Basic Information

Belize

Belize

Score

Belize

|

5-10 years

|

Belize

|

5-10 years

| https://www.investous.com/international/

Website

Rating Index

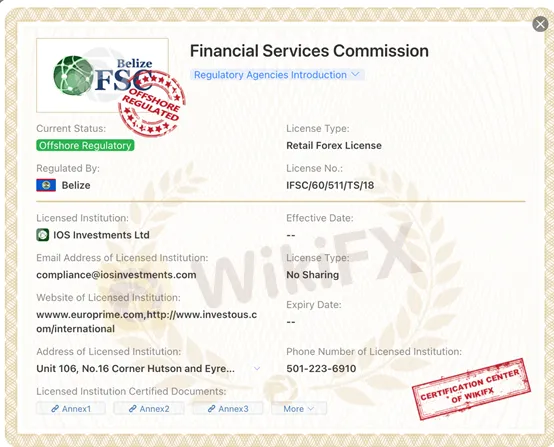

Licenses

LicensesLicensed Entity:IOS INVESTMENTS LTD

License No. IFSC/60/511/TS/18

Belize

Belize investous.com

investous.com United States

United States

| Registered in | Belize |

| Regulated by | FSC |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Information not available |

| Minimum Initial Deposit | $250 |

| Maximum Leverage | Information not available |

| Minimum spread | Information not available |

| Trading platform | Information not available |

| Deposit and withdrawal method | Information not available |

| Customer Service | Email/ phone number/ address |

| Fraud Complaints Exposure | Yes |

.

Investous is an online trading platform that offers a wide range of financial instruments for trading, including forex, stocks, commodities, and indices. The platform is regulated by the Belize Financial Services Commission (FSC) under the license number IFSC/60/511/TS/18, indicating offshore regulation. Regulatory oversight is an important factor to consider when choosing a broker, as it provides some level of assurance regarding the company's operations and adherence to certain standards.

Investous provides access to over 270 assets, allowing clients to trade various currency pairs in the forex market, stocks of global companies, popular commodities, and global stock indices. The platform offers four different account types based on the deposit amount, each with its own features and benefits. Clients can choose between the MetaTrader 4 (MT4) platform, known for its advanced tools and user-friendly interface, and the Investous WebTrader, a web-based platform that offers essential trading features and order execution capabilities.

Educational resources are available on the platform, including a glossary, sections on technical and fundamental analysis, and a video library categorized by skill levels. Traders can also access an economic calendar to stay informed about important events and economic indicators that may impact the financial markets.

Customer support is provided through live chat, email, and phone. However, it is important to note that Investous has received negative reviews and complaints, including allegations of fraud and manipulation. Traders are advised to conduct thorough research, consider the credibility of the platform, and exercise caution when making investment decisions.

Investous offers several advantages to traders, including a wide range of account options tailored to diverse needs. They provide access to popular trading platforms like MetaTrader 4 (MT4), which offer comprehensive analysis tools and efficient trade execution. Additionally, Investous supports various payment methods, making deposits and withdrawals convenient for traders. However, one significant drawback is the lack of regulation, which raises concerns about the security and transparency of the brokerage. The absence of regulatory oversight also means that traders may have limited protection and recourse compared to regulated brokers. It is crucial for potential traders to carefully consider these pros and cons before choosing to trade with Investous.

| Pros | Cons |

| Multiple account options for diverse needs | Lack of regulation |

| Support for various payment methods | Potential security and transparency concerns |

| Access to popular trading platforms | Limited trader protection |

| Comprehensive educational resources | Limited educational resources and tools |

| High minimum deposit requirements |

Based on the information provided, INVESTOUS is regulated by the Belize Financial Services Commission (FSC) under the license number IFSC/60/511/TS/18. The regulatory status indicates that it is an offshore regulation.

Regulatory oversight is an important factor to consider when choosing a broker, as it can provide some level of assurance regarding the company's operations and adherence to certain standards. However, it is advisable to conduct further research and due diligence to gather more up-to-date information on the broker's regulatory standing, as well as consider other factors such as trading conditions, customer feedback, and the credibility of the broker.

1. Forex: Investous offers a variety of currency pairs for trading in the foreign exchange market. This includes major currency pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic currency pairs.

2. Stocks: Clients can trade stocks of various companies listed on major global stock exchanges. Investous provides access to a range of popular stocks, allowing clients to speculate on the price movements of companies such as Apple, Amazon, Google, and more.

3. Commodities: Investous offers trading opportunities in the commodity market. Clients can trade popular commodities like gold, silver, crude oil, natural gas, and other precious metals and energy resources. Trading in commodities allows clients to take advantage of price fluctuations in these markets.

4. Indices: Investous provides access to global stock indices, allowing clients to trade on the performance of a basket of stocks representing a specific market or industry. Some of the indices available for trading include the S&P 500, Dow Jones, FTSE 100, DAX 30, and Nikkei 225, among others.

Pros and Cons

| Pros | Cons |

| Diverse range of trading instruments | Potential risk associated with volatile markets |

| Access to over 270 assets | Limited availability of certain niche assets |

| Opportunity to trade in various markets | Dependency on external market factors |

| Availability of major currency pairs | Market price fluctuations can impact trading outcomes |

| Access to popular global stocks | Complexity in analyzing and understanding multiple markets |

| Trading opportunities in commodities | Potential impact of geopolitical events on markets |

| Access to global stock indices | Lack of guaranteed returns or profitability |

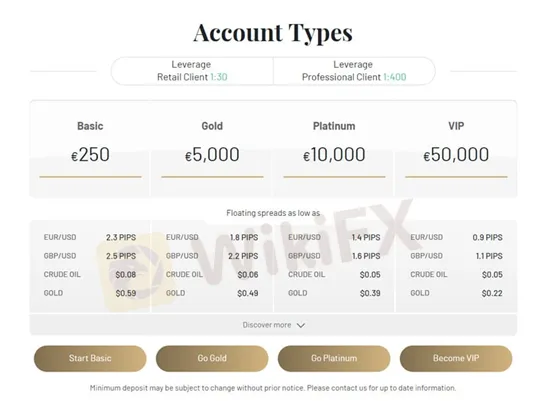

Investous offers four different account types based on the size of the deposit made by the client. The account types are as follows:

1. BASIC ACCOUNT: This account requires a minimum deposit of $250. It provides floating spreads, with rates as low as 2.3 pips for EUR/USD, 2.5 pips for GBP/USD, $0.08 for crude oil, and $0.59 for gold. Basic Accounts receive one free withdrawal and have access to daily news, Trading Central, and Trading Central SMS Alerts. There is one basic lesson available, but no webinars.

2. GOLD ACCOUNT: A deposit of $5,000 is required for a Gold Account. It offers floating spreads with lower rates compared to the Basic Account, such as 1.8 pips for EUR/USD, 2.2 pips for GBP/USD, $0.06 for crude oil, and $0.49 for gold. Gold Accounts receive one free withdrawal per month and have access to daily news, Trading Central, and Trading Central SMS Alerts. Additionally, two basic lessons and one webinar per month are available.

3. PLATINUM ACCOUNT: To open a Platinum Account, a deposit of $10,000 is required. This account type provides even lower floating spreads, with rates as low as 1.4 pips for EUR/USD, 1.6 pips for GBP/USD, $0.05 for crude oil, and $0.39 for gold. Platinum Accounts receive three free withdrawals per month and have access to daily news, Trading Central, and Trading Central SMS Alerts. Clients with a Platinum Account can access three advanced lessons and two monthly webinars.

4.VIP ACCOUNT: The highest account tier is the VIP Account, which requires a deposit of $50,000. It offers the best rates for floating spreads, starting at 0.9 pips for EUR/USD, 1.1 pips for GBP/USD, $0.05 for crude oil, and $0.22 for gold. VIP Accounts have no fees on withdrawals and provide access to daily news, Trading Central, and Trading Central SMS Alerts. Clients with a VIP Account can access five advanced lessons and five monthly webinars.

To cancel an Investous account, clients can contact customer support via email or phone to communicate their intention to cancel. It is recommended to reach out to the account manager directly for assistance with the account cancellation process.

| Pros | Cons |

| Multiple account options cater to different deposit sizes higher-tier accounts | Higher minimum deposit requirements for |

| Access to daily news, Trading Central, and Trading Central SMS Alerts | Possible limitations on access to educational resources for lower-tier accounts |

| Lower spreads offered for higher-tier accounts | Limited number of free withdrawals per month |

| Potential restrictions on available trading features and tools based on account type |

The maximum trade sizes vary depending on the asset type with Investous. Here is a summary of the maximum trade sizes for different asset categories:

1. FOREX: The maximum trade size for forex assets ranges from 10 to 30 lots, depending on the specific currency pair. The exact maximum trade size for each currency pair can be found in the Legal section of the Investous website.

2. Stocks: The maximum trade size for stocks is 10 lots, and the default leverage is set at 10.

3. Indices: For indices, the maximum trade size is three lots, and the default leverage is set at 50% of the account leverage.

4. Energy: The maximum trade size for energy assets is 50 lots, and the default leverage ranges from 25% to 50% of the account leverage.

5. Commodities: The maximum trade size for commodities is 20 lots, and the default leverage is set at 25% of the account leverage.

6. Metals: For metals, the maximum trade size is 100 lots, and the default leverage is set at 50% of the account leverage.

Investous does not charge any deposit fees, which encourages users to fund their trading accounts without incurring additional costs. However, there are withdrawal fees associated with certain payment methods. For credit and debit card withdrawals, a fee of 3.5 percent is applied, which can be relatively high. Wire transfer fees vary depending on the currency, ranging from 20 CHF, 3,000 JPY, 30 USD, 24 EUR, 182 CNY, 20 GBP, to 1,800 RUB. E-wallet withdrawals have percentage-based fees, including 3.5 percent for Neteller, 2 percent for Perfect Money or Skrill, 3.5 percent for Qiwi, and 0.9 percent for Webmoney.

Withdrawal fees differ based on the type of account. Basic, Silver, and Gold Account holders are charged a withdrawal fee of 35 USD/EUR/GBP/CHF or 2,500 RUB. However, Platinum and Diamond Account holders enjoy fee-free withdrawals. It's worth noting that under specific circumstances, Investous may apply a larger withdrawal fee of 50 EUR or its equivalent if there has been no trading activity or insufficient documentation for identity verification.

Investous also imposes inactivity fees to account holders who have not been active for at least a month. The fee is charged on a monthly basis and is denominated in EUR, with the equivalent amount in the client's currency determined by the prevailing exchange rate. The inactivity fee starts at 10 EUR for the second month of inactivity and increases to 80 EUR for two to three months, 120 EUR for three to six months, and 200 EUR for more than six months of inactivity.

Regarding commissions, Investous does not charge any commission fees on trades. Instead, the broker generates profits through the spread, which is the difference between the buying and selling prices of an asset.

| Pros | Cons |

| No deposit fees | Withdrawal fees for certain payment methods |

| No commission fees | Inactivity fees for dormant accounts |

| Fee-free withdrawals for Platinum and Diamond Account holders | Larger withdrawal fee under specific circumstances |

| Inactivity fees increase over time |

Investous provides several options for depositing and withdrawing funds from your trading account. Deposits can be made through credit card, wire transfer, or electronic payments such as Skrill. The minimum deposit amount for credit card and electronic payments is $250/€250/£250/руб 10,000, while wire transfers require a minimum deposit of $1,000/€1,000/£1,000. The maximum daily deposit and maximum monthly deposit vary depending on the deposit method.

For withdrawals, you can initiate the process by logging into your Investous account and selecting the “Withdrawal” option. The minimum withdrawal amount is $10 or its equivalent. Withdrawals must be made using the same method that was used for depositing funds. If the initial deposit was made via credit card and you wish to withdraw more than the initial deposit, the remaining balance will be transferred via wire transfer. In such cases, you will need to provide images of the front and back of the credit card used for the deposit.

Investous requires account verification before withdrawals can be processed to comply with Know Your Customer (KYC) standards and Anti-Money Laundering (AML) regulations. Account verification involves providing an official government-issued ID with a photo (e.g., passport or driver's license) and proof of address, such as a utility bill or bank statement from the past six months.

It's important to note that specific deposit and withdrawal methods, as well as associated fees or processing times, may be subject to change, and it is recommended to refer to Investous' official website or contact their customer support for the most up-to-date information and details regarding deposit and withdrawal processes.

| Pros | Cons |

| Multiple deposit options available | Account verification required for withdrawals |

| Clear instructions for deposit and withdrawal processes | Potential delays in processing withdrawals |

| Compliance with KYC and AML regulations | Withdrawals limited to the same method as deposit |

| Variety of maximum deposit options | Additional documentation may be required for withdrawals |

| Possible fees associated with certain withdrawal methods | |

| Changes in deposit and withdrawal methods and fees |

Investous offers clients two trading platforms: MetaTrader 4 (MT4) and the Investous WebTrader.

1. MetaTrader 4 (MT4): MetaTrader 4 is a widely recognized and highly popular trading platform in the industry. It is known for its robust features, advanced tools, and user-friendly interface. MT4 provides traders with access to real-time market data, advanced charting capabilities, and a wide range of technical indicators for analyzing price movements. Traders can customize the platform according to their preferences and trading strategies. MetaTrader 4 is available for desktop download, and there are also mobile versions compatible with Android and iOS devices.

2. Investous WebTrader: The Investous WebTrader is a web-based trading platform that allows clients to trade directly from their web browser without the need for any software installation. The WebTrader is designed to be user-friendly and provides a clean interface for easy navigation. It offers essential trading features and tools, including real-time quotes, interactive charts, and order execution capabilities. The Investous WebTrader is accessible from any device with an internet connection, providing flexibility and convenience for traders.

Both platforms offer trading functionality and access to a wide range of financial instruments, including forex, stocks, commodities, and indices. Clients can choose the platform that best suits their preferences and trading needs.

| Pros | Cons |

| Robust features and advanced tools | Lack of additional platform options |

| User-friendly interface | Limited customization options |

| Real-time market data | No integrated social trading features |

| Advanced charting capabilities | Limited availability of educational resources |

| Access from desktop and mobile devices | Limited integration with third-party tools |

| Web-based platform available |

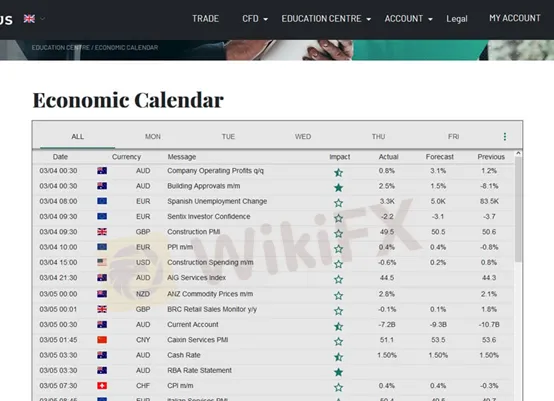

Investous provides an economic calendar on its website, offering traders a valuable tool to stay informed about important events and economic indicators that can impact the financial markets. The economic calendar displays a range of information for each event, including the data, currency, message, impact, forecast, actual, and previous figures.

Traders can customize the view of the economic calendar by adjusting various filters. These filters allow users to select their preferred time zone, filter events based on their importance or impact level, and filter events by the specific currency pairs that may be affected. By using these filters, traders can focus on the events that are most relevant to their trading strategies and interests.

The economic calendar also allows traders to navigate easily through different days of the week using the provided tabs. This feature enables users to access historical and upcoming events, facilitating comprehensive analysis and planning.

Investous offers a range of educational resources designed to cater to traders of various skill levels. While the extent of access to these resources may vary based on the account type and deposit amount, Investous strives to provide valuable educational materials to all clients.

One of the available resources is a comprehensive glossary that covers key terms related to CFDs and forex trading. This glossary aims to provide concise explanations in an easily understandable manner.

Investous also offers educational sections dedicated to technical analysis and fundamental analysis. These sections provide overviews of these analysis methods, including explanations of technical indicators, moving averages, Fibonacci retracements, and the relative strength index (RSI). While these explanations lack graphical examples, they still offer insights into the concepts and techniques involved in analysis.

Leverage and margins are also covered in the educational resources. Investous provides explanations of these concepts, along with an overview of trading with leverage and the purpose and mechanics of a margin call.

A notable feature of Investous is its extensive video library. The Videos on Demand (VOD) section includes categorized videos for different skill levels, such as Forex Intro, Forex Beginners, and Forex Intermediate. The videos cover a wide range of topics, including order types, market analysis, trading psychology, capital management, and global trading.

It's worth mentioning that Investous also provides asset-specific information under the CFD tab in the main navigation menu, allowing traders to access resources related to specific assets.

Overall, Investous offers a diverse set of educational resources, including glossaries, written explanations, and video content, to help traders enhance their knowledge and understanding of trading concepts, strategies, and analysis techniques.

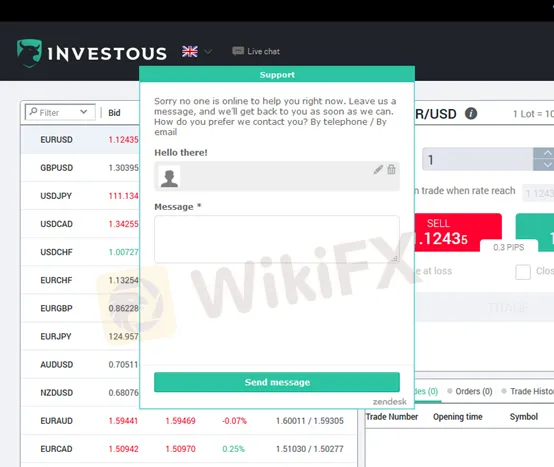

Investous offers several methods to contact their customer support team for assistance. Here are the available options:

1. Live Chat: Investous provides a live chat feature accessible through a floating button in the bottom right corner of every page on their website. The chatbot offers a selection of topics to choose from, allowing you to get quick assistance. If needed, you may also have the option to chat with a human representative.

2. Email: You can reach Investous customer support by sending an email to info.int@investous.com. This allows you to communicate your queries, concerns, or requests in writing, and the support team will respond to you via email.

3. Phone: Investous provides a phone number for customer support, which is +27 10 753 1165. You can use this number to directly contact their support team and speak with a representative over the phone.

On our website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Investous is an online trading platform that offers a range of investment opportunities to traders. Its advantages lie in its user-friendly interface, extensive educational resources, and a wide selection of financial instruments. However, some disadvantages include limited availability of certain assets, high fees, and concerns regarding its regulatory compliance. While Investous provides educational support for traders, potential users should carefully consider these drawbacks before engaging in trading activities on the platform.

Q: Is INVESTOUS regulated?

A: Yes, INVESTOUS is regulated by the Belize Financial Services Commission (FSC) under the license number IFSC/60/511/TS/18. However, it is important to conduct further research and due diligence to gather more up-to-date information on the broker's regulatory standing.

Q: What markets can I trade with Investous?

A: Investous offers a diverse range of trading instruments across different markets, including forex, stocks, commodities, and indices.

Q: What account types does Investous offer?

A: Investous offers four different account types: Basic Account, Gold Account, Platinum Account, and VIP Account. The account type is determined by the size of the deposit made by the client.

Q: What are the maximum trade sizes and leverage offered by Investous?

A: The maximum trade sizes and leverage vary depending on the asset type. For forex, the maximum trade size ranges from 10 to 30 lots, depending on the currency pair. The maximum trade size for stocks is 10 lots. Indices have a maximum trade size of three lots, while energy assets have a maximum trade size of 50 lots. Commodities have a maximum trade size of 20 lots, and metals have a maximum trade size of 100 lots.

Q: How can I deposit and withdraw funds with Investous?

A: Investous provides several options for depositing and withdrawing funds, including credit card, wire transfer, and electronic payments such as Skrill. The minimum deposit and withdrawal amounts vary, and specific methods may have associated fees or processing times.

Q: What trading platforms does Investous offer?

A: Investous offers two trading platforms: MetaTrader 4 (MT4) and the Investous WebTrader. MT4 is a popular and widely recognized trading platform with advanced features, while the WebTrader is a web-based platform that allows trading directly from a web browser.

Q: What educational resources does Investous provide?

A: Investous offers a range of educational resources, including a glossary, sections on technical and fundamental analysis, explanations of leverage and margins, and an extensive video library categorized by skill level.

Q: How can I contact Investous customer support?

A: You can contact Investous customer support through live chat, email (info.int@investous.com), or phone (+27 10 753 1165).

Q: What are some reviews and complaints about Investous?

A: There are negative reviews and complaints regarding Investous, including allegations of pyramid scheme practices, scam and fraud allegations, and claims of induced fraud. It is important to consider these reviews when making a decision and conduct thorough research.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Lorenzo Jirschek

Taiwan

They used YouTube ads to attract people without any experience to sign up, and then there were instructors who kept talking nonsense that there was a high profit opportunity to ask me to increase my deposit, and my deposit of 500usd was lost.

Exposure

FX3791350144

Mexico

I opened my account with this company some time ago. At first, everything was fine with personalized attention, but they only gave you instructions to place an order. They didn’t tell you what the stop loss was. First they let you win and then they make you lose money when you place an order, because I am a novice, so I invested more money to maintain the open operation according to them. In the end, I lost a lot of money. Beware of the meaningless operations of those who encourage you to open up. In the end, I can only withdraw $500

Exposure

王丽14553

Hong Kong

Investous is a fraud platform. Do not be deceived. I found that I was deceived so I want to withdraw, but I cannot. They require the criminal record and I give them. Then, they suspended my account and say that they had transferred the left balance to may account. I asked them for the receipt and these liars said the money was detained due to inactivity of my account. Is there any way to complain? These foreign liars.

Exposure

™妖♠孽

Venezuela

At present I believe that investous is a reliable broker, and the trading conditions such as the range of instruments, spreads and fees can meet my needs! The only flaw for me is the regulation, it's a less strict offshore license.

Positive