Company Summary

| IBF Review Summary | |

| Founded | 2005 |

| Registered Country/Region | Indonesia |

| Regulation | BAPPEBTI, JFX |

| Market Instruments | Forex, Metals, Energies, Asian Index, US Index |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | IBFTrader |

| Minimum Deposit | / |

| Customer Support | Tel: (022) 86061128 |

IBF Information

IBF, established in 2005, is regulated by both BAPPEBTI and JFX. It offers trading in Forex, Metals & Energies, Asian Index, and US Index. The broker utilizes segregated accounts for client funds and operates on its proprietary IBFTrader platform, accessible on both iOS and Android.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

Is IBF Legit?

IBF has a Retail Forex License regulated by BAPPEBTI and the Jakarta Futures Exchange (JFX) in Indonesia.

| Regulated Authority | Current Status | Regulated Country | License Type | License No. |

| BAPPEBTI | Regulated | Indonesia | Retail Forex License | 912/BAPPEBTI/SI/8/2006 |

| Jakarta Futures Exchange | Regulated | Indonesia | Retail Forex License | SPAB-142/BBJ/08/05 |

What Can I Trade on IBF?

IBF offers trading in Forex, Metals, Energies, Index Asia (combined stock prices indicating market conditions), and US Index (reflecting the strength of the US Dollar).

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Energies | ✔ |

| Index Asia | ✔ |

| US Index | ✔ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Futures | ❌ |

Account

IBF uses segregated accounts for all customer funds, as required by BAPPEBTI regulations. These accounts are held with major banks like Bank Central Asia (BCA) and Bank Mandiri.

IBF Fees

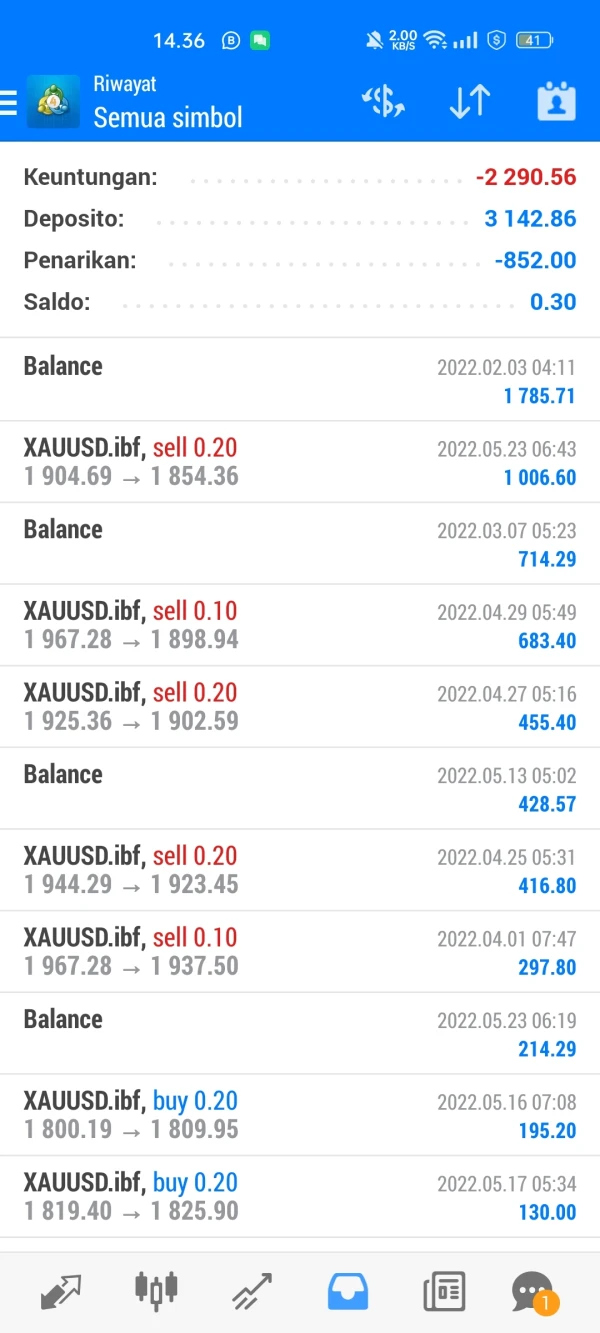

IBF offers very low spreads for trading metals like Gold (XAU/USD) and Silver (XAG/USD), and there are no transportation and storage costs. However, there is no information provided about specific commission fees.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| IBFTrader | ✔ | iOS, Android | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

FX1687518065

Indonesia

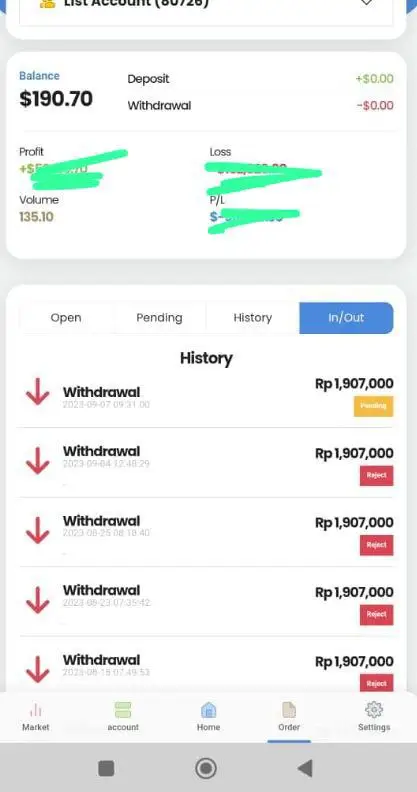

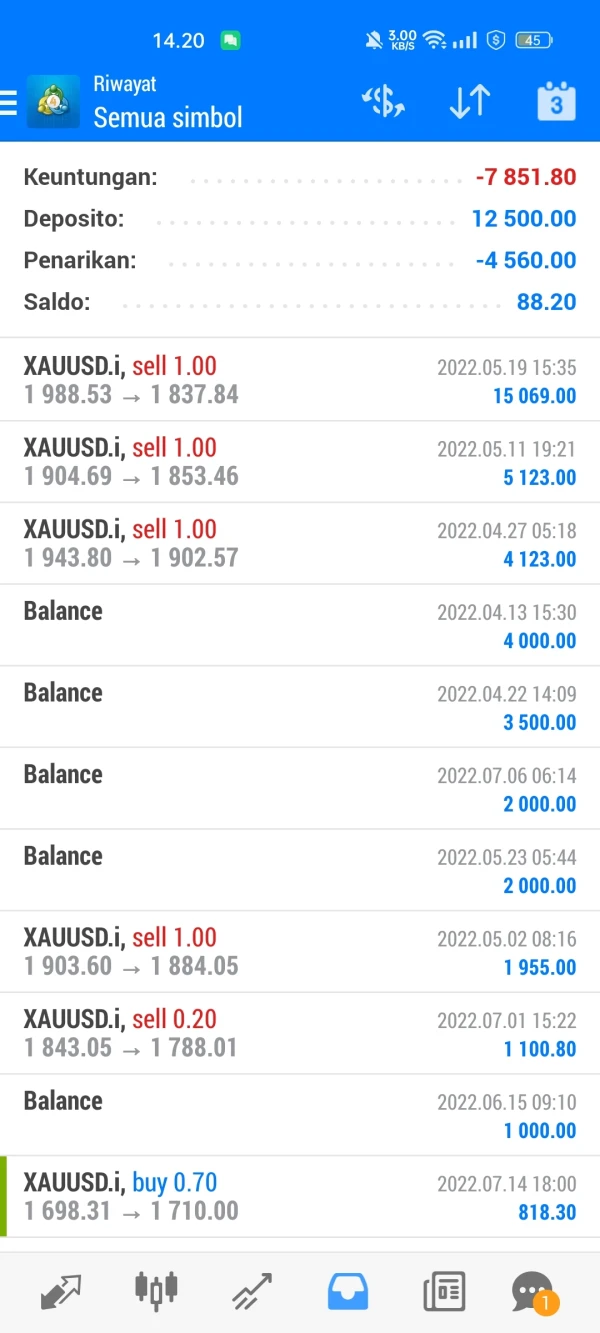

My acquaintance has opened 2 accounts where the data has been verified. Account 1 is at a loss, and account 2 is profitable. From account 2, I successfully withdrew 4 times, but when I wanted to withdraw the remaining amount, I couldn't. Instead, IBF questioned the already verified data, and the amount withdrawn was just the capital and profit. The other account actually still has 1.9 million left, but it couldn't be withdrawn either, they said. What a loss!

Exposure

Rey

Philippines

I have been in contact with IBFX for several weeks trying to close down my account. I originally thought I had transferred the money from Zions bank, a bank which they use to transfer funds, Into my personal account. However I sent them my personal banks ABA number. Zions bank said they rejected the transfer due to using the ABA routing number of my personal bank. They say they do not have the money. IBFX says They do not have the money. My account is now empty and no one will refund my money. I would have never had thought this would happen with a US broker. I expect it from form cyprus bucket shop but not with a broker such as IBFX. I will scream here until I see justice and my account properly funded. IBFX you have been warned.

Exposure

FX5944873722

Malaysia

I wanted to close my account and transfer my investment. But they refused my application. I wanted to reported it and get it punished.

Exposure

aa_haq

Indonesia

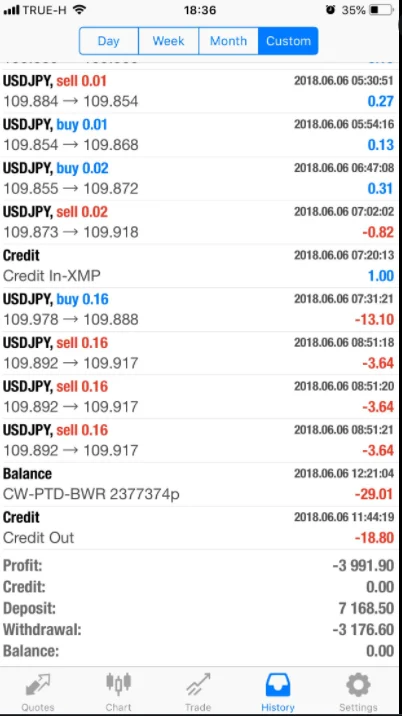

Transaction fee is too expensive: $50 per lot.

Neutral

メ错了而已

United States

The pages of this website are all in Indonesian language, which I can't understand at all. I can't find a place to switch languages either. If you are not a native speaker, don't waste your time here.

Positive

H Global Trade

Indonesia

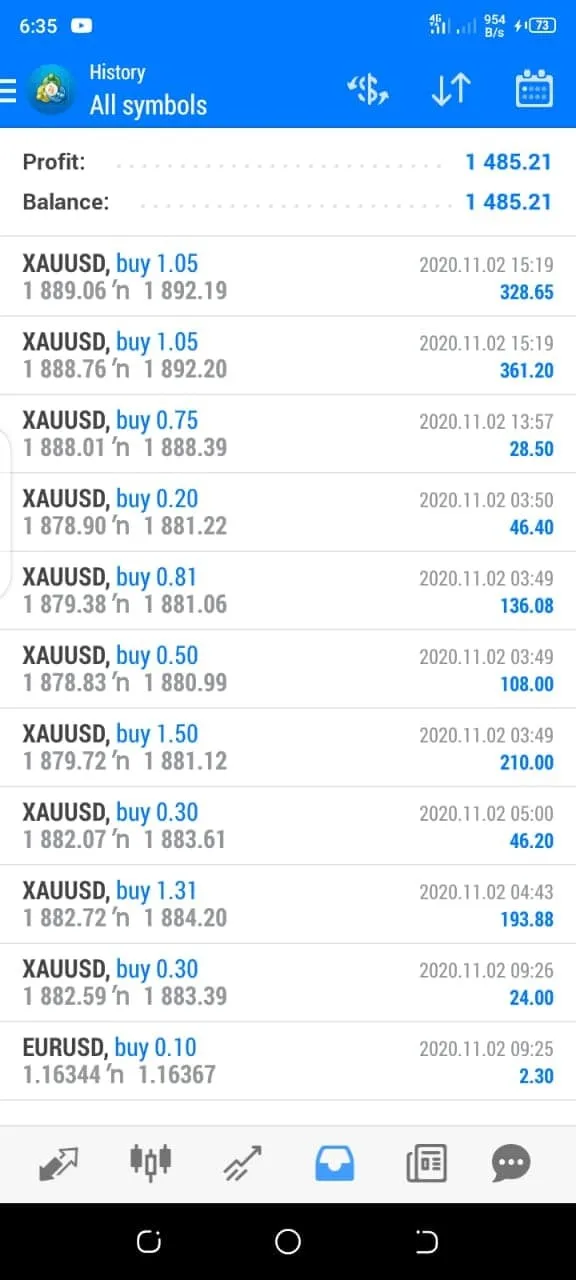

I was at a loss by this broker team. the address of the broker is in the Sunday market, please investigate so that the person in prison is imprisoned. I lost a lot of money and my account was played by the IBF trader Please help me to catch on behalf of the great who works at the IBF Sunday market ITS Tower, I have been scammed. made sweet promises, apparently my money was lost. I still have the phone number of this scammer and the photo of the culprit who tricked me. please help to follow up [d83d][de2d][d83d][de2d][d83d][de2d][d83d][de2d] (085156763863) Fraudster Office address Niffaro Park, ITS Tower, Jl. Raya Pasar Minggu No. 18, RT.1/RW.1, Pejaten Timur. district. Ps. Sunday, South Jakarta City, Special Capital Region of Jakarta 12510. 9th floor office no. 3 ( https://goo.gl/maps/yGF2BMYnzJurUagG8 ) I was blackmailed by someone who worked at IBF on behalf of Agung. was promised a big profit opportunity but my money just disappeared, less than 3 months was gone. they only look for commissions from traded transactions when I want my money to be held on the grounds that there must be a letter of agreement between the account owners. even though the account I use is a personal account.

Exposure