公司簡介

| 台新證券 檢討摘要 | |

| 成立年份 | 2009 |

| 註冊國家/地區 | 台灣 |

| 監管機構 | 台北交易所 |

| 市場工具 | 證券、期貨、股票、ETF、債券、商品、衍生品、債券 |

| 交易平台 | / |

| 客戶支援 | 24/7 在線聊天 |

| 電話:02-4050-9799(星期一至星期五,上午8時至下午5時) | |

| 電郵:ec@tssco.com.tw | |

台新證券 資訊

台新證券 成立於台灣,並受台北交易所監管,是一個提供證券、期貨、股票、ETF、債券、商品、衍生品和債券交易的線上交易平台。

優點與缺點

| 優點 | 缺點 |

|

|

|

|

台新證券 是否合法?

台新證券 持有在台灣由台北交易所監管的「證券交易」牌照。

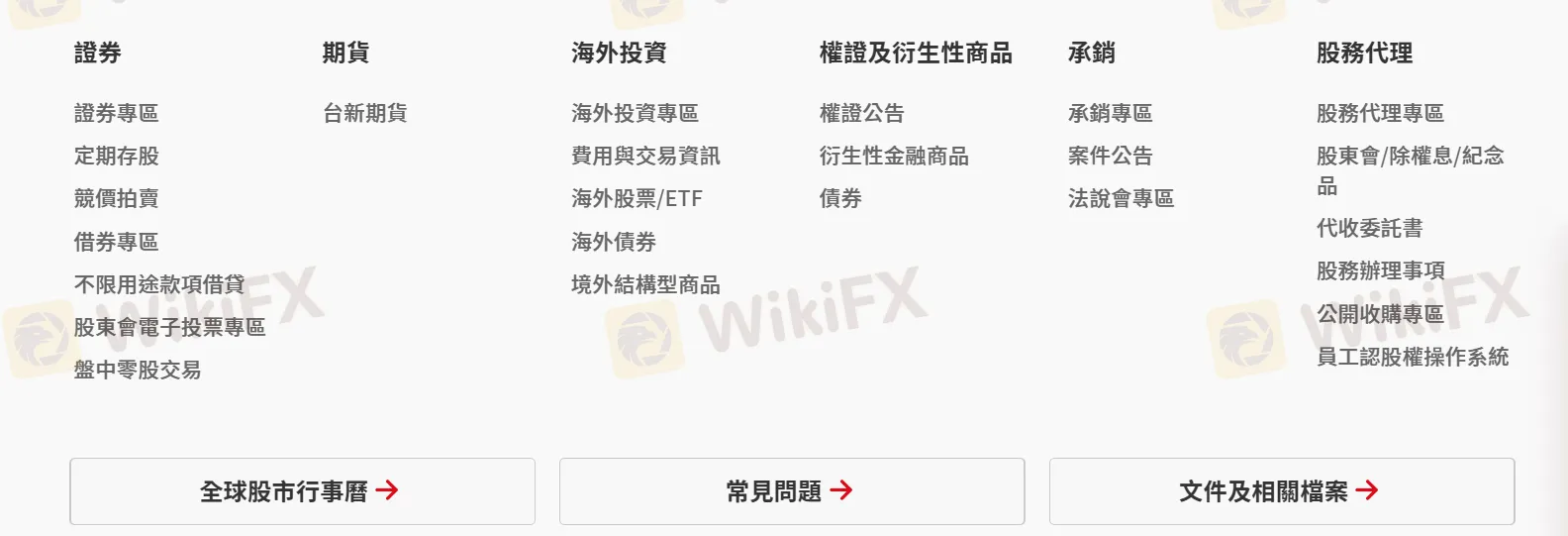

我可以在台新證券上交易什麼?

透過台新證券平台,客戶可以交易證券、期貨、股票、ETF、債券、商品、衍生品和債券。

| 可交易工具 | 支援 |

| 證券 | ✔ |

| 期貨 | ✔ |

| 股票 | ✔ |

| ETF | ✔ |

| 債券 | ✔ |

| 商品 | ✔ |

| 衍生品 | ✔ |

| 債券 | ✔ |

| 外匯 | ❌ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

| 期權 | ❌ |

帳戶類型

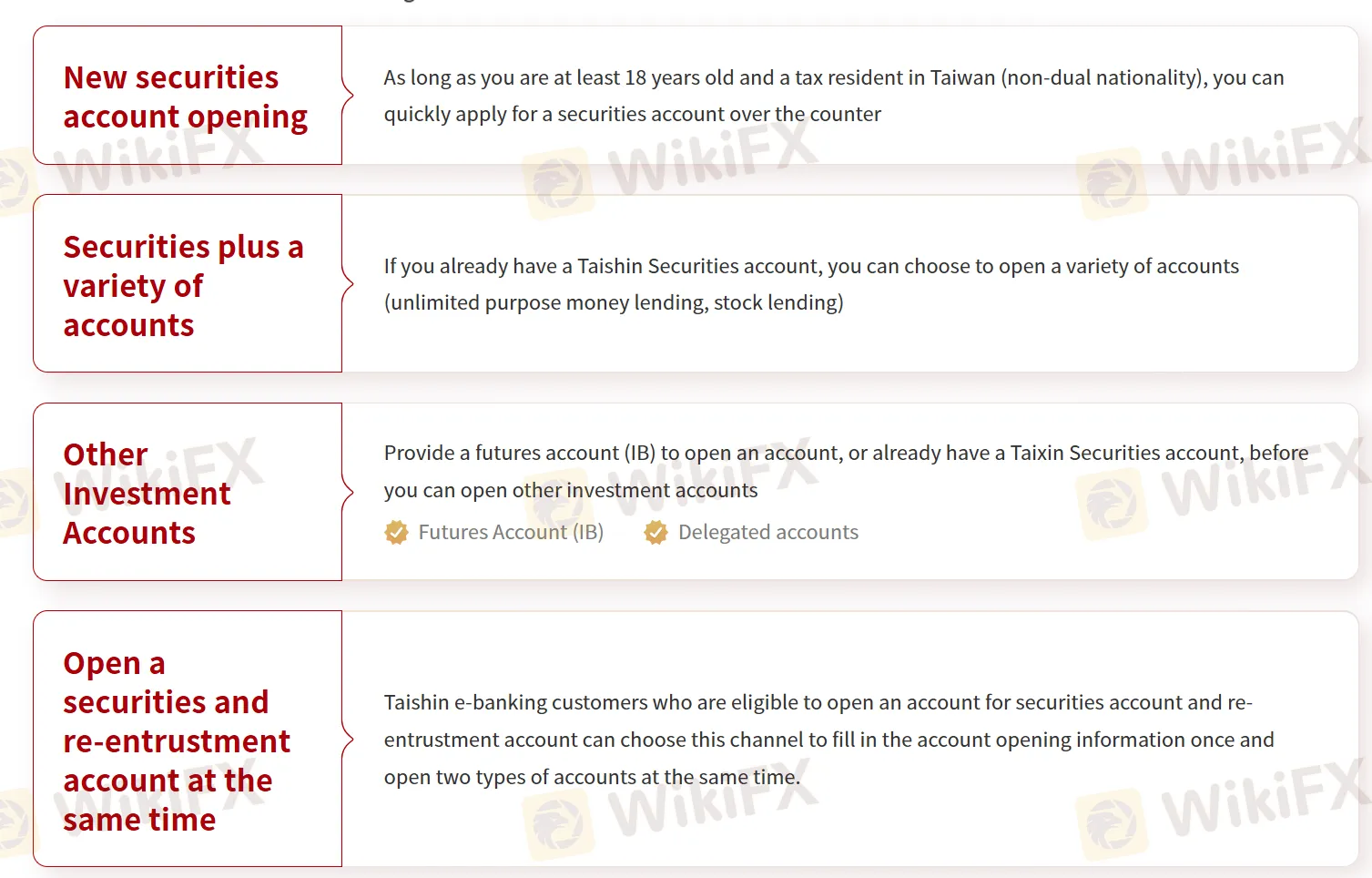

台新證券 提供四種帳戶類型:

- 新證券帳戶開戶:適用於年滿18歲且為台灣稅務居民(非雙重國籍)的個人,可快速透過櫃檯申請開立證券帳戶。

- 證券加多種帳戶:適用於現有台新證券帳戶持有人,提供無限制的目的性貸款和股票借貸等選項。

- 其他投資帳戶:需要提供期貨帳戶(IB)才能開立,或已擁有台新證券帳戶,然後可以開立其他投資帳戶,如期貨帳戶(IB)和受託帳戶。

- 同時開立證券和再委託帳戶:允許符合資格的台新電子銀行客戶一次填寫申請資訊,同時開立證券和再委託帳戶。

交易平台

| 交易平台 | 支援應用程式 | 可用設備 | 適用對象 |

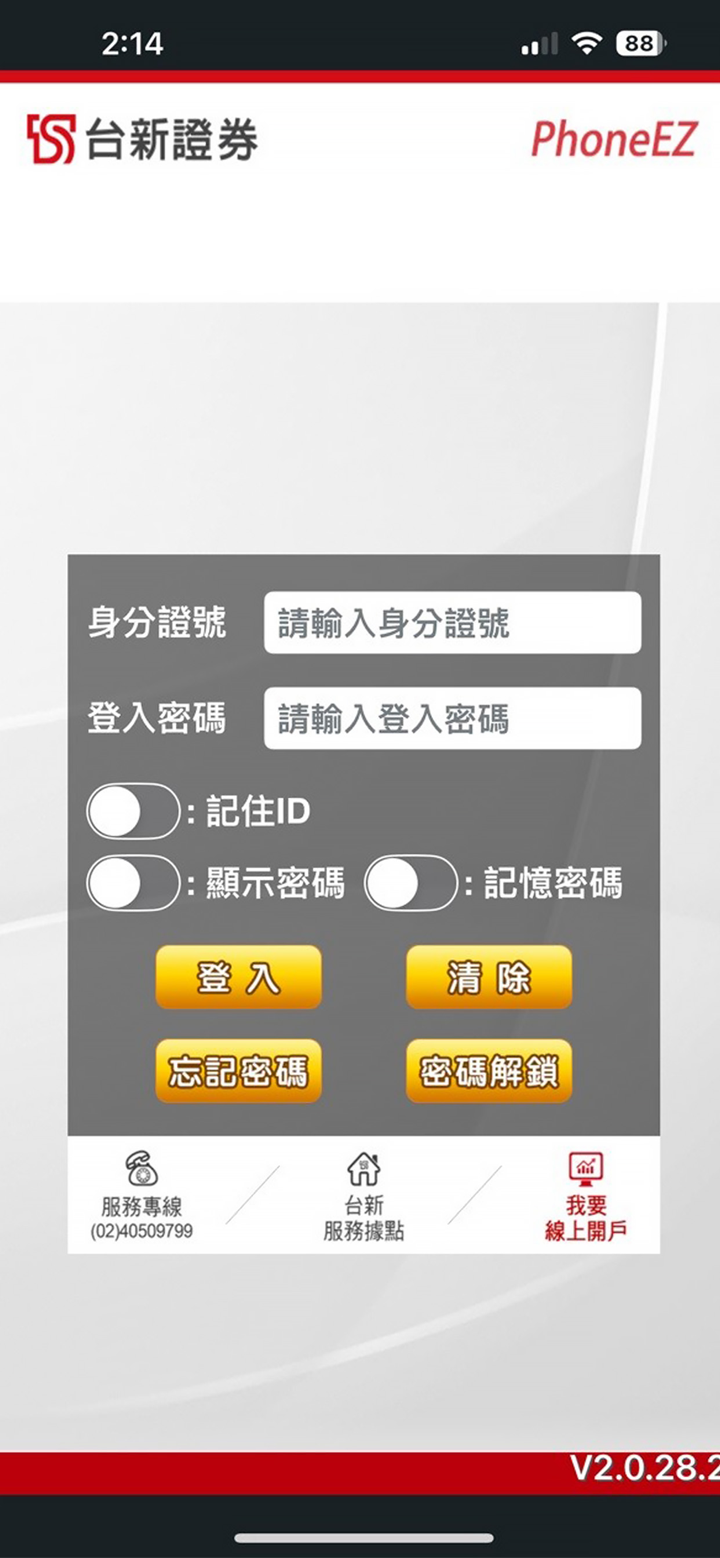

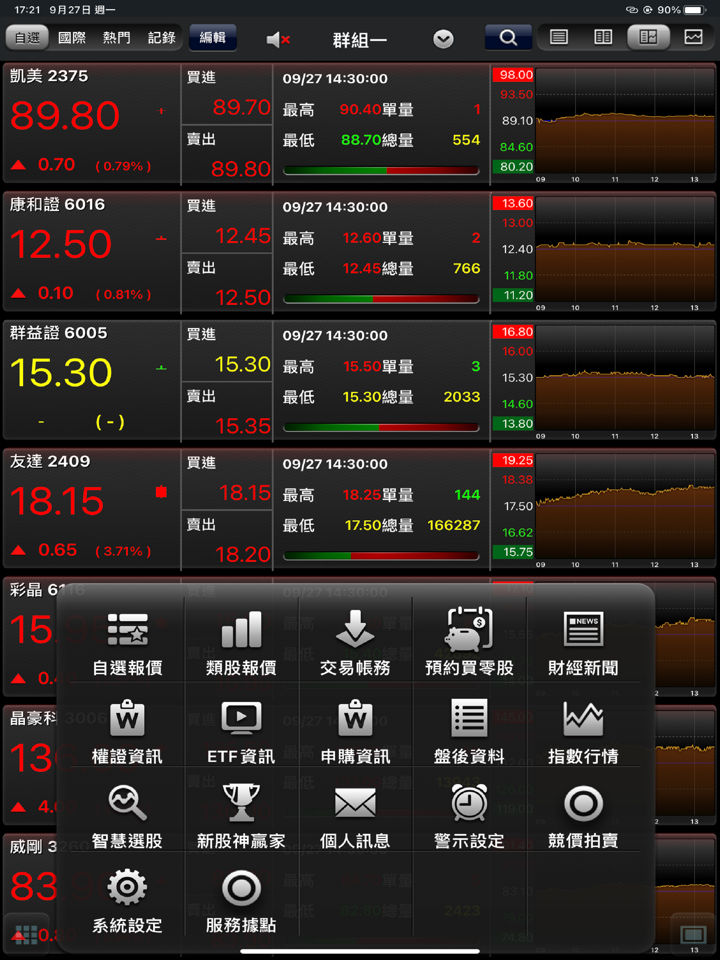

| 應用程式交易 | Woojii, PhoneEZ | 手機應用程式 | 手機用戶 |

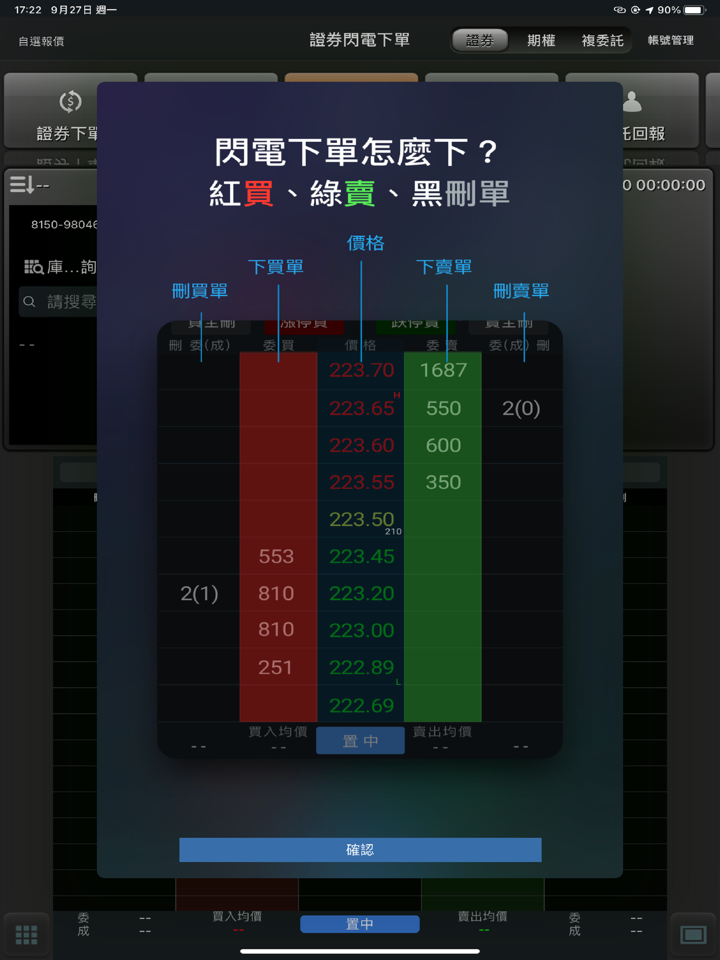

| 電腦交易 | Super Smart Star, 台新快速手, WEB交易, API交易, 全球期貨之星 | 桌面, 網頁瀏覽器, API | 桌面用戶, 算法交易 |

| 語音交易 | 語音交易 | 手機 | 基於語音的訂單 |

| 證書區域 | 證書區域 | 未明確列出,可能是基於桌面的證書管理 | 證書管理 |