Abstract:Global currencies like the South African Rand and Japanese Yen could stabilize if proposed U.S. debt ceiling increase legislation passes. Amid market uncertainties, key economies in the Asia Pacific face strains. The potential slowdown of U.S. monetary policy could boost these currencies, easing the U.S. Dollar's dominance.

The South African Rand and Japanese Yen, two of the most affected currencies in 2023, might experience a turnaround if the proposed legislation to increase the U.S. government debt ceiling is successfully passed. This development could foster stability in the largest government bond market worldwide, potentially easing the Dollar.

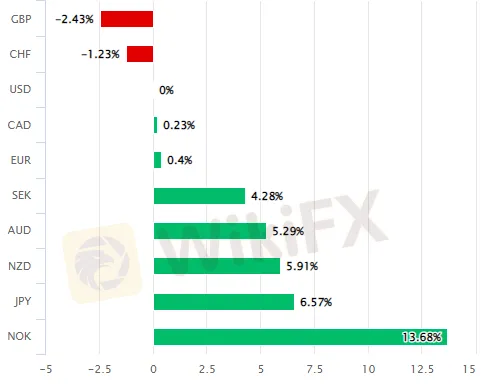

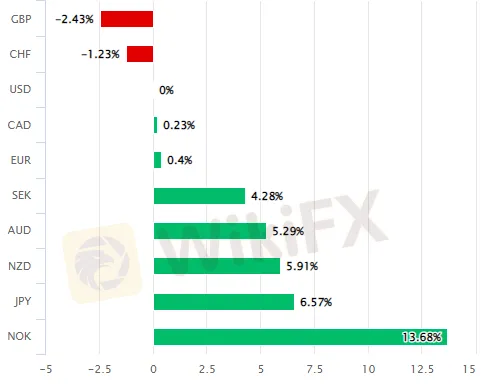

In the face of global market jitters, the Rand remained stable, whereas the Yen exceeded expectations. Commodities plunged, stock indices dipped, and sovereign bonds gained in almost every global sector on Wednesday.

This negative trend in risk assets followed closely after official data was released, indicating that core sectors in some top economies of the Asia Pacific region were strained in April. Both South Korea and Japan witnessed a simultaneous decline in industrial production and retail sales.

The National Bureau of Statistics of China released the composite PMI for the manufacturing and services sectors, suggesting a gradual economic recovery in the world's second-largest economy. This could be another sign of the toll taken by the global monetary policy tightening.

CitiFX analyst Varshi Karamsetty cites the mixed local sentiment from trader Alexey Kovalchuk. He idntifies 19.86 and 20 as resistance levels for USDZAR, with a robust support zone at 19.50-60. Kovalchuk advises going long on the pair but suggests a tight stop below 19.70.

Karamsetty also notes the ongoing geopolitical issues and Eskom as significant concerns.

The tightening of the global monetary policy and subsequent fallout has adversely affected government bond markets worldwide, bolstering the U.S. Dollar for the most part of this year. However, some currencies, like the Rand and other BRIC group currencies, have seen a sharper sell-off due to economic vulnerabilities and potential sanctions fears.

The Japanese Yen has also been significantly affected, thanks to its negative benchmark interest rates and near-zero yields. This has made it a soft target in the speculative market, spurring fresh discussions about the possibility of intervention to bolster the currency.

Adam Cole, RBC Capital Markets chief FX strategist, sees little chance of such an intervention altering the trend of Yen depreciation, given the opposing domestic policy directions in the US and Japan.

A silver lining for several currencies might be the probable successful passage of legislation to raise the U.S. government debt ceiling, potentially averting a technical default.

The implications of the legislation will affect the U.S. economy, bond markets, and the Fed's interest rate policy. Steven Blitz, TS Lombard's chief U.S. economist, believes the markets will soon swap their debt ceiling anxiety for real problems.

The legislation might trigger price action like in late March and early April when small and medium-sized U.S. banks showed instability, prompting the Fed to adopt a more moderate interest rate policy.

The U.S. Treasury would need to execute funding operations to replenish its drained cash reserves once the legislation is passed. This could stress the balance sheets of commercial banks already under pressure.

Blitz opines that future scenarios heavily rely on the Treasury's strategy to rebuild finances and the Fed's response. He suggests this could serve as a chance for the Fed to slow down the economy and find reasons to bypass the June hike.

Decreasing commercial bank deposits in the U.S. and a rising number of problematic banks have led the Fed to be wary about the implications of its interest rate policy.

The increasing “credit tightening” could persuade the Fed to hold back in June and the subsequent months. This could weaken the U.S. Dollar and boost currencies like the Yen and Rand, especially considering the recent uptick in market interest rate expectations.

Stay informed with the latest news by downloading and installing the WikiFX App on your smartphone. Get the App now at: https://social1.onelink.me/QgET/px2b7i8n