Top Forex Brokers Offering Free Demo Accounts

Access demo accounts from top forex brokers. Practice trading risk‑free and explore platforms before investing.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:A buy limit is an order to purchase a currency pair at a specified price or lower. Learn how to use this tool to automate entries and improve your forex trading strategy.

In the fast-paced world of foreign exchange (forex) trading, success often hinges on precision and strategy. Traders must execute their plans with discipline, entering and exiting positions at optimal price points to maximize potential gains while managing risk. One of the most fundamental tools for achieving this precision is the buy limit order. A buy limit is a type of pending order that instructs a broker to automatically purchase a currency pair at a specific price that is below the current market price. This allows traders to set their desired entry point in advance and wait for the market to “come to them,” rather than constantly monitoring charts.

The primary purpose of a buy limit order is to buy into a currency pair after its price has dipped, based on the trader's analysis that the price will rebound and move higher after hitting that lower entry point. It is a strategic tool for traders who believe an asset is temporarily overpriced and want to purchase it at a discount. Understanding how to correctly place, manage, and integrate buy limit orders into a broader trading plan is a crucial skill. It distinguishes reactive trading from proactive, strategy-driven execution, forming a cornerstone of disciplined market participation for both novice and experienced traders.

A buy limit order is an instruction given to a trading platform to execute a buy trade at a predetermined price that is lower than the current market price. It is one of several “pending order” types, meaning it is not executed instantly like a market order. Instead, it remains inactive until the market price drops to the level specified by the trader.

The core logic behind a buy limit is rooted in the “buy low, sell high” principle. Traders use this order type when their analysis suggests that a currency pair, despite being in a potential uptrend, will experience a temporary price drop (a pullback or retracement) before continuing its upward trajectory. By setting a buy limit, the trader aims to enter the market at the bottom of this dip, securing a more favorable entry price than if they had bought at the prevailing market rate .

For example, if the EUR/USD currency pair is currently trading at 1.0850, but a trader's analysis identifies a strong support level at 1.0800, they might place a buy limit order at 1.0800. If the market price falls to this level, the order is automatically triggered, and a long (buy) position is opened. If the price never reaches 1.0800 and instead continues to rise, the order remains unfilled.

The mechanics of a buy limit order are straightforward. When a trader places this order, they specify two key parameters: the currency pair they wish to trade and the exact entry price . This order is then sent to the broker's server and held until the market conditions are met.

In forex trading, price is quoted with two figures: the bid price and the ask price. The bid is the price at which a trader can sell the base currency, while the ask is the price at which they can buy it. A buy limit order is triggered when the ask price falls to the level of the specified limit price . Once triggered, the order is filled at that price or, in some cases, a better (lower) one if available, though this is less common in liquid markets.

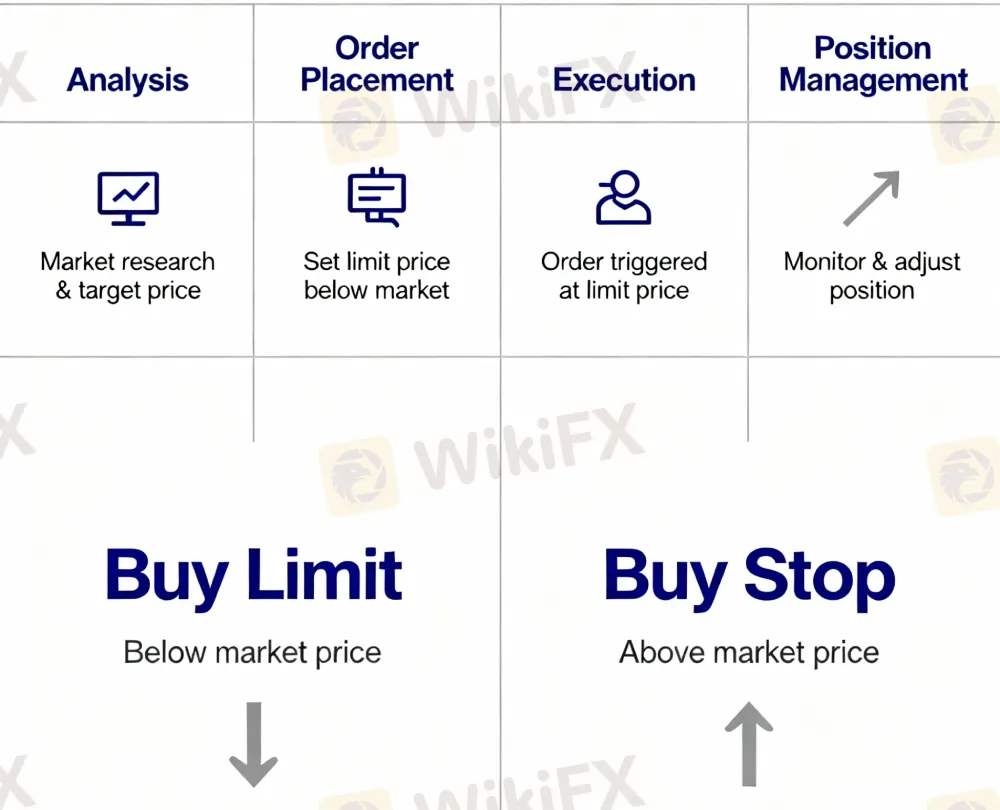

Here is a breakdown of the process:

A crucial aspect to understand is the difference between a buy limit and a buy stop order. While both are pending buy orders, a buy stop is placed above the current market price and is used to enter a trade when the price breaks through a resistance level, capitalizing on upward momentum. A buy limit, in contrast, is counterintuitive to momentum; it anticipates a price reversal from a lower level.

Employing buy limit orders offers several distinct advantages that can enhance a trading strategy and promote disciplined habits.

Despite their benefits, buy limit orders are not without risks. The primary danger is that the trader's analysis is incorrect and the price continues to fall after the order is triggered.

Placing a buy limit order is a standard feature on virtually all modern trading platforms, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5). The process is generally similar across different brokers.

Beyond simple support-level entries, buy limit orders can be integrated into more complex strategies. Traders can place a series of buy limit orders at successively lower levels within a broad support zone—a technique known as scaling in. This allows a trader to build a position at an average price, reducing the risk of entering their full position at a single, potentially flawed, entry point.

Expert traders emphasize that the effectiveness of a buy limit order depends entirely on the quality of the underlying analysis. It is not the order itself that creates profit, but the strategic reason for placing it at a specific level. Successful use requires a deep understanding of market structure, support and resistance, and price action. By combining this technical analysis with the disciplined execution that buy limit orders provide, traders can significantly elevate their approach from reactive speculation to a structured, professional trading methodology.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Access demo accounts from top forex brokers. Practice trading risk‑free and explore platforms before investing.

Top 10 Largest UK Market Makers: J.P. Morgan, Barclays, BNP Paribas, NatWest Markets, HSBC, Nomura, RBC, Lloyds, Winterflood, and UBS lead FCA/LSE rankings by volume and liquidity. Updated 2026 list.

UK forex starts Sun 22:00 GMT, London session 08:00-16:00 GMT. Ultimate guide to 2026 hours, peak liquidity times, GMT/BST shifts for max profits.

Sundramoorthy said investment scams continued to ensnare victims from all walks of life, including highly educated professionals accustomed to analytical and evidence-based thinking