회사 소개

| HUA TAI 리뷰 요약 | |

| 설립 | 1991년 |

| 등록 국가/지역 | 중국 |

| 규제 | CFFEX |

| 시장 상품 | 주식, 옵션, 귀금속 |

| 서비스 | 자산 보관 서비스, 운영 아웃소싱 서비스 |

| 계정 유형 | 실제 계정 |

| 레버리지 | 최대 1:2 |

| 거래 플랫폼 | MD5, Zhangle App |

| 결제 방법 | 은행 송금 |

| 고객 지원 | 전화: 955597 |

| 이메일: 95597@htsc.com | |

| 주소: 중국 난징시 강동 중로 228번지, 강서성, 중국 | |

HUA TAI 정보

HUA TAI은 1991년에 설립된 중국의 중개업체입니다. 제공하는 거래 상품은 주식, 옵션, 귀금속을 포함합니다. CFFEX에 의해 규제를 받고 있습니다.

장단점

| 장점 | 단점 |

| 규제 | 수수료 정보 없음 |

| 다양한 거래 상품 | 최소 입금에 대한 명확한 정보 없음 |

| 다양한 서비스 제공 | 제한된 계정 유형 제공 |

| 데모 계정 없음 | |

| MT4 지원 없음 |

HUA TAI이 신뢰할 수 있나요?

HUA TAI은 중국의 CFFEX에 의해 규제를 받고 있습니다. 현재 상태는 규제를 받고 있습니다.

| 규제 국가 | 규제 기관 | 규제 업체 | 라이센스 유형 | 라이센스 번호 | 현재 상태 |

| 중국 | CFFEX | 华泰期货有限公司 | 선물 라이센스 | 0011 | 규제 받음 |

HUA TAI에서 무엇을 거래할 수 있나요?

HUA TAI 트레이더들에게 주식, 옵션, 귀금속 거래를 제공합니다.

| 거래 가능한 상품 | 지원 |

| 주식 | ✔ |

| 옵션 | ✔ |

| 귀금속 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 선물 | ❌ |

서비스

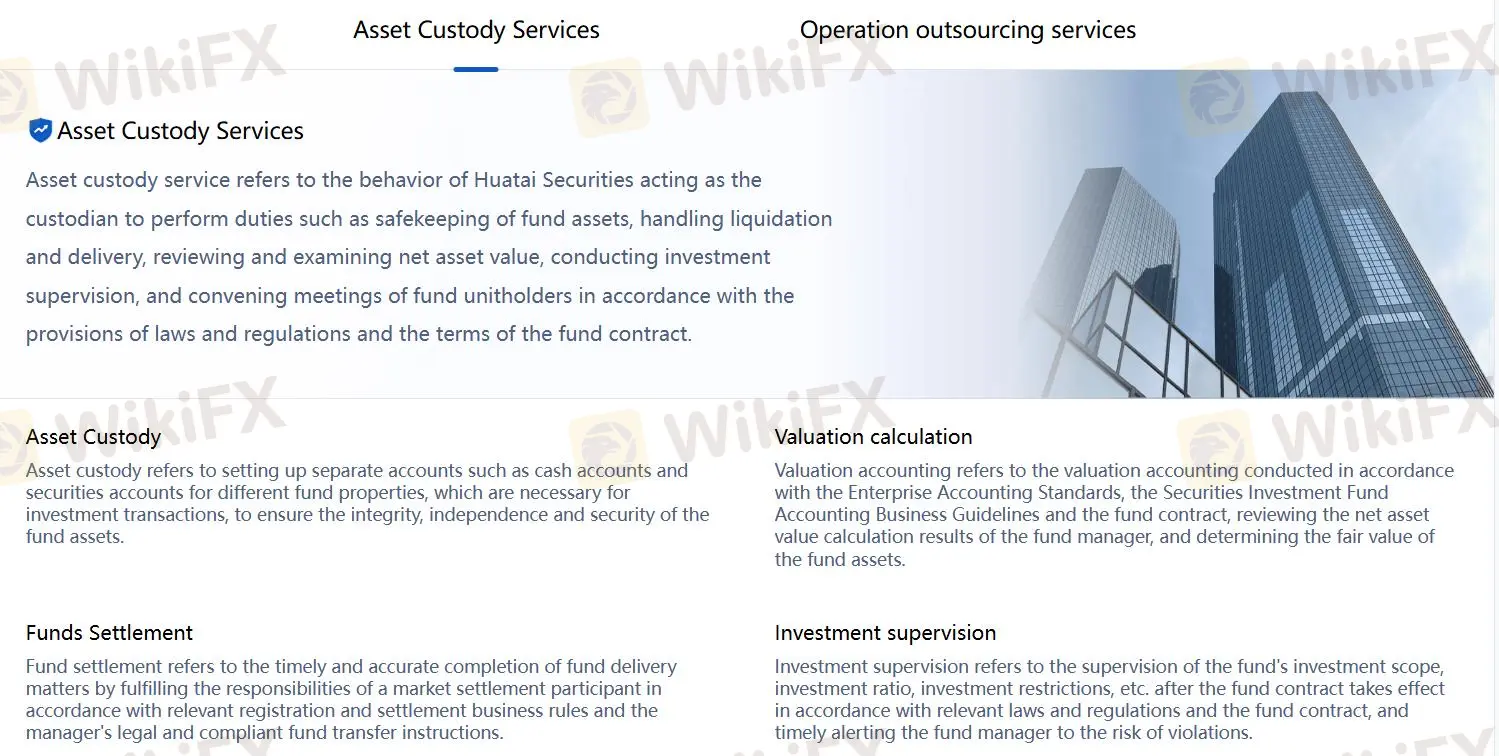

HUA TAI은 자산 보관 서비스, 운영 아웃소싱 서비스를 제공합니다. 자산 보관 서비스에는 자산 보관, 가치 평가, 투자 감독, 자금 결제가 포함됩니다. 운영 아웃소싱 서비스에는 주식 등록, 계정 감독, 가치 평가, 정보 공개가 포함됩니다.

계정 유형

HUA TAI은 트레이더들에게 1개의 계정 유형인 라이브 계정을 제공합니다.

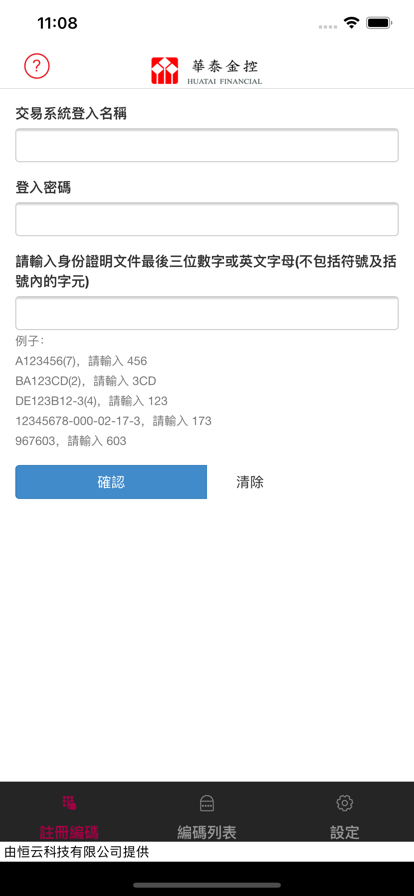

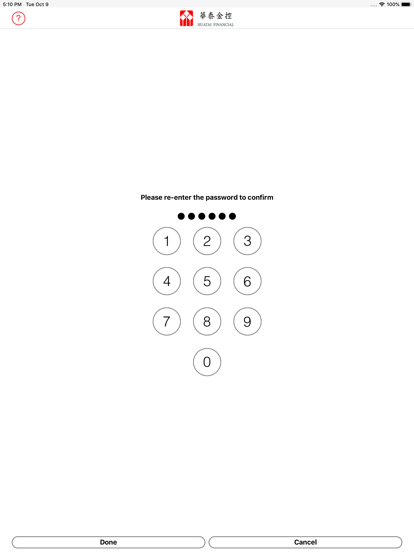

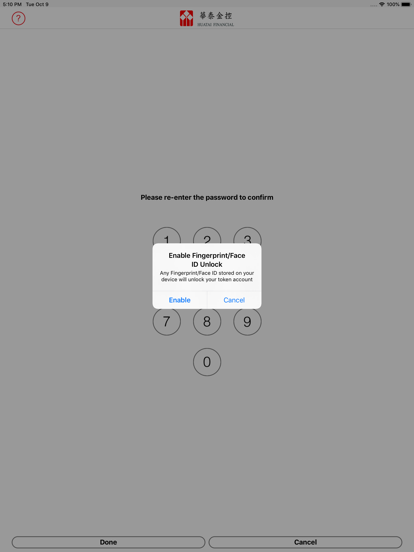

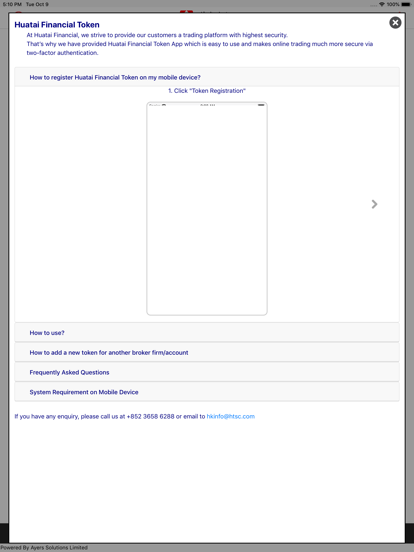

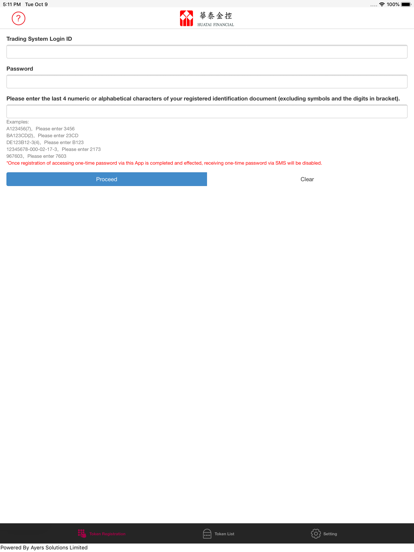

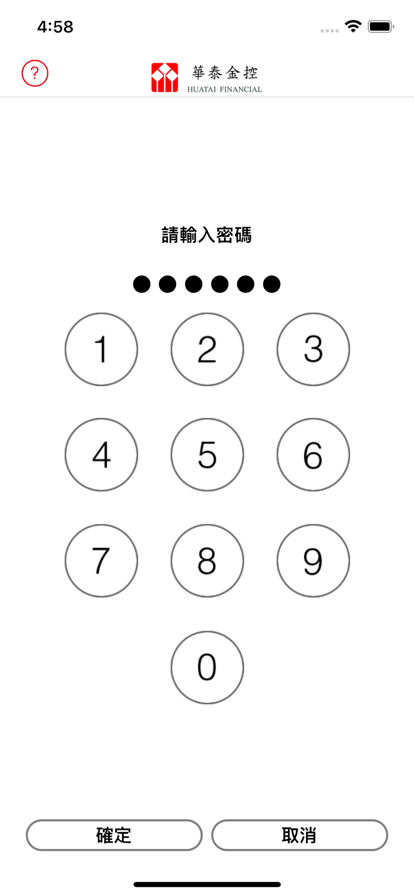

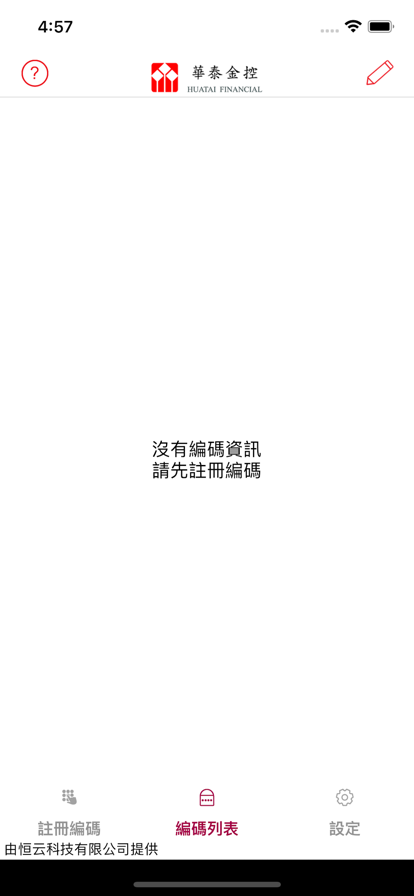

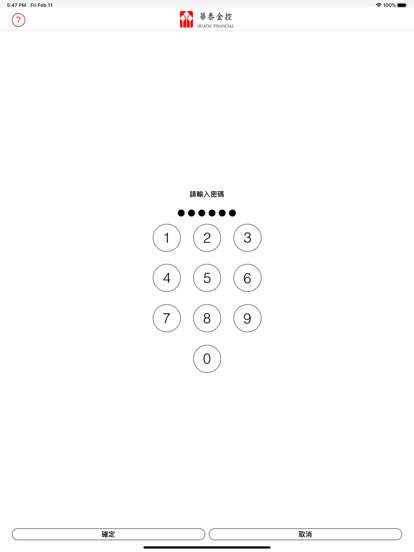

거래 플랫폼

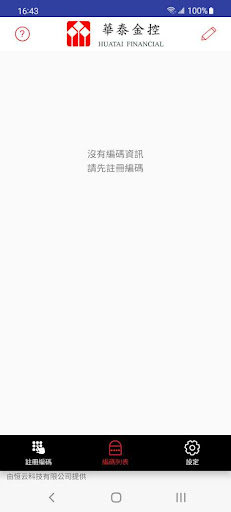

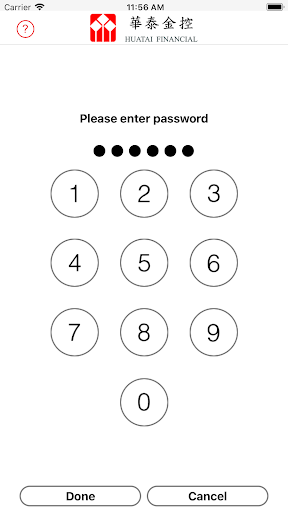

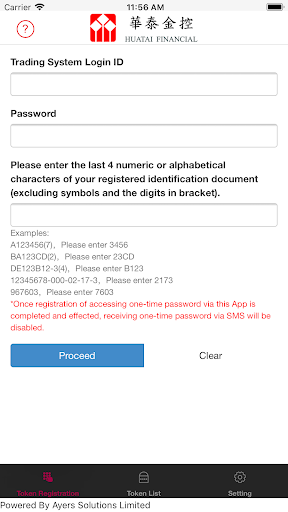

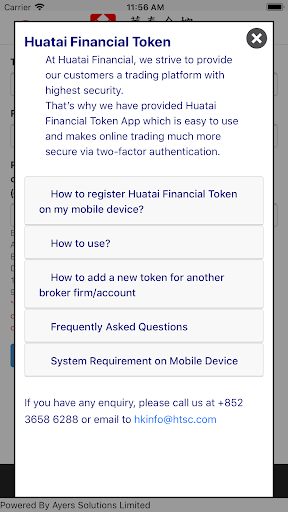

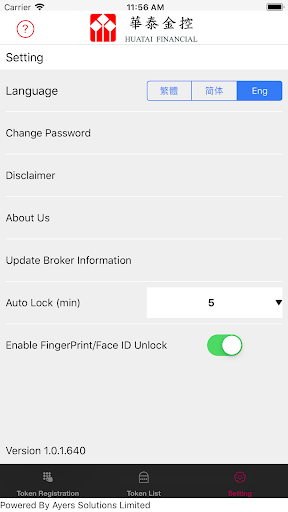

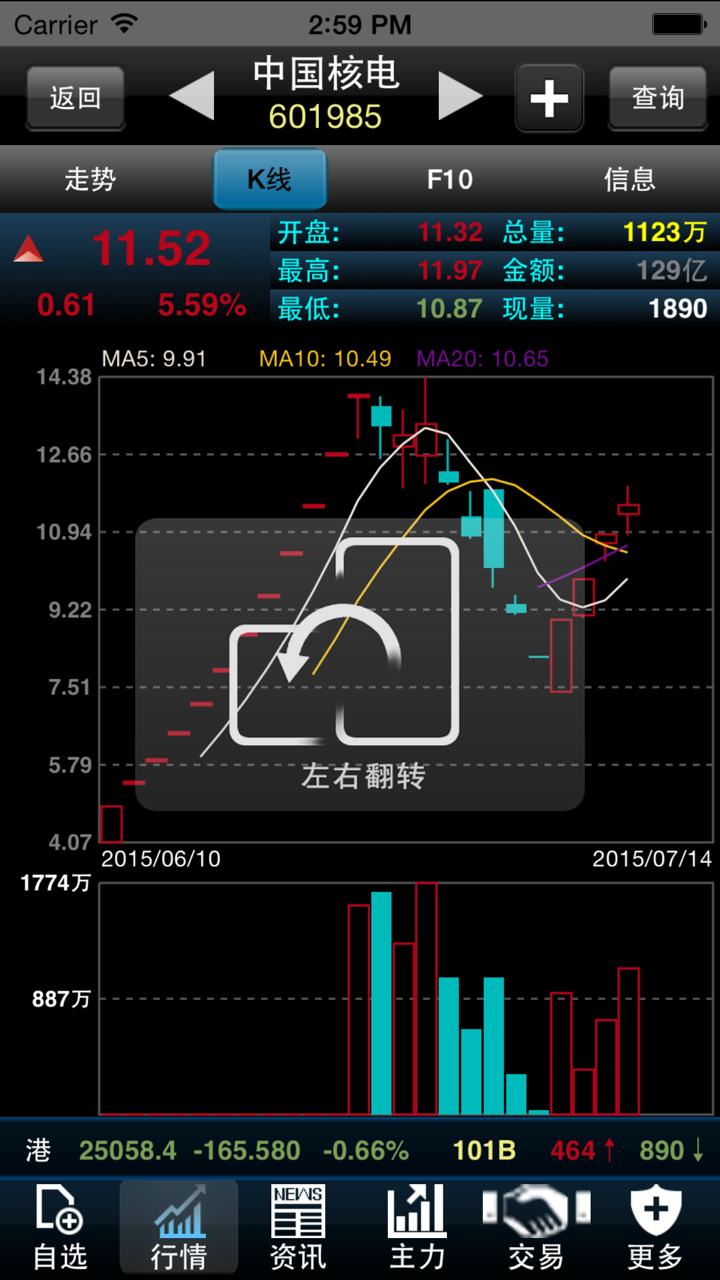

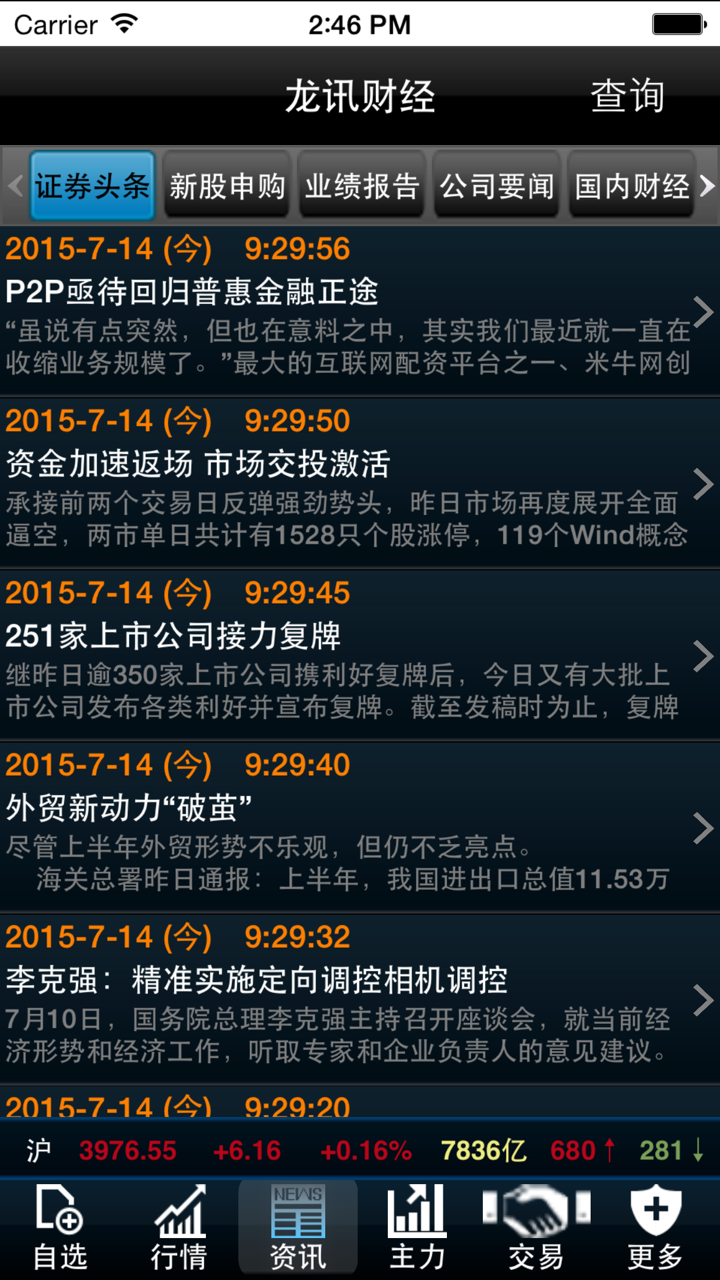

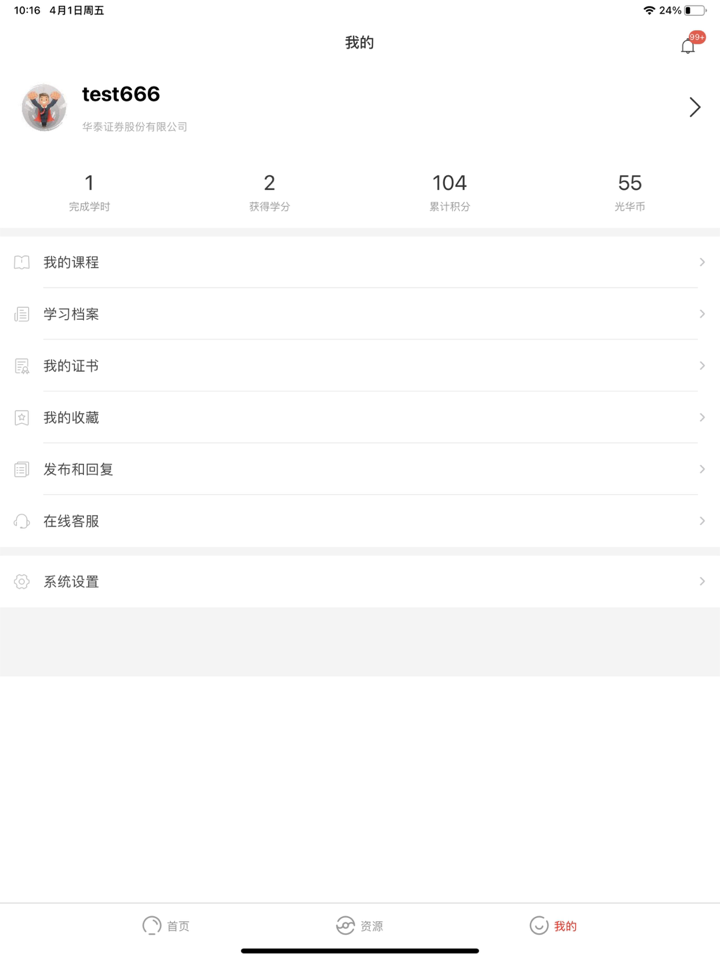

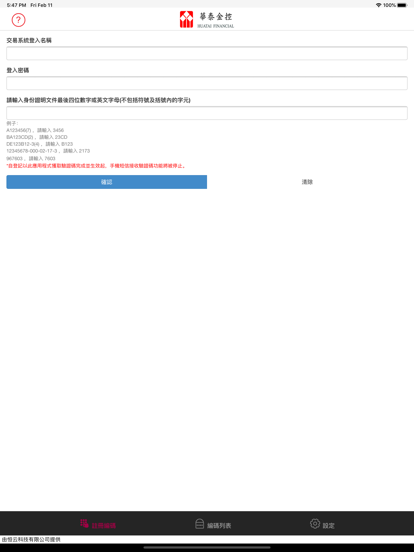

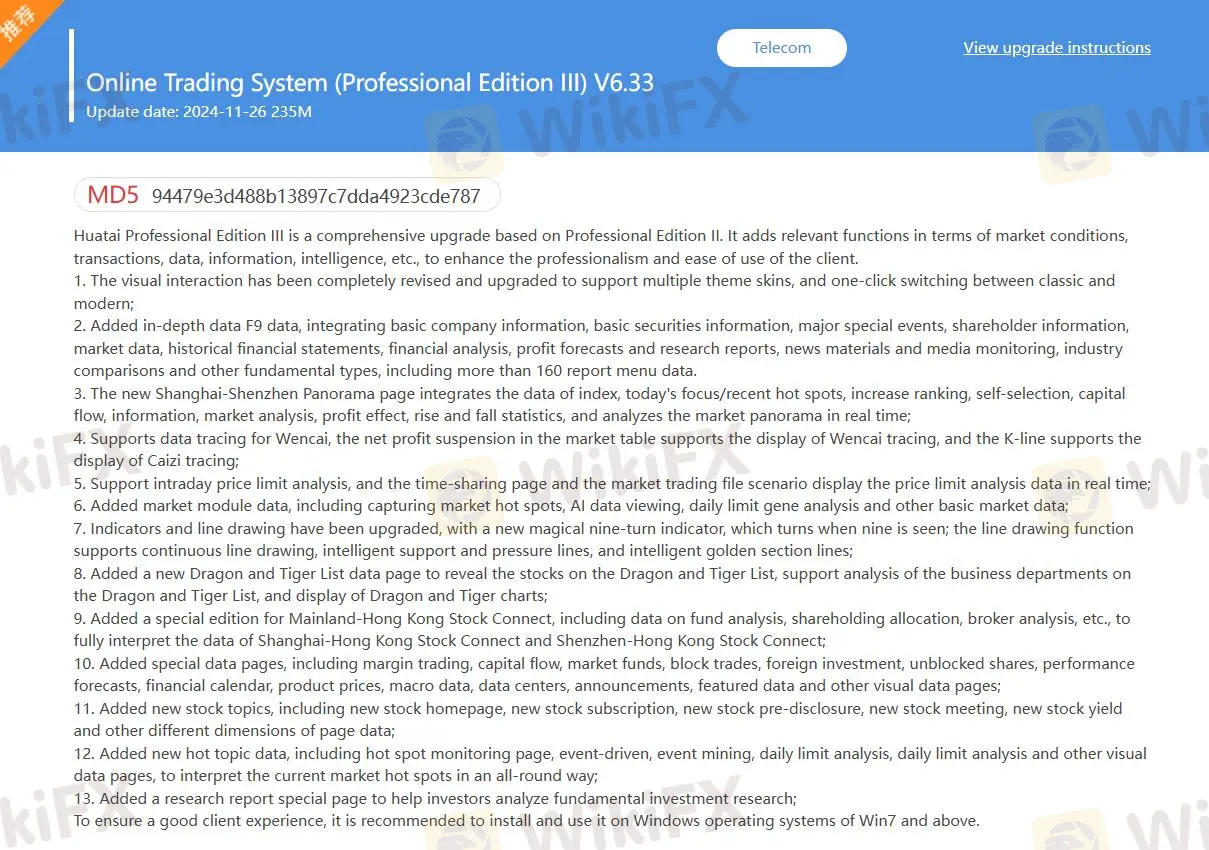

HUA TAI의 거래 플랫폼은 MD5, Zhangle App으로 PC, Mac, iPhone 및 Android에서 트레이더를 지원합니다.

| 거래 플랫폼 | 지원 | 사용 가능한 기기 |

| MD5 | ✔ | 웹 |

| Zhangle App | ✔ | 모바일 |

| MT4 마진 웹 트레이더 | ❌ | |

| MT5 | ❌ |

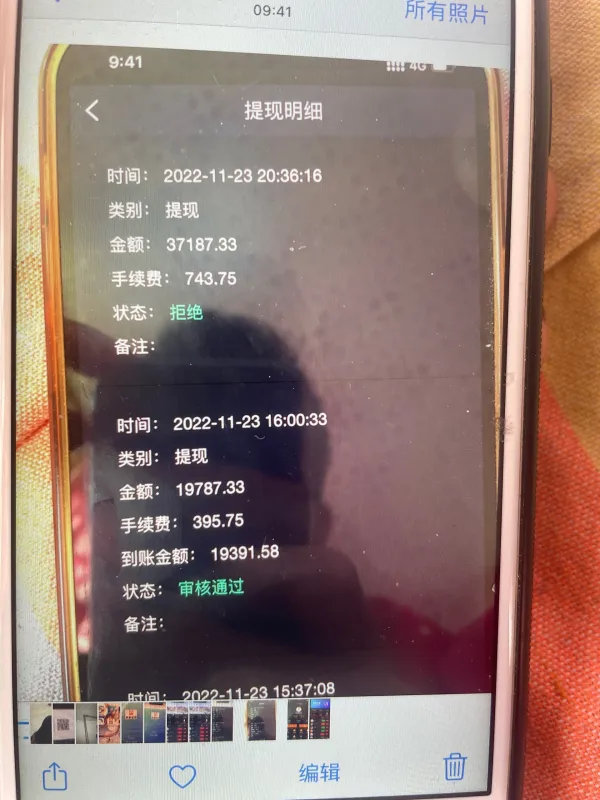

입출금

HUA TAI의 입출금 방법은 은행 송금입니다. ICBC 카드, ABC 카드, CCB 카드, BOC 카드 등의 직불 카드를 지원합니다.