Abstract:Forex trading beginners could often come across the term ”margin” when involving in forex trading.

Maybe it is a completely new concept to you. Either way, it is a very important topic that you will need to master in order to become a successful Forex trader.

Margin and leverage are among the most important concepts to understand when trading forex. In this article, we will go into more detail about exactly what the margin is, how margin trading within forex works, and some things you should look out for.

What Is Margin in Forex Trading

Margin in trading is the deposit required to open and maintain a position. When trading on margin, you will get full market exposure by putting up just a fraction of a trades full value. So margin is not a cost or a fee, but it is a portion of the customer's account balance that is set aside in order trade. Investors use margin trading in forex to increase possible return on investment.

A margin account, at its core, involves borrowing to increase the size of a position and is usually an attempt to improve returns from investing or trading. Using a ‘margin account’, an investor will use their own funds to put forward a percentage of a larger value investment, with the broker putting forward the rest.

Margin and leverage

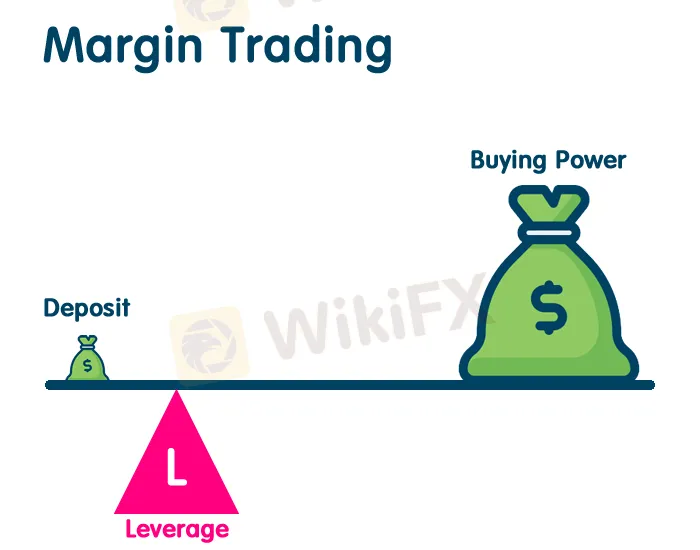

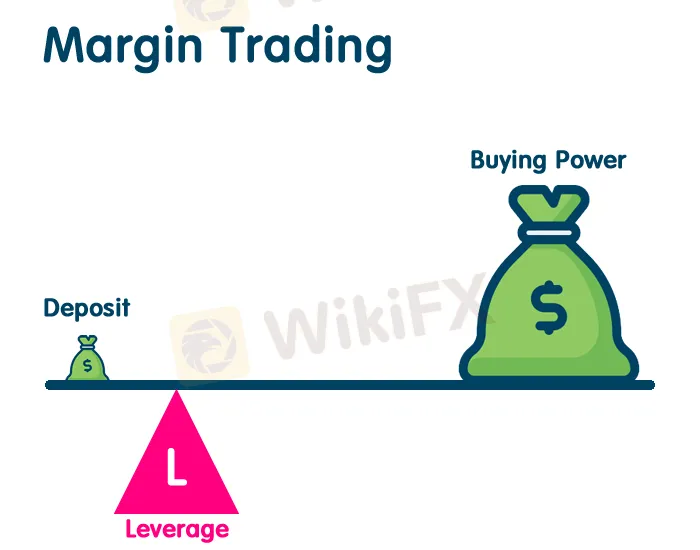

Margin and leverage are two sides of the same coin. Margin is the minimum amount of money required to place a leveraged trade, while leverage provides traders with greater exposure to markets without having to fund the full amount of the trade.

The margin required by your FX broker will determine the maximum leverage you can use in your trading account. Therefore, trading with leverage is also sometimes referred to as “trading on margin”. For example, A minimum margin requirement of 0.5% is the same as 200:1 leverage. A leverage ratio of 100:1 would be 1%.

Example of buying on margin

Let's say a broker offers leverage of 1:50 for Forex trading. This means that for every 50 units of currency in an open position, 1 unit of the currency is required as the margin. In other words, if the size of your desired Forex position was $50, the margin would be $1.

Further, let‘s say EUR/USD is trading at $1.1128, with a buy price of 1.11284 and a sell price of 1.11276. You think that the euro is set to gain value against the dollar, so you decide to buy a single lot to the value of €100,000. With the trading margin, you don’t have to put down the full amount of the trade. In this case, you only have to commit €2000 as margin.

What Is A Margin Call

A margin call is what happens when a trader no longer has any usable/free margin. In other words, the account needs more funding. This tends to happen when trading losses reduce the usable margin below an acceptable level determined by the broker. The point where your broker initiates a margin call is called the margin call level.

You have to know the two kinds of margin firstly:

Initial margin

The initial margin is the minimum amount youll need to put up to open a position. It is sometimes called the deposit margin, or just the deposit.

Maintenance margin

The maintenance margin, also known as variation margin, is additional funds that may be required from you if your position moves against you. Its purpose is to ensure you have enough money in your account to fund the present value of the position at all times – covering any running losses.

The maintenance margin is the required percentage of the total investment that is less than the initial margin, and which the investor must maintain in their trading account in order to avoid a margin call.

Once the investors account has fallen below the required maintenance margin level, the broker will send a margin call to the investor to notify him that he must put more cash into the account to make up for the difference between the current price and the maintenance margin requirement.

Pros And Cons of Margin in Forex Trading

Margin trading can open great possibilities for you as a forex trader to engage in markets to a much higher level than you could with just your own funds. Buying on margin means that you have the potential to spread your capital even further, as you can diversify your positions over a wider array of markets. Beyond this, margin trading means you can always be in a position to make a move in the forex market if you spot an opportunity.

It is well worth remembering though, that as the largest trading market in the world by volume, the forex market can move incredibly fast. Therefore, although margin can magnify profits, it can also amplify losses if the market moves against you. This is because your loss is calculated from the full value of the position, not your deposit, and it is possible to lose more than your initial deposit on a trade. The very best advice you can heed is to take the opportunity that a margin presents, but remain mindful and have a strong risk management strategy in place.