Company Summary

| Qorva Markets Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Comoros |

| Regulation | Unregulated |

| Market Instruments | Primarily Forex |

| Demo Account | / |

| Leverage | Up to 1:500 |

| Spread | Starts from 0 pips |

| Trading Platform | Web Trading Platform, Mobile App |

| Min Deposit | None |

| Customer Support | +971-50-8596-279 |

| info@qorvamarkets.com | |

| Online chat | |

| Physical Address: Office #210, Al-Nasar Sports Club, Dubai, UAE | |

Qorva Markets Information

Founded in 2023 and with its headquarters in Comoros, Qorva Markets provides Forex trading to international investors. The platform fits both new and seasoned traders with several account kinds and leverage up to 1:500. The lack of control, though, increases trading risks.

Pros and Cons

| Pros | Cons |

| High leverage of up to 1:500 | Unregulated |

| No minimum deposit requirements | Limited to Forex trading |

| No deposit or withdrawal fees | No Demo or Islamic accounts |

Is Qorva Markets Legit?

Qorva Markets is an unlicensed broker in Comoros. It is neither licensed or regulated by the FCA (Financial Conduct Authority) in the UK, ASIC (Australian Securities and Investments Commission), or other recognised financial regulatory entities. Lack of regulation raises worries about broker transparency and security.

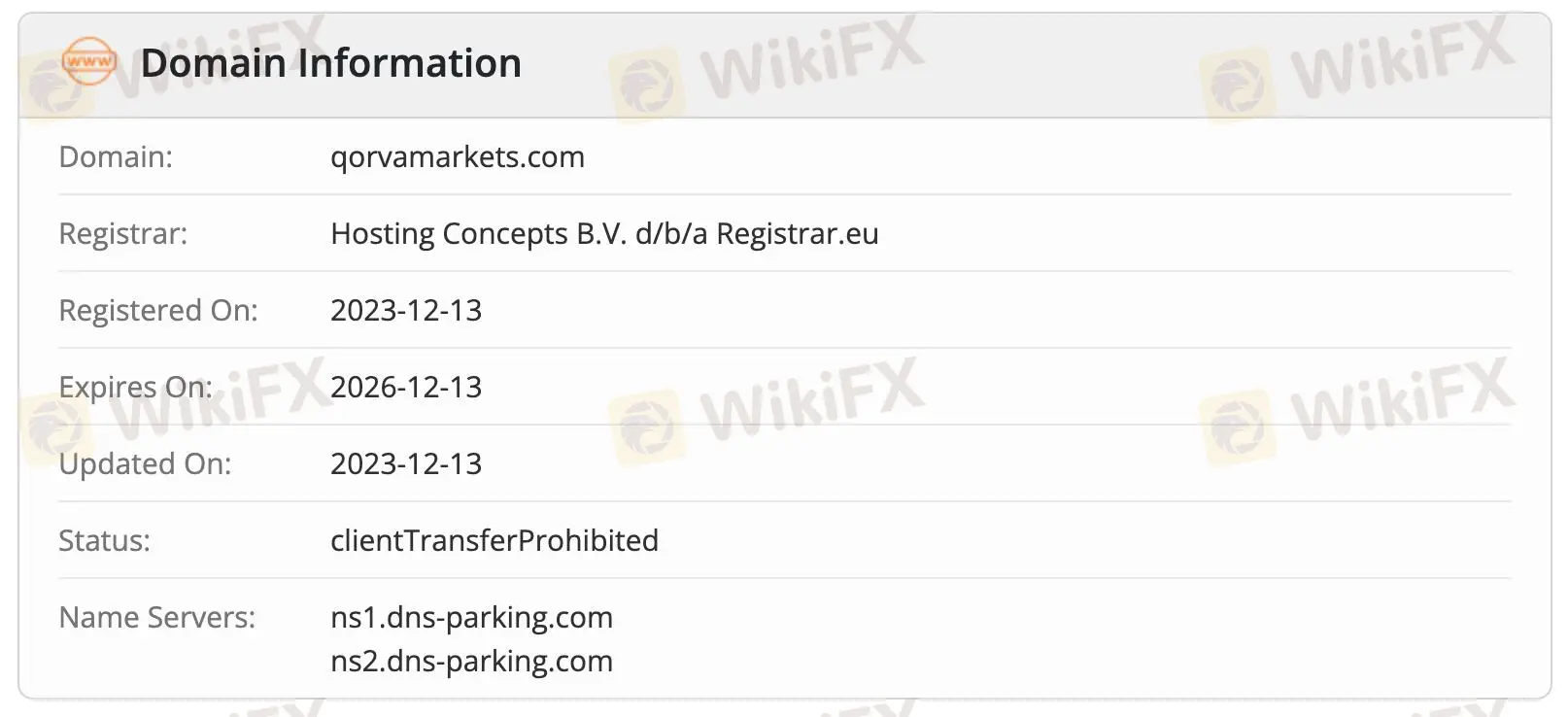

Hosting Concepts B.V. registered qorvamarkets.com on December 13, 2023, according to WHOIS. Domain expires December 13, 2026, and was last updated the same day as registration.

What Can I Trade on Qorva Markets?

Qorva Markets primarily focuses on Forex trading.

Account Types

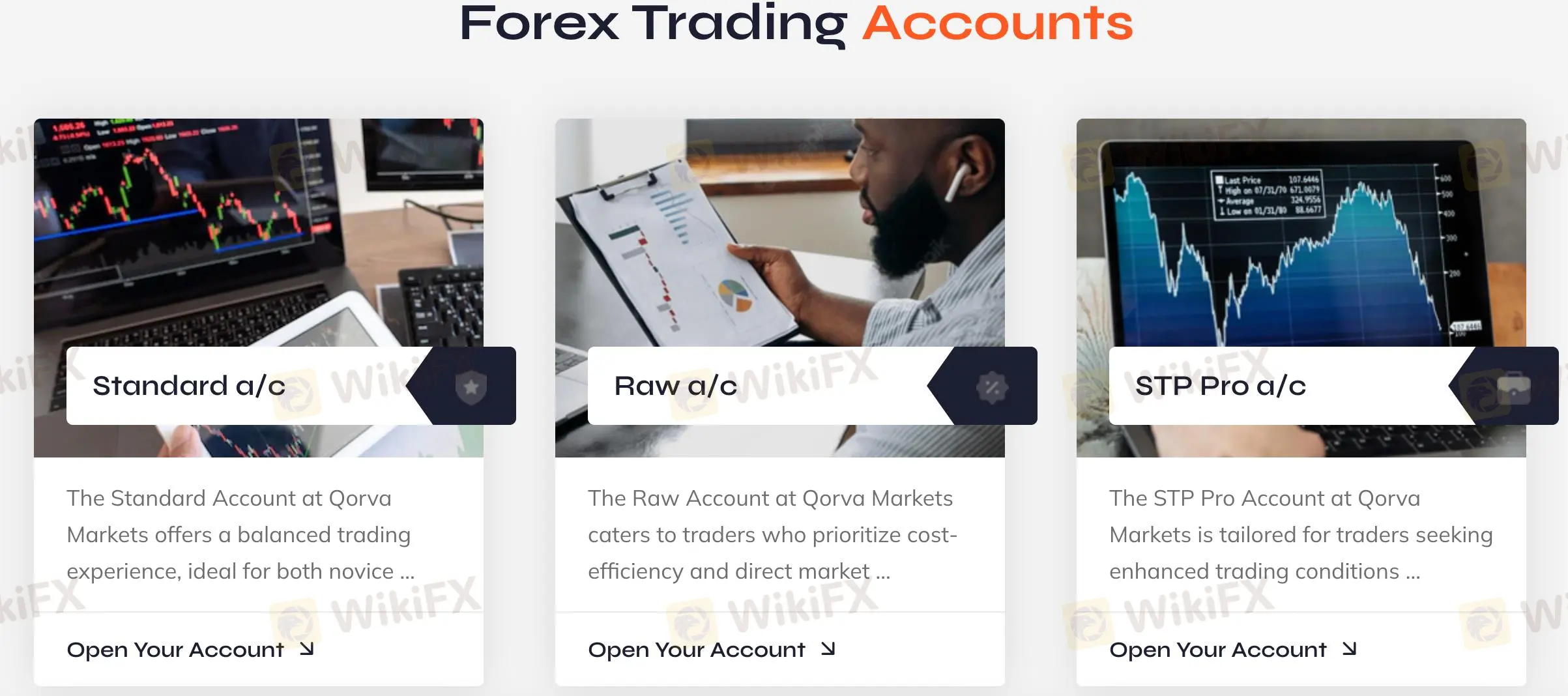

Qorva Markets offers three live trading accounts. Theres no mention of Demo or Islamic accounts.

| Account Type | Leverage | Commission | Min Deposit | Spread |

| Standard | Up to 1:500 | None | None | Fixed from 3 pips |

| Raw | Up to 1:100 | $6/lot | None | Fixed from 0 pips |

| STP Pro | Up to 1:300 | None | None | Tight Spreads |

Leverage

Using leverage up to 1:500, Qorva Markets allows traders to control bigger positions using less funds.

Qorva Markets Fees

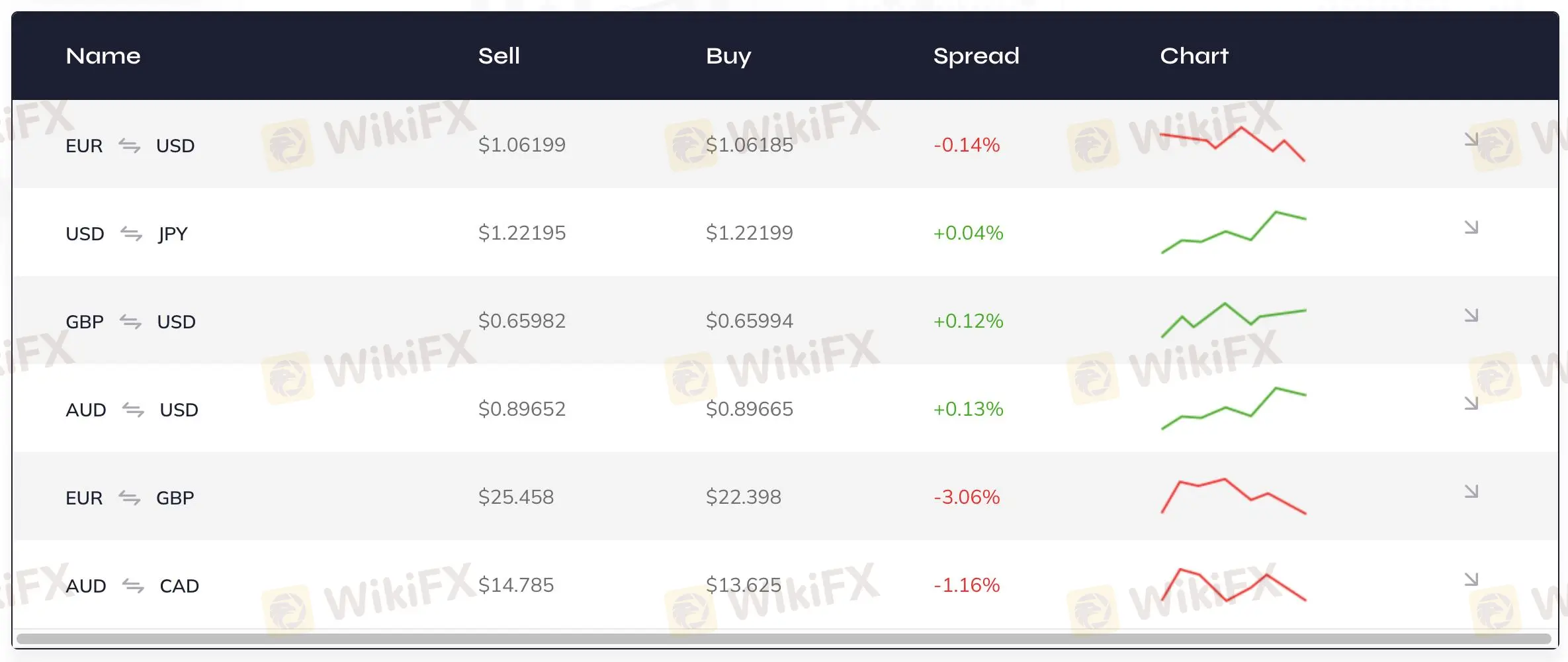

Qorva Markets' trading fees are attractive compared to industry standards. The broker offers tight spreads, with differences depending on the account type.

Standard Account: No commission; spreads start from 3 pip.

Raw Account: $6 per lot commission; spreads start from 0 pips.

STP Pro Account: No commission; tight spreads.

Non-Trading Fees

| Non-trading Fees | |

| Deposit Fee | Free |

| Withdrawal Fee | Free (Bank fees may apply) |

| Inactivity Fee | None |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| Web Trading Platform | ✔ | Web | Traders who prefer browser-based trading |

| Mobile App | ✔ | iOS, Android | Traders seeking on-the-go trading accessibility |

Deposit and Withdrawal

Qorva Markets charges no deposit or withdrawal fees. Furthermore, no minimum deposit is needed for any kind of account, so traders have freedom.