DoreenVanDenHeever

1-2年

Is automated trading with Expert Advisors (EAs) available on Mega Securities' trading platforms?

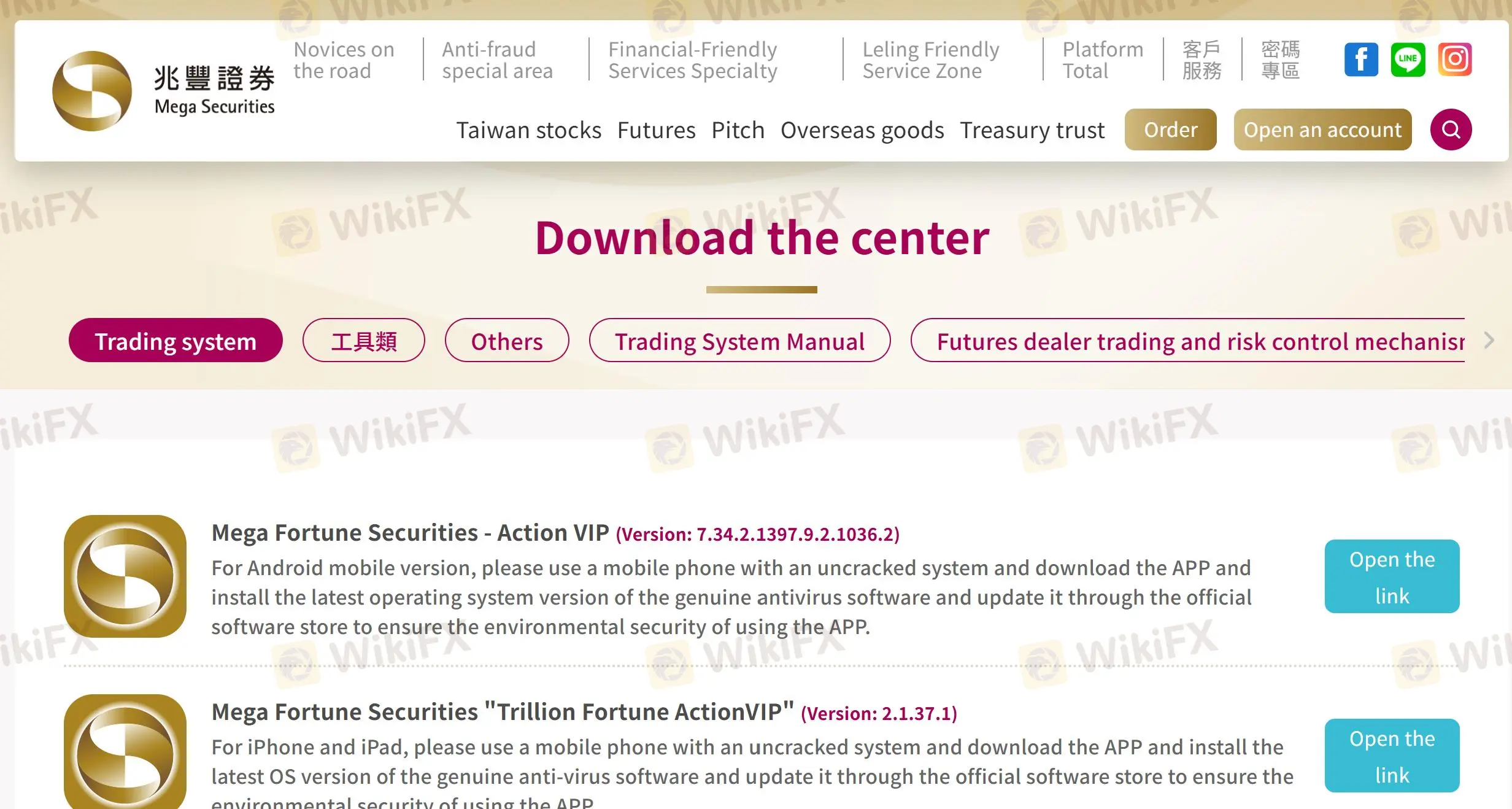

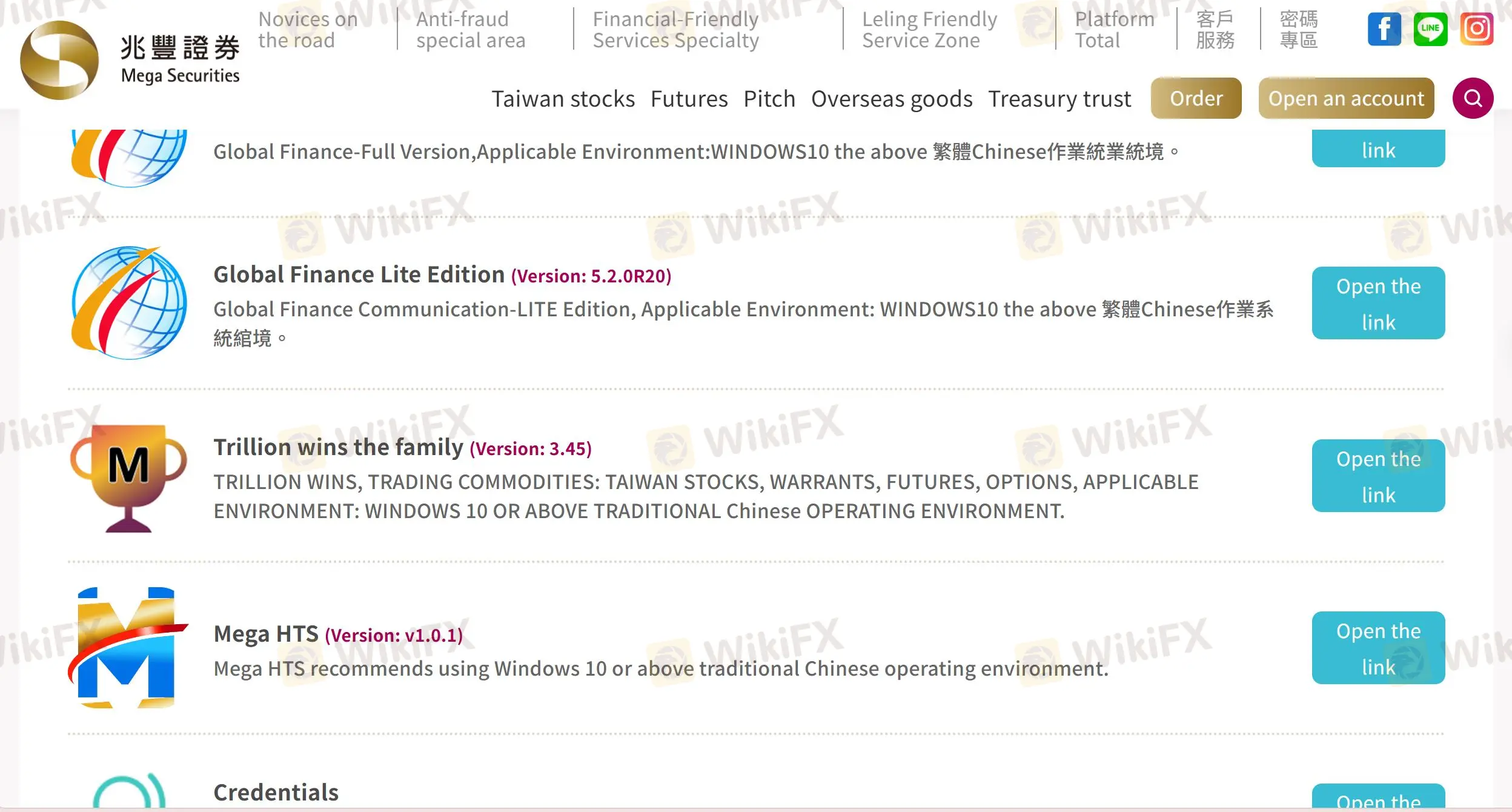

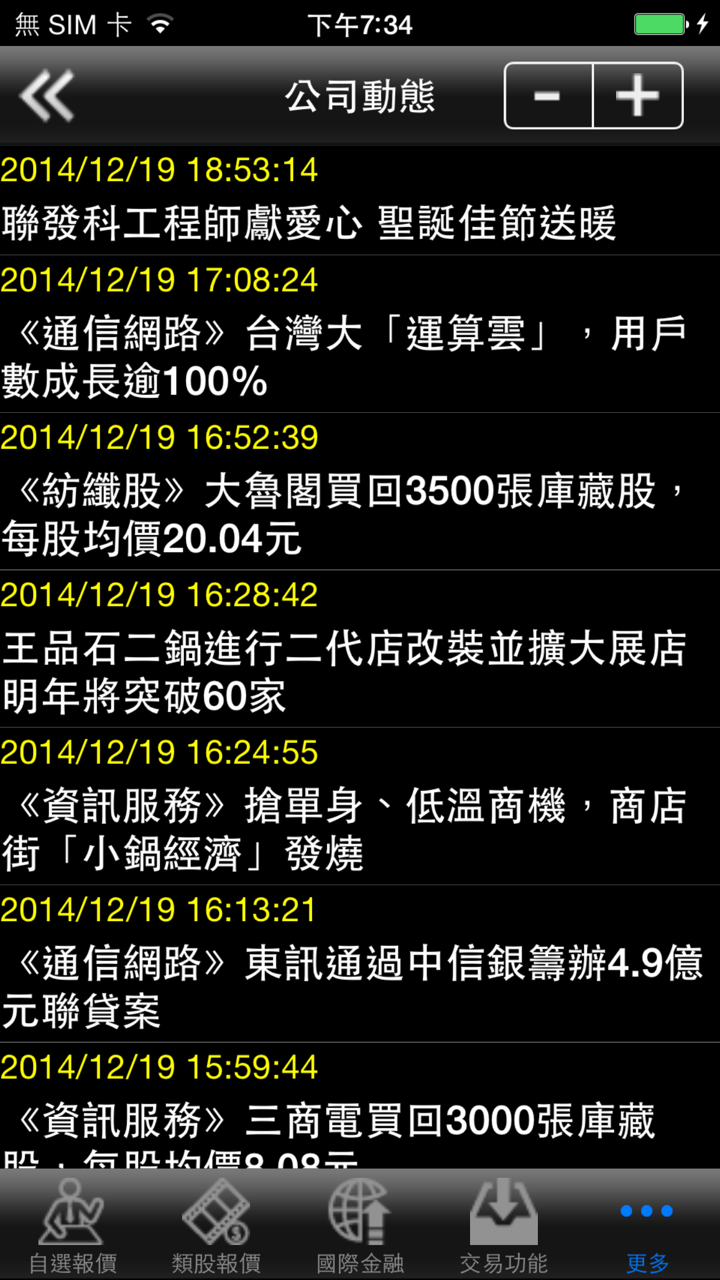

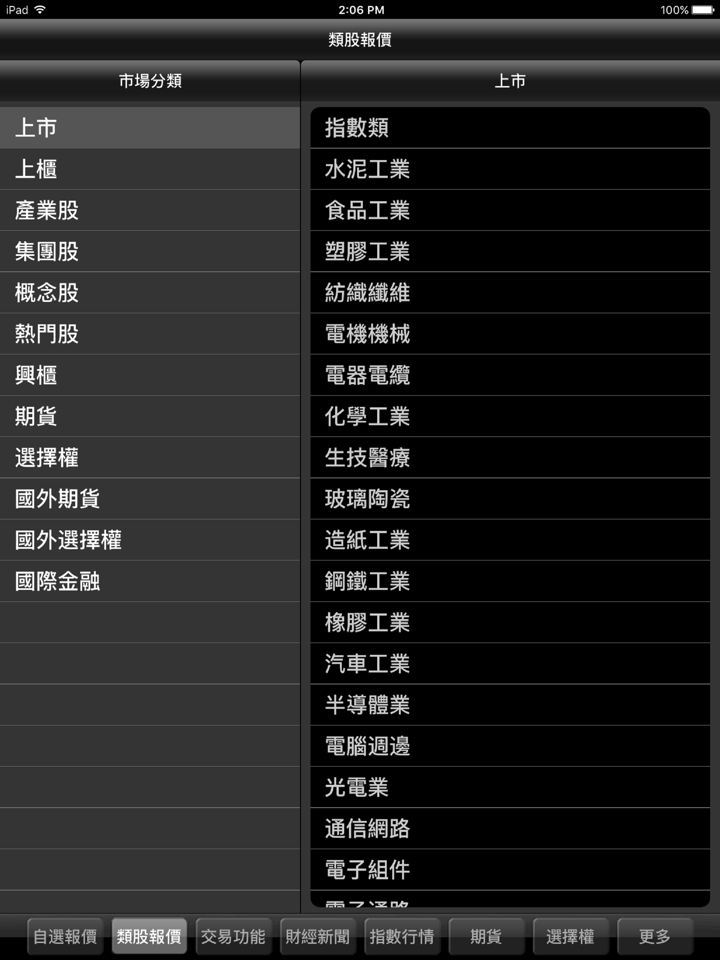

From my hands-on experience exploring Mega Securities, I found their suite of trading platforms is largely self-developed, including names like Mega Fortune Securities, Global Finance, and Mega HTS. Unlike brokers that rely on standard MetaTrader platforms (such as MT4 or MT5), Mega Securities operates on its own proprietary systems. This has direct implications for anyone interested in automated trading—specifically with Expert Advisors (EAs).

Expert Advisors are most commonly utilized within the MetaTrader environment, given its extensive support for algorithmic trading and custom scripting. On Mega Securities, however, I did not find any clear support for EAs or similar automated trading scripts. Their platforms are designed in-house for their proprietary trading solutions, and there’s no indication of API integration or scripting capabilities that mirror what MetaTrader offers. For me, as someone who occasionally deploys automated strategies, this is a key limitation. It means that users expecting to run standard EAs will not have native support or infrastructure for doing so at Mega Securities.

While the broker appears robust in risk management and is well-regulated within Taiwan, the lack of automated trading tools may not suit traders who prioritize algorithmic or hands-free strategies. It’s important to carefully consider your trading approach and software requirements before deciding if Mega Securities is a match for your needs.

Broker Issues

Leverage

Platform

Account

Instruments

joalund

1-2年

How do Mega Securities' swap fees for overnight financing stack up against those charged by competing brokers?

As an independent trader focused on risk management and transparency, I pay close attention to a broker’s fee structure—especially swap fees, since these can directly erode profits or increase costs for positions held overnight. With Mega Securities, I quickly noticed that their fee structure, particularly regarding swap or overnight financing fees, is not clearly detailed in their public materials. This lack of transparency makes it difficult for me to anticipate and plan for the costs I might incur on longer-term trades, and that’s a concern.

My experience has shown that most reputable brokers provide a clear breakdown of swap rates or overnight fees per instrument right on their platforms or websites. In contrast, the absence of such information from Mega Securities leaves me uncertain whether their fees are competitive when compared to the broader regional or international brokers I’ve used. While Mega Securities is regulated by Taiwan’s TPEx, and appears to offer a mature risk management system, I remain cautious about the actual trading costs. Not knowing the overnight financing rates up front could present an unexpected risk, and this lack of clarity makes it tough for me to confidently compare Mega Securities with other brokers who provide full transparency on this critical issue.

For my own trading, especially with strategies that involve holding positions overnight, I prefer working with brokers who disclose all relevant costs clearly. Until swap fee information is made public and straightforward to access, I would be careful with committing significant capital over multi-day trades at Mega Securities.

Broker Issues

Fees and Spreads

helpneeded

1-2年

What is the lowest amount I’m allowed to withdraw in a single transaction from my Mega Securities account?

After thoroughly examining all the available details about Mega Securities, I found that information about the minimum withdrawal amount per transaction is not provided on their official documentation or public disclosures. As an experienced trader, I’ve learned that withdrawal policies—especially minimum withdrawal thresholds—are crucial for planning both short-term liquidity and effective risk management.

However, Mega Securities operates under the regulatory oversight of TPEx in Taiwan, and the company has a physical office presence confirmed in Taipei, which bolsters my trust in their operational transparency. Yet, the absence of clear withdrawal terms, including limits or associated fees, does leave some important questions unanswered for me. In my practice, when a broker’s withdrawal specifics are not explicit, I always recommend reaching out directly to their customer service by email or phone to ensure all terms are understood before initiating significant transactions. This approach helps safeguard against unwanted surprises or potential delays that can disrupt trading plans.

In summary, based on my review, Mega Securities does not publicly specify a lowest withdrawal amount per transaction, so clarification from official customer support is necessary before proceeding with any withdrawal request.

Broker Issues

Deposit

Withdrawal

edgeisedge

1-2年

Can you outline the particular advantages Mega Securities offers in terms of its available trading instruments and fee system?

From my experience navigating various brokers, Mega Securities stands out primarily for being a regulated entity under the Taipei Exchange (TPEx), which reassures me about its legitimacy, particularly for stock, futures, and trust trading. In Taiwan’s market, this regulatory oversight is crucial, especially when dealing with a range of financial products. What appeals to me is Mega Securities’ clear dedication to offering multiple asset classes—stocks, futures, and trusts—accessible through several self-developed trading platforms tailored for both mobile and desktop environments. As a trader, I appreciate this flexibility, as it allows me to diversify my strategies and adjust my trading to different devices depending on where I am.

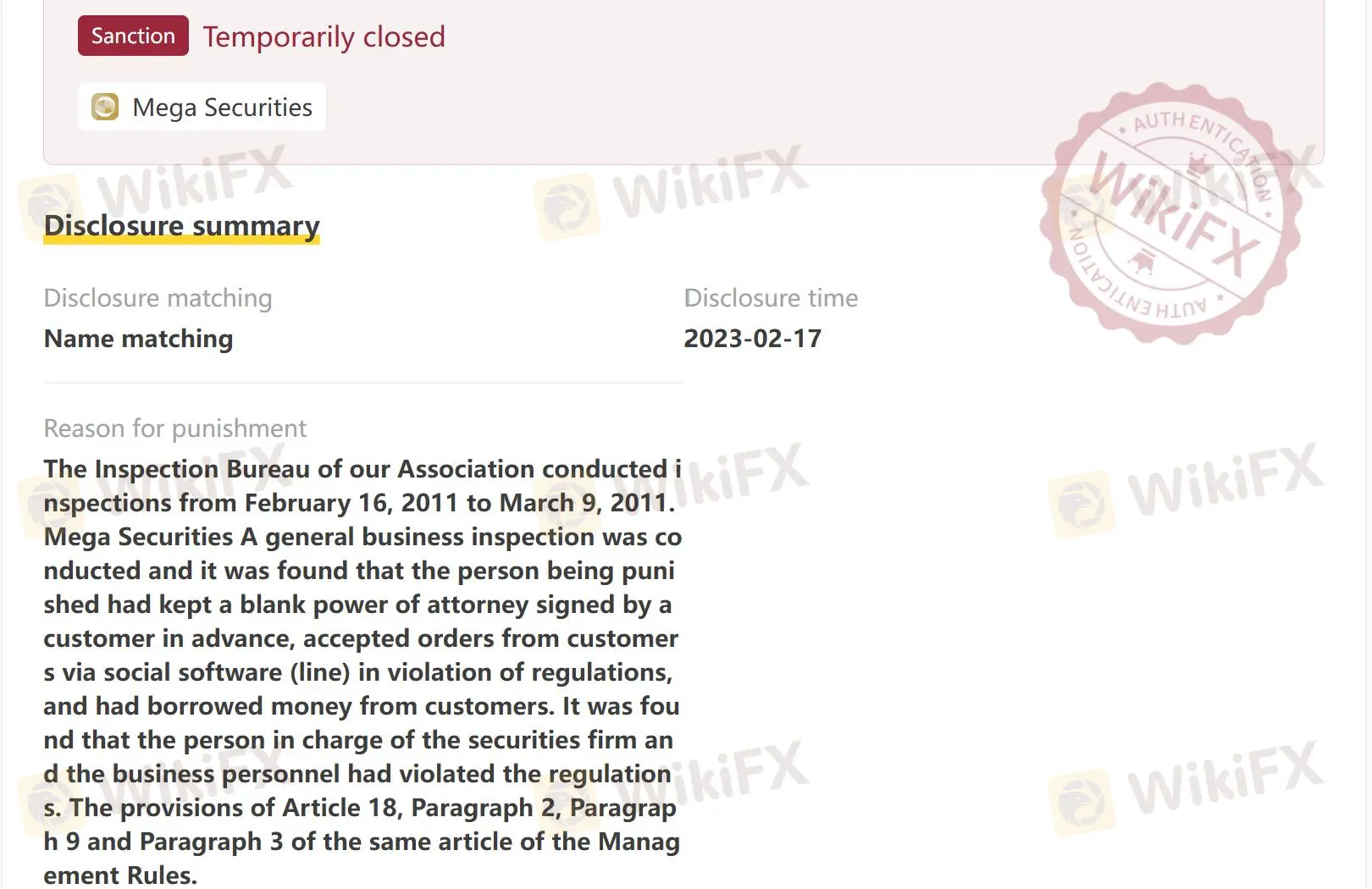

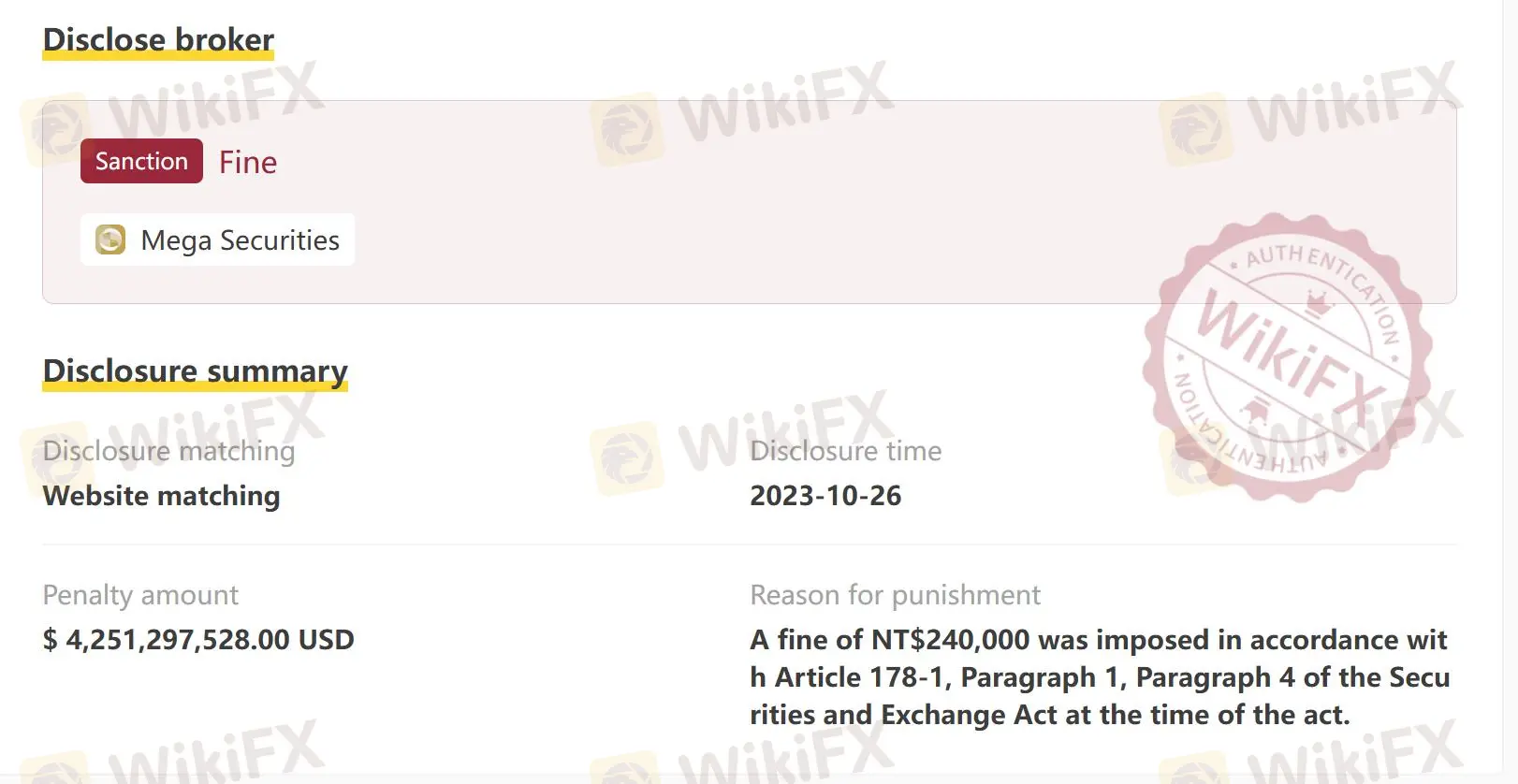

However, when it comes to the fee structure, I have to be extra cautious. Based on the information available, Mega Securities’ fee system isn’t fully transparent; many details remain unclear. For me, this lack of fee clarity means I’m unable to calculate costs with confidence, which is a significant consideration before committing substantial capital. Moreover, it’s relevant to mention that, although the broker is regulated, it has faced regulatory sanctions in the past, so I take that as a reminder to perform thorough due diligence and remain vigilant. In summary, while Mega Securities provides access to a good selection of trading instruments in a regulated environment, the fee transparency issues require careful attention before making trading decisions.