회사 소개

| Kontakperkasa Futures 리뷰 요약 | |

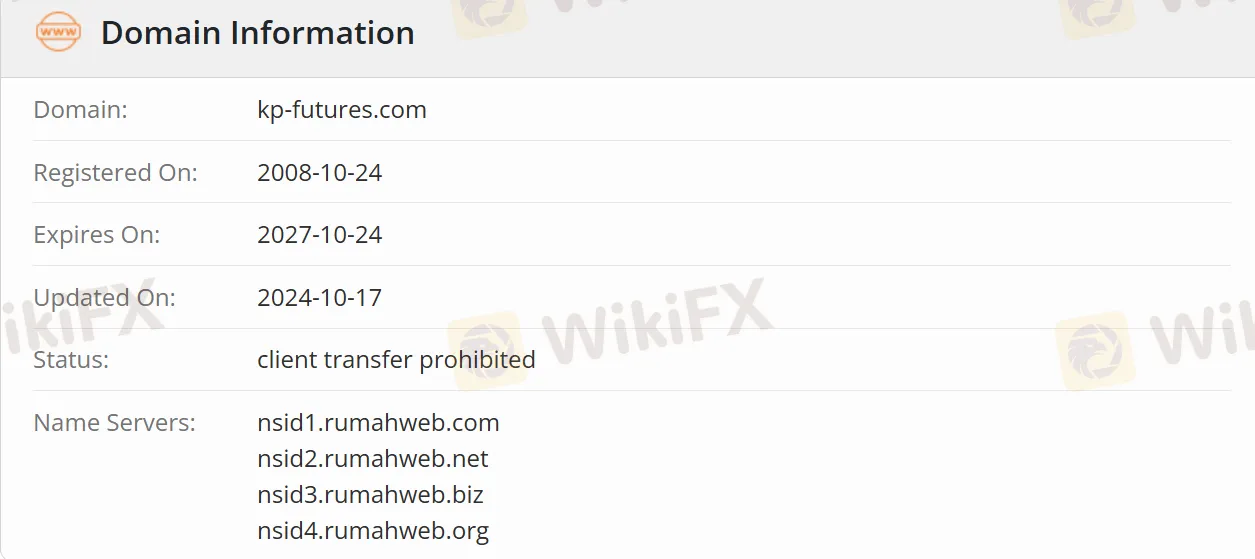

| 설립일 | 2008-10-24 |

| 등록 국가/지역 | 인도네시아 |

| 규제 | 규제됨 |

| 시장 상품 | 상품 선물, 주가 지수 파생상품, 외환, 귀금속 |

| 데모 계정 | ✅ |

| 거래 플랫폼 | TradingView |

| 고객 지원 | customer.care@kontak-perkasa-futures.co.id |

| 전화: (021) 5793 6555 | |

| 팩스: (021) 5793 6550 | |

| Sudirman Plaza, Gedung Plaza Marein Lt. 7 & 19 Jl. Jend. Sudirman Kav. 76-78, Jakarta 12910 | |

Kontakperkasa Futures 정보

PT Kontak Perkasa Futures는 인도네시아의 규제된 선물 중개업체입니다. 자카르타를 본사로 하여 상품 선물, 주가 지수 파생상품, 외환 거래 등을 제공하며 온라인 계정 개설과 실시간 거래를 지원합니다. 인도네시아 시장에 관심이 있는 투자자나 금, 야자유 등 특정 상품에 관심이 있는 투자자에게 적합합니다.

장단점

| 장점 | 단점 |

| 규제됨 | 주로 인도네시아 국내 시장을 대상으로 함 |

| 다양한 거래 상품 | 숙박료 |

| 데모 계정 제공 | 언어 장벽 |

| TradingView 이용 가능 | 레버리지 비공개 |

Kontakperkasa Futures 합법적인가요?

Kontakperkasa Futures은 BAPPEBTI가 발급한 선물 중개업 면허(No 41/BAPPEBTI/SI/XII/2000)를 보유하고 있으며 자카르타 선물 거래소와 인도네시아 선물 청산소에 등록되어 있습니다.

Kontakperkasa Futures에서 무엇을 거래할 수 있나요?

| 제품 카테고리 | 제품명/코드 | 계약 사양 |

| 상품 선물 | 금 선물 (GOL) | 1 kg/lot, 순도 ≥99.99% LBMA 표준최소 가격 변동: Rp50/그램 |

| 250 그램 금 선물 (GOL250) | 250 그램/lot납품은 ≥4 lot 필요 | |

| 올레인 선물 (OLE) | 20 톤/lot최소 가격 변동: Rp5/kg | |

| 주가 지수 파생상품 | 항셍 지수 (HKK50_BBJ) | $5/지수 포인트 |

| 니케이 225 (JPK50_BBJ) | $5/지수 포인트 | |

| 외환 및 귀금속 | EURUSD/GBPUSD/USDJPY 등 | 표준 로트/미니 로트 옵션 |

| 은 선물 (XAG10_BBJ) | 10 온스/lot |

계정 유형

Kontakperkasa Futures는 초보자들이 거래를 연습할 수 있는 데모 계정을 제공합니다. 실제 계정은 개인 계정과 기관 계정으로 나뉩니다.

Kontakperkasa Futures 수수료

| 유형 | 수수료 구조 |

| 기본 수수료 | $15 당면당, $30 전체 로트 (매수 + 매도) |

| 부가가치세(VAT)(수수료의 11%) | $3.3 전체 로트 당 |

| 숙박 수수료 | $3 로트 당 밤 (HKK5U) |

| $2 로트 당 밤 (JPK50) | |

| $5 로트 당 밤 (XUL10) |

입출금

은행 송금은 인도네시아의 주요 은행(IDR 및 USD 계정, BCA, Mandiri, CIMB Niaga 등)을 지원합니다. 인출 처리 시간은 1 영업일(T+1)이며 신원 및 거래 기록을 확인해야 합니다.