公司简介

| Finansia 评论摘要 | |

| 成立时间 | 2002 |

| 注册国家/地区 | 泰国 |

| 监管 | 无监管 |

| 交易产品 | 证券 |

| 模拟账户 | ❌ |

| 交易平台 | Finansia HERO (PC, iOS, Android) |

| 最低存款 | / |

| 客服支持 | 电话:02 782 2400 |

| 邮箱:cxcenter@fnsyrus.com | |

Finansia 信息

成立于2002年,总部位于泰国的Finansia Syrus Securities是一家经纪公司,提供包括证券交易、IPO认购和教育研讨会在内的广泛服务。尽管在泰国证券交易所上运营为第24号经纪商,但在全球范围内没有受到监管,并且没有模拟或伊斯兰账户选择。

优缺点

| 优点 | 缺点 |

| 免费投资研讨会 | 无监管 |

| 提供多种账户类型 | 没有模拟账户供练习 |

| 强大的内部交易平台(Finansia HERO) | 未明确最低存款 |

| 悠久的运营历史 |

Finansia 是否合法?

Finansia 不是由任何主要金融监管机构许可或监管。尽管在泰国注册,但泰国证券交易委员会(SEC)不控制其国际或货币经纪服务。

WHOIS记录显示fnsyrus.com域名于2009年5月26日注册,最后修改日期为2025年5月16日。将于2026年5月26日到期。其当前状态为“客户转移禁止”,这表明它是活跃的,并受到未经授权的修改或转移的保护,表明它是一个在标准保护政策下运行的活跃和功能性域名。

Finansia 服务

Finansia Syrus Securities专注于为泰国的零售和机构客户提供证券经纪服务,提供全面的投资服务。作为泰国证券交易所的重要参与者(第24号经纪商),它提供数字交易工具、市场研究和教育支持。

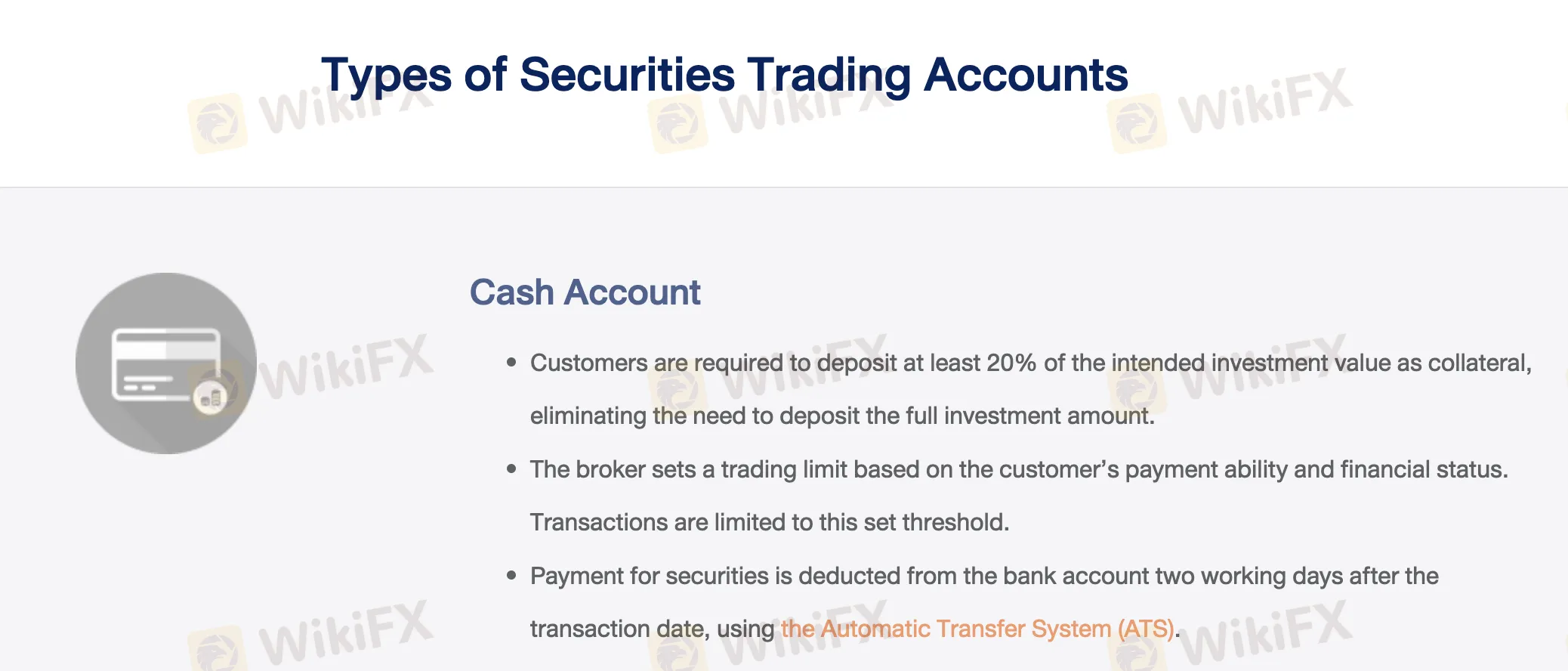

账户类型

Finansia 提供三种实际交易方式: 现金账户、现金余额账户和信用余额账户。每种账户都适用于不同的交易需求,取决于财务灵活性和风险态度。官方网站没有演示账户或伊斯兰账户(无隔夜利息)的迹象。

| 账户类型 | 主要特点 | 适用对象 |

| 现金 | 存入交易价值的≥20%作为抵押品;后续通过ATS支付 | 资金灵活的交易者 |

| 现金余额 | 预先存入交易金额的100%;获得利息 | 保守型投资者、追求利息的人 |

| 信用余额 | 使用抵押品进行保证金交易;经纪人自动借贷 | 经验丰富、风险承受能力高的交易者 |

Finansia 费用

特别是对于利用互联网交易渠道的客户,对于高交易量的交易者,Finansia Syrus Securities 的交易费用相对于泰国行业平均水平来说相当便宜,低至0.10%。费用系统是分层的,因此较低的费率会奖励更多的交易活动。

| 每日交易(泰铢) | 有投资顾问(现金账户) | 现金余额 / 信用余额账户 | 在线渠道 |

| ≤ 5 百万 | 0.25% | 0.20% | 0.15% |

| 5百万 < 价值 ≤ 10 百万 | 0.22% | 0.18% | 0.13% |

| 10百万 < 价值 ≤ 20 百万 | 0.18% | 0.15% | 0.11% |

| > 20 百万 | 0.15% | 0.12% | 0.10% |

交易平台

Finansia Syrus Securities 提供 Finansia HERO 交易系统,支持PC、iOS和Android。寻求实时统计数据、自动下单、回测和可配置股票扫描的活跃和精通技术的交易者会发现它非常适合。

| 交易平台 | 支持 | 可用设备 | 适用对象 |

| Finansia HERO | ✔ | PC、iOS、Android | 寻求以人工智能驱动工具、自动化和实时选股的活跃交易者 |

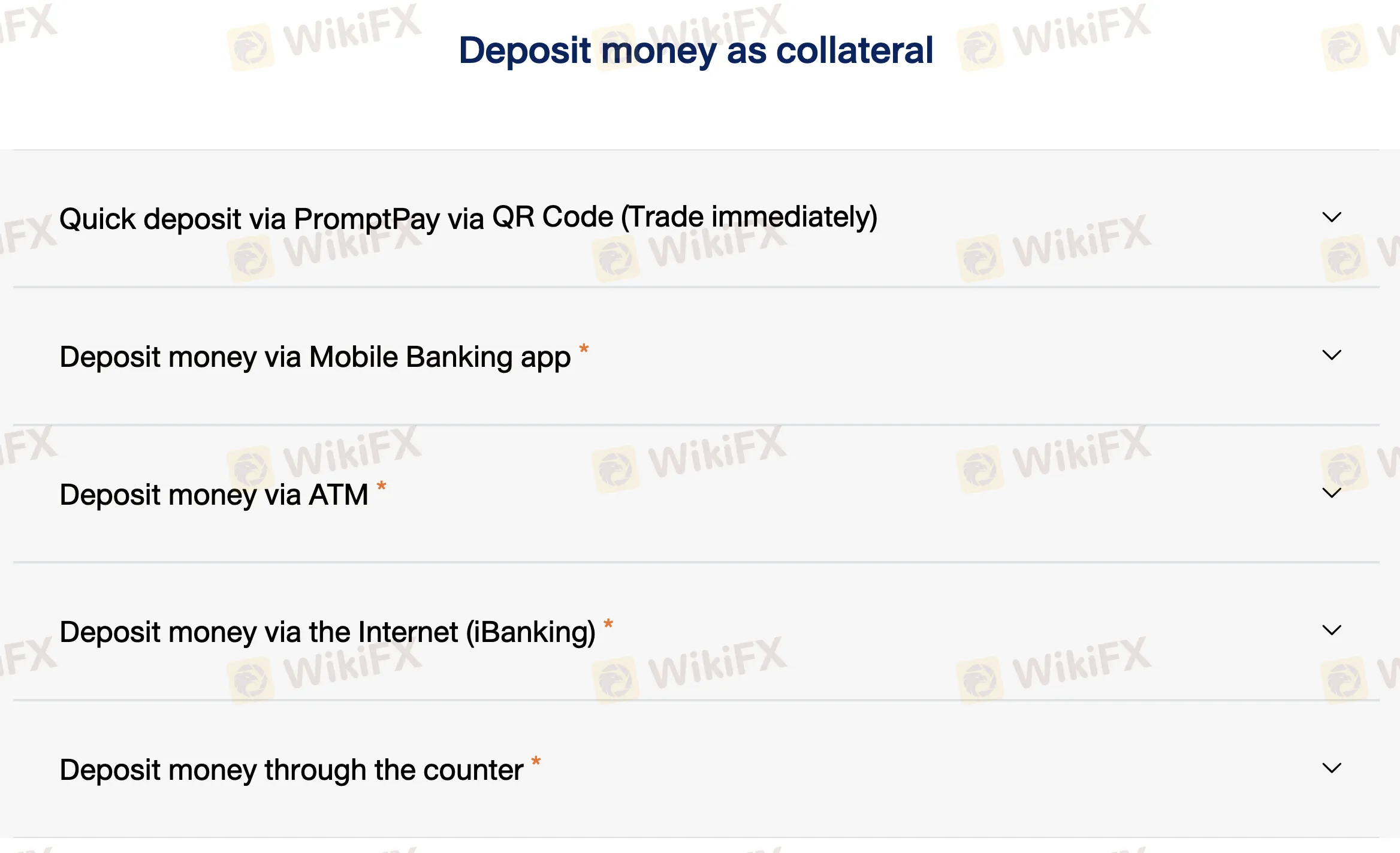

存款和取款

尽管支持高达2,000,000泰铢的存款通过PromptPay QR,Finansia 不会强制收取存款费用,最低存款要求没有明确规定。存款必须来自与证券交易账户所有者姓名相同的账户。

| 支付方式 | 费用 | 处理时间 |

| PromptPay QR Code | 免费 | 即时(8:00–18:00) |

| 手机银行应用 | 各银行不同 | |

| ATM 转账 | ||

| 网上银行(iBanking) | ||

| 银行柜台存款 |