Company Summary

| ABXReview Summary | |

| Registered On | 1999-02-26 |

| Registered Country/Region | Australia |

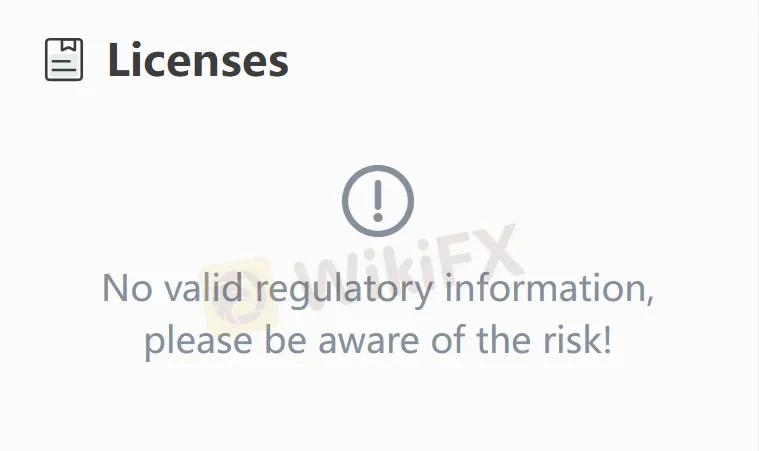

| Regulation | Unregulated |

| Market Instruments | Gold, Silver, and Platinum |

| Trading Platform | MetalDesk |

| Customer Support | Phone: +61 7 3211 5007 (Australia) |

| Phone: +66 (0)2 231 8171 (Thailand) | |

| Phone: +852 3956 7193 (Hong Kong) | |

| Phone: +357 25262656 (Cyprus) | |

| Fax: +61 7 3236 1106 (Australia) | |

| Fax: +852 3956 7100 (Hong Kong) | |

| Fax: +357 25560815 (Cyprus) | |

| Email: info@abx.com | |

| LinkedIn, Facebook, Twitter | |

ABX Information

Allocated Bullion Exchange (ABX) is a global electronic exchange for physical precious metals. Through its self-developed MetalDesk platform, ABX connects seven major global trading hubs to provide allocated physical precious metal trading services such as gold, silver, and platinum. The platform offers efficient trading solutions for participants across the entire industry chain, from miners to investors.

Pros and Cons

| Pros | Cons |

| Global tradingDiversified gold, silver, and platinum | UnregulatedOnly precious metals |

| High entry barriers for some products (e.g., silver with a minimum trading unit of 25,000 ounces) |

Is ABX Legit?

ASIC regulates ABX, but in reality, it is not. Traders are advised to verify the authenticity of this claim with the ASIC regulatory authority.

What Can I Trade on ABX?

On the ABX platform, investors can trade various physical precious metal products, including gold, silver, and platinum.