Company Summary

| Halkbank | Basic Information |

| Company Name | Halkbank |

| Founded | 1933 |

| Headquarters | Turkey |

| Regulations | Not regulated |

| Tradable Assets | Mutual Funds, Government Bonds, Eurobonds, Repo, Stock, and more |

| Account Types | Current. Savings, Cumulative Account |

| Payment Methods | Halkbank branches, Internet Branch, Halkbank Mobile, Halkbank Dialog, and ATMs |

| Trading Platforms | Turkish Electronic Fund Trading Platform (TEFAS) |

| Trading Tools | A range of calculation tools |

| Customer Support | Phone (0-850-222-0-400) |

Overview of Halkbank

Halkbank, founded in 1933 and headquartered in Turkey, provides traders with access to a wide array of financial services. Through its platform, traders can engage in the trading of various assets such as mutual funds, government bonds, Eurobonds, repo, stock, and more. Offering account types tailored to diverse financial needs, including current, savings, and cumulative accounts, Halkbank aims to deliver accessible and professional trading services leveraging its trading platforms. However, it's essential to recognize that Halkbank lacks regulatory oversight, emphasizing the importance for traders to thoroughly assess the potential risks before engaging in trading activities.

Is Halkbank Legit?

Halkbank is not regulated. Please be aware that this broker operates without regulation from recognized financial authorities, indicating a lack of oversight. Trading with an unregulated broker like Halkbank entails certain risks that traders should carefully consider. These risks include limited options for dispute resolution, potential concerns regarding fund safety and security, and a lack of transparency in the broker's operations.

Pros and Cons

Halkbank presents traders with a diverse range of trading instruments and multiple account types, providing flexibility in their trading activities. The availability of various deposit and withdrawal methods enhances convenience for customers. However, the lack of educational resources limits the support available to traders, hindering their ability to make informed decisions. Moreover, unclear information on spread and commission further complicates the trading experience. Overall, while Halkbank offers opportunities for trading, traders should exercise caution due to the lack of regulatory supervision and limited support resources.

| Pros | Cons |

|

|

|

|

|

|

|

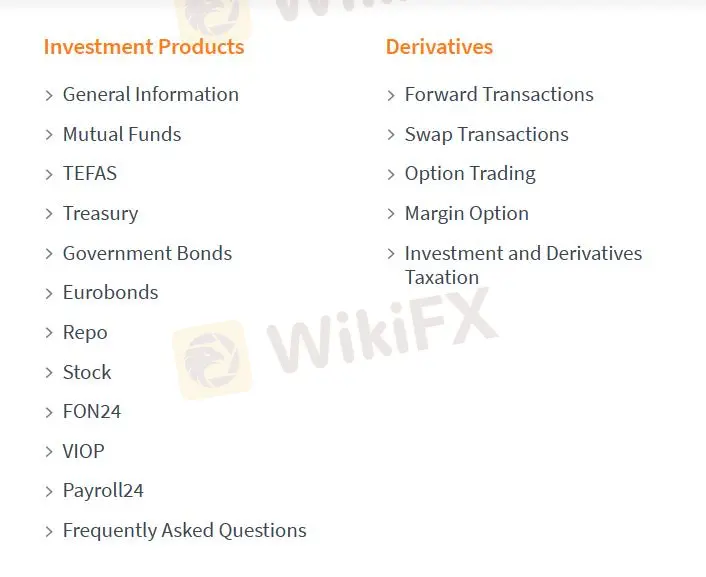

Trading Instruments

Halkbank utilizes a variety of trading instruments to manage its financial operations:

Mutual Funds: Halkbank provides services to mutual funds that have an Active Fund Distribution Agreement.

Government Bonds: Government bonds are public debt instruments issued with maturities of one year or more, subject to coupon or discounted operation.

Eurobonds: Eurobonds are public debt instruments issued with maturities of one year or more, subject to coupon operation.

Repo: It is a borrowing transaction that expresses the sale of an asset on a certain date with the promise of repurchase at a certain rate.

Stocks: It is a legally valuable document that represents a part of the equal shares of the capital of a joint stock company and is issued in accordance with the legal form requirements.

Forward Transactions: It is the process of buying/selling an asset for a future date at a price set from today.

Swap Transactions: It is a product that is generally used to protect against changes in interest and exchange rates. The most commonly used types of “swap”, which is used to mean “exchange of assets”, are money and interest swaps.

Option Trading: An option is the right to buy or sell the contracted product at a future date, at a price determined today.

Margin Option: It is an option transaction made with the bank by showing the time deposit as collateral by the saver who finds the deposit/deposit interest low and wants to increase the interest income.

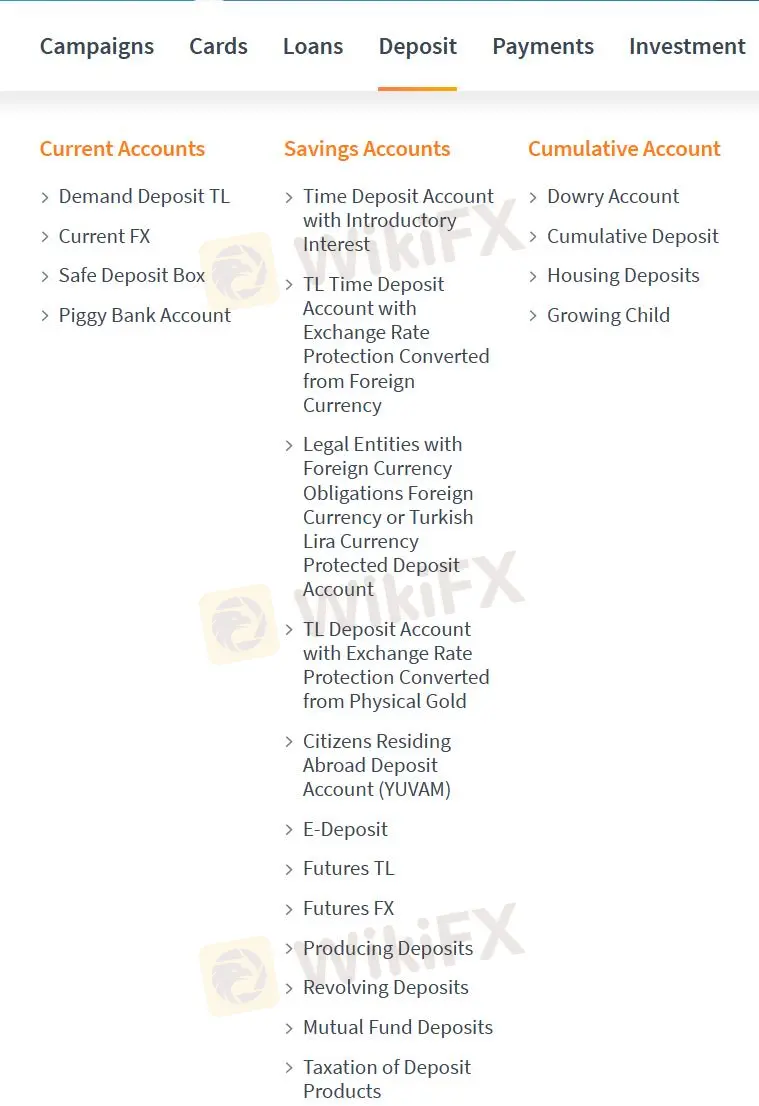

Account Types

Halkbank offers three main types of accounts, each with various sub-accounts tailored to meet different financial needs:

Current Account:

Demand Deposit TL Account: Allows transactions such as EFT, wire transfer, bill payments, and card payments, including the option for an Open Account to address instant cash needs.

Current FX Account: A foreign currency savings account.

Piggy Bank Account: Designed for children aged 0-18 to cultivate saving habits and financial literacy.

Savings Account:

Time Deposit Account with Introductory Interest: Offers advantageous Turkish Lira Time Deposit Account with introductory interest for savings.

TL Time Deposit Account with Exchange Rate Protection: Allows conversion of foreign currency into Turkish lira with exchange rate protection, providing high returns on deposits.

Legal Entities with Foreign Currency Obligations Foreign Currency or Turkish Lira Currency Protected Deposit Account: Designed for legal entities with foreign exchange obligations to manage import price or foreign currency loan repayments.

TL Deposit Account with Exchange Rate Protection Converted from Physical Gold: Offers competitive deposit product with exchange rate difference protection and additional income by converting physical gold into Turkish lira.

Futures TL: Provides risk-free return and protection against long-term interest rate changes with affordable interest rates.

Futures FX: A foreign currency savings account.

Producing Deposits: Allows regular interest income by evaluating investments with maturity ranging from 366-370 days.

Revolving Deposits: Enables taking advantage of market parity opportunities by buying/selling TL/USD/EUR while investing in time deposits.

Mutual Fund Deposits: Allows simultaneous investment in mutual funds and deposits.

Cumulative Account:

Dowry Account: A savings deposit account for those planning to marry, offering state contributions if the first marriage occurs by age 27 after saving for a minimum of 3 years.

Cumulative Deposit: Long-term account for accumulating savings with periodic transfers.

Housing Deposits: Savings deposit account for individuals aiming to purchase their first house, eligible for state contributions after saving for at least 36 months.

Growing Child: Account for children to develop saving habits, allowing periodic transfers to build savings for their future.

Deposit & Withdraw Methods

Halkbank provides bill payment options through its branches, Internet Branch, Halkbank Mobile, Halkbank Dialog, and ATMs. Through the Internet Branch, customers can instantly pay bills by entering billing information, view unpaid invoices, and complete membership online. Similarly, Halkbank Mobile allows instant bill payments through a dedicated section, with membership registration available through the mobile app.

Trading Platforms

Halkbank provides the Turkish Electronic Fund Trading Platform (TEFAS) as its trading platform. Within this platform, Halkbank facilitates the trading of mutual fund participation shares, excluding certain types such as Private Funds, Real Estate Investment Funds, Venture Capital Investment Funds, Guaranteed Funds, and Capital Protected Funds.

Trading Tools

Halkbank offers a range of calculation tools and trading utilities to assist customers with their financial needs, including loan calculator, open account interest calculation, deposit yield calculation, repo yield, securities, yield, calculator, currency converter, fund amount calculation, tax calendar.

Customer Support

Customers can submit opinions, suggestions, and complaints about products and services through an online application form or by calling the Halkbank Dialog at 0-850-222-0-400 and selecting option 5 in the Voice Response System. Halkbank ensures that all feedback is promptly evaluated, and customers are contacted regarding the outcomes. Customers can report lost or stolen items by calling the Halkbank Dialog at 0-850-222-0-400. Customers can also reach out to Halkbank via twitter for inquiries.

Conclusion

In conclusion, Halkbank offers traders a diverse range of trading instruments and multiple account types, fostering flexibility in their trading endeavors. The availability of various deposit and withdrawal methods further enhances convenience for customers. However, the absence of regulatory oversight raises concerns about potential risks associated with trading through Halkbank. Additionally, the lack of educational resources limits the support available to traders, impeding their ability to make well-informed decisions. Furthermore, unclear information on spread and commission adds complexity to the trading experience.

FAQs

Q: Is Halkbank regulated?

A: No, Halkbank operates without regulation, meaning it lacks oversight from recognized financial regulatory authorities.

Q: What trading instruments are available on Halkbank?

A: Halkbank offers a variety of trading instruments, including Mutual Funds, Government Bonds, Eurobonds, Repo, Stock, and more.

Q: What account types does Halkbank offer?

A: Halkbank provides various account types, including Current, Savings, and Cumulative Account, catering to different financial needs and preferences.

Q: How can I contact Halkbank's customer support?

A: You can contact Halkbank's customer support by calling the Halkbank Dialog at 0-850-222-0-400 or by submitting opinions, suggestions, and complaints through an online application form. Additionally, for lost or stolen items, you can report them by calling the Halkbank Dialog at the same number.

Risk Warning

Engaging in online trading carries substantial risks, and there's a possibility of losing your entire investment. It's important to recognize that online trading may not be suitable for all traders or investors. Prior to proceeding, it's crucial to thoroughly comprehend the associated risks. Furthermore, please be aware that the information presented in this review may evolve as the company's services and policies are continuously updated. The date of this review's creation is also worth considering, as information may have changed since then.