公司簡介

| LIMIT PRIME 評論摘要 | |

| 成立年份 | 2017 |

| 註冊國家/地區 | 黑山 |

| 監管 | SCMN |

| 市場工具 | 外匯、商品、指數、股票、金屬 |

| 模擬帳戶 | ✅ |

| 槓桿 | 最高1:100 |

| 點差 | 浮動 |

| 交易平台 | MT5 |

| 最低存款 | €100 |

| 客戶支援 | 電話:+382 68 036 998 |

| 電郵:info@limitprime.com | |

| 地址:Ulica 8 marta bb, objekat 14E, Podgorica | |

| 社交媒體:Facebook、Instagram、LinkedIn、YouTube | |

LIMIT PRIME 資訊

LIMIT PRIME 是一家受監管的經紀公司,提供各種交易工具和靈活的付款選項,適合有經驗的交易者。其優勢包括高安全性和透明費用;然而,潛在的缺點可能是帳戶不活躍費用和缺乏適合初學者的平台。

優缺點

| 優點 | 缺點 |

| 良好監管 | 帳戶類型有限 |

| 免佣金 | |

| 分離帳戶 | |

| 負債保護 | |

| 提供模擬帳戶 | |

| 提供MT5 | |

| 多種付款方式 | |

| 多種交易工具 |

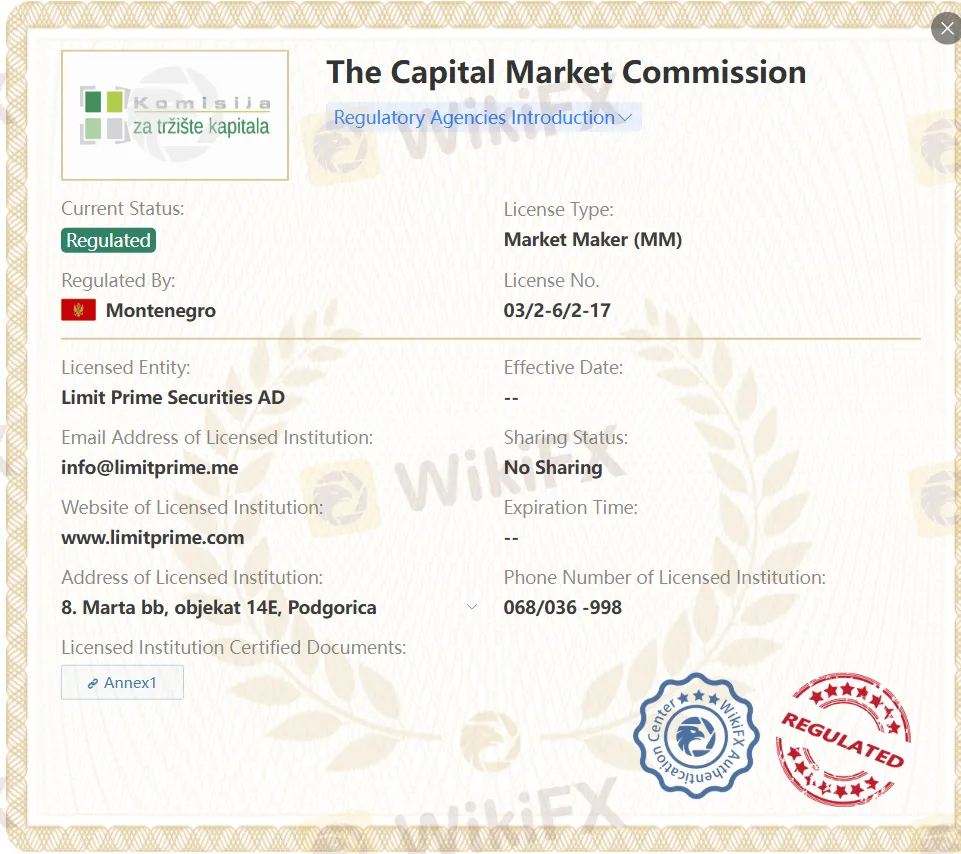

LIMIT PRIME 是否合法?

LIMIT PRIME 是一家受監管的經紀公司。Limit Prime Securities 受MIFID II規定、ESMA監管,由黑山資本市場管理局許可和監管。

| 監管國家 | 監管機構 | 監管狀態 | 受監管實體 | 許可類型 | 許可號碼 |

| 黑山資本市場委員會(SCMN) | 受監管 | Limit Prime Securities AD | 市場製造商(MM) | 03/2-6/2-17 |

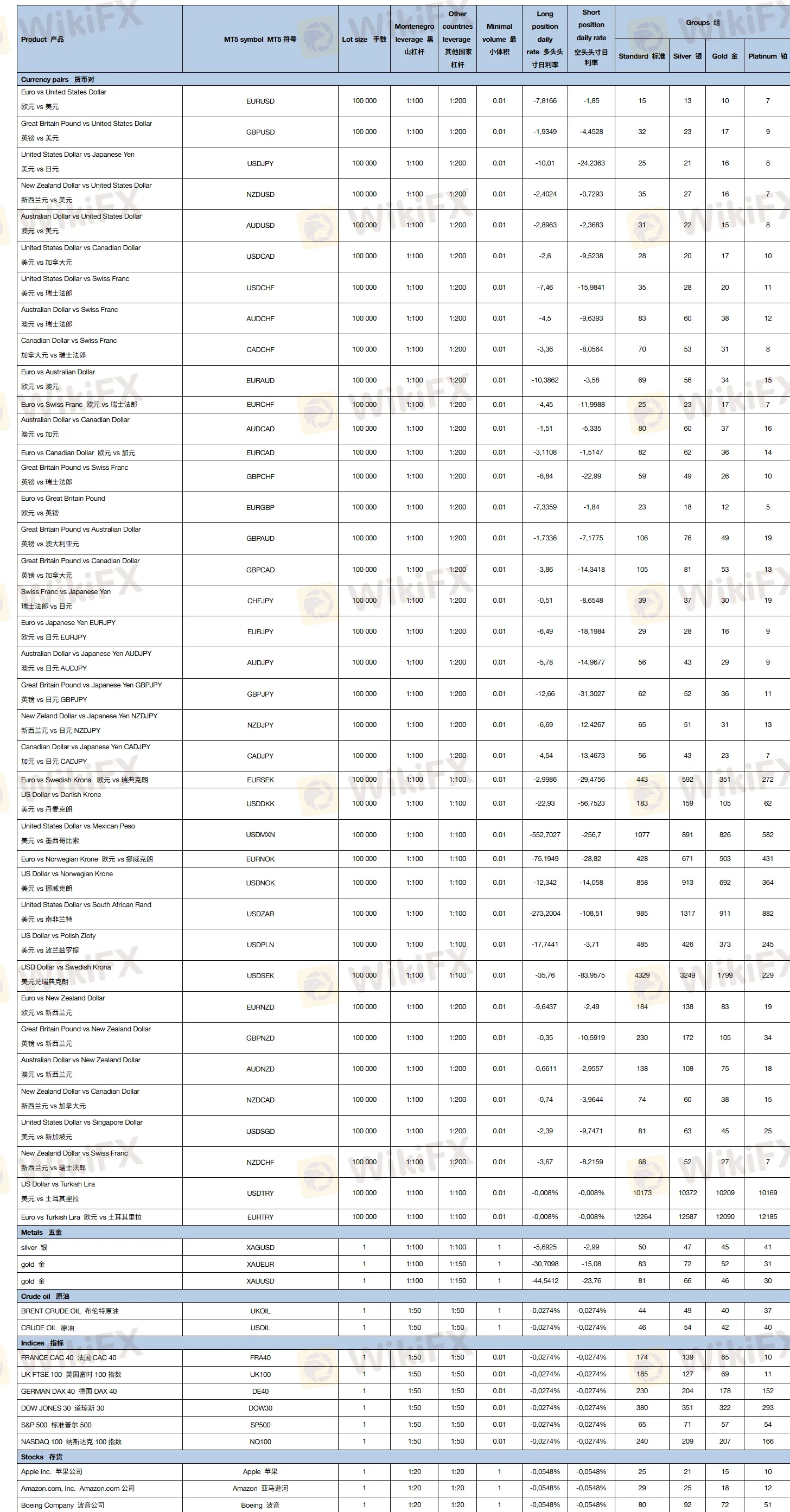

我可以在LIMIT PRIME上交易什麼?

這些是可以在LIMIT PRIME上交易的工具:40種外匯、商品、指數、股票和金屬。

| 交易資產 | 可用 |

| 外匯 | ✔ |

| 商品 | ✔ |

| 指數 | ✔ |

| 股票 | ✔ |

| 金屬 | ✔ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 期權 | ❌ |

| 基金 | ❌ |

| 交易所交易基金 | ❌ |

帳戶類型

LIMIT PRIME提供模擬帳戶,讓交易者在不冒真金白銀的風險下測試這個平台。

LIMIT PRIME提供一種活動帳戶:標準帳戶。當客戶開始交易時,他們必須支付最低100歐元,這將自動將他們歸類為標準交易組。

槓桿

該平台的槓桿高達1:100。槓桿是指借入資金進行投資以放大投資回報的行為。它使投資者能夠用較少的自有資金實現更大的投資規模,從而在投資收益高時實現更大的回報。

費用

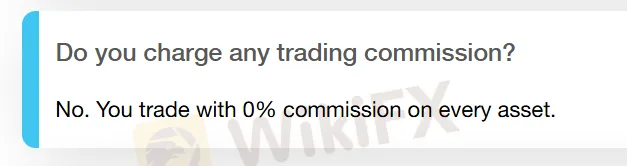

直接成本:公司不向客戶收取任何交易佣金。

每當夜間有未平倉頭寸時,掉期將從客戶的帳戶中扣除。

間接成本:所有未進行任何交易以及在帳戶批准日期起三個月內未進行至少一筆交易的客戶被視為不活躍帳戶。每筆提款將對不活躍帳戶收取20美元的佣金。

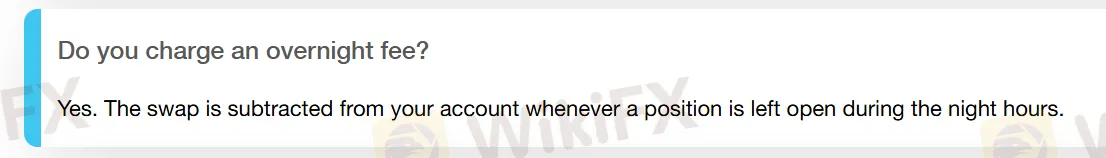

LIMIT PRIME是一家受監管的公司,其客戶享有負債保護。這意味著客戶的帳戶不會被提取比實際擁有的資金更多的款項。

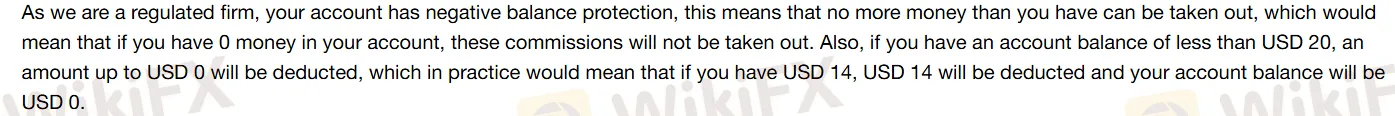

交易平台

MT5 是全球最受歡迎的交易平台之一。這是一個先進的平台,支援多種金融產品的交易,提供自動交易系統、技術工具和複製交易功能。

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| MT5 | ✔ | 桌面、手機、網頁 | 經驗豐富的交易者 |

| MT4 | ❌ | / | 初學者 |

存款和提款

LIMIT PRIME 提供以下付款方式:銀行轉帳、萬事達卡、Skrill、Neteller、Visa 和美國運通。