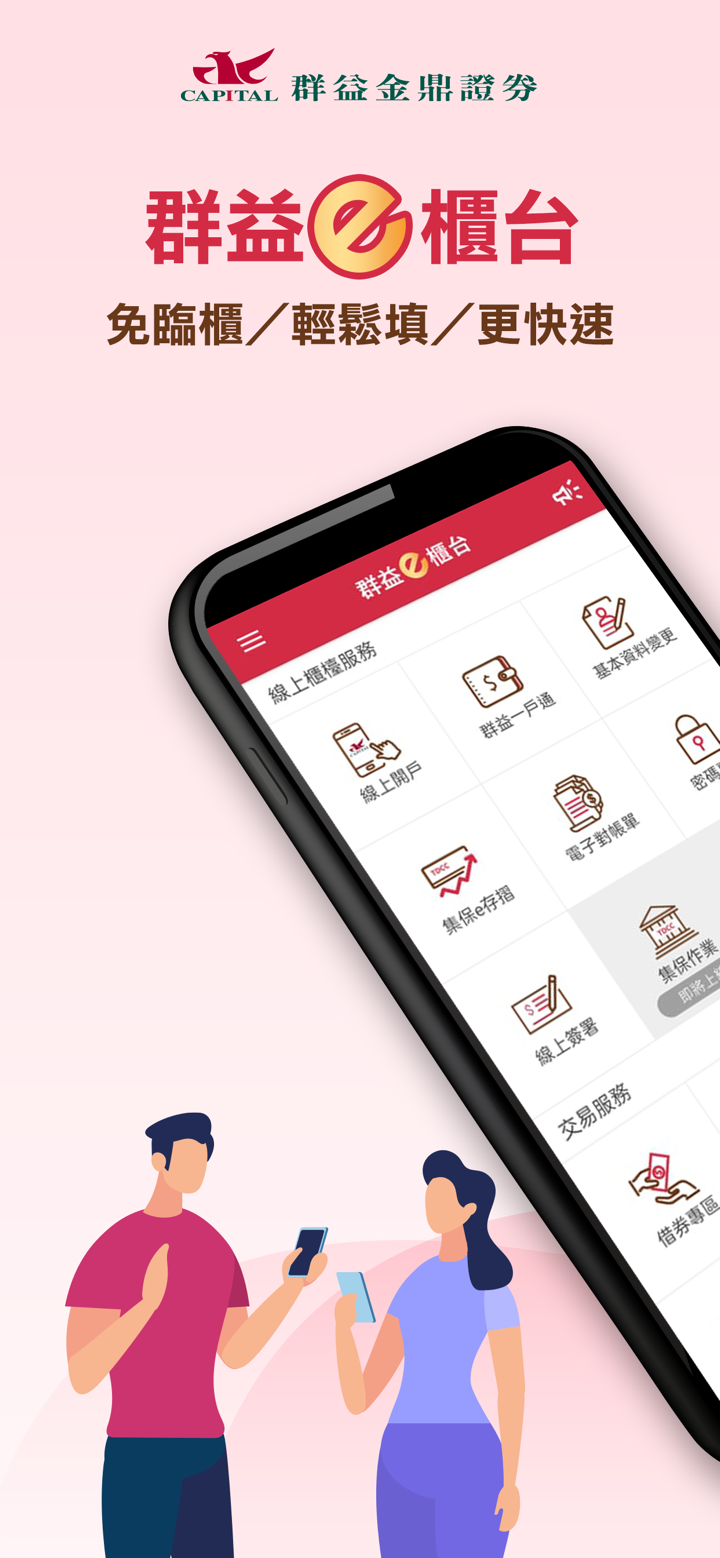

Profil perusahaan

| The Capital GroupRingkasan Ulasan | |

| Didirikan | 1998 |

| Negara/Daerah Terdaftar | Taiwan |

| Regulasi | Bursa Taipei |

| Instrumen Pasar | Saham, Future |

| Akun Demo | / |

| Leverage | / |

| Spread | / |

| Dukungan Pelanggan | Alamat: Lantai 11, No. 156, Sec. 3, Minsheng E. Rd., Distrik Songshan, Kota Taipei 105, Taiwan (R.O.C.) |

| Tel: 886-2-412-8878 | |

| E-mail: service@capital.com.tw | |

Informasi The Capital Group

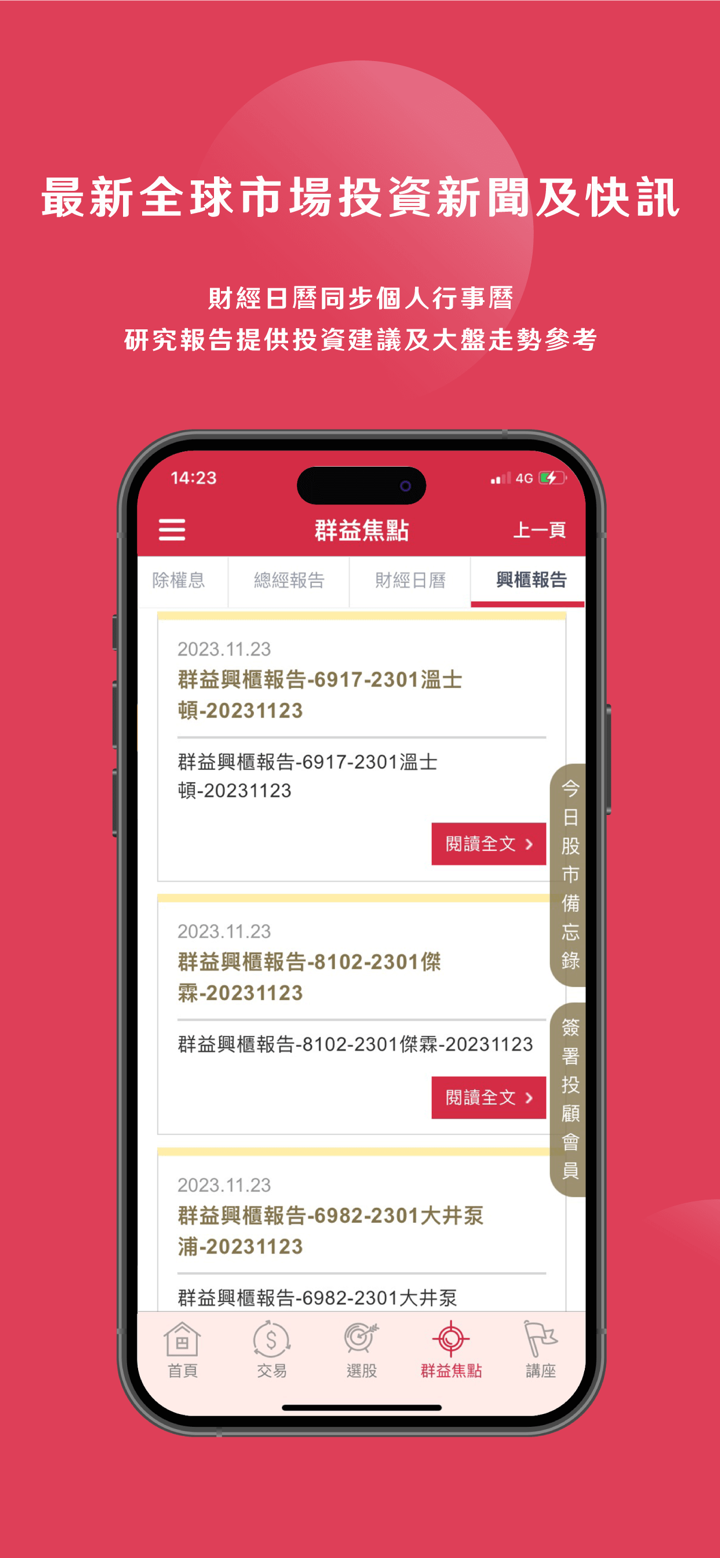

Didirikan pada tahun 1998, The Capital Group terdaftar di Taiwan dan diatur oleh Bursa Taipei di bawah pengawasan Unreleased. Menawarkan perdagangan saham dan opsi.

Pro dan Kontra

| Pro | Kontra |

| Teregulasi | Kurangnya instrumen perdagangan |

| Akun demo tidak tersedia | |

| MT4/MT5 tidak tersedia | |

| Kurangnya informasi Spread | |

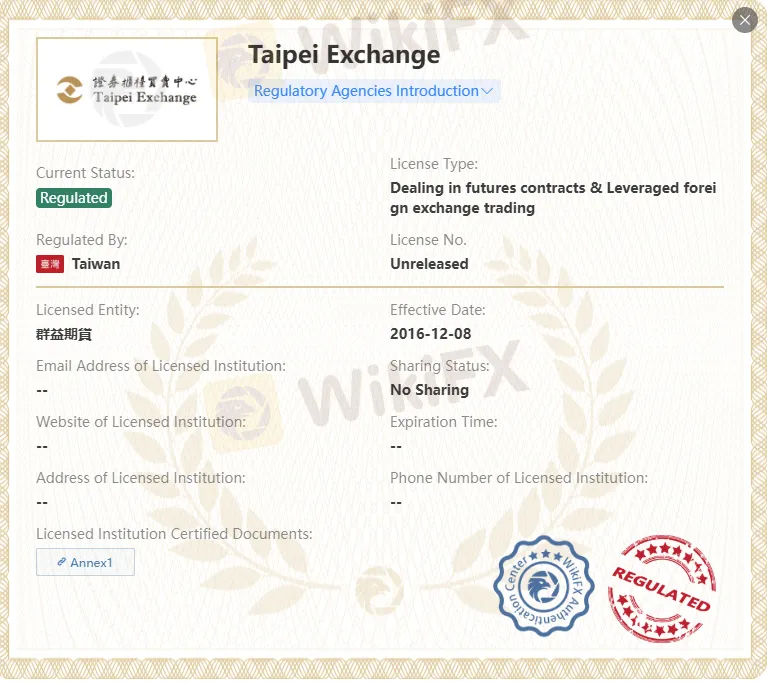

Apakah The Capital Group Legal?

Ya. The Capital Group memiliki lisensi dari Bursa Taipei untuk menawarkan layanan.

| Regulator | Status Saat Ini | Entitas yang Diatur | Jenis Lisensi | No. Lisensi |

| Bursa Taipei | Teregulasi | The Capital Group | Bertransaksi dalam kontrak berjangka & Perdagangan valuta asing berleverage | Unreleased |

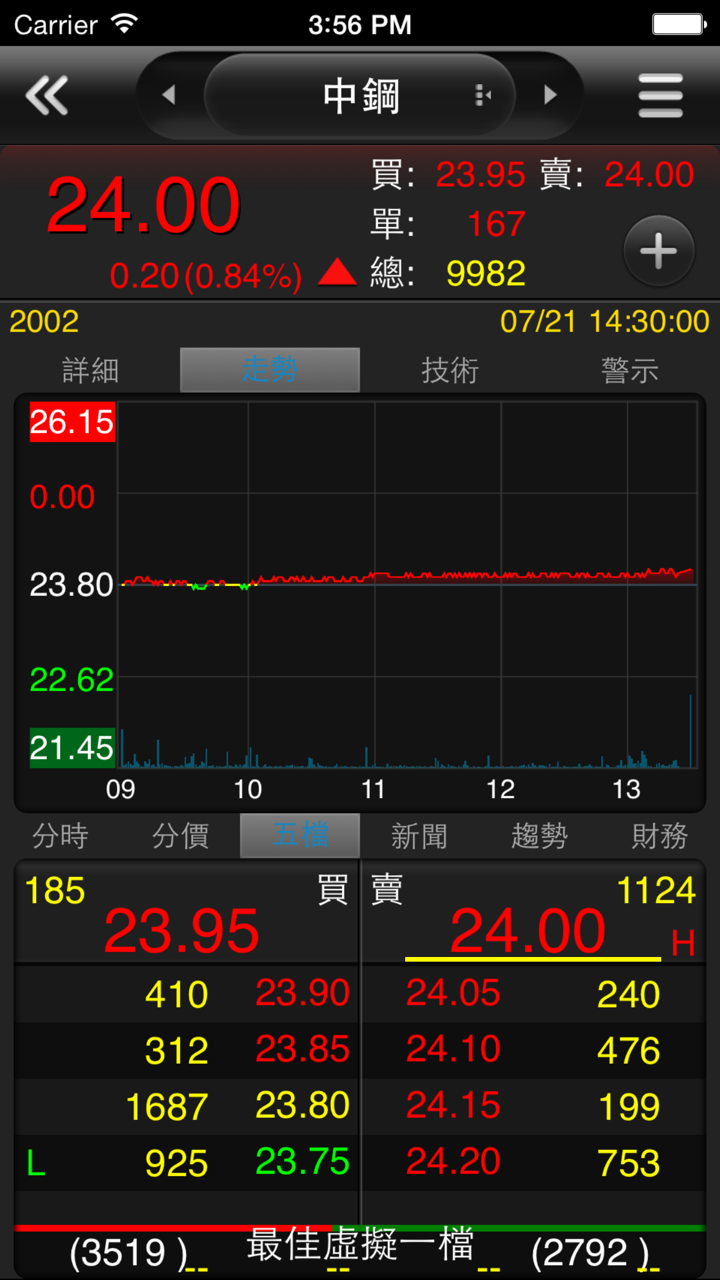

Apa yang Bisa Saya Perdagangkan di The Capital Group?

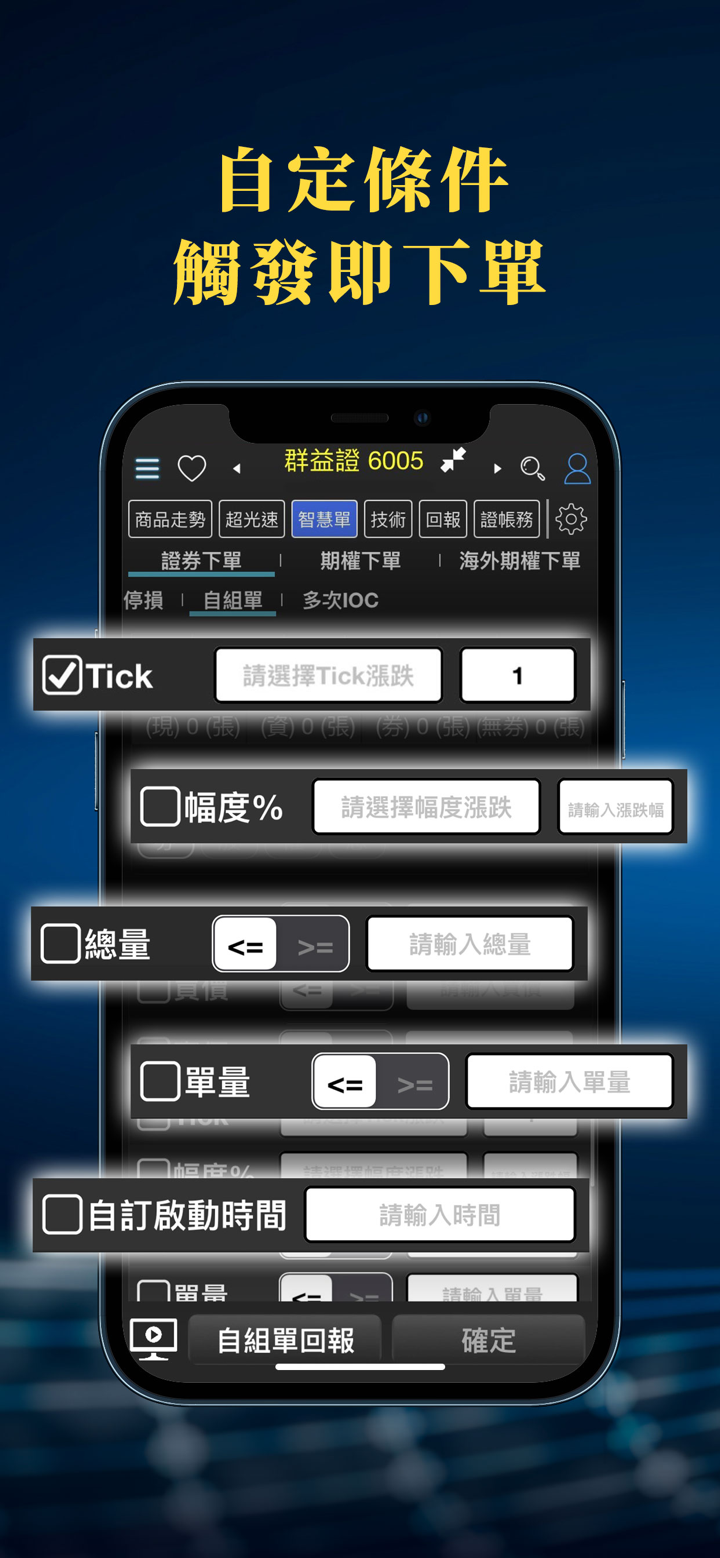

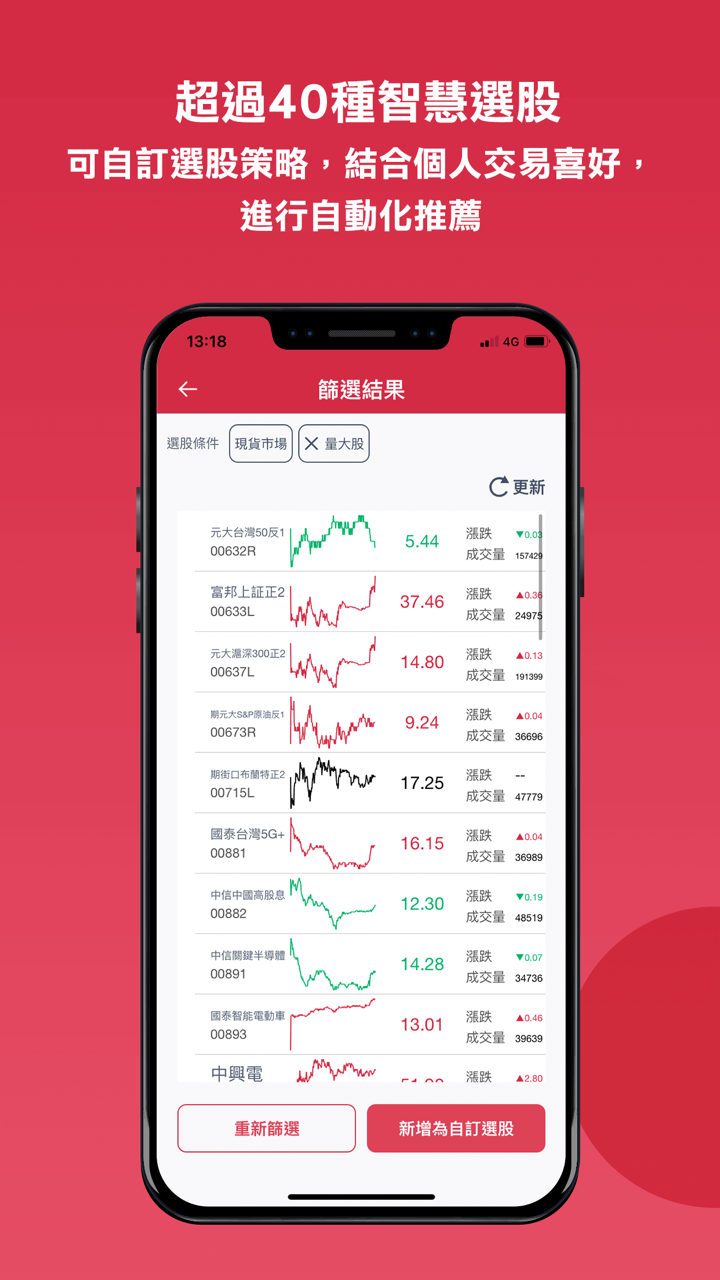

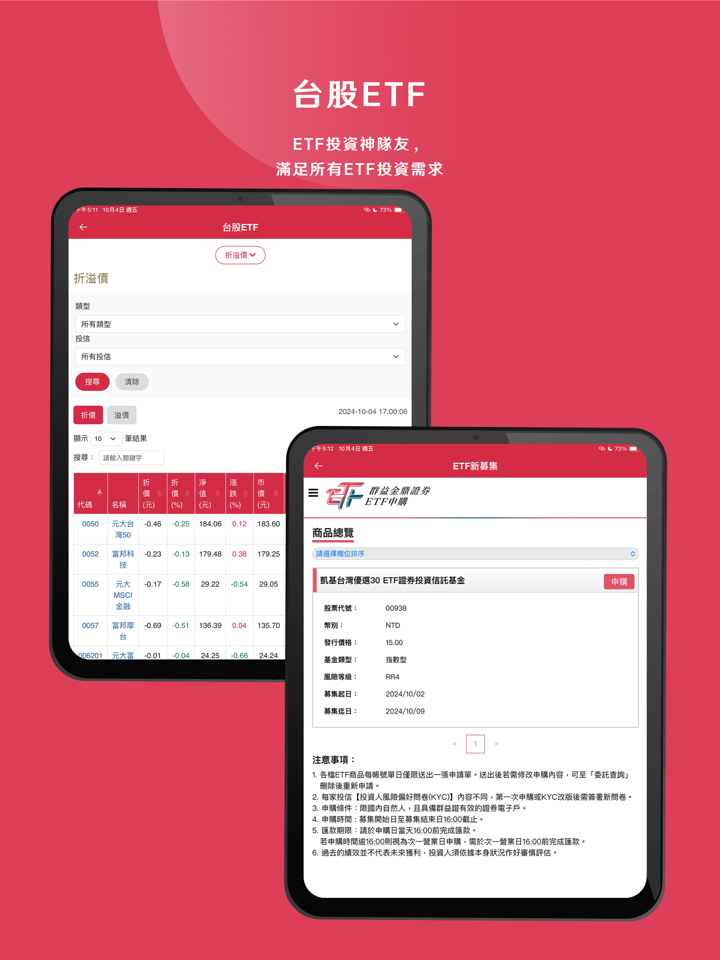

The Capital Group menyediakan saham dan futures.

Tidak ada perdagangan ETF atau obligasi. Anda tidak akan memiliki beragam pilihan investasi yang baik.

| Instrumen yang Dapat Diperdagangkan | Didukung |

| Futures | ✔ |

| Saham | ✔ |

| Forex | ❌ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Kriptokurensi | ❌ |

| Obligasi | ❌ |

| Opsi | ❌ |

| ETF | ❌ |

FX3792673861

Hong Kong

90% penipuan di pasar dimulai dengan "saham yang direkomendasikan"! Kebanyakan penipuan dimulai dengan "saham yang direkomendasikan". Stok yang direkomendasikan oleh "master stok yang direkomendasikan" akan membuat Anda sedikit menguntungkan. Setelah mendapatkan kepercayaan Anda, mereka mulai merekomendasikan untuk melakukan sesuatu yang lain, untuk membuka akun di platform lain. Kemudian mereka akan membuat Anda kehilangan semua dana dengan sengaja, tetap melalaikan dan mendesak Anda untuk menambah dana. Jika tidak, Anda dikeluarkan dari grup. Jika Anda terus menyetor, itu hanya akan memungkinkan Anda kehilangan lebih banyak. Tolong identifikasi rutinitas platform ini dan hindari ditipu: 1. Dengan membungkus dirinya sendiri, perusahaan fasad mendorong klien untuk berdagang. Perangkat lunak perdagangan juga dimanipulasi oleh perusahaan. 2 Selama klien mendapat untung, platform akan membekukan akun mereka, sehingga penjualan saham tidak akan mungkin dilakukan. Kemudian pedagang akan memodifikasi harga untuk membuat klien menderita kerugian. 3. Dalam ungkapan mereka yang luar biasa, mereka akan menutup posisi secara wajib untuk menghindari kerugian ketika Anda mendapat untung. Pada saat ini, klien tidak tahu karena mereka tidak tahu jumlah perusahaan. 4. Dengan mengendalikan platform perdagangan, mereka menyuntikkan dana virtual dan memanipulasi pasar untuk membuat klien menderita kerugian. 5. Dengan memperbesar leverage perdagangan 10 atau 100 kali, mereka mengoperasikan pasar untuk membuat klien menderita kerugian.

Paparan

欧阳73633

Hong Kong

Tidak dapat menarik dana sama sekali. Minta saya untuk membayar margin dengan berbagai alasan ketika saya mendapat untung tetapi saya tidak dapat menarik dana. Saya bertanya-tanya mengapa broker besar tidak mengizinkan saya menarik dana?

Paparan

FX1460433056

Thailand

Capital Group memberi Anda banyak produk perdagangan, mulai dari saham hingga kontrak berjangka, opsi, dan valas. Ini berarti Anda dapat menyebarkan investasi Anda ke pasar yang berbeda dan meminimalkan risiko. Platform perdagangan mereka juga cukup manis, dengan semua lonceng dan peluit yang Anda butuhkan untuk berdagang dan melacak investasi Anda seperti seorang profesional. Saya sangat tertarik dengan rangkaian produk dan fitur yang mereka tawarkan.

ulasan netral

S MD

Singapura

Capital Group menjadi pilihan yang bagus karena biaya dan komisi yang kompetitif. Tidak ada biaya atau biaya tersembunyi, yang merupakan nilai tambah yang besar bagi saya. Broker menawarkan spread rendah dan harga transparan, membuat trading dengan mereka menjadi pengalaman yang hemat biaya. Saya menghargai kenyataan bahwa saya tidak terkena biaya atau biaya tak terduga, dan saya dapat dengan mudah menghitung biaya perdagangan saya.

Baik

FX1036206024

Argentina

Tidak banyak yang bisa dikatakan, menurut saya pelayanan yang diberikan oleh Capital Group cukup memuaskan bagi saya. Keamanan adalah hal terpenting saat saya memilih broker, dan uang saya aman saat ini.

Baik