مقدمة عن الشركة

| Kontakperkasa Futures ملخص المراجعة | |

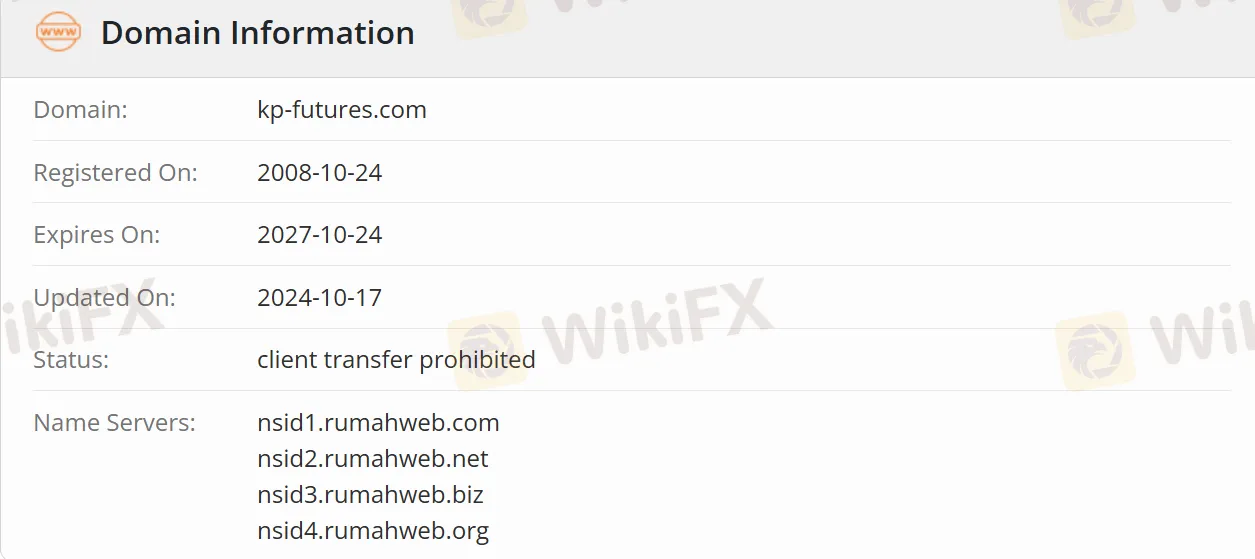

| تأسست | 2008-10-24 |

| البلد/المنطقة المسجلة | إندونيسيا |

| التنظيم | منظم |

| أدوات السوق | عقود السلع الأساسية، مشتقات مؤشرات الأسهم، الفوركس، والمعادن الثمينة |

| حساب تجريبي | ✅ |

| منصة التداول | TradingView |

| دعم العملاء | customer.care@kontak-perkasa-futures.co.id |

| هاتف: (021) 5793 6555 | |

| فاكس: (021) 5793 6550 | |

| سوديرمان بلازا، جيدونج بلازا مارين الطابق 7 و 19 جل. جند. سوديرمان كاف. 76-78، جاكرتا 12910 | |

Kontakperkasa Futures معلومات

شركة PT Kontak Perkasa Futures هي شركة وساطة مستقبلية منظمة في إندونيسيا. مقرها الرئيسي في جاكرتا، وتقدم خدمات تداول لعقود السلع الأساسية، مشتقات مؤشرات الأسهم، صرف العملات الأجنبية، إلخ، وتدعم فتح الحساب عبر الإنترنت والتداول في الوقت الحقيقي. مناسبة للمستثمرين المهتمين بالسوق الإندونيسي أو السلع الخاصة مثل الذهب وزيت النخيل.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| منظمة | تستهدف بشكل رئيسي السوق المحلية الإندونيسية |

| عدة أدوات تداول | رسوم البقاء ليلًا |

| حساب تجريبي متاح | عائق اللغة |

| TradingView متاحة | الرافعة المالية غير معلن عنها |

هل Kontakperkasa Futures شرعية؟

Kontakperkasa Futures تحمل ترخيص عمل وساطة مستقبلية (رقم 41/BAPPEBTI/SI/XII/2000) صادر عن BAPPEBTI ومسجلة في بورصة جاكرتا للعقود الآجلة وشركة تسوية العقود الآجلة الإندونيسية.

ما الذي يمكنني تداوله على Kontakperkasa Futures؟

| فئة المنتج | اسم المنتج/الرمز | مواصفات العقد |

| عقود السلع الأساسية | عقود الذهب (GOL) | 1 كجم/لوت، نقاء ≥99.99% معيار LBMAالحد الأدنى لتغيير السعر: Rp50/غرام |

| عقود الذهب 250 جرام (GOL250) | 250 جرام/لوتيتطلب التسليم ≥4 لوتات | |

| عقود الأولين (OLE) | 20 طن/لوتالحد الأدنى لتغيير السعر: Rp5/كجم | |

| مشتقات مؤشرات الأسهم | مؤشر هانج سنغ (HKK50_BBJ) | $5/نقطة مؤشر |

| نيكي 225 (JPK50_BBJ) | $5/نقطة مؤشر | |

| الفوركس والمعادن الثمينة | اليورو/الدولار الأمريكي/الجنيه الإسترليني/الين الياباني، إلخ. | خيارات اللوت القياسي/اللوت المصغر |

| عقود الفضة (XAG10_BBJ) | 10 أوقية/لوت |

نوع الحساب

Kontakperkasa Futures يوفر حسابات تجريبية للمبتدئين لممارسة التداول. تنقسم الحسابات الحقيقية إلى حسابات فردية وحسابات مؤسسية.

Kontakperkasa Futures الرسوم

| النوع | هيكل الرسوم |

| العمولة الأساسية | $15 لكل جانب$30 لكل لوت كامل (شراء + بيع) |

| ضريبة القيمة المضافة (ضريبة القيمة المضافة)(11% من العمولة) | $3.3 لكل لوت كامل |

| رسوم الليلة | $3 لكل لوت لكل ليلة (HKK5U) |

| $2 لكل لوت لكل ليلة (JPK50) | |

| $5 لكل لوت لكل ليلة (XUL10) |

الإيداع والسحب

تدعم التحويلات البنكية حسابات IDR و USD للبنوك الإندونيسية الرئيسية (مثل BCA و Mandiri و CIMB Niaga). وقت معالجة السحب هو يوم عمل واحد (T+1)، ويجب التحقق من الهوية وسجلات المعاملات.