公司简介

| 立花証券 评论摘要 | |

| 成立时间 | 2008 |

| 注册国家/地区 | 日本 |

| 监管 | FSA(受监管) |

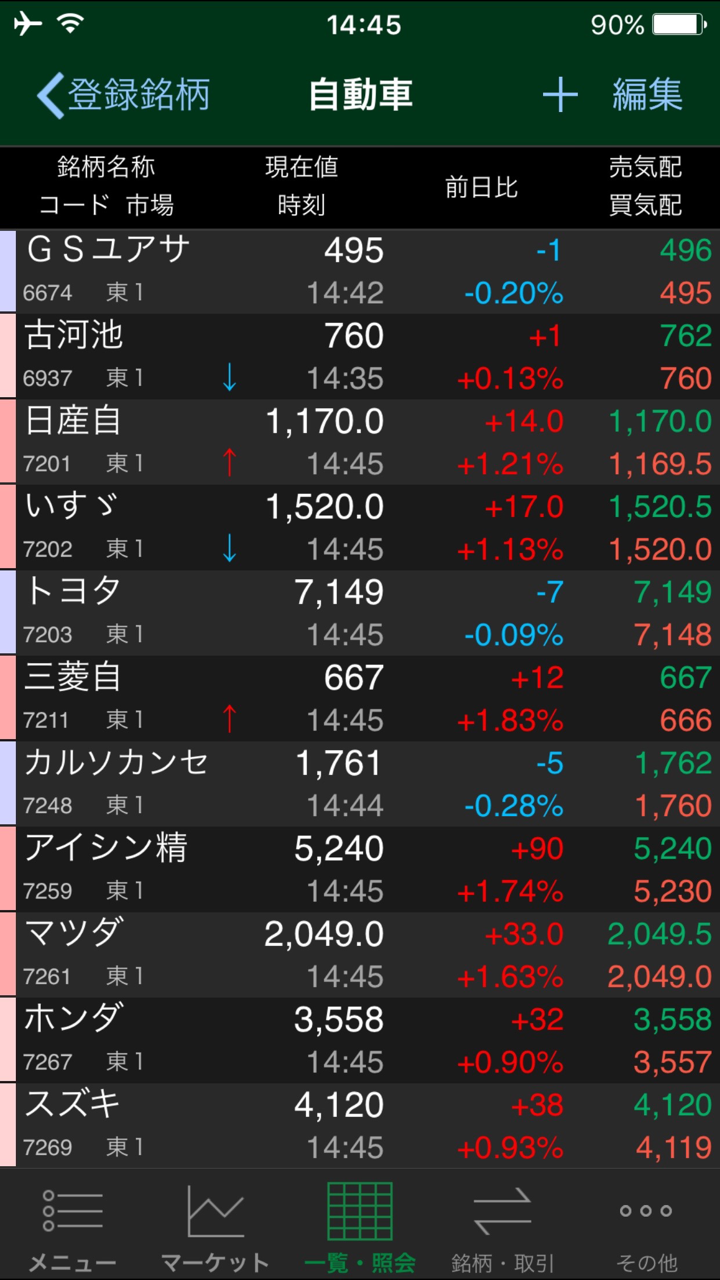

| 市场工具 | 股票、衍生品和基金 |

| 交易平台 | 立花証券 Trade Rich 和 立花証券 股票交易应用 |

| 客户支持 | 电话:0120-66-3303,03-5652-6221 |

| 邮箱: info@t-stockhouse.jp | |

| 奖金 | ✔ |

立花証券 信息

立花証券 是日本的一家机构,提供多样化的金融服务。该平台提供丰富多样的投资产品,涵盖实物股票、保证金交易、投资信托、交易所 外汇(如“立花証券 Kurikku 365”)、日经225指数期货和期权等。同时,立花証券 证券配备了一系列投资信息工具,如 立花証券 Trade Rich、AI 结算日历等。此外,该平台还设有客户服务和问答部分,以便及时回答投资者的问题。

优缺点

| 优点 | 缺点 |

| 受监管 | 语言限制(日语) |

| 丰富多样的投资产品 | 复杂的规则(处理手续费 计算) |

| 多样的 存款方式 | |

| 长时间操作 | |

| 提供奖金 |

立花証券 是否合法?

立花証券 是一家正规合法的金融机构。日本金融厅(FSA)监督该证券公司的交易业务,其许可证号为“関東財務局長(金商)第110号”。

我可以在 立花証券 交易什么?

在立花証券,投资者可以进行各种产品的交易,如股票、金融衍生品(日经225期货、日经225迷你期货等)和基金产品。

| 可交易工具 | 支持 |

| 股票 | ✔ |

| 衍生品 | ✔ |

| 基金 | ✔ |

| 外汇 | ❌ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 期权 | ❌ |

| 交易所交易基金 | ❌ |

账户类型

立花証券主要提供证券交易账户。投资者在开立证券账户后,可以根据自身需求申请开立融资交易账户、外汇交易账户等。

立花証券费用

立花証券的手续费因产品而异。

例如,股票实物交易的手续费可以按照每笔订单计算(单笔计费)或按照每日总交易金额计算(固定配额计费),起步为55日元(含税);融资交易的手续费免费(除了一些特定交易);投资信托无购买费,但存在其他手续费如信托报酬;Kurikku 365的手续费根据月度交易次数确定;日经225期货的手续费起步为247日元(含税),日经225迷你期货起步为27日元(含税),日经225期权的手续费约为协议金额的0.11%,起步为165日元(含税)。

不同业务的收费标准不同。例如,“在线存款服务”免费,提取资金无费用;投资信托提取的费用为每笔1100日元(含税)。

交易平台

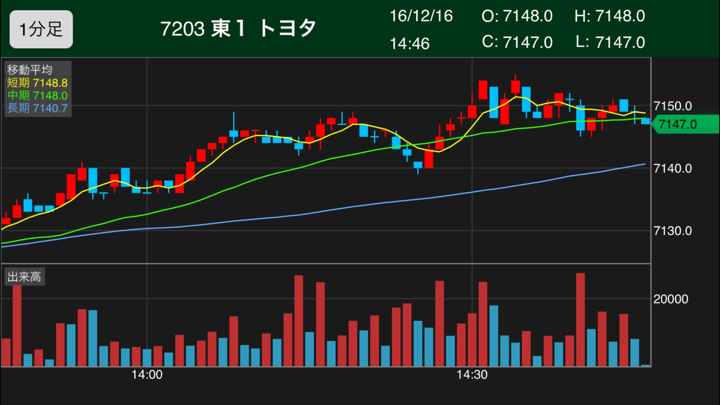

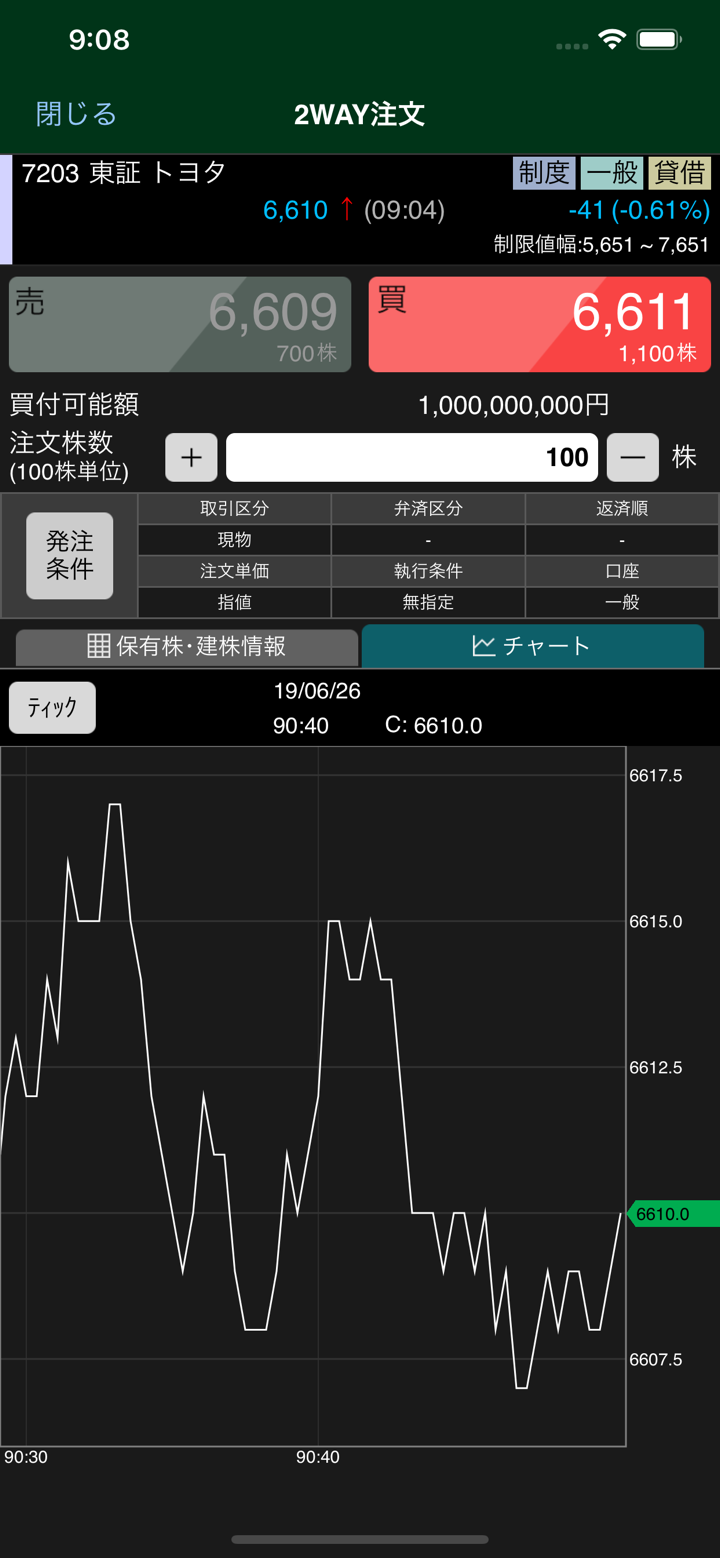

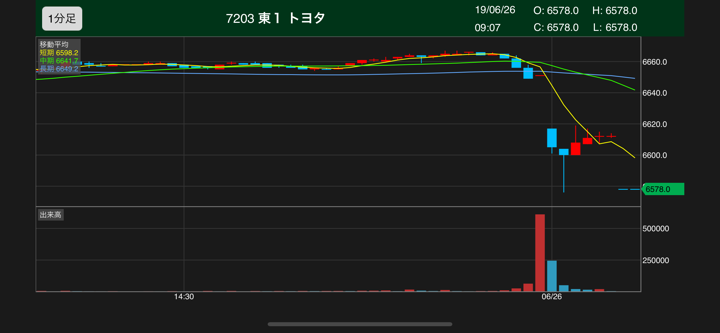

立花証券提供多样化的交易平台,包括立花証券 Trade Rich和立花証券股票交易App。立花証券 Trade Rich功能丰富,立花証券股票交易App支持手机和平板电脑操作。此外,还有一个基于Web的交易平台,满足不同投资者的使用习惯。

| 交易平台 | 支持 | 可用设备 |

| 立花証券 Trade Rich | ✔ | Web |

| 立花証券股票交易App | ✔ | 手机 |

存款和取款

存款有三种方式:“在线存款服务”、存入专用转账账户和定额转账服务(用于定期投资需求)。

就取款而言,手续费由公司承担。

奖金

立花証券 证券推出了一项优惠活动,新开立的账户的实物股票交易手续费最长可达半年(120个工作日)为0日元,旨在吸引投资者开立账户并体验平台的服务。

此外,平台上的一些产品在特定条件下还提供手续费减免和其他优惠政策。例如,“Kurikku 365”如果月交易量超过1,000单位,则下个月的某些时期的手续费可以豁免。