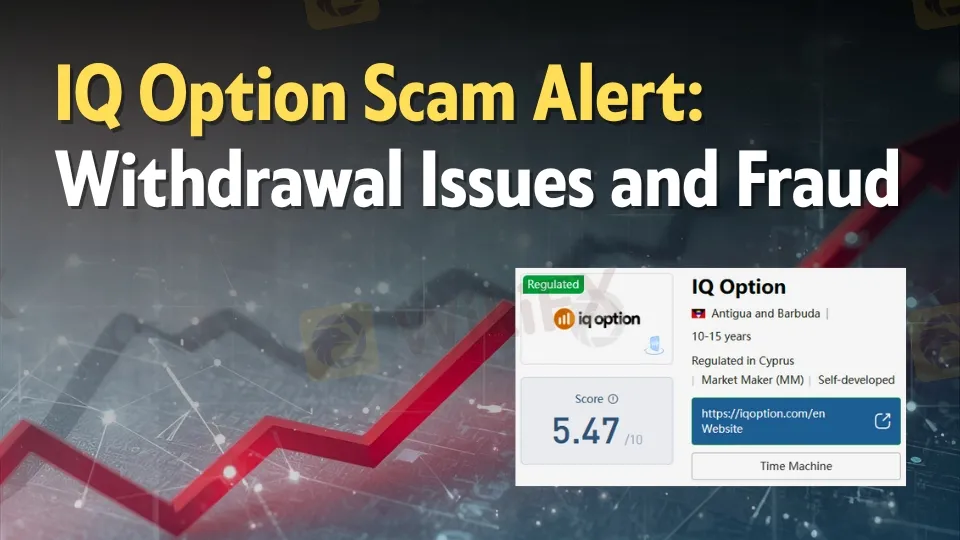

Abstract:IQ Option faces allegations of fraud for blocking withdrawals, manipulating prices, and operating with weak regulatory oversight despite CySEC licensing claims.

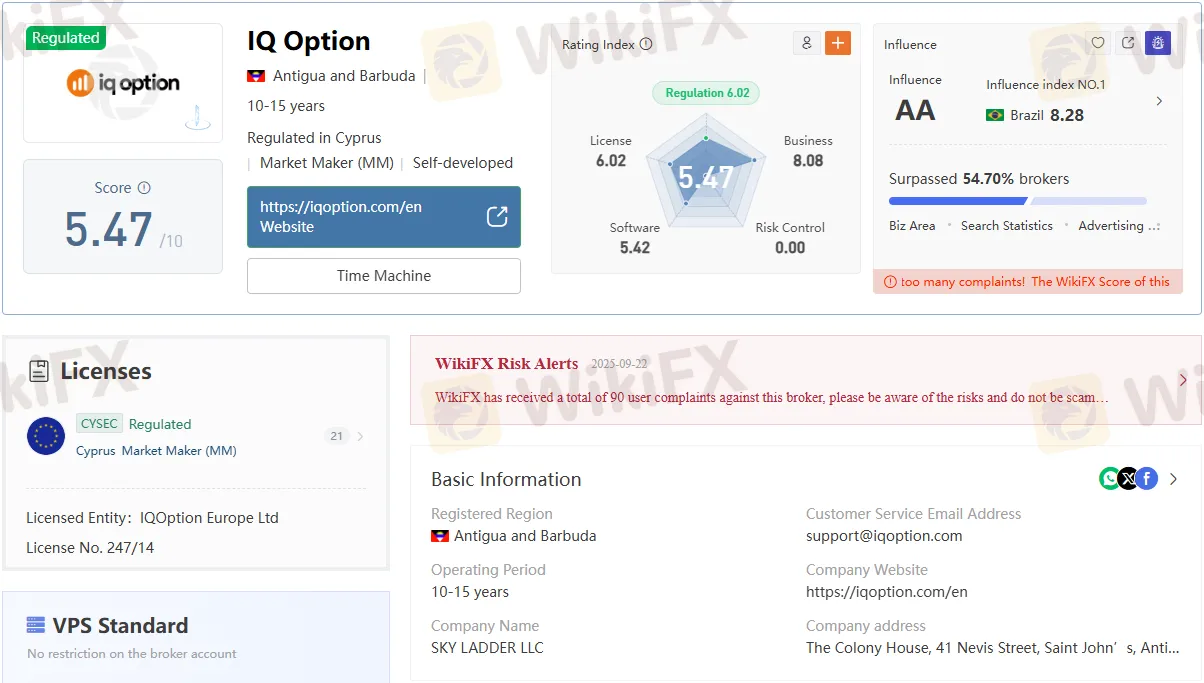

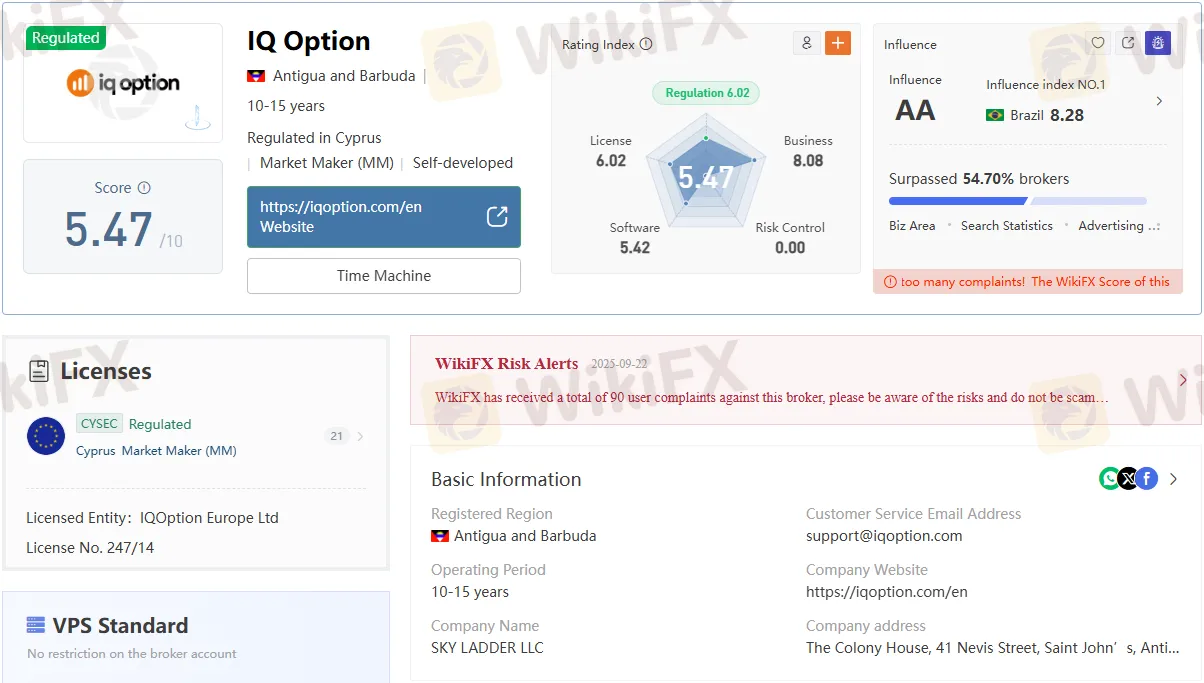

IQ Option stands accused allegations of fraudulent practices involving systematic withdrawal restrictions, price manipulation, and deceptive business operations that trap investors with promises of profitable trading while preventing fund recovery. The platform operates under multiple regulatory jurisdictions with a concerning pattern of 90 documented user complaints and a WikiFX rating of only 5.47/10, raising serious questions about its legitimacy as a safe trading environment.

Regulatory Framework and Compliance Issues

IQ Option operates through IQOption Europe Ltd under the Cyprus Securities Exchange Commission (CySEC) license 247/14, yet maintains a dual structure that confuses regulatory protections. The platform presents itself with two distinct identities: a chaotic, unregulated global version and a supposedly secure European variant, both of which have been characterized as traps by affected users. The company frequently changes its name, registered address, and licensing structure, having altered these elements multiple times over seven years to potentially evade legal responsibility.

Binary options trading platforms like IQ Option operate in a heavily scrutinized regulatory environment, with many jurisdictions implementing complete bans due to widespread fraud concerns. The U.S. Securities and Exchange Commission and Commodity Futures Trading Commission have issued investor alerts specifically warning about the rise in fraud complaints linked to binary options trading platforms. These regulatory bodies note that many online binary option trading platforms operate in violation of the law, with some refusing to credit customer accounts and manipulating software to generate losing trades.

Account Verification Delays and Documentation Manipulation

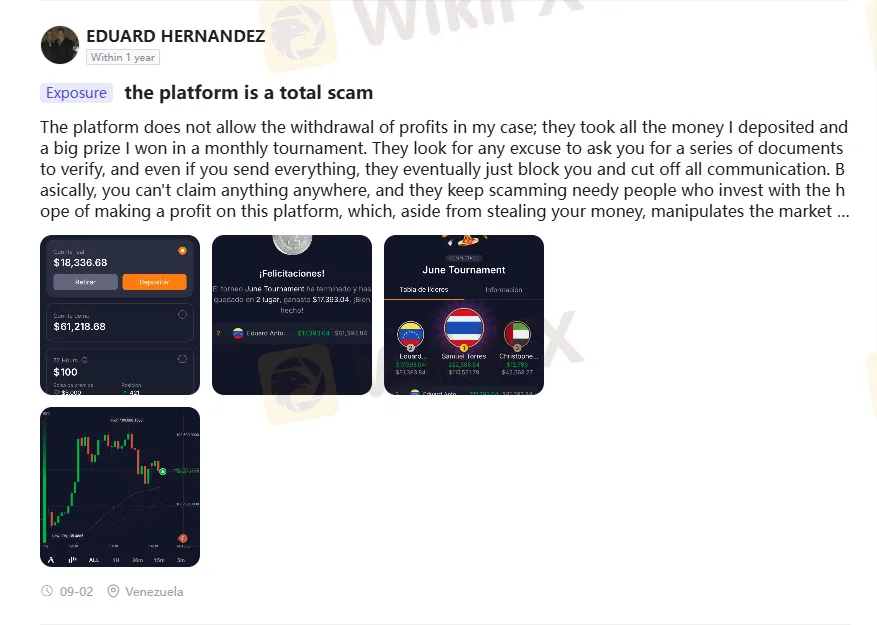

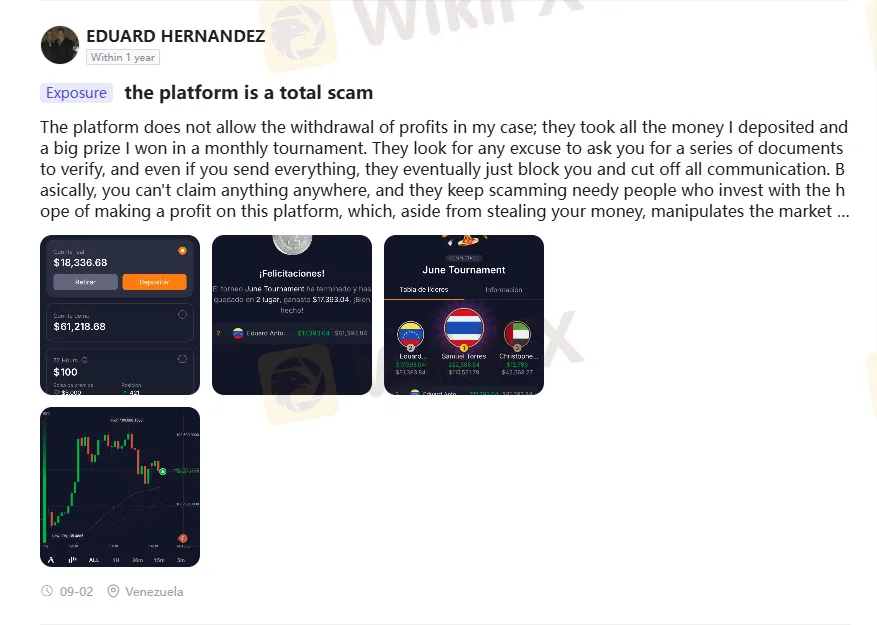

The platform employs systematic account verification delays as a method to prevent fund withdrawals, requesting excessive documentation that serves no legitimate purpose. Users report being asked for a continuous series of documents to verify accounts, with the platform finding excuses to deny verification even when all requested materials are provided. Eduardo Hernandez's case exemplifies this pattern, where, despite completing all verification requirements and winning $17,393.04 in a tournament, the platform blocked his account and terminated all communication.

IQ Option has ignored formal requests for basic account documentation for periods exceeding 55 days, exploiting vague terms that allow response times of up to three months for complaints rather than documentation requests. This manipulation of their own policies creates deliberate delays and accountability avoidance while customers remain unable to access their funds. The platform's customer service systematically fails to provide account statements, signed contracts, or clarifications regarding user rights and applicable licensing protections.

Withdrawal Processing Times and Banking Restrictions

IQ Option's withdrawal processing system creates multiple barriers that delay or prevent fund recovery despite claims of processing requests within 24 hours for e-wallets. Bank card withdrawals can extend up to 21 days, with some investigations taking up to 180 business days in rare cases, creating extensive periods where funds remain inaccessible. The platform enforces the same-method withdrawal policies that restrict users to the payment methods used for deposits, limiting flexibility and creating additional barriers for fund recovery.

Withdrawal processing times vary significantly based on geographic location, with countries like India and Pakistan experiencing particular delays due to regulatory restrictions and banking partnerships. Users in these regions face additional complications when using local banking channels, with the platform recommending international e-payment methods that may not be readily available to all customers. These geographical restrictions disproportionately affect users in developing markets where binary options trading is particularly prevalent.

Binary Options Manipulation and Price Distortion

The platform engages in systematic price manipulation through its over-the-counter (OTC) market operations that appear designed to generate customer losses rather than facilitate legitimate trading. Users report experiencing unnatural price spikes occurring seconds before trade closures, converting winning positions into losses through artificial market movements that do not reflect actual market conditions. This manipulation creates a controlled environment where the broker can move prices arbitrarily to ensure customer losses while maintaining the appearance of legitimate market activity.

Binary options platforms commonly manipulate trading software to distort prices and payouts, according to complaints filed with regulatory authorities. These manipulative practices include misrepresenting the odds of winning and creating artificial volatility that favors the house edge over legitimate market movements. The lack of transparency in OTC markets provides binary options platforms with opportunities to control pricing mechanisms without external market oversight or validation.

Deposit Methods and Money Laundering Concerns

IQ Option accepted customer deposits through 231 personal accounts via Papara Bank in Turkey and 296 different Bitcoin wallets, creating a complex web of financial transactions that lacks proper institutional oversight. These deposit methods involved no official company accounts; instead, routing customer funds through random individuals and dubious third parties that raise serious money laundering concerns. The Cyprus Securities Exchange Commission has issued documented warnings regarding such practices by the company, which can be verified through official regulatory channels.

The platform's deposit infrastructure deliberately makes it easy to deposit money while creating extreme difficulties for withdrawals, revealing the true intent behind these complex financial arrangements. Each Bitcoin transaction utilized a new wallet address, creating nearly 300 separate cryptocurrency endpoints for customer deposits while providing no corresponding withdrawal mechanisms. This asymmetrical deposit-withdrawal system serves to trap customer funds within the platform's ecosystem while maintaining plausible deniability regarding fund recovery obligations.

Customer Complaints and Regulatory Warnings

WikiFX has received 90 user complaints against IQ Option, with the platform earning a risk score of 5.47/10 due to excessive customer grievances and operational concerns. Recent complaints focus primarily on withdrawal restrictions, account verification manipulation, and systematic blocking of profitable accounts. The Forex Peace Army and other industry watchdogs document ongoing patterns of customer fund seizure and communication termination following profit generation.

Customer testimonials reveal consistent patterns where profitable trading activity triggers account restrictions and withdrawal denials. Users report successful trading for months without issues until significant profits accumulate, at which point the platform implements verification requirements that prove impossible to satisfy. This pattern suggests deliberate targeting of successful traders to retain their funds through administrative barriers rather than honoring withdrawal requests.

VIP Account Schemes and False Promises

The platform operates a “VIP Diamond” account system that promises dedicated account managers, priority withdrawals, and exclusive support, but fails to deliver these advertised benefits. VIP clients report receiving identical treatment to regular users despite paying higher fees and meeting elevated deposit requirements. These premium account structures serve primarily as revenue enhancement mechanisms rather than providing genuine value-added services.

Account verification delays persist regardless of VIP status, with high-value customers experiencing identical documentation requirements and processing delays as standard account holders. The lack of differentiated service for premium customers reveals the superficial nature of VIP programs that exist solely to extract additional fees rather than improve customer experience. These programs exploit customer psychology by creating perceived exclusivity while delivering identical substandard service across all account tiers.