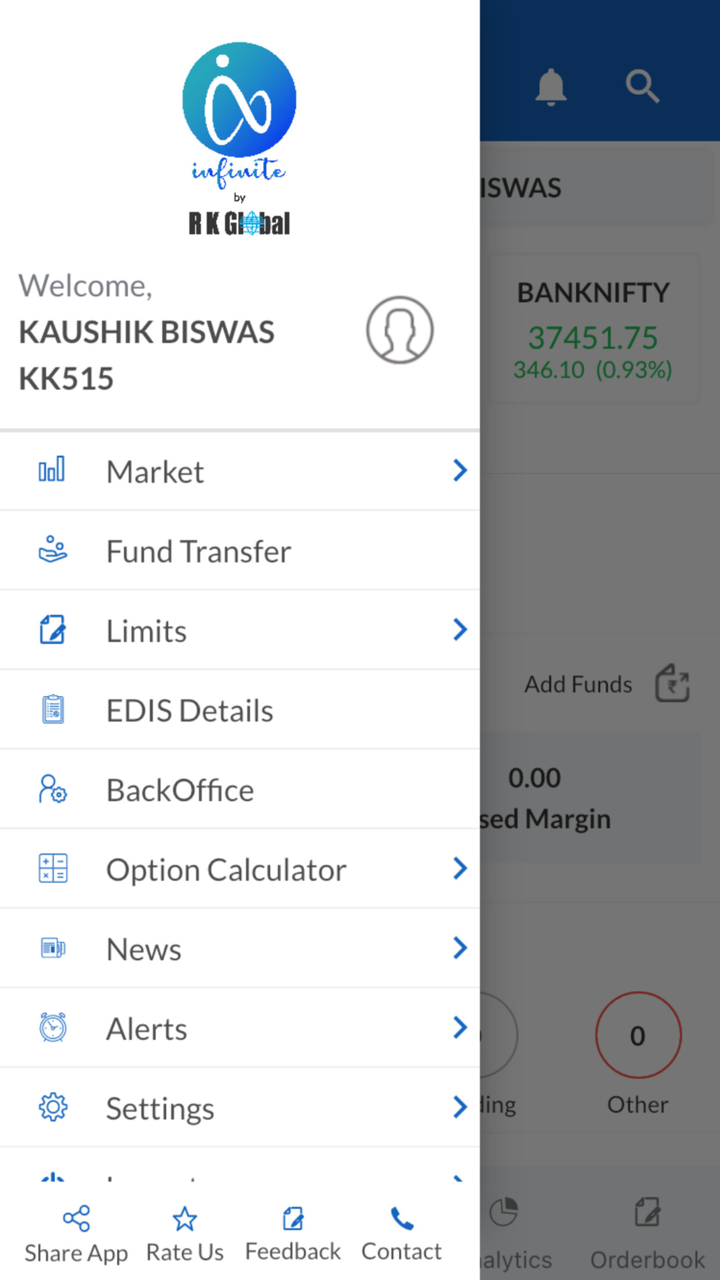

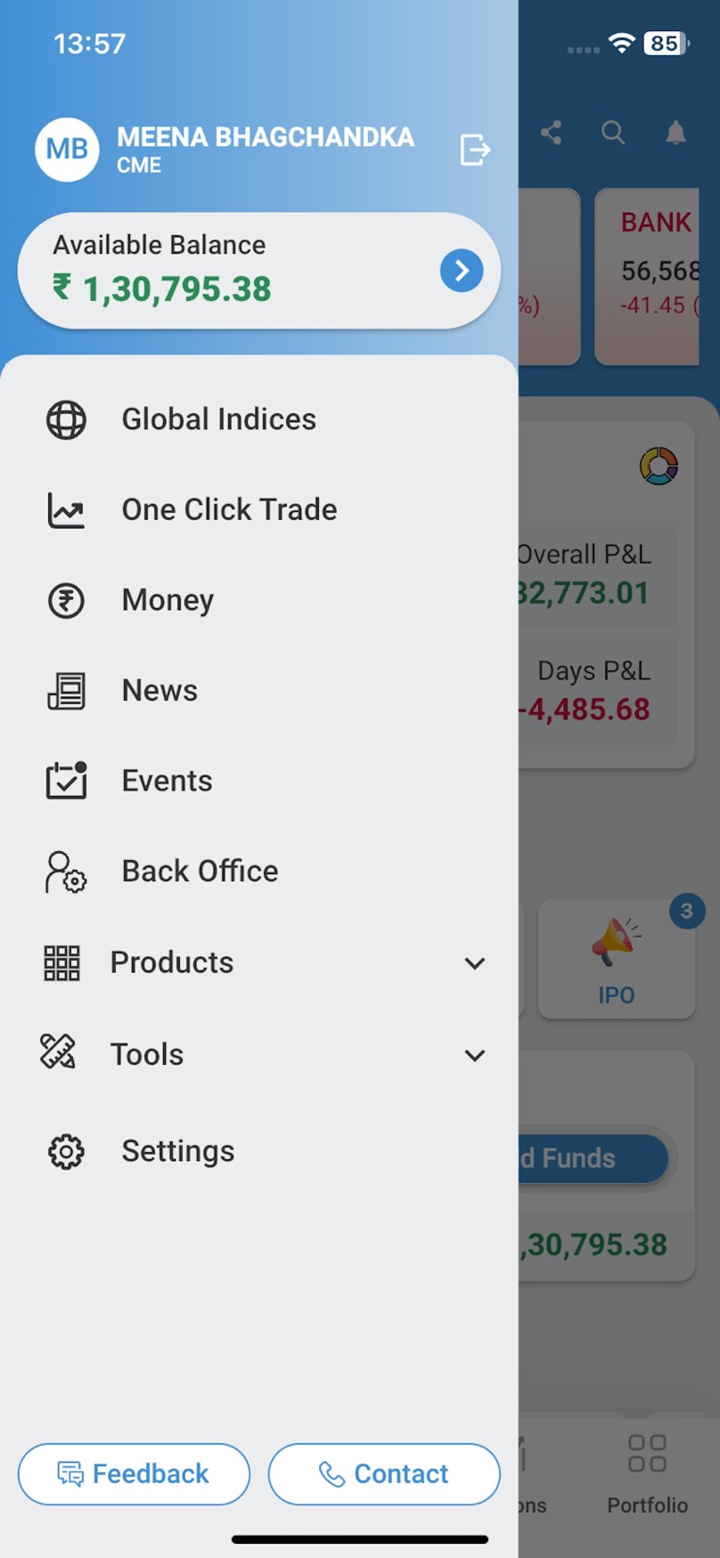

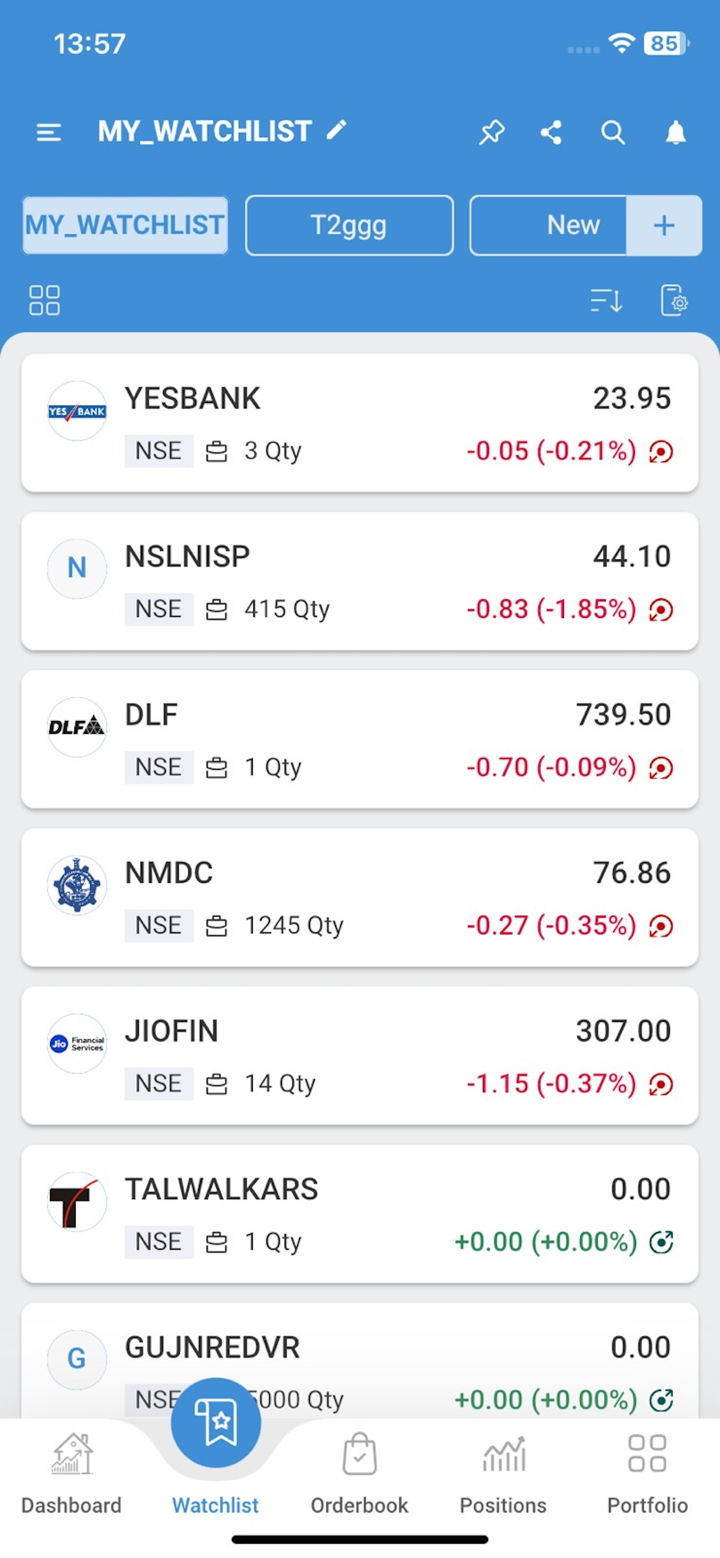

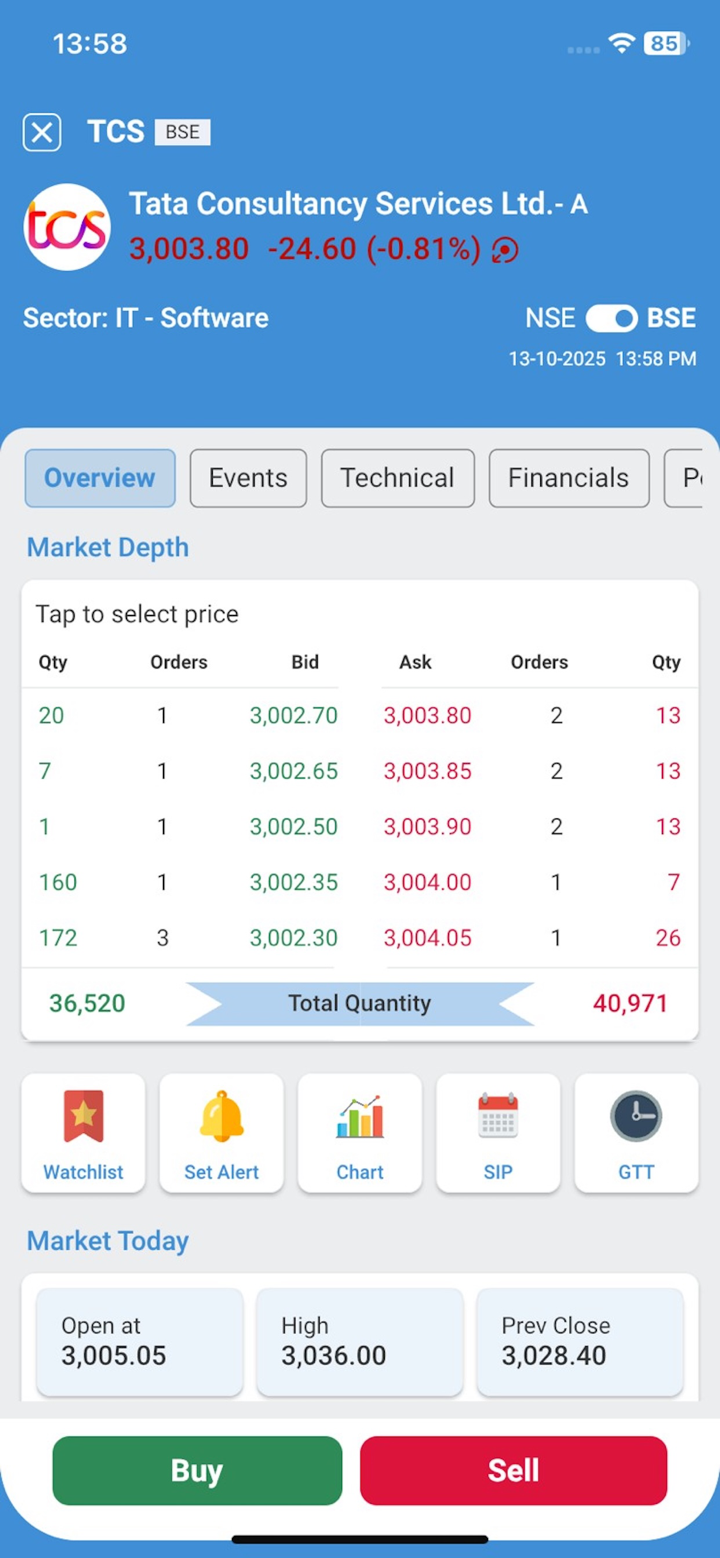

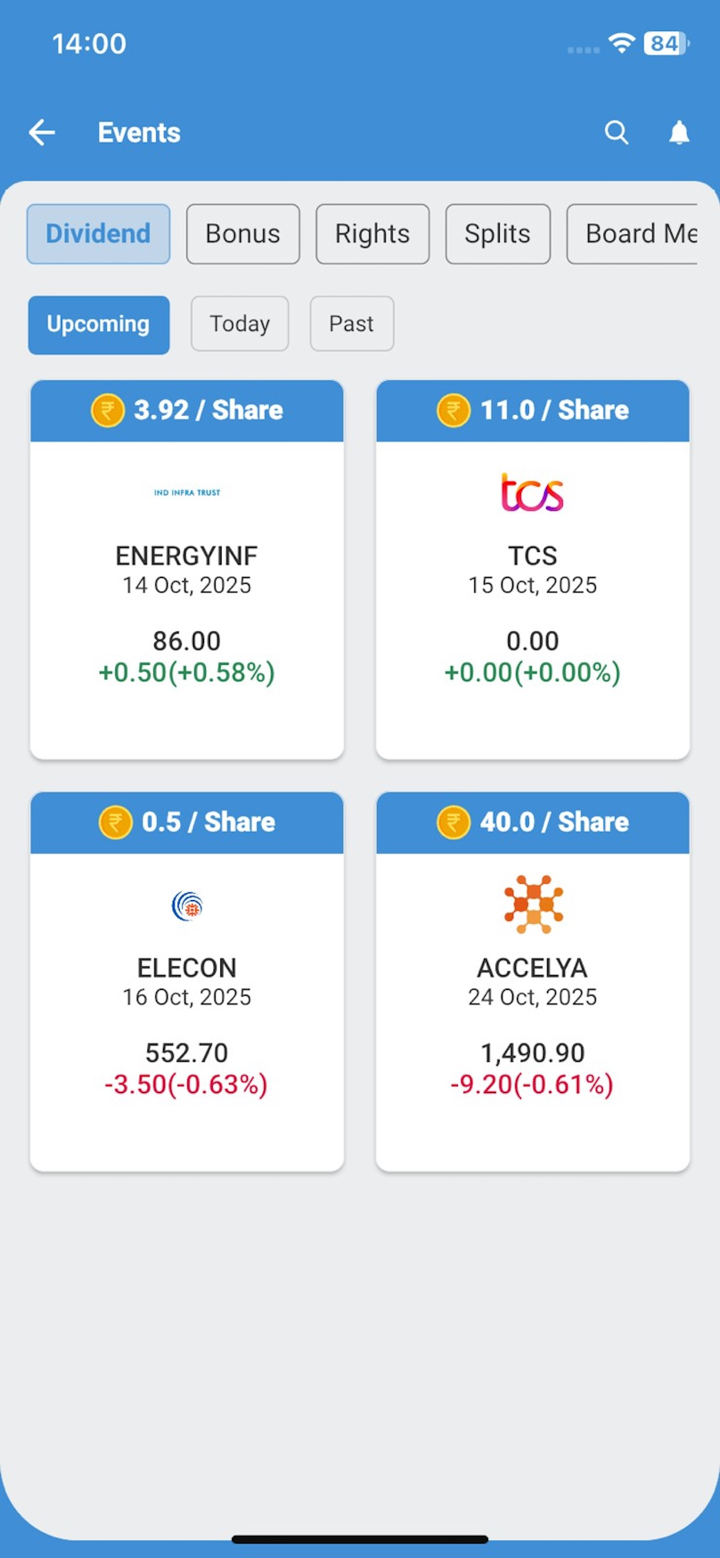

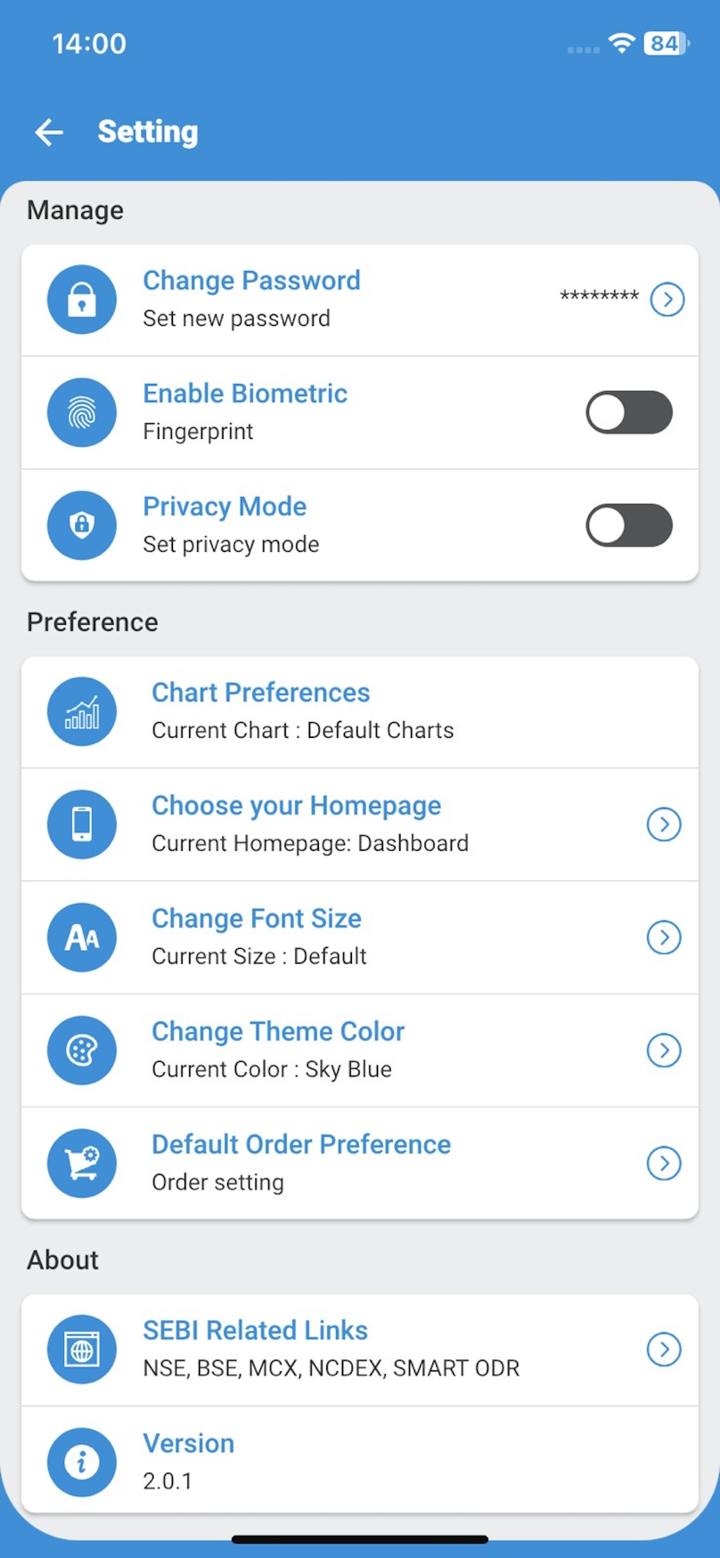

RK Global可用的交易平台

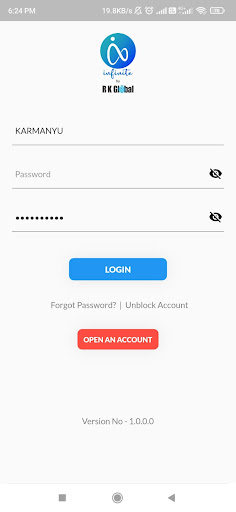

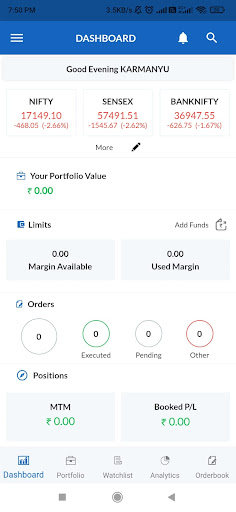

RKG Diet ODIN-Diet ODIN 10x Setup 是一款桌面高速交易終端,支持多筆交易和多段交易,為客戶提供實時訪問以太幣報價的快捷方式。它支持高級訂單類型,例如括號訂單和覆蓋訂單。RKG Net。 Net-RKG Net.Net是一個快速、方便、易訪問的在線交易交易網站,具有與交易終端相同的功能,提供無需安裝或下載即可快速、輕鬆訪問的在線交易工具。

RK Global 的優缺點

RK Global的主要優勢是:

1. 24/7 客戶服務

2. 創新的交易平台

RK Global 的主要缺點是:

1、監管信息不明確

2. 多重收費

3. 未提供賬戶及存取款方式