公司簡介

| HoxtonWealth 評論摘要 | |

| 成立年份 | 2023 |

| 註冊國家/地區 | 英國 |

| 監管 | 無監管 |

| 投資方案 | 管理投資組合、低成本投資、退休計劃、替代投資和道德投資 |

| 平台/應用程式 | Hoxton Wealth App |

| 客戶支援 | 聯絡表格 |

| 電話:+1 737 249 9620 | |

| 實際地址:美國德克薩斯州奧斯汀市國會大道111號500套房,郵編78701 | |

| 美國新澤西州澤西市哈德遜街101號,郵編07302 | |

HoxtonWealth 資訊

HoxtonWealth 成立於2023年,總部設於英國。公司提供五種投資方案和Hoxton Wealth App作為其交易平台。然而,該公司並未受到監管。

優缺點

| 優點 | 缺點 |

| 提供五種投資方案 | 無監管 |

| 提供多種金融服務 |

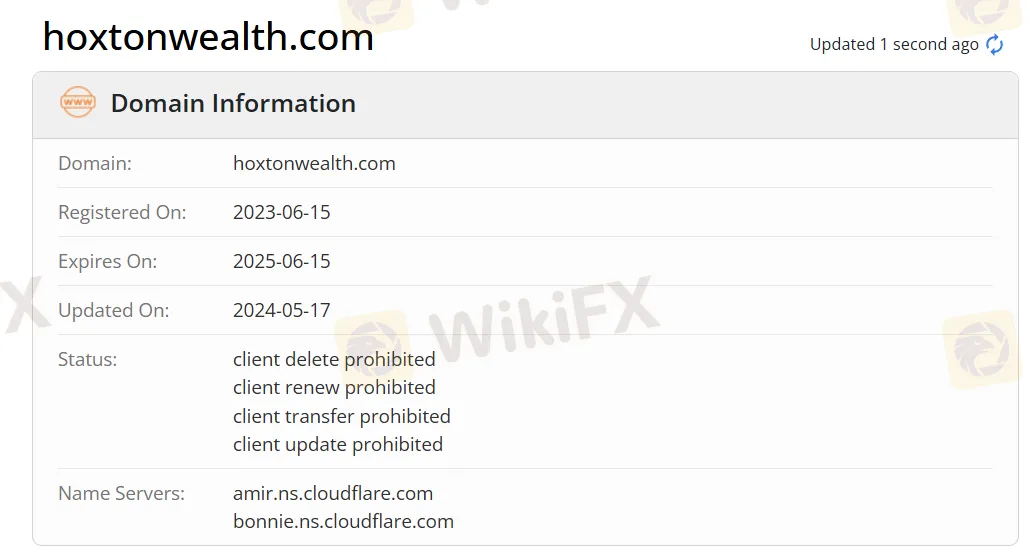

HoxtonWealth 是否合法?

HoxtonWealth 未受監管,其域名hoxtonwealth.com於2023年6月15日註冊,有效期至2025年6月15日。

投資方案

Hoxton Wealth提供五種投資方案,包括管理投資組合、低成本投資、退休計劃、替代投資和道德投資。

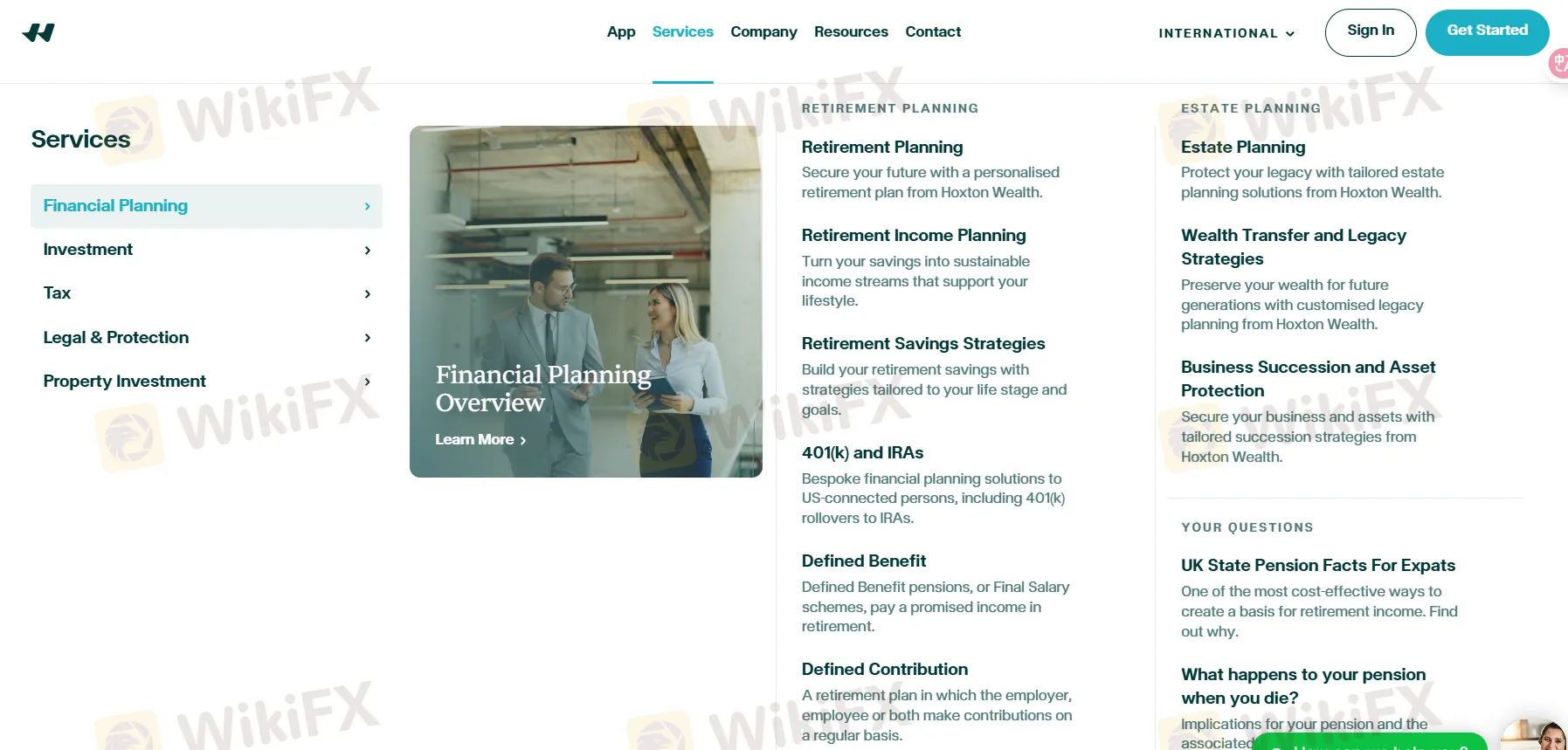

金融服務

Hoxton Wealth提供多元化的金融服務,包括退休計劃、投資建議、稅務支援、法律和保險解決方案、物業投資諮詢,以及遺產和財富轉移規劃。他們還就英國國家養老金等問題提供指導。

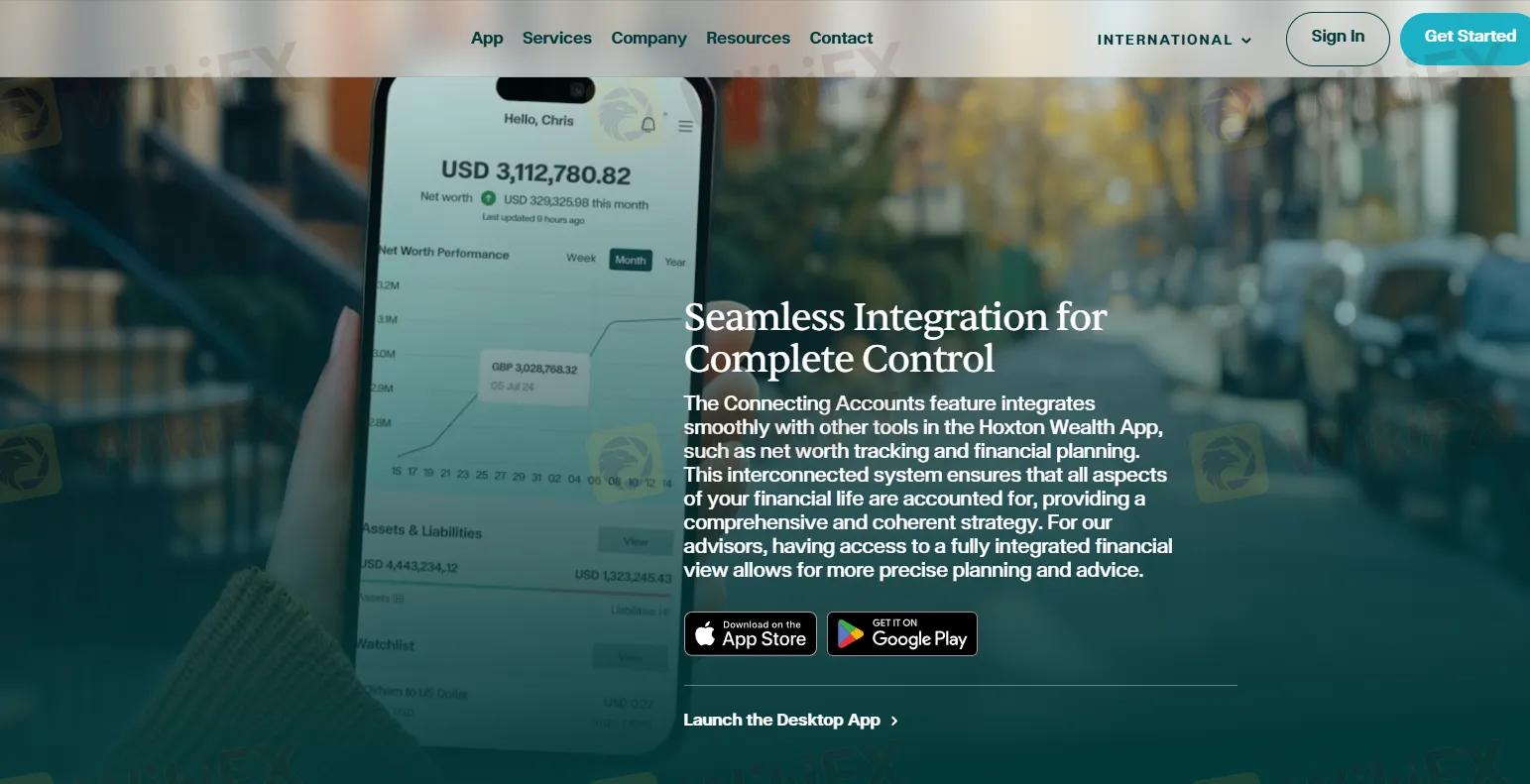

交易平台

Hoxton Wealth的交易平台是 Hoxton Wealth App。它可以連接各種金融帳戶,不受貨幣、機構或地區的限制,並提供實時淨值跟踪。此應用程式可從Apple App Store和Google Play下載,也可作為桌面應用程式使用。