Abstract:Beware of Fake RS Finance scams: learn key warning signs, user reviews, and tips to protect your money from fraudulent financial services. Stay safe!

Staying safe in the world of online finance requires constant vigilance. With new platforms popping up every day, it's essential to know how to identify which companies are legitimate and which are out to deceive unsuspecting investors. One name that has recently emerged with countless red flags is “Fake RS Finance”—a textbook example of a financial scam you need to stay away from.

What Is Fake RS Finance?

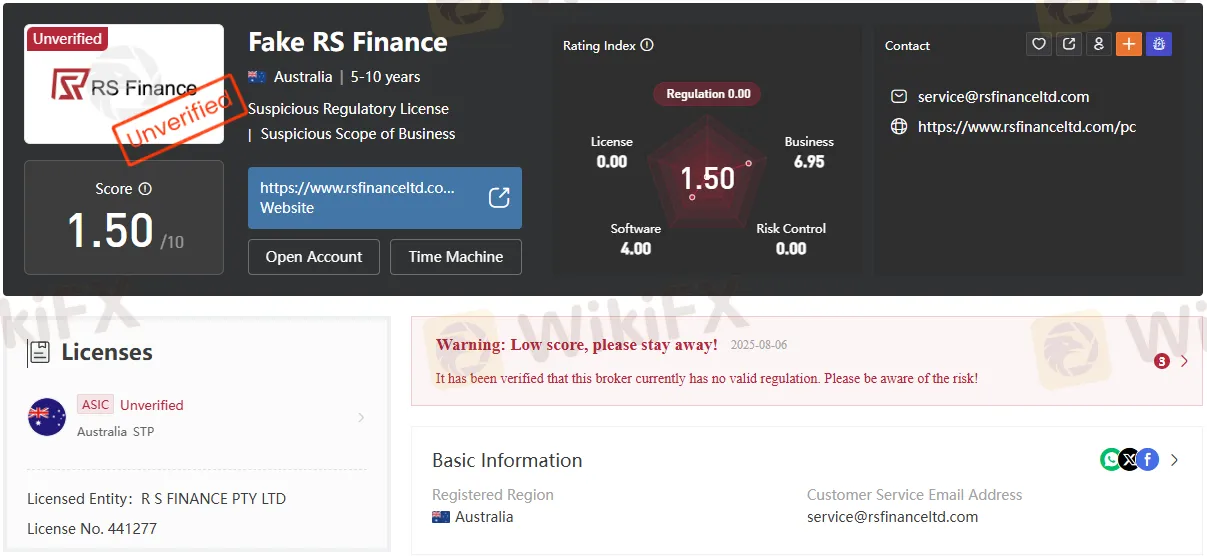

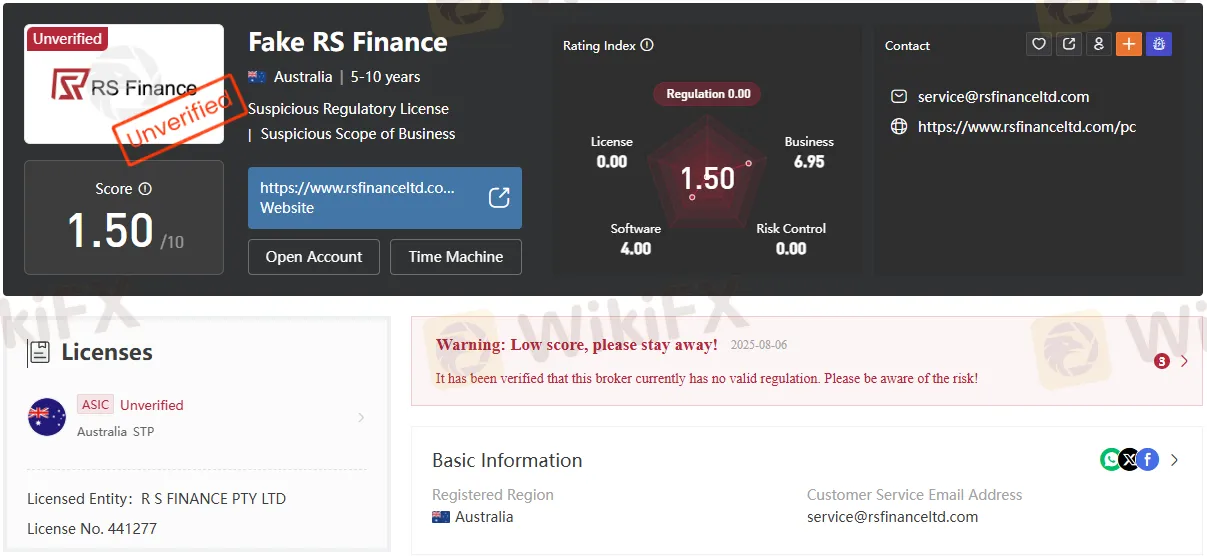

Fake RS Finance claims to be an Australia-based financial service provider. However, upon closer inspection, it becomes clear that the platform is riddled with warning signs. Not only is its regulatory status “suspicious or cloned,” but it is also marked as “unverified” according to trusted watchdog WikiFX. The entity's license is either unverified or outright fake, and its domain registration leads to an unrelated address in Hong Kong—another major alarm bell for potential investors.

Key Warning Signs of Fake RS Finance

- Lack of Verification: WikiFX, a globally recognized broker assessment platform, clearly marks Fake RS Finance as unverified and suspiciously cloned. This alone is enough reason for caution.

- Fake Regulatory Claims: The licensing information is unverifiable. The company lists an Australian location but fails to provide any proof of valid financial regulation.

- Negative User Reviews: Users have labeled RS Finance a scam, with several warnings about the difficulty of withdrawing profits and accusing the broker of manipulating exchange rates to force losses and liquidate accounts.

- Misleading Domain Registration: While advertising itself as an Australian entity, the websites domain is registered in Hong Kong. This discrepancy is a classic sign of scam operations masking their true origins.

- Low Trust Score: With an alarmingly low WikiFX score of 1.50 out of 10, Fake RS Finance ranks far below reputable platforms.

What Users Are Saying

Heres a sample of what customers have experienced:

- “RS Finance: scam. It attracted users with profits and set a lot of difficulty when withdrawing. Beware.”

- “This is a scam broker. Artificially manipulates the exchange rate to go against your position, thereby liquidating your account!”

These personal accounts reinforce why you should think twice before trusting your funds with entities like Fake RS Finance.

How to Protect Yourself from Scams

With scammers getting more sophisticated, keep these points in mind:

- Always check regulatory status through independent and official financial bodies.

- Search for independent, third-party reviews—not just testimonials posted on the brokers own site.

- Be wary of discrepancies in contact details, licensing, and office locations.

- Trust your instincts: If a brokers website feels off or information is hard to verify, walk away.

Conclusion

The financial world is full of opportunities—but also pitfalls. As the example of Fake RS Finance demonstrates, scam brokers disguise themselves with slick websites, fake credentials, and manipulated user feedback. Always perform due diligence and consult recognized authorities before investing. Remember, protecting your assets starts with informed choices—dont let scammers take advantage of your hard-earned money.

Dont let a flashy marketing campaign fool you—unregulated brokers can come with serious risks. To stay safe, download the WikiFX app by scanning the QR code below for a quick and reliable verification before you invest.