Abstract:Saint Vincent and the Grenadines is one of the most popular offshore jurisdictions in the world for forex brokers. The Caribbean country is well-known for its low taxes and ease of doing business, but it also has little oversight over forex brokers registered there.

Saint Vincent and the Grenadines is one of the most popular offshore jurisdictions in the world for forex brokers. The Caribbean country is well-known for its low taxes and ease of doing business, but it also has little oversight over forex brokers registered there.

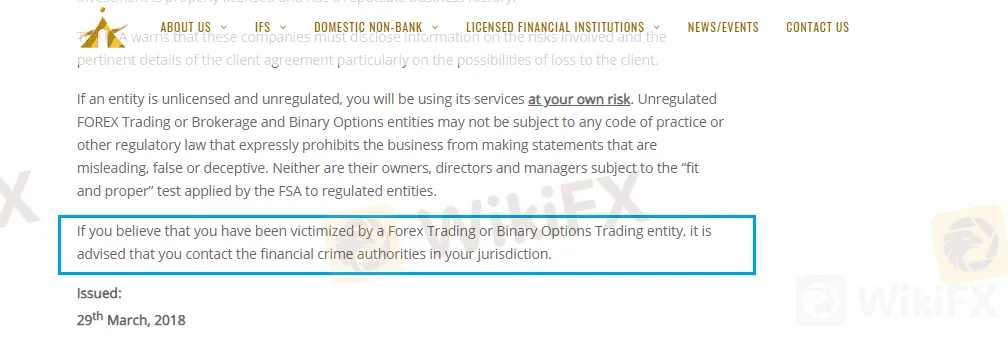

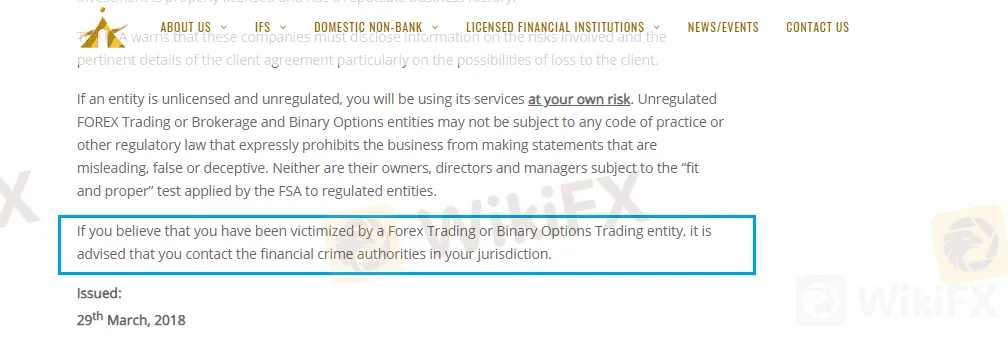

Traders in Saint Vincent and the Grenadines who are considering opening an account with a forex broker should be aware that the government does not “regulate, monitor, supervise, or license” any forex brokers. This is clearly stated on Saint Vincent and the Grenadines Financial Services Authority's website, which means that any broker claiming to be regulated in the country is lying.

Lax regulations, on the other hand, mean great opportunities for forex traders looking to take advantage of high trading leverage, which can be as high as 1: 1000 in Saint Vincent and the Grenadines.

An Overview of the SVG FSA

Because of the growing demand for the financial sector and offshore zones, the Financial Services Authority was established with the responsibility of regulating non-banks, certain entities in the financial sector, and controlling the international financial services industry in St. Vincent and the Grenadines.

The SVG FSA was established seven years ago, in November 2012, with the mission of developing, regulating, and supervising St. Vincent and the Grenadines as a secure and competitive financial center in the international and financial sectors in accordance with best practices, through the promotion of integrated operations, as stated on the authority's official website. However, the main topic in the financial investment world, Forex Trading or Brokerage activity, which is also rapidly growing in demand, does not have a solution for regulation of Forex, CFDs, and Binary Options in SVG.

According to the official warning, the SVG FSA's activities do not include the regulation or even licensing of the Forex business.

“Some financial institutions falsely claim to be registered or licensed in our jurisdiction.” Their motivation is most likely illegal, and potential customers should exercise extreme caution when doing business with them.

Why not use an SVG FSA-registered broker?

St. Vincent and the Grenadines (SVG) is a Caribbean island that has become well-known for its tax haven services to international businesses. St. Vincent is an appealing option for financial institutions and businesses that, for various reasons, prefer to conduct business through an offshore company. Because the jurisdiction offers easy-to-achieve setup requirements through a very quick, simplified process, while the firm does not necessarily need an office in SVG, it allows the firm to maintain low initial capital, no strict establishment rules or requirements, and yet allows running a global business. Furthermore, no strict regulation or oversight of the company's operations is in place. Because the forex business in St Vincent is not regulated, the SVG broker can operate, provide trading environments, and accept forex payments via credit cards, but is not supervised.

Because SVG FSA allows for low setup requirements with no business planning, management interviews, or background checks. While the registered company operates without a Handbook, Regulatory Reporting, or Imposition of Fines in the event of malicious service, there is no implied protection such as Fund Segregation, Negative Balance Protection, or Compensation in the event of insolvency. The obvious question is:

Why Should You Trade with SVG Broker?

As a result, in addition to beautiful seaside beaches, the SVG, with its offshore environment, has become a well-known hub of financial firms, even though the legal environment can be quite lax when it comes to the Forex business and brokerage itself. Check out the UK's FCA Authority and its strict regulation, oversight of brokerages, and heavy fines if the company fails to meet its obligations for a better understanding.

Investment and trading services are becoming increasingly popular. However, to avoid falling victim to the growing number of scams and frauds, you should carefully select a company before proceeding with any funding. Forex and derivatives trading as a decentralized market can be a high-risk opportunity if the company provides trading services without strict industry oversight. As a result, to protect yourself from potential scammers, we always recommend choosing among the most reputable and, of course, heavily regulated brokers. For example, learn about and compare eToro's offering and heavy regulation. You can also read our article Forex Trading Scams to learn how to protect yourself and gain a better understanding of how frauds operate.

Furthermore, most offshore brokers, such as SVG Brokers, are associated with other companies, and while the offering differs slightly from the majority of frauds, the outcome is equally disappointing. The main concern is a lack of regulatory oversight, which places SVG companies well below the recommended safety line. In essence, you only get the company's honest word.

SVG FSA receives complaints and reports of scams.

We have received numerous user reviews, the vast majority of which are negative. What exactly are the complaints about? Client withdrawal is refused, which means that a client who invests cannot withdraw profits or funds.

In that case, the SVG FSA will be unable to assist through customer protection, advise, or take further action, leaving the trader completely alone. As a result, there is no way to complain or receive assistance from the authorities.

Furthermore, many imposters use SVG as their address, regulation, or registration while pretending to be a legitimate firm. The SVG authorities recognized that potential and warned potential or already engaged traders that trading with an unlicensed and unregulated company puts the trader at risk. Because an unlicensed or offshore broker is frequently not subject to any oversight of practice or regulatory laws, the company may easily mislead or falsify any information or service it provides.

The SVG FSA's only attempt to protect clients is to issue an advisory and list entities on the alert list in the event of false license claims in the SVG jurisdiction, but the protection “actions” end there. Investor Alerts - SVG FSA

Examining the Forex Brokers List in Saint Vincent and the Grenadines

We have currently reviewed many Forex Brokers from St. Vincent and the Grenadines, but none of them were included in the list of trusted brokers with a safe trading recommendation. The only brokerages that can be trusted are those that have additional licenses from reputable authorities and conduct business in SVG. Before signing up, carefully review the broker's regulation status, authorization claims, news, and reputation by reading reviews and verifying the legitimacy of the documentation.

You can also find and verify the company on the regularly updated Brokers list to avoid or submit your inquiry. Then, if you find a broker on the list, you should avoid any cooperation or trading with them at all costs, as the list consists primarily of unregulated and offshore firms.

About WikiFX

WikiFX was created to assist traders in determining whether a broker is regulated or unregulated. It has over 37,000 brokers listed on the platform and collaborates with 30 financial regulators.

WikiFX's database is sourced from official regulatory bodies such as the FCA, ASIC, and others. Fairness, objectivity, and fact are also emphasized in the published content. WikiFX does not charge fees for public relations, advertising, ranking, data cleaning, or other illogical services. WikiFX will do everything possible to maintain database consistency and synchronization with authoritative data sources such as regulatory authorities, but cannot guarantee that the data will always be up to date.

WikiFX can expose the broker's illegal activities and help financial regulators resolve any cases. The WikiFX Right Protection team is responsible for all resolved cases reported to WikiFX from around the world. Use the WikiFX App at all times to help you choose the best broker for your trading journey.

SVG Regulation Conclusion

Finally, traders and investors should ensure that they have a clear understanding of the procedures and risks involved if the company or another offering the forex trading opportunity is not properly licensed.

Because of the recent growth of the international Forex trend, trading investors are urged to exercise caution before signing up for or accepting the offering. Any broker who declares FSA SVG regulation has made a false claim. As it is now clear why SVG incorporated firms disclose information on risks, particularly the possibility of loss, we advise avoiding offers from brokers mentioning their SVG FCA regulated status. To become a trustworthy provider of financial and trading services, the firm must be strictly regulated and maintain a high level of reputation throughout its operational history. It does not lend credibility to the brokerage, which is based offshore and was established with a low registration requirement while none of the protective principles were followed.

Stay tuned for more news about St Vincent and the Grenadines Forex Brokers