कंपनी का सारांश

| HUA TAI समीक्षा सारांश | |

| स्थापित | 1991 |

| पंजीकृत देश/क्षेत्र | चीन |

| नियामक | CFFEX |

| बाजार उपकरण | स्टॉक, विकल्प, प्रमुख धातु |

| सेवाएं | संपत्ति संरक्षण सेवाएं, संचालन आउटसोर्सिंग सेवाएं |

| खाता प्रकार | लाइव खाता |

| लीवरेज | 1:2 तक |

| ट्रेडिंग प्लेटफॉर्म | MD5, Zhangle App |

| भुगतान विधि | बैंक ट्रांसफर |

| ग्राहक सहायता | फोन: 955597 |

| ईमेल: 95597@htsc.com | |

| स्थानीय पता: नंबर 228, जियांगडोंग मध्य मार्ग, नांजिंग, जियांगसू प्रांत, चीन | |

HUA TAI जानकारी

HUA TAI, 1991 में स्थापित, चीन में पंजीकृत एक दलाली है। यह वित्तीय उपकरणों की व्यापार विधियों को कवर करता है, जिसमें स्टॉक, विकल्प, प्रमुख धातु शामिल हैं। इसे CFFEX द्वारा नियामित किया जाता है।

लाभ और हानि

| लाभ | हानि |

| नियामित | कोई कमीशन की जानकारी नहीं |

| व्यापक व्यापार उपकरण | न्यूनतम जमा के बारे में स्पष्ट जानकारी नहीं है |

| कई सेवाएं प्रदान की जाती हैं | सीमित खाता प्रकार प्रदान की जाती हैं |

| कोई डेमो खाता नहीं | |

| MT4 समर्थित नहीं है |

HUA TAI क्या विधि है?

HUA TAI चीन में CFFEX द्वारा नियामित किया जाता है। इसकी वर्तमान स्थिति नियामित है।

| नियामित देश | नियामक प्राधिकरण | नियामित संस्था | लाइसेंस प्रकार | लाइसेंस नंबर | वर्तमान स्थिति |

| चीन | CFFEX | 华泰期货有限公司 | फ्यूचर्स लाइसेंस | 0011 | नियामित |

मैं HUA TAI पर क्या ट्रेड कर सकता हूँ?

HUA TAI ट्रेडर्स को स्टॉक, विकल्प, मूल्यवर्धित धातुएं ट्रेड करने का विकल्प प्रदान करता है।

| व्यापार्य उपकरण | समर्थित |

| स्टॉक | ✔ |

| विकल्प | ✔ |

| मूल्यवर्धित धातुएं | ✔ |

| विदेशी मुद्रा | ❌ |

| कमोडिटीज़ | ❌ |

| सूचकांक | ❌ |

| भविष्य | ❌ |

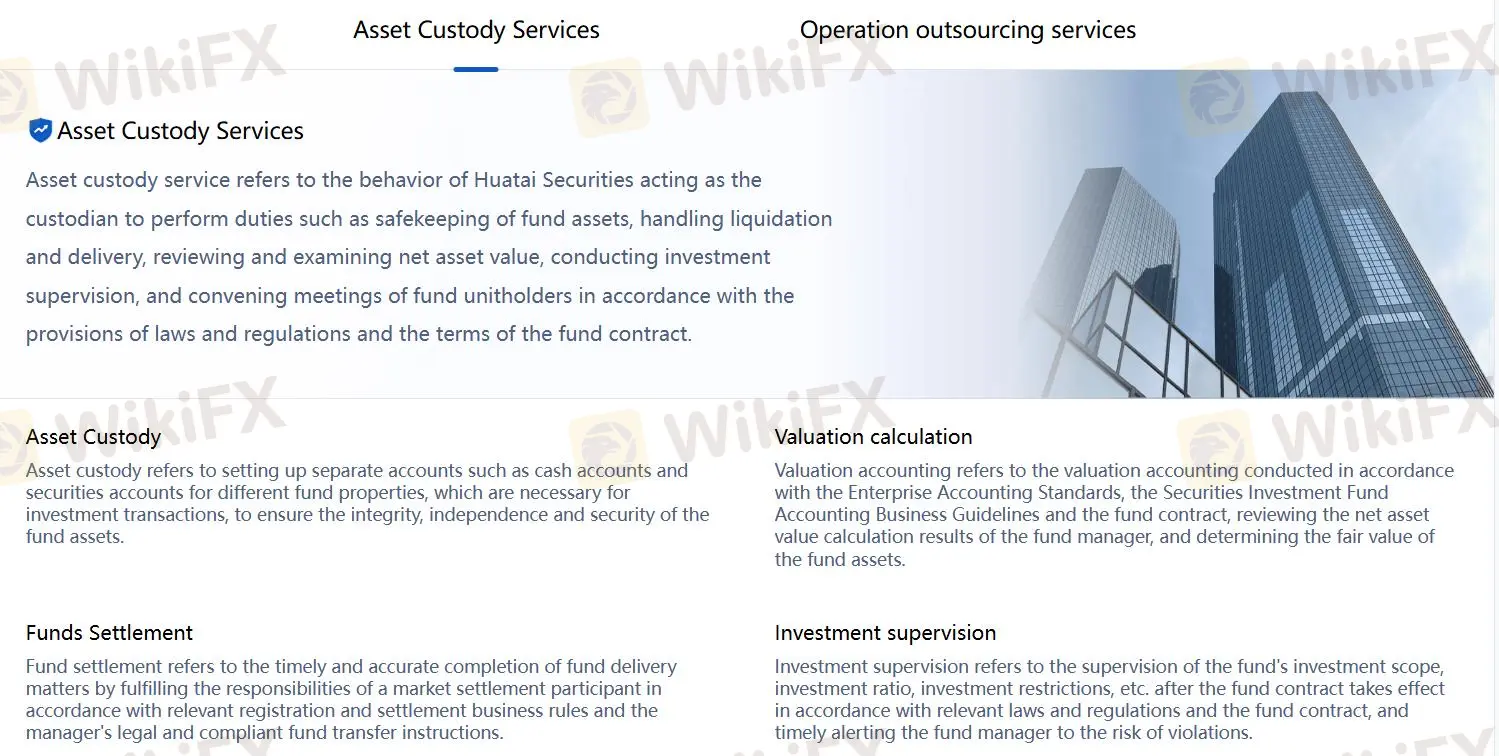

सेवाएं

HUA TAI मुद्रा रखरखाव सेवाएं, संचालन आउटसोर्सिंग सेवाएं प्रदान करता है। मुद्रा रखरखाव सेवाएं मुद्रा रखरखाव, मूल्यमापन गणना, निवेश पर्यवेक्षण, निधि निपटान शामिल हैं। संचालन आउटसोर्सिंग सेवाएं

शेयर पंजीकरण, खाता पर्यवेक्षण, मूल्यमापन गणना, सूचना का प्रकटीकरण शामिल हैं।

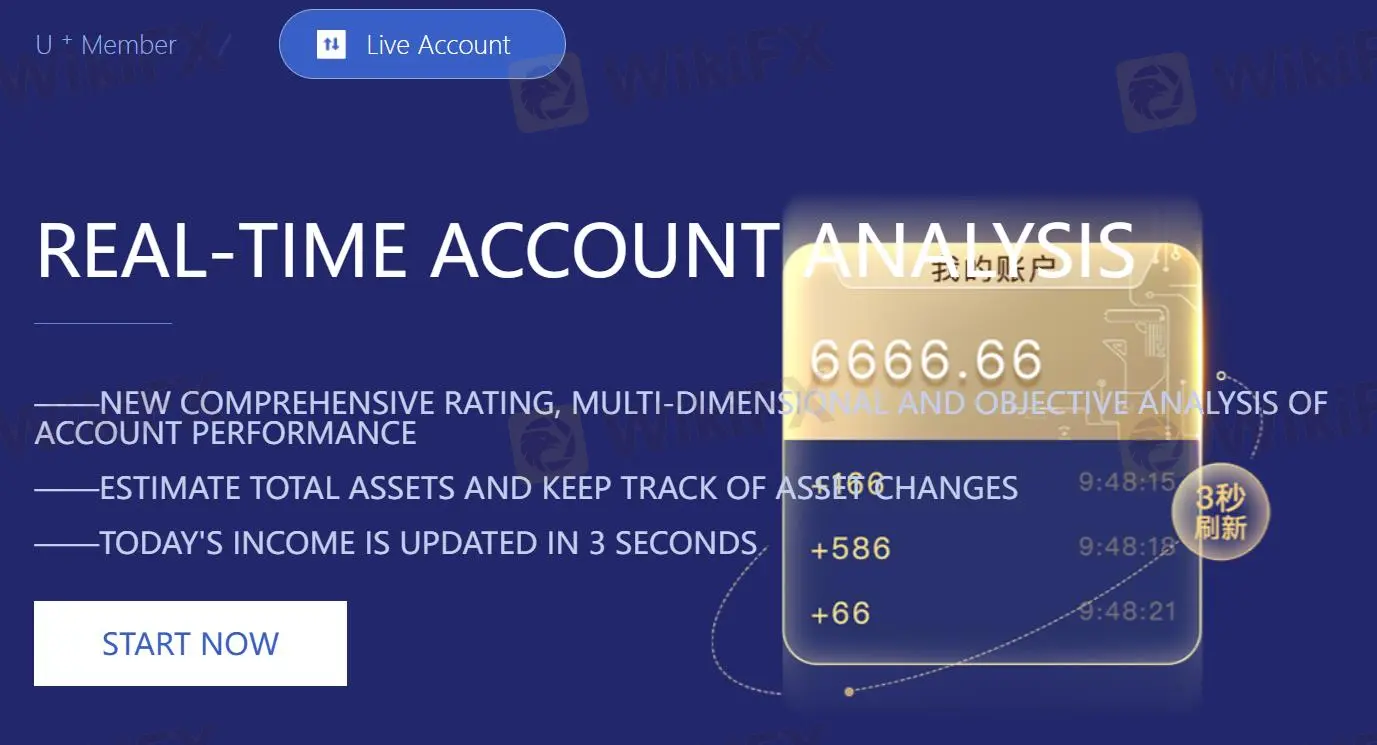

खाता प्रकार

HUA TAI ट्रेडर्स को 1 प्रकार का खाता प्रदान करता है - लाइव खाता।

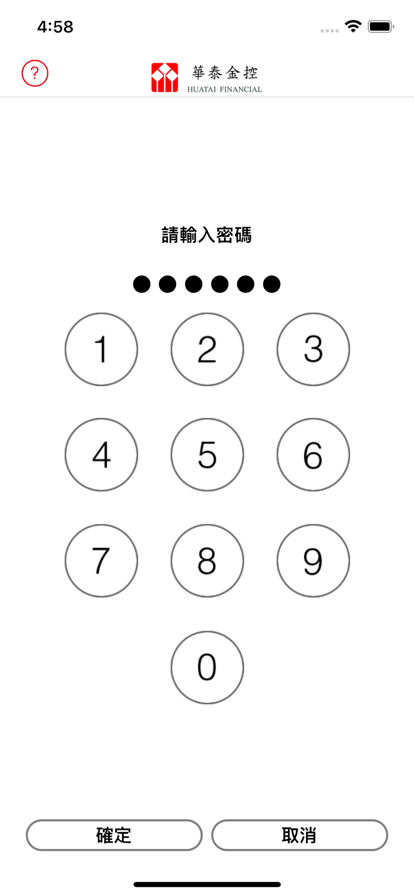

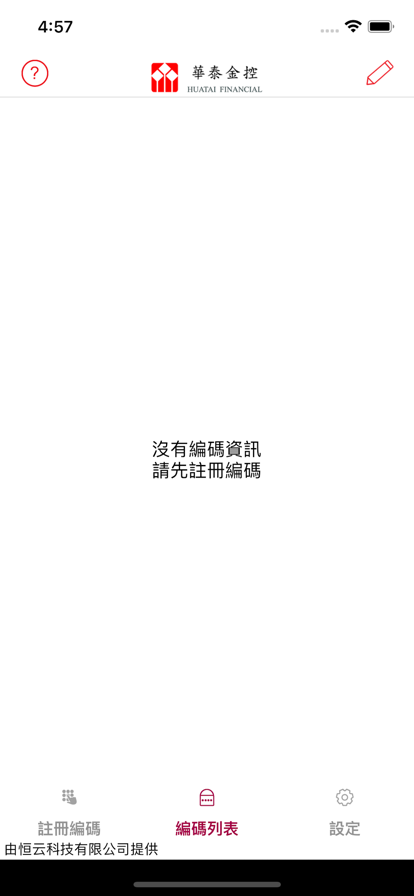

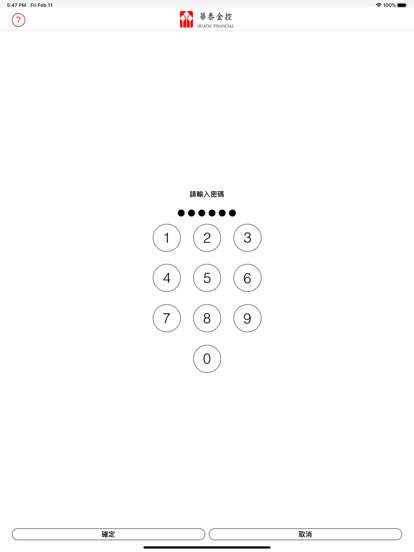

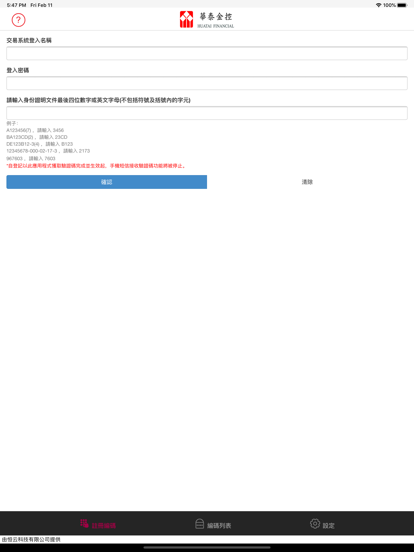

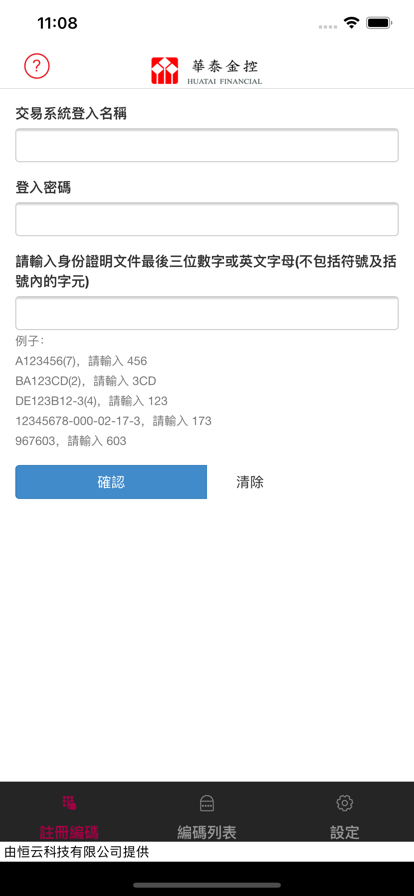

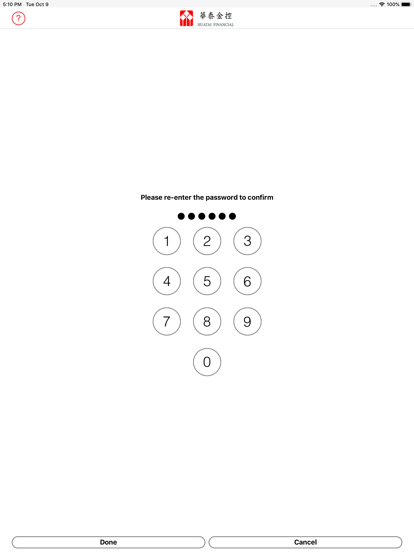

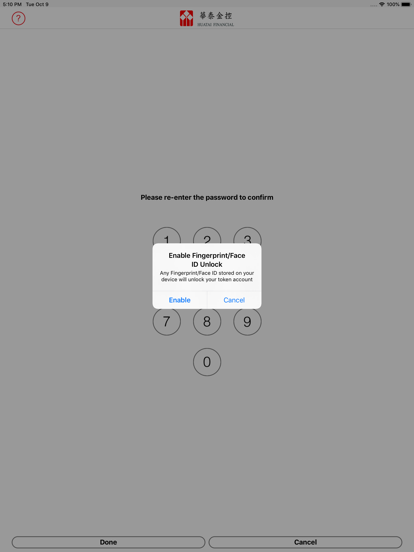

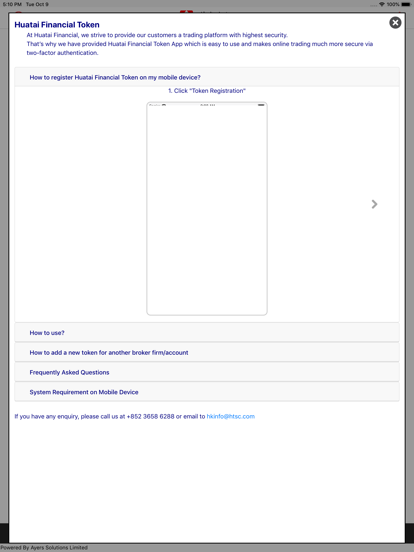

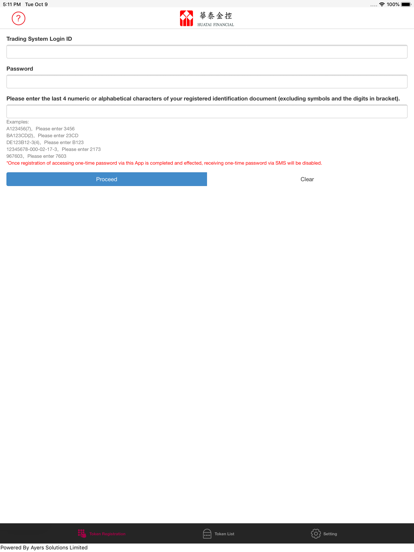

ट्रेडिंग प्लेटफॉर्म

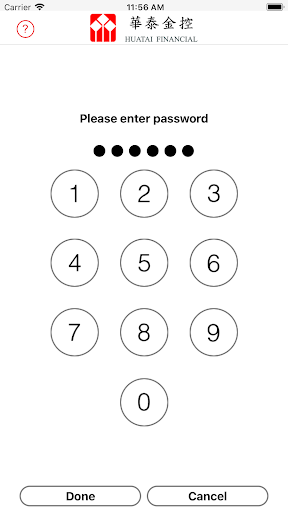

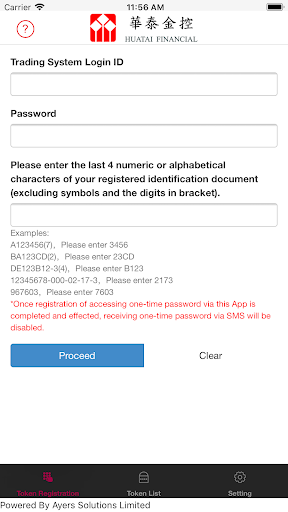

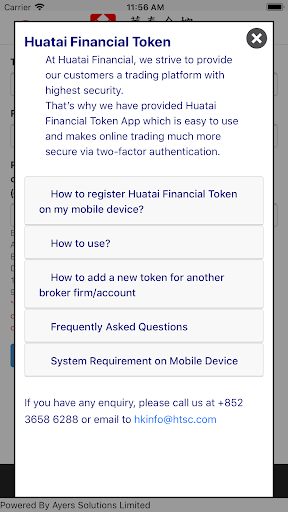

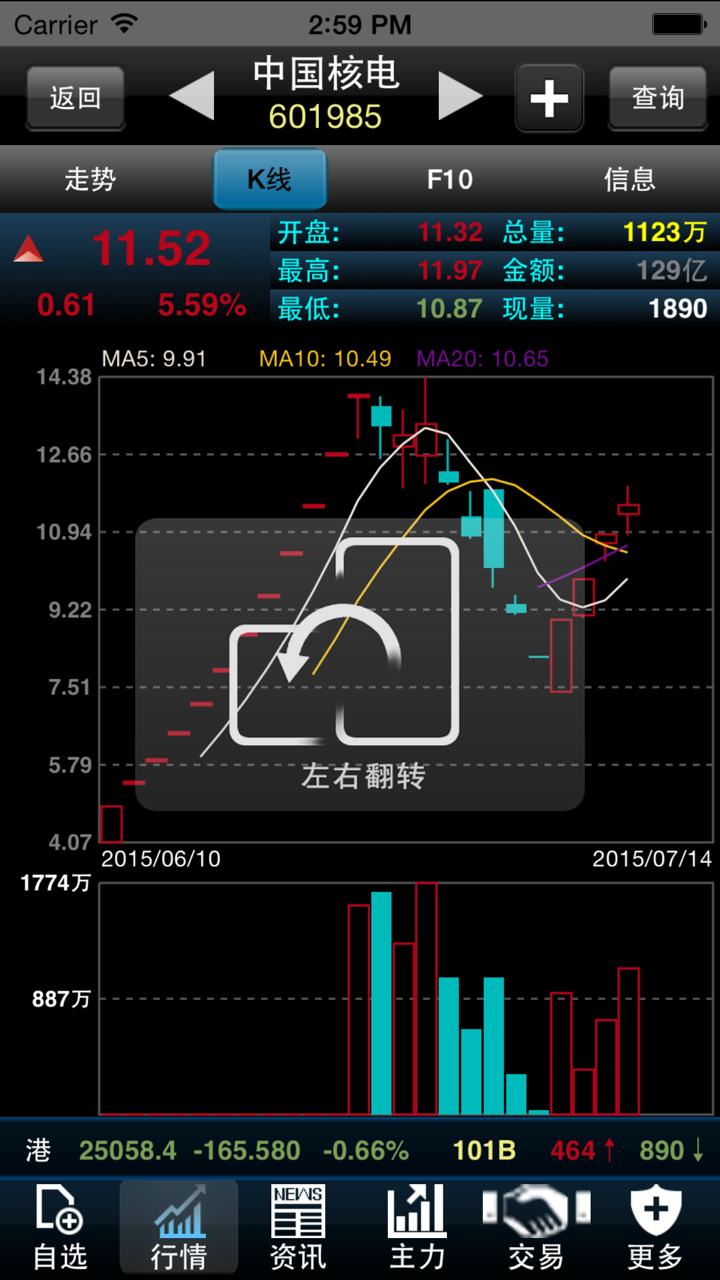

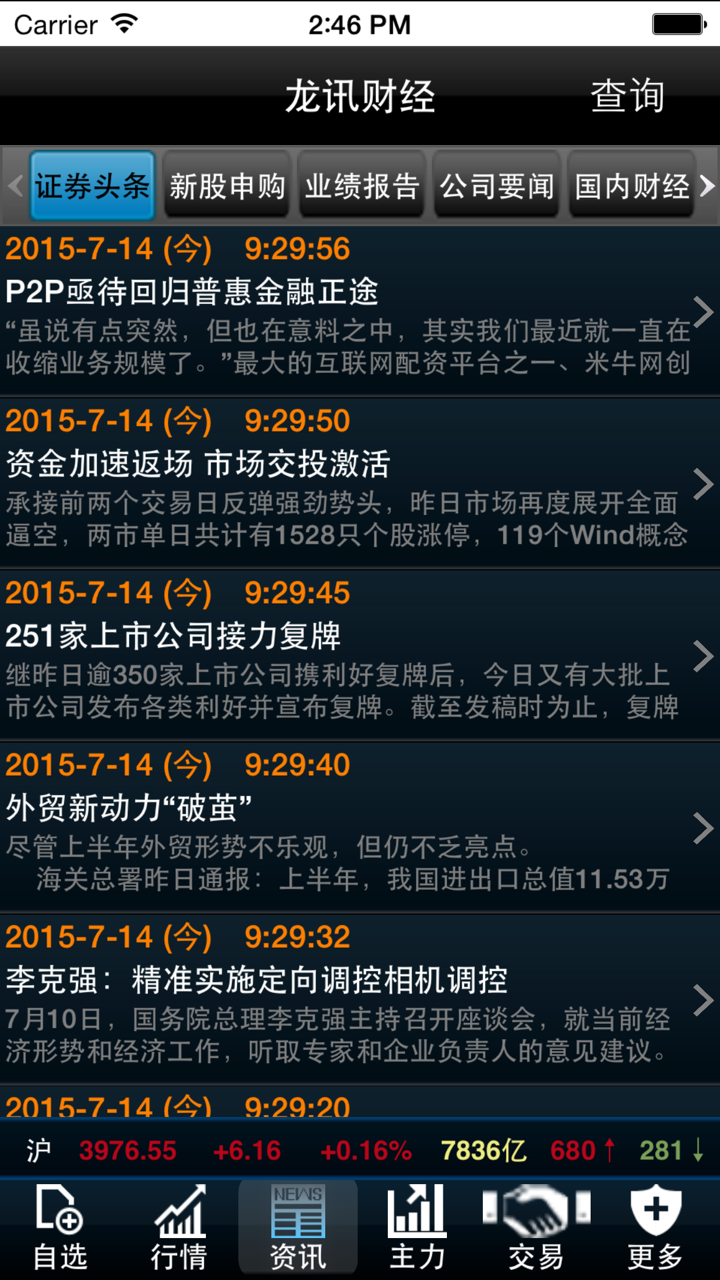

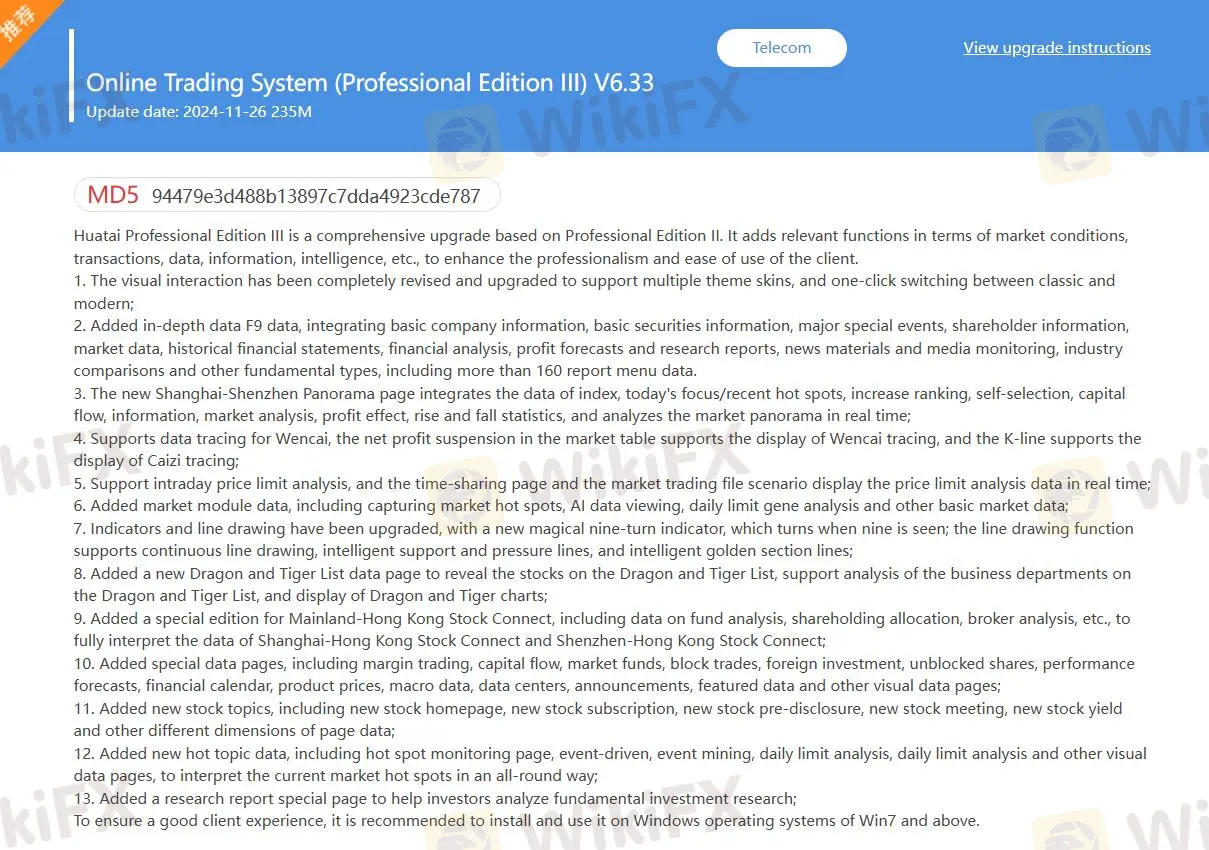

HUA TAI के ट्रेडिंग प्लेटफॉर्म MD5, Zhangle App हैं, जो PC, Mac, iPhone और Android पर ट्रेडर्स का समर्थन करते हैं।

| ट्रेडिंग प्लेटफॉर्म | समर्थित | उपलब्ध उपकरण |

| MD5 | ✔ | वेब |

| Zhangle App | ✔ | मोबाइल |

| MT4 मार्जिन वेबट्रेडर | ❌ | |

| MT5 | ❌ |

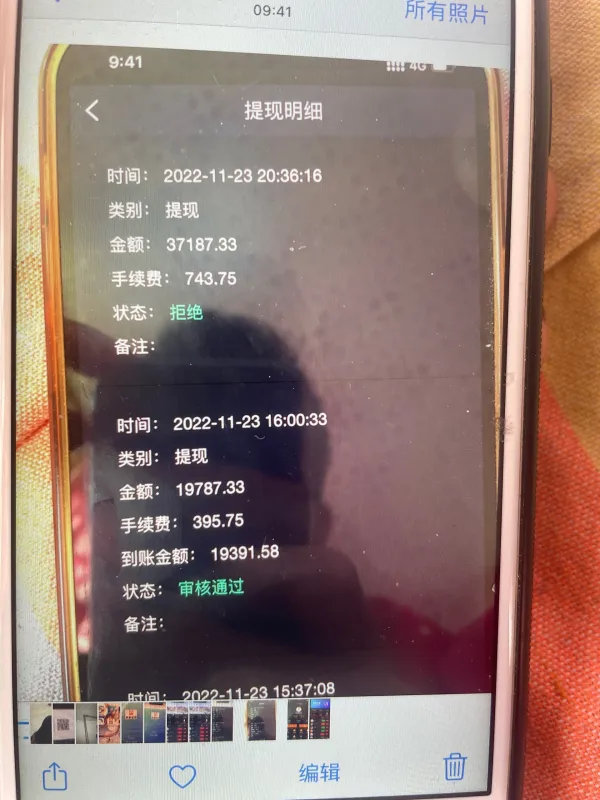

जमा और निकासी

इसकी जमा और निकासी विधि बैंक ट्रांसफर है। यह निम्नलिखित डेबिट कार्ड का समर्थन करता है, जैसे ICBC कार्ड, ABC कार्ड, CCB कार्ड, BOC कार्ड, आदि।