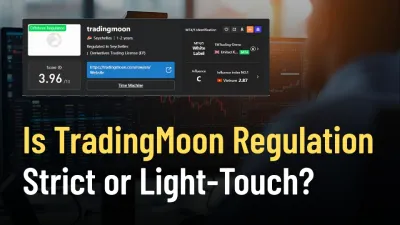

Is TradingMoon Regulation Strict or Light-Touch?

TradingMoon operates under offshore regulation by Seychelles FSA. License SD042 covers forex and derivatives trading.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Monex Group, a well-known online services provider, has introduced new margin account services for US-based stocks. According to the company's announcement, the new trading security will be accessible on January 23, 2023.

Monex Group, a well-known online services provider, has introduced new margin account services for US-based stocks. According to the company's announcement, the new trading security will be accessible on January 23, 2023.

The broker, in partnership with its business in the United States, provides Wall Street stock trading services that are less common in Japanese investment organizations. This means that customers may trade throughout longer session hours and with unrestricted real-time stock pricing.

The implementation of a US stock margin account has been delayed due to technological flaws. However, the technical team has addressed the issue and ensured that the program will function smoothly in the following week.

“With US equities margin trading, investors may trade double the amount of their initial money (margin deposit) on the same day and buy and sell the same stock as many times as they like,” the business noted.

A loaded condition is included with the new account. To have access to the service, a customer must deposit a minimum of $2,900 for activation. Furthermore, the customer will be obliged to contribute to the commission and interest charges.

“At first, only the PC version will be available for purchase, but in the future, we plan to expand the service in various ways to make margin trading of US stocks more convenient, such as enabling trading via the ”TradeStation U.S. Stock Smartphone“ and adding time periods to order types,” Monex explained.

Japanese brokerages have recently begun offering comparable US stock margin trading. However, the account differs from others in that the customer must create a separate foreign stock margin trading account.

Monex's Expansion Strategy

Monex signed a financial securities-related collaboration agreement with AEON Bank towards the end of 2022. The signature, however, is subject to state authorities' confirmation for legitimacy.

Monex is obligated under the agreement to give AEON Bank customers access to asset management services. In order to establish a long-term relationship with Monex, the bank plans to expand its offers.

“After the Partnership goes into force, AEON Bank will continue to market mutual funds as a financial goods brokerage agent commissioned by Monex, while Monex will execute client transactions and maintain customer accounts,” the company revealed.

By modifying the conditions of asset management products, the two financial firms want to establish a long-term working partnership. This is motivated by requests to remove the registration barrier for retail customers in the market arena.

Download link for the mobile app

https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

TradingMoon operates under offshore regulation by Seychelles FSA. License SD042 covers forex and derivatives trading.

DB Investing regulation is offshore under Seychelles FSA, offering oversight but limited protection, with reported withdrawal risks for traders.

Does TrioMarkets’ entry into funded trading represent an opportunity or a risk? A new analysis reviews the business model, regulatory context, and broker evaluation on WikiFX before making a decision.

ehamarkets is the focus of many traders on broker review platforms for all the negative reasons. Among the many complaints against the Malaysia-based forex broker, the withdrawal issue and the utter helplessness of the trader in recovering their funds stood out. The broker is accused of denying traders their funds using numerous excuses. So, if you were planning to invest in this forex broker, do not miss reading this ehamarkets review article. Take a look!