Company Summary

| Aspect | Information |

| Company Name | Onvista bank |

| Registered Country/Area | Germany |

| Years | 5-10 years |

| Regulation | Unregulated |

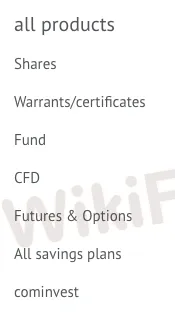

| Market Instruments | Shares, Warrants/certificates, Fund, CFD, Futures & Options, All savings plans, and cominvest |

| Order Types | Market, limit, Stop, Stop Limit, Trailing stop, One cancels the other, If-Done, Next, Next-One Cancels the Other |

| Customer Support | Interested party service (Tel: +49 (0) 69-7107 - 0 and Email: info@onvista-bank.de), Customer service (Tel: +49 (0) 69 7107 - 530 and Email: service@onvista-bank.de), and Press contact (Email: presse@comdirect.de) Tel: +49 (0) 69 7107 - 555), Telephone securities trading (Tel: +49 (0) 69 7107 - 555), and GTS software (Tel: +49 (0) 69 7107 - 760) |

| Trading Tools | Telephone trading, Web trading, Mobile web trading, GTS trading software, and Postbox |

Overview of Onvista bank

Onvista Bank, established in Germany for 5-10 years, operates without regulatory oversight. The platform provides a range of market instruments, including shares, warrants/certificates, funds, CFDs, and more. Traders can execute various order types, such as market, limit, stop, and others.

The customer support is extensive, with services like interested party support, general customer service, and telephone securities trading. The platform also offers multiple trading tools, including telephone trading, web trading, mobile web trading, GTS trading software, and Postbox.

Regulatory Status

Onvista bank operates as an unregulated trading platform. Unregulated institutions may have fewer safeguards in place, exposing users to potential cybersecurity threats and data breaches.

Pros and Cons

| Cons | Cons |

| Flexible Market Instruments | Lack of Regulatory Oversight |

| Various Order Types | No Investor Compensation Scheme |

| Demo Account Availability | Pssibility of Limited Asset Protection |

| Extensive Customer Support | Restricted Geographical Access |

Pros:

Flexible Market Instruments: Onvista Bank provides a wide range of market instruments, allowing users to diversify their investments.

Various Order Types: The platform supports various order types, providing flexibility for traders in executing their strategies.

Extensive Customer Support: Onvista Bank offers comprehensive customer support services, including interested-party support and telephone securities trading.

Multiple Trading Tools: The platform provides various trading tools, including telephone trading, web trading, mobile web trading, GTS trading software, and Postbox.

Cons:

Lack of Regulatory Oversight: Onvista Bank operates without regulatory oversight, which may pose risks for users in terms of investor protection.

No Investor Compensation Scheme: As an unregulated entity, Onvista Bank might not provide users with the protection of an investor compensation scheme, which could be a concern for traders in the event of financial difficulties.

Possibility of Limited Asset Protection: Unregulated entities may have fewer safeguards in place for the protection of user assets, potentially leading to increased risk for investors.

Restricted Geographical Access: The availability of services and support may be restricted to certain geographical regions, limiting access for users outside those areas.

Market Instruments

offers a range of market instruments to suit your investment goals and risk appetite.

Shares: Own a piece of your favorite companies and participate in their growth through dividends and potential capital appreciation. Onvista provides access to a wide range of shares listed on domestic and international exchanges.

Warrants/Certificates: Leverage structured products like warrants and certificates for magnified returns or income generation. These instruments offer exposure to underlying assets like stocks, indices, or currencies with varying degrees of risk and potential rewards.

Funds: Diversify your portfolio with mutual funds and ETFs (Exchange Traded Funds) offered by various fund houses. Choose from passively managed index funds to actively managed thematic funds based on your investment objectives and risk tolerance.

CFDs (Contracts for Difference): Gain exposure to various assets without physically owning them through CFDs. This leveraged instrument allows you to speculate on price movements of stocks, indices, commodities, and more, amplifying potential gains and losses.

Futures & Options: For experienced traders seeking advanced risk management strategies, Onvista offers access to futures and options contracts. These derivatives allow you to hedge existing positions, speculate on future price movements, or generate income through various strategies.

All Savings Plans: Secure your future with various savings plans like recurring deposits, SIPs (Systematic Investment Plans), and tax-saving schemes offered by Onvista. These plans provide disciplined investment habits and potential long-term wealth creation along with tax benefits in some cases.

Cominvest: Access real-time market data, research reports, and advanced charting tools on Onvista's proprietary Cominvest platform. This comprehensive platform empowers you to make informed investment decisions with all the necessary information at your fingertips.

Order Types

Onvista bank offers a variety of order types to give you greater control over your trades and manage risk.

Market: Buy/sell immediately at the best available price. Fastest execution, but no price control.

Limit: Buy/sell only at a specified price or better. Guarantees price, but might not execute it if the market doesn't reach it.

Stop: Buy/sell when the price reaches a specific trigger level. Limits losses if the price moves against you.

Stop-Limit: Combines stop and limit. Order triggers as a stop, but only executes at the specified limit price or better. Adds price control to stop-loss protection.

Trailing Stop: Automatically adjusts stop price as the market moves in your favor, but not against you. Locks in profits while giving room for further price increases.

One Cancels the Other (OCO): Two orders placed simultaneously, where filling one cancels the other. Useful for managing risk and specific price scenarios.

If-Done: Order only becomes active if another order fills first. Allows for complex strategies based on price movements.

Next: Sequence of orders where each subsequent one is placed only if the previous one fills. Useful for automated execution of pre-defined plans.

Next-One Cancels the Other (NOCO): Combines next and OCO. Filling one order in the sequence cancels all remaining ones. Adds risk management to sequential order execution.

How to Open an Account?

Opening an account with Onvista bank is a straightforward process that can be completed online in minutes. Here's a breakdown of the steps involved:

Visit the Onvista bank website and click “Open Account.”

Fill out the online application form: The form will request your personal information Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: Onvista bank offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the Onvista bank trading platform and start making trades.

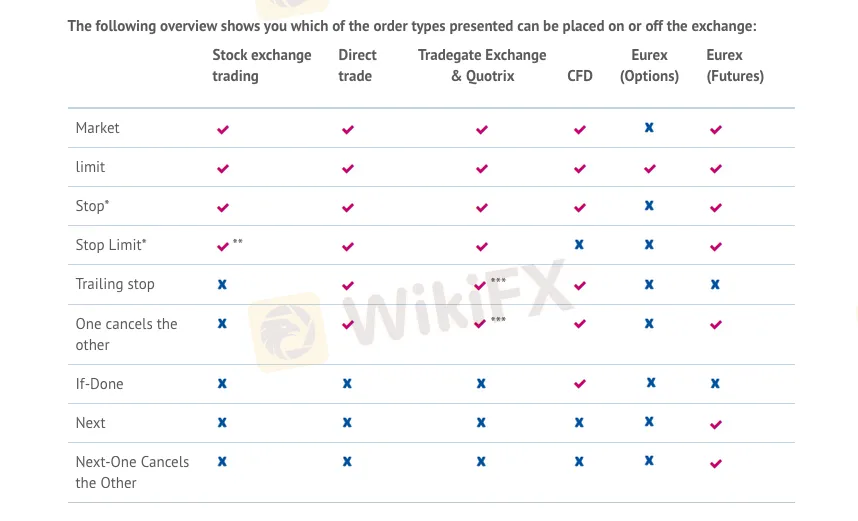

Customer Support

Onvista Bank provides a comprehensive customer support system, ensuring users have access to assistance through various channels.

For general inquiries and information, individuals can reach out to the Interested Party Service via telephone at +49 (0) 69-7107 - 0 or by emailing info@onvista-bank.de. Customer Service, available at +49 (0) 69 7107 - 530 and service@onvista-bank.de, is dedicated to addressing specific user-related queries and concerns.

Press inquiries can be directed to the Press Contact through email at presse@comdirect.de, and by phone at Tel: +49 (0) 69 7107 - 555.

Onvista Bank also offers Telephone Securities Trading support at +49 (0) 69 7107 - 555, assisting users engaged in securities trading.

Furthermore, users seeking support for the GTS software can contact the dedicated support team at +49 (0) 69 7107 - 760.

Trading Tools

Onvista Bank offers a set of trading tools to accommodate various preferences and trading styles:

Telephone Trading: For those who prefer a more traditional approach, Onvista Bank provides telephone trading services. Investors can execute trades and manage their portfolios through a phone call, ensuring accessibility and convenience.

Web Trading: Onvista Bank's web trading platform offers a user-friendly interface for online trading. Investors can access real-time market data, execute trades, and manage their investments directly through the web interface, providing flexibility and convenience.

Mobile Web Trading: With Onvista Bank's mobile web trading, investors can trade on the go using their smartphones or tablets. The mobile platform is optimized for ease of use and provides flexibility for users who prefer managing their investments from anywhere.

GTS Trading Software: Onvista Bank offers the GTS (Global Trading System) trading software, providing advanced features and tools for more experienced traders. GTS enhances the trading experience with sophisticated analysis tools, charting capabilities, and customizable options.

Postbox: The Postbox feature serves as a communication tool within the platform, ensuring that users receive important updates, notifications, and relevant information. It helps investors stay informed about market changes, account activities, and any other essential messages.

Conclusion

While Onvista Bank offers a range of flexible market instruments and various order types, the lack of regulatory oversight can be concerning, particularly with the absence of an investor compensation scheme and potentially limited asset protection.

Additionally, while the platform provides extensive customer support, it may be subject to geographical restrictions, limiting accessibility for users outside specific regions.

Traders should carefully weigh these factors to make informed decisions based on their risk tolerance and preferences.

FAQs

Q: What will this change for onvista bank customers?

A: Nothing will initially change for customers. onvista bank will continue to maintain customer relationships unchanged for the time being and offer the usual service. We gradually approach all customers with an offer to switch to comdirect and explain the process to them.

Q: Do customers have to go through the account opening process when switching to comdirect?

A: To change your depot, you need to open a new depot with comdirect. However, the entire opening process is easy and convenient to go through online in just a few minutes.

Q: Is the financial portal onvista.de also affected by the discontinuation?

A: onvista media GmbH, the operator of the financial portal, is an independent subsidiary of Commerzbank and is not affected by the discontinuation. Customers can continue to use all services (e.g. sample portfolio and watchlist) as well as the entire range of information as usual.

Q: How can I revoke a power of attorney immediately?

A: The power of attorney can be revoked immediately by any account holder. Please submit a written/telephone order to onvista bank.

Q: Is custody account management free?

A: With the 5 euro fixed price model, portfolio management is free.