Abstract:Choosing a broker is an important first step when you start trading. Many people look at well-known companies like MultiBank Group. But is it the right choice for your trading style and how much risk you want to take? This review will help answer that question. We will look past the marketing promises to give you a complete and fair analysis of the main things that matter most to traders: safety, costs, and technology. Our goal is to break down the key points you need to know, helping you make a smart decision. This is not just another basic overview; it's a detailed look from a trader's point of view.

Choosing a broker is an important first step when you start trading. Many people look at well-known companies like MultiBank Group. But is it the right choice for your trading style and how much risk you want to take? This review will help answer that question. We will look past the marketing promises to give you a complete and fair analysis of the main things that matter most to traders: safety, costs, and technology. Our goal is to break down the key points you need to know, helping you make a smart decision. This is not just another basic overview; it's a detailed look from a trader's point of view.

What We'll Cover:

· Trust and Regulation: Is your money safe?

· Fees and Spreads: What are the real trading costs?

· Trading Platforms: How good is the user experience?

· Account Types and Tradable Assets.

· A practical walkthrough of the client journey.

· Our final verdict and who this broker is best for.

Quick Verdict: At a Glance

For traders who need a quick summary before reading all the details, this table shows the main strengths and weaknesses of MultiBank Group. It's a balanced view to help you quickly see if this broker matches what you're looking for.

Regulation and Trust

When you give a broker your money, regulation is not just a small detail; it's the foundation of your security. We found MultiBank Group to be in a strong position here, working as a multi-regulated global company. This is an important sign of trustworthiness, as it means the broker must follow strict rules across multiple international areas.

A Multi-Regulated Broker

A broker that is willing to be watched by several respected authorities shows a commitment to being transparent and operating with integrity. MultiBank Group is regulated by some of the world's most respected financial organizations.

· ASIC (Australia): The Australian Securities and Investments Commission is a top-level regulator known for its strict requirements. MultiBank Group's entity MEX Australia Pty Ltd is authorized.

· BaFin (Germany): The Federal Financial Supervisory Authority makes sure companies follow the strict financial laws of Germany and the European Union.

· CIMA (Cayman Islands): The Cayman Islands Monetary Authority provides a strong regulatory framework for international finance. MultiBank FX International Corporation is licensed by CIMA.

· Other Regulators: The group also holds licenses from other authorities like the FSC (British Virgin Islands) and AUSTRAC (Australia), further strengthening its global compliance footprint.

Client Fund Security

Beyond licensing, we looked at the practical steps in place to protect client funds. MultiBank Group uses two important protocols that are standard practice for top-level brokers.

First is the use of segregated accounts. This means that client funds are kept in accounts separate from the company's operating funds. In the unlikely event of the broker facing financial problems, your money is not considered part of its assets and stays protected.

Second is the provision of negative balance protection. This is an important safety net for traders, especially in volatile markets. It makes sure that you cannot lose more money than the amount you have put in your account. Your account balance will not go into a negative value, protecting you from unexpected debt.

Breaking Down Costs: Fees and Spreads

A broker's fee structure directly affects your profits. We did a detailed analysis of all costs associated with MultiBank Group, from trading fees like spreads and commissions to non-trading fees that can often be overlooked. Understanding these costs is essential for accurate trade planning and comparison with other brokers.

Trading Fees: Spreads and Commissions

MultiBank Group offers different account levels, allowing traders to choose a cost model that best fits their trading volume and style. The main trading costs are built into the MultiBank Group trading spreads and, on some accounts, a fixed commission.

A spread-only account, like the Standard, is simpler for beginners as the cost is built directly into the buy and sell price. A commission-based account, like the ECN, offers raw, institutional-grade spreads (often starting from 0.0 pips) but charges a fixed commission per trade. This model is typically more cost-effective for high-volume traders and scalpers. The Pro account sits in the middle, offering lower spreads than the Standard account with zero commission.

To provide a clear comparison, we looked at the costs across the main account types.

Non-Trading Fees to Know

It's important to look beyond the spreads. Non-trading fees can add up and affect your bottom line.

· Withdrawal Fees: MultiBank Group does not charge fees for most deposit methods. However, withdrawal fees can apply depending on the method used. For example, bank wire transfers may have a fee, while some e-wallet options might be free. It is important to check the specific fee for your chosen method in the client portal.

· Inactivity Fees: An inactivity fee is a common industry practice. If an account stays dormant (no trading activity) for a period of 90 days, a fee may be charged. We found this fee to be around $60 per quarter, so traders should be aware of this if they plan to take long breaks from trading.

· Deposit Fees: In our review, we found that MultiBank Group generally does not charge fees for putting funds into your account, which is a positive aspect of their service.

Trading Platforms: MT4 and MT5

The trading platform is your main tool for interacting with the market. MultiBank Group has chosen to focus only on the MetaTrader suite, offering the globally recognized MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. This decision provides traders with strong, familiar, and powerful technology.

The Power of MultiBank Group MT4

The MultiBank Group MT4 platform remains the industry standard for a reason. It strikes a perfect balance between a user-friendly interface and advanced functionality, making it suitable for both new and experienced traders. Our experience with the platform was smooth. The terminal felt stable, and order execution was quick, which is important during fast-moving market conditions.

Key Features:

· Advanced Charting: The platform offers powerful charting tools with multiple timeframes and drawing objects to perform detailed technical analysis.

· Technical Indicators: It comes pre-loaded with dozens of the most popular technical indicators, and thousands more are available for download from the community marketplace.

· Expert Advisors (EAs): A standout feature of MT4 is its strong support for automated trading through EAs. Traders can use their own algorithms or use third-party robots to execute trades 24/5.

· One-Click Trading: This function allows for quick trade execution directly from the chart, an important feature for scalpers and news traders.

Upgrading to MT5

For traders seeking more advanced tools, MultiBank Group also provides MT5. While it maintains the familiar feel of its predecessor, MT5 introduces several key upgrades. It offers more timeframes, a greater number of built-in technical indicators, a built-in economic calendar, and an improved strategy tester for EAs. It is the logical next step for traders who find they have outgrown the capabilities of MT4.

Mobile and Web Trading

In today's market, access on the go is essential. The MT4 and MT5 mobile apps for iOS and Android are fully featured, allowing you to manage your account, analyze charts, and place trades from anywhere. For those who cannot install software or prefer a simpler approach, the WebTrader platform provides full functionality directly from any modern web browser, offering flexibility without compromise.

> Ready to experience the power of the industry-standard MT4 platform, enhanced by MultiBank Group's execution? You can open a free demo account to explore all the features risk-free.

Accounts and Instruments

MultiBank Group provides a structured range of account types designed to cater to different levels of trader experience and capital. Paired with this is a broad selection of tradable instruments, giving clients access to a diverse set of global markets from a single platform.

Choosing the Right Account

Selecting the correct account is key to optimizing your trading costs and experience.

· Standard Account: This account is perfect for beginners. With a reasonable minimum deposit and a spread-only cost structure, it removes the complexity of commission calculations, allowing new traders to focus on their strategy.

· Pro Account: Aimed at more experienced traders, the Pro account is a balanced, all-around option. It offers significantly lower spreads than the Standard account while remaining commission-free, making it a competitive choice for consistent traders.

· ECN Account: This is the premium offering for professionals, scalpers, and algorithmic traders. It provides direct access to interbank pricing with raw spreads starting from 0.0 pips. The cost is a transparent, fixed commission per trade, which is highly cost-effective for high-volume strategies.

What You Can Trade

MultiBank Group offers a comprehensive portfolio of CFD instruments across several asset classes. This allows for significant diversification and the ability to trade on various market events.

· Forex: An extensive list including all Major, Minor, and a wide range of Exotic currency pairs.

· Metals: Trade precious metals like Gold (XAU/USD) and Silver (XAG/USD) against the US Dollar.

· Indices: Access major global stock indices such as the S&P 500, NASDAQ 100, FTSE 100, and DAX 40.

· Shares: Trade CFDs on a selection of popular stocks from major US and European exchanges.

· Commodities: Speculate on the price of key commodities like Crude Oil (WTI, Brent) and Natural Gas.

· Cryptocurrencies: Gain exposure to the crypto market by trading CFDs on leading digital assets like Bitcoin and Ethereum.

A Practical Walkthrough

A review is incomplete without understanding the real-world client experience. We went through the entire process, from opening an account to placing our first trade, to give you a clear, step-by-step picture of what to expect. The process was logical and efficient.

Step-by-Step Guide

1. Registration: The initial sign-up is a straightforward digital form on their website. It requires basic personal information like your name, email, and country of residence. This took only a few minutes to complete.

2. Verification (KYC): After registration, you enter the secure client portal to complete the Know Your Customer (KYC) process. This is a mandatory regulatory step. We were prompted to upload a proof of identity (like a passport or driver's license) and a proof of address (like a recent utility bill or bank statement). Our documents were reviewed and the account was verified in under 24 hours.

3. Funding Your Account: Once verified, funding the account was simple. The client portal presented several deposit options, including bank wire, credit/debit cards, and various e-wallets. We chose to deposit via credit card, and the funds were reflected in our trading account almost instantly.

4. Placing Your First Trade: We downloaded the MultiBank Group MT4 terminal using the link provided in the client portal. After logging in with our new credentials, we located the EUR/USD pair in the 'Market Watch' window. We right-clicked on it, selected 'New Order', set our desired volume (lot size), and executed a market 'Buy' order. The trade appeared in the 'Terminal' window at the bottom of the screen immediately.

> As we've shown, the process is straightforward. If you're ready to get started and follow along, you can begin the secure application process on their official site.

Final Verdict and Recommendation

After a thorough examination of MultiBank Group's regulation, fees, platforms, and client journey, we can draw a clear conclusion. The broker stands out for its strong regulatory framework, offering a high degree of security and trust. Its tiered account structure provides genuine value, especially for high-volume traders who can leverage the tight MultiBank Group trading spreads on the ECN account. The exclusive focus on the MetaTrader suite ensures a stable and powerful trading experience.

The main drawbacks to consider are the potential for inactivity fees for dormant accounts and withdrawal fees on certain payment methods. These are not unusual in the industry but require awareness.

Our Recommendation

We find MultiBank Group to be a strong and reliable contender in the crowded broker space. It is particularly well-suited for:

· Traders who prioritize regulatory security and fund safety above all else.

· High-volume traders, scalpers, and algorithmic traders who can maximize profitability with the ECN account's low-cost structure.

· Traders who are already skilled with or specifically want to use the industry-standard MT4 and MT5 platforms.

For individuals who fit this profile, MultiBank Group offers a compelling package of security, technology, and competitive pricing that is hard to overlook.

> For traders who fit this profile, MultiBank Group presents a compelling and reliable option. To see their latest account offerings and any available promotions, we recommend visiting their official website directly.

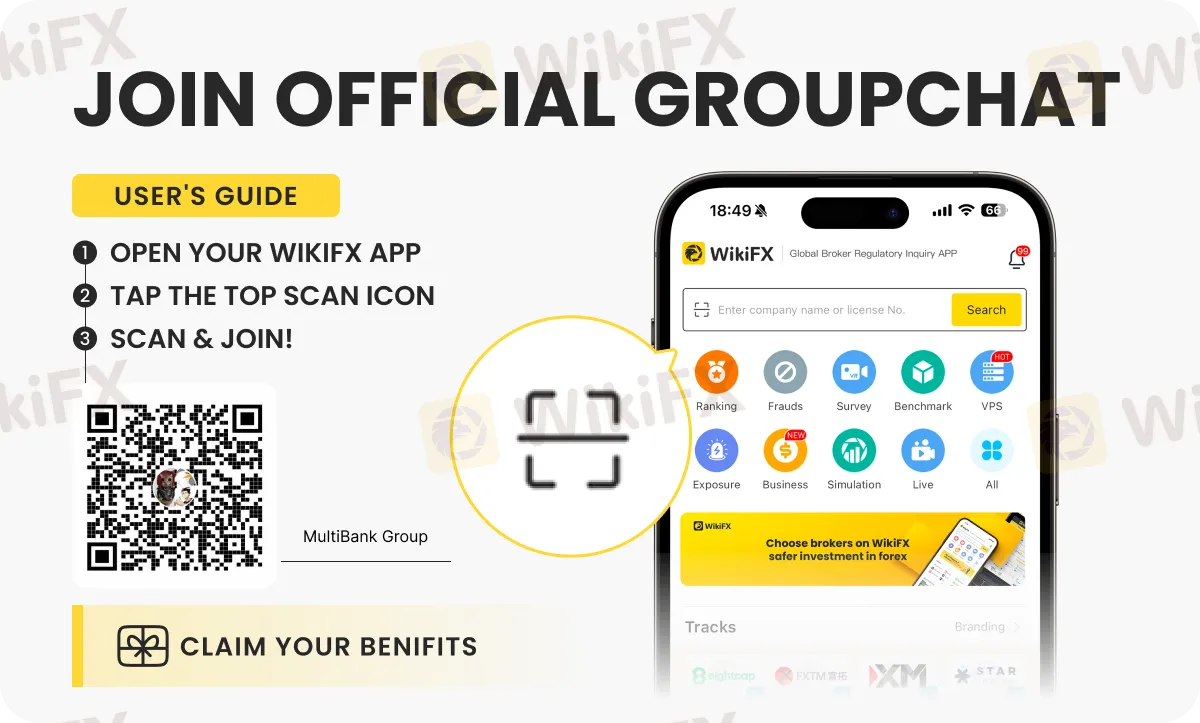

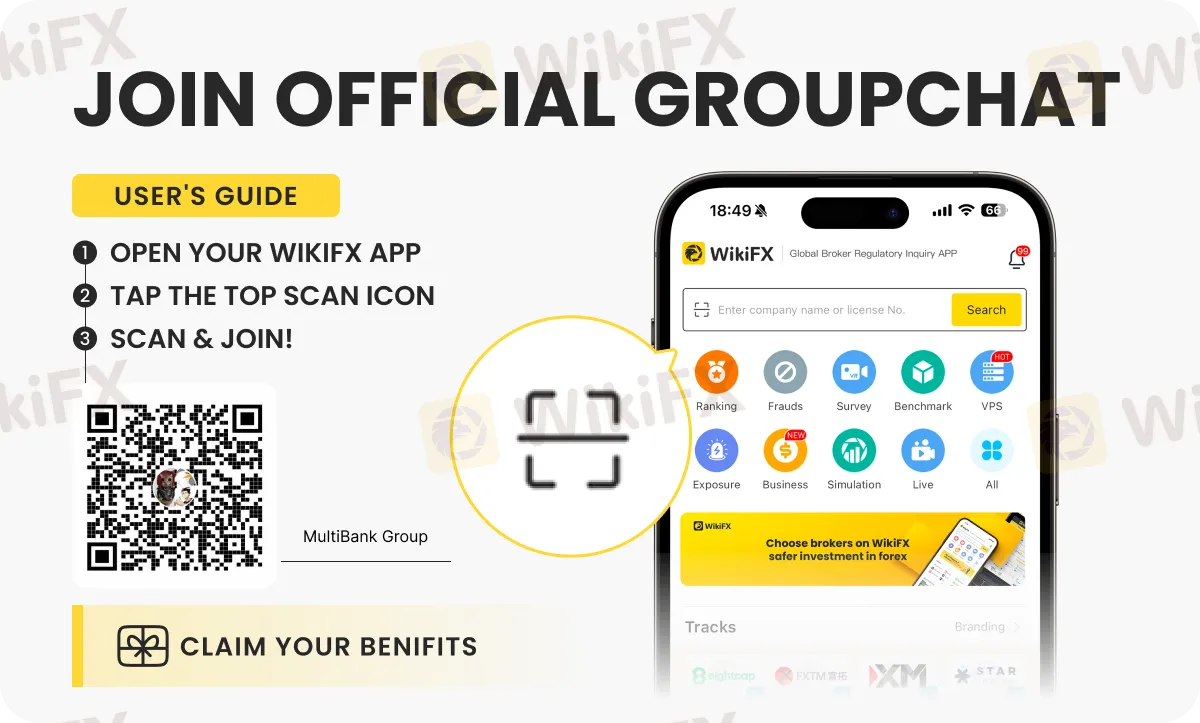

We have created an official MultibankGroup Broker community! Join it Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.