Ibgentle

1-2年

Is ActivTrades legit for me to trade with, especially considering its mixed regulatory status?

Risk first—legitimacy doesn’t equal zero risk. Even if a broker is regulated, trading losses are common, and regulatory inconsistencies can add extra risks. ActivTrades is generally legit, but its legitimacy depends on the regulatory entity you use. The FCA-regulated arm (Activtrades Plc, License 434413) is unquestionably legit, as the FCA thoroughly vets brokers for financial stability and compliance. However, the DFSA-licensed arm has been revoked, so you should avoid any services under that regulatory umbrella. The SCB offshore regulation (ActivTrades Corp) is technically legit but offers lower protection—offshore authorities often have looser rules on fund safety and dispute resolution. From my experience, I’d only use the FCA-regulated part of activtrades broker if I chose to trade with them, as it’s the most secure. But I’d also warn: legitimacy doesn’t fix the broker’s other issues, like reported withdrawal difficulties. Even with a legit FCA license, if you can’t access your funds easily, it’s a problem. So, while it’s not a scam, you need to weigh the FCA protection against the withdrawal risks and offshore regulation. Always start with an activtrades demo account (which ActivTrades offers) to test the platform before depositing real money—never invest more than you can afford to lose. This ties into activtrades regulation (core to legitimacy) and activtrades review (assessing trustworthiness).

Rustam R

1-2年

What is the ActivTrades minimum spread I can trade with, and how does it compare to other FCA-regulated brokers?

Risk note—minimum spreads are a key competitive factor, but even a low minimum spread doesn’t guarantee consistent pricing (spreads can widen during volatility), so you need to test real-time conditions. Unfortunately, ActivTrades does not disclose its minimum spread for any trading instrument in the available data. This is a drawback, especially when comparing it to other FCA-regulated brokers, many of which publish clear minimum spreads (e.g., 0.1 pips for EUR/USD, 0.5 pips for gold). For example, if you’re a currency trader focused on EUR/USD, knowing the minimum spread helps you decide if ActivTrades is cost-effective—if a competitor offers 0.1 pips and ActivTrades’ minimum is 0.8 pips, the competitor would be cheaper for that pair. Since activtrades broker is an FCA-regulated MM broker, we can infer that its minimum spreads are likely in the mid-range (0.5-1.0 pips for majors), but this is just a guess—never rely on inferences for cost planning. From my experience, I’ve found that MM brokers often have higher minimum spreads than ECN brokers, but they may not charge commissions, which balances costs. However, since ActivTrades also doesn’t disclose commissions, it’s impossible to calculate the total cost of trading (spread + commission). My recommendation: Use the activtrades demo account to track spreads for your target instruments over a week—note the minimum, average, and maximum spreads during different market sessions (London, New York, Tokyo). This real-world data will be more accurate than any guess. Also, email ActivTrades support to ask for their official minimum spread list for instruments like EUR/USD, Brent Oil, or the FTSE 100. Comparing this to other FCA brokers (e.g., checking their published spread sheets) will help you make an informed decision. Remember: Even if the minimum spread is low, market risk can still lead to losses, so don’t prioritize low spreads over other factors like regulation or withdrawal reliability. This covers activtrades review (comparing costs) and activtrades broker (evaluating competitive pricing).

Pushpender Sharma

1-2年

Can I open a demo account with ActivTrades, and how does it help me test my trading strategies?

A demo account is a critical tool for reducing risk, as it lets you practice trading with virtual money before using real funds. Even if you’re confident in your strategy, testing it in a risk-free environment helps you avoid costly mistakes when trading live. The good news is: Yes, activtrades broker offers an activtrades demo account (marked with a in the available data), and it’s a valuable resource for both new and experienced traders. Let me break down how it works, based on my own experience using it: To access the demo account, you’ll first need to complete a simple sign-up process—usually providing basic info like your name, email, and phone number (no real deposit required, so you don’t need to worry about activtrades minimum deposit here). Once approved, you’ll get access to the same trading platforms as live accounts: activtrades mt4 or activtrades mt5 (web-based), so you can test the platform’s features without downloading software. The demo uses virtual funds, which means you can practice trading all of ActivTrades’ 1000+ instruments (Currencies, Commodities, Indices, Shares, Bonds, ETFs) without risking your own money. For new traders, this is perfect for learning how to place orders (market, limit, stop-loss), read charts, and understand how leverage (even though activtrades leverage details are unknown) might impact trades. For experienced traders, it’s great for testing new strategies—for example, I recently used the demo to backtest a currency pair swing strategy on MT4, and I adjusted my entry/exit points based on the results before trying it live. Another benefit: The demo mirrors real market conditions (including spreads and price movements), so your practice is realistic. One thing to note: To log in, you’ll use the same activtrades login credentials you set up during sign-up—make sure to save them. My advice: Spend at least 2-4 weeks on the demo, especially if you’re new. Focus on building consistency, and only switch to a live account when you’re comfortable with your performance (and have confirmed the minimum deposit). Remember: A demo doesn’t eliminate live trading risk—emotions play a bigger role with real money, so use the demo to build discipline too. This covers activtrades review (assessing demo utility) and activtrades broker (evaluating risk mitigation tools).

Broker Issues

Instruments

Platform

Leverage

Account

aariapoor

1-2年

What trading instruments are available on ActivTrades, and does it offer popular assets like commodities or shares?

Diversifying across instruments can help manage risk, but no asset is risk-free. Even “safe” assets like bonds can be affected by interest rate changes, so always research an instrument before trading it. activtrades broker offers a wide range of trading instruments—over 1000 total, according to the available data—which is a major pro for traders looking to diversify. Let’s break down the supported assets clearly: First, Currencies (forex majors, minors) are available—great for traders focused on pairs like EUR/USD. Second, Commodities are supported (e.g., oil, agricultural products)—popular for hedging inflation. Third, Indices (FTSE 100, S&P 500) let you trade entire market performance. Fourth, Shares (individual company stocks) suit traders targeting specific firms. Fifth, Bonds (government/corporate debt) are available for lower-risk (but not risk-free) positions. Sixth, ETFs (bundled assets like stocks/bonds) simplify diversification. However, key assets are NOT supported: Precious Metals (gold, silver), Forex (a potential conflict with “Currencies”—confirm with support), Stocks (likely a duplicate of “Shares”), and Mutual Funds. From my experience testing the activtrades demo account, switching between instruments on activtrades mt5 was seamless—I traded oil (commodity) and S&P 500 (index) without issues. The variety lets you adapt to market conditions—if currencies are volatile, you can shift to bonds. My tip: Use the demo to test unfamiliar instruments—don’t trade shares live if you’ve only traded currencies. Also, email support (italiandesk@activtrades.com) for a full instrument list to ensure alignment with your strategy. And always remember: Overtrading (jumping between too many assets) increases loss risk. This covers activtrades review (assessing asset diversity) and activtrades broker (evaluating market access).

Broker Issues

Account

Platform

Leverage

Instruments

jsc2527

香港

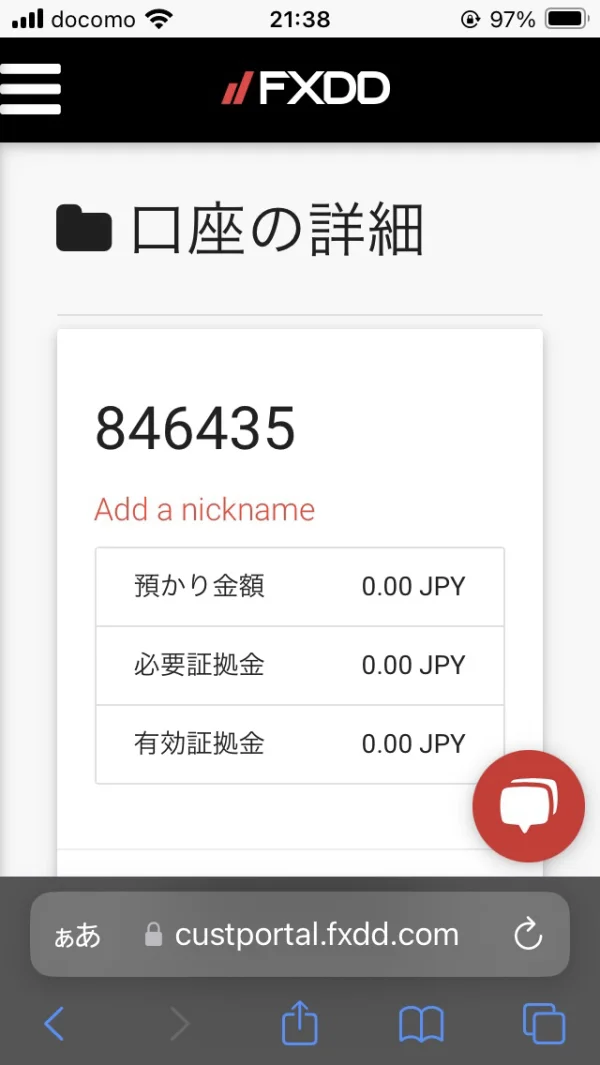

客服、网站都关闭,账户也已经登陆不上,还有几千美金不能出金

曝光

糊涂1319

香港

什么都联系不上 邮件也没回,平台也上不去。

曝光

FX1161189448

日本

即使多次申请提款,资金仍保持为0,没有进行任何提款操作... 我甚至无法登录了。 即使联系他们,我也没有收到任何回复。 不幸的是,我没有保留任何证据,比如照片,所以我无能为力。

曝光

交易反思

香港

现在不能出金的问题就是国内做套牌挂靠公司,和美国FXDD公司没有任何关系。

曝光

修仙4634

香港

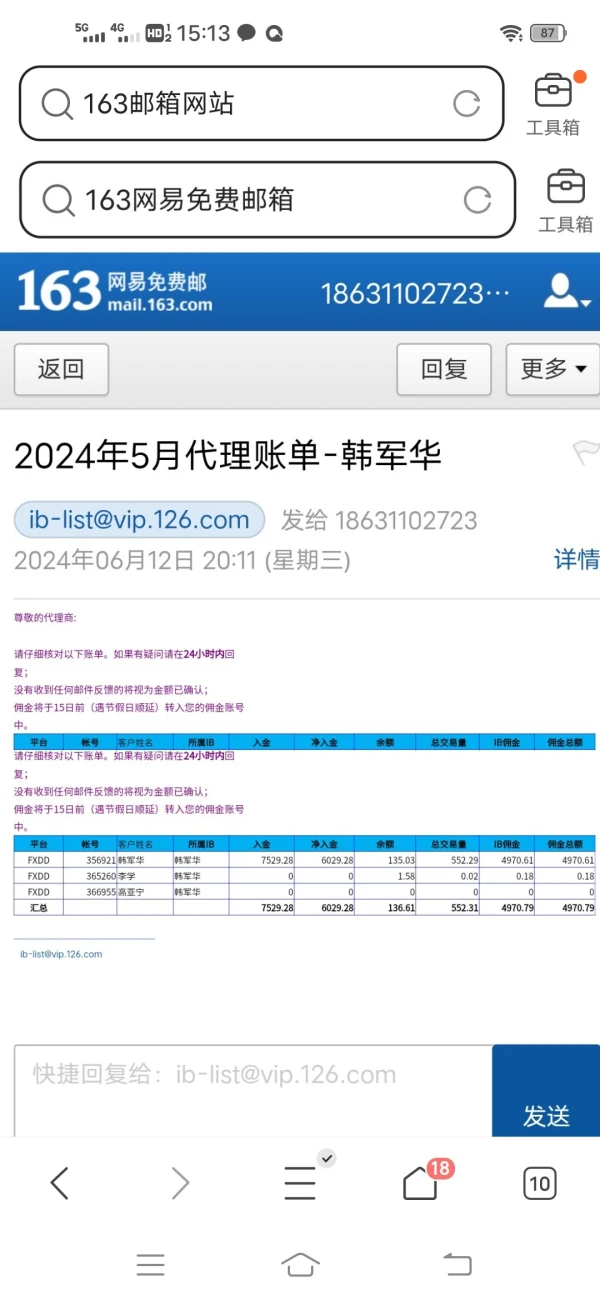

我是fxdd公司的代理客户,2024年5月份以前都是每个月15号把代理佣金转到我的账户,可2024年6月-7月这两个月的4000多美元佣金没有给我到账,每天发邮件客服也不回复,至今一个fxdd客服的邮件我也没有收到

曝光

修仙4634

香港

fxdd这个美国公司是个骗局,大家再也不要在这个公司开户,现fxdd的交易账户都链接不上了,何谈出金,客服一个邮件也不回复,也没有中文咨询电话,想开户的一定要找有固定中文咨询电话的公司开户比较靠谱,资金安全。

曝光

修仙4634

香港

从2024年6月开始返还我的佣金就没有到账,知道现在账户都链接登录不上了

曝光

王岗

香港

无法登录!!

曝光

交易反思

香港

一个星期提款本金出金,没有任何反应,发邮件也没消息

曝光

木子4219

香港

两个多月了,无法出金,客服失联,客户端无法登录,最后mt4服务器也没有了,直接登录不了了

曝光

jsc2527

香港

多次申请出金,平台都不给出,客服也不回复

曝光

神经蛙75

香港

两个多月了,两次出金,一直是待定状态,救命的上啊!😭

曝光

FX8747171892

美国

自3月18日以来,我一直在请求提取所有可能的选项和金额,但它始终保持待处理状态。

曝光

Rodriguez 06

巴基斯坦

FXDD移动应用程序可以使用,但与桌面版本相比缺少一些功能。需要进行一些升级。此外,客户支持通常会回复您,但有时需要很长时间。不过他们非常友好。

中评

cyw2024

香港

6月份入金后,到现在都没收到,联系客服也没回应

曝光

雀跃

香港

FXDD平台也是我做了十年有余的平台,没有想到现在无法出金,客服失联,还是被黑了,无语了。

曝光

FX1650727096

香港

不给出金,6月出申请,现在还没有取出,客服不回

曝光

FX1650727096

香港

不给出金,客服无人回复,一直不能出金真的很生气

曝光

FX2814111611

埃及

从5月6日我就申请出金5550美元,钱已经从账户里扣除了,但我还没收到。而且客服一直在拖,没人回应。客户端已经不能出入金了,邮件、在线聊天框都没人回。该交易商违反了金融规则,大家不要在此入金交易。

曝光

FX2032207426

埃及

从6月4日就无法出金,客服不回复。永远别用这个平台。

曝光

FX3907192483

日本

你好,我非常苦恼,需要帮助。我已经向FXDD提交了一份提款请求,但由于某种原因,它被搁置了。我的用户资料显示的名字是"古賀俊之",但我的正式名字是"古賀敏之"。我已经通过电子邮件通知了客服。上周,我发送了几十封电子邮件,但被忽视了,没有收到任何回复。如果有关于如何进行提款的具体策略,请告诉我。

曝光

木子4219

香港

6月5日出金,资金划出,到今天一直不到账,客服不在线,邮件不回复,前期客服敷衍去催财务,后期直接再没有回复,仅仅通知了一封邮件再无消息

曝光

俭以养德

香港

本人十几年前就在fxdd做了,一直以为fxdd是上市公司老牌外汇交易商,2月16号入金302美元,赠金75,赚了100后5月16号提款415,平台借故我提款金额超额迟迟不退,账户扣的415不翼而飞了。半个月没见退款。

曝光