Şirket özeti

| The Capital Groupİnceleme Özeti | |

| Kuruluş Yılı | 1998 |

| Kayıtlı Ülke/Bölge | Tayvan |

| Düzenleme | Taipei Borsası |

| Piyasa Araçları | Hisse Senedi, Vadeli İşlemler |

| Deneme Hesabı | / |

| Kaldıraç | / |

| Spread | / |

| Müşteri Desteği | Adres: 11F., No. 156, Sec. 3, Minsheng E. Rd., Songshan Dist., Taipei City 105, Tayvan (R.O.C.) |

| Tel: 886-2-412-8878 | |

| E-posta: service@capital.com.tw | |

The Capital Group bilgileri

1998 yılında kurulan The Capital Group, Tayvan'da kayıtlı olup Taipei Borsası tarafından düzenlenmektedir. Hisse senedi ve opsiyon ticareti sunmaktadır.

Artıları ve Eksileri

| Artılar | Eksiler |

| Düzenlenmiş | Yetersiz işlem enstrümanları |

| Deneme hesabı mevcut değil | |

| MT4/MT5 mevcut değil | |

| Spread bilgisi eksik | |

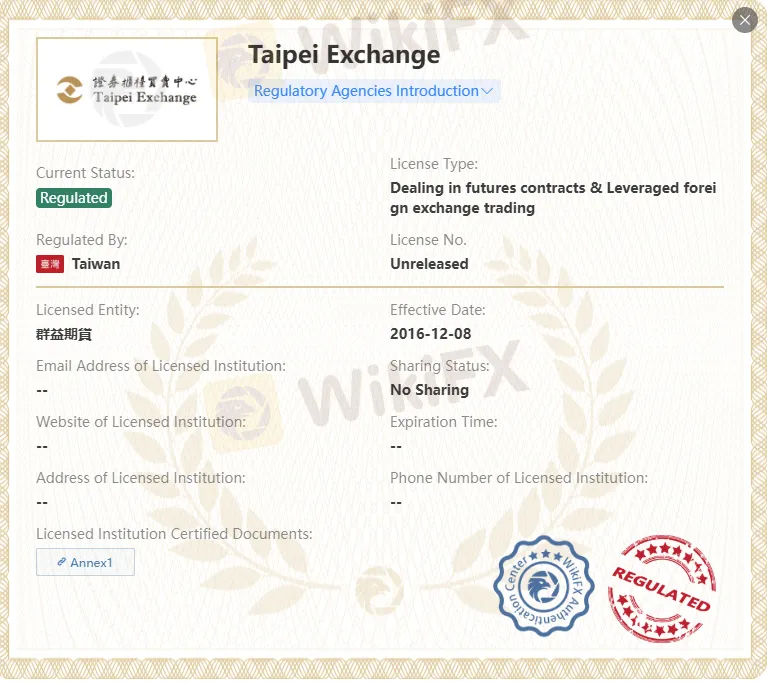

The Capital Group Yasal mı?

Evet. The Capital Group, hizmetler sunmak için Taipei Borsası tarafından lisanslanmıştır.

| Düzenleyici | Mevcut Durum | Düzenlenmiş Kuruluş | Lisans Türü | Lisans No. |

| Taipei Borsası | Düzenlenmiş | The Capital Group | Vadeli işlem sözleşmeleri ve Kaldıraçlı döviz ticareti | Yayınlanmamış |

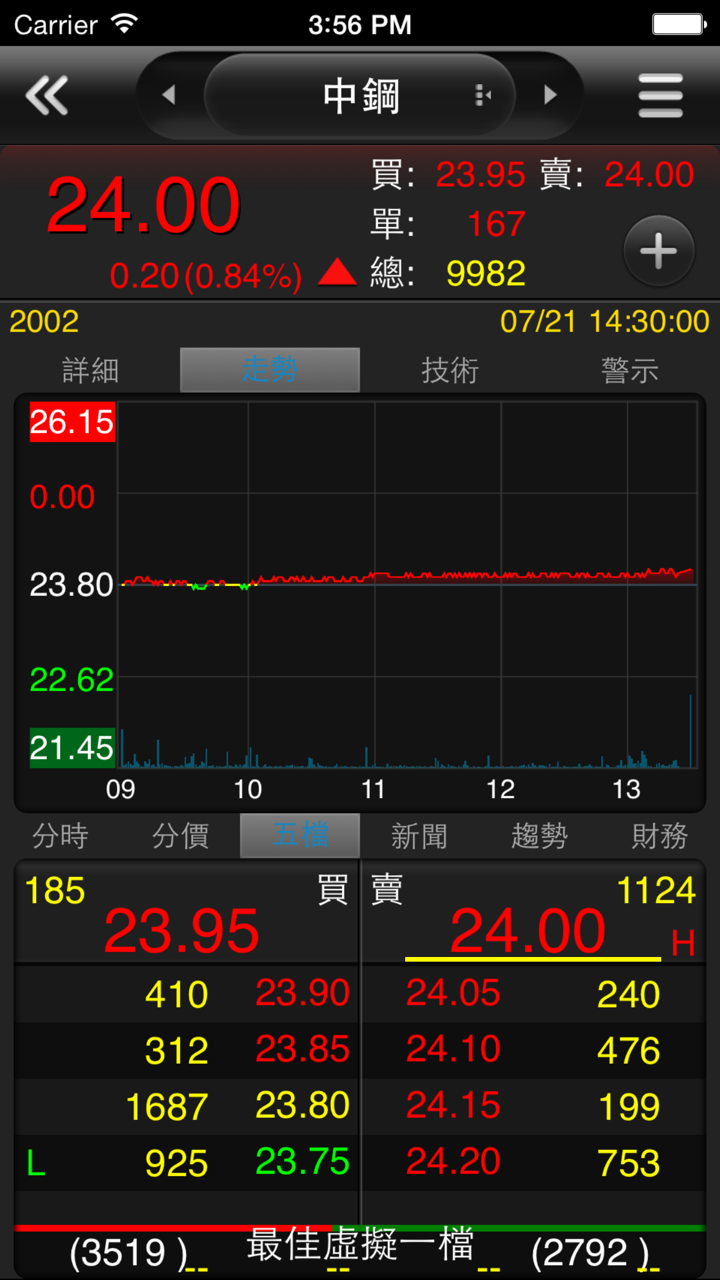

The Capital Group Üzerinde Ne İşlem Yapabilirim?

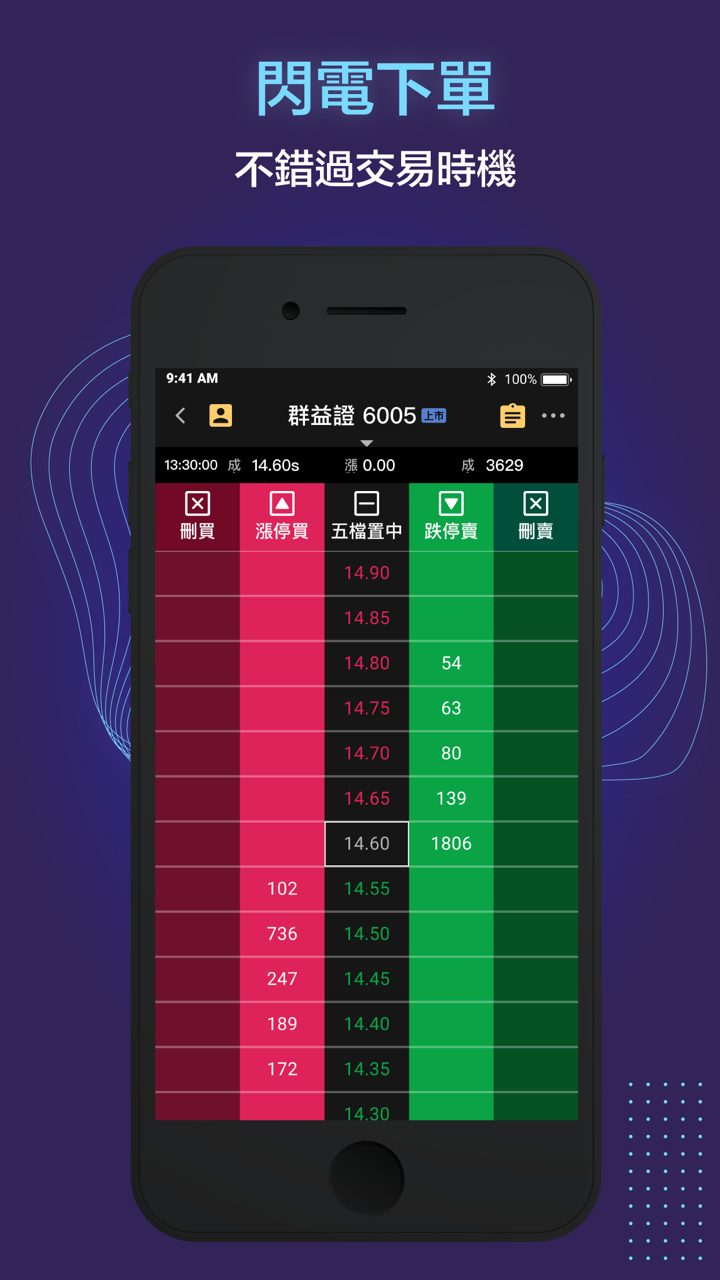

The Capital Group, hisse senetleri ve vadeli işlemler sunmaktadır.

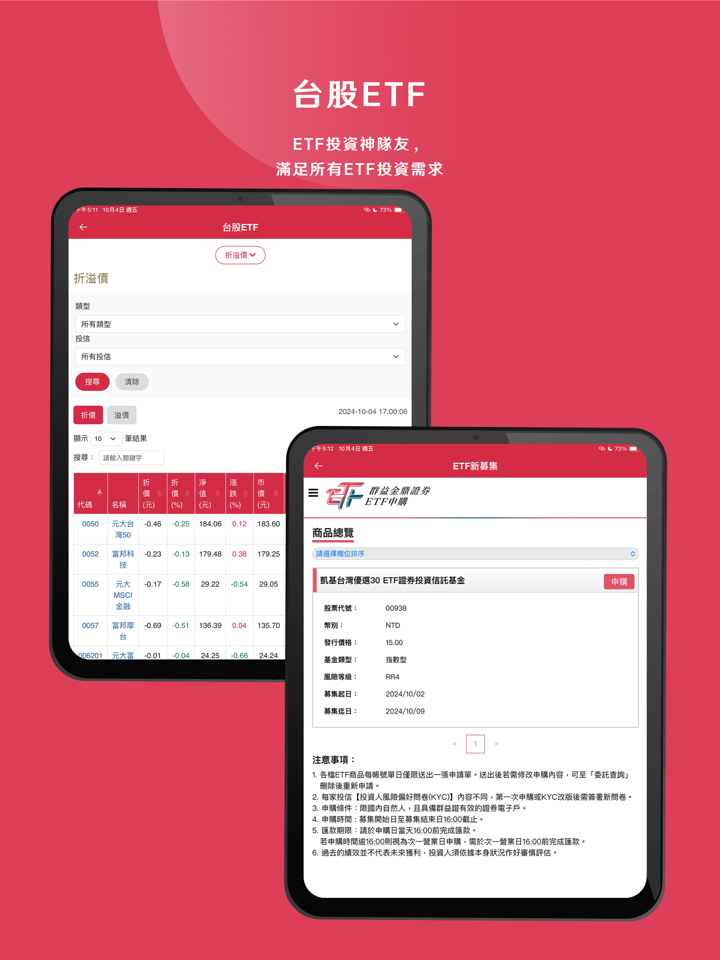

ETF'lerin ticareti veya tahvillerin ticareti yok. Yatırım seçeneklerinizin iyi bir karışımına sahip olmayacaksınız.

| İşlem Yapılabilir Enstrümanlar | Desteklenen |

| Vadeli İşlemler | ✔ |

| Hisse Senetleri | ✔ |

| Forex | ❌ |

| Emtialar | ❌ |

| Endeksler | ❌ |

| Kripto Paralar | ❌ |

| Tahviller | ❌ |

| Opsiyonlar | ❌ |

| ETF'ler | ❌ |

FX3792673861

Hong Kong

市面上90%的骗局从“荐股”开始的!大多数骗局都是从“荐股”开始,往往那些所谓的“荐股大师”开始推荐的股票都会让你盈利一点点,在直播间或者是在群内推荐股票,慢慢取得你的信任后,开始推荐去做别的。在别的平台开.户操作。往往做别的开始也会让你盈利一点点,但是亏损一两次就会把你之前盈利的钱连本带利全都亏完,这时候老师会以各种理由敷衍你,说操作失误等等之类的话。然后叫你再入金,这时你不入金的话他就会把你踢出群,拉.黑删.除。如果你继续入金的话只会越陷越深!最后的结果也是一样亏空殆尽。 认清平台套路,避免上当受骗: 1、构建虚.假交易平台,不法人员往往是虚建包装成一个高大上的公司平台,给投资者传送模拟的交易软件,软件实际由他们控制。软件里投资产品的行情、价格走势都是他们自行设置,随他们掌控。 2、冻结客户资金,使其不能正常操作:在投资者盈利的时候,冻结投资者账户,使其买入之后不能正常卖出,然后其他操盘手将价格方向拉大,让投资者实际盈利变亏损。 3、在客户盈利时,强行平仓:美名其曰,避免你亏损,因为交易软件他们有后台控制,发现投资者盈利时,强制平仓。投资者因为往往都是网络开通账户,一无合同,二不知公司名称地址,往往被强制平仓后,无能为力,求告无门。 4、操作软件,控制行情:在交易平台中设置虚拟账户,进而对该账户虚拟注.资,进而通过虚拟资金控制交易行情,致使受害人亏损。 5、放大交易杠杆,设置资金放大比例数十或数百倍于受害人的“主力账户”,进而通过放大后的资金优势操作、控制市场行情,使受害人亏损

Teşhir

欧阳73633

Hong Kong

根本就沒有辦法出金,盈利賺錢了各種理由讓我教保證金,就是不讓我出金,一個勁的讓我買,我不明白,這麼大的平台不讓我出金

Teşhir

FX1460433056

Tayland

Capital Group, hisse senetlerinden vadeli işlemlere, opsiyonlara ve forex'e kadar bir dizi ticari ürünle sizi korur. Bu, yatırımlarınızı farklı pazarlara yayabileceğiniz ve riskleri en aza indirebileceğiniz anlamına gelir. Ticaret platformları da oldukça tatlı, bir profesyonel gibi ticaret yapmak ve yatırımlarınızı takip etmek için ihtiyacınız olan tüm çan ve ıslıklarla. Sundukları ürün yelpazesi ve özelliklerden oldukça memnunum.

Doğal

S MD

Singapur

Capital Group, rekabetçi ücret ve komisyonları nedeniyle mükemmel bir seçim olacaktır. Benim için çok büyük bir artı olan hiçbir gizli ücret veya ücret yok. Komisyoncu, düşük spreadler ve şeffaf fiyatlandırma sunarak onlarla ticareti uygun maliyetli bir deneyim haline getirir. Beklenmedik ücretler veya ücretlerle karşılaşmadığım için minnettarım ve işlemlerimin maliyetini kolayca hesaplayabiliyorum.

Pozitif

FX1036206024

Arjantin

Söylenecek fazla bir şey yok, Capital Group'un sunduğu hizmetin beni tatmin ettiğini düşünüyorum. Bir komisyoncu seçtiğimde güvenlik en önemli şeydir ve şu anda param güvende.

Pozitif