Company Summary

| GULF BROKERSReview Summary | |

| Registered On | 2012-01-05 |

| Registered Country/Region | Australia |

| Regulation | FSA (Offshore Regulated) |

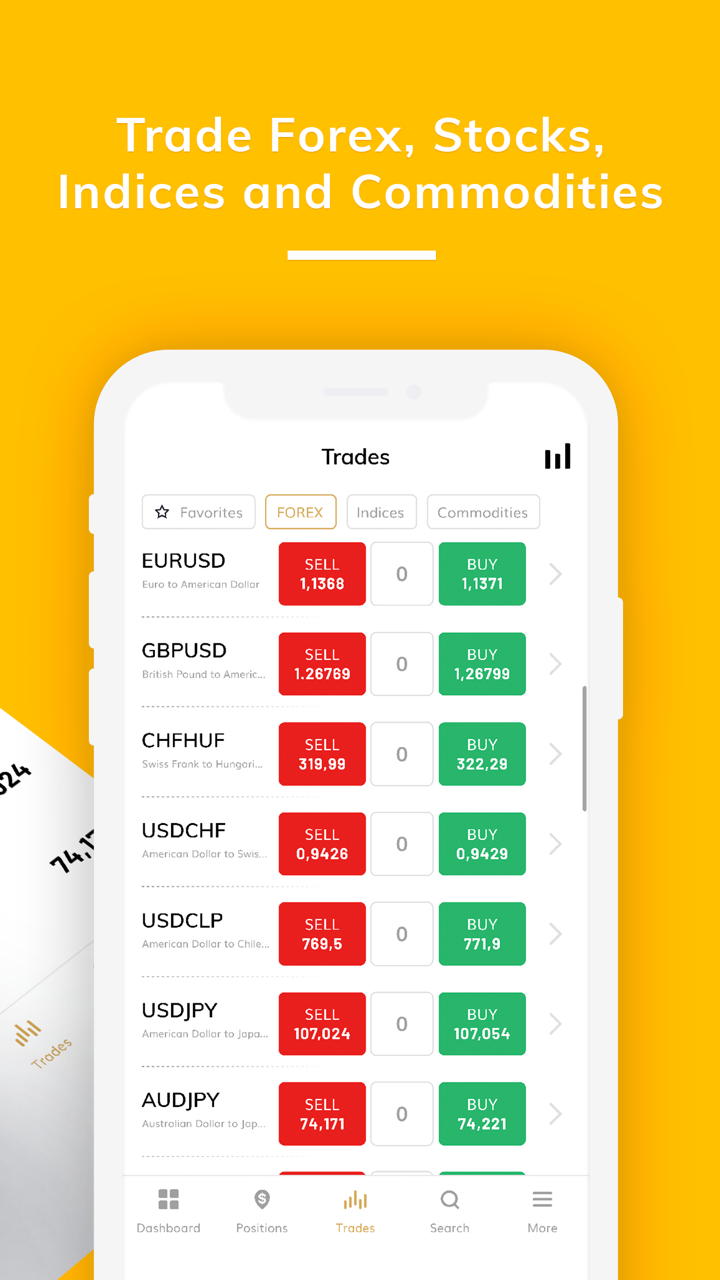

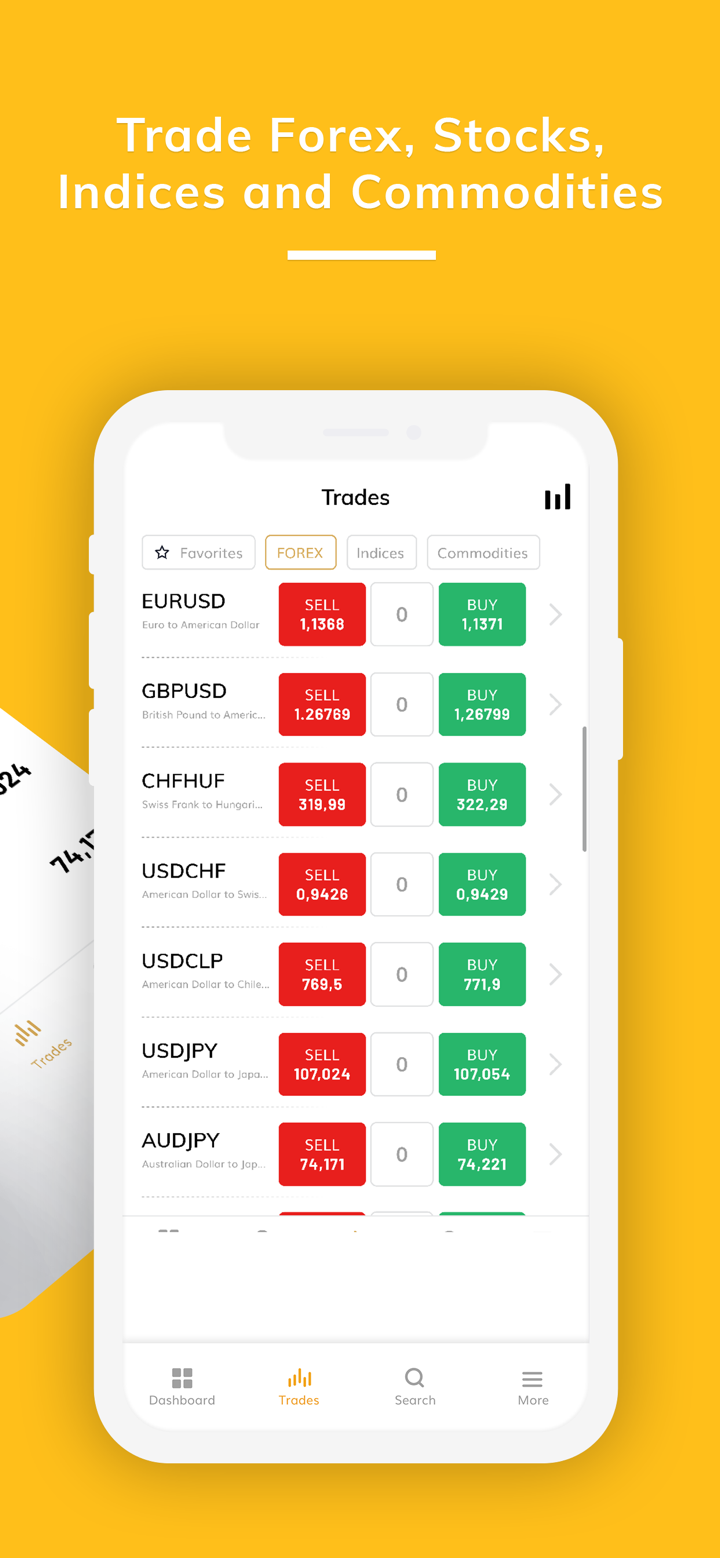

| Market Instruments | Forex, stock indices, shares, and commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 0.0 pips |

| Trading Platform | MT5 (Web-based platforms, iOS, and Android) |

| Min Deposit | $20,000 |

| Customer Support | +44 20 3885 7310 |

| support@gulfbrokers.com | |

| Twitter, Instagram, Facebook | |

| GULF BROKERS LTD Room B11, First Floor, Providence Complex, Providence, Mahe Seychelles. | |

GULF BROKERS Information

GULF BROKERS is an online broker that provides global traders with multi-category trading services, including forex, stocks, commodities, indices, etc. The platform uses MetaTrader 5 (MT5) as its core trading tool, supporting mobile and web-based operations. With a minimum deposit of $20,000, it is suitable for certain traders but not for small-scale investors.

Pros and Cons

| Pros | Cons |

| Multiple trading instruments | Offshore regulation (FSA) |

| Flexible accounts | Minimum deposit of $20,000 (Silver account) |

| MT5 available | Inactivity fee for dormant accounts |

| Leverage up to 1:500 | Minimum spread of 3 pips (EUR/USD) |

Is GULF BROKERS Legit?

GULF BROKERS is a legitimate and regulated online broker, holding a financial investment business license (SD013) issued by the Financial Services Authority (FSA) of Seychelles. The broker complies with international standards, including anti-money laundering (AML) regulations and client fund segregation rules, which ensure a high level of security for investors funds. This makes GULF BROKERS a reputable choice for traders seeking a regulated broker, although its offshore regulatory status may be a concern for some.

What Can I Trade on GULF BROKERS?

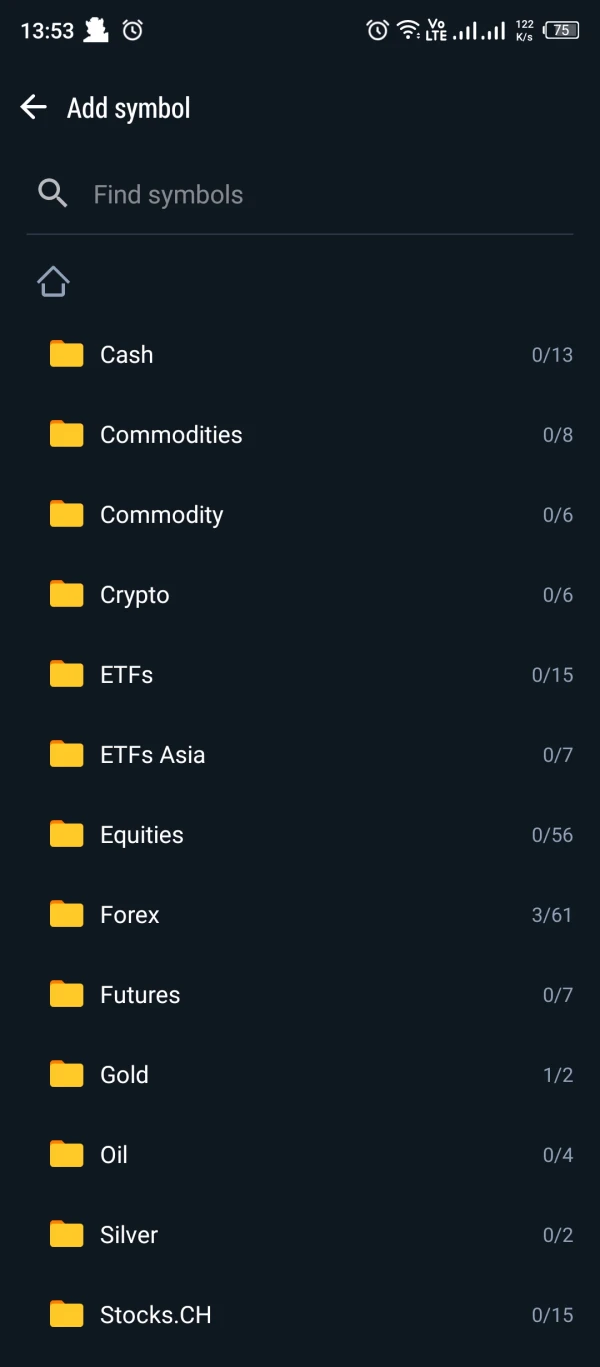

GULF BROKERS offers a range of tradable instruments, including GULF BROKERS forex, shares, commodities, and indices. The platform provides access to a variety of forex pairs, including major, minor, and exotic currencies, which allows traders to participate in global currency markets. In addition to forex, GULF BROKERS offers shares from various global markets, enabling traders to invest in stocks from leading companies.

However, GULF BROKERS does not offer trading in ETFs, bonds, or mutual funds. Overall, GULF BROKERS provides a solid selection of instruments, with a particular emphasis on GULF BROKERS forex trading, which can appeal to both experienced and new traders.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Shares | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type

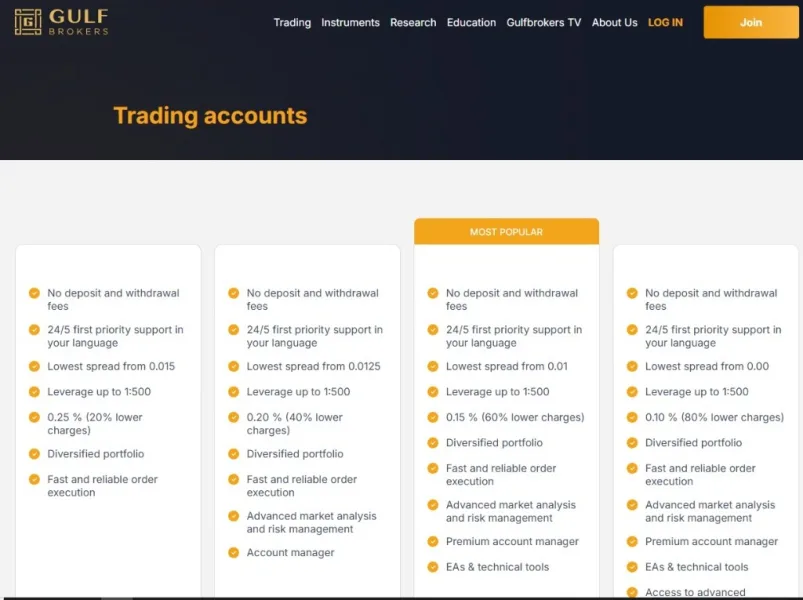

GULF BROKERS offers four account types, each designed to cater to different trading needs and capital levels. The Silver account requires a minimum deposit of $20,000, while the Gold account demands a $50,000 deposit. For more advanced traders, the Platinum account has a $200,000 deposit requirement, and the Diamond account requires a $500,000 minimum deposit.

All accounts come with no deposit or withdrawal fees, and customer support is available 24/5 for every account type. In terms of spreads, the Silver account offers spreads from 0.015 pips, while the Diamond account features spreads starting from 0.0 pips. The Platinum and Gold accounts offer tighter spreads, with Platinum starting from 0.01 pips and Gold from 0.0125 pips.

GULF BROKERS offers maximum leverage of 1:500 across all account types, allowing traders to manage larger positions with a smaller initial capital. Trading fees vary by account level, with lower fees for higher-tier accounts. The Silver account charges 0.25%, while Gold, Platinum, and Diamond accounts charge progressively lower fees.

| Account Type | Silver | Gold | Platinum | Diamond |

| Minimum Deposit | $20,000 | $50,000 | $200,000 | $500,000 |

| Deposit and withdrawal fees | No | No | No | No |

| Customer Support | 24/5 | 24/5 | 24/5 | 24/5 |

| Lowest spread | From 0.015 pips | From 0.0125 pips | From 0.01 pips | From 0.0 pips |

| Maximum Leverage | 1:500 | 1:500 | 1:500 | 1:500 |

| Fees | 0.25 % (20% lower charges) | 0.20 % (40% lower charges) | 0.15 % (60% lower charges) | 0.10 % (80% lower charges) |

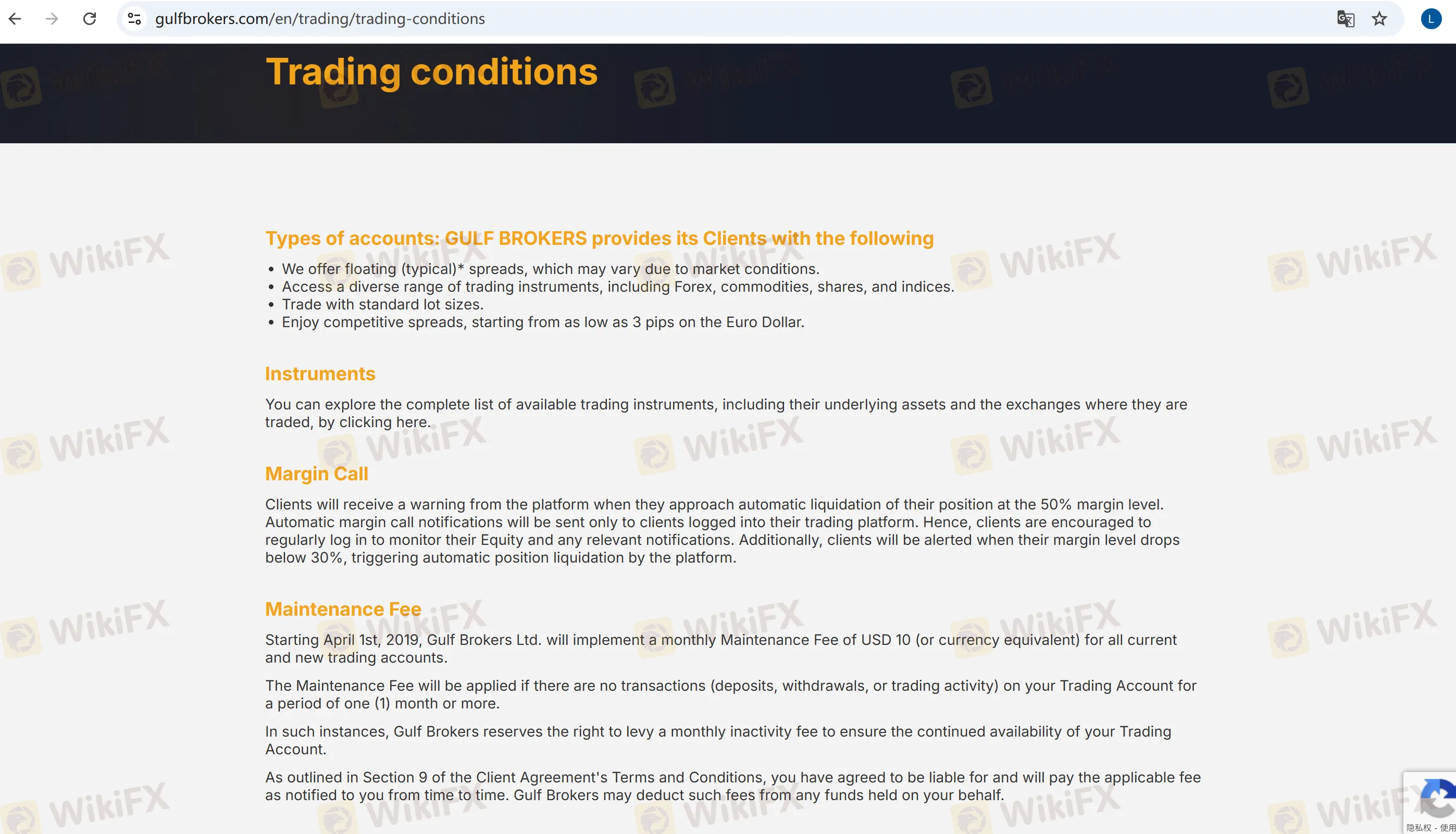

GULF BROKERS Fees

GULF BROKERS has competitive trading fees, with floating spreads that start from 0.015 pips for the Silver account and tighten for higher-tier accounts. The Diamond account offers the lowest spreads, starting at 0.0 pips. The Gold and Platinum accounts have spreads from 0.0125 and 0.01 pips, respectively, offering more favorable conditions for active traders.

In terms of commission, GULF BROKERS charges between 0.10% and 0.25%, depending on the account type. Higher-tier accounts benefit from lower commission rates, with Diamond accounts receiving the lowest charges at 0.10%.

For non-trading fees, GULF BROKERS charges an inactivity fee of $10 or its equivalent per month for accounts with no trades, deposits, or withdrawals for over a month. Margin interest is waived for Islamic accounts, while standard accounts incur overnight interest at market rates.

Leverage

GULF BROKERS offers up to 1:500 leverage on all its account types, allowing traders to control larger positions with a relatively small initial deposit. This is significantly higher than the standard leverage offered by many other brokers in the industry, which typically ranges from 1:100 to 1:200 for retail accounts. The high leverage is especially beneficial for experienced traders who wish to maximize their trading opportunities, but it also carries higher risk due to the increased exposure to market fluctuations.

Trading Platform

GULF BROKERS offers the MT5 (MetaTrader 5) platform, which is compatible with web-based platforms, iOS, and Android devices. This allows traders to access their accounts and execute trades across various devices.

The GULF BROKERS MT5 platform provides essential tools for analysis, including real-time market data, charting features, and technical indicators, which are commonly used by professional traders. It supports advanced order types and automated trading features, which can help experienced traders manage their positions and strategies.

For beginner traders, GULF BROKERS offers a demo account with $100,000 in virtual funds, providing an opportunity to practice using the platform without financial risk. This feature can help new users become familiar with the interface and trading tools available on the GULF BROKERS trading platform.

In summary, GULF BROKERS MT5 offers a versatile and accessible platform for both professional and beginner traders, allowing them to trade on a variety of devices while benefiting from advanced trading tools and a risk-free environment for practice.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Web-based platforms, iOS, and Android | Professional traders |

Nguyễn Đức Nhân

Vietnam

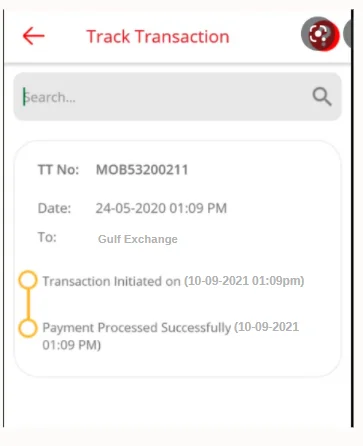

GULF invited clients to deposit fund through calls and induced them to add fund to fix bugs. When it came to withdrawal, it set varied complicated steps.

Exposure

FX2485519922

Vietnam

GULF deducted the tax and delayed to hand out the stock interest.

Exposure

FX4049978810

Vietnam

Money is deducted from guest account automatically, which investors will not be informed of via email or with notice. It is totally unreasonable, irresponsible and unaccountable.

Exposure

SeptiSakina

Indonesia

Some shortcomings that need to be noted are weak regulation due to offshore operations, relatively high spreads for some instruments, lack of transparency regarding account types and other fees, lack of regulation in Europe or Indonesia, deposit methods that do not support local Indonesian options, sometimes slow or unresponsive customer service, unsuitability for beginner traders with small capital, no negative balance protection, and a somewhat slow application that makes it less suitable for beginners, though it can be used on MT5. The spreads are also quite large in my opinion.

Neutral

FX1287201128

United Arab Emirates

I give Gulf Broker five stars, for its fast deposit and withdrawal. Never have any issues or problems, Kim is always here to solve my problems, thank you.

Neutral

FX1229335420

New Zealand

I've been using other broker's trading apps, but It's frustrating when you see price moves manipulated. But with GULF BROKERS, it's been a while trading with mobile apps and even on my desktop. With my demo account, no issues were found. Market execution is great. Thanks to the team and the management. God Bless.

Positive

创意窗饰

Malaysia

I used this broker one year ago, and I think it is an excellent broker. Educational resources and tools are very friendly to beginners, like me. Their customer support team were very patient and professional to help me complete my trades at the very beginning. I remember I made a profits of $1286 on this platform, and I withdrew my profits quickly. I would definitely give it five stars!

Positive

Andy loh

Malaysia

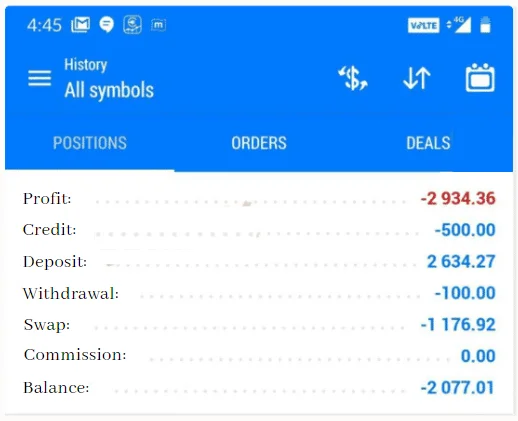

I Lost huge amount because of Gulf Broker. They will give you wrong advise multiple times. You will end up paying swap charges, brokerage and filling their pocket.

Exposure

FX1173277285

India

Lost huge amount because of Gulf Broker. They will give you wrong advise not once, not twice but multiple times. You will end up paying swap charges, brokerage and filling their pocket. They don't care about their loss.

Exposure

FX1391495872

India

gulf they don't have money management again to again ask fund up for equity maintenance still no profit totally lost my 1200 dollar in just 4 months and swap amount and spread is high not suitable Indian traders [d83d][de2d][d83d][de21]

Exposure