Company Summary

| Aspect | Information |

| Registered Country/Area | Australia |

| Founded year | 2012 |

| Company Name | MEX Exchange |

| Regulation | ASIC |

| Minimum Deposit | No minimum deposit |

| Maximum Leverage | Up to 1:500 |

| Spreads | Average spreads as low as 0.5 pips for EURUSD, 1.0 pips for EURGBP, 0.8 pips for EURJPY, 0.8 pips for GBPUSD, 1.5 pips for XAUUSD |

| Trading Platforms | MEX NexGen MT4, MT4 Terminal, MT4 Web Terminal, MetaTrader4 Mac, MT4 Mobile, MAM (Multi-Account Manager), FIX API |

| Tradable assets | Foreign Exchange (FX), Metals (Gold & Silver), CFDs |

| Account Types | Classic Account, ECN Account |

| Demo Account | N/A |

| Customer Support | Phone and Email |

| Payment Methods | VISA/MasterCard credit cards, bank wire transfers, Skrill, Neteller |

| Educational Tools | MetaTrader 4 User Guide, Market Analysis, MEX Blog, LepusProprietaryTrading, Autochartist, Economic Calendar, MetaTrader 4 video tutorials, signal providers |

Overview of MEX Exchange

MEX Exchange is a reputable online trading platform regulated by ASIC, the Australian Securities and Investment Commission. Traders can benefit from MEX Exchange's maximum leverage of up to 1:500, allowing for greater trading potential. The platform offers competitive spreads on various currency pairs and precious metals, with average spreads as low as 0.5 pips for EURUSD. MEX Exchange provides a range of trading platforms, including MEX NexGen MT4, MT4 Terminal, MT4 Web Terminal, MetaTrader4 Mac, MT4 Mobile, MAM, and FIX API, ensuring flexibility and convenience for traders across multiple devices.

With a wide range of tradable assets, including Foreign Exchange (FX), Metals (Gold & Silver), and CFDs, traders have diverse options to explore. MEX Exchange offers different account types, such as the Classic Account and ECN Account, catering to various trading preferences.

Customer support is available through phone and email, ensuring assistance whenever needed. MEX Exchange accepts various payment methods, including VISA/MasterCard credit cards, bank wire transfers, Skrill, and Neteller. Furthermore, MEX Exchange offers a comprehensive set of educational tools, such as the MetaTrader 4 User Guide, Market Analysis, MEX Blog, LepusProprietaryTrading, Autochartist, Economic Calendar, MetaTrader 4 video tutorials, and signal providers.

Is MEX Exchange legit or a scam?

MEX Exchange is regulated by the Australian Securities and Investment Commission (ASIC) and meets strict capital requirements. When funding your trading account client funds are held in segregated client trust accounts with Australian banks. MEX Exchange currently holds a full license from the Australian Securities and Investments Commission (Regulatory Number: 416279).

Pros and Cons

MEX Exchange has several advantages that make it an attractive online trading platform. Firstly, it is regulated by ASIC, ensuring that it operates within the legal framework and meets the required standards. Traders also benefit from a wide range of tradable assets, including foreign exchange, metals, and CFDs, providing diverse options for investment. Another advantage is the absence of a minimum deposit requirement. Competitive spreads on currency pairs and precious metals further enhance the trading experience. MEX Exchange offers multiple trading platforms, allowing traders to choose the one that suits their preferences. The platform also provides a maximum leverage of up to 1:500.

However, there are some drawbacks to consider. MEX Exchange does not offer a demo account and it lacks transparency on additional fees, such as intermediary transfer and conversion fees. Customer support channels are also limited, potentially affecting the availability and responsiveness of assistance. Moreover, it lacks comprehensive educational resources beyond these tools, which may be a disadvantage for traders seeking extensive educational materials.

| Pros | Cons |

| Regulated by ASIC | No demo account available |

| Wide range of tradable assets | Lack of transparency on additional fees (intermediary transfer, conversion fees) |

| No minimum deposit requirement | Limited customer support channels |

| Competitive spreads on currency pairs and precious metals | Lack of educational resources beyond trading tools |

| Multiple trading platforms available | |

| Maximum Leverage of up to 1:500 | |

| Convenient deposit and withdrawal options |

Market Instruments

MEX offers a wide broad range of financial instruments to choose from, Foreign Exchange, Metals (Gold & Silver), and CFDs.

Contract for Difference (CFD):

MEX Exchange offers Contract for Difference (CFD) trading as an alternative to trading futures online. CFDs allow traders to speculate on the price movements of various financial instruments without actually owning the underlying assets. This flexible online trading option provides opportunities to profit from both rising and falling markets.

Forex:

MEX Exchange allows traders to participate in the Foreign Exchange (Forex) market, which is the international market for currency trading. Through MEX's ECN Trading Platforms, traders can access the Forex market and engage in currency trading. The platform provides a range of currency pairs and leveraged trading options, enabling traders to take advantage of fluctuations in exchange rates.

Metals:

MEX Exchange offers a selection of metals for trading, including but not limited to Gold, Silver, Platinum, Copper, and Aluminium. Trading metals provides an opportunity to diversify investment portfolios and potentially benefit from price movements in these commodities. MEX facilitates trading in metals through its online platform, allowing traders to speculate on price changes and potentially profit from market fluctuations.

It is important to note that trading CFDs, Forex, and metals involves risks, and individuals should carefully consider their investment objectives and risk tolerance before engaging in such activities. It is recommended to seek professional advice and conduct thorough research to make informed trading decisions.

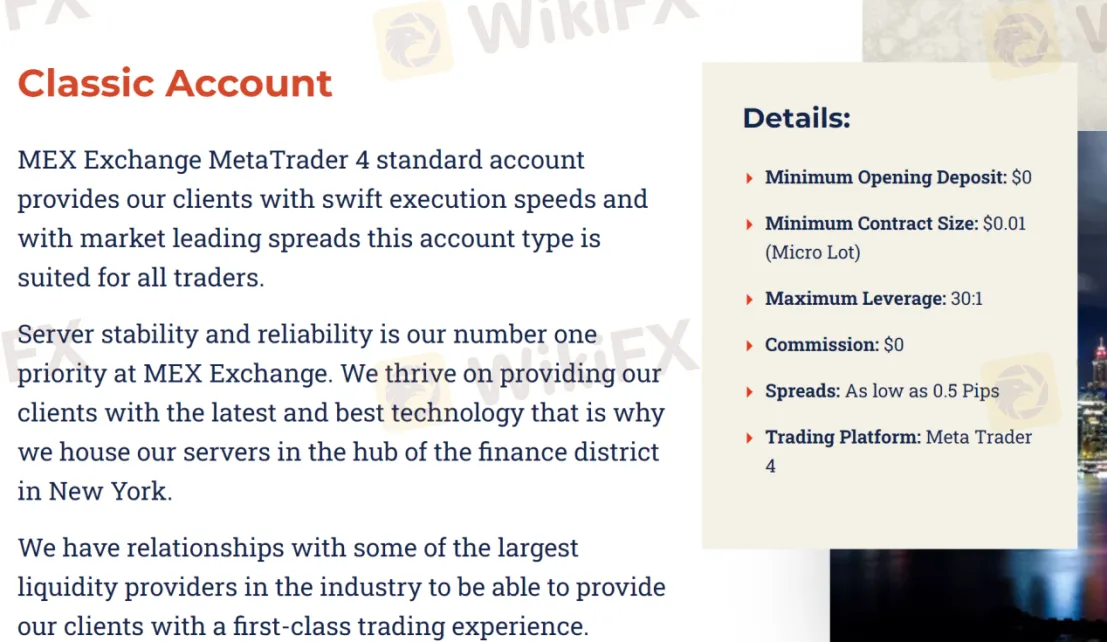

Account Types

The Classic Account offered by MEX Exchange on their MetaTrader4 platform is an exceptional choice for traders seeking efficient execution speeds and competitive spreads. Designed to cater to the needs of all traders, this account type ensures an effective trading experience. With a minimum opening deposit of $0 and a minimum contract size of $0.01 (Micro Lot), the Classic Account provides flexibility to traders of all levels. Additionally, a maximum leverage of 30:1, zero commission, and spreads as low as 0.5 Pips make this account type even more attractive. Experience the power of trading on the renowned MetaTrade4 platform with MEX Exchange.

MEX Exchange provides its clients with market-leading pricing and trading conditions through the MT4 platform, offering them access to True ECN Connectivity. By utilizing MEX ECN, this forex trading platform directly sources its raw feed from their ECN (Electronic Communication Network) connection, resulting in the tightest spread on EURUSD starting from 0.0 pips on average. With a minimum opening deposit of $0 and a minimum contract size of $0.01 (Micro Lot), clients have the opportunity to leverage up to 1:30, while incurring a commission of $7. The trading experience is further enhanced by the availability of the Meta Trader4 platform.

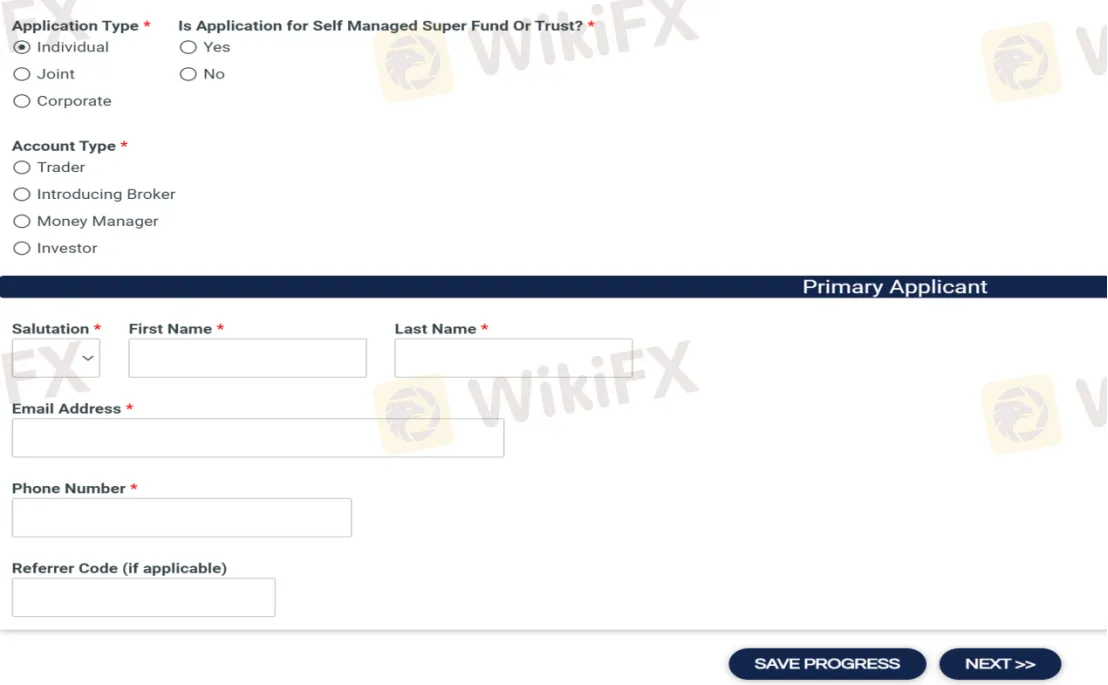

How to Open an Account?

To open an account with MEX Exchange, please follow these main procedures:

1. Visit the MEX Exchange website at https://www.mexexchange.com/.

2. Locate and click on the “Live Account” button. This will typically be found on the homepage or in the top menu.

3. Fill out the account registration form. Provide accurate and relevant information, including your name, email address, phone number, and country of residence.

4. Submit your registration form. You may receive a confirmation email to verify your email address.

5. Complete the verification process. This usually involves providing additional documents to confirm your identity and address, such as a valid government-issued ID, proof of address (utility bill or bank statement), and potentially other documents as required by MEX Exchange.

6. Wait for the verification process to be completed. Once your account is verified, you will receive notification from MEX Exchange.

7. Fund your account. Follow the instructions provided by MEX Exchange to deposit funds into your trading account. They typically offer various payment methods, such as bank transfers, credit/debit cards, or electronic payment systems.

Leverage

MEX Exchange offers flexible leverage options for different trading products. For forex products, clients can enjoy leverage of up to 1:500. For precious metals, the leverage is set at 1:250, while for spot commodities, it is set at 1:100. It's important to note that the actual leverage obtained may vary depending on the specific instrument being traded and the trader's level. Professional traders may have access to higher leverage levels upon confirming their status and meeting the necessary criteria. These varying leverage options provide traders with the flexibility to choose the level of risk they are comfortable with and tailor their trading strategies accordingly.

Spreads &Commissions

MEX Exchange Classic accounts provide competitive average spreads on various currency pairs and precious metals. For EURUSD, the average spread is as low as 0.5 pips, while for EURGBP, it is 1.0 pips. Traders looking to trade EURJPY can benefit from an average spread of 0.8 pips, while GBPUSD offers an average spread of 0.8 pips. XAUUSD, which represents trading in gold, has an average spread of 1.5 pips.

It's important to note that there are no trading fees associated with Classic accounts on MEX Exchange. Instead, traders are charged a commission of $7 per lot traded. Furthermore, the Classic account on MEX Exchange offers competitive pricing on USD, with an average spread of 0.4 pips.

Trading Platform

MEX Exchange provides traders with a diverse range of trading platforms to suit their preferences and needs. These include the MEX NexGen MT4, MT4 Terminal, MT4 Web Terminal, MetaTrader4 Mac, MT4 Mobile, MAM (Multi-Account Manager), and FIX API.

The MEX Exchange MT4 platform offers a comprehensive trading experience, allowing users to trade in foreign exchange (FX), metals, and CFDs. Leveraging MEX's cutting-edge ECN technology and the robust MT4 trading system, the platform ensures excellent reliability and precise execution with strict five-digit two-way pricing. This combination of advanced technology and pricing accuracy empowers traders to make informed decisions and execute trades with confidence. Whether accessing the platform through a desktop computer, web browser, Mac device, or mobile device, MEX Exchange strives to deliver a seamless trading experience across multiple devices and operating systems. Additionally, professional traders can take advantage of the MAM and FIX API functionalities, which offer enhanced control and customization options for managing multiple accounts and accessing trading interfaces pro-grammatically.

Minimum Deposit

MEX Exchange offers two different types of trading accounts, the Classic account, and the ECN account. Both account types do not have any minimum deposit requirement, which is advantageous for new traders looking to enter the market.

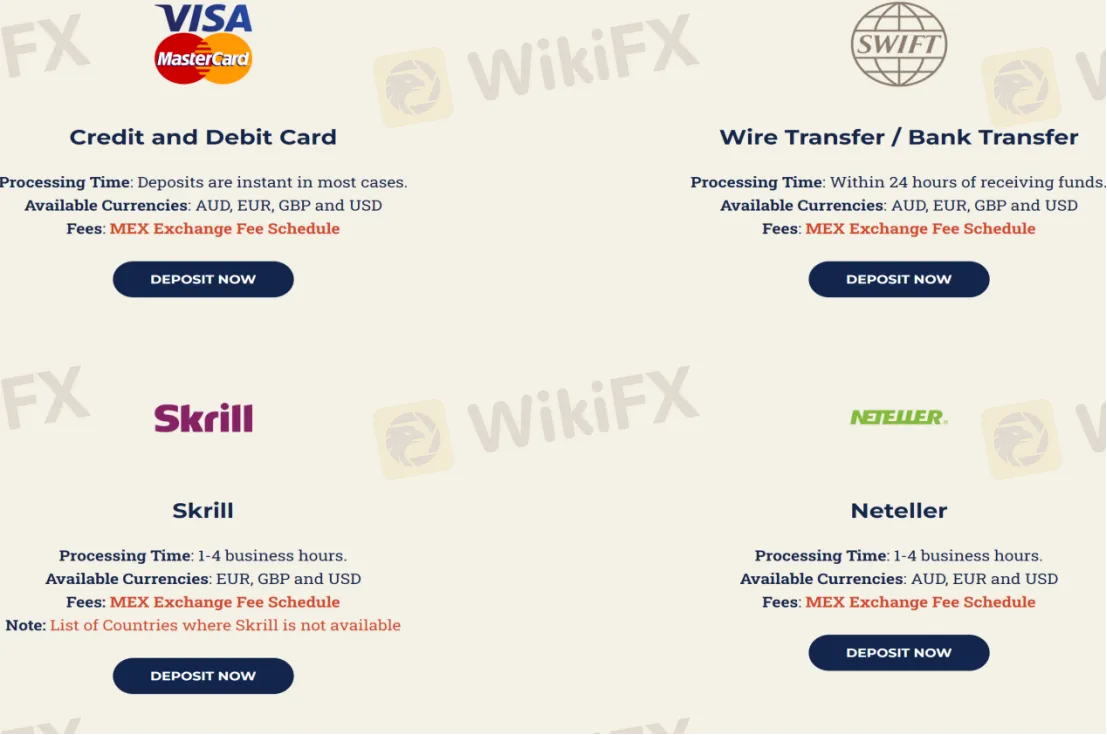

Deposit & Withdrawal

Deposits and withdrawals at MEX Exchange are designed to be convenient and efficient for traders. To deposit funds, traders have several options available. They can use VISA or MasterCard credit cards, which are generally processed instantly. Bank wire transfers are also accepted, with funds typically processed within 24 hours. Skrill and Neteller are alternative options, with processing times of 1-4 hours. It's important to note that credit cards and wire transfers support deposits in AUD, EUR, GBP, and USD, while Skrill and Neteller do not support deposits in AUD. MEX Exchange does not charge any internal deposit or withdrawal fees. MEX Exchange encourages clients to utilize their Client Portal for depositing funds, as it offers instant card funding.

When it comes to withdrawals, MEX Exchange recommends using their Client Portal. Withdrawals can be easily initiated by completing the online form on the relevant page. It's important to note that funds can only be withdrawn to an account or credit card in the same name as the MEX trading account. Third-party transfers will not be processed. MEX Exchange does not impose any internal fees for deposits or withdrawals. However, it's worth considering that payments to and from international banking institutions may incur intermediary transfer fees and/or conversion fees, which are independent of MEX Exchange. The responsibility for any such fees lies with the client.

Customer Support

MEX Exchange provides customer support to assist traders with their inquiries and trade management. The company's customer support can be contacted through various channels. The physical address of MEX Exchange is located at Level 61, Suite 61.03, MLC Centre, 19-29 Martin Place, Sydney, NSW 2000, Australia. For phone support, traders in Australia can dial 1800 859 092, while international traders can call +61 2 9195 4000. If traders prefer managing their trades over the phone, they can select option 4 for trade support. Additionally, traders can reach out to MEX Exchange's customer support team via email at support@mexexchange.com. Whether it's for general inquiries or assistance with trade-related matters, MEX Exchange aims to provide responsive and helpful customer support to its clients.

Educational Resources

MEX Exchange provides a comprehensive set of educational resources to support traders in their journey. These resources include a MetaTrader4 User Guide, which helps users navigate and utilize the platform effectively. Market Analysis is also available, offering insights and analysis on various financial markets to assist traders in making informed decisions. The MEX Blog provides articles and updates on market trends and trading strategies. Additionally, MEX Exchange offers education through LepusProprietaryTrading, which provides training and educational materials to enhance traders' knowledge and skills. Traders can also benefit from Autochartist, a powerful tool that identifies trading opportunities through pattern recognition. The Economic Calendar keeps traders informed about upcoming economic events that can impact the markets. For those who prefer video tutorials, MEX Exchange offers MetaTrader4 video tutorials, guiding users through the platform's features and functionalities. Moreover, traders can explore different signal providers to gain insights from experienced traders and enhance their trading strategies. With these educational resources, MEX Exchange aims to empower traders with the knowledge and tools necessary to make informed trading decisions.

Conclusion

In conclusion, MEX Exchange is a reputable online trading platform based in Australia and regulated by ASIC. The platform provides a maximum leverage of up to 1:500, allowing for greater trading potential. MEX Exchange offers a range of trading platforms, ensuring flexibility and convenience for traders across multiple devices. With a diverse range of tradable assets and different account types, traders have various options to suit their preferences. Customer support is available through phone and email, and the platform accepts multiple payment methods for deposit and withdrawal. Additionally, MEX Exchange provides a comprehensive set of educational tools to empower traders with knowledge and enhance their trading skills. However, it's worth noting that MEX Exchange does not offer a demo account, which could be a disadvantage for traders who prefer to practice and test strategies before investing real money.

FAQs

Q: What is the regulation for MEX Exchange?

A: MEX Exchange is regulated by ASIC, the Australian Securities and Investment Commission.

Q: Is there a minimum deposit requirement for MEX Exchange?

A: No, MEX Exchange does not have a minimum deposit requirement.

Q: What is the maximum leverage offered by MEX Exchange?

A: MEX Exchange offers a maximum leverage of up to 1:500.

Q: What trading platforms are available on MEX Exchange?

A: MEX Exchange offers MEX NexGen MT4, MT4 Terminal, MT4 Web Terminal, MetaTrader4 Mac, MT4 Mobile, MAM (Multi-Account Manager), and FIX API as trading platforms.

Q: What assets can be traded on MEX Exchange?

A: Traders can trade Foreign Exchange (FX), Metals (Gold & Silver), and CFDs on MEX Exchange.

Q: What types of accounts does MEX Exchange offer?

A: MEX Exchange offers Classic Account and ECN Account as account types.

Q: How can I contact customer support at MEX Exchange?

A: You can contact MEX Exchange's customer support through phone and email.

Q: What payment methods are accepted by MEX Exchange?

A: MEX Exchange accepts VISA/MasterCard credit cards, bank wire transfers, Skrill, and Neteller as payment methods.

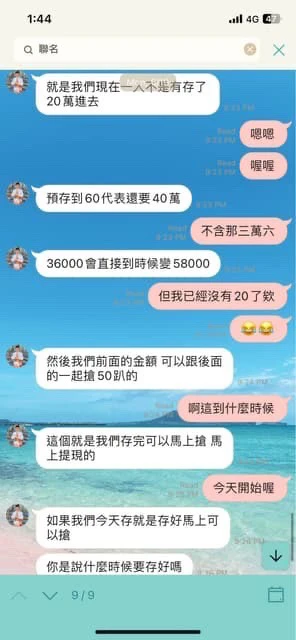

車英愛

Taiwan

I have been cheated out of 600,000 by a scumbag, who said that he wanted to invest with me for my own good, and he also said that he could withdraw cash immediately. An the result? Except for the first success, I couldn't withdraw money after that, which is ridiculous. He kept saying that he loved me and would not lie to me, but in the end he lured me into investing in a fraudulent platform!

Exposure

雯雯

Hong Kong

Be careful. The platform always failed to close the position.

Exposure

FX1222473326

Malaysia

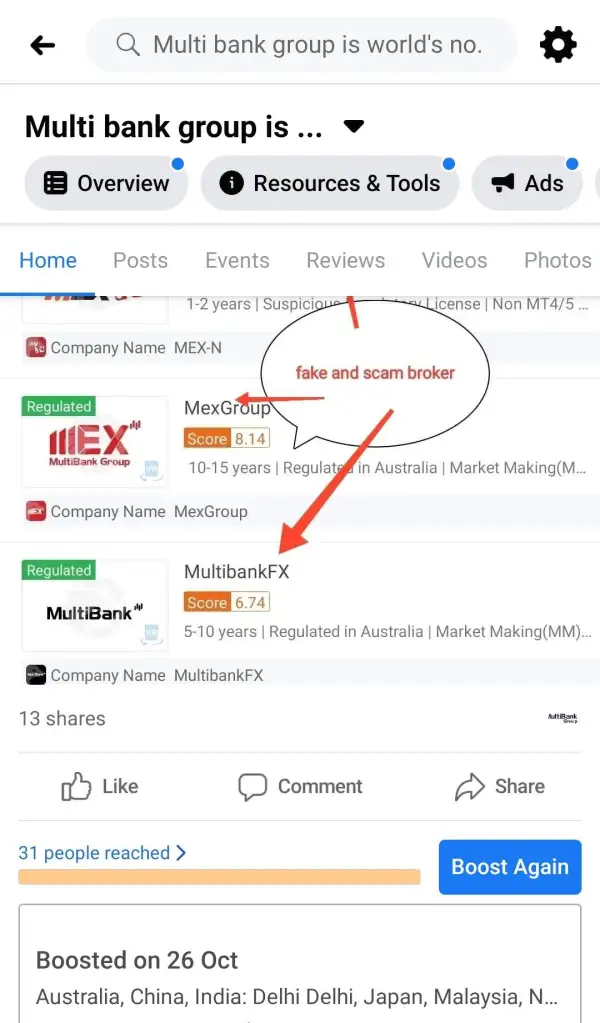

Multi bank group/mex is world's no 1 scam broker All your profit will be deducted during you wanna do a withdraw. This is a real market marker, fake and scam broker. Please be away from this scammer.

Exposure

FX1680448319

Belarus

The broker is very easy to use, the columns are clear, the app is very advanced, and I can trade anytime, anywhere.

Positive

Tarek7950

United Arab Emirates

Very good experience trading with those guys. Recommended 10/10

Positive

Cinderella

Australia

I have only good impressions! A large number of assets, and options of a different kinds. You can use any strategy. There is no minimum deposit requirement. Deposits and withdrawals are fast, and no fees are charged. Their live chat support is also very nice. The best is that newbies can trade with a demo account!

Positive

FX3336949252

Hong Kong

MEX rejected withdrawal without reason. My account No. 33508416 opened an account through their Dubai office in September. I wanted to invest in October. It has been a month since I withdrew the money from the platform. The funds have not been processed yet. The official website asked the customer service to inform the cash department to hurry up. But it has never been processed. It's too hateful and shameless. Why could I deposit but not withdraw?

Exposure

FX1222473326

Malaysia

you win broker loss ao you can not withdraw

Exposure

FX1222473326

Malaysia

MultiBank Group and mex continues its global scammer by revoked a regulatory license in the UK FCA. The company is one of the largest scammer financial derivatives groups globally, with a annual turnover of over -US$1.9 trillion and gross profit of -US$85.6 million in 2019.

Exposure