Buod ng kumpanya

| IFX Buod ng Pagsusuri | |

| Itinatag | 2015 |

| Nakarehistrong Bansa/Rehiyon | United Kingdom |

| Regulasyon | FCA (na-exceed), DFSA (na-exceed) |

| Mga Serbisyo | Mga solusyon sa pagbabayad, banyagang palitan |

| Demo Account | ✅ |

| Suporta sa Customer | Telepono: +4402074958888 |

| Email: private@ifxpayments.com | |

| London: 33 Cavendish Square London, W1G 0PW | |

| Dubai: Unit 31-46 Central Park offices DIFC | |

| Amersham: Chalfont Court, 5 Hill Avenue Amersham, HP6 5BB | |

| Warsaw: WorkIN, ul. Senatorska 200‑075 Warszawa | |

Impormasyon Tungkol sa IFX

Ang IFX ay isang kumpanya na nakatuon sa pagbibigay ng komprehensibong mga Solusyon sa Pagbabayad at serbisyong Banyagang Palitan sa mga gumagamit. Ito ay naka-rehistro sa UK, ngunit ang mga lisensya nito na inisyu ng FCA at DFSA ay na-exceed, na nangangahulugang hindi dapat balewalain ang potensyal na panganib.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Mga demo account | Na-exceed na mga lisensya |

| Mahabang kasaysayan |

Tunay ba ang IFX?

Ang IFX ay na-exceed ang regulasyon sa kasalukuyan. Mangyaring maging maingat sa panganib!

| Status ng Regulasyon | Na-exceed |

| Regulado ng | Financial Conduct Authority (FCA) |

| Lisensyadong Institusyon | IFX (UK) Ltd |

| Tipo ng Lisensya | Lisensya sa Pagbabayad |

| Numero ng Lisensya | 900517 |

| Status ng Regulasyon | Na-exceed |

| Regulado ng | Dubai Financial Services Authority(DFSA) |

| Lisensyadong Institusyon | IFX (UK) Ltd |

| Tipo ng Lisensya | Karaniwang Lisensya sa Financial Service |

| Numero ng Lisensya | F001814 |

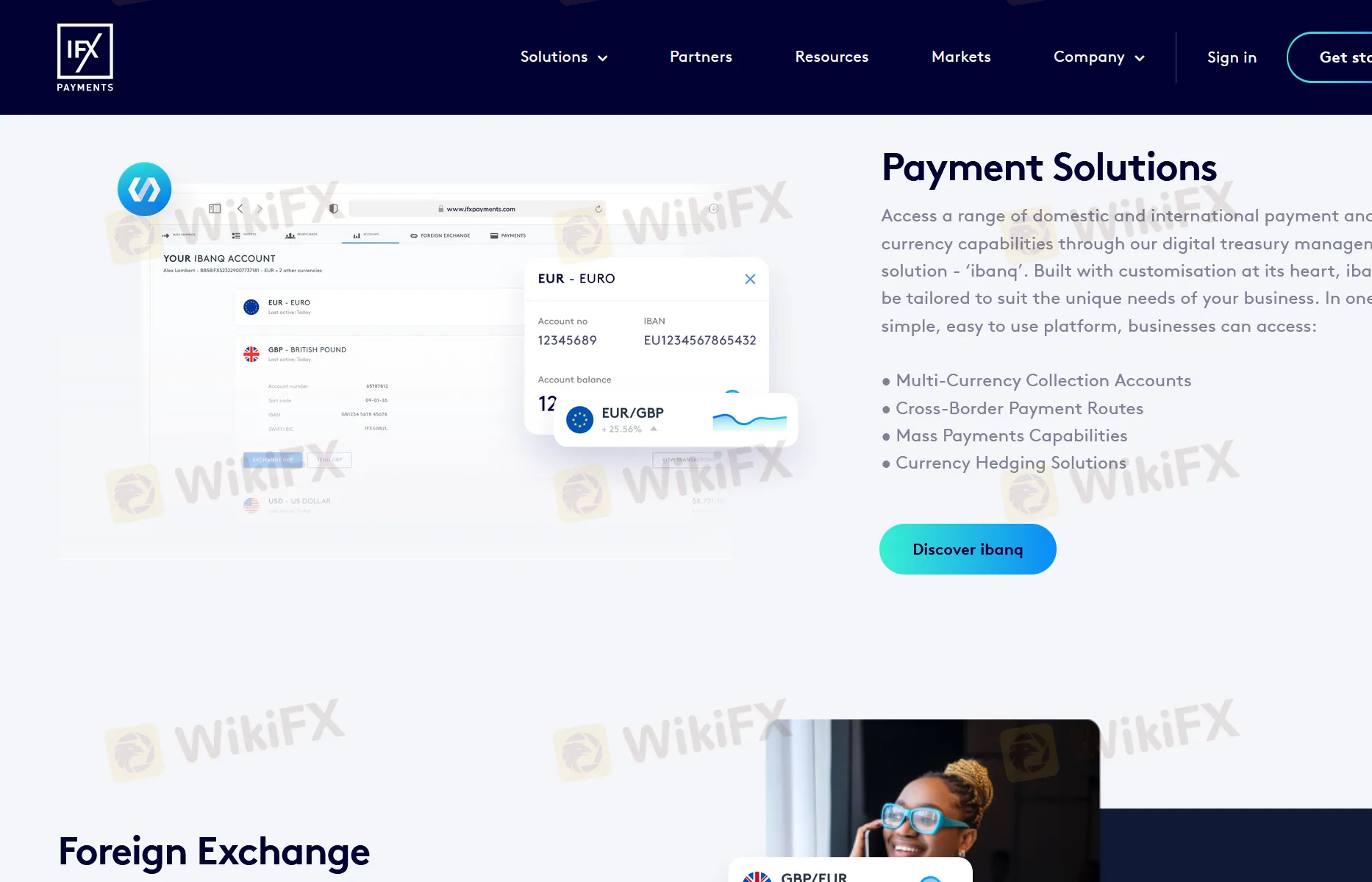

IFX Mga Serbisyo

IFX nag-aalok ng mga solusyon sa Pagbabayad at serbisyong Palitan ng Banyagang Pera

| Mga Tradable na Kasangkapan | Suportado |

| Mga Solusyon sa Pagbabayad | ✔ |

| Palitan ng Banyagang Pera | ✔ |

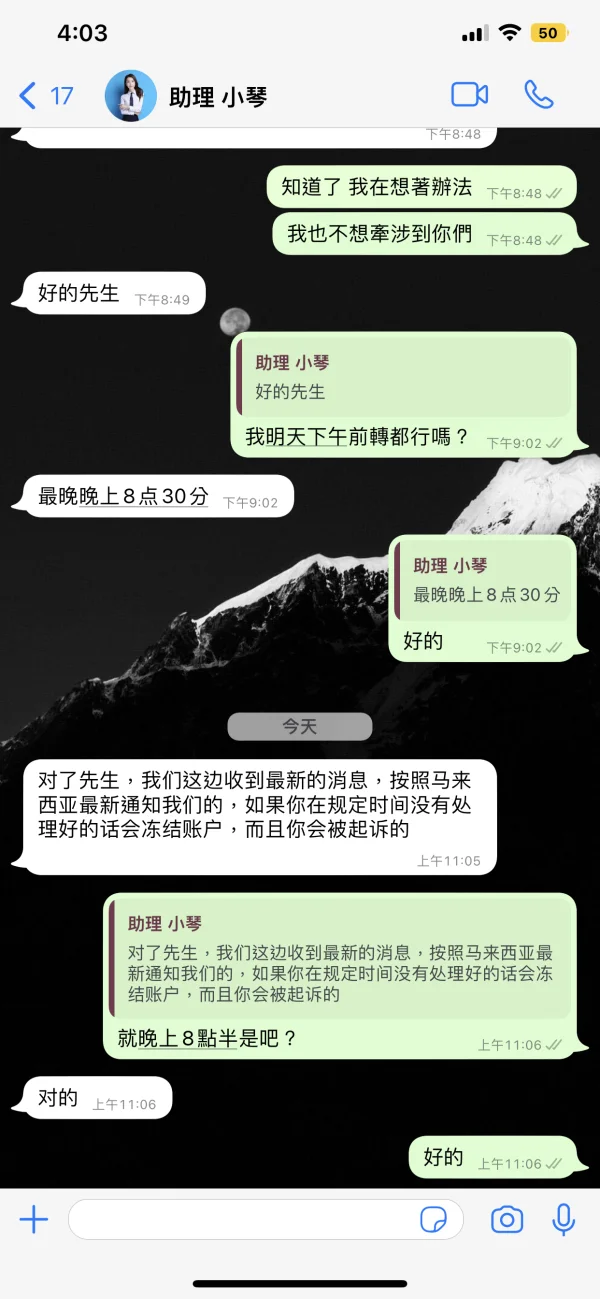

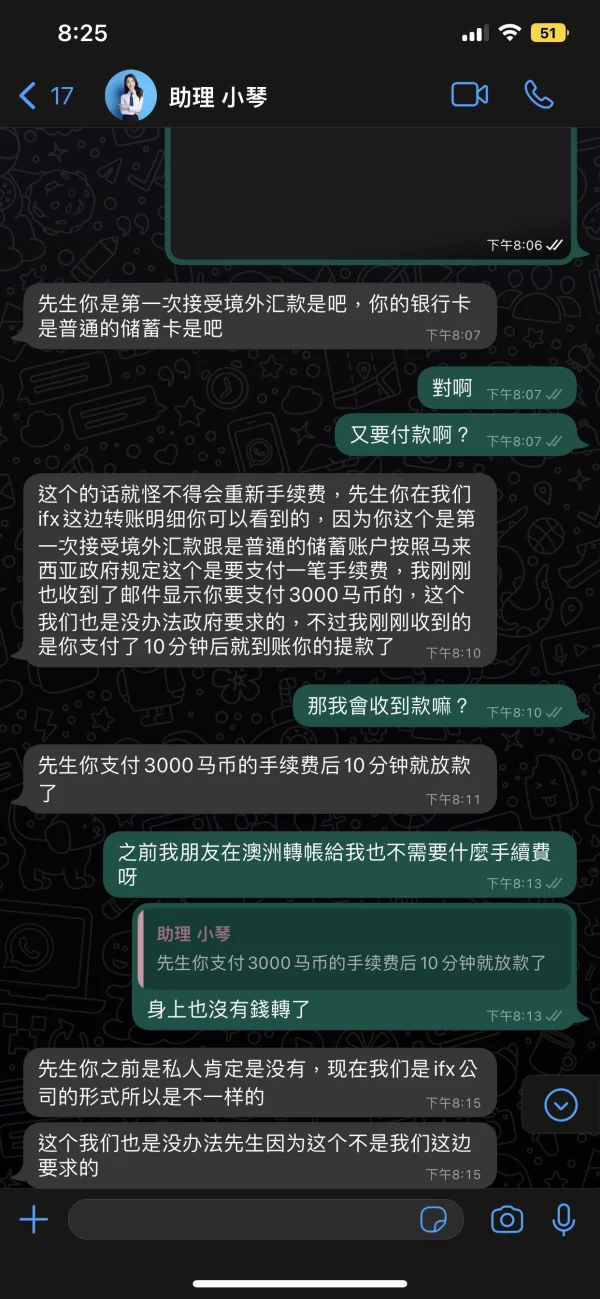

E1211

Malaysia

Talaga bang RM3000 ang handling fee at idedemanda ba ako kapag hindi ko ito binayaran? Totoo ba ang website na ito?

Paglalahad

Red Star

Hong Kong

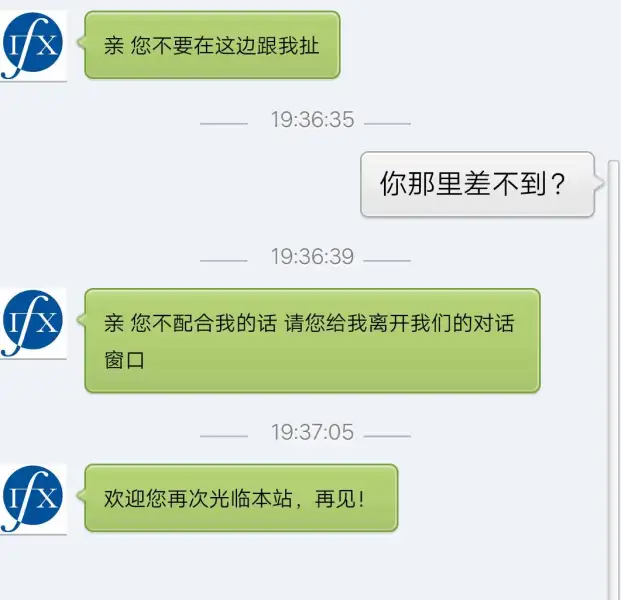

假平台,出不了金,报警后平台把我的用户名也删了,提醒广大群众千万不要上当。

Paglalahad

五四六一九一六六八

Hong Kong

,这个平台不给出金,把客户账号锁定了,找各种原因不给出金,说身份信息卡号不对。

Paglalahad

FX1287225689

Morocco

Sa totoo lang, ang IFX ay magandang platform para sa mga serbisyo sa paglilipat ng bayad. Ilang beses ko nang ginamit ang mga serbisyo nito at kinikilala ko ang mahusay na serbisyo nito.

Positibo

A瞬间

United Kingdom

Mayroon akong napakagandang karanasan sa pangangalakal sa IFX. Maraming salamat sa customer support na mahusay na tumulong sa akin kapag mayroon akong mga tanong at problema. Saludo ako sa inyong mga kasama!

Positibo

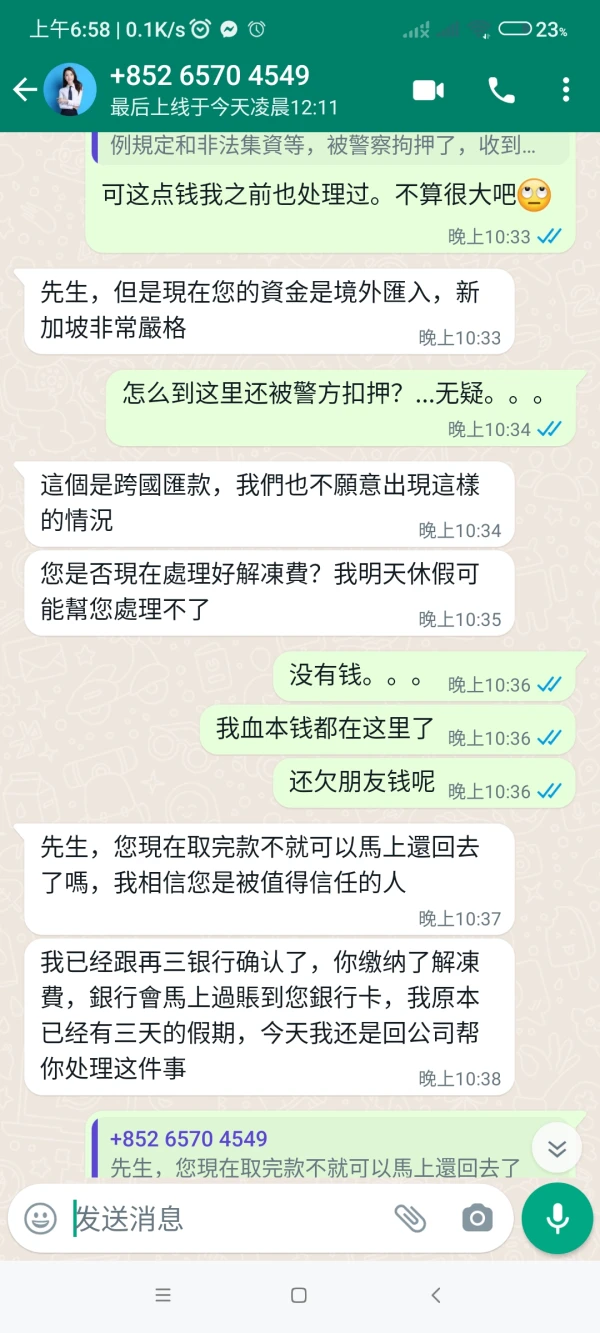

lee9022

Singapore

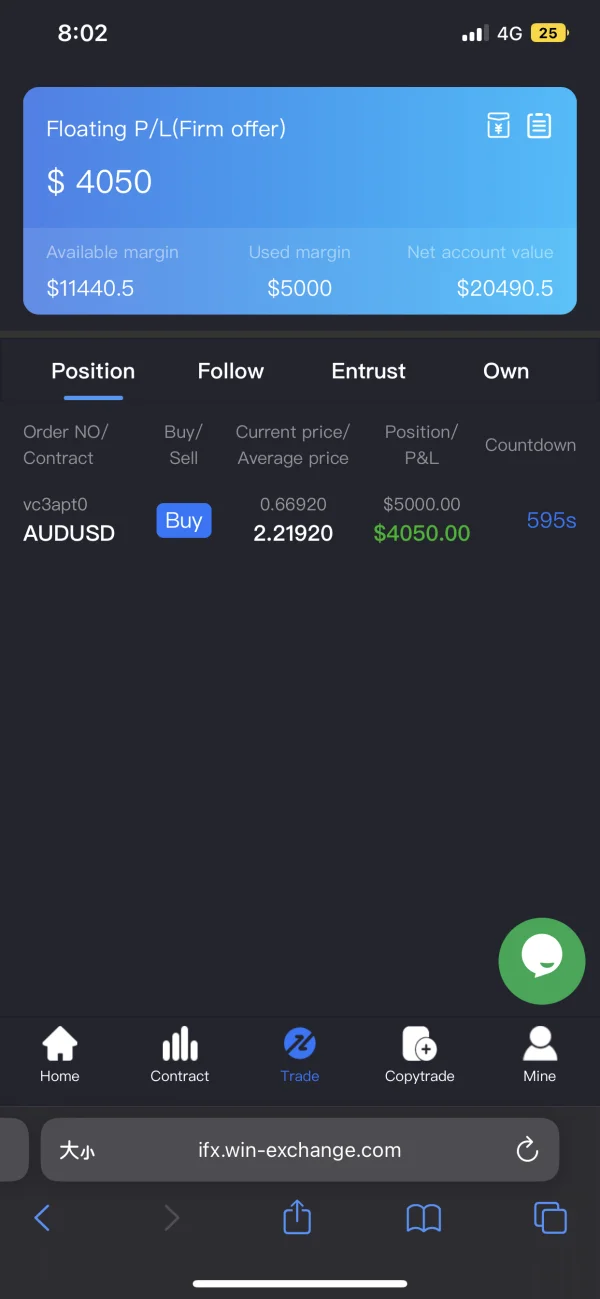

Panloloko, gusto ng boss na magbayad ka ng komisyon, processing fee, margin, ncome tax at unfreezing fee. Walang katapusang bayad

Paglalahad

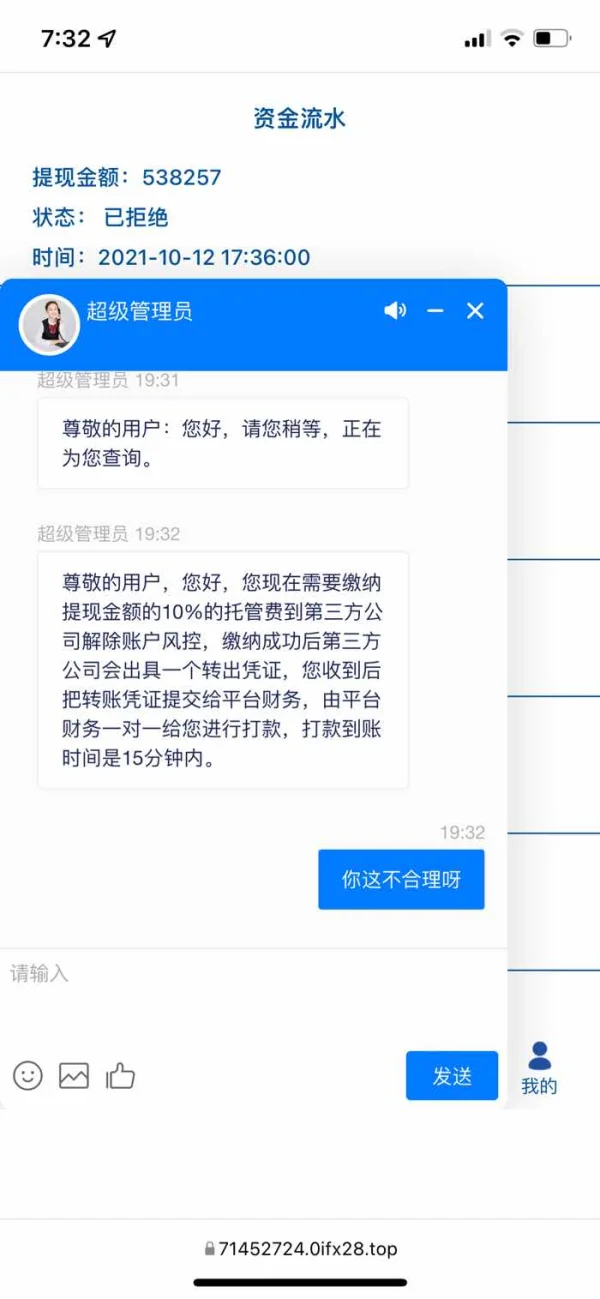

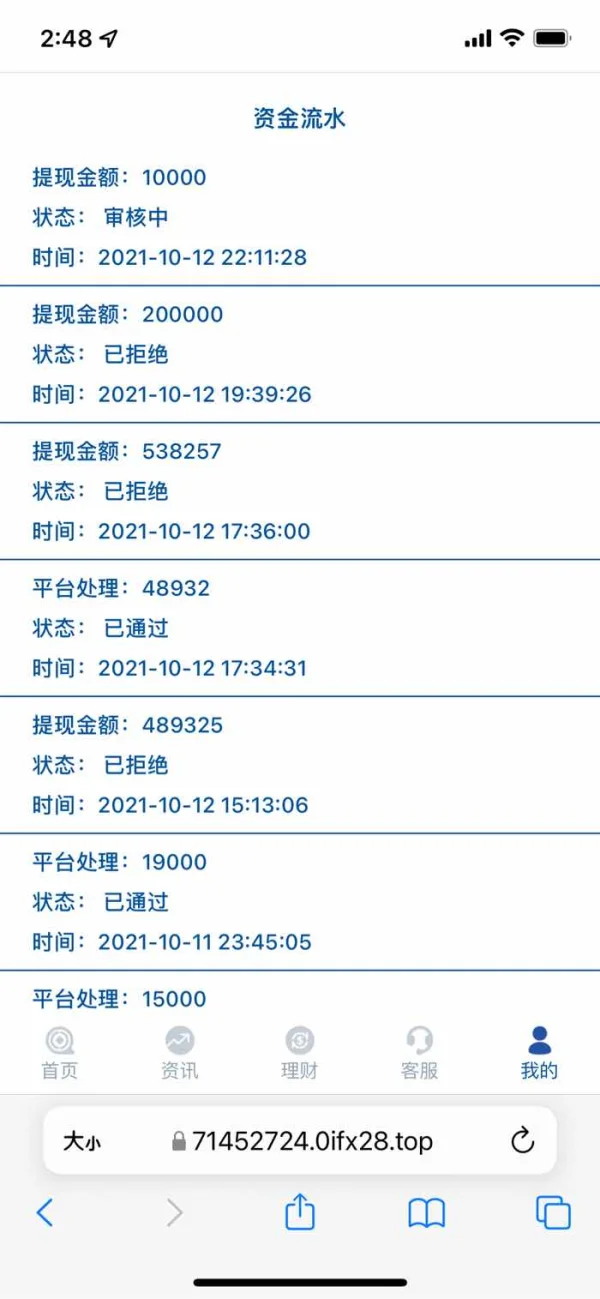

生死劫

Hong Kong

Oo, nagkaroon ako ng magandang karanasan sa mga pagbabayad sa IFX. Si Sunny ay lubos na nakatulong at sinubukan ang kanyang makakaya upang mahanap ako ng pinakamahusay na halaga ng palitan. Mahusay na serbisyo at salamat.

Positibo

༺蜜糖༻

Hong Kong

Hindi makaatras. Sinabi nito sa akin na magdeposito para sa maraming mga kadahilanan. Ito ba ay isang pandaraya?

Paglalahad

FX4234736427

Hong Kong

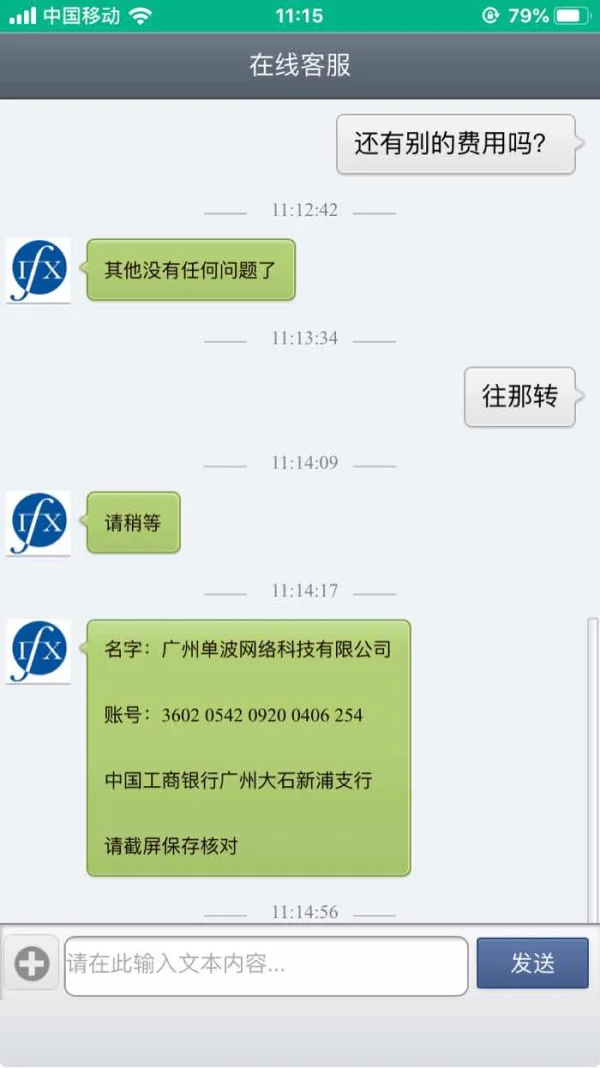

诈骗你入金各种理由以及借口让你交保证金风险金,其次说是系统维护修补漏洞,最后无法联系逃跑

Paglalahad

随风29414

Hong Kong

无法出金,还要继续充值解冻,直接就是骗子。

Paglalahad

Red Star

Hong Kong

IFX markets Inc 是黑平台,提现时说我初始信息有误,需交百分之二十的保证金,交了后说还要再交各种理由的费用,无法出金,纯黑诈骗平台。望监管部门能够重视,能够挽回老百姓损失的血汗钱。

Paglalahad