Abstract:In today’s review, we are focusing on the forex broker named Galileo FX.

About Galileo FX

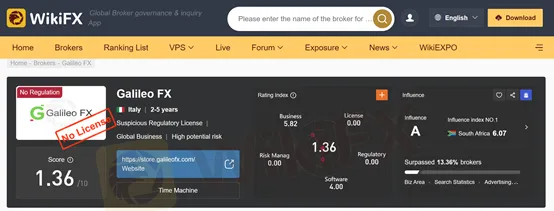

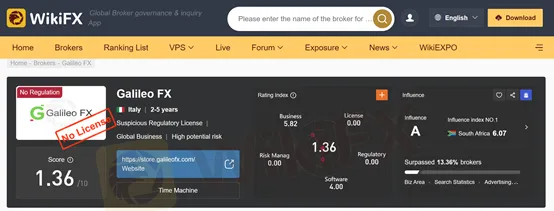

Galileo FX is a forex broker registered in Italy. Founded in 2020, Galileo FX positions itself as an automated trading software designed to execute trades based on pre-programmed instructions and real-time market analysis. However, before you consider investing with Galileo FX, it's crucial to delve into the facts and assess its legitimacy. WikiFX has raised concerns by giving Galileo FX an alarmingly low score of 1.36/10.

Regulatory Status

One of the most critical aspects to consider when evaluating a forex broker's legitimacy is its regulatory status. Unfortunately, Galileo FX falls short in this area as it is not regulated by any recognized regulatory institution. This is a significant red flag for potential investors. Trading with an unregulated broker carries substantial risks, as there is no oversight or protection in place to safeguard your funds. In the event of any issues or disputes, the lack of regulation can leave you vulnerable, and your money may not be recoverable. It is strongly advised to exercise caution when dealing with unregulated brokers.

Trading Platforms

Galileo FX offers its clients access to the widely used trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are renowned for their user-friendly interfaces and comprehensive analytical tools. While the choice of trading platforms is a positive aspect of Galileo FX, it is important to remember that the quality of the platform alone does not guarantee the broker's overall reliability.

Investor Feedback

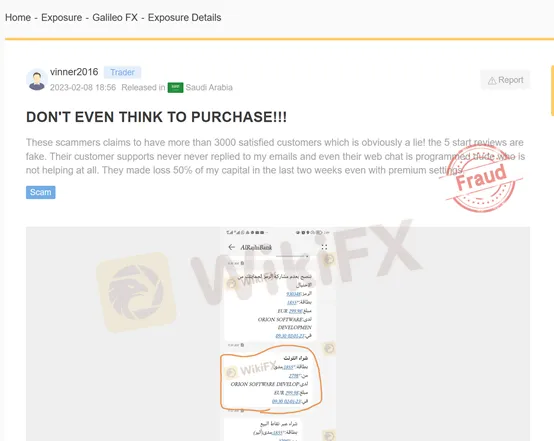

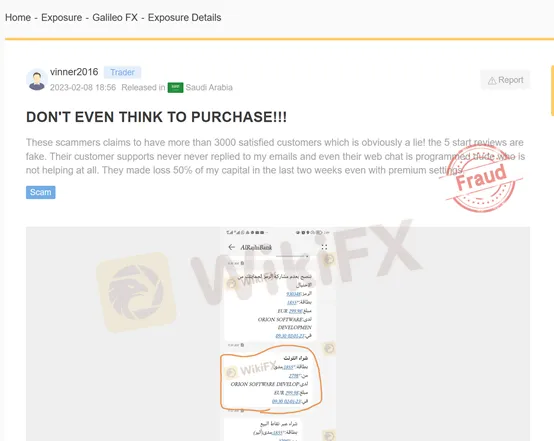

To gain a deeper understanding of the experiences of Galileo FX clients, we looked into investor feedback. One concerning report comes from an investor in Saudi Arabia who shared their experience with WikiFX. The investor stated that the customer support of Galileo FX never responded to their emails, and even the web chat feature provided no assistance. Furthermore, this unfortunate individual claimed to have lost 50% of their capital in just two weeks while trading with Galileo FX. Such negative experiences raise significant concerns about the broker's ability to support its clients and protect their investments.

Conclusion: Is Galileo FX Legit?

Galileo FX's legitimacy as a forex broker is highly questionable. The absence of regulation, coupled with alarming customer feedback and a low rating on WikiFX, suggests that this broker may not be a safe choice for traders. The forex market is fraught with risks, and it is essential to prioritize safety and security when selecting a broker to entrust with your hard-earned capital.

Before considering any investment with Galileo FX or any other broker, it is advisable to conduct thorough research, read reviews, and carefully assess the broker's regulatory status. Additionally, always exercise caution and only invest funds that you can afford to lose. Ultimately, your financial well-being is paramount, and choosing a reputable and regulated broker should be a top priority in your forex trading journey.