회사 소개

| IFX 리뷰 요약 | |

| 설립 연도 | 2015 |

| 등록 국가/지역 | 영국 |

| 규제 | FCA (초과), DFSA (초과) |

| 서비스 | 결제 솔루션, 외환 거래 |

| 데모 계정 | ✅ |

| 고객 지원 | 전화: +4402074958888 |

| 이메일: private@ifxpayments.com | |

| 런던: 33 Cavendish Square London, W1G 0PW | |

| 두바이: Unit 31-46 Central Park offices DIFC | |

| Amersham: Chalfont Court, 5 Hill Avenue Amersham, HP6 5BB | |

| Warsaw: WorkIN, ul. Senatorska 200‑075 Warszawa | |

IFX 정보

IFX은 사용자에게 포괄적인 결제 솔루션 및 외환 거래 서비스를 제공하는 회사입니다. 영국에 등록되어 있지만 FCA 및 DFSA가 발급한 라이선스가 초과되었으며, 잠재적인 위험을 무시할 수 없습니다.

장단점

| 장점 | 단점 |

| 데모 계정 | 초과된 라이선스 |

| 긴 역사 |

IFX 합법성

IFX은 현재 규제를 초과했습니다. 위험에 유의하십시오!

| 규제 상태 | 초과됨 |

| 규제 기관 | 금융행정청 (FCA) |

| 라이선스 기관 | IFX (UK) Ltd |

| 라이선스 유형 | 결제 라이선스 |

| 라이선스 번호 | 900517 |

| 규제 상태 | 초과됨 |

| 규제 기관 | 두바이 금융서비스 규제청(DFSA) |

| 라이선스 기관 | IFX (UK) Ltd |

| 라이선스 유형 | 일반 금융 서비스 라이선스 |

| 라이선스 번호 | F001814 |

IFX 서비스

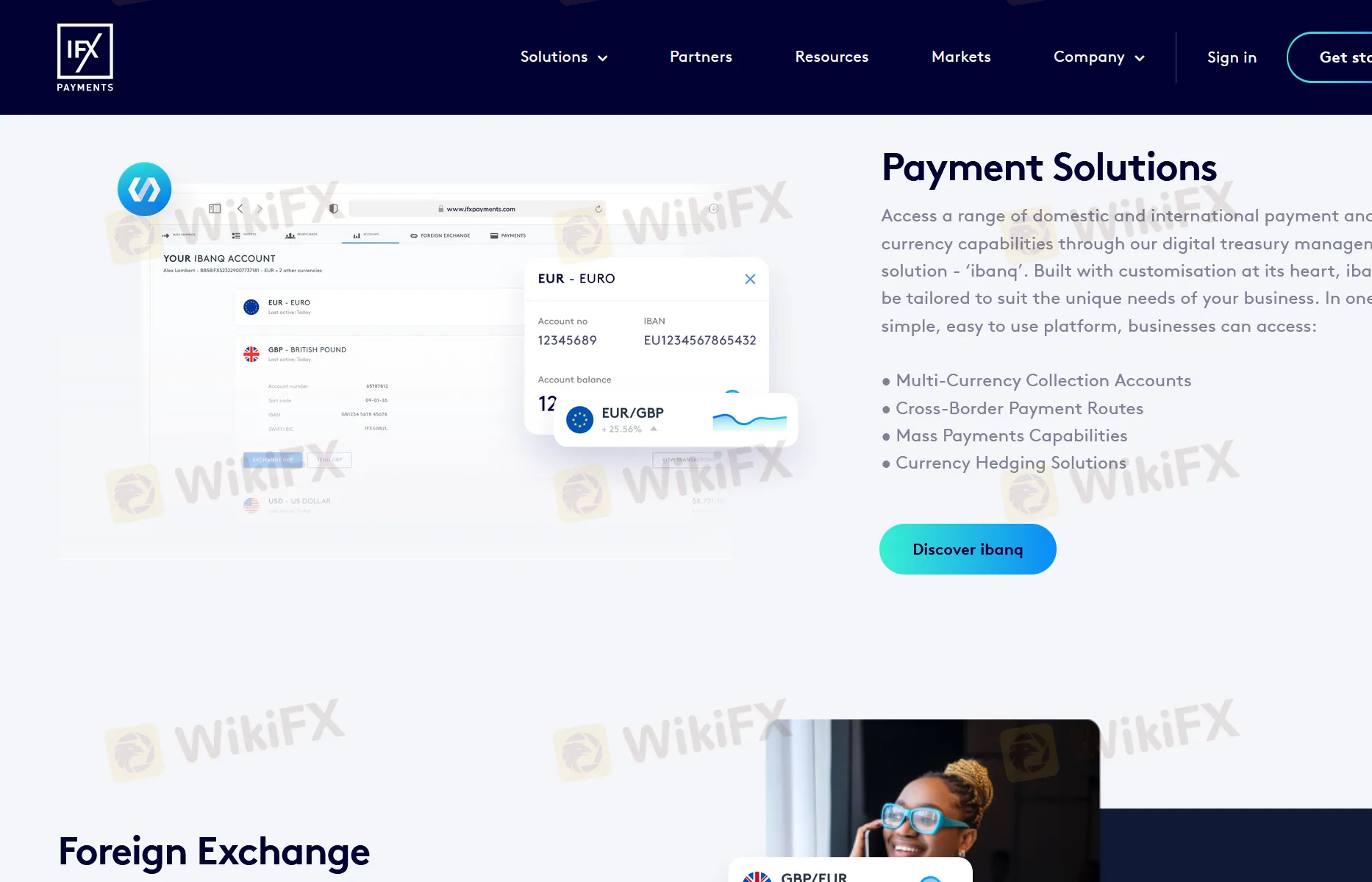

IFX은 결제 솔루션 및 외환 서비스를 제공합니다

| 거래 가능한 상품 | 지원 |

| 결제 솔루션 | ✔ |

| 외환 | ✔ |

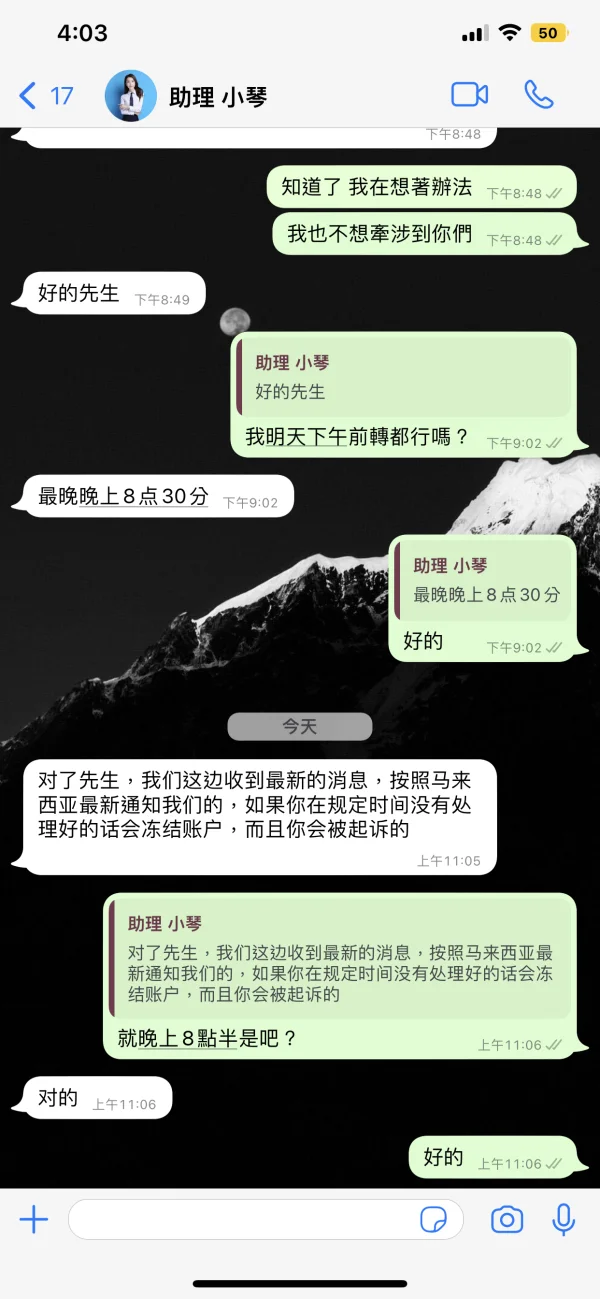

E1211

말레이시아

취급 수수료는 정말 RM3000이며 지불하지 않으면 소송을 당합니까? 이 웹사이트가 사실인가요?

신고

Red Star

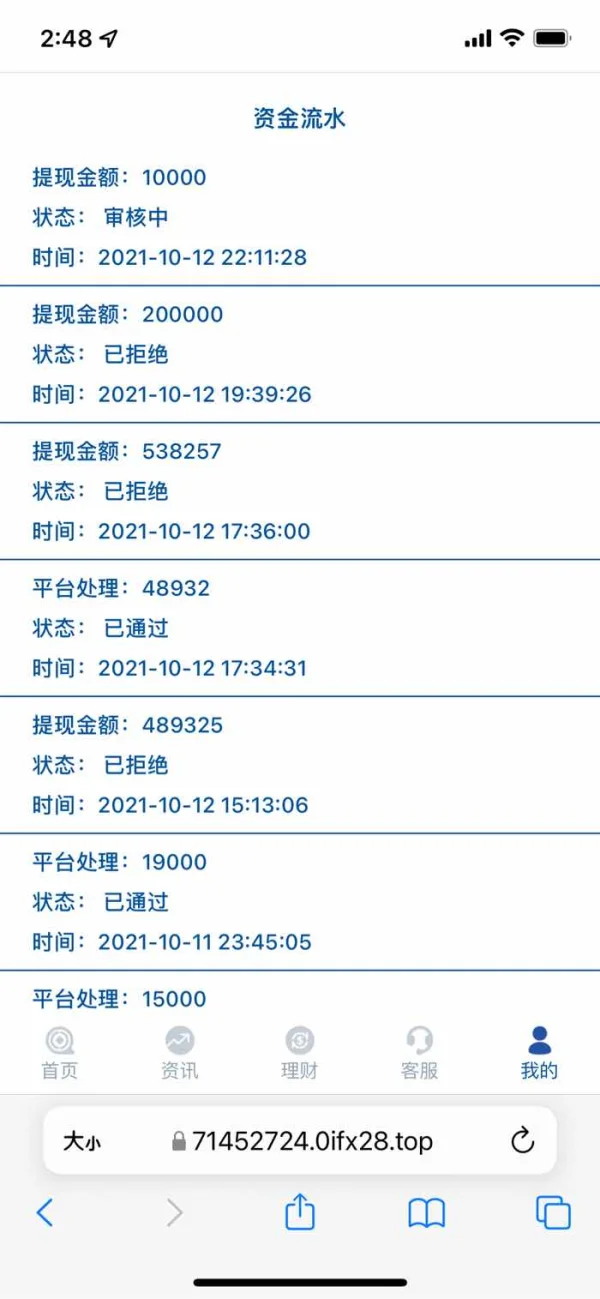

홍콩

인출은 사용할 수 없습니다 IFX 경찰에 신고 한 후 내 계정이 취소되었습니다.

신고

五四六一九一六六八

홍콩

탈퇴 할 수 없음. 플랫폼이 고객의 계정을 잠그고 인출에 대한 액세스 권한을 부여하지 않아 ID 정보가 잘못되었습니다.

신고

FX1287225689

모로코

솔직히 IFX는 지불 이체 서비스를 위한 좋은 플랫폼입니다. 나는 그 서비스를 여러 번 사용해 보았고 그 훌륭한 서비스를 인정합니다.

좋은 평가

A瞬间

영국

나는 IFX에 대해 아주 좋은 거래 경험을 가지고 있습니다. 질문이나 문제가 있을 때 저를 잘 도와주는 고객 지원에 대단히 감사합니다. 나는 당신의 사람들에게 경의를 표합니다!

좋은 평가

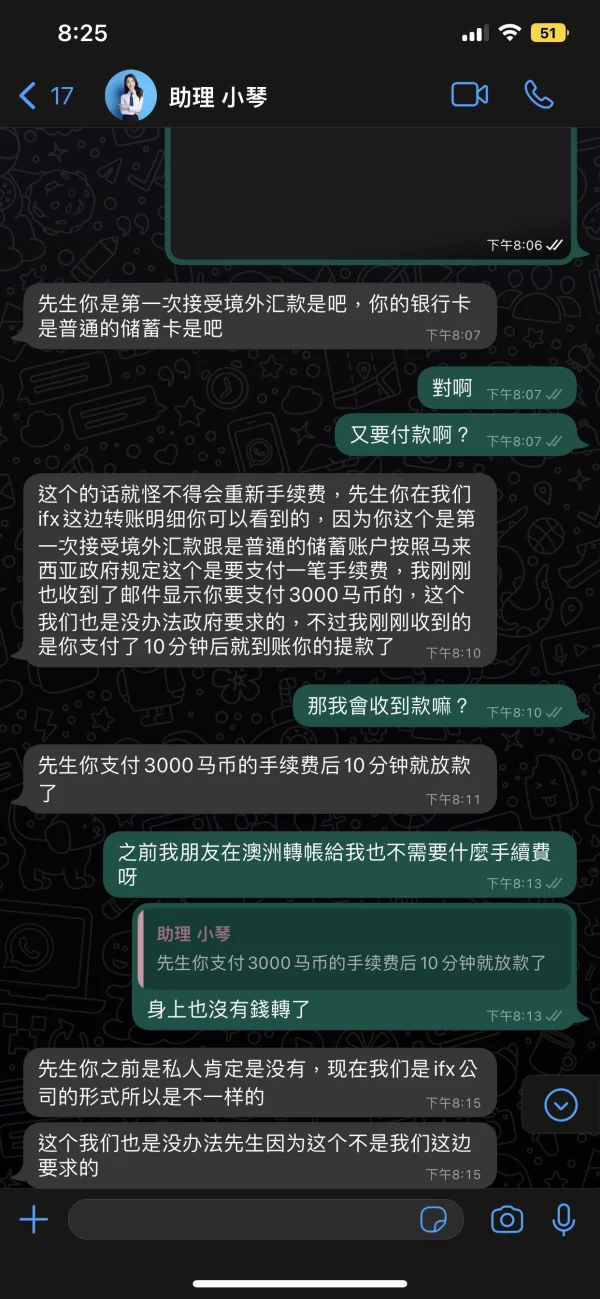

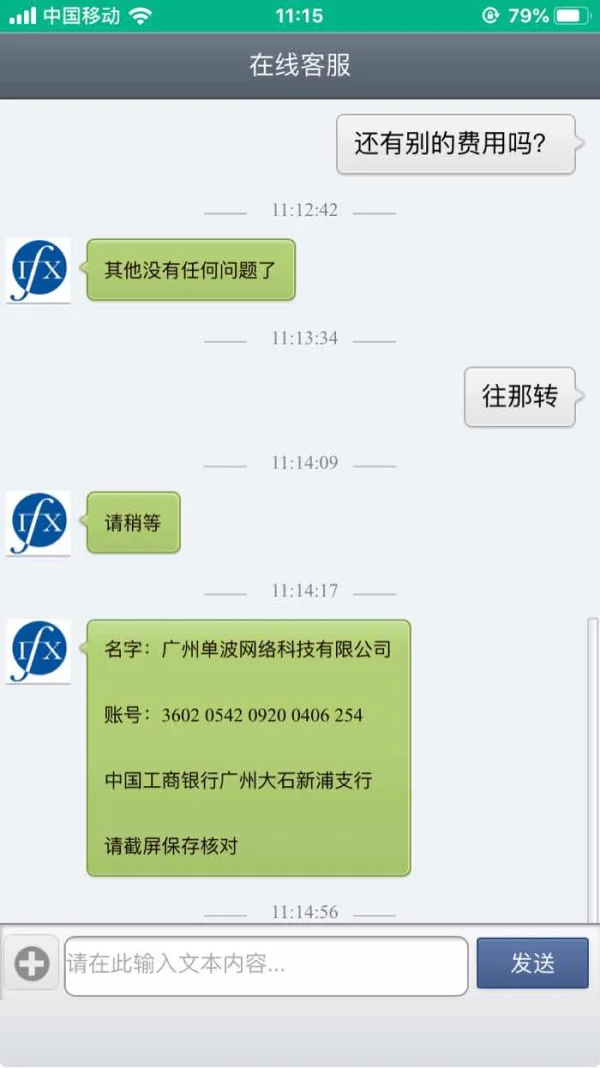

lee9022

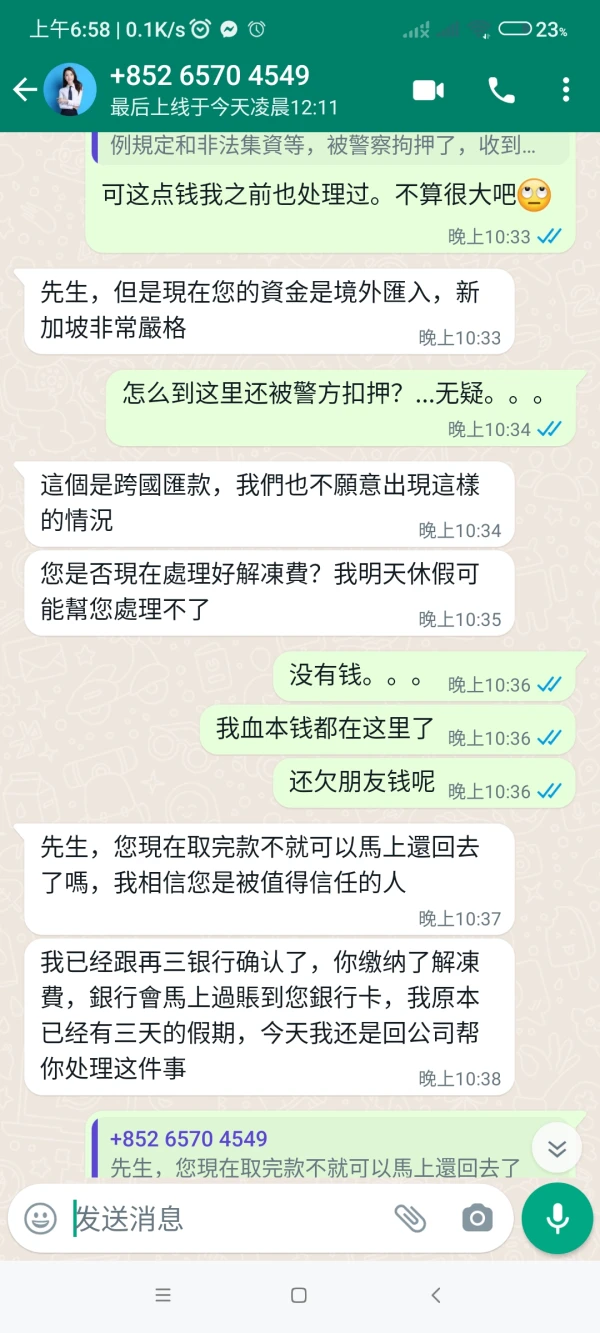

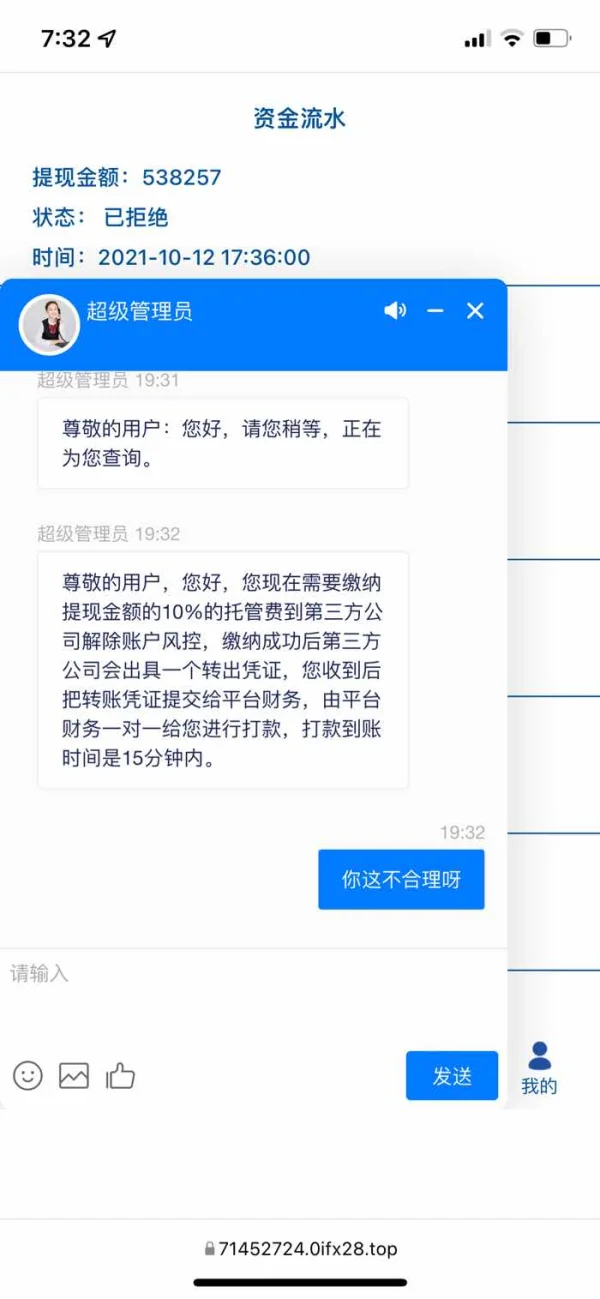

싱가포르

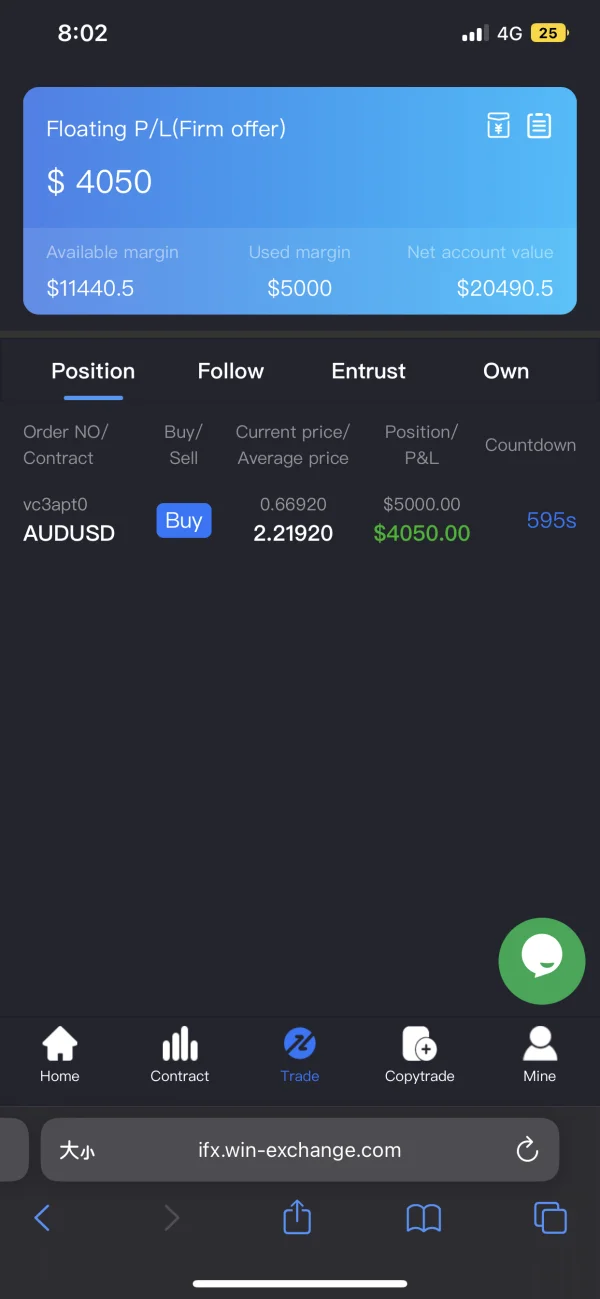

사기, 상사는 수수료, 처리 수수료, 마진, 엔컴 세금 및 해동 수수료를 지불하기를 원합니다. 끝없는 수수료가 있습니다

신고

生死劫

홍콩

예, IFX 결제에 대해 즐거운 경험을 했습니다. Sunny는 매우 도움이 되었고 최고의 환율을 찾기 위해 최선을 다했습니다. 훌륭한 서비스와 감사합니다.

좋은 평가

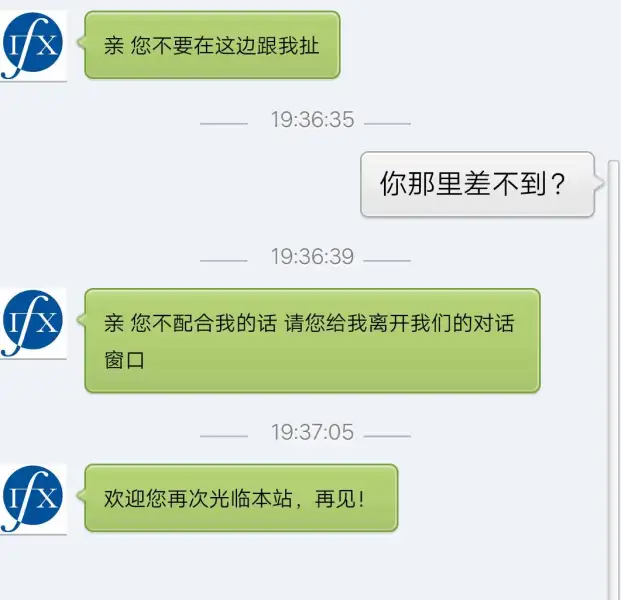

༺蜜糖༻

홍콩

철회할 수 없습니다. 여러 가지 이유로 입금하라고 했습니다. 사기였나요?

신고

FX4234736427

홍콩

IFX 다양한 변명으로 마진을 요구할 것입니다. 버그를 고치겠다고 주장하면서 액세스 권한을 부여하지 않고 절대 포기하지 않았습니다.

신고

随风29414

홍콩

사기 플랫폼은 인출에 액세스 할 수 없었으며 계정을 동결 해제하기 위해 돈을 요구했습니다.

신고

Red Star

홍콩

IFX 처음에 마진을 지불하도록 요청한 사기 플랫폼으로, 다양한 수수료를 요구하면서 인출에 대한 액세스 권한을 부여하지 않았습니다.

신고