Company Summary

| Aspect | Information |

| Registered Country/Area | Hong Kong |

| Founded Year | Not specified, but the company is 2-5 years old |

| Company Name | MetaTrader 4 Global Limited |

| Regulation | Unregulated |

| Minimum Deposit | Varies depending on the broker (typically $100-$500+) |

| Maximum Leverage | Up to 1:500 |

| Spreads | Variable spreads starting from 0.5 pips |

| Trading Platforms | MetaTrader 4 for Windows |

| Tradable Assets | Forex, Commodities, Indices, Stocks, Cryptocurrencies |

| Account Types | Standard Account, Micro Account, ECN Account, Pro Account |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Email (service@usgmk.com) |

| Payment Methods | Bank wire transfers, credit/debit cards, online payment systems |

| Educational Tools | Not specified |

Overview of MetaTrader 4

MetaTrader 4 (mtr4.com) is an unregulated trading platform based in Hong Kong. It offers a variety of financial instruments, including forex, commodities, indices, stocks, and cryptocurrencies. However, the platform lacks valid regulation and has received numerous complaints regarding fund withdrawals and potential scams, so caution is advised.

Traders on MetaTrader 4 can access a wide range of market instruments. Forex trading includes major currency pairs like EUR/USD and exotic pairs such as USD/ZAR. Commodities such as gold (XAU/USD) and crude oil (WTI and Brent) are also available. Traders can speculate on the performance of global stock markets through indices like the S&P 500 and the FTSE 100. Additionally, individual stocks from various exchanges, including well-known companies like Apple Inc. and Microsoft Corporation, can be traded. Cryptocurrencies like Bitcoin and Ethereum are also supported.

The platform offers different account types to suit various trading preferences. These include the Standard Account, Micro Account, ECN Account, and Pro Account. Leverage options go up to 1:500, allowing traders to control larger positions with less capital. Spreads start from 0.5 pips, and the minimum deposit varies depending on the broker, typically ranging from $100 to $500 or more. Traders can deposit and withdraw funds using bank wire transfers, credit/debit cards, and online payment systems. However, it is important to exercise caution due to the platform's lack of regulation and the complaints raised by users.

Pros and Cons

MetaTrader 4 (MT4) offers a wide range of market instruments, including forex, commodities, indices, stocks, and cryptocurrencies, providing diverse trading opportunities. It provides different account types and leverage options up to 1:500, allowing for customization and potential profit amplification. With variable spreads from 0.5 pips. The platform has a user-friendly interface with robust features for market analysis and supports automated trading strategies through expert advisors (EAs). It is available on Windows and mobile devices (iOS and Android) for convenient trading. However, there are concerns about the lack of valid regulation and oversight, complaints regarding fund withdrawals and potential scams, limited customer support through email, lack of transparency, the current unavailability of the main website, frozen withdrawals, sudden currency changes, and a lack of educational resources and advanced trading tools.

| Pros | Cons |

| Wide selection of market instruments: forex, commodities, indices, stocks, and cryptocurrencies | Lack of valid regulation and oversight |

| Different account types to suit various trading preferences | Numerous complaints regarding fund withdrawals and potential scams |

| Leverage options up to 1:500 | Limited customer support through email |

| Variable spreads starting from 0.5 pips | Lack of transparency regarding operations |

| User-friendly interface with robust features for market analysis | Main website is currently down |

| Supports automated trading strategies through expert advisors (EAs) | Concerns about frozen withdrawals and sudden currency changes |

| Availability on Windows and mobile devices (iOS and Android) | Lack of educational resources and advanced trading tools |

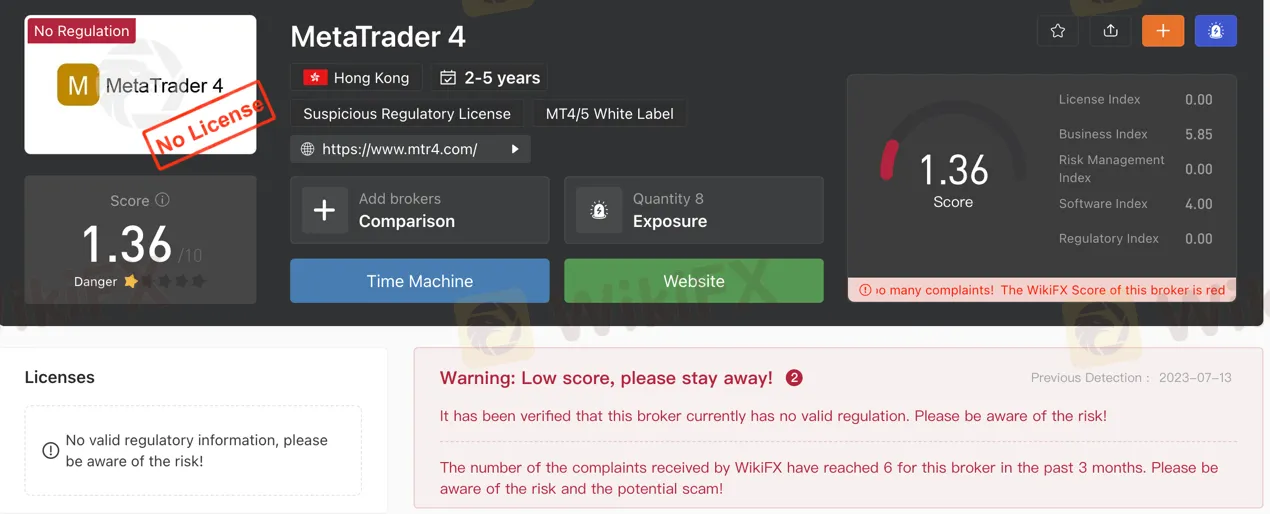

Is MetaTrader 4 Legit?

MetaTrader 4 (mtr4.com) is an unregulated platform, lacking valid regulation. This poses a risk for traders, as there is no oversight or protection provided by a regulatory authority. Additionally, the platform has received a significant number of complaints in the past three months, raising concerns about its legitimacy and potential for scams. Traders should exercise caution and be aware of the risks associated with using an unregulated platform like MetaTrader 4.

Market Instruments

FOREX: MetaTrader 4 provides a wide selection of currency pairs for forex trading. Traders can engage in the buying and selling of major pairs such as EUR/USD, GBP/USD, and USD/JPY. Additionally, they can trade cross pairs like EUR/GBP or exotic pairs such as USD/ZAR or AUD/CAD. The platform's forex instruments allow traders to speculate on the fluctuations in exchange rates and take advantage of global currency movements.

COMMODITIES: MetaTrader 4 enables traders to participate in the commodities market by offering various instruments. Users can trade precious metals like gold (XAU/USD) and silver (XAG/USD), as well as energy commodities such as crude oil (WTI and Brent). Additionally, agricultural commodities like corn, wheat, and soybeans can also be traded on the platform. These commodity instruments allow traders to diversify their portfolios and take positions based on supply and demand dynamics.

INDICES: MetaTrader 4 provides access to a wide range of global indices, allowing traders to speculate on the performance of different stock markets. Some of the popular indices available include the S&P 500, Dow Jones Industrial Average, Nasdaq Composite, FTSE 100, DAX 30, and Nikkei 225. Trading index instruments allows investors to take positions on the overall market performance, hedging against specific stocks or sectors.

STOCKS: MetaTrader 4 offers a selection of stocks from various global exchanges, allowing traders to invest in individual companies. Users can trade stocks of well-known companies like Apple Inc. (AAPL), Microsoft Corporation (MSFT), Amazon.com Inc. (AMZN), and Alphabet Inc. (GOOGL). Trading stock instruments provides an opportunity to benefit from the performance of specific companies and their underlying fundamentals.

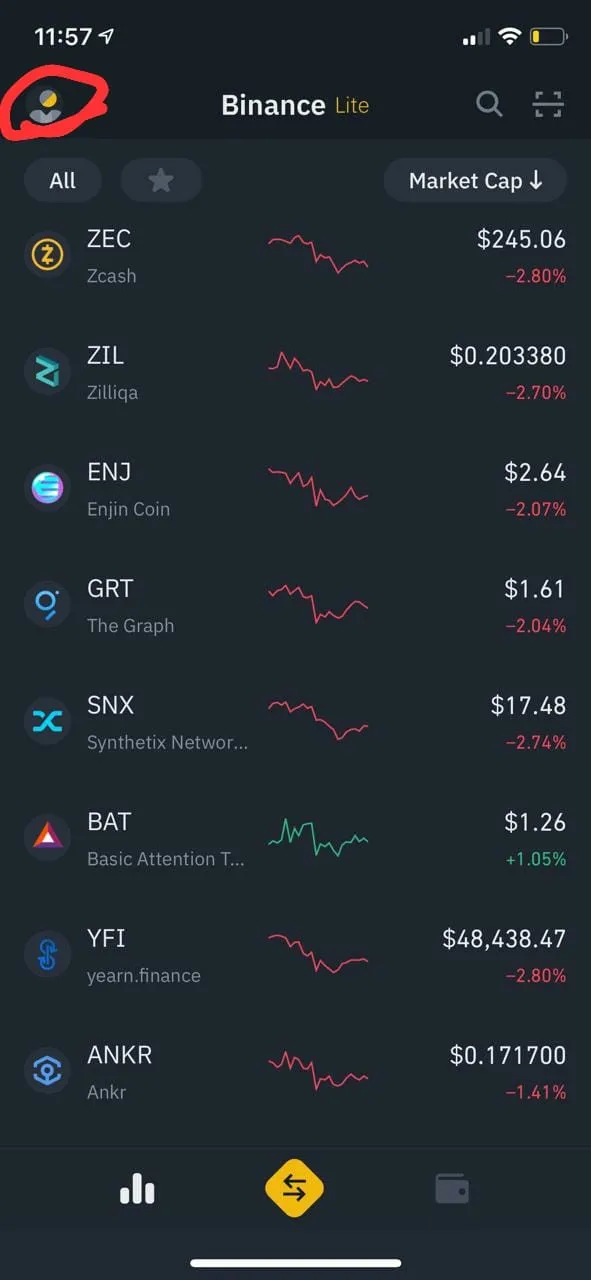

CRYPTOCURRENCIES: MetaTrader 4 enables trading of popular cryptocurrencies like Bitcoin (BTC/USD), Ethereum (ETH/USD), Ripple (XRP/USD), and Litecoin (LTC/USD). Traders can speculate on the price movements of these digital assets, taking advantage of their high volatility. The platform's cryptocurrency instruments cater to those interested in the emerging and rapidly evolving crypto market.

Pros and Cons

| Pros | Cons |

| Wide selection of currency pairs for forex trading | Lack of valid regulation and oversight |

| Access to various commodity instruments | Main website is currently down |

| Availability of global indices for trading | |

| Option to invest in individual stocks | |

| Trading popular cryptocurrencies |

Account Types

1. STANDARD ACCOUNT:

The Standard account on MetaTrader 4 is designed for traders who prefer a straightforward trading experience. It offers a standard spread and is suitable for both beginners and experienced traders. This account type does not require a minimum deposit and allows traders to access a wide range of financial instruments. For instance, traders can trade major currency pairs such as EUR/USD, GBP/USD, and USD/JPY.

2. MICRO ACCOUNT:

The Micro account is tailored for traders who prefer smaller trade sizes and lower risk exposure. It allows traders to trade with micro-lots, which are one-hundredth the size of a standard lot. This account type is suitable for novice traders who want to start with smaller investments. Traders can access multiple financial instruments and execute trades at a smaller scale, such as trading 0.01 lots of EUR/GBP or 0.05 lots of USD/CHF.

3. ECN ACCOUNT:

The ECN (Electronic Communication Network) account type provides direct access to liquidity providers and allows for faster execution and tighter spreads. It is suitable for experienced traders who require faster order execution and a transparent trading environment. Traders can access a wide range of financial instruments and benefit from low bid/ask prices. The ECN account offers features like depth of market (DOM) and allows for scalping and expert advisor (EA) trading strategies.

4. PRO ACCOUNT:

The Pro account is designed for professional traders who require advanced trading conditions and access to additional tools and features. It offers tighter spreads, lower commissions, and higher leverage options. Traders with larger trading volumes can benefit from reduced trading costs and enhanced trade execution speed. The Pro account is suitable for professional traders who implement complex trading strategies and require a higher level of control over their trades.

Pros and Cons

| Pros | Cons |

| Wide range of financial instruments available | Spreads can be wider than on other platforms |

| Suitable for both beginners and experienced traders | Minimum deposit requirements vary by broker |

| Access to a variety of trading tools and features | Customer support can be slow or unresponsive |

Leverage

MetaTrader 4 (mtr4.com) provides leverage options up to 1:500, allowing traders to control larger positions with a smaller amount of capital.

Spreads & Commissions

MetaTrader 4 (mtr4.com) offers variable spreads starting from 0.5 pips on major currency pairs like EUR/USD. The platform also charges commissions on specific accounts and instruments, with commissions ranging from $2 to $7 per lot.

Minimum Deposit

The minimum deposit required to start trading on MetaTrader 4 (mtr4.com) varies depending on the broker you choose. Generally, the minimum deposit can range from $100 to $500 or more.

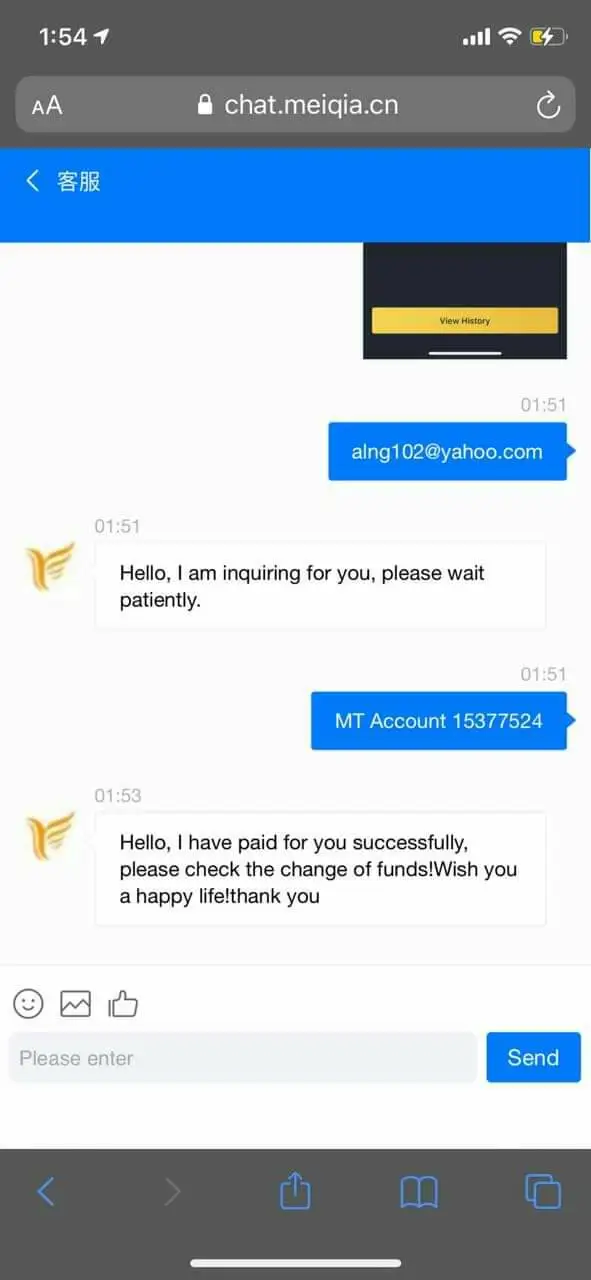

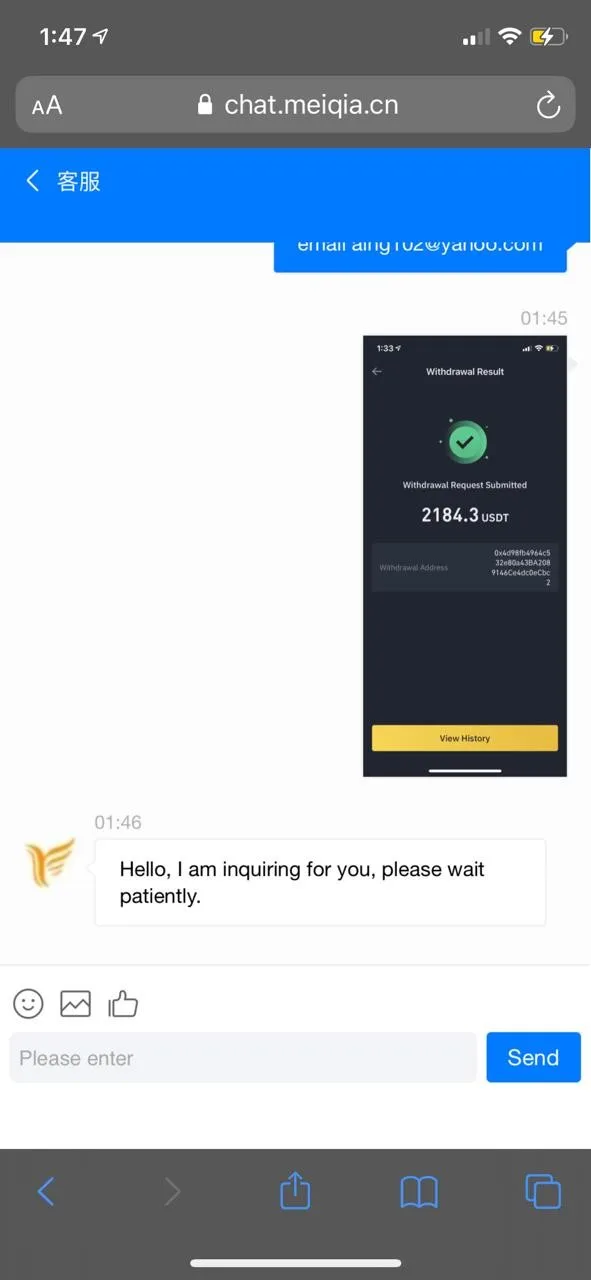

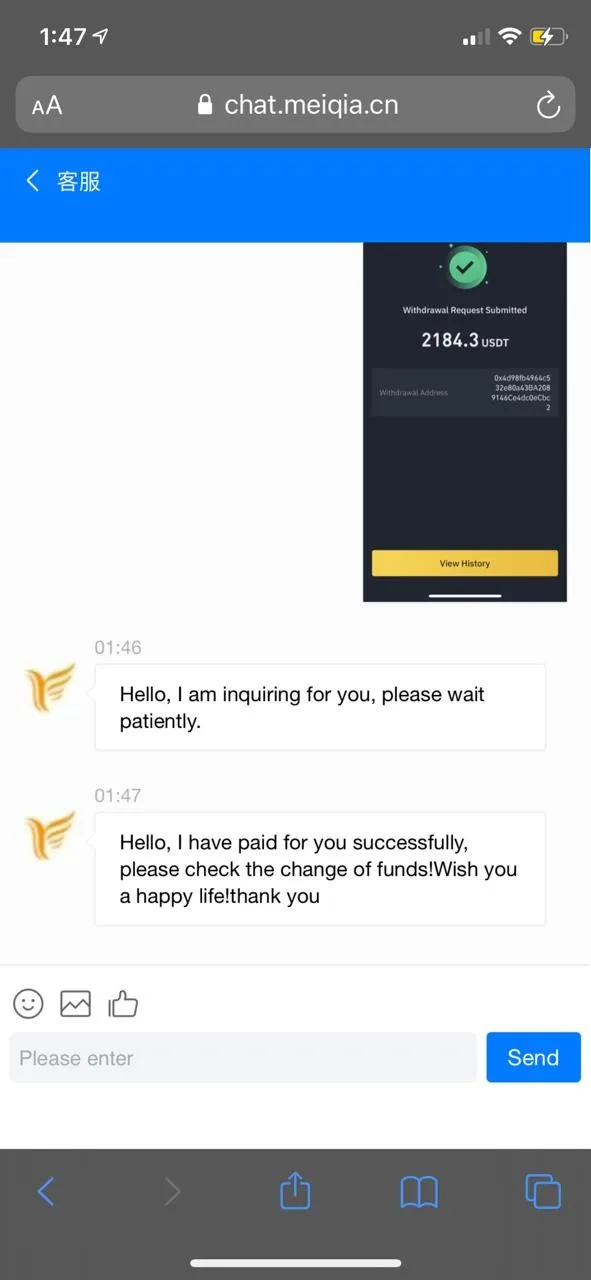

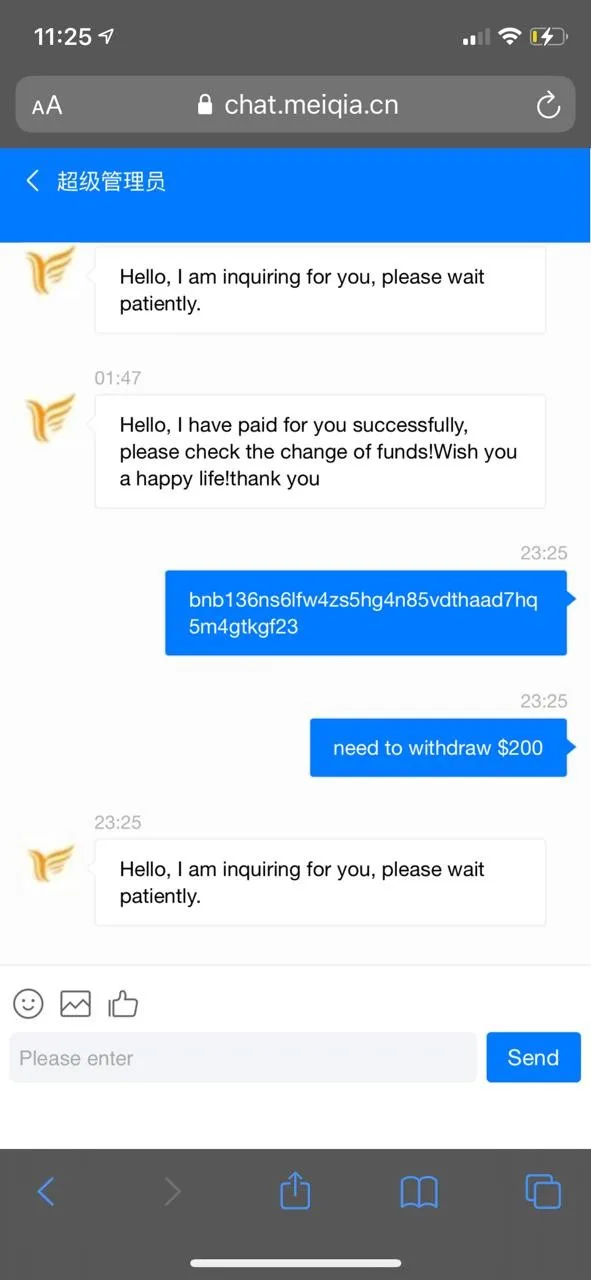

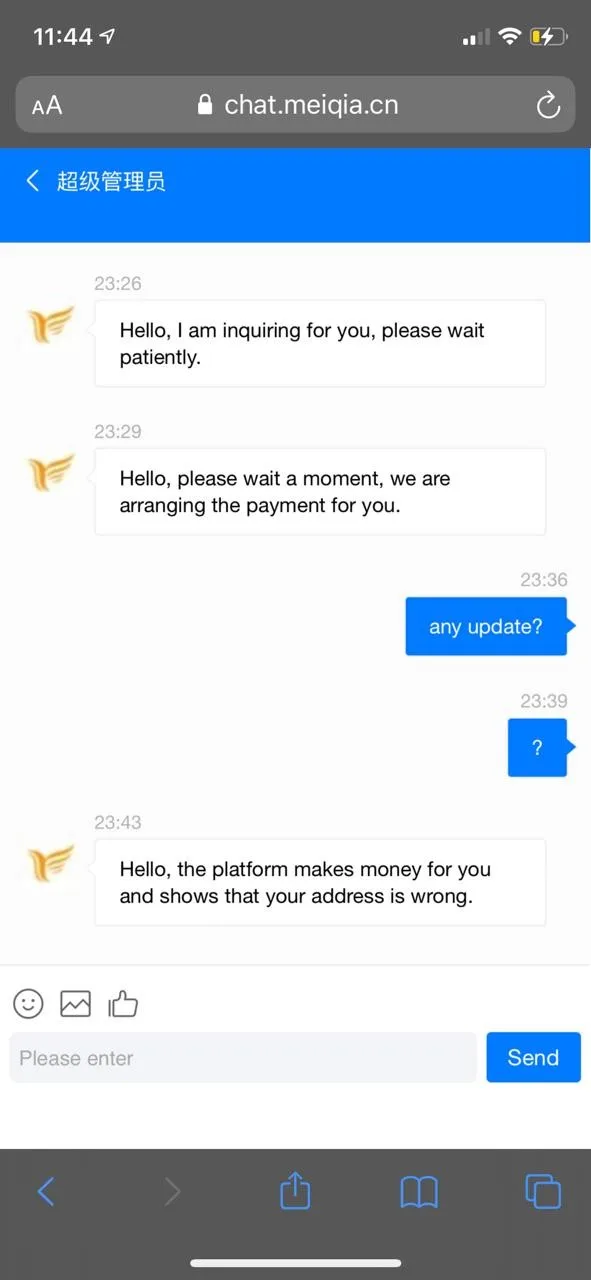

Deposit & Withdrawal

MetaTrader 4 (mtr4.com) supports various payment methods, including bank wire transfers, credit/debit cards, and online payment systems. The minimum deposit amount is $100, allowing traders to start trading with a relatively small investment. Withdrawals are processed promptly, typically within 1-3 business days, depending on the chosen withdrawal method.

Trading Platforms

MetaTrader 4 (mtr4.com) is a trading platform that offers Meta Trader 4 for Windows. This platform is widely used by traders for its robust features and user-friendly interface. It provides a comprehensive set of tools for market analysis, including charting tools and a wide range of technical indicators. Traders can execute different types of orders, such as market orders and pending orders, with order execution capabilities. Additionally, MetaTrader 4 supports automated trading strategies through the use of expert advisors (EAs), allowing traders to develop and implement their own custom trading algorithms. The platform is also available for mobile trading, enabling traders to access their trading accounts on iOS and Android devices. Overall, MetaTrader 4 (mtr4.com) is a popular trading platform for Windows users.

Pros and Cons

| Pros | Cons |

| User-friendly interface | No direct customer support |

| Wide range of features | Not great for high-frequency trading |

| Available for mobile trading | Charting package does not provide for a custom timeframe |

Customer Support

MetaTrader 4 (mtr4.com) provides customer support through email. Traders can reach out to the platform's customer support team by sending an email to service@usgmk.com.

Reviews

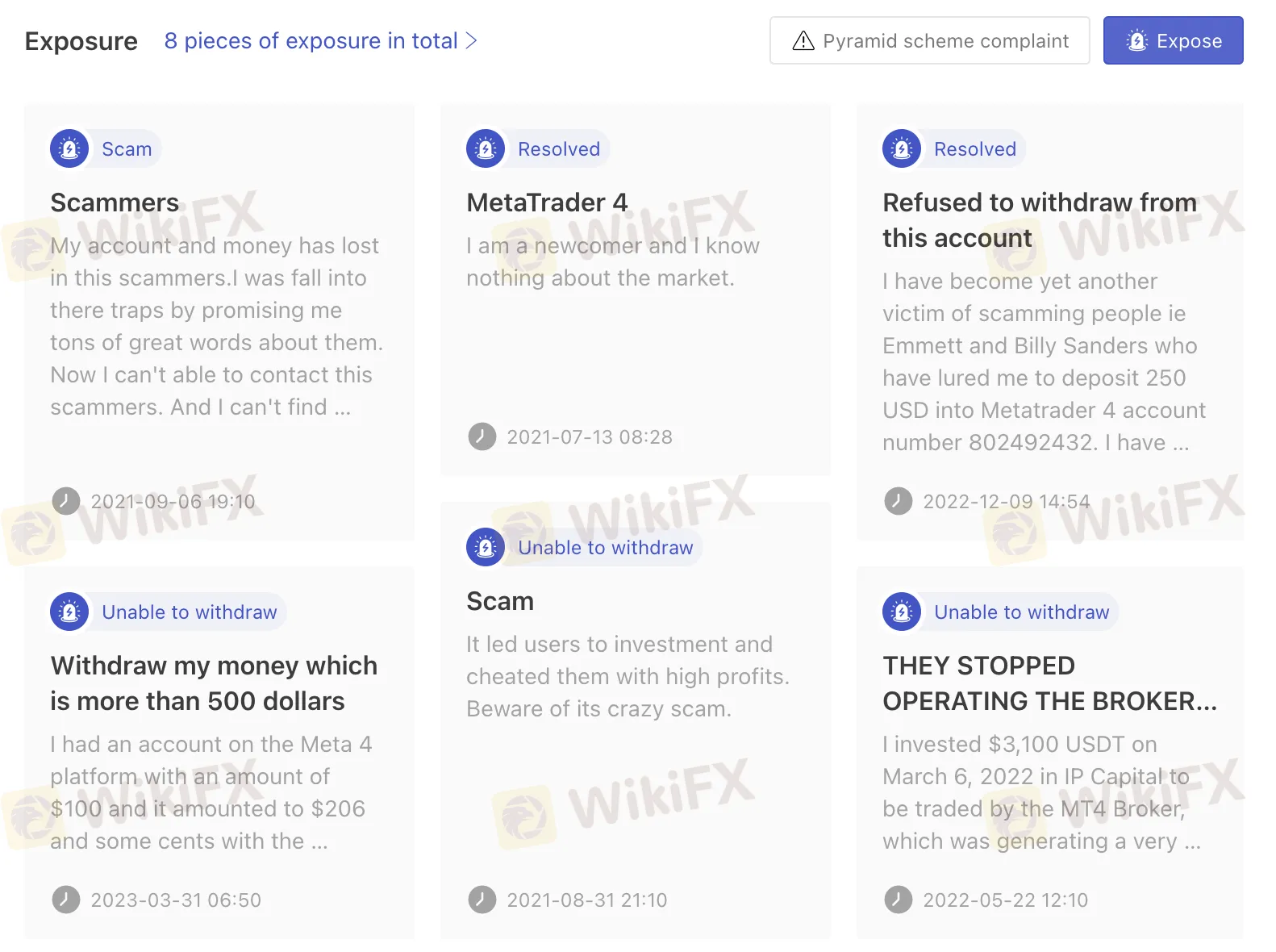

The reviews of MetaTrader 4 (mtr4.com) expose several concerns raised by users. One user mentioned being unable to withdraw their money, which amounted to over $500. Another user reported their account being suspended and disabled without prior notice and having difficulties in receiving their funds. There were also complaints about scams, where users had deposited funds but were unable to contact the platform or retrieve their money. Instances of sudden changes in currencies and freezing of withdrawals were mentioned as well. It is essential for users to exercise caution and be aware of potential risks when using this platform.

Conclusion

In conclusion, MetaTrader 4 (mtr4.com) is an unregulated trading platform that poses risks for traders due to the lack of valid regulation and oversight. The platform has received numerous complaints in recent months, raising concerns about its legitimacy and potential for scams. While MetaTrader 4 provides a wide range of market instruments such as forex, commodities, indices, stocks, and cryptocurrencies, traders should approach the platform with caution. The account types offered cater to different trader preferences, but it is important to note that the platform lacks transparency regarding its operations. MetaTrader 4 offers leverage options and spreads starting from 0.5 pips, but commissions and minimum deposit requirements vary depending on the chosen broker. The platform supports various payment methods for deposits and withdrawals, with prompt withdrawal processing. MetaTrader 4 is a widely used trading platform known for its robust features and user-friendly interface, supporting market analysis tools and automated trading strategies. However, customer support is limited to email, and there have been concerns raised by users regarding withdrawal issues, account suspensions, scams, and frozen withdrawals. Traders should carefully consider these factors and exercise caution when using MetaTrader 4.

FAQs

Q: Is MetaTrader 4 a regulated platform?

A: No, MetaTrader 4 is an unregulated platform, lacking valid regulation.

Q: What market instruments can I trade on MetaTrader 4?

A: MetaTrader 4 offers forex, commodities, indices, stocks, and cryptocurrencies for trading.

Q: What are the different account types on MetaTrader 4?

A: MetaTrader 4 provides Standard, Micro, ECN, and Pro account types.

Q: What leverage options does MetaTrader 4 offer?

A: MetaTrader 4 provides leverage options up to 1:500.

Q: What are the minimum deposit requirements for MetaTrader 4?

A: The minimum deposit varies depending on the broker, typically ranging from $100 to $500 or more.

Q: How can I deposit and withdraw funds on MetaTrader 4?

A: MetaTrader 4 supports various payment methods, including bank wire transfers, credit/debit cards, and online payment systems.

Q: What are the available trading platforms for MetaTrader 4?

A: MetaTrader 4 is available for Windows and mobile devices (iOS and Android).

Q: How can I contact customer support for MetaTrader 4?

A: Customer support for MetaTrader 4 can be reached via email at service@usgmk.com.

Q: What do reviews say about MetaTrader 4?

A: Reviews mention concerns about withdrawal issues, account suspensions, scams, sudden currency changes, and frozen withdrawals.

Q: What should I be aware of when using MetaTrader 4?

A: Users should exercise caution due to the platform's unregulated nature and the raised concerns in user reviews.

FX3739673730

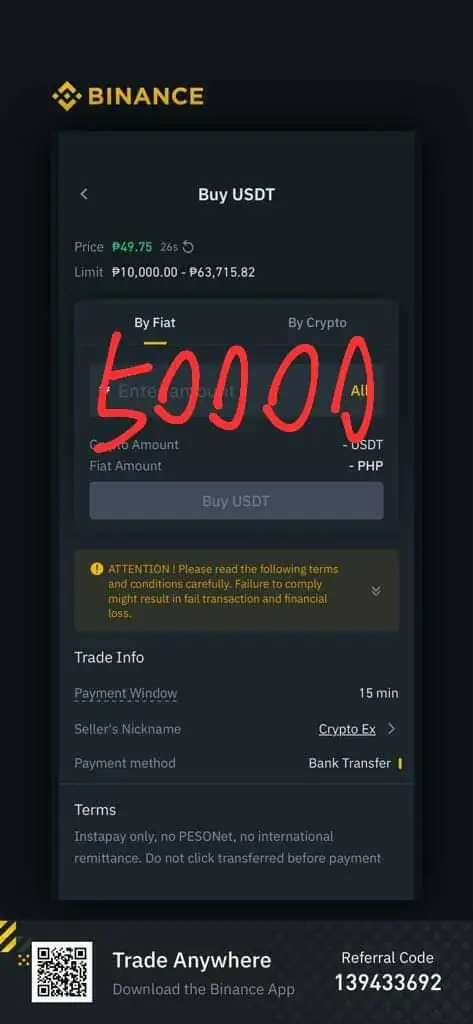

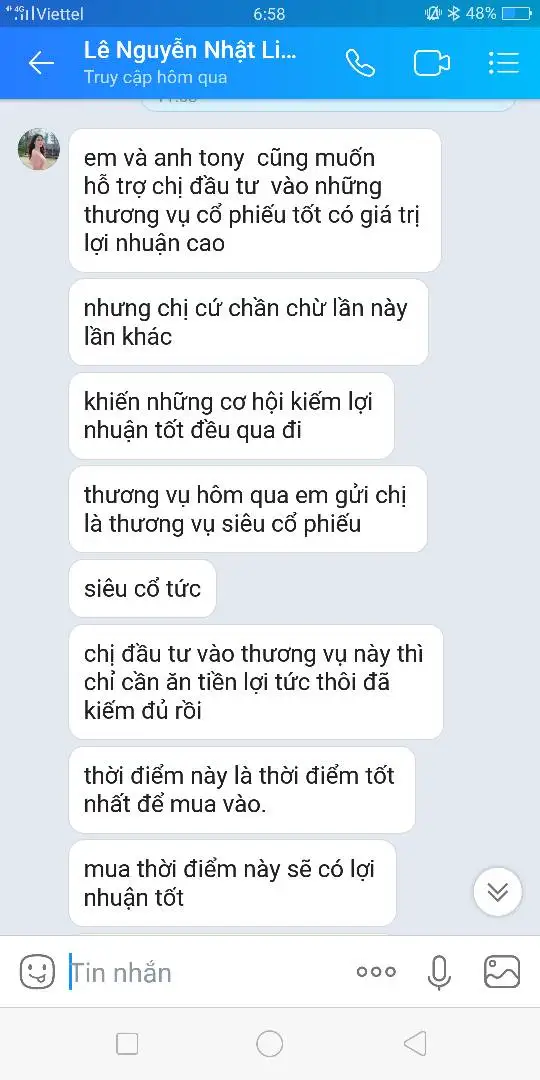

Philippines

I hope you can help me cuz I invested a lot of money here

Exposure

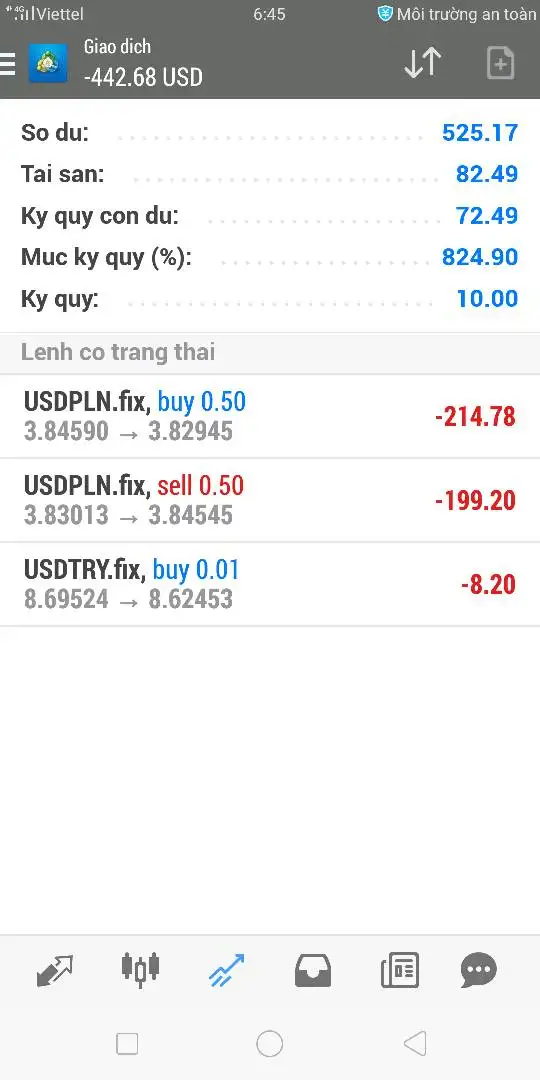

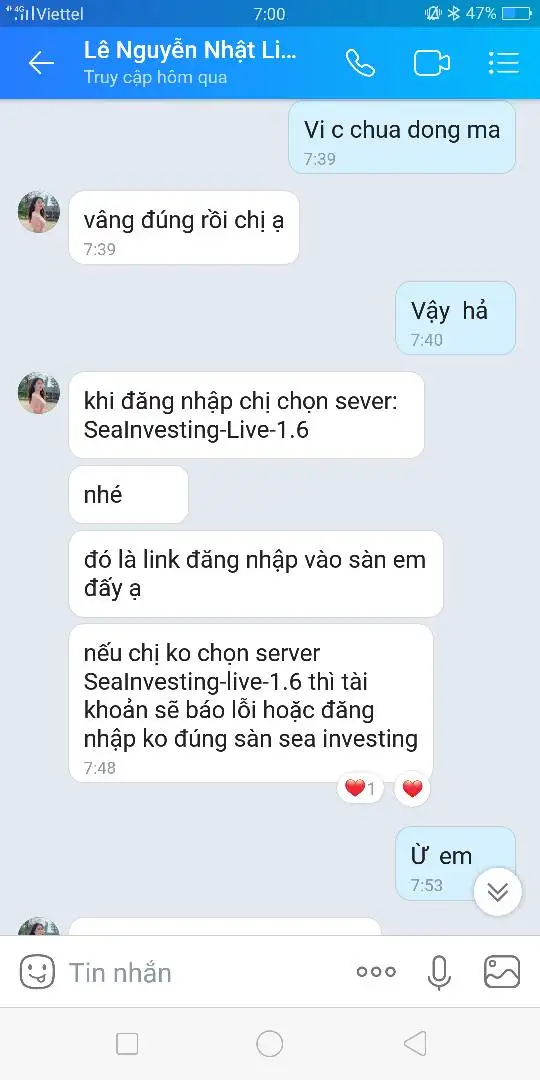

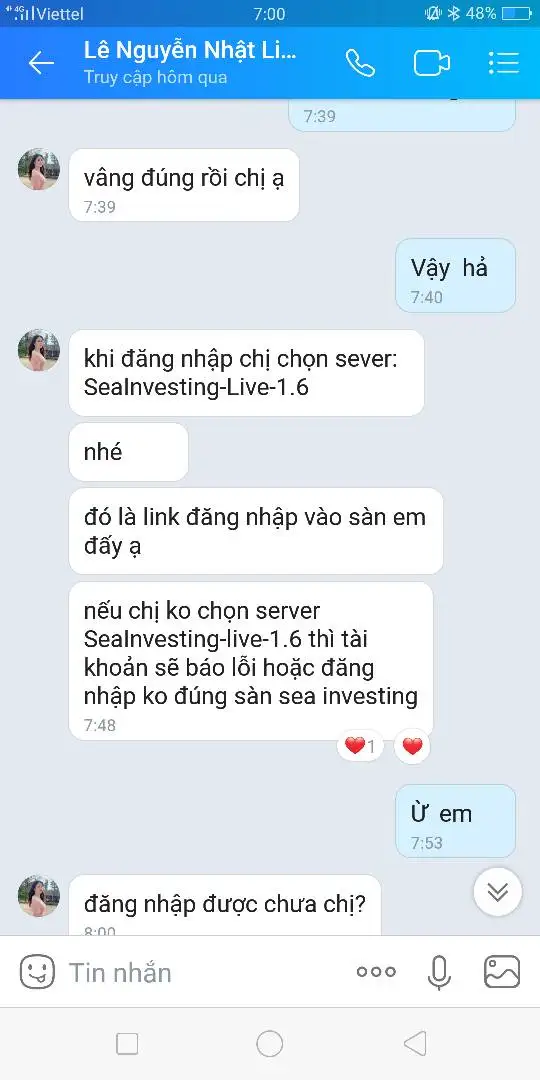

FX3940974930

Vietnam

I am a newcomer and I know nothing about the market.

Exposure

Rey

Philippines

It led users to investment and cheated them with high profits. Beware of its crazy scam.

Exposure

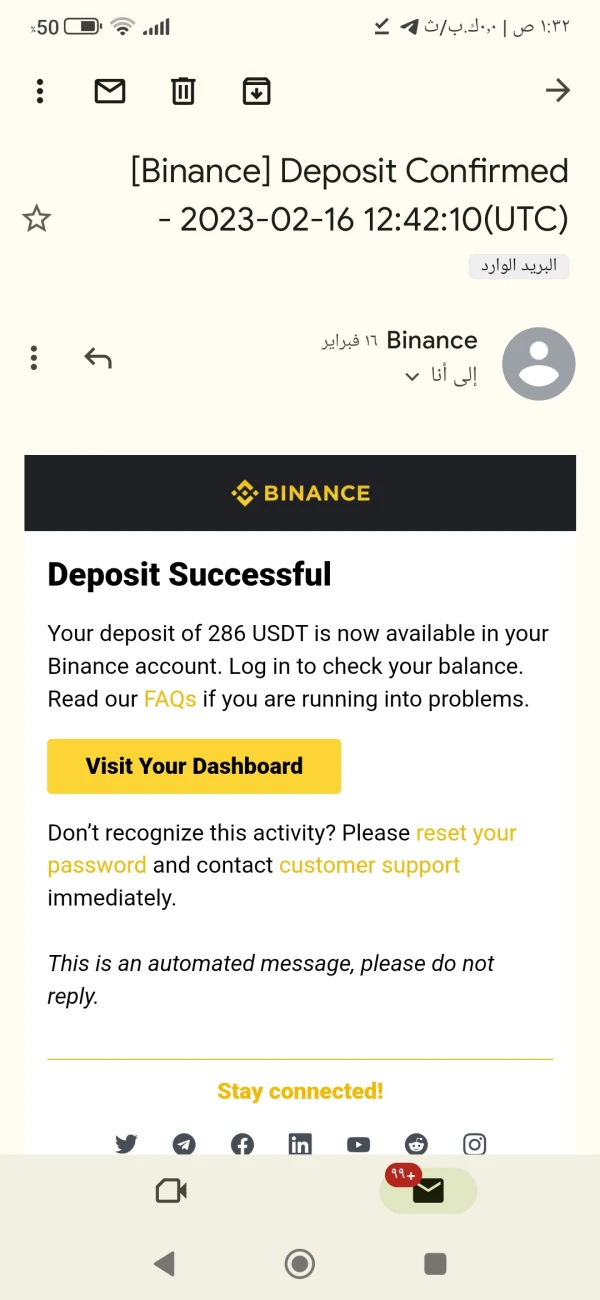

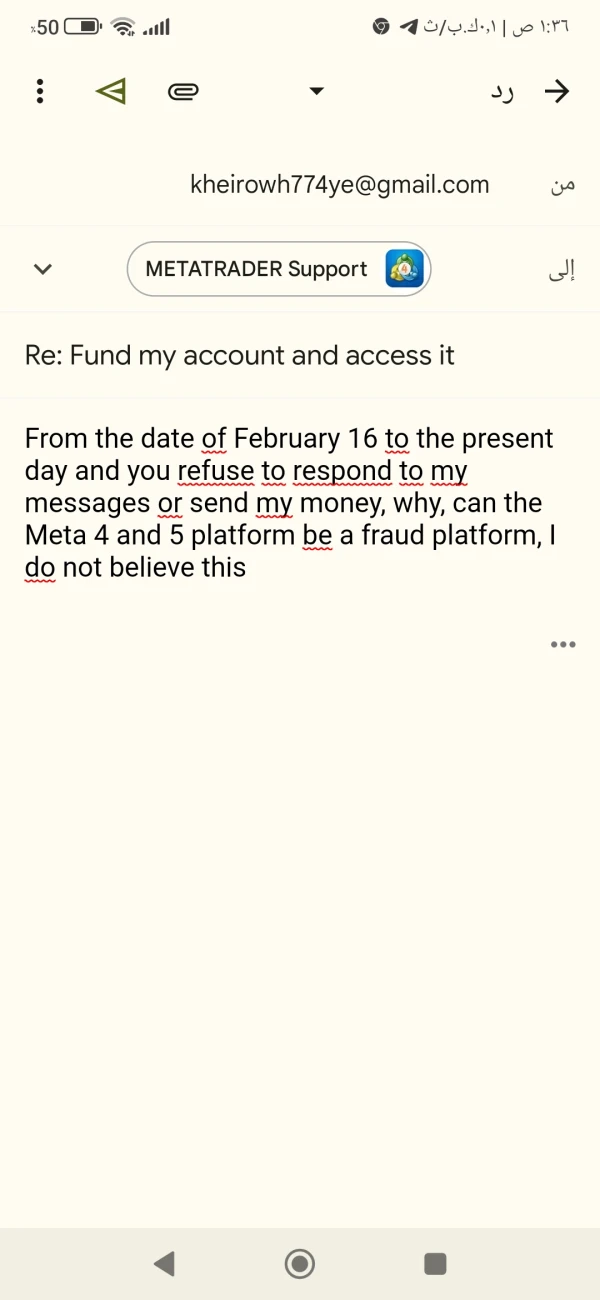

FX6017975182

Yemen

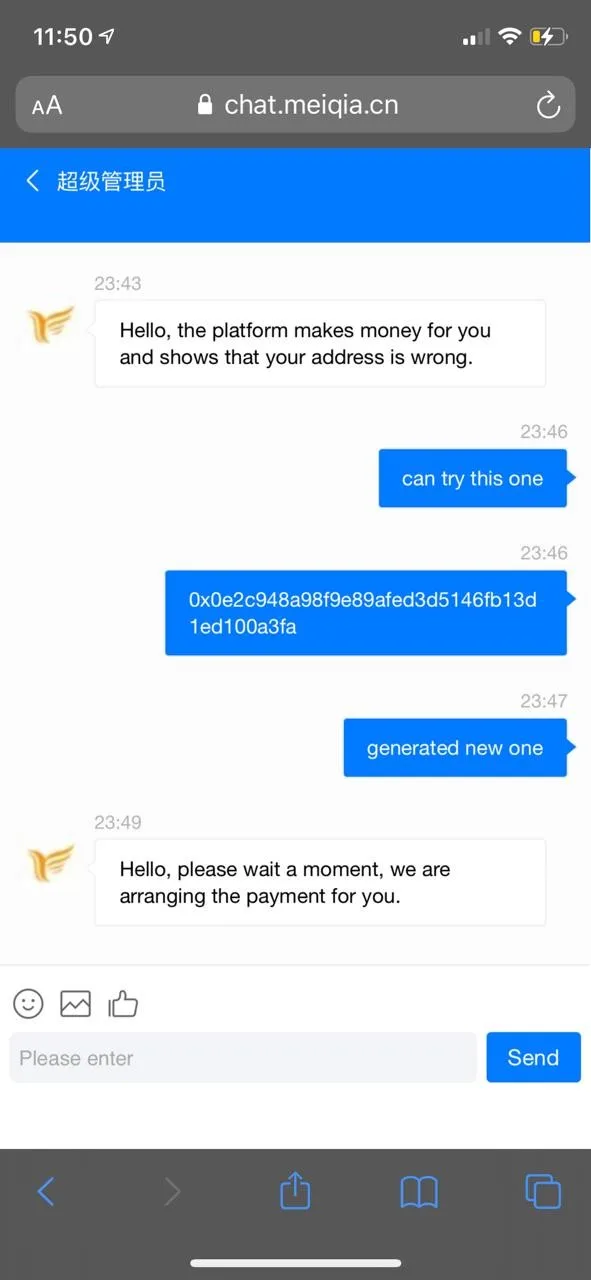

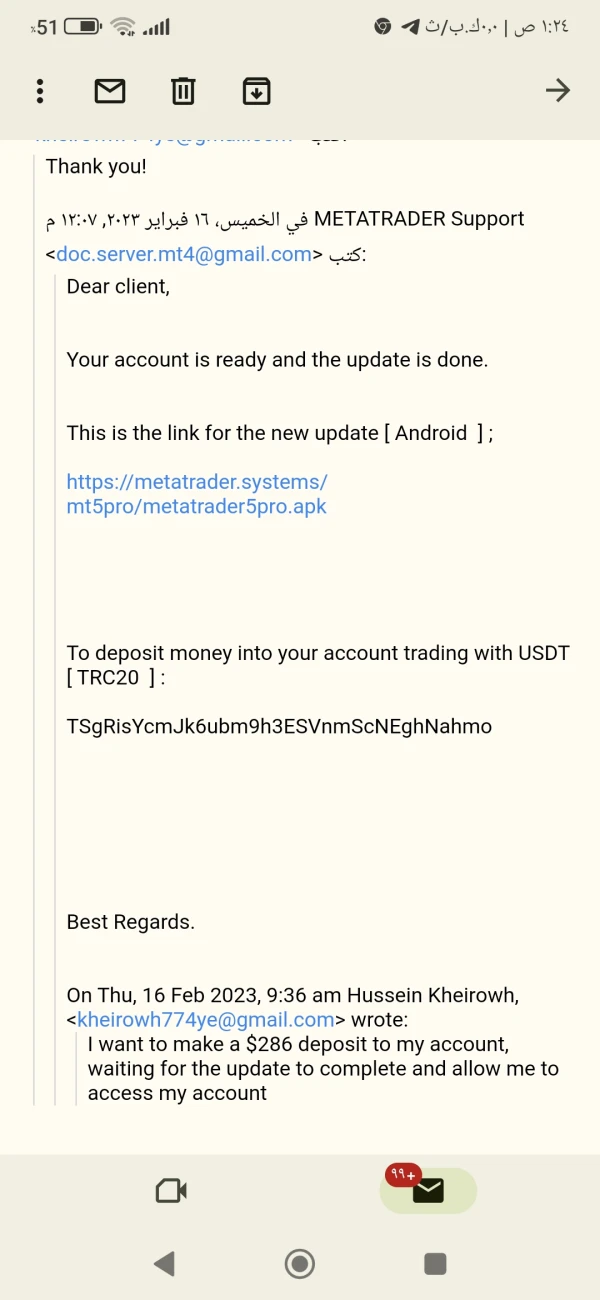

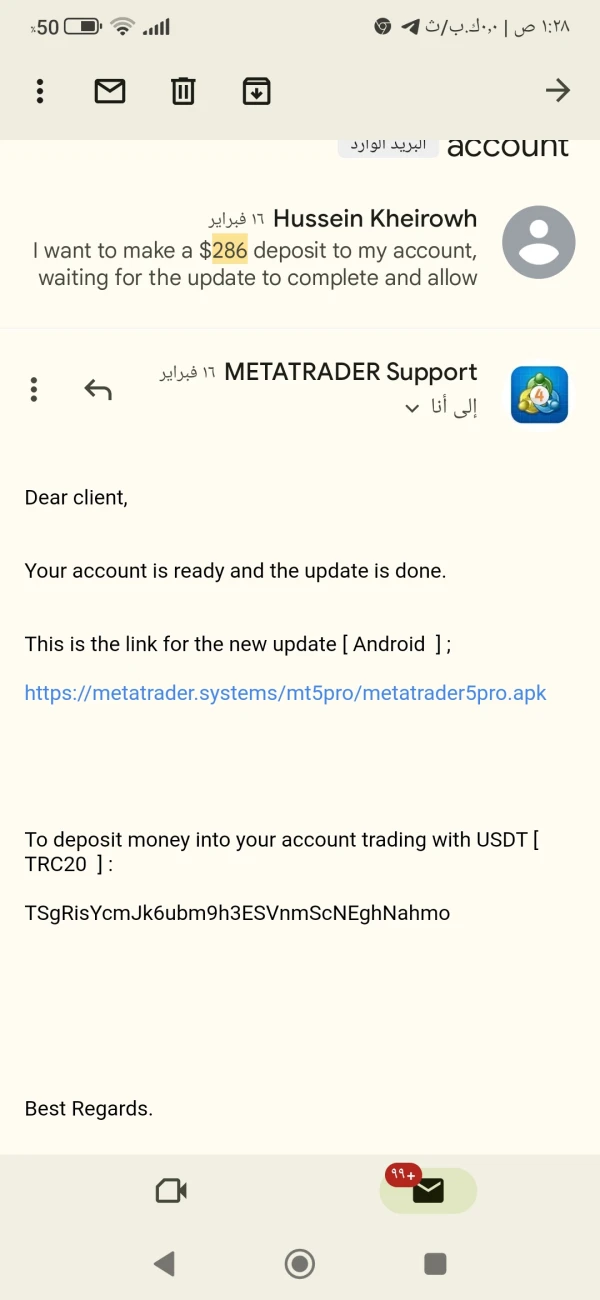

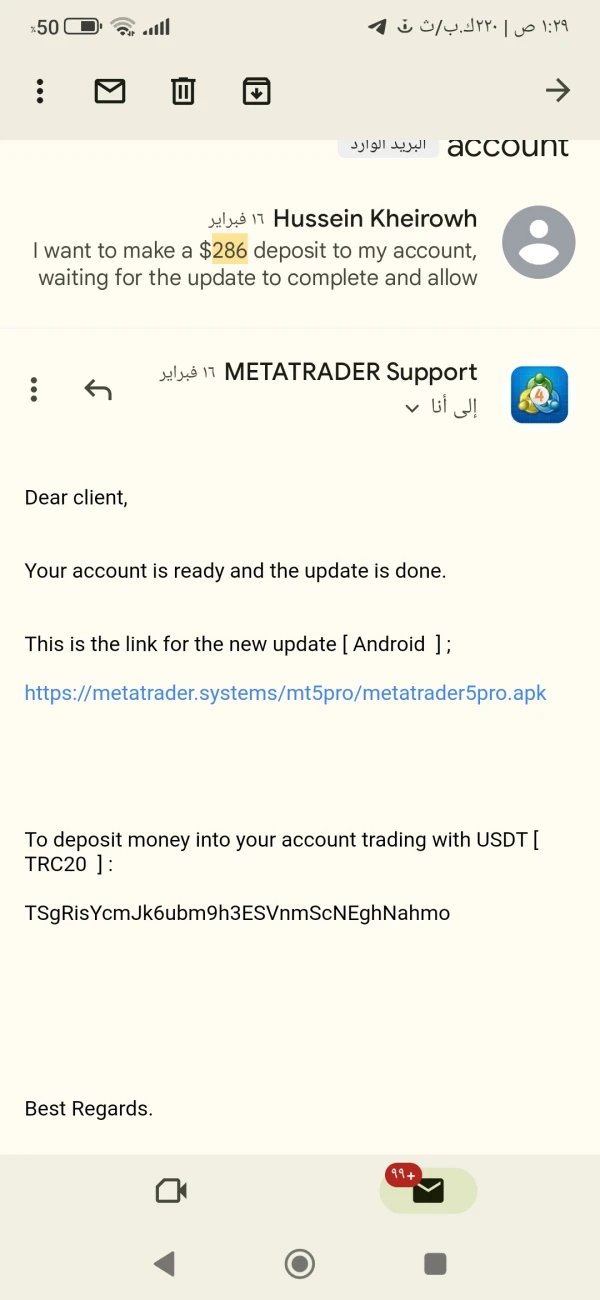

I had an account on the Meta 4 platform with an amount of $100 and it amounted to $206 and some cents with the profits. Suddenly the account was suspended and disabled and they said that it was transferred to Meta 5. I had a mentor in trading from Proft Master named Dr. Jassim Al-Sharif, who refused to continue with me on the pretext that the amount was small, so I added $286 was sent to the address that I got from the Meta 4 platform, and they sent the new server, which is MGK global Ltd, and I logged into the new server, but they refused to fund it with my credit with them. And my account number is 801759, and I asked them several times to send my money to my Binance wallet, but they did not respond to my messages since I sent them the amount of 286 dollars until now, and they have a total of 502 dinars and some cents, and I do not know how to get them or them until now.

Exposure

Howard Peng

Vietnam

I have been trying to withdraw for over a month but still haven't been allowing me to. I have even lost count of how many times I keep calling the support team.

Neutral

Guo Jia Hao

United Arab Emirates

Its name MetaTrader sounds quite funny, hahha, using the same name as the famous third-party trading platform-MetaTrader. I occasionally saw this broker when I look for forex brokers, but I cannot open its official website…

Neutral

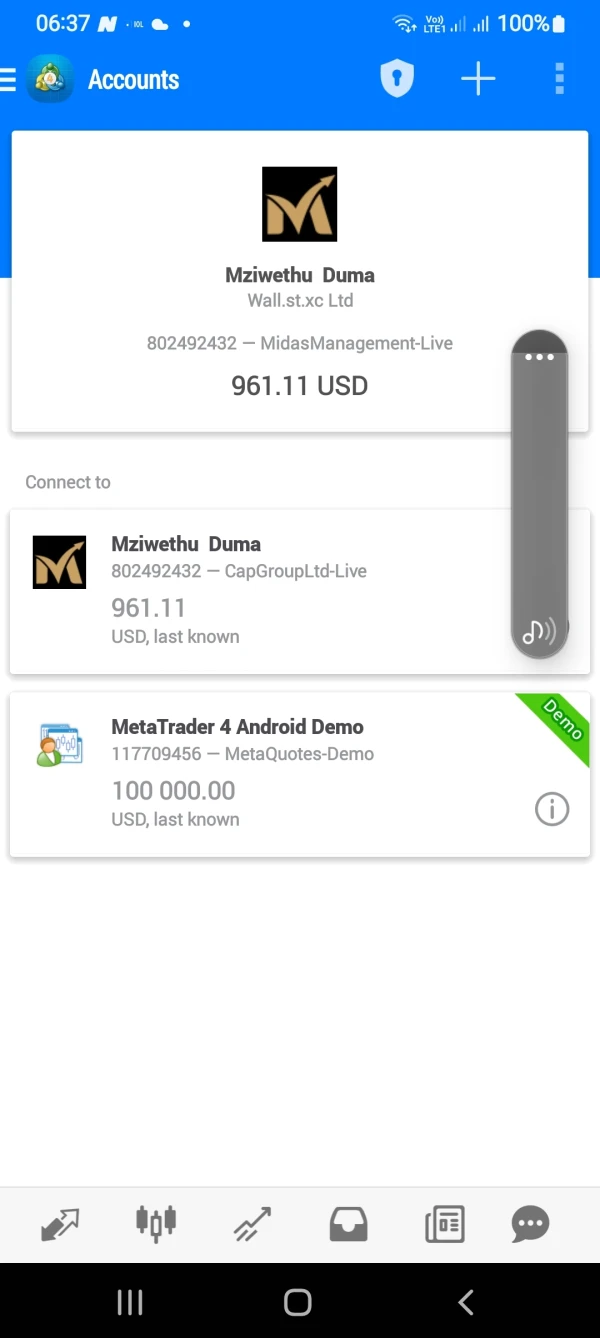

Mziwethu

South Africa

I have become yet another victim of scamming people ie Emmett and Billy Sanders who have lured me to deposit 250 USD into Metatrader 4 account number 802492432. I have followed their instructions and guidelines whilst the trading was continuing I noticed that I had tripled my profit and I informed Billy Sanders that I would like to withdraw from this account and he sent me the withdrawal forms of which I filled it up and sent it back that was the last time I heard from him...I am heartbroken and devastated because I had previously informed Billy that my source of income had challenges and I relied on this profit to pay my kids school fees. Please assist me in getting what is due to me.

Exposure

Ashmerhl

United States

This is the greatest app, suitable for trading 👍, buying and Selling of bitcoins, it's very very good indeed

Positive

VICENTEMARTINEZ

Colombia

I invested $3,100 USDT on March 6, 2022 in IP Capital to be traded by the MT4 Broker, which was generating a very good profit. After March 29, due to alleged fraud, the company froze all withdrawals, not allowing me to make any. Later the Broker stopped operating and this is the moment in which I continue without being able to withdraw my money. Later, the company arbitrarily changed the currency in which I invested, which was USDT, for another called IUSD, and it is in this currency that it shows the balance that I currently have in my account. I make this complaint in order for you to take action on the matter and order the reimbursement of my money from the appropriate person. Attached I send the proof of Deposit to the company IP Capital and the proof of the current balance of my account in that company. I thank you in advance for your attention and collaboration for the prompt approval of this request. Sincerely. VICENTE ARNULFO MARTÍNEZ ROLDÁN C.C. 71,686,904

Exposure

FX3739673730

Philippines

My account and money has lost in this scammers.I was fall into there traps by promising me tons of great words about them. Now I can't able to contact this scammers. And I can't find them.

Exposure

FX3739673730

Philippines

The balance in my account disappeared. Help.

Exposure