Capital.com Expands into Kenya with Local Licence

Capital.com secures a Kenyan CMA licence and appoints Samwel Kiraka as CEO, marking a major step in its Africa expansion strategy.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Interactive Brokers and its licenses.

Interactive Brokers is widely recognized as one of the most reputable brokers in the trading world. With access to global markets and a wide range of financial instruments, its a popular choice among retail and institutional investors alike. The company has built a strong reputation through its years of operation and advanced trading platforms. However, despite its good standing in many regions, a deeper look into its regulatory background reveals some areas of concern that traders should not ignore, especially if they want to avoid being caught in potential scams.

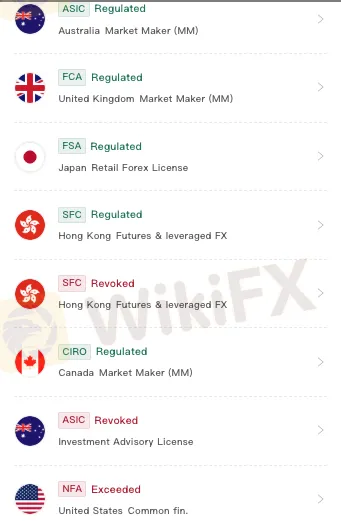

On the surface, Interactive Brokers appears well-regulated and trustworthy. It is licensed by some of the most respected financial authorities in the world. In Australia, the broker is regulated by the Australian Securities & Investments Commission (ASIC) under license number 453554. This license is in good standing and allows the firm to operate as a market maker. In the United Kingdom, Interactive Brokers is also regulated by the Financial Conduct Authority (FCA) under license number 208159, again holding a valid market maker license.

In Japan, Interactive Brokers is overseen by the Financial Services Agency (FSA), which regulates the countrys financial services providers. The broker holds license number 187, giving it permission to offer retail forex trading to Japanese clients. The firm also operates under the Canadian Investment Regulatory Organization (CIRO), which supervises investment and mutual fund dealers across Canada. Although the license number has not been publicly released, it is listed as actively regulated.

Interactive Brokers is also authorized by the Securities and Futures Commission (SFC) of Hong Kong. One of its licenses, under license number ADI249, is for dealing in futures contracts and leveraged foreign exchange trading and remains in good standing. This strong presence in multiple regulated markets gives Interactive Brokers an advantage when it comes to investor trust and transparency.

However, not all of its regulatory records are flawless. Some licenses have been revoked or flagged, which could raise questions about the brokers internal practices or past issues. One such example is a second license under ASIC in Australia, license number 000245574, which was meant for investment advisory services but has now been revoked. This indicates that the broker may have failed to meet the regulator's expectations or compliance standards in that specific area.

Additionally, another license under Hong Kongs SFC, listed as license number AEX264, has also been revoked. This means that at some point, the broker was no longer permitted to legally operate under that license in Hong Kong. Furthermore, its National Futures Association (NFA) license in the United States (license number 0258600) is marked as “Exceeded,” suggesting that the broker may be operating beyond the authorized scope allowed by its registration in the U.S. While these issues don't prove wrongdoing, they do serve as red flags that traders must take seriously when deciding which branch of the company they are dealing with.

These revoked or exceeded licenses dont necessarily mean that Interactive Brokers is a scam, but they highlight the risks of assuming that a global brand is entirely safe in all regions. Regulatory issues, even when they apply to only one license or region, can expose investors to problems like poor protection, fewer legal rights, or unclear dispute resolution. In some cases, brokers with mixed regulatory histories have been linked to scams or grey-area practices that left traders with unexpected losses.

Despite these issues, Interactive Brokers still holds a WikiScore of 8.20/10 on WikiFX, a global platform that evaluates brokers based on licenses, trading environment, risk control, and operations. This high score reflects a generally favourable reputation, but traders are advised not to ignore the fine print. Even a well-rated broker can have blind spots or past missteps.

In conclusion, Interactive Brokers combines strengths with warning signs. While it is widely regulated and respected, its history of revoked and exceeded licenses shows that no broker is beyond scrutiny. Traders should always verify which entity and regulatory body theyre dealing with before depositing funds or opening accounts. Staying alert to these details is one of the best ways to avoid being misled or pulled into unexpected scams.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Capital.com secures a Kenyan CMA licence and appoints Samwel Kiraka as CEO, marking a major step in its Africa expansion strategy.

Nearly 400 investors have urged the Labuan FSA to take stricter measures against a company accused of running an illegal forex trading scheme, which has reportedly caused losses exceeding RM104 million.

LMS Forex Broker Review 2026 – Regulation, Risks & WikiFX Score 1.49/10. Is LMS a safe forex broker? Read our in-depth LMS broker review covering regulation, trading conditions, risks, comparison with regulated brokers, FAQ, and why WikiFX gives LMS a low score of 1.49/10.

eToro is regulated by ASIC, FCA, CySEC, MAS & ADGM, though some users report withdrawal delays and offshore risks.